America’s Stablecoin Law Puts Crypto On Main Street

The GENIUS Act turns dollar stablecoins from a gray area into regulated payment rails. Here’s what the law enables, who moves first, and the playbook to ship in the next 12 to 24 months.

The breakthrough that changes the rails

On July 18, 2025, the United States signed into law the Guiding and Establishing National Innovation for U.S. Stablecoins Act. In one ceremony, dollar stablecoins jumped from gray zone to green light. The promise is simple to state and hard to overstate: regulated, dollar‑backed tokens can now move like software while being supervised like money.

This is the payments story to watch. Not because speculation has won, but because payments finally have a canonical way to put a U.S. dollar on the internet with legal clarity. The question is no longer whether stablecoins are allowed. The question is who puts them to work the fastest and with the cleanest user experience.

What the law actually says

The law does three big things.

-

Creates a new issuer category. It establishes the permitted payment stablecoin issuer, or PPSI. Only PPSIs and certain comparably regulated foreign issuers may mint payment stablecoins for use in the United States. The statute defines what counts as a payment stablecoin, which assets may back it, how reserves must be held, which disclosures must be made, and who can supervise the issuer. For the canonical language, read the GENIUS Act text at Congress.gov.

-

Pulls issuers into AML. Issuers become financial institutions under the Bank Secrecy Act with recordkeeping, monitoring, and suspicious activity reporting duties. They must maintain the technical ability to comply with lawful orders, including blocking, freezing, or burning tokens when ordered by a court or authorized agency, as summarized in the Senate Banking fact sheet.

-

Mandates cash‑like reserves and transparency. Reserves must be one for one in high quality liquid assets such as cash, demand deposits, and short duration U.S. Treasuries, with monthly public disclosures. Issuers cannot pay interest merely for holding a stablecoin. The goal is simple: make a payment stablecoin behave like cash, not like a savings product.

There is a timing detail that matters for roadmaps. Regulators have a deadline to write rules. The law takes effect on the earlier of 18 months from enactment or 120 days after final rules are issued. That creates a window to build pilots during 2025 to 2026 and to scale in 2026 to 2027 once supervisory plumbing is live.

Why this could be the iPhone moment for payments

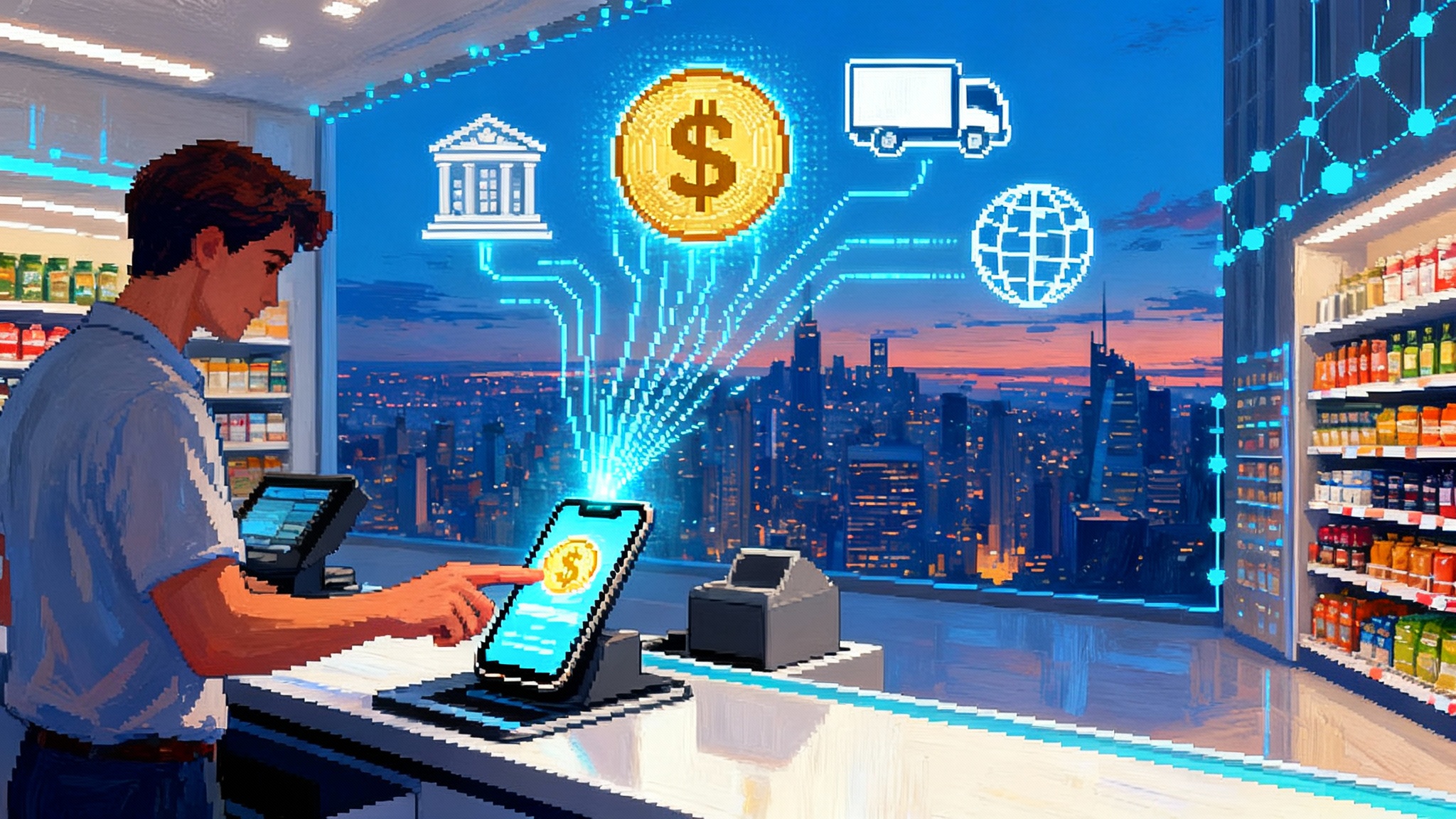

In 2007, the smartphone turned the internet from a place you visited into the thing you carried. This law can do the same for money. Stablecoins take the dollar from a bank ledger that closes at night and on weekends and move it to blockchains that are open, programmable, and instant. Nothing about that idea is new. What is new is that the United States now says who is allowed to issue, how the reserves work, what happens if something goes wrong, and which agencies can knock on the door.

This combination of speed and supervision is the unlock. If you are a bank, you can now treat stablecoins as a new settlement asset you can explain to a risk committee. If you are a retailer, you can reduce fees and fraud on card‑like payments and settle in minutes instead of days. If you are a fintech, you can build payout products that work across borders without signing up for bespoke local banking in every corridor. If you are a developer, you get a universal dollar primitive that is programmable and trusted enough for mainstream users.

The immediate playbook by sector

Here is what happens first, and why.

-

Banks: offer issuance, custody, and settlement. Regional and money‑center banks will either become PPSIs themselves or partner with one. The near‑term revenue is not consumer wallets; it is corporate settlement. Think treasury teams using stablecoins for supplier payments, marketplace disbursements, and cash concentration between subsidiaries. Banks can also wrap stablecoin rails inside their own portals and sell faster receivables to clients without the headache of new logins. For a parallel track on deposit tokens, see how JPM Coin debuts on Base.

-

Fintechs: turn tokens into payout engines. Fintechs already run at internet speed on the front end and bank speed on the back end. Stablecoins close that gap. Expect early wins in creator payouts, gig worker earnings, and cross‑border platform disbursements. The compliance edge will belong to those who embed know your customer, travel rule messaging, and sanctions screens at the moment of address collection, not after the fact. The action item is to expose a stablecoin payout option next to ACH and wires, then route by least cost and fastest delivery.

-

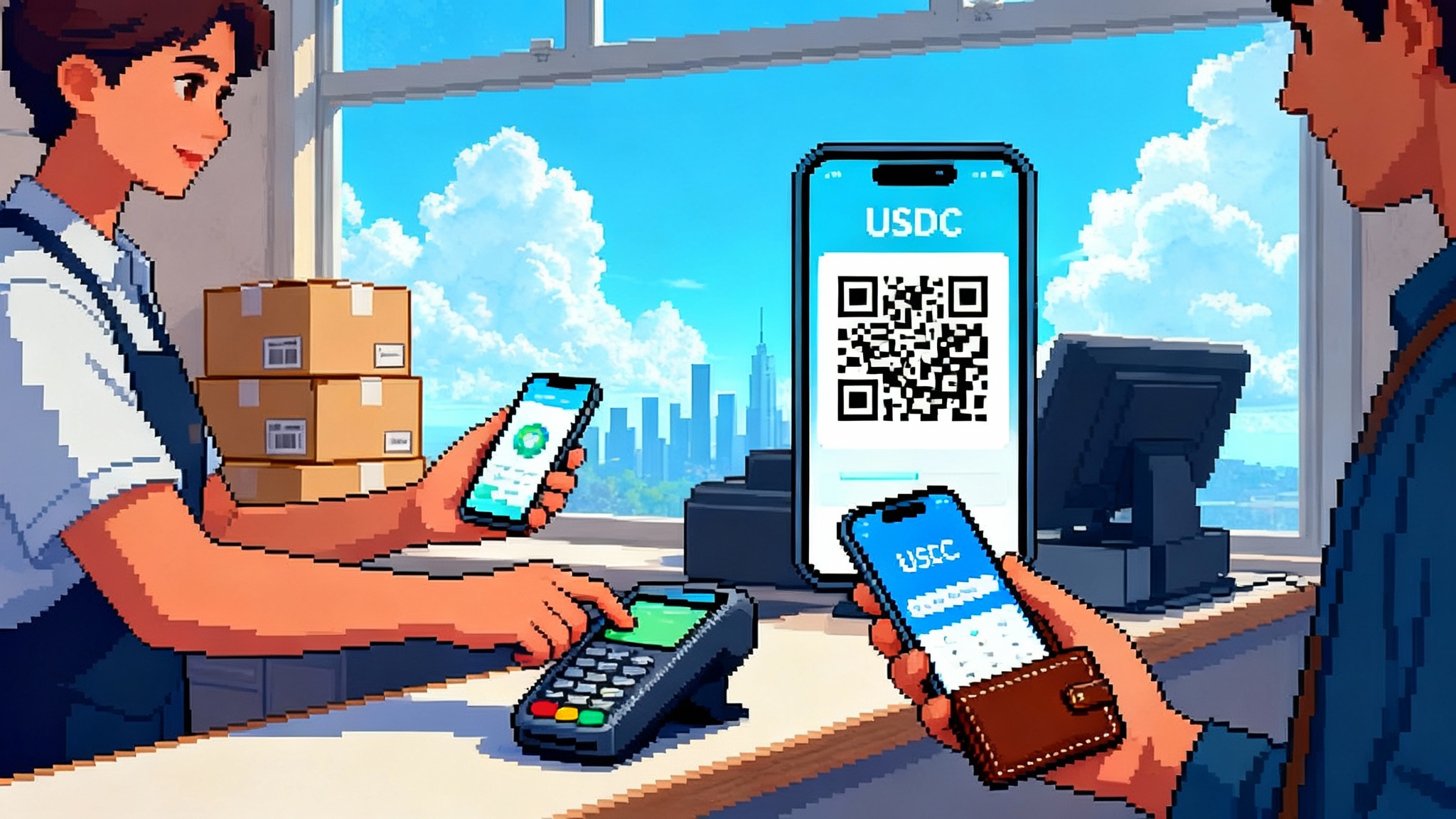

Retailers and platforms: accept, auto‑convert, and settle. The first step is to accept stablecoins at checkout on the networks where your customers already are. The second is to auto‑convert to dollars in the background with guaranteed quotes, so finance teams see no change in cash management. The third is to settle supplier invoices and marketplace earnings in stablecoins to collapse settlement cycles. The action item is to pilot stablecoin acceptance in a few online storefronts where chargeback rates are painful or international acceptance is complex.

-

Marketplaces and payroll providers: pay anyone, anywhere, 24 by 7. Gig platforms and payroll firms can move from batch files to streaming money. Stablecoin payroll with same day redemption makes the waiting period between work and pay disappear. The action item is to roll out opt‑in stablecoin payouts with clear tax withholding and instant conversion to local fiat for workers who want it.

Layer twos become the new card networks

Most of the volume will not live on a base chain. Ethereum layer twos and other high throughput chains will carry mainstream payments because they feel instant, are cheap, and are already connected to major wallets. That trend accelerates with data availability advances captured in L2 fee freefall trends.

What does that look like in practice?

-

Pick two or three networks where your customers live today. Base, Optimism, and Arbitrum lead on liquidity for dollar tokens, while zk‑based networks increasingly offer low fees with stronger settlement assurances. Maturity in fraud‑proof systems like OP fault proofs and BoLD will keep pushing risk down.

-

Use account abstraction to make wallets feel like apps. Users should be able to tap a button, pay with stablecoins without seeing seed phrases, and recover access if they lose a phone. If you are a processor, bake this into your SDKs so merchants never read a single glossary page.

-

Hide gas. If a consumer needs the native token to move a dollar, you have already lost. Sponsor gas for purchases and bake the fee into your spread. Treat the chain like a switch, not a destination.

-

Preauthorize and settle like cards, but at internet speed. You can mirror a card flow with a hold and a capture, then settle the net in stablecoins. Refunds can be handled by signing and sending a token back to the customer’s wallet with a receipt that is easier to reconcile than a stack of chargeback codes.

-

Build for chain and jurisdiction failover. If a network pauses or fees spike, your routing should fail over to another chain. If a destination country tightens rules, your policy engine should reroute to a compliant corridor by reading issuer and address metadata at runtime.

Circle, Tether, and the new PPSIs

-

Circle: Circle has spent years building a compliance‑first posture. The PPSI framework matches that approach. Expect Circle to seek federal supervision where available, to double down on monthly reserve attestations, and to publish more granular wallet policy. The growth lever is distribution. Circle will focus on issuing across the dominant layer twos, embedding into large processors, and using bank partnerships to turn corporate treasuries into onchain settlement hubs.

-

Tether: Tether dominates offshore liquidity. The new rules draw a firm line for the U.S. market. A foreign issuer that wants U.S. access must meet comparable standards and comply with lawful orders. That means documented reserves, sanctions controls, and the demonstrated ability to freeze or burn when ordered. If an issuer does not comply, the law directs Treasury to designate it and restrict centralized trading venues in the United States from offering that asset. The strategic choice for Tether is either to wall off U.S. distribution or to stand up a fully compliant channel for American counterparties.

-

New PPSIs: This is where the action will be. Expect two models. First, banks or bank subsidiaries that issue directly, with reserve assets in their own balance sheet and a simple redemption window. Second, nonbank PPSIs supervised at the federal level or by states with harmonized standards. The winning differentiators will be distribution, not just licensing. A PPSI that lands processors, payroll platforms, and developer tooling will beat one with a license and no pipes.

Processors, wallets, and developers: how to win in the next 12 to 24 months

Think of this in three layers.

- Acceptance and payout

-

Processors should add a stablecoin rail next to cards and ACH. Make it one checkbox for merchants, with managed compliance, managed wallets, and stablecoin to fiat conversion on receipt. Support at least two dollar tokens from independent issuers to minimize single‑issuer risk.

-

Wallets should ship consumer grade recovery, biometrics, and spend controls. If a wallet cannot set a per‑merchant allowance, flag risky addresses, and support family accounts, it is not ready for the mainstream.

-

Developers should reach for a single SDK that signs, sponsors gas, manages smart session keys, and routes to the cheapest chain that meets policy. Abstract the chain. Expose only a promise: when the customer taps pay, the merchant gets a dollar‑equivalent with a receipt.

- New money motions that print immediate value

-

Merchant payouts. Marketplaces can settle seller earnings hourly instead of weekly. Faster settlement reduces working capital, which is worth more than a small card discount.

-

Remittances. Corridors that have historically cost 5 to 7 percent and taken days can drop to sub‑1 percent with delivery in minutes. Build a network of cash‑out partners where regulators permit it, and always provide an in‑app quote that includes every fee.

-

Payroll. Offer on‑demand pay in stablecoins, with automated withholding and employer controls. Add auto‑conversion to local currency and tax export files so accountants do not revolt.

-

Loyalty. Issue points that are denominated in dollars and live on open rails. Let customers move value between a store wallet and a multi‑merchant coalition. That unlocks redemption at the speed of the internet and improves breakage economics in your favor when customers choose to hold.

- Risk, compliance, and operations that scale

-

Address screening and travel rule. Collect wallet addresses early, screen them, and attach travel rule data when required. Do not design this as a separate step. Bake it into checkout.

-

Freeze and refund playbooks. Issuers must be able to freeze and burn under a lawful order. Processors and wallets should mirror that capability with merchant‑facing controls that can rapidly refund or hold funds with clear logs for auditors.

-

Reserve monitoring. If you are an issuer or a partner with balance sheet exposure, build automated checks that compare circulating supply to disclosed reserves each month and alert on gaps. Treat reserve transparency as an always‑on signal.

-

Incident response. Write a playbook for chain outages, issuer designations, or sanctions events. Your plan should include immediate routing changes, customer messaging, and a reconciliation mode that degrades gracefully without losing records.

Compliance realities you cannot ignore

-

Reserves: one for one in cash and short duration government assets. No risky paper. Monthly disclosures. Independent attestations. If you are a corporate treasurer evaluating an issuer, read the reserve policy like you would a money market fund’s statement of additional information.

-

No interest: stablecoins are not savings accounts. Issuers cannot pay yield for simply holding the token. If a platform offers yield, understand whether it comes from staking of other assets, lending programs, or rebates, and whether you are comfortable with that risk.

-

Lawful orders: issuers must be able to block, freeze, and burn when ordered. That is controversial in crypto circles. It is table stakes for regulated finance. Make sure your own applications can respect holds and blocks that come from the issuer or a court.

-

Foreign issuers: if they do not comply with a lawful order, they can be designated, and centralized intermediaries in the United States will be restricted from offering their tokens. If your business relies on a foreign stablecoin, plan for an exit ramp or a swap path.

-

Scope of activity: PPSIs are limited to issuance, redemption, custody, and reserve management, plus directly supporting activities. If you are designing an all‑in‑one super app inside the issuer, separate regulated issuance from unregulated bells and whistles using clean legal entities and interfaces.

What to build now vs. next

Build now

-

Add a stablecoin pay and payout button for a subset of customers who opt in. Make it disappear into your current flows. Ask for a wallet, offer a hosted option, and sponsor gas.

-

Ship treasury tools that let finance teams hold zero tokens overnight if they want. Instant auto‑conversion removes the fear of volatility.

-

Integrate two layer twos and route by smart policy. Customers should never have to pick a network.

-

Draft your compliance blueprint. Map know your customer, travel rule, sanctions checks, freeze and refund flows, and issuer incident responses. Put this in front of your regulator if you have one.

Build next

-

Issue co‑branded or private label stablecoins as a retailer or platform, in partnership with a PPSI. The use case is closed‑loop loyalty that spends like cash inside your ecosystem and settles like cash with suppliers.

-

Stand up stablecoin payroll with opt in and auto‑conversion. Start with contractors and move to employees once your tax teams are comfortable.

-

Expand to new corridors. For cross‑border businesses, the second or third corridor is where margin and retention show up. Ship the first corridor to learn. Scale the next two to matter.

The risks if we stall

The worst outcome is to wait for perfect clarity. The law already gives enough guidance to start. If incumbents hesitate, new PPSIs and wallets will own the customer interface while traditional processors get pushed deeper into commodity plumbing. If builders ignore user experience, consumers will meet the law through confusing seed phrases and strange fees and will walk away. If issuers fail on transparency, one incident can put all dollar tokens under a cloud.

The bottom line

The United States just gave dollar stablecoins a legal home. The job now is to turn that legal clarity into everyday utility. That means bank‑grade controls that disappear into software. It means processors adding a single checkbox. It means retailers piloting auto‑convert acceptance. It means developers routing to the best chain without making customers pick one.

We have seen this movie. When the right rules and the right user experience arrive together, new rails become the default. If the industry ships now, this will read as the moment the internet finally got a native dollar that everyone could use.