UBS Just Took Tokenized Fund Orders Live In Production

UBS just ran live onchain subscriptions and redemptions for its tokenized U.S. dollar money market fund using a Digital Transfer Agent standard. Here is how these rails compress reconciliation from days to minutes and make automation the default.

The week the fund order went onchain

UBS quietly crossed a line this week. The bank processed a live subscription and redemption for its tokenized U.S. dollar money market fund, uMINT, using a new technical standard called the Digital Transfer Agent (DTA). The production run was small, but it was real money and real plumbing. UBS acted as fund sponsor, DigiFT took the order as an onchain distributor, and the workflow executed on Ethereum using smart contracts rather than emailed forms and batch files. UBS called it the first end to end in production tokenized fund workflow, and that is the headline to remember. UBS release spells out the details.

If that sounds like one more pilot, it is not. It is the moment a global bank used public chain logic to do the most boring, most important part of funds: take in money, issue shares, take back shares, return money. Once that loop works at production grade, everything around it can begin to speed up.

Why this changes the clock speed of funds

Anyone who has worked a fund order knows the choreography. A distributor sends a subscription order to the transfer agent. A custodian moves cash. The fund administrator strikes a net asset value. Multiple systems reconcile at the end of day. Exceptions are chased by email. Even in efficient shops this dance takes a day or two, and exceptions can linger for a week.

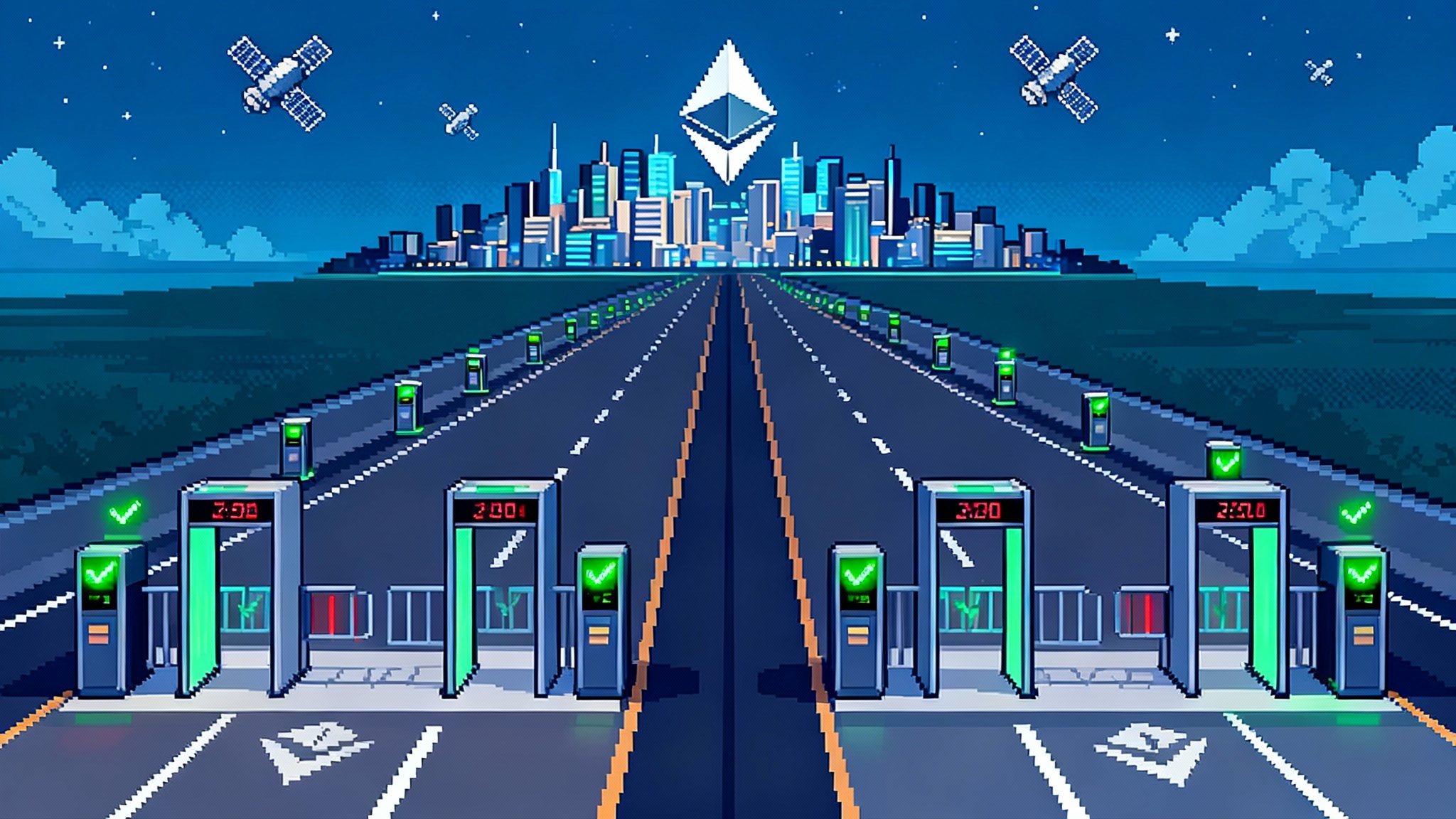

The new rails turn that choreography into a single state machine. The DTA standard defines how a fund’s smart contract keeps the register. When a SWIFT message arrives with an instruction, the contract updates the register and emits events that downstream systems consume. Instead of every participant maintaining a separate ledger and proving they agree, they read from the same source of truth. Reconciliation goes from days to minutes because there is nothing left to reconcile beyond cash settlement and a lightweight audit.

For readers who prefer a metaphor, imagine the fund register as a shared spreadsheet where each row is a share position and each change is cryptographically signed. Under the old model, every participant kept a private copy and compared the spreadsheets overnight. Under the new model, everyone reads the same sheet and changes propagate instantly.

As payments leaders move core flows onchain, the industry playbook is converging. See how card networks are adopting similar patterns in Visa’s stablecoin shift goes multichain.

The rails behind the breakthrough

Three pieces clicked into place.

-

A fund data model that lives onchain. The Digital Transfer Agent defines how a tokenized fund manages share issuance, transfer restrictions, redemptions, and the golden record of who owns what. It is not a firm specific system. It is a repeatable pattern asset managers can adopt.

-

A bridge from bank systems to onchain logic. Instead of building bespoke blockchain gateways, banks can use existing SWIFT infrastructure and the ISO 20022 message formats they already speak. A subscription or redemption message travels the usual secure path, lands in a runtime that translates it into a smart contract call, then writes back confirmations in the same ISO format. That makes this plug and play for operations teams rather than a science project for engineers. For a deeper look at how SWIFT messages trigger onchain actions, see the Swift and Chainlink partnership recap.

-

Oracles and policy engines that make compliance and pricing programmable. A modern fund needs price truth and rule checks. NAV data can be posted onchain by the fund administrator or an oracle network. Transfer restrictions and know your customer rules can be expressed as code that runs before a share transfers. This is already moving. Superstate uses onchain NAV feeds for a tokenized treasury fund, and WisdomTree recently announced onchain NAV for a tokenized private credit product. The names differ across providers, but the pattern is the same. Pricing and policy stop being spreadsheets and become callable services. Privacy sensitive checks can leverage confidential smart contracts on Ethereum.

Put those together and the back office becomes event driven. A subscription instruction mints shares to a whitelisted wallet. A redemption instruction burns shares and releases cash. Every action emits a machine readable event that custodians, administrators, and distributors can consume immediately.

Collapsing reconciliation in practice

Consider a typical end of month surge. Hundreds of orders arrive before a cutoff. Under the traditional model, they queue for overnight processing. Exceptions spill into the next day. Under the DTA model, each order is validated as it arrives. If a wallet is not allowed to hold the share class, the policy engine rejects it in seconds. If the cash leg lands, the fund contract mints and the administrator’s system sees the position change instantly. The only delays are where they must be: the bank rails that move money and the human review on flagged cases.

This is why the UBS event matters. It shows that an institutional fund can keep the official register onchain and still live inside the bank processes that auditors and regulators already understand. As soon as that is true, the incentives flip. Every second spent reconciling two systems that could reference an onchain golden record becomes a cost without a benefit.

What becomes default when the rails are standard

- Programmable compliance. Instead of manual allowlists, role based controls live in the fund’s policy. A distributor can only mint to the wallets it has screened. A wallet can hold units only if its verifiable credentials prove the right attributes. Violations are blocked by code before they settle.

- NAV oracles. When the administrator publishes NAV onchain, every participant reads the same price at the same time. Secondary venues can enforce a price band, lending protocols can size collateral, and administrators can audit a single feed.

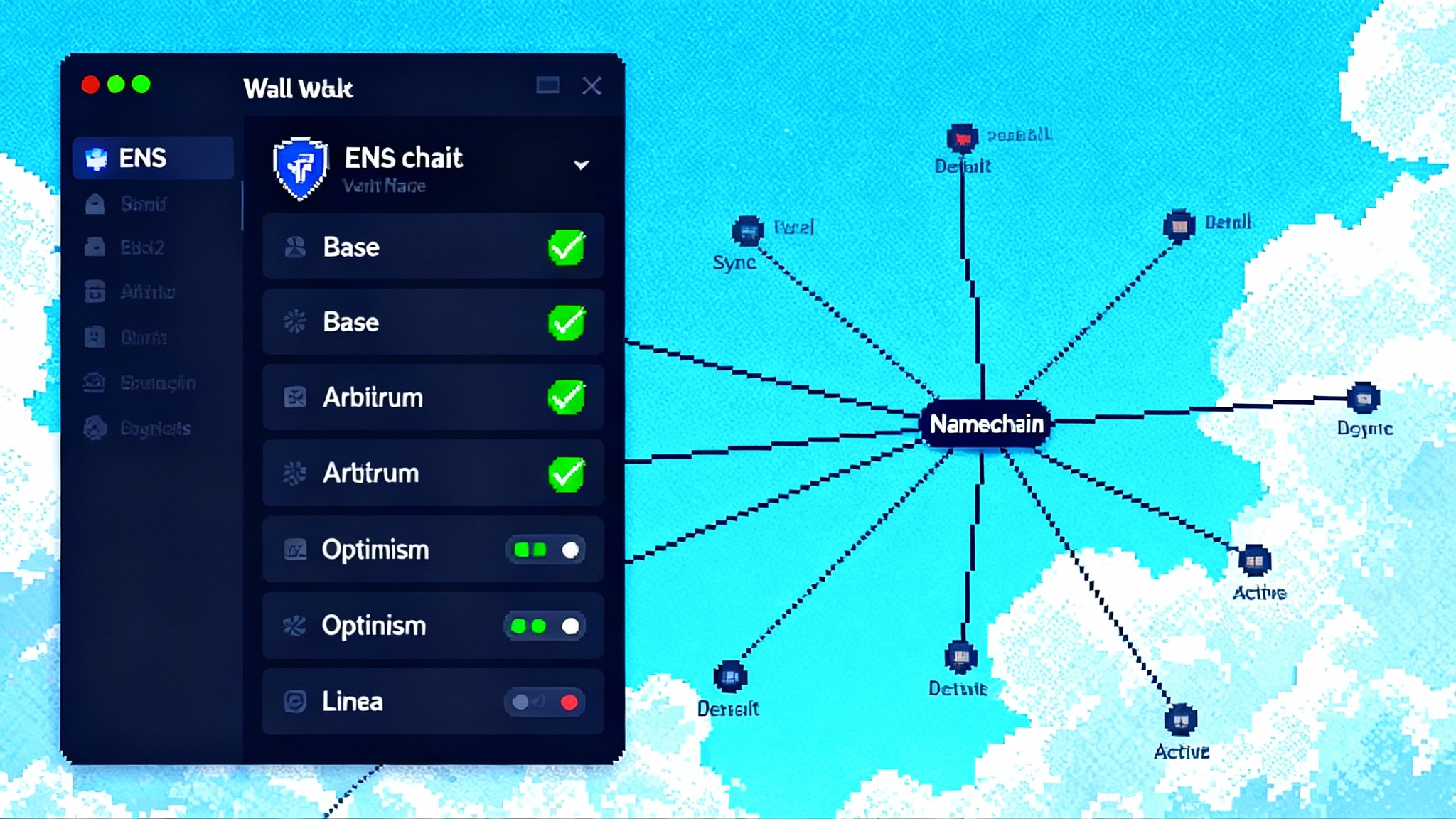

- Cross chain distribution. Funds do not need to pick a single chain silo. Interoperability protocols can coordinate across networks so a fund can maintain a central share register and distribute units where the investors are. That means a compliant share class on a low fee network for retail distribution, with institutional units on a different network where custody integrations are mature.

- Corporate actions automation. Today a dividend or split drives thousands of emails and file drops. With onchain lifecycle events, the fund contract emits a machine readable instruction that downstream systems apply the same minute. The participants still need controls and approvals, but the mechanics of who gets what and when are encoded, not re keyed.

2026: what this unlocks for the main players

Asset managers

- Instant settlement share classes. Launch a T+0 share class for large orders that meet stricter pre funding rules. How to do it: use ISO 20022 messages for pre validation and require cash on hold before the cutoff. The DTA contract mints on receipt, and the administrator reconciles positions in near real time.

- Automated lifecycle events. Encode distributions and fee accruals. Set a calendar for dividend events and use the contract to calculate per wallet entitlements based on the position at record time. The administrator signs off on the event, then the contract writes the entries and emits artifacts for accounting.

- Real time transfer agency for model portfolios. Create programmable baskets that move as one. Let a managed account switch from a short duration fund to an ultra short fund atomically based on preset risk rules. The funds’ policy engines clear the transfer in seconds, not days.

Exchanges and alternative trading systems

- Collateral that behaves like cash. Tokenized fund units with onchain NAV and redemption rights can be accepted as collateral with lower haircuts. Trading venues can build same session credit checks because they can query balances and price in real time.

- Secondary liquidity with price bands. List a share class with automated market makers that reference a NAV oracle and enforce a tight band around the official price. This avoids stale premium or discount dynamics and lets investors move between cash and fund units intraday.

- Atomic switch between cash tokens and fund tokens. Use delivery versus payment that locks both legs until conditions are met. This reduces fails and enables refinance style flows where a trader can pledge fund units, receive cash, and unwind in one coordinated transaction.

Wallets and custodians

- Rights aware wallets. Display not just a balance but a checklist of what a holder can do. For example, eligible for dividend, eligible for switch, restricted from transfer to non qualified wallets. Pull those rights from the fund’s policy contract and verifiable credentials. UX will improve as smart accounts in mainstream wallets become standard.

- One click participation in corporate actions. When a consent or election is required, present a signed, pre filled choice inside the wallet. The wallet submits an instruction as a transaction, and the fund contract records it with an audit trail.

- Embedded tax and reporting. Collect lot level data as events occur and generate reports continuously rather than in one year end scramble. Provide administrators with provable records that tie each report to an onchain event.

The near term watchlist

Standardization battles

There will be more than one standard for a while. Some banks will keep tokenized mirrors on private ledgers. Others will adopt public chain standards. The practical rule for 2026 is to pick formats that convert cleanly to ISO 20022 messages and to pick smart contract patterns that multiple administrators and distributors can support. Write your request for proposal accordingly. Ask vendors to demonstrate how a subscription instruction in ISO 20022 becomes a specific function call and how the confirmation returns to your books.

Custody and identity plumbing

The legal entity identifier has been in regulations for years. The verifiable legal entity identifier is the digital credential version that lets a wallet prove the organization behind it and the roles of people who control it. Expect to see vLEI baked into investor onboarding so that policy engines can decide in milliseconds whether a wallet is allowed to receive a share class. If you are a transfer agent or a distributor, begin mapping where you can accept vLEI during onboarding and where you still need document uploads. Pilot with one jurisdiction first where qualified vLEI issuers are already active.

Layer two networks and real world asset marketplaces

Lower fees, account abstraction, and better user experience make layer two networks attractive for distribution. Real world asset platforms offer ready made investor pools and compliance wrappers. Both want the same flow of assets. Asset managers should run a two lane strategy. Publish a canonical register on a high security network that your risk team is comfortable with. Distribute a share class on one or two networks where your investors already hold other assets. Use an interoperability protocol to synchronize the state. Insist that marketplaces read your onchain policy and NAV feeds rather than invent their own.

What to do now

- Ask your administrator for an onchain plan. If they do not have one, write down the exact lifecycle events you want to automate in 2026 and ask them to quote timelines and controls.

- Choose one fund and one distributor for a 90 day sprint. Scope only the subscription, redemption, and a single distribution event. Use ISO 20022 for all messages, and make every state change emit an event that lands in your accounting system.

- Make NAV a product. Decide who calculates it, who posts it onchain, and how often. Start at daily. Add intraday only when operations is comfortable. Treat the oracle feed as part of your official record.

- Prepare identity. Secure a plan to issue and validate verifiable credentials for investors and for your own operational roles. Test denial flows as carefully as you test happy paths.

- Write escape hatches. Define how you will pause mints, process exceptions offchain, and resume. Regulators care about graceful failure as much as speed.

What could still go wrong

- Fragmentation. If every bank adopts a different standard, the gains shrink. Fight this by insisting that smart contracts and messages follow published, open specifications and by choosing vendors who interoperate.

- Chain risk. Networks can slow or halt. Choose networks with credible uptime records and clear incident response. Keep cash settlement on bank rails. Keep a playbook for delayed finality.

- Key management. Smart contract controls are only as good as the keys that sign them. Use hardware backed custody for operational keys and require multiple approvals for sensitive actions. Treat policy updates like code releases with change control and independent review.

The takeaway

This week’s production order at UBS is not the end of the story. It is the beginning of a new default. When a standard fund workflow runs onchain using the same bank rails that institutions already trust, the burden of proof flips. Slow reconciliation and manual lifecycle events start to look like legacy choices, not regulatory requirements. The action now is to pick one fund, one distributor, and one administrator and make the loop real in your own stack. The teams that do that in early 2026 will set the pace for the rest of the market.