GENIUS Act Turns Stablecoins Into U.S. Payment Rails

A builder’s field guide to year one under the GENIUS Act: issuer licensing, reserve and disclosure rules, why no-yield reshapes product design, and how wallets, L2s, and merchants plug in.

What just happened, in plain English

The GENIUS Act is now law in the United States. It treats payment stablecoins like a new kind of regulated money instrument, not a speculative token. Think of it as a new set of rails laid alongside Automated Clearing House and card networks, but with instant settlement and programmable features. It creates a permissioned class of issuers, sets strict reserve and disclosure rules, prohibits interest on consumer stablecoin balances, and gives agencies a clear playbook for supervision. If you are building wallets, layer 2 commerce, or merchant checkout, the next twelve months will decide who becomes the default option.

If you want to read the underlying framework, start with the Congress.gov GENIUS Act summary. It is the clearest snapshot of what the statute requires and when various rules must be written.

The pillars: what the law actually does

Here are the pieces that matter for builders, banks, and merchants.

-

Issuer licensing

- Who can issue: federally permitted payment stablecoin issuers, insured depository institutions and their subsidiaries, and state permitted issuers that register and meet federal standards.

- How you qualify: submit a charter or license application, show a compliant reserve policy, independent auditors, real-time risk monitoring, and a redemption plan with service level commitments.

- Where the line is drawn: trading platforms that do not issue the coin remain subject to separate market rules, but if they issue a payment stablecoin, they enter the issuer regime.

-

Reserves and redemptions

- One-to-one backing with permitted assets only, such as United States currency, deposits at insured banks and credit unions, short-dated United States Treasury bills, Treasury-backed repos, government money market funds, and central bank balances. No commercial paper, no corporate bonds, no yield farming.

- Segregation and custody: reserves must be held bankruptcy remote and cannot be repledged for risky activity. Expect custody to live at highly regulated banks and trust companies.

- Redemption duty: issuers must redeem at par. The law requires clear and conspicuous redemption terms, posted publicly, and timely processing. Think in practical terms as T plus zero for institutions and T plus one for retail, with fees and cutoffs disclosed in plain language.

-

Monthly disclosures and audits

- Monthly reserve reports reviewed by a registered public accounting firm. Larger issuers must publish annual audited financial statements and executive attestations.

- The reports need to match the contract. If your token contract emits supply and redemption events, make sure the ledger and the reserve statement can be reconciled by an auditor.

-

The no-yield rule

- Issuers cannot pay interest to consumers for holding payment stablecoins. Marketing cannot imply a return. Builders must design rewards around payments, not balance-based yield. Examples that fit: merchant-funded discounts, flat fee rebates on transactions, loyalty points that are not pegged to account balance, and network fee sponsorship at checkout.

-

Compliance perimeter

- Anti money laundering rules still apply. Know your customer is table stakes for custodial wallets and for issuers, and information sharing for the Travel Rule will be expected when transfers meet the thresholds. Office of Foreign Assets Control screening and sanctions controls are mandatory for issuers and their agents. Non custodial wallets are not issuers, but they will feel the practical effects through onramps, offramps, and merchant processors.

The practical result is simple. A United States payment stablecoin will look and feel like digital cash that settles instantly, with the transparency of a money market fund and the compliance stack of a financial institution.

The next 12 months: a builder timeline

Here is a concrete timeline for product roadmaps. Treat the dates as milestones for internal go to market and risk reviews.

-

Now to January: application windows and interim guidance

- Issuers: submit preliminary applications, reserve policies, attest schedules, and an operational wind down plan. Draft consumer disclosures. Stand up a public status page for issuance, supply, and redemption queues.

- Banks and trust companies: finalize custody models for reserve assets, including segregated tri party accounts for Treasury bills and government money market funds. Build daily cutoffs and liquidity ladders that support same day redemptions.

- Wallets and merchant processors: stub in token lists scoped to permitted United States stablecoins and prewire compliance hooks, including sanctions screening, inbound transfer risk scoring, and Travel Rule data fields for larger payments.

-

February to April: proposed rules and pilot corridors

- Expect proposed rules clarifying reporting formats, executive certifications, and reserve composition haircuts. Pilot issuer programs will go live in limited corridors, for example payroll disbursements, cross platform refunds, marketplace payouts, and business to business settlement.

- Builders should run integration pilots with two chains, one optimistic rollup and one zero knowledge rollup, to benchmark finality, gas costs, and reorg risk under account abstraction flows. Pre agree on a failure policy for reverts at checkout.

-

May to July: final rules, public attestations, and performance targets

- By mid year, expect the first batch of permitted issuers to publish monthly reserve attestations on a fixed calendar. Wallets and processors should consume machine readable attestations and show a simple green or amber badge in product.

- Merchants should set target service levels for stablecoin refunds and chargeback equivalents. A realistic target is to resolve 95 percent of refund requests within 24 hours and return funds within two business days when the merchant opts to off ramp to a bank account.

-

August to October: enforcement and scale

- Enforcement begins. Unlicensed issuance risks civil and criminal penalties. Wallets should delist non compliant consumer stablecoins for United States users. Merchant processors should enforce allowlists and sanity checks on token contracts before enabling onchain checkout.

- Issuers compete on reliability. Latency to mint and redeem, daily cutoffs, and the shape of the liquidity ladder will be the deciding factors, not the size of a marketing budget.

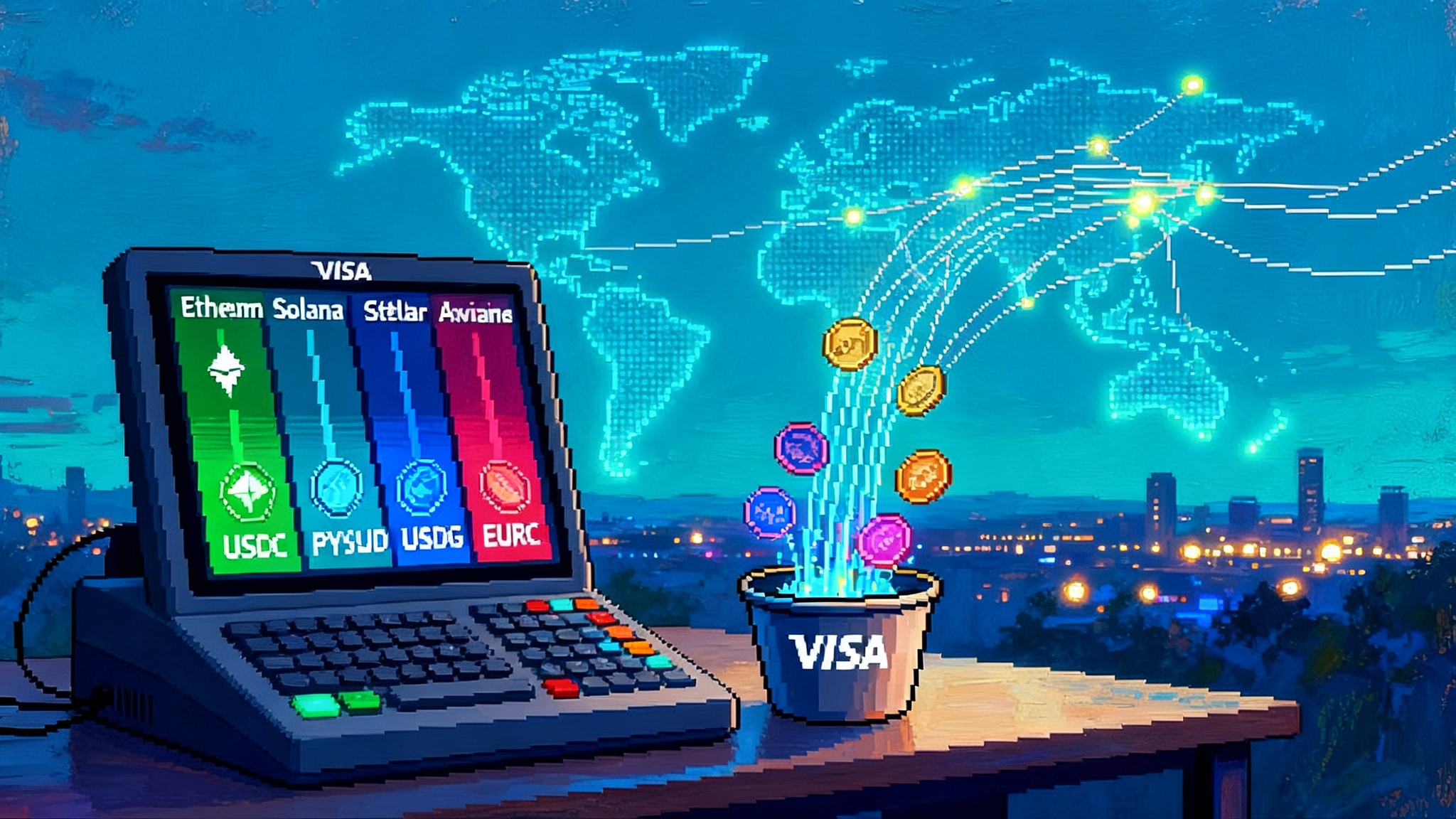

The competitive map: USDC, PYUSD, and a U.S. Tether

The near term landscape looks like a three horse race, with room for bank issued entrants and niche vertical plays.

-

USDC from Circle

- Strengths: deep banking integrations, multichain distribution, and a long track record of reserves transparency. If Circle becomes a federally permitted issuer, expect strong adoption in business to business settlement, payroll, and wallet funding. USDC already powers many onchain commerce pilots, so merchant enablement is likely to be turnkey.

- Weaknesses: multichain complexity in consumer wallets can create routing failures at checkout. Builders should hide chain selection with intents and offer one click cross chain settlement under account abstraction.

-

PYUSD from PayPal, issued by Paxos

- Strengths: a giant existing merchant and consumer network, strong compliance DNA, and a direct path to checkout in the PayPal and Venmo surfaces. Expect PYUSD to show up in marketplace payouts and refunds quickly, since those flows are already integrated.

- Weaknesses: historically conservative chain support, which may slow experimentation on newer layer 2 networks. The no yield rule also limits consumer incentives, so expect merchant funded rewards and fee sponsorship.

-

A United States compliant Tether

- Tether has signaled a domestic product designed for the new rules, issued by a regulated United States entity and marketed to American residents. The company has stated that the product will not pay yield. Early reporting suggests Anchorage Digital Bank as the issuing bank partner, which would give Tether a compliant custody and controls stack out of the gate. See Reuters: Tether U.S. stablecoin plan for the initial contours of the plan.

- Expect a dual brand strategy. USDT remains the international liquidity instrument, while the new domestic coin aligns to United States disclosures and redemption standards. If Tether executes on fast redemptions and institutional corridors, it will be a credible competitor in merchant payouts and broker dealer settlements.

-

Bank issued entrants

- Large banks will pilot network restricted coins that settle only among their clients. Think of this as a digital cashier’s check that moves over a private corridor but can interoperate with public chains through whitelisted bridges. These projects will matter for corporate treasury and trade finance more than for retail checkout in the near term.

How this rewires wallets, layer 2 commerce, and merchant adoption

-

Wallet experience

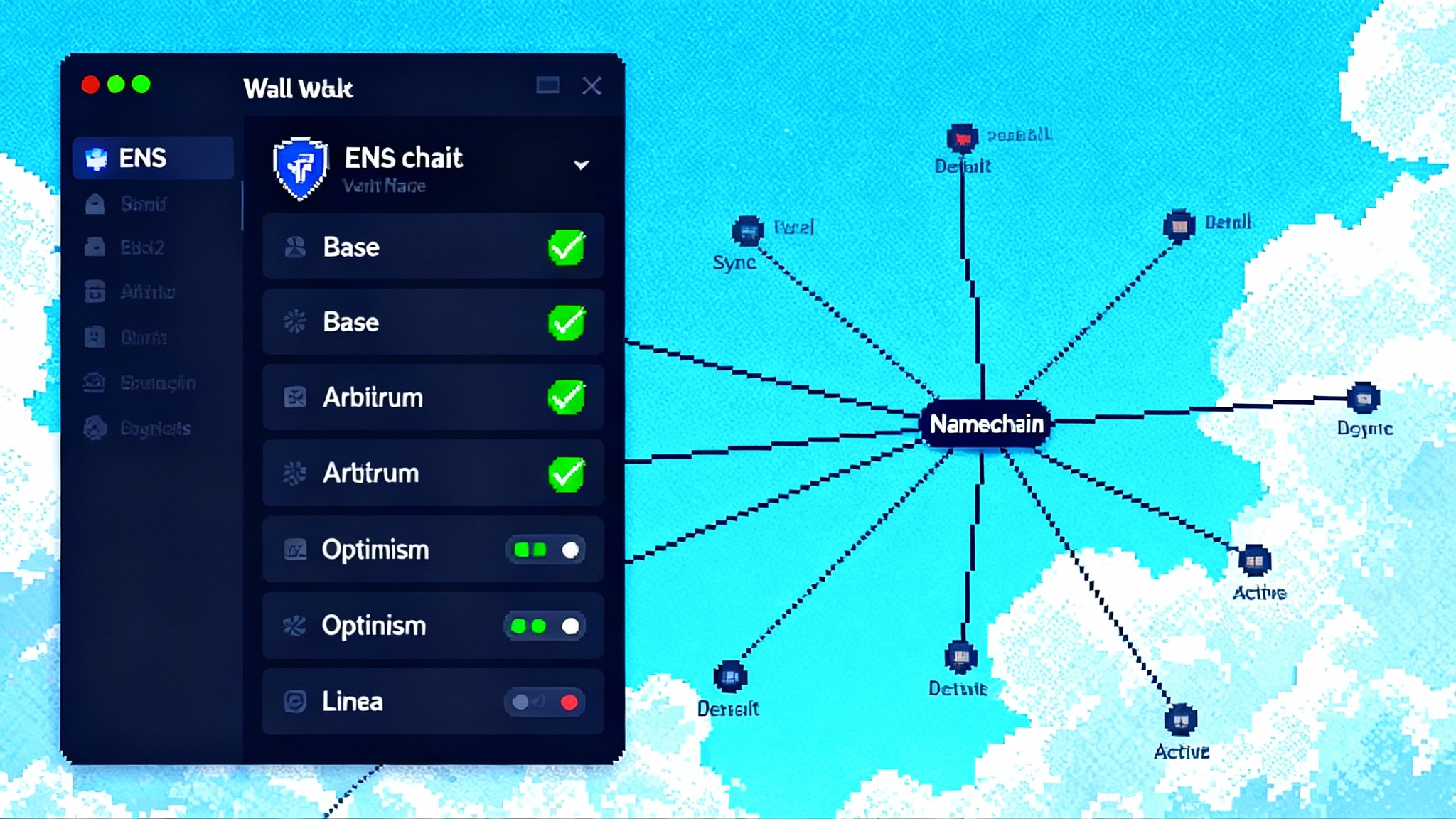

- Account abstraction turns a wallet into a smart account with programmable rules. The metaphor is a staffed checkout lane that can follow instructions, for example sponsor my gas, only pay verified merchants, and fall back to another chain if the first route fails. For consumers, that means one tap checkout, biometrics, and no visible seed phrases.

- Intents let users express the outcome they want, not the steps. A payment intent can say pay 19.99 dollars to Merchant A within 30 seconds and use any permitted United States stablecoin, then the router chooses the best path. This hides chain selection and makes wallet to wallet payments feel like a card authorization and capture.

- Compliance inside the flow: non custodial wallets will not collect know your customer info, but they can attach optional Travel Rule payloads when a payment crosses a threshold or when a merchant requests it. A simple consent screen and a proof generator satisfy both privacy and compliance teams. For a preview of where wallet UX is heading, see ENSv2’s Namechain resets Web3 UX.

-

Layer 2 commerce

- Rollups make stablecoin commerce cheap and fast. Builders should target two classes of chains. Merchant chains, which are battle tested and supported by processors and paymasters, and experimental chains, which are great for rewards and early adopters. Design an escape hatch to mainnet for refunds and dispute resolution.

- Gas sponsorship should be a product, not a favor. Merchants can pay a fixed fee per checkout to a paymaster, which covers gas on supported chains. The checkout stack enforces a maximum gas cap, retries on a second chain if needed, and records a canonical receipt that includes amount, asset, chain, block reference, and refund address. Recent work on permissionless proofs on L2s will further reduce trust assumptions for high volume payments.

-

Merchant adoption

- Merchants care about two things, cost and certainty. The new rails cut interchange like costs, and instant settlement reduces chargeback exposure. The catch is operational readiness. Merchants will ask how to price refunds when the payment moved across chains, how to reconcile stablecoin receipts against invoices, and how quickly they can off ramp to a bank account. Solve those with libraries and dashboards, and adoption follows. As large networks expand settlement, Visa’s stablecoin move to Stellar and Avalanche shows how enterprise appetite grows when fees and reconciliation improve.

Integration playbooks for banks and fintechs

-

Banks and trust companies

- Decide your role: issuer, reserve custodian, or both. If you issue, you accept redemption obligations and public scrutiny. If you custody, you sell safety and execution.

- Build a liquidity ladder: cash, demand deposits, Treasury bills, and overnight repos. Target 10 to 20 percent in immediate liquidity for daily redemptions. Define stress scenarios and a block level watermark to pause mints during an audit exception.

- Instrument the program: real time dashboards for supply, reserve composition, redemption queues, and outlier detection. Publish a machine readable reserve file every month with a signed hash onchain. Offer an application programming interface for wallets to fetch the latest attestation.

- Compose legal with code: embed redemption terms in both the prospectus and the token contract docs. Map every plain language commitment to a measurable service level, for example submit redemptions received by 3 p.m. Eastern Time for same day wire settlement.

-

Fintechs and wallets

- Become an agent, not a shadow issuer. Integrate with one or more licensed issuers and distribute only permitted United States stablecoins to American users.

- Build an intents router. Given an amount in dollars and a merchant endpoint, your router picks the coin and the chain, sponsors gas if necessary, and returns a canonical receipt. Cache price quotes for 30 seconds to avoid re quoting at checkout.

- Add trust signals to the user interface. Show issuer, last attestation date, and a redemption time estimate. Display a warning when the coin is outside the United States perimeter or missing a recent report.

- Implement refund primitives. A payment should ship with a one time refund key that a merchant can use within a fixed window. Publish a reference implementation for refunds that can settle in the original coin or in dollars to a bank account.

-

Merchant processors

- Support stablecoin routing as a first class payment method. Treat coins like card networks in your configuration, for example allow USDC and PYUSD for the United States and route to the cheapest supported layer 2.

- Offer automatic off ramp. Many merchants will want dollars in the bank at the end of each day. Batch settlements at predictable windows and show fees upfront.

- Implement dispute workflows. Onchain payments are final, but consumer protection is not optional. Provide a portal where customers can request a refund, submit receipts, and receive status updates. Tie this to a ledgered case system so auditors can follow the trail.

- Build a compliance layer. Screen addresses, collect Travel Rule data when the amount crosses policy thresholds, and keep auditable logs. Merchants need a buttoned up story for their finance and legal teams.

Where developers can win right now

-

Account abstraction toolkits

- Ship a production grade account abstraction software development kit with pre audited smart accounts, session keys for checkout, and a paymaster network that supports fee sponsorship in approved coins. Include reference user interface components and a route chooser that prefers the cheapest chain with on time finality.

-

Intents and programmable checkout

- Build a Payment Intent standard that encodes amount, memo, invoice id, deadline, merchant endpoint, and refund policy. Provide an event spec for a canonical receipt emitted at settlement. Publish adapters for major wallets and layer 2s. The goal is to make paying a URL feel like tapping a card.

-

Issuer status and attest ingestion

- Create a public registry that fetches monthly issuer reports, verifies signatures, and writes a hash onchain. Expose a three color status indicator and a webhook for changes. Wallets show this in product, merchants use it to accept or decline coins at checkout.

-

Onchain refunds and partial captures

- Implement partial capture, cancellation, and refund flows that mirror card rails. Map each flow to a smart contract method with idempotency keys so merchants can safely retry.

-

Treasury bills as a service for issuers

- Issuers must juggle cash, deposits, and Treasury bills. Build secure workflows for allocations, laddering, and daily reconciliation. Expose a daily liquidity forecast that ties directly to redemption queues and settlement windows.

Guardrails and gotchas

-

Do not sneak in yield

- Do not offer balance based bonuses, synthetic interest, or opt in savings on the stablecoin itself. Reward payments and behavior at checkout. If you want to offer interest, do it in a separate insured deposit account with clear separation.

-

Design for redemptions, not just mints

- The hard part is handling redemptions during stress. Instrument your queue, publish cutoffs, and build playbooks for when Treasury bill auctions are closed or when a bank wire window misses.

-

Respect state lines

- Federal preemption covers licensure for permitted issuers, but state consumer protection laws still apply. Keep your disclosures, marketing, and support policies ready for state review. If you are a money transmitter for non issuance activity, confirm whether you still need state licenses.

-

Build incident response like an airline

- When something fails, your status page should show the route, the chain, the block, the error class, and the estimated time to recovery. Customers do not need a forensic report, they need confidence and a clock.

The bottom line

The GENIUS Act did not turn every token into money. It carved out a narrow, regulated lane for payment stablecoins and asked issuers to prove, every month, that one coin equals one dollar. That clarity is a gift for builders. If you focus on instant, low cost settlement, usable wallets, and honest receipts, the new rails will do the rest. Over the next year, the winners will not be the loudest brands, they will be the teams that make paying with a dollar on the internet feel as simple as tapping a card and as reliable as a wire.