Telegram Locks In TON, Web3’s First Billion-User Rail

Telegram just made TON the default for Mini Apps, rolled out TON Wallet in the United States, and added Chainlink’s CCIP and a decentralized AI network. This is crypto’s clearest path to a billion users.

Breaking: Telegram just turned TON into crypto’s mainstream onramp

Telegram has done something the industry talked about for years and rarely delivered: it chose a single chain and built the rails into the default user experience. In January 2025, Telegram and The Open Network Foundation announced TON as the exclusive blockchain for Telegram Mini Apps, with a one-month migration window for any app that touches on-chain features. That policy change means every new crypto interaction inside Telegram will assume TON by default, from wallet connections to asset transfers. It is the equivalent of a city declaring one standard gauge for every railway and then paving the stations into everyone’s pocket.

If the policy were the only news, it would already matter. But it lands alongside two other catalysts. First, Telegram’s integrated TON Wallet is now available to users in the United States, removing the last major geographic gap. Second, in October 2025 Chainlink expanded CCIP and Data Streams to TON, connecting the network to dozens of other chains and to professional-grade market data. Add Telegram’s new Cocoon decentralized AI network, which pays GPU providers in Toncoin for confidential inference, and the result looks like crypto’s first credible billion-user distribution channel.

To be clear about terms: web3 is the next generation of the web where ownership and value transfer are built into the network through blockchains. TON is the high-throughput blockchain that now powers Telegram’s on-chain experiences. Mini Apps are web applications that run natively inside Telegram chats. With the wallet baked into the interface and a single chain standard, a user can go from chat to purchase to gameplay to ownership in seconds, not minutes.

Why this moment is different from every previous “super app” attempt

For years, crypto adoption tripped over the same three hurdles:

- The user had no wallet in the app. Opening a browser extension, finding a seed phrase, and bridging tokens felt like airport security at rush hour.

- The developer faced a combinatorial mess of wallets, signing standards, chains, and bridges. Every integration meant support tickets.

- Distribution came last. Even if the product worked, onboarding the next hundred thousand users required partnerships that few startups could secure.

Telegram changes the order of operations. The wallet is visible in the side menu, the default chain is preselected, and distribution is built in through channels, groups, and bot discovery. When a policy sets a single wallet connect protocol and a single chain for Mini Apps, the matrix of possible failure modes collapses. Developers get a sane baseline. Users stop asking “which network am I on” because the answer is always TON. The friction drops from ten taps to two.

There is an analogy worth keeping in mind. The smartphone era only exploded after Apple unified the App Store, payments, and a secure hardware identity. Telegram is doing a software version of the same thing for on-chain actions inside chat, echoing the broader app store moment for DeFi.

What this unlocks inside Telegram

1) Payments that feel like messages

The biggest change is mental. If a payment feels like sending a photo in a chat, users will do it more often and for smaller amounts. With TON Wallet live globally, including the U.S., and with Toncoin as the default currency for non-fiat platform interactions, several payment patterns become trivial:

- Peer-to-peer tips and remittances to contacts with no extra app install.

- In-chat checkout for digital goods, content subscriptions, and pay-per-feature models.

- Channel monetization and Mini App payouts denominated in Toncoin, with automated revenue shares.

- Stablecoin flows for cross-border payments, where settlement happens at messaging speed and without bank hours, a trend accelerated by America’s stablecoin law.

Think of a news channel that sells a one-day pass to a premium live stream. Today that is a link out to a website and a card form. In Telegram it becomes a chat prompt that triggers a wallet approval and then gates the channel. No redirects, no browser, no re-entering email.

2) Games that convert curiosity into ownership

Telegram already proved it can send millions of users into a casual game overnight. With the wallet integrated and TON as the default, the onramp to actual ownership changes the economics:

- Loot that matters: cosmetic items, boosts, and seasonal passes can be minted on TON and traded in liquid markets.

- Fair drops at scale: verifiable randomness and transparent odds reduce the gray areas that haunt web games.

- Creator economies: streamers and community leaders can mint limited-run items for their audiences and earn secondary sales.

A concrete example: a Mini App dungeon crawler runs inside a group chat. Defeating a boss drops a tokenized key that unlocks a new map. Players can keep the key, gift it to a friend, or sell it. The drop is scarce, the ownership is real, and the action happens without leaving Telegram.

3) Digital goods that behave like assets

Telegram already made usernames, stickers, and emojis feel collectible. With the new policy, tokenization inside the app standardizes on TON. That means a consistent market structure for pricing, trading, and royalties. For brands, it looks like this:

- Release a limited sticker pack tied to a live event, with guaranteed scarcity and transparent ownership.

- Offer access keys that unlock members-only channels and Mini App features.

- Run loyalty programs where points are portable across partner Mini Apps because they live on the same chain.

None of this requires a user to learn new jargon. To them, it will look like buying and using digital items that work across their favorite Telegram spaces.

4) AI agents that can see a balance and settle a bill

Cocoon, a decentralized network for confidential compute, gives developers a way to run private inference jobs and pay GPU providers in Toncoin. Combine that with bots that can hold a wallet session and you get a new class of agent:

- A travel assistant that negotiates options in a group chat and then books using funds the group pre-deposited.

- A trading helper that watches price oracles and executes a preauthorized swap if conditions are met.

- A personal tutor bot that charges per answer and pays model inference costs on demand, keeping user prompts private.

The important shift is not that these things are theoretically possible. It is that the wallet, the chain, and the user interface now ship together.

The infrastructure that makes it believable

The glue behind this moment is a few boring but vital standards.

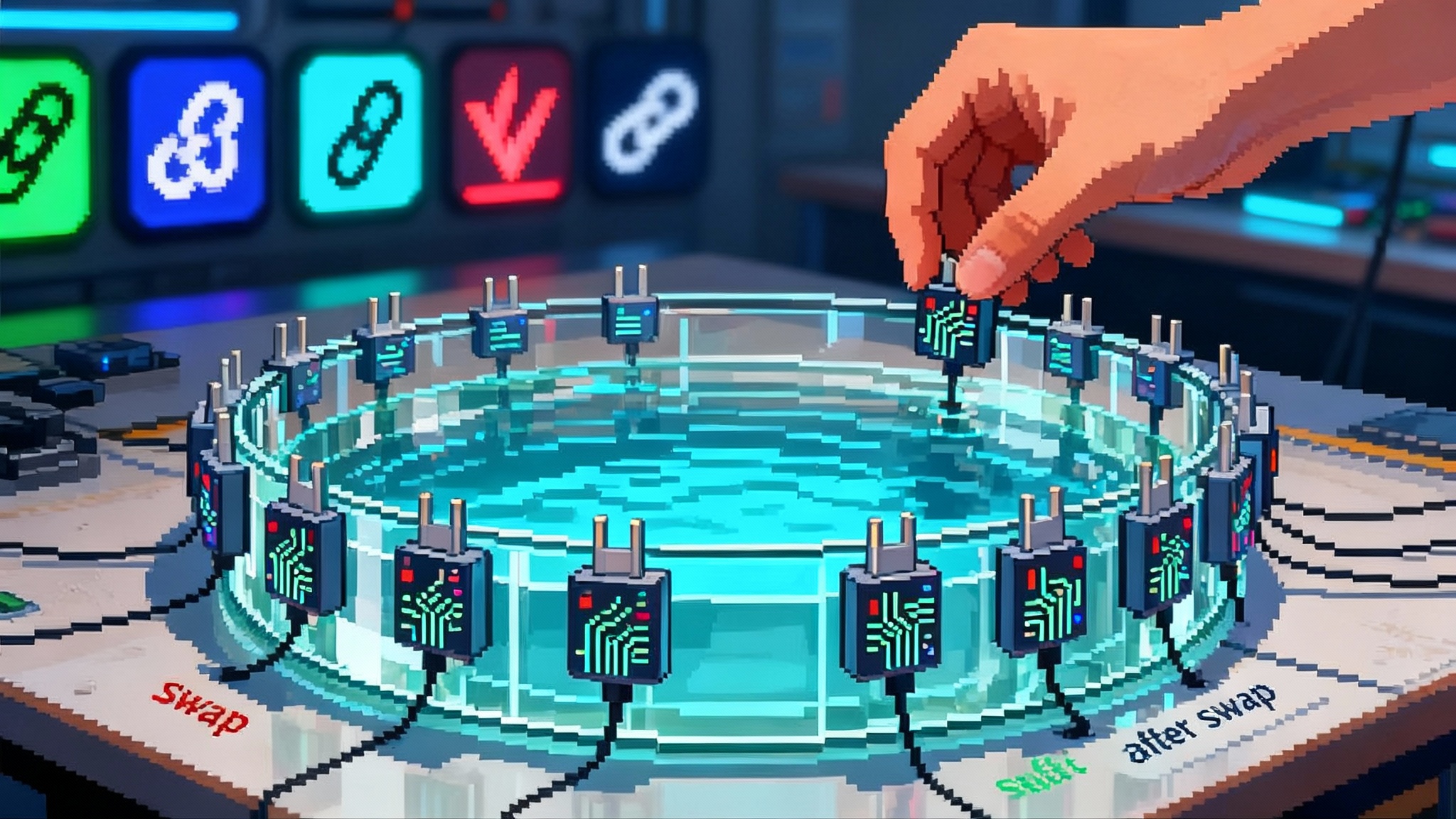

- One wallet connect protocol for Mini Apps. That removes entire classes of bugs related to mismatched wallets and signature formats.

- A chain with fast finality and simple account abstraction. That keeps user approvals under a second for common actions and simplifies recovery.

- Interoperability and data feeds that let assets and information flow in and out without hubs and spokes.

This is where Chainlink matters. In October 2025, Chainlink brought CCIP to TON and added low-latency Data Streams. CCIP connects TON to more than sixty chains and establishes a canonical cross-chain route for Toncoin. Data Streams brings market data suitable for trading and gaming. The short version: liquidity can move in, prices can be trusted, and developers can compose with the rest of crypto without leaving Telegram. The same pattern that pushed deposit tokens go mainstream now comes to chat-native apps.

With the U.S. rollout of TON Wallet, compliant onramps via partners, and a policy that sets Toncoin as the currency for non-fiat platform transactions, the pieces line up. The app where people already spend hours each day is becoming a place where value moves as easily as words.

The immediate playbook for builders

If you want to capture the opportunity, treat Telegram like an operating system and TON as the native kernel. Here is a concrete plan you can execute in weeks, not quarters.

Week 1 to 2: Ship a thin slice

- Pick a chat-native use case. Good first picks include a gated content channel, a community tip jar, or a simple game with a single on-chain collectible.

- Implement the wallet handshake using the required connect protocol. Make one on-chain action delightful, not five actions acceptable.

- Price the first item in Toncoin and, if your audience needs it, surface a stablecoin option for predictability.

Why this works: you are proving that the chat flow feels natural, and you are collecting the first usage data that will drive your next iteration.

Week 3 to 4: Wire growth into the product

- Add invite-for-reward loops where users earn in-app points that map to on-chain items. Because everything runs on the same chain, you can later mint those points without migrations.

- Use Telegram’s ad tools and any available Mini App ad credits to run small, targeted campaigns that push users directly into the bot or Mini App. Optimize for cost per on-chain action, not cost per click.

- Stand up a partner page and a channel, then run weekly drops that require an on-chain action to claim.

Why this works: Telegram’s distribution is native to how communities already form. You are matching the mechanics to the setting instead of dragging users elsewhere.

Month 2: Add money and markets

- If you are building a game, mint a single scarce item with clear utility and a posted supply curve. Avoid complex currencies and focus on items that players understand.

- If you are building a creator tool, let creators set price, scarcity, and royalties for their drops. Build a secondary market inside your Mini App so value stays in your ecosystem.

- Integrate Data Streams or comparable price feeds for any feature that reacts to markets. If your product touches other chains, plan a CCIP route for assets so you do not strand users who want to bring value from elsewhere.

Why this works: you are adding volatility-proof structure. Items, not points. Oracle-verified prices, not guesses. Bridges with guardrails, not ad hoc wrappers.

Month 3: Aim for autonomy and resilience

- Build a treasury policy. Decide what you will hold as Toncoin, what you will convert to stablecoins, and how you will handle revenue shares with creators.

- Implement compliance deep in the stack for U.S. users. That includes sanctions screening, suspicious activity monitoring where required, and clear user disclosures around refunds and chargebacks for digital goods.

- Prepare for platform risk. Keep your on-chain contracts and state portable, and design graceful degradation paths if Telegram policies tighten for any category you serve.

Why this works: you are turning a chat toy into a business. The moment distribution accelerates, the boring parts need to be in place.

Product recipes to steal

Sometimes it helps to see the whole loop. Here are four recipes you can adapt.

-

Creator membership: Users join a public channel, preview content, and pay in Toncoin for a thirty-day access key that is minted as a token. The bot checks ownership on entry. Renewal is a single tap. Secondary markets let fans resell time they do not use.

-

Co-op game night: A Mini App hosts a weekly boss fight. Entry requires a low-cost ticket priced in Toncoin. Winners earn a cosmetic that is tradeable, and a small portion of ticket revenue goes to the guild’s treasury automatically.

-

Pay-per-answer tutoring: A bot backed by a large language model on Cocoon charges per detailed explanation. It pays GPU inference fees as it goes and shares ten percent of revenue with community curators who create the best prompts and examples.

-

Local remittances: A neighborhood group uses a tipping bot to move value to a member who covers shared expenses. Once a month, the bot settles to a bank account through a fiat off-ramp partner. Receipts are posted in the chat so everyone can audit.

Each of these flows is short, human, and anchored in the tools Telegram now ships by default.

The risks and the honest mitigations

Choosing one chain for a platform introduces concentration risk. If TON experiences congestion during a large event, it can degrade user experience across many Mini Apps. The mitigation is architectural and operational: design contracts to pause nonessential features during spikes, keep noncritical items off peak, and use queues for expensive writes. Another risk is policy. Telegram has been clear about setting standards for on-chain integrations. That clarity is useful, but it means changes can ripple widely. You should own your minting contracts and keep your state exportable so you can replicate your product experience off Telegram if needed.

For U.S. builders, compliance is not optional. Work with partners for onramps and offramps, institute clear refund policies, and be explicit about what users are buying. If you sell digital keys, say so. If you are running a game with tradeable items, post drop rates and scarcity numbers. Transparency reduces confusion and keeps support costs down.

Finally, do not build tokenomics that require a bull market. Design items that are fun to own and useful to hold even when prices move sideways. Telegram’s distribution can deliver millions of curious users. Your product should convert curiosity into durable usage without leaning on speculation.

What success could look like in twelve months

If this platform shift works, by late 2026 Telegram could look like a marketplace of Mini Apps where:

- Tens of millions of users have made a first on-chain purchase without leaving chat.

- Thousands of creators sell memberships, drops, and access keys that can be traded.

- Games treat on-chain items like guitars and skins, not like spreadsheets.

- Agents that can see and spend balances handle real tasks, from travel booking to group budgeting.

The measuring sticks will be boring and important: first-purchase conversion rates, seven-day retention, chargeback rates on digital goods, and secondary sales velocity. If those numbers look like modern ecommerce rather than crypto experiments, web3 will have crossed a line.

The bottom line

A platform with more than nine hundred million monthly users just set a single default for wallets and chain, connected that chain to the wider crypto economy, and introduced a practical way to fund private AI. For builders, the opportunity is not theoretical. The rails are in the app, the standards are defined, and the audience is already there. The next wave of web3 growth will not be a separate destination. It will be a chat window that quietly became a checkout, a storefront, a game lobby, and a wallet. The teams that win will be the ones who ship simple flows quickly, wire growth into the product, and design for the long haul.

The immediate playbook for builders

If you want to capture the opportunity, treat Telegram like an operating system and TON as the native kernel. Here is a concrete plan you can execute in weeks, not quarters.

Week 1 to 2: Ship a thin slice

- Pick a chat-native use case. Good first picks include a gated content channel, a community tip jar, or a simple game with a single on-chain collectible.

- Implement the wallet handshake using the required connect protocol. Make one on-chain action delightful, not five actions acceptable.

- Price the first item in Toncoin and, if your audience needs it, surface a stablecoin option for predictability.

Why this works: you are proving that the chat flow feels natural, and you are collecting the first usage data that will drive your next iteration.

Week 3 to 4: Wire growth into the product

- Add invite-for-reward loops where users earn in-app points that map to on-chain items. Because everything runs on the same chain, you can later mint those points without migrations.

- Use Telegram’s ad tools and any available Mini App ad credits to run small, targeted campaigns that push users directly into the bot or Mini App. Optimize for cost per on-chain action, not cost per click.

- Stand up a partner page and a channel, then run weekly drops that require an on-chain action to claim.

Why this works: Telegram’s distribution is native to how communities already form. You are matching the mechanics to the setting instead of dragging users elsewhere.

Month 2: Add money and markets

- If you are building a game, mint a single scarce item with clear utility and a posted supply curve. Avoid complex currencies and focus on items that players understand.

- If you are building a creator tool, let creators set price, scarcity, and royalties for their drops. Build a secondary market inside your Mini App so value stays in your ecosystem.

- Integrate Data Streams or comparable price feeds for any feature that reacts to markets. If your product touches other chains, plan a CCIP route for assets so you do not strand users who want to bring value from elsewhere.

Why this works: you are adding volatility-proof structure. Items, not points. Oracle-verified prices, not guesses. Bridges with guardrails, not ad hoc wrappers.

Month 3: Aim for autonomy and resilience

- Build a treasury policy. Decide what you will hold as Toncoin, what you will convert to stablecoins, and how you will handle revenue shares with creators.

- Implement compliance deep in the stack for U.S. users. That includes sanctions screening, suspicious activity monitoring where required, and clear user disclosures around refunds and chargebacks for digital goods.

- Prepare for platform risk. Keep your on-chain contracts and state portable, and design graceful degradation paths if Telegram policies tighten for any category you serve.

Why this works: you are turning a chat toy into a business. The moment distribution accelerates, the boring parts need to be in place.

Product recipes to steal

Sometimes it helps to see the whole loop. Here are four recipes you can adapt.

-

Creator membership: Users join a public channel, preview content, and pay in Toncoin for a thirty-day access key that is minted as a token. The bot checks ownership on entry. Renewal is a single tap. Secondary markets let fans resell time they do not use.

-

Co-op game night: A Mini App hosts a weekly boss fight. Entry requires a low-cost ticket priced in Toncoin. Winners earn a cosmetic that is tradeable, and a small portion of ticket revenue goes to the guild’s treasury automatically.

-

Pay-per-answer tutoring: A bot backed by a large language model on Cocoon charges per detailed explanation. It pays GPU inference fees as it goes and shares ten percent of revenue with community curators who create the best prompts and examples.

-

Local remittances: A neighborhood group uses a tipping bot to move value to a member who covers shared expenses. Once a month, the bot settles to a bank account through a fiat off-ramp partner. Receipts are posted in the chat so everyone can audit.

Each of these flows is short, human, and anchored in the tools Telegram now ships by default.

The risks and the honest mitigations

Choosing one chain for a platform introduces concentration risk. If TON experiences congestion during a large event, it can degrade user experience across many Mini Apps. The mitigation is architectural and operational: design contracts to pause nonessential features during spikes, keep noncritical items off peak, and use queues for expensive writes. Another risk is policy. Telegram has been clear about setting standards for on-chain integrations. That clarity is useful, but it means changes can ripple widely. You should own your minting contracts and keep your state exportable so you can replicate your product experience off Telegram if needed.

For U.S. builders, compliance is not optional. Work with partners for onramps and offramps, institute clear refund policies, and be explicit about what users are buying. If you sell digital keys, say so. If you are running a game with tradeable items, post drop rates and scarcity numbers. Transparency reduces confusion and keeps support costs down.

Finally, do not build tokenomics that require a bull market. Design items that are fun to own and useful to hold even when prices move sideways. Telegram’s distribution can deliver millions of curious users. Your product should convert curiosity into durable usage without leaning on speculation.

What success could look like in twelve months

If this platform shift works, by late 2026 Telegram could look like a marketplace of Mini Apps where:

- Tens of millions of users have made a first on-chain purchase without leaving chat.

- Thousands of creators sell memberships, drops, and access keys that can be traded.

- Games treat on-chain items like guitars and skins, not like spreadsheets.

- Agents that can see and spend balances handle real tasks, from travel booking to group budgeting.

The measuring sticks will be boring and important: first-purchase conversion rates, seven-day retention, chargeback rates on digital goods, and secondary sales velocity. If those numbers look like modern ecommerce rather than crypto experiments, web3 will have crossed a line.

The bottom line

A platform with more than nine hundred million monthly users just set a single default for wallets and chain, connected that chain to the wider crypto economy, and introduced a practical way to fund private AI. For builders, the opportunity is not theoretical. The rails are in the app, the standards are defined, and the audience is already there. The next wave of web3 growth will not be a separate destination. It will be a chat window that quietly became a checkout, a storefront, a game lobby, and a wallet. The teams that win will be the ones who ship simple flows quickly, wire growth into the product, and design for the long haul.

The immediate playbook for builders

If you want to capture the opportunity, treat Telegram like an operating system and TON as the native kernel. Here is a concrete plan you can execute in weeks, not quarters.

Week 1 to 2: Ship a thin slice

- Pick a chat-native use case. Good first picks include a gated content channel, a community tip jar, or a simple game with a single on-chain collectible.

- Implement the wallet handshake using the required connect protocol. Make one on-chain action delightful, not five actions acceptable.

- Price the first item in Toncoin and, if your audience needs it, surface a stablecoin option for predictability.

Why this works: you are proving that the chat flow feels natural, and you are collecting the first usage data that will drive your next iteration.

Week 3 to 4: Wire growth into the product

- Add invite-for-reward loops where users earn in-app points that map to on-chain items. Because everything runs on the same chain, you can later mint those points without migrations.

- Use Telegram’s ad tools and any available Mini App ad credits to run small, targeted campaigns that push users directly into the bot or Mini App. Optimize for cost per on-chain action, not cost per click.

- Stand up a partner page and a channel, then run weekly drops that require an on-chain action to claim.

Why this works: Telegram’s distribution is native to how communities already form. You are matching the mechanics to the setting instead of dragging users elsewhere.

Month 2: Add money and markets

- If you are building a game, mint a single scarce item with clear utility and a posted supply curve. Avoid complex currencies and focus on items that players understand.

- If you are building a creator tool, let creators set price, scarcity, and royalties for their drops. Build a secondary market inside your Mini App so value stays in your ecosystem.

- Integrate Data Streams or comparable price feeds for any feature that reacts to markets. If your product touches other chains, plan a CCIP route for assets so you do not strand users who want to bring value from elsewhere.

Why this works: you are adding volatility-proof structure. Items, not points. Oracle-verified prices, not guesses. Bridges with guardrails, not ad hoc wrappers.

Month 3: Aim for autonomy and resilience

- Build a treasury policy. Decide what you will hold as Toncoin, what you will convert to stablecoins, and how you will handle revenue shares with creators.

- Implement compliance deep in the stack for U.S. users. That includes sanctions screening, suspicious activity monitoring where required, and clear user disclosures around refunds and chargebacks for digital goods.

- Prepare for platform risk. Keep your on-chain contracts and state portable, and design graceful degradation paths if Telegram policies tighten for any category you serve.

Why this works: you are turning a chat toy into a business. The moment distribution accelerates, the boring parts need to be in place.

Product recipes to steal

Sometimes it helps to see the whole loop. Here are four recipes you can adapt.

-

Creator membership: Users join a public channel, preview content, and pay in Toncoin for a thirty-day access key that is minted as a token. The bot checks ownership on entry. Renewal is a single tap. Secondary markets let fans resell time they do not use.

-

Co-op game night: A Mini App hosts a weekly boss fight. Entry requires a low-cost ticket priced in Toncoin. Winners earn a cosmetic that is tradeable, and a small portion of ticket revenue goes to the guild’s treasury automatically.

-

Pay-per-answer tutoring: A bot backed by a large language model on Cocoon charges per detailed explanation. It pays GPU inference fees as it goes and shares ten percent of revenue with community curators who create the best prompts and examples.

-

Local remittances: A neighborhood group uses a tipping bot to move value to a member who covers shared expenses. Once a month, the bot settles to a bank account through a fiat off-ramp partner. Receipts are posted in the chat so everyone can audit.

Each of these flows is short, human, and anchored in the tools Telegram now ships by default.

The risks and the honest mitigations

Choosing one chain for a platform introduces concentration risk. If TON experiences congestion during a large event, it can degrade user experience across many Mini Apps. The mitigation is architectural and operational: design contracts to pause nonessential features during spikes, keep noncritical items off peak, and use queues for expensive writes. Another risk is policy. Telegram has been clear about setting standards for on-chain integrations. That clarity is useful, but it means changes can ripple widely. You should own your minting contracts and keep your state exportable so you can replicate your product experience off Telegram if needed.

For U.S. builders, compliance is not optional. Work with partners for onramps and offramps, institute clear refund policies, and be explicit about what users are buying. If you sell digital keys, say so. If you are running a game with tradeable items, post drop rates and scarcity numbers. Transparency reduces confusion and keeps support costs down.

Finally, do not build tokenomics that require a bull market. Design items that are fun to own and useful to hold even when prices move sideways. Telegram’s distribution can deliver millions of curious users. Your product should convert curiosity into durable usage without leaning on speculation.

What success could look like in twelve months

If this platform shift works, by late 2026 Telegram could look like a marketplace of Mini Apps where:

- Tens of millions of users have made a first on-chain purchase without leaving chat.

- Thousands of creators sell memberships, drops, and access keys that can be traded.

- Games treat on-chain items like guitars and skins, not like spreadsheets.

- Agents that can see and spend balances handle real tasks, from travel booking to group budgeting.

The measuring sticks will be boring and important: first-purchase conversion rates, seven-day retention, chargeback rates on digital goods, and secondary sales velocity. If those numbers look like modern ecommerce rather than crypto experiments, web3 will have crossed a line.

The bottom line

A platform with more than nine hundred million monthly users just set a single default for wallets and chain, connected that chain to the wider crypto economy, and introduced a practical way to fund private AI. For builders, the opportunity is not theoretical. The rails are in the app, the standards are defined, and the audience is already there. The next wave of web3 growth will not be a separate destination. It will be a chat window that quietly became a checkout, a storefront, a game lobby, and a wallet. The teams that win will be the ones who ship simple flows quickly, wire growth into the product, and design for the long haul.

The immediate playbook for builders

If you want to capture the opportunity, treat Telegram like an operating system and TON as the native kernel. Here is a concrete plan you can execute in weeks, not quarters.

Week 1 to 2: Ship a thin slice

- Pick a chat-native use case. Good first picks include a gated content channel, a community tip jar, or a simple game with a single on-chain collectible.

- Implement the wallet handshake using the required connect protocol. Make one on-chain action delightful, not five actions acceptable.

- Price the first item in Toncoin and, if your audience needs it, surface a stablecoin option for predictability.

Why this works: you are proving that the chat flow feels natural, and you are collecting the first usage data that will drive your next iteration.

Week 3 to 4: Wire growth into the product

- Add invite-for-reward loops where users earn in-app points that map to on-chain items. Because everything runs on the same chain, you can later mint those points without migrations.

- Use Telegram’s ad tools and any available Mini App ad credits to run small, targeted campaigns that push users directly into the bot or Mini App. Optimize for cost per on-chain action, not cost per click.

- Stand up a partner page and a channel, then run weekly drops that require an on-chain action to claim.

Why this works: Telegram’s distribution is native to how communities already form. You are matching the mechanics to the setting instead of dragging users elsewhere.

Month 2: Add money and markets

- If you are building a game, mint a single scarce item with clear utility and a posted supply curve. Avoid complex currencies and focus on items that players understand.

- If you are building a creator tool, let creators set price, scarcity, and royalties for their drops. Build a secondary market inside your Mini App so value stays in your ecosystem.

- Integrate Data Streams or comparable price feeds for any feature that reacts to markets. If your product touches other chains, plan a CCIP route for assets so you do not strand users who want to bring value from elsewhere.

Why this works: you are adding volatility-proof structure. Items, not points. Oracle-verified prices, not guesses. Bridges with guardrails, not ad hoc wrappers.

Month 3: Aim for autonomy and resilience

- Build a treasury policy. Decide what you will hold as Toncoin, what you will convert to stablecoins, and how you will handle revenue shares with creators.

- Implement compliance deep in the stack for U.S. users. That includes sanctions screening, suspicious activity monitoring where required, and clear user disclosures around refunds and chargebacks for digital goods.

- Prepare for platform risk. Keep your on-chain contracts and state portable, and design graceful degradation paths if Telegram policies tighten for any category you serve.

Why this works: you are turning a chat toy into a business. The moment distribution accelerates, the boring parts need to be in place.

Product recipes to steal

Sometimes it helps to see the whole loop. Here are four recipes you can adapt.

-

Creator membership: Users join a public channel, preview content, and pay in Toncoin for a thirty-day access key that is minted as a token. The bot checks ownership on entry. Renewal is a single tap. Secondary markets let fans resell time they do not use.

-

Co-op game night: A Mini App hosts a weekly boss fight. Entry requires a low-cost ticket priced in Toncoin. Winners earn a cosmetic that is tradeable, and a small portion of ticket revenue goes to the guild’s treasury automatically.

-

Pay-per-answer tutoring: A bot backed by a large language model on Cocoon charges per detailed explanation. It pays GPU inference fees as it goes and shares ten percent of revenue with community curators who create the best prompts and examples.

-

Local remittances: A neighborhood group uses a tipping bot to move value to a member who covers shared expenses. Once a month, the bot settles to a bank account through a fiat off-ramp partner. Receipts are posted in the chat so everyone can audit.

Each of these flows is short, human, and anchored in the tools Telegram now ships by default.

The risks and the honest mitigations

Choosing one chain for a platform introduces concentration risk. If TON experiences congestion during a large event, it can degrade user experience across many Mini Apps. The mitigation is architectural and operational: design contracts to pause nonessential features during spikes, keep noncritical items off peak, and use queues for expensive writes. Another risk is policy. Telegram has been clear about setting standards for on-chain integrations. That clarity is useful, but it means changes can ripple widely. You should own your minting contracts and keep your state exportable so you can replicate your product experience off Telegram if needed.

For U.S. builders, compliance is not optional. Work with partners for onramps and offramps, institute clear refund policies, and be explicit about what users are buying. If you sell digital keys, say so. If you are running a game with tradeable items, post drop rates and scarcity numbers. Transparency reduces confusion and keeps support costs down.

Finally, do not build tokenomics that require a bull market. Design items that are fun to own and useful to hold even when prices move sideways. Telegram’s distribution can deliver millions of curious users. Your product should convert curiosity into durable usage without leaning on speculation.

What success could look like in twelve months

If this platform shift works, by late 2026 Telegram could look like a marketplace of Mini Apps where:

- Tens of millions of users have made a first on-chain purchase without leaving chat.

- Thousands of creators sell memberships, drops, and access keys that can be traded.

- Games treat on-chain items like guitars and skins, not like spreadsheets.

- Agents that can see and spend balances handle real tasks, from travel booking to group budgeting.

The measuring sticks will be boring and important: first-purchase conversion rates, seven-day retention, chargeback rates on digital goods, and secondary sales velocity. If those numbers look like modern ecommerce rather than crypto experiments, web3 will have crossed a line.

The bottom line

A platform with more than nine hundred million monthly users just set a single default for wallets and chain, connected that chain to the wider crypto economy, and introduced a practical way to fund private AI. For builders, the opportunity is not theoretical. The rails are in the app, the standards are defined, and the audience is already there. The next wave of web3 growth will not be a separate destination. It will be a chat window that quietly became a checkout, a storefront, a game lobby, and a wallet. The teams that win will be the ones who ship simple flows quickly, wire growth into the product, and design for the long haul.

The immediate playbook for builders

If you want to capture the opportunity, treat Telegram like an operating system and TON as the native kernel. Here is a concrete plan you can execute in weeks, not quarters.

Week 1 to 2: Ship a thin slice

- Pick a chat-native use case. Good first picks include a gated content channel, a community tip jar, or a simple game with a single on-chain collectible.

- Implement the wallet handshake using the required connect protocol. Make one on-chain action delightful, not five actions acceptable.

- Price the first item in Toncoin and, if your audience needs it, surface a stablecoin option for predictability.

Why this works: you are proving that the chat flow feels natural, and you are collecting the first usage data that will drive your next iteration.

Week 3 to 4: Wire growth into the product

- Add invite-for-reward loops where users earn in-app points that map to on-chain items. Because everything runs on the same chain, you can later mint those points without migrations.

- Use Telegram’s ad tools and any available Mini App ad credits to run small, targeted campaigns that push users directly into the bot or Mini App. Optimize for cost per on-chain action, not cost per click.

- Stand up a partner page and a channel, then run weekly drops that require an on-chain action to claim.

Why this works: Telegram’s distribution is native to how communities already form. You are matching the mechanics to the setting instead of dragging users elsewhere.

Month 2: Add money and markets

- If you are building a game, mint a single scarce item with clear utility and a posted supply curve. Avoid complex currencies and focus on items that players understand.

- If you are building a creator tool, let creators set price, scarcity, and royalties for their drops. Build a secondary market inside your Mini App so value stays in your ecosystem.

- Integrate Data Streams or comparable price feeds for any feature that reacts to markets. If your product touches other chains, plan a CCIP route for assets so you do not strand users who want to bring value from elsewhere.

Why this works: you are adding volatility-proof structure. Items, not points. Oracle-verified prices, not guesses. Bridges with guardrails, not ad hoc wrappers.

Month 3: Aim for autonomy and resilience

- Build a treasury policy. Decide what you will hold as Toncoin, what you will convert to stablecoins, and how you will handle revenue shares with creators.

- Implement compliance deep in the stack for U.S. users. That includes sanctions screening, suspicious activity monitoring where required, and clear user disclosures around refunds and chargebacks for digital goods.

- Prepare for platform risk. Keep your on-chain contracts and state portable, and design graceful degradation paths if Telegram policies tighten for any category you serve.

Why this works: you are turning a chat toy into a business. The moment distribution accelerates, the boring parts need to be in place.

Product recipes to steal

Sometimes it helps to see the whole loop. Here are four recipes you can adapt.

-

Creator membership: Users join a public channel, preview content, and pay in Toncoin for a thirty-day access key that is minted as a token. The bot checks ownership on entry. Renewal is a single tap. Secondary markets let fans resell time they do not use.

-

Co-op game night: A Mini App hosts a weekly boss fight. Entry requires a low-cost ticket priced in Toncoin. Winners earn a cosmetic that is tradeable, and a small portion of ticket revenue goes to the guild’s treasury automatically.

-

Pay-per-answer tutoring: A bot backed by a large language model on Cocoon charges per detailed explanation. It pays GPU inference fees as it goes and shares ten percent of revenue with community curators who create the best prompts and examples.

-

Local remittances: A neighborhood group uses a tipping bot to move value to a member who covers shared expenses. Once a month, the bot settles to a bank account through a fiat off-ramp partner. Receipts are posted in the chat so everyone can audit.

Each of these flows is short, human, and anchored in the tools Telegram now ships by default.

The risks and the honest mitigations

Choosing one chain for a platform introduces concentration risk. If TON experiences congestion during a large event, it can degrade user experience across many Mini Apps. The mitigation is architectural and operational: design contracts to pause nonessential features during spikes, keep noncritical items off peak, and use queues for expensive writes. Another risk is policy. Telegram has been clear about setting standards for on-chain integrations. That clarity is useful, but it means changes can ripple widely. You should own your minting contracts and keep your state exportable so you can replicate your product experience off Telegram if needed.

For U.S. builders, compliance is not optional. Work with partners for onramps and offramps, institute clear refund policies, and be explicit about what users are buying. If you sell digital keys, say so. If you are running a game with tradeable items, post drop rates and scarcity numbers. Transparency reduces confusion and keeps support costs down.

Finally, do not build tokenomics that require a bull market. Design items that are fun to own and useful to hold even when prices move sideways. Telegram’s distribution can deliver millions of curious users. Your product should convert curiosity into durable usage without leaning on speculation.

What success could look like in twelve months

If this platform shift works, by late 2026 Telegram could look like a marketplace of Mini Apps where:

- Tens of millions of users have made a first on-chain purchase without leaving chat.

- Thousands of creators sell memberships, drops, and access keys that can be traded.

- Games treat on-chain items like guitars and skins, not like spreadsheets.

- Agents that can see and spend balances handle real tasks, from travel booking to group budgeting.

The measuring sticks will be boring and important: first-purchase conversion rates, seven-day retention, chargeback rates on digital goods, and secondary sales velocity. If those numbers look like modern ecommerce rather than crypto experiments, web3 will have crossed a line.

The bottom line

A platform with more than nine hundred million monthly users just set a single default for wallets and chain, connected that chain to the wider crypto economy, and introduced a practical way to fund private AI. For builders, the opportunity is not theoretical. The rails are in the app, the standards are defined, and the audience is already there. The next wave of web3 growth will not be a separate destination. It will be a chat window that quietly became a checkout, a storefront, a game lobby, and a wallet. The teams that win will be the ones who ship simple flows quickly, wire growth into the product, and design for the long haul.