Polygon’s POL and AggLayer Reset the Multichain Liquidity Map

As major exchanges auto-converted MATIC to POL in mid-October 2025 and AggLayer shipped AggKit for non CDK chains, Polygon is moving to a single network token and standardized cross-chain state. Here is what changes, who captures value, and what builders should ship before 2026.

The news in one sentence

October 2025 closed the book on MATIC as major exchanges converted balances to POL, while AggLayer introduced AggKit so that even non CDK chains can join its mesh. Together, a single network token and standardized way to sync state across chains point to a real reset in how liquidity, value capture, and user experience will work across the Polygon ecosystem and beyond. Coinbase’s help center confirms auto-conversion during October 14 to 17, 2025, a visible signal that the migration is now operational at scale.

Why a single network token matters now

Tokens do not only pay fees. In practice they define the rail where value settles and accrues. Migrating from a chain token tied to one network to a network token designed for an aggregated ecosystem changes several things at once:

- Uniform inventory. Market makers, custodians, and exchanges can keep one balance sheet line for Polygon exposure rather than juggling MATIC on some venues and POL on others.

- Aligned incentives. Staking and rewards can point at the same target, using POL as a common unit for staking and ecosystem airdrops.

- Simpler fees. Gas, rebates, and protocol fees can be measured and routed in a single currency, even if individual chains choose different gas tokens locally.

If fragmentation felt like carrying around a handful of foreign coins at every airport, a single network token is the multi country debit card that just works at check in, the cafe, and the ride to the city. You still visit many terminals, but your wallet stops being the bottleneck.

Standardized cross-chain state is the missing rail

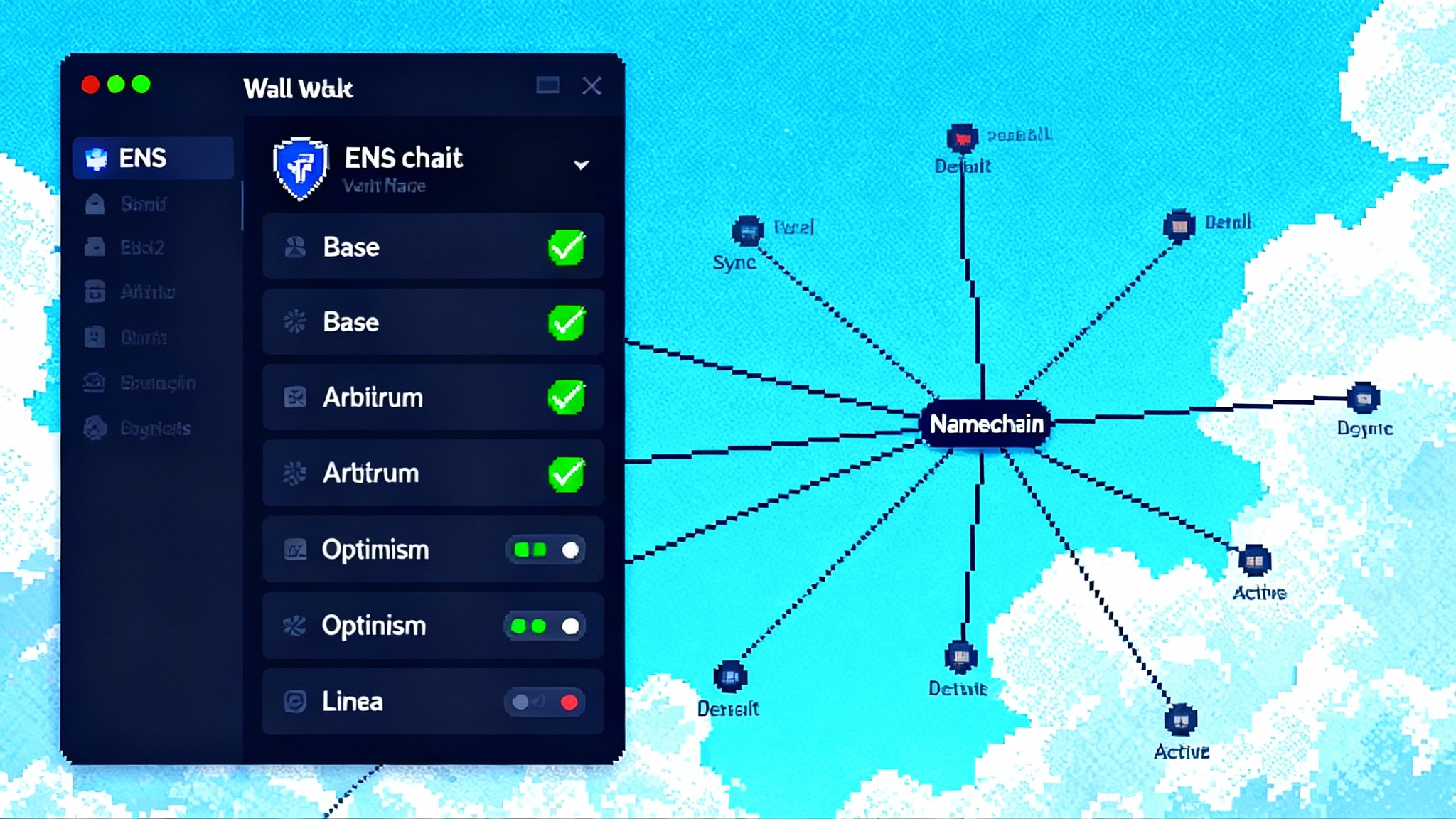

Tokens unify the accounting. The hard part is unifying truth. AggLayer’s approach is to standardize how chains read and write to a shared view of state. With AggKit, non CDK chains can now integrate more directly, using two components that do what the names imply: AggSender to safely write a chain’s state into AggLayer, and AggOracle to safely read the AggLayer’s global state back on chain. The post introducing AggKit to non CDK chains ties this to the v0.3.5 release that hardens security and updates the unified bridge.

What this gives developers is a standard way to confirm that something which happened on Chain A can be safely acted upon on Chain B within predictable windows. Instead of bespoke trust graphs, each new chain plugs into the same interop circuit.

Think of AggLayer like a modern shipping standard. Before containers, every port had its own cranes and customs recipes. Containers won because they made the box and the manifest standard, which let ports invest in speed without negotiating every dock. AggLayer aims to do that for cross-chain state. Chains still pick their engines and rules, but the boxes and manifests match.

How defragmentation of liquidity happens in practice

Liquidity fragments in four quiet ways:

- Canonical confusion: The same asset exists as many wrapped versions, each with slightly different risk and price.

- Crossing costs: Moving between chains involves time, fees, and bridge risk, which raises the hurdle for arbitrage and market making.

- Split incentives: Programs reward liquidity on one chain that is not reusable on another, so capital sits in separate buckets.

- Operational drag: Custodians, venues, and traders must reconcile snapshots across multiple ledgers, which slows inventory moves.

A single network token and standardized cross-chain state attack all four. Here is the mechanism:

- Fewer wrappers. If the unified bridge and AggLayer state become the default path, then assets pick up a canonical route.

- Faster, safer settlement. When chains can safely read and write a shared state, an arbitrage that needed two slow hops collapses into one predictable handoff.

- Network-wide incentives. Rewarding POL stakers or liquidity providers based on aggregated activity makes sense when the activity is legible across the mesh.

- Tighter operations. Exchanges and market makers can fund and rebalance in POL across integrated chains with less reconciliation overhead.

Picture a set of small ponds feeding into a lake through narrow streams. In the old world, each pond rose and fell on its own, and fishers had to row between them. With a deeper channel between ponds and the lake, water levels equalize faster. That is what defragmentation looks like when the rails are in place.

The MEV map gets redrawn

When value moves across chains with predictable settlement, the search space for profitable reordering expands. Today, most maximal extractable value is trapped inside one chain’s block builder and its mempool. As AggLayer normalizes cross-chain reads and writes, several shifts follow:

- Cross-chain atomicity becomes routine. Bundled operations across chains turn two independent bets into a single packaged outcome. That tends to compress spreads and move more value capture to the protocol layer where bundling occurs, a trend echoed by Uniswap’s DUNA shift primes protocol fees.

- Shared rails change who captures value. If a standardized interop path becomes the default for cross-chain bundles, value can accrue to whoever runs or secures those rails.

- Orderflow markets evolve. Wallets and apps will negotiate for better execution that spans multiple chains. Private relay routes and intent-based execution will become more common.

The end state is not zero MEV. It is a transition from fragmented, opaque capture to network-level, auctioned capture with clearer rules.

Simpler UX by design

People do not want to think about chains. They want outcomes. The combination of uniform token accounting and standardized cross-chain state lets wallets and apps hide the plumbing without hiding the guarantees.

- One balance view. A wallet can show a unified POL balance backed by holdings and claims across connected chains.

- Fewer approvals. If the canonical bridge and AggLayer state become the default, apps can request one durable permission for a family of actions rather than one per chain, much like how a TON-only pivot compresses crypto UX.

- Predictable timing. A standardized state machine lets wallets display real-time arrival windows.

- Gas that does not trap users. With a shared unit and paymaster patterns, apps can front gas where it makes sense and settle fees in POL after the fact, a pattern that rhymes with Visa’s multichain stablecoin expansion.

The result is not magic. It is product discipline supported by rails that finally make the right abstractions possible.

What builders should ship before 2026

1) Adopt canonical routing for assets

- Integrate the unified bridge as the default route where it is available and safe. Treat alternative wrappers as opt in, not the default.

- Normalize token metadata. Use a single asset identifier across chains and contracts.

- Build inventory-aware contracts. Let treasuries and liquidity managers query balances across chains in one call and rebalance through standardized messages.

2) Make POL a first-class citizen in your system

- Denominate protocol fees, rebates, and staking rewards in POL where possible. If you support other gas tokens locally, reconcile to POL in your accounting and analytics.

- Expose a clear POL runway in your docs and app: how much POL is needed for users, how you subsidize gas, and how fees flow back to the treasury or to stakers.

3) Ship cross-chain execution that puts users first

- Add intent-based flows for complex actions, with one approval and a guaranteed outcome or a revert with proof.

- Support private orderflow for sensitive trades and publish execution receipts afterward for auditability.

- Implement commit-reveal or preconfirmation guarantees for large orders.

4) Prepare your protocol for MEV that spans chains

- Add hooks for solver competitions. Let solvers bid to execute cross-chain bundles where your users get paid for orderflow.

- Add anti-sandwich constraints to your routing. Enforce user-first constraints by design and document them.

- Share the wins. If your protocol captures new value from cross-chain auctions, route a portion to POL stakers or to public goods that strengthen the shared rails.

5) Harden for interoperability risk

- Treat the AggLayer path as a dependency. Monitor its status, version changes, and timelocks on upgrades. Build auto pause logic that reroutes to safe fallbacks if a dependency degrades.

- Test failure modes explicitly. Simulate partial delivery where one leg arrives and another is delayed.

- Keep proofs verifiable in your front end. If the app shows a green checkmark for a cross-chain action, wire that to verifiable data the user or a watchdog can inspect.

6) Design your data model for a mesh, not a lane

- Use a chain-id-agnostic internal model. Reference positions and obligations by a global identifier, then map to per-chain addresses at the edge.

- Build analytics that speak in outcomes. Track fill rates, arrival times, and cost per completed action across the mesh.

What could still go wrong

- Security regression in the interop path. Favor conservative limits while the release hardens, and escalate gradually as the system proves itself under load.

- Liveness stalls. If one chain in a bundle slows finality, users feel the worst-case latency. Expose real-time expectations in the UI and let users choose faster, slightly more expensive routes when they need them.

- Governance misalignment. If shared rails capture more value, arguments will follow about how to split it.

- Unexpected custody rules. Some venues may support POL differently than others for a time. Build deposit and withdrawal checks that recognize venue-specific rules and steer users to the path that will not strand funds.

Metrics that will show it is working

- Share of cross-chain transactions that use the standardized path.

- Median cross-chain arrival time for common operations like a deposit to a lending market on another chain.

- Spread compression across identical assets on connected chains.

- Protocol and wallet-level MEV rebates paid back to users.

- Growth of POL staking participation and the portion of protocol fees or airdrops routed to those stakers.

Context you can cite inside your org

- Exchanges executed the migration at production scale, which reduced operational fragmentation and simplified custody. Coinbase publicly documented its mid-October conversion window.

- AggKit is live as part of AggLayer updates and explicitly targets non CDK chains with a standard read-write model.

- Polygon PoS connecting to AggLayer is on the near-term roadmap. Treat it as a practical constraint for routing decisions in the next releases of your product.

The takeaway

This year’s pair of moves turned a long-running thesis into practical rails. A single network token got real when exchanges converted balances on a schedule. A standardized cross-chain state machine got real when AggKit opened the door to chains that did not share Polygon’s stack. Taken together, they change who can move liquidity, who captures the value of coordination, and how products can hide the pain of multichain from users. Builders who adapt their accounting, routing, and execution models to these rails will be positioned to capture the network effects of liquidity that finally acts like one pool rather than many buckets.