Cryptocurrencies

Cryptocurrencies

Articles under the Cryptocurrencies category.

EigenLayer Multichain Restaking puts Ethereum Security on L2s

EigenLayer’s multichain verification began rolling out in July 2025 on Base Sepolia, extending Ethereum-grade security to Layer 2 networks. With slashing live since April 17, 2025, AVSs can now run on fast rollups, reshaping fees, MEV, and yield.

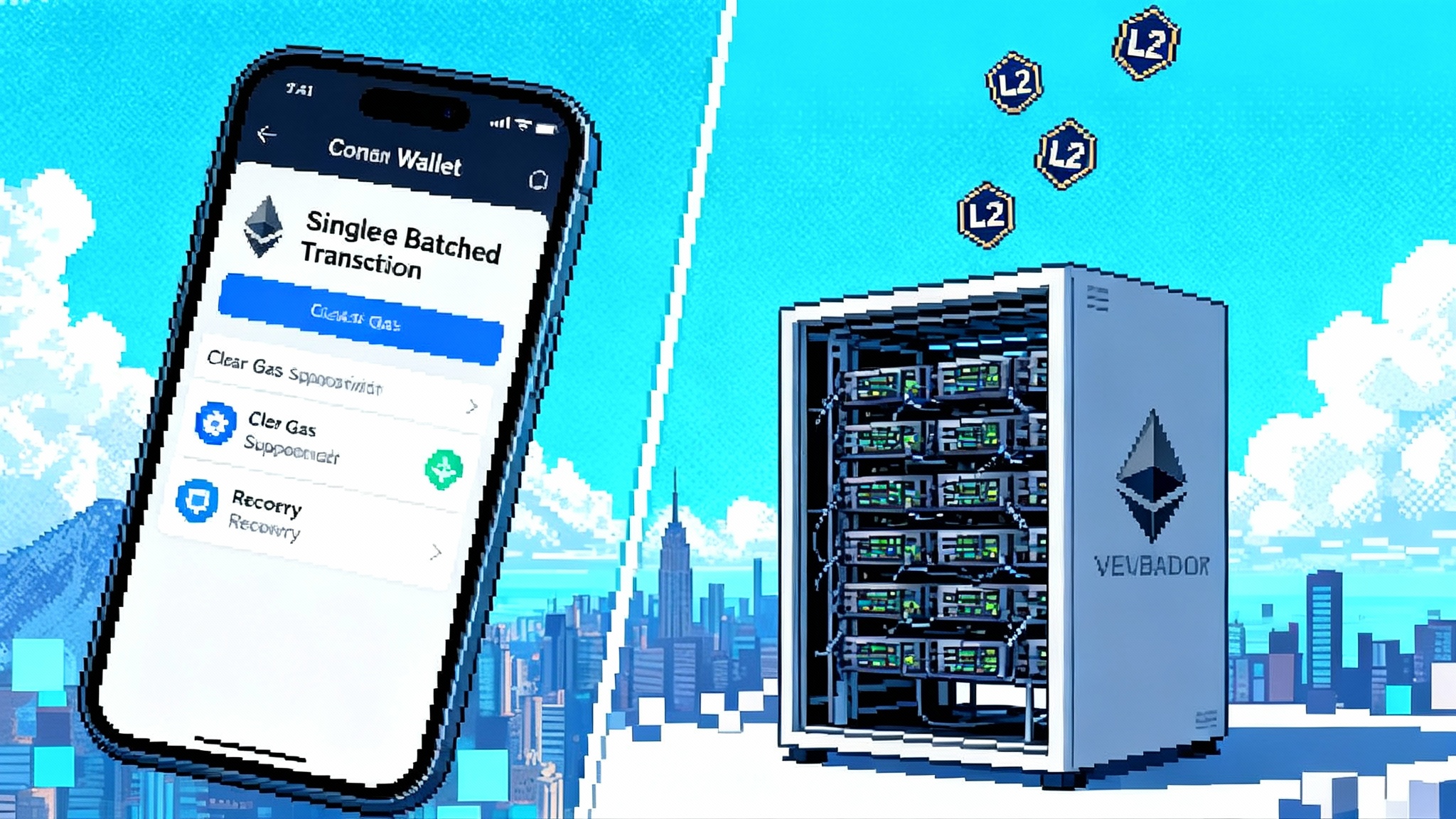

Post Pectra Ethereum: Smart Accounts and Staking Reset UX

Ethereum’s Pectra upgrade flipped two baselines at once: native smart-account powers with EIP-7702 and bigger effective validator balances. Here is how wallets, staking markets, and L2s will compete over the next six months.

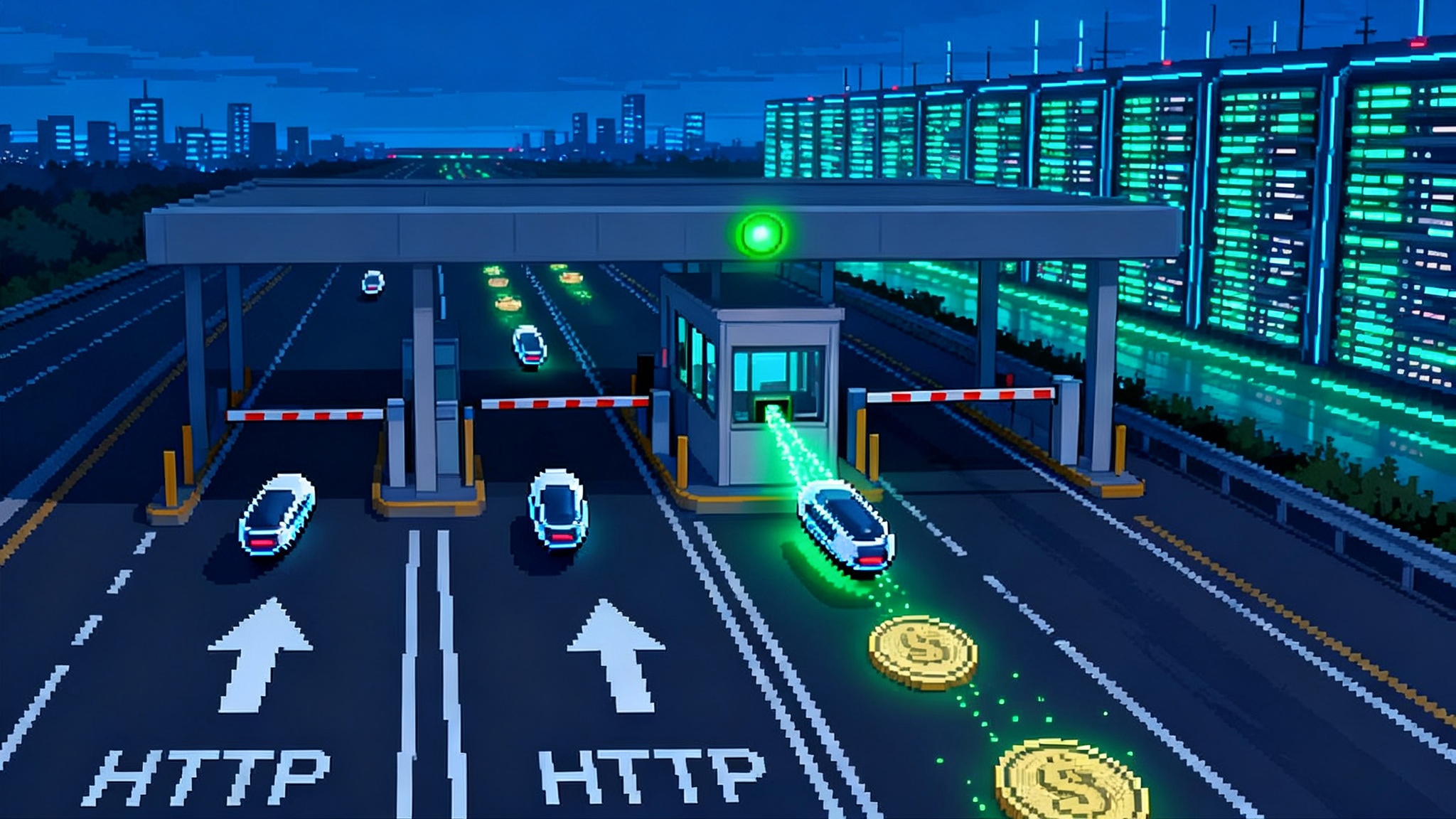

AI Agents Get a Cash Rail: x402 and the Bot-to-Bot Economy

A dormant web status code just woke up. With x402, AI agents can pay in stablecoins inside standard HTTP 402 flows, unlocking pay-per-API, streaming compute, and machine commerce. See how it works, what changes next, and how to ship today.

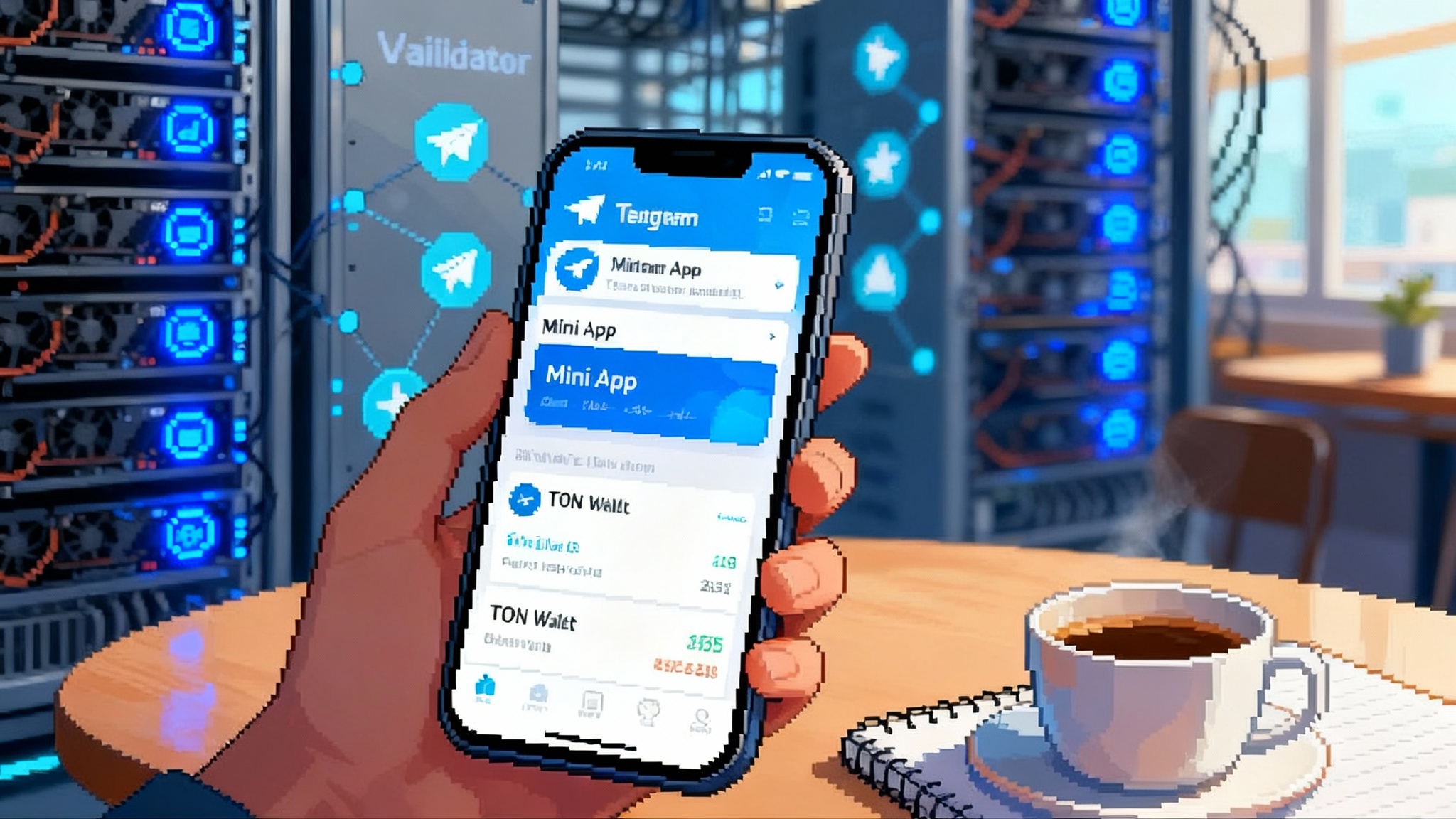

Telegram Locks In TON, Web3’s First Billion-User Rail

Telegram just made TON the default for Mini Apps, rolled out TON Wallet in the United States, and added Chainlink’s CCIP and a decentralized AI network. This is crypto’s clearest path to a billion users.

XRP’s First U.S. Spot ETF Goes Live, Fueling XRPL’s EVM Run

Canary’s spot XRP ETF opened on November 13 with heavy demand, setting a 2025 day one record. Here is how regulated inflows could amplify activity on XRPL’s new EVM sidechain, AMMs, and payments, plus a practical playbook for builders and investors.

America’s Stablecoin Law Puts Crypto On Main Street

The GENIUS Act turns dollar stablecoins from a gray area into regulated payment rails. Here’s what the law enables, who moves first, and the playbook to ship in the next 12 to 24 months.

JPM Coin Debuts on Base, Deposit Tokens Go Mainstream

JPMorgan just switched on a USD deposit token for institutions on Base, signaling that regulated money can finally run on public rails. Here is why deposit tokens are poised to win corporate payments after the GENIUS Act and how builders can ship on bank-grade infrastructure.

PeerDAS Is Live: Fusaka Triggers the L2 Fee Freefall

On December 3, 2025, Ethereum activates PeerDAS in the Fusaka upgrade, opening the door to bigger blob capacity and cheaper data for rollups. Here is how it could push L2 fees toward sub-cent and what teams should ship in the next 90 days.

Anyone Can Challenge: OP Fault Proofs and Arbitrum BoLD

Arbitrum and the OP Stack just crossed a trust milestone: anyone can now challenge invalid rollup state on Ethereum. Here is what changes for withdrawals, bridges, exchanges, and builders in 2025.

Babylon’s Q4 Push Makes Bitcoin a Shared Security Layer

Babylon’s Q4 2025 launch turns one Bitcoin stake into security for many chains through multi-staking and a new EVM mainnet. We unpack how it works, what to build now, and the milestones to watch into early 2026.

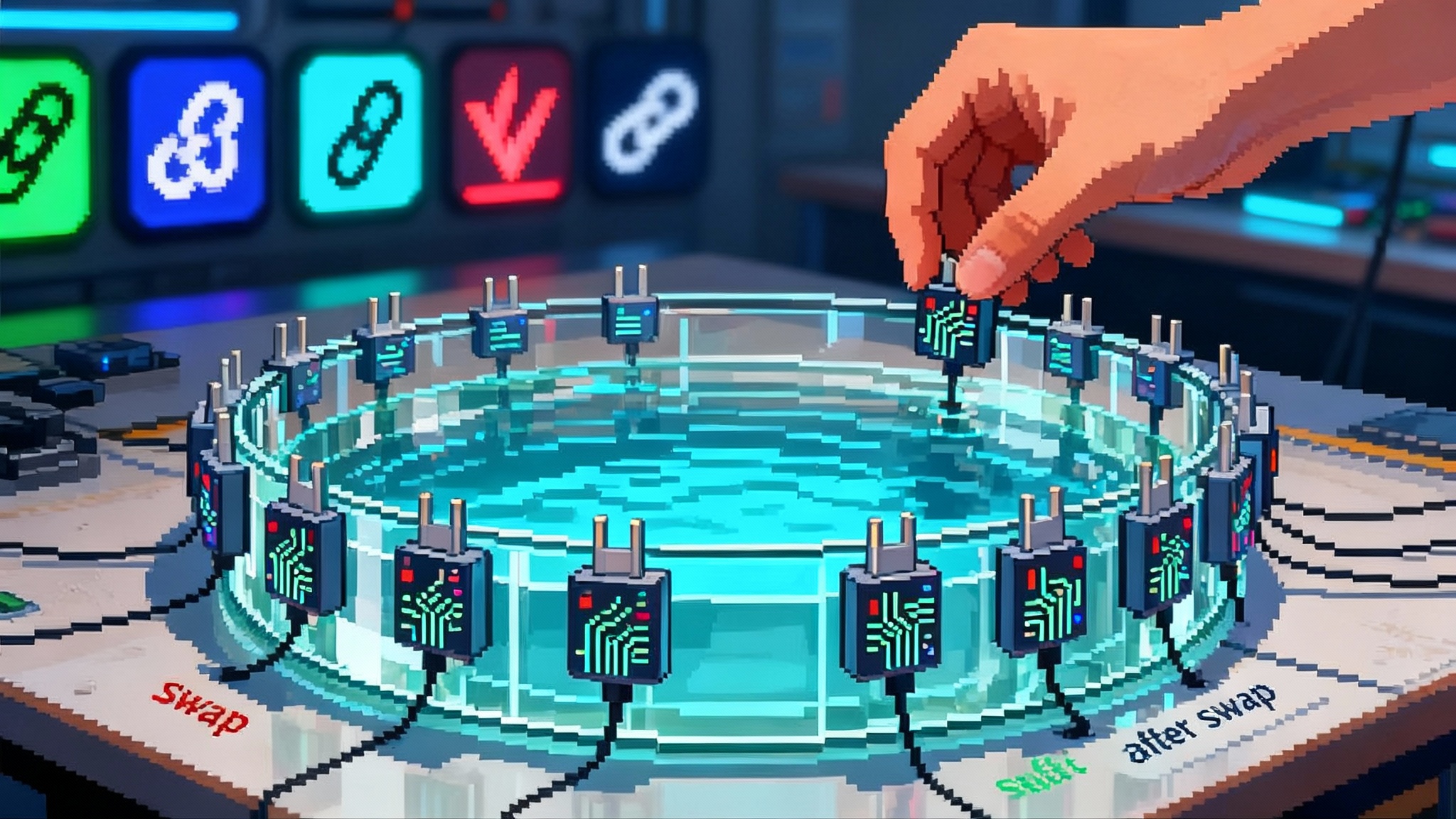

Uniswap v4 hooks and the app store moment for DeFi

Uniswap v4 launched hooks, compact smart contracts that turn every pool into a programmable platform. The result is dynamic fees, MEV-aware execution, and compliance-ready liquidity across chains, with wallets and aggregators set to weave hooks into intent-based routing.

Hong Kong turns on real value tokenization with Ensemble

At Hong Kong FinTech Week on November 3, 2025, the HKMA launched the Ensemble Pilot to move live tokenized deposits and money market funds, while the SFC let licensed exchanges tap global order books. Here is why that combination matters and how to build on it.

Firedancer Hits Mainnet: Solana’s New MEV and Throughput Math

Pieces of Firedancer are now live on Solana mainnet as top validators begin migrating. Here is how a true multi‑client network will change block production, fee capture, and reliability, plus what builders and operators should do next.

Helium’s carrier-grade turn: AT&T, Movistar, and free mobile

In 2025, Helium moved from clever experiment to carrier‑grade reality. AT&T enabled Passpoint roaming onto community hotspots, Movistar began rolling out Helium in Mexico, and Helium Mobile made its Zero plan truly free. Here is what changed, why it matters, and what to watch in 2026.

Solana’s First U.S. Spot ETF With Staking Opens The Floodgates

Bitwise’s BSOL launched under September’s generic listing standards and included on-chain staking from day one. Here is how a quiet rule change set off an altcoin ETP race, and what the next year could mean for flows, validator policy, custody, and tax.

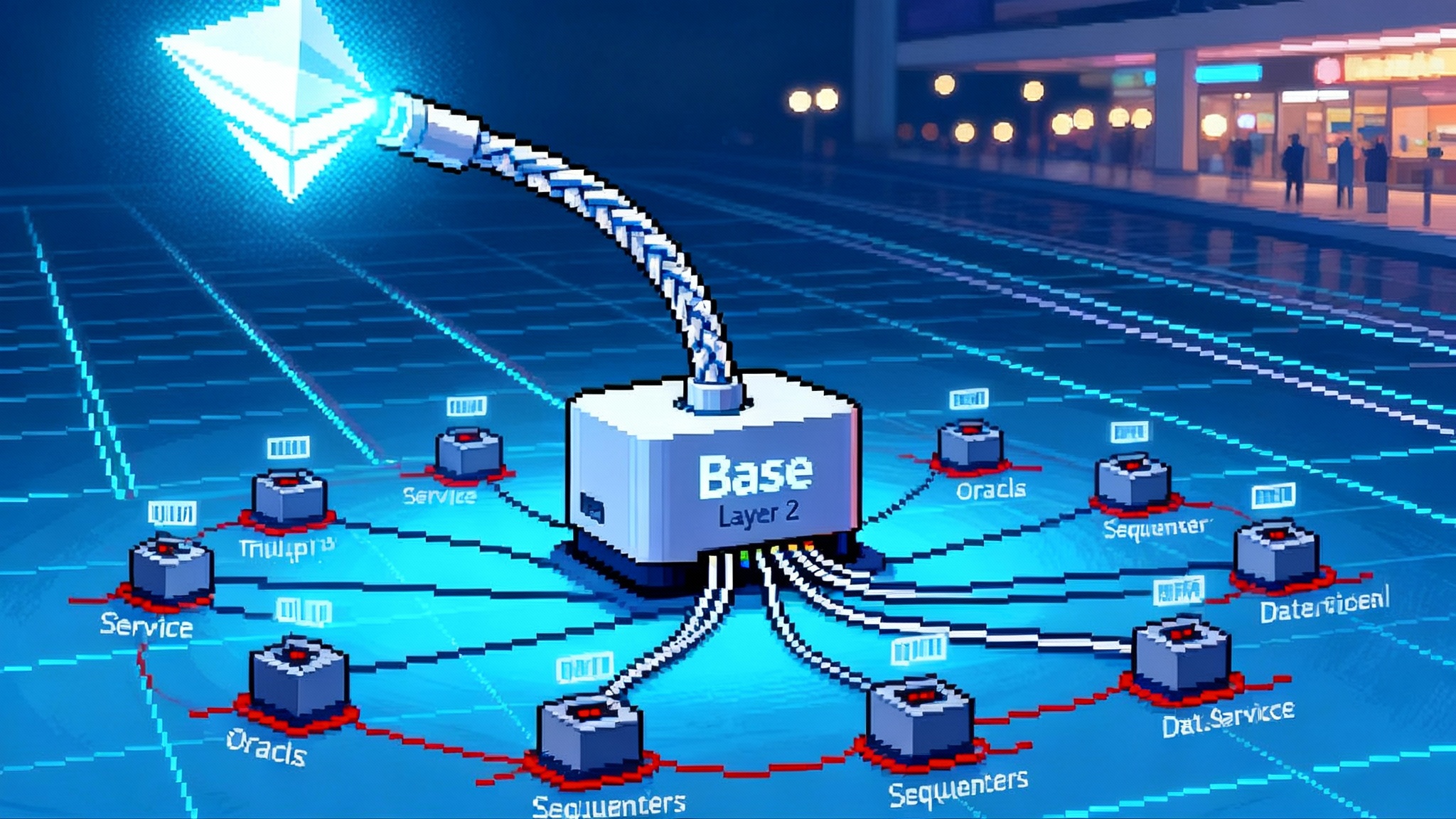

Restaking goes multi-chain as EigenLayer hits Base L2

EigenLayer just switched on multichain verification, letting Actively Validated Services run on Base and other Layer 2s while keeping Ethereum-grade security. See what it unlocks, who it shifts, and how to build for 2025 and 2026.

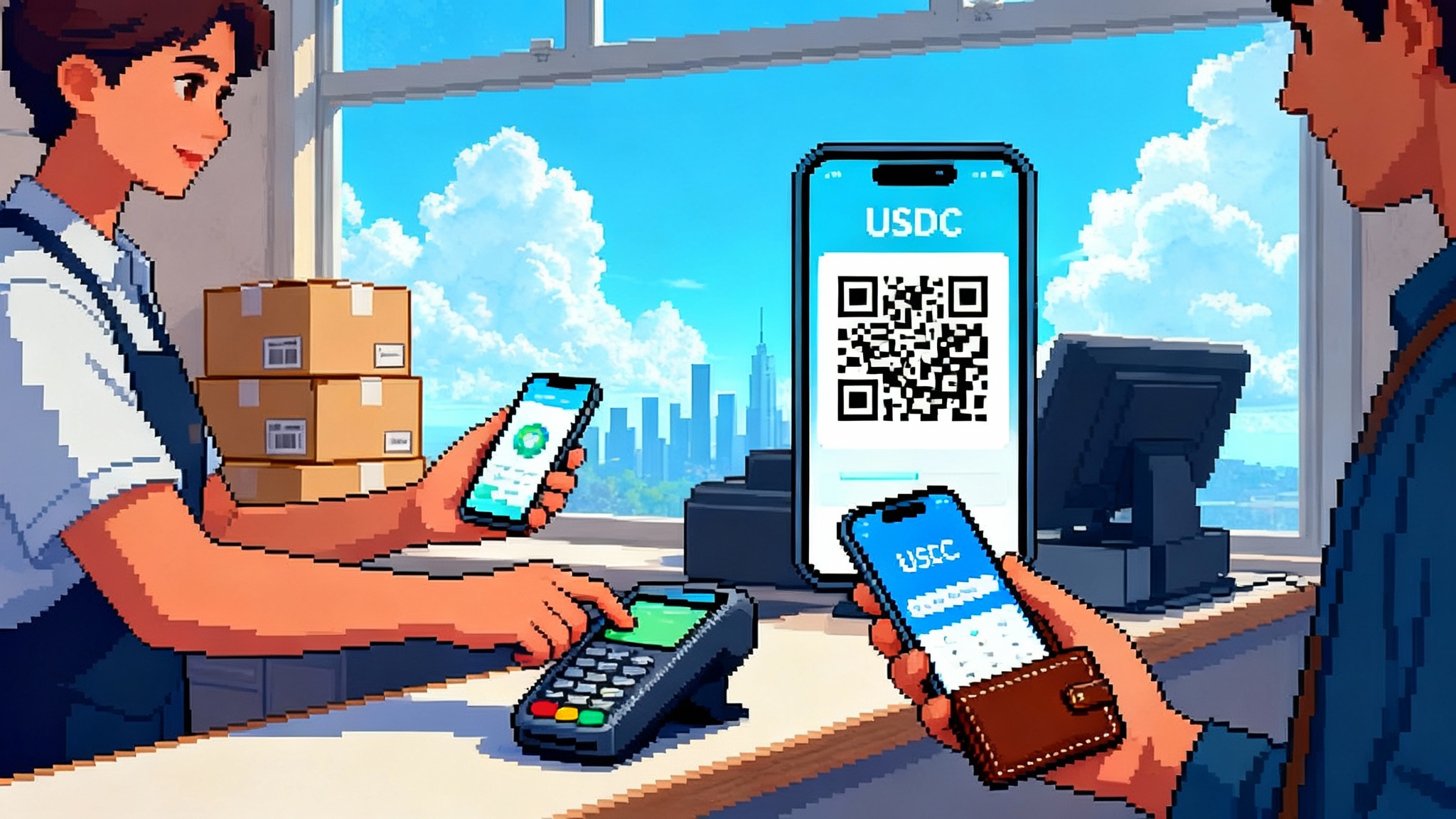

USDC at Checkout: Stripe, Shopify and Coinbase Go Live

Stripe adds recurring stablecoin billing, and Shopify with Coinbase enable USDC on Base at checkout. Merchants get lower fees, faster settlement, and global reach.

America's Stablecoin Law: The 2026 Builder's Field Guide

The GENIUS Act is now law. This field guide shows builders exactly what changes in 2026: who can issue on-chain dollars, how rulemaking will unfold, what audits and disclosures will be required, and where the biggest product wins lie.