Telegram’s TON-Only Pivot Compresses Years of Crypto UX

Telegram is making TON the exclusive chain for Mini Apps and standardizing wallet links with TON Connect. The shift could bring stablecoin payments, on-chain ads, and DeFi bots to mainstream chat in months, not years.

Telegram makes TON the default chain for Mini Apps

Telegram and the TON Foundation have announced that TON becomes the exclusive blockchain for Telegram’s Mini Apps, and that developers must use TON Connect as the standard way to link wallets to their apps. The move comes with a one month migration window and a clear intention to unify the on-chain experience across Telegram’s nearly one billion users. The TON partnership announcement spells out the new rules and timelines.

If this sounds like a distribution shock, it is. Telegram is not adding a crypto tab or a speculative corner. It is fusing payments, identity, and programmable money into the core of a chat platform that people already open dozens of times a day. That changes the speed at which Web3 features can be discovered, trusted, and used.

Why this is different from every Web3 launch before it

Most crypto consumer funnels have been uphill battles: download a new wallet, write down a seed phrase, bridge assets, learn a new chain, decipher gas fees, then finally tap a button. Telegram collapses that staircase into a hallway. You tap a Mini App from a message or channel, authorize with TON Connect, and pay with Toncoin or a stablecoin without leaving chat. The cognitive load and the cold start friction drop at the same time.

Think of TON Connect like Sign in with a platform, but for blockchain actions. It gives Mini Apps one predictable handshake for transactions and signatures. Users stop juggling QR codes and mismatched wallets. Developers stop writing integration code for five different wallet libraries and the same number of error states. A common connector standard removes most of the weird edge cases that break onboarding. This aligns with broader wallet improvements such as seedless smart accounts that reduce setup pain.

The second difference is the audience. Telegram’s scale means small conversion rate improvements turn into millions of users. Even a niche Mini App can find momentum when discovery happens inside channels, comments, and forwards, not on an app store search page. And because Mini Apps live where conversations start, creators and communities can push users directly into on-chain actions with one tap instead of one link plus six steps.

The immediate unlocks inside chat

Stablecoin payments that feel like texting

Tether launched USDt on TON in April 2024, with Telegram’s in-app Wallet integrating simple send and receive flows. The result is a stablecoin that behaves like a message: you pick a contact, type an amount, and the system handles the rails. No extra downloads, no long addresses. This alone reframes peer to peer commerce, cross border transfers, and creator payouts inside chat. See the USDt launch on TON.

What changes for a real person: a designer in Lagos can invoice a client in Berlin and settle in minutes. A micro-merchant can run a Telegram channel with a paywalled catalog and accept stablecoins with near zero marginal cost. Policy momentum like the stablecoin race to 2026 could further normalize this behavior.

On-chain ads and direct creator payouts

Telegram’s advertising platform shares a fixed percentage of ad revenue with channel owners and pays in Toncoin. By anchoring the flow in TON, creators can reinvest earnings into their growth without leaving chat. In practice that means a channel can accept payments, fund promotions, reward moderators, and buy services from other Mini Apps using the same unit of account. A circular economy forms, and because the wallet is native to chat, the loop has fewer leaks.

DeFi bots and automation you can control from a thread

Telegram already birthed a category of trading and automation bots. Standardizing on TON Connect brings them closer to the mainstream. Users can authorize recurring actions and then monitor or cancel them from a chat thread. A Mini App can expose a simple list of intents like swap, stake, save, or rebalance. Under the hood it can route to liquidity on TON-based decentralized exchanges, manage risk, and post on-chain receipts. The user sees a clean message confirming what happened and why.

What developers can build first

The near term opportunity is not to invent a new protocol. It is to translate existing high demand use cases into the chat-native form factor and ship fast. Here are concrete patterns that are now within reach.

- Checkout and remittances inside channels

- What: One-tap stablecoin checkout for digital goods, donations, and invoices. Automatic receipts and refunds with Jetton tokens or Toncoin.

- Why now: TON Connect removes wallet fragmentation; USDt on TON reduces price volatility; the chat surface reduces drop-off.

- How: Build a Mini App that generates payment requests, validates settlement on-chain, and posts receipts back to the thread. Add a contact picker for pay requests and a link for external buyers who are not on Telegram yet. Localize pricing and seed the first 1,000 purchases with subsidized fees.

- Performance advertising tools for creators

- What: Spend Toncoin ad credits to acquire subscribers, then retarget with triggered messages tied to on-chain events. Offer cohort analytics, not just channel growth charts.

- Why now: Creator payouts and ad buying share a unit of account. The attribution loop can include on-chain conversions.

- How: Build a Mini App that listens to channel engagement, matches it to on-chain activity, and suggests a daily budget. Provide safe defaults for creative, targeting, and frequency. Include a cost-per-acquired-subscriber estimate that updates in real time.

- Loyalty and tokenized access

- What: Token-gated content and status badges tied to purchase history, event attendance, or creator tasks.

- Why now: A Telegram-native wallet with a single chain reduces access-check complexity. Badges can be Jettons or non-fungible tokens with clear transfer rules.

- How: Offer a plug-in for channels that mints badges upon qualified actions and adds a visible role in comments. Keep it simple: one badge per tier, clear perks, clear expiration.

- Games with real ownership and simple onboarding

- What: Tap-to-earn and skill games that turn progress into tradable in-game assets and offer USDt-denominated prizes.

- Why now: Mini Apps can reach millions overnight; custody and non-custody can coexist behind TON Connect.

- How: Start with a single core loop. Price in USDt, not volatile tokens. Run weekly tournaments and publish transparent prize distributions.

- DeFi companions

- What: Automated savings and swaps with plain-language explanations and opt-in automation. Think of it as a financial assistant in chat.

- Why now: Standardized wallet linking and a single chain make the safety model easier to explain.

- How: Use explicit intents. Every message should show what will happen, the max cost, and how to undo it. Log on-chain IDs with a copy button.

The risks and how to navigate them

Platform lock-in

Risk: Building only for Telegram plus TON concentrates distribution and dependency. If policies change, your funnel can shrink overnight.

What to do: Treat Telegram like a high heat market entry, not your only market. Design a portable core that can run as a web app. Keep user state portable with export tools and privacy-respecting email capture. Price your unit economics assuming you may need to acquire some traffic off-platform.

Compliance and geofencing

Risk: Payments, advertising, and financial bots are regulated. Jurisdictions differ on what is a money service, a security, or a promotion. App store policies for iOS and Android also shape what you can show and sell.

What to do: Build a rules engine on day one. Map features to regions. Toggle flows based on user country. Offer custodial onboarding only in allowed regions and push self-custody elsewhere. For anything that touches yield or tokens with potential securities characteristics, require explicit disclosures and extra friction. Publish a plain-language policy page inside your Mini App.

Cross-chain liquidity and fragmentation

Risk: The rest of the crypto world is not sitting still. Liquidity lives across many chains. If you need assets that are not on TON, bridging introduces latency, fees, and risk.

What to do: Design with native-first assets wherever possible. For cross-chain, prefer well reviewed providers and limit exposure to just-in-time bridges. Batch operations, pre-fund popular pairs, and show users a clear ETA and total cost when bridging is required. If your product depends on external liquidity, maintain a standing dashboard that tracks slippage and depth.

Identity and support

Risk: Chat-native identity is convenient but exploitable. Users will authorize things they do not understand if it looks like a normal message.

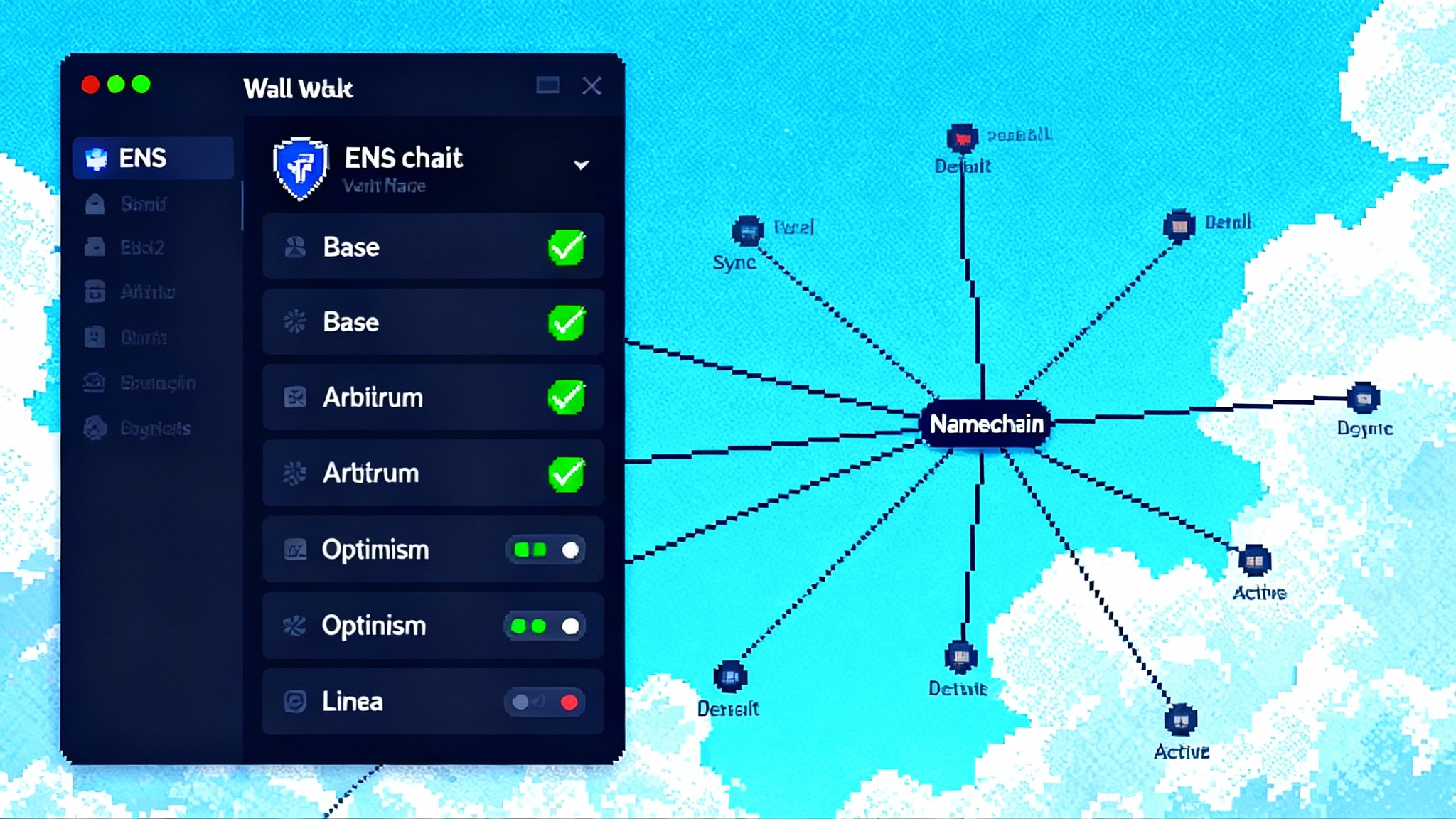

What to do: Build support into the product. Every on-chain action should have a reversal policy, a visible transaction link, and a human contact path. Cap daily spend by default and let users raise it. Spell out what you will never ask for, and enforce strong separation between support chats and transaction flows. Identity improvements like ENS Namechain resets UX can help tie names to reputation.

A 90-day playbook to capture the new funnel

You have one quarter to go from idea to a growing Mini App. Here is a concrete schedule that assumes a small full-stack team with a product manager, a designer, and two engineers.

Week 1

- Pick a single high-frequency use case. Examples: collect donations for a creator channel, run weekly game tournaments, sell digital templates, or offer simple USDt remittances.

- Draft the measurable goal: 10,000 weekly active users, a 20 percent week one conversion from viewers to payers, or 5,000 completed purchases.

- Choose a privacy posture. Decide up front what personal data you log and why. Default to the minimum.

Week 2

- Implement TON Connect for sign-in and signatures. Build a local simulator that scripts edge cases like canceled signatures and low balances.

- Sketch the chat-first flows. Every critical step should happen in one screen with a clear fallback to a message thread.

Week 3

- Add payments. Support Toncoin and USDt. Normalize all prices in USDt for clarity. Auto-calc local currency display for top regions.

- Implement receipts as messages with on-chain IDs and a refund button.

Week 4

- Ship a closed alpha with 100 testers. Instrument the funnel top to bottom: discovery source, connect rate, payment success, day one retention, seven day retention.

- Write human-readable error messages. Replace codes with causes and fixes.

Week 5

- Open to a friendly channel with 50,000 to 200,000 subscribers. Offer a simple promotion mechanic: share to unlock a perk, refer three friends to earn a badge, or complete your first purchase to get a small credit.

- Enable a basic help bot that can see the last five actions and propose remedies.

Week 6

- Run pricing experiments. Test flat pricing vs. usage tiers. Cap daily spend by default.

- Add a risk dashboard for your team: failed transactions, average fee, average completion time, and refund rate.

Week 7

- Start paid acquisition inside Telegram. Set a daily Toncoin budget. Track cost per subscriber and cost per completed action.

- Bundle a creator toolkit if your product depends on channels. Make it zero setup: paste one snippet, get analytics and suggested campaigns.

Week 8

- Launch in two more languages. Add region toggles to satisfy local rules. Audit copy for clarity.

- Publish your transparency page with daily metrics and your security practices.

Week 9

- Introduce loyalty. One badge per tier, visible in comments. Tie perks to measurable behavior, not vague engagement.

- If relevant, add a savings or rewards feature with conservative limits and clear risk disclosures.

Week 10

- Negotiate distribution with larger channels. Offer revenue share in Toncoin and a co-branded landing experience.

- Create two creator case studies with exact numbers and screenshots of chat flows.

Week 11

- Improve success rate. Pre-check balances and fees before prompting a signature. Queue transactions during network congestion and update users in-thread.

- Prepare a fallback web version for users without Mini App support, keeping the core flows identical.

Week 12

- Plan a seasonal event or a tournament. Set a weekly cadence of fresh content, not just sporadic drops.

- Lock in a governance rhythm. Even if you do not use a token, publish a roadmap survey and act on it.

How this compresses time for the whole industry

In consumer crypto, what takes years is not writing code. It is getting people to care, try, and come back. Telegram’s TON-only shift removes dozens of tiny speed bumps that cause most users to give up. For developers, one wallet connect standard, one chain, and one surface to design for can eliminate months of integration work and testing debt. For users, chat-native stablecoins and clear receipts turn a frightening new concept into a familiar pattern.

There are real risks. Dependence on a single platform concentrates power and policy risk. Compliance work will not vanish. Cross-chain connectivity will matter for advanced users and institutions. But the practical path forward is clear: build small, ship fast, keep users safe, and let the distribution do its work.

If this moment holds, the next wave of crypto products will not feel like crypto products. They will feel like messages that can move value, with the option to open the hood when you want to. That is the most honest form of adoption. You do not talk people into it. You put it where they already are.

The bottom line

Telegram’s decision to standardize wallet connections and make TON the exclusive chain for Mini Apps is a forcing function. It aligns incentives for users, creators, and developers around one set of rails. Stablecoin payments become normal. On-chain ads gain instant settlement. DeFi bots gain clarity and safety. The window to seize this is short. Choose a narrow problem, build the chat-first version, and measure everything. The funnel is already open. It is on you to step into it.