Hong Kong turns on real value tokenization with Ensemble

At Hong Kong FinTech Week on November 3, 2025, the HKMA launched the Ensemble Pilot to move live tokenized deposits and money market funds, while the SFC let licensed exchanges tap global order books. Here is why that combination matters and how to build on it.

What just happened at Hong Kong FinTech Week

On November 3, 2025, Hong Kong moved real money onto real ledgers. The Hong Kong Monetary Authority said the next phase of Project Ensemble will process live tokenized deposits and begin with tokenized money market funds. The announcement was explicit about enabling real value transactions rather than more proofs of concept, and it set out a path to expand financial applications over the next year. You can see the core commitment in the HKMA Ensemble Pilot remarks.

On the same day, the Securities and Futures Commission told the market that licensed virtual asset exchanges in Hong Kong can connect to their global order books. Officials framed it as a practical way to deepen liquidity and align with how liquidity is aggregated in traditional markets, as covered by Reuters on SFC liquidity shift.

Two switches flipped the same day. One moves cash and funds on chain so they can settle instantly and programmatically. The other connects Hong Kong order flow to global liquidity. Together, they form a functional rail for real world assets in Asia in 2026.

How the Ensemble Pilot works in plain language

Tokenized deposits are digital representations of bank deposits issued by licensed banks. They are not a new currency. They sit on a ledger where movement and ownership can be enforced by code. The pilot’s first production use case focuses on money market funds because that is where many corporate treasuries park idle cash. If treasurers can move cash from a tokenized deposit into a tokenized fund and back again in minutes, they get same day yield capture, precise cut off control, and automatic cash sweeps at end of day.

The mechanism looks like this:

- A client holds a tokenized deposit at a participating bank, recorded on an Ensemble connected network. The balance is fully reflected on the bank core ledger, so the legal claim is identical to a regular deposit.

- A tokenized money market fund, run by an approved manager and custodian, issues and redeems fund tokens based on net asset value. Fund records sync to the same or an interoperable network.

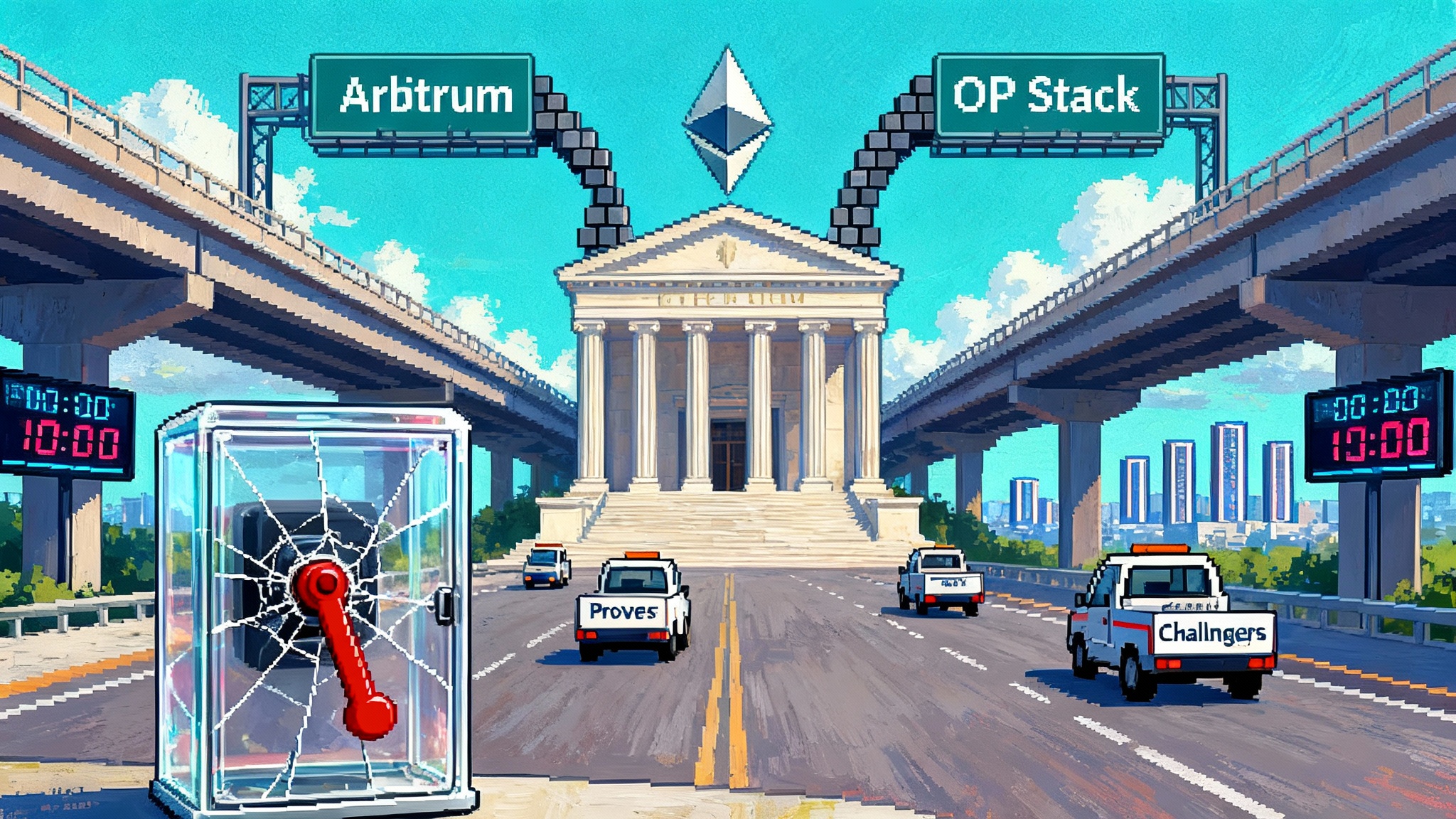

- A smart contract executes delivery versus payment. When the client subscribes, the contract simultaneously moves deposit tokens to the fund and fund tokens to the client. No pending wires. No daylight exposure.

- Corporate treasury policies and regulatory checks run before each movement. Whitelists and risk rules can be enforced by the ledger itself, not just by back office checklists.

Because the assets and the money both live on programmable ledgers, operations that used to rely on time windows and manual reconciliations become event driven. Cut offs become code. NAV strikes can align with programmable settlement. Liquidity buffers can be monitored in real time instead of end of day.

SFC liquidity connectivity in practice

Here is how global order book access changes the trading experience for licensed Hong Kong venues. Before November 2025, a buy order on a local platform could only match against orders placed with that same platform in Hong Kong. Now, that same order can be routed or matched against orders sitting on an affiliated platform in regions such as Europe or the Middle East, under shared surveillance and risk controls. That matters for price depth, spreads, and execution certainty, especially during volatile windows when local books thin out.

For institutions, this is a prerequisite for serious market making in tokenized assets. For issuers of tokenized funds or real world assets, it means the listing venue is plugged into a larger pool, which improves launch conditions. For regulators, the model still preserves traceability and accountability, since the connectivity is permissioned, supervised, and designed to maintain delivery versus payment and client protection standards.

What accelerates in 2026

The 2026 calendar will not just be about more pilots. Expect three practical shifts:

-

Tokenized cash management goes mainstream for Asia treasuries. Large corporates with Hong Kong regional hubs will begin end of day cash sweeps from operational accounts into tokenized money market funds, with automatic redemptions in the morning. The yield pick up is not new, but the certainty and speed are. The process becomes intraday, not T+1. Treasurers can embed investment policy checks in software, and compliance teams can approve or halt flows with an on chain rule rather than an email.

-

Cross border settlements become programmable. With deposits and funds tokenized under bank supervision, it becomes easier to negotiate supplier payments that settle against delivery milestones, escrow terms, or shipment data. A Hong Kong buyer can release payment to a regional supplier when a bill of lading event hits an oracle, with money arriving as a tokenized deposit at the supplier bank in minutes. If the supplier wants overnight yield, it can auto subscribe into a tokenized fund and redeem before payroll the next morning.

-

Capital market issuance gets a matching cash leg. Tokenized primary issues need instant settlement to eliminate failed trades and collateral drag. With tokenized deposits available, issuers can request funds at closing as a programmable transfer, not a series of cut off dependent wires. That simplifies reconciliations and reduces syndicate frictions.

These shifts are incremental and boring in the best way. They replace email chains and end of day batch files with deterministic workflows. That is how meaningful infrastructure change feels when it hits production.

What it means for stablecoins

Stablecoins will not disappear, but their job description changes. In Hong Kong, a regulated stablecoin license regime coexists with tokenized deposits under central bank supervision. That pushes corporate treasurers toward using tokenized deposits for day to day settlement, because the legal claim and accounting treatment are identical to bank cash. Stablecoins retain comparative advantages in a few areas:

- Open network reach. If you must pay counterparties outside a bank permissioned network, a widely accepted stablecoin can be a bridge in the interim. For consumer adoption patterns, see the USDC at Checkout playbook.

- 24 by 7 programmability across public chains. Some developers will keep building consumer applications and cross platform experiences that rely on public chain composability.

- Cross jurisdiction wallets for long tail suppliers or marketplaces, where bank coverage is patchy and onboarding is costly.

As tokenized deposits and tokenized funds become interoperable across regulated networks, many institutions will prefer settlement assets that map cleanly to existing treasury, audit, and regulatory controls. Expect stablecoin issuers to respond with stronger reserve transparency, direct bank connectivity, and permissioned rails that interoperate with institutional networks. For a US policy view, read the America's stablecoin law field guide.

Competitiveness for the United States and the European Union

The United States has the deepest capital markets and the most active stablecoin issuers, but its regulatory picture remains fragmented. Agencies disagree on classification and perimeter, and federal legislation has been slow. Tokenized deposit initiatives exist at individual banks, yet there is no unified public signal equivalent to a central bank endorsed pilot for production settlement of tokenized cash at national scale. That gap will matter in 2026 when issuers, fund managers, and treasurers pick where to launch repeatable tokenized cash programs.

The European Union has the clearest statute in Markets in Crypto Assets for stablecoins and tokenized instruments, and European custodians have advanced digital asset capabilities. But the European approach has been more conservative about exchange connectivity and cross border order flow in digital assets. Liquidity is still fragmented. Hong Kong combining real value tokenized money with exchange connectivity could become a regional advantage while the United States and Europe work through legal harmonization and competition considerations.

In short, Hong Kong chose to ship two practical pieces at once. If the United States wants to keep its edge, it needs a visible path for tokenized bank money and consistent rules for exchange connectivity. If the European Union wants to lead, it needs to marry MiCA clarity with deeper liquidity access across borders. Both have the talent and infrastructure. What they lack are the green lights that turn experiments into utilities.

A builder’s playbook for the next 180 days

You do not need to wait for perfect clarity to start. You do need to build with the rails and rules that now exist.

-

Pick a settlement asset and map the legal claim. If you are serving institutions in Hong Kong, prioritize tokenized deposits at a participating bank that is connected to the Ensemble Pilot. Confirm how balances reconcile to the bank core ledger and how client claims are recorded. For consumer applications, decide when to use a regulated stablecoin and how it connects to your institutional flows.

-

Choose your fund partner for sweep and yield. For treasury use cases, identify money market funds that will tokenize under Hong Kong rules and can plug into the same or interoperable networks. Build a subscription and redemption module that enforces investment policy rules, cut off logic, and compliance checks in code.

-

Implement true delivery versus payment by design. Settlement is not a user interface feature. Use atomic swaps or contractual settlement primitives that move cash and assets simultaneously. Write pre trade checks for whitelists, sanctions, and investor eligibility. Log the entire pre trade decision tree for audit.

-

Prepare for SFC exchange connectivity. If you list or market tokenized instruments, assume your venue or broker will connect to global order books through an affiliated platform. That means your trade engine must handle deeper books, multi venue best execution, and shared surveillance messages. Build order routing that honors regulatory flags and client consents. Expect standard interfaces for compliance events such as cancellation, pause, and post trade reporting.

-

Build compliance into the wallet layer. Enforce know your customer, anti money laundering, and travel rule checks before a wallet touches production balances. Consider segregated wallet tiers for retail, professional investors, and institutions. Implement proof of control for addresses and authorize device binding. For privacy, explore zero knowledge proofs for selective disclosure, but do not rely on them to replace baseline checks.

-

Harden your oracle and event inputs. If your product triggers payments on logistics or market data events, treat oracles as critical infrastructure. Use signed data, multiple sources, and circuit breakers. Give operations teams the ability to halt automation and push manual overrides when something breaks.

-

Establish a reconciliation ritual. Even with atomic settlement, regulators and auditors will ask how your on chain records reconcile to bank ledgers and fund registries. Automate daily reconciliations with exception queues. Build human readable reports that a non technical auditor can follow.

-

Start with a closed loop, then open it. Launch with a set of allow listed counterparties and a fixed number of banks and funds. Prove out straight through processing, reporting, and incident handling. Only then add external venues, cross jurisdiction flows, and public chain bridges.

-

Design for failover. Payments and redemptions must continue even if your smart contract pauses. Pre agree manual fallback procedures with banks and fund administrators. Run live drills. Document how clients can exit to conventional rails.

-

Measure the business outcome, not the blockchain. Track settlement time saved, failed trades avoided, cash yield captured, and working capital unlocked. Make these metrics visible to treasurers and boards. They care about cash and risk.

What could go wrong and how to mitigate it

- Fragmented standards. If each bank and fund manager implements different interfaces, developers face a patchwork. Join industry working groups early and push for shared message formats, identity standards, and testing sandboxes. Treat interoperability as a product requirement, not a hope.

- Liquidity mismatches in tokenized funds. Money market funds hold short dated instruments, but intraday redemption pressure can still strain liquidity. Build guardrails, redemption windows, and dynamic fees into smart contracts that mirror the fund prospectus.

- Cross venue compliance drift. Global order book connectivity will stress surveillance. Implement shared alert taxonomies and test case libraries with your affiliates. Use synthetic trade data to train models before go live.

- Vendor lock in. If your product depends on a single bank flavor of tokenized deposits, your roadmap depends on theirs. Architect adapters so you can swap settlement providers without a full rewrite.

The bottom line

On one day in November, Hong Kong coupled a real settlement asset with real liquidity access. The Ensemble Pilot brings tokenized deposits and money market funds into production. The SFC move gives licensed exchanges the depth they need. The effect is cumulative. Issuers can plan products that settle in seconds. Treasurers can run playbooks that used to require batch files and end of day cut offs. Developers can ship workflows that feel like modern software, not email dressed up as finance.

This is not about headlines. It is about utility. If you build in or for Asia, the window to ship tokenized cash, funds, and cross border settlement products is open. Pick your settlement asset, wire up delivery versus payment, and integrate the new liquidity. The market will reward teams that turn these switches into experiences clients can trust.