Space's new middle mile: optical links go multi-orbit

After World Satellite Business Week, operators signaled a pivot: standardized laser links that let LEO, MEO, and GEO networks peer like the internet. The next year is a land‑grab for interoperability, routing, and ground upgrades.

The week the lasers got organized

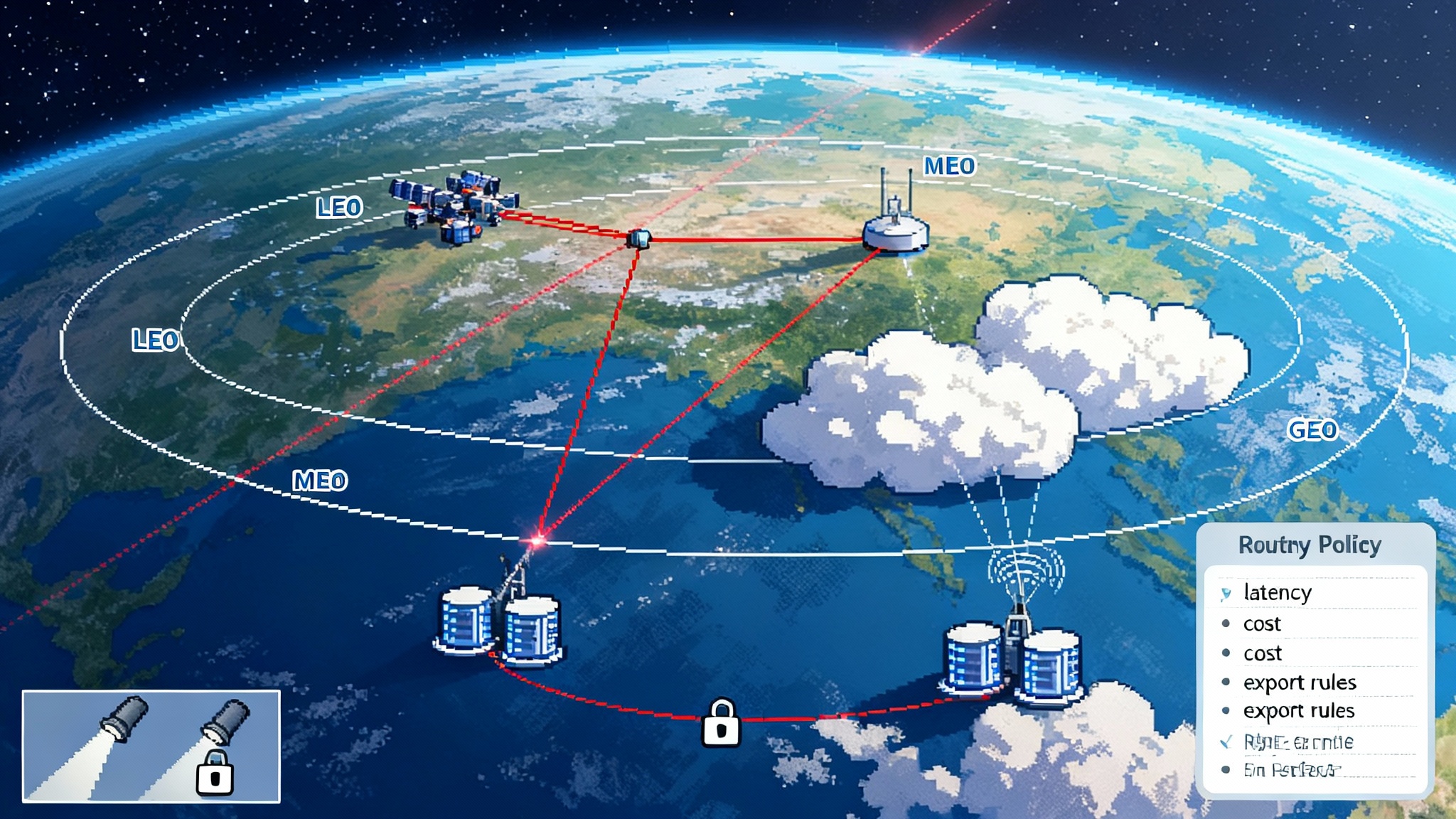

In Paris, World Satellite Business Week is where the industry swaps slideware for signatures. This year, one theme cut across panels, MoUs, and demo reels: optical links are leaving the silo of single constellations and heading for a multi-orbit mesh. In plain terms, satellites will start talking to satellites outside their own families, across low Earth orbit, medium Earth orbit, and geostationary orbit. Not by radio, but by pencil-thin beams of light.

You have seen pieces of this before. Starlink has flown thousands of optical crosslinks inside its own fleet. The European Data Relay System proved that a laser path from a LEO imager to a GEO relay can move pictures to the ground minutes faster than waiting for the next pass. The US Space Development Agency wrote a practical spec so defense satellites from different builders could pass data using common laser terminals.

The new shift is that commercial incumbents in GEO and MEO, and new LEO fleets, are now preparing to peer with each other. The vocabulary sounded suddenly familiar to anyone who watched the internet grow up: open interfaces, interop testing, peering points, settlements, and routing policy. Put it together and you get a space-based middle mile. Data will hop via light from one network to another above the atmosphere, then drop into the ground at the best spot for cost, latency, or policy.

The next 12 months look like a land‑grab to define who interconnects with whom, on what technical standard, and under which rules.

From laser islands to a space middle mile

A decade ago, most optical terminals were custom jobs. Two satellites with the same hardware could talk. Strangers could not. That is changing. Defense programs forced practical interoperability, not just in the lab but on orbit. Commercial terminal makers learned to build to that spec. And operators who watched terrestrial backbones turn into neutral middle miles are ready to reuse the playbook in space.

Think of it like this. Undersea cables and long-haul fiber carry the world’s traffic between cities and cloud regions. They are the middle mile between local access and data centers. A similar layer is coalescing in orbit. LEO brings density and low latency. MEO brings regional persistence and capacity. GEO brings field of view and maturity. Put optical crosslinks on all three and you can move bits between orbits the way an internet backbone moves bits between cities.

The result is not one giant network. It is a fabric of networks that peer. Each keeps its own customers and coverage. Between them sits an exchange powered by laser beams.

What changed at World Satellite Business Week

Three patterns stood out.

-

Interop demos moved from PowerPoint to hardware. Terminal vendors brought test results showing lock and pass with competitors at standard data rates. Operators described pilot campaigns to validate cross-constellation links in 2025.

-

GEO and MEO incumbents signaled intent to add optical ports to next-gen birds. Not for every satellite at once, but enough to create on-ramps and off-ramps. The pitch ties to opex: fewer gateways and fiber backhauls if you can ride space-to-space longer.

-

LEO fleets leaned into open peering. Second-generation designs increasingly assume optical neighbor links are table stakes and third-party peering is a growth lever for defense transport, Earth observation downlink, and cloud backhaul.

This is not a single deal. It is a chorus that sets expectations. The center of gravity moved from internal optimization to external interconnection.

The nuts and bolts, without the jargon

An optical inter-satellite link is just a fast flashlight that blinks data. The trick is to keep two pencil beams pointed at each other across hundreds or thousands of kilometers while both platforms move.

Here is what matters and why:

-

Wavelength and power: Most terminals use infrared light around 1550 nm, the same region used in fiber optics. It is eye-safe at distance and plays well with mature detectors. More power helps the link budget, but heat and power draw onboard matter, so efficiency wins.

-

Pointing, acquisition, and tracking: The satellites must find each other, lock, and stay locked despite jitter. The shorter the wavelength, the tighter the beam, and the tighter your pointing. Think of balancing a laser pointer on a boat while hitting a dime on another moving boat. Good terminals shrink acquisition time to seconds.

-

Data rate: Today 10 to 100 Gbps per link is common in specs. Compression and aggregation stack on top. For EO, moving raw imagery out fast is the difference between waiting an hour and acting in minutes.

-

Interoperability layer: Terminals can all shine light, but they must speak the same framing and handshakes to exchange data. Defense drove a practical baseline. Civil standards bodies are aligning. The short version: there is progress on a common language for lasers.

-

Routing: Once you can pass bits, you need to decide where to send them. This is where internet lessons apply. You can imagine a simple, BGP-like policy engine in space. Each operator advertises what paths it offers at what cost, with constraints like export control, geography, and latency. A LEO router picks the next hop: another LEO, up to MEO, up to GEO, or down to a ground station.

-

Security: Links use strong encryption at the link and network layers. Keys rotate. Policies travel with packets. For sensitive users, you can keep data in space until the last hop into a secure ground enclave, which helps with sovereignty rules.

Put together, this is not magic. It is what you would build if you took the internet’s interconnection model and moved part of it above the weather.

Why operators are peering now

-

Economics: Ground infrastructure is expensive. Building and leasing hundreds of gateways, terrestrial backhaul, and co-lo racks eats capital and operating budgets. If you can stay in space longer and downlink near your destination or your customer’s cloud region, you spend less on terrestrial miles.

-

Latency: Every detour to ground adds time. A multi-orbit hop can be faster than a long fiber route. Example: a ship in the South Atlantic needs a chart update hosted in a European cloud. A LEO-to-MEO hop to a ground station in Lisbon can beat a LEO-to-ground in Brazil plus terrestrial backhaul.

-

Demand shocks: Defense customers want resilient transport that works when fiber is cut or gateways are jammed. Earth observation fleets need to empty sensors fast during disasters and conflicts. Cloud providers want flexible backbones to tie edge sites to regions. None of these wants a single-provider, single-orbit dependency.

-

Maturity: The hardware is ready. Unit costs are falling. The standards are good enough to start.

What this unlocks

-

Defense transport: The military’s new architecture relies on moving targeting data and comms traffic through a diverse set of orbits and vendors. A commercial optical middle mile lets the government buy transport as a service across multiple providers instead of buying entire constellations. It also allows allied nations and commercial operators to participate without surrendering control of their fleets.

-

Earth observation downlink: Imagine a flood mapping satellite that collects imagery over Southeast Asia. Instead of waiting to pass over a ground station, it zaps the data by laser to a GEO or MEO relay, then straight into a cloud region in Singapore. First responders see updates in minutes, not hours. The same relay could aggregate data from multiple imagers, so small EO companies do not need to build global ground networks.

-

Cloud backhaul: Hyperscalers already run ground stations and edge nodes. A multi-orbit space middle mile lets them place gateways where power and fiber are cheap and abundant, and only drop from orbit near their core regions. This cuts costs and smooths performance for content delivery and satellite direct-to-device.

-

Enterprise networks: Maritime and aviation operators can mix and match capacity. A cruise line could buy a baseline service from one LEO, burst via another during high demand, and fall back to a GEO beam in bad weather, with the handoffs occurring in space.

How peering might work in practice

Take a simple, concrete flow:

-

A drone snaps 4K video of a wildfire. The data goes up to a LEO satellite in view.

-

That LEO has three choices. It can downlink to the nearest ground gateway, hand to a neighbor LEO heading toward the target cloud region, or hand upward to a MEO that can see both the drone’s region and a ground gateway near the incident command center.

-

The network uses a routing policy. The policy says defense traffic is priority one, disaster traffic priority two, and bulk transfers afterward. It also says to avoid downlinks in certain countries for legal reasons.

-

The LEO hands the video to a MEO via an optical link. The MEO relays it to a GEO that can see the whole affected region and a cloud region in Australia. The GEO drops the data at an optical ground station tied to that cloud.

-

Minutes after the drone flies, the incident team has the footage. No global ground network required. The satellites settle the transaction later, not unlike how internet transit is billed.

The new part is not the physics. It is the policy layer that decides the path and the business layer that pays for it.

Business models and settlements

Two models are likely to coexist.

-

Bilateral peering: Two operators agree to exchange traffic under a balanced ratio or small fee. This is common when both sides have similar value to offer. It is simple and fast to stand up for pilots.

-

Paid transit: One operator buys capacity from another, measured in gigabits per second or terabytes moved, with priority classes. Think of it as wholesale in space. Defense agencies might pre-purchase reservations. EO companies might buy burst packs to clear payloads after a big collection.

Operators will also experiment with on-net and off-net pricing, just like terrestrial ISPs. Moving your own customers’ traffic inside your constellation remains cheapest. Off-net via a partner costs more, but is available when needed.

A small but important detail: accounting for latency guarantees. Buyers will want to pay for performance, not just volume. Expect contracts with latency buckets and rebates if paths miss targets.

The trade-offs and the hard parts

-

Precision and scale: LEO-to-LEO is now routine at scale, but LEO-to-GEO links are longer and beams are tighter. Terminals must be stable and accurate. Vibrations from reaction wheels, thermal flexing, and pointing errors all matter. This is solvable with engineering and calibration, but it takes time to mature.

-

Weather still matters at the last hop: Optical links in space are above the atmosphere, so they are fine. The downlink to ground is not. Clouds block light. Operators will hedge with multiple optical ground stations and hybrid RF fallbacks so that the last hop is reliable.

-

Export controls and policy: Peering is not purely technical. Some countries restrict where certain kinds of data can land. Defense traffic often has nationality and alliance constraints. Routing policy engines must be able to encode these rules and enforce them.

-

Vendor lock-in versus standards: Everyone likes the idea of interoperability, but every operator also likes differentiation. Expect a minimum common spec for link establishment and framing, plus vendor-specific extensions that offer better acquisition speed or higher throughput inside a single fleet. This is the same tension the internet lived with for decades.

-

Security model: A multi-operator network expands the attack surface. Operators will need hardware roots of trust in terminals, strong identity for satellites, and tamper-evident logs so that customers can audit how traffic moved. Some buyers will ask for post-quantum cryptography on the control plane. Plan for it now.

Ground upgrades are the quiet unlock

The middle mile is only as useful as its endpoints. Three ground changes will decide who wins this land‑grab.

-

Optical ground stations near cloud regions: Putting OGS sites near large data centers shortens the terrestrial tail. Sites need good weather diversity and cheap power.

-

Space-aware routing in the ground network: Gateways should speak the same policies as satellites. If a LEO hands to GEO due to weather, the ground should not undo that with a long-haul backhaul. Treat orbit selection and ground path as one system.

-

Containerized gateway stacks: The days of bespoke racks in remote huts are ending. Expect gateway-in-a-box systems that spin up in colo facilities with standard orchestration and monitoring. That cuts opex and speeds deployment.

The 12-month roadmap

The next year will be a race to establish habits that become defaults.

-

Q4 and Q1: More public interop tests. Expect cross-vendor optical terminals to show acquisition and pass at common data rates in both lab and air-to-ground tests. Operators will publish early routing policy frameworks and security white papers to reassure buyers.

-

First half: Pilot links between a LEO fleet and a MEO or GEO platform over select corridors. Think North Atlantic, Europe to Middle East, and Pacific rims where traffic is rich and ground weather is varied. Some of these pilots will carry real customer traffic during off-peak windows.

-

Second half: First commercial services with settlement. Likely in defense transport and EO backhaul, where the buyer value is clearest and policy alignment is easiest. Early adopters will be operators that already run hybrid networks across orbits.

-

Throughout: Terminal procurement for next-gen birds will bake in optical ports and the interop spec. This creates a snowball effect. Every new satellite that launches with a compatible port raises the value of the shared fabric.

What this means if you build, buy, or regulate

-

Builders: Design for interop by default. Put one port aside for the common spec even if your fleet prefers your tuned protocol inside. Budget for precision pointing upgrades if you want to reach GEO. Invest in on-orbit calibration and health monitoring for terminals.

-

Operators: Write routing and security policy now. Decide what you will carry, when, for whom, and at what price. Publish it. You do not need perfection. You need a credible policy that partners can integrate. Stand up an interop team that speaks both network engineering and legal.

-

Earth observation providers: Model your downlink costs under three scenarios. Today’s ground-only approach, a hybrid with occasional optical relay, and an optical-first plan once corridors open. You will likely find that time-to-data drops the most in disaster response regions where your customers care most.

-

Defense buyers: Ask for multi-orbit paths as a service, not single-operator circuits. Write RFPs that reward interop and weather diversity. Require path transparency logs so you can prove where your data traveled.

-

Regulators: Make optical ground station siting easier. Harmonize permit timelines. Publish clear guidance on data landing and lawful intercept rules for optical downlinks so providers can encode them in routing policy.

The bottom line

Optical crosslinks are no longer a novelty. They are becoming the quiet backbone between orbits. After this year’s industry gathering, the direction is clear. The space middle mile will not be owned by one company. It will be peered, policy-driven, and increasingly standardized. The prize is lower latency, lower opex, and higher resilience across defense, Earth observation, and cloud backhaul.

The real work now is not just launching more satellites. It is writing the policies, building the ground, and agreeing on the handshakes that let different fleets trust each other enough to pass traffic.

Takeaways and what to watch next

-

Expect the first live, cross-operator optical relays in 2025 along a few well-chosen corridors. Watch for announcements that include not just a demo, but a tariff and an SLA.

-

Watch terminal vendors publish interop matrices. The more pairings that pass at speed and acquisition time targets, the faster this market moves from trial to product.

-

Follow where optical ground stations land. The winners will pair clear skies with proximity to major cloud regions. Ground siting will separate pilots from profitable services.

-

Look for routing policy disclosures. The operators that explain how traffic is classified and steered will win trust from defense and enterprise buyers.

-

Track how standards bodies and defense specs converge. A common handshake across vendors is what turns a handful of bilateral links into a fabric.

If the last decade was about getting lasers to work in space, the next year is about getting them to work together. That is how a cluster of constellations becomes an economy.