Post Pectra, passkeys make smart wallets the default

Ethereum’s May 7 Pectra upgrade quietly flipped a switch. With EIP-7702 live, any wallet can act like a smart account for gasless, batched, recoverable actions. Over the next year, fintechs and L2s will race to own onboarding and bring 100 million users into crypto.

The day wallets changed without most people noticing

On May 7, 2025, Ethereum activated its Pectra upgrade on mainnet. The change landed at epoch 364032 and it felt like a routine protocol update. In reality, it rewired the front door to crypto. Pectra included a set of proposals that targeted user experience, and among them sat a simple but powerful switch: EIP-7702. If Pectra was the engine tune-up, EIP-7702 was the key that lets any standard wallet behave like a smart wallet on demand. The Ethereum Foundation’s announcement framed it as a broad UX booster, but the implications for onboarding are direct and urgent. Within days, developer teams across exchanges, wallets, and Layer 2 networks began shipping demos and production code that lean on passkeys and smart-account patterns to remove the sharp edges from crypto onboarding. Pectra’s mainnet activation details explain the when and why.

What EIP-7702 actually does

Think of a regular Ethereum wallet as a metal key. It opens a door, but that is all it can do. A smart account is more like a programmable badge that can open doors, log entries, split bills with roommates, and block a door after hours. EIP-7702 lets the metal key temporarily act like the programmable badge without forcing the user to move into a new apartment.

In technical terms, EIP-7702 adds a transaction type that allows an Externally Owned Account to set a tiny snippet of special code, called a delegation designator, that points the account’s execution to a smart-account implementation. This turns on features like transaction batching, gas sponsorship, and granular permissions for the duration you choose. Then you can switch back. The official specification lays out the mechanism and the design constraints that keep it forward-compatible with long-term account-abstraction plans. For a deeper dive, read the official EIP-7702 specification.

Passkeys turn confusing setup into a tap

Near the surface, the most visible change will be how new users create wallets. Passkeys use the same Web Authentication standard that powers passwordless sign-in on phones and laptops. Instead of staring at a 12-word seed phrase and hoping you never lose it, you register a passkey backed by your device’s secure hardware or a synced password manager. Face ID, Touch ID, or a hardware key can unlock your wallet. If you replace your phone, your passkey follows you through iCloud Keychain, Google Password Manager, or a third-party manager, depending on what you chose.

EIP-7702 does not invent passkeys. It makes them practical at scale. When a wallet flips into its smart-account mode, it can validate passkey signatures, attach a recovery flow, and still fall back to the original private key in emergencies. The result is less anxiety for new users and fewer dead ends for support teams.

Gasless, batched, recoverable: why UX finally crosses the chasm

Three capabilities are about to define the default crypto experience.

-

Gasless by design: With 7702, a wallet can delegate to code that accepts a sponsor for gas. The app or network can pay the fee, or let the user pay fees in stablecoins instead of Ether. For a first-time user, the difference is night and day. Click a button, confirm with Face ID, and you are done. No exchange hop to “buy a bit of Eth for gas.”

-

Batched actions that feel like one step: Today, common flows take two transactions. You approve a token, then you spend it. Batching turns that into one action. A decentralized exchange can wrap approval and swap in a single confirm. A game can mint, move, and list an item in one go. Fewer waits, fewer misclicks.

-

Real recovery that normal people can use: Smart-account logic allows multiple signers and recovery paths. You can set a passkey as a co-signer, add a hardware key, or designate a time-locked recovery that kicks in if you lose everything. The original private key still exists, but it no longer feels like a single point of failure.

Put together, these features turn crypto from a series of puzzles into a single, understandable interaction. That lowers drop-off in sign-up funnels and brings the next wave of users into reach.

The post-Pectra launch sprint is already here

Since activation, teams have moved quickly. Developers at major players have published 7702 proxies and adapters that let existing smart-account implementations work with EIP-7702. Wallet providers have shown passkey logins that create a wallet in seconds. Smart-account toolkits highlight session keys, limited-scope permissions, and gas sponsors that make in-app flows feel like any mainstream checkout. The pattern mirrors Telegram’s TON-only pivot, where integrated onboarding compresses years of crypto UX into minutes.

If you build a consumer app today, you no longer need a browser extension to get a modern wallet experience. You can spawn a passkey-backed smart account inside your app in a few clicks, sponsor the first transactions, and bundle actions so that onboarding feels like signing in to a streaming service.

Why this pulls fintechs into the wallet layer

Fintechs live and die by conversion and compliance. They know how to design identity flows, mitigate fraud, and run risk models. Until now, crypto wallets sat apart from those strengths. Pectra plus EIP-7702 changes the calculus.

-

Integrated identity and fraud checks: Passkeys tie a signer to a device and an origin. Fintechs can pair that with traditional checks to reduce account takeovers. A bank can let a passkey drive the wallet while still applying its own device reputation system.

-

Native compliance touchpoints: Smart-account code can enforce per-transaction rules. Daily limits, restricted token lists, or jurisdictional switches can live at the wallet layer rather than spread across dozens of apps.

-

Clear customer support paths: When a user loses a device, a help center can guide them through a time-locked recovery or a multi-factor rekey instead of telling them the funds are gone. That is a customer experience fintech teams understand and can support.

Expect consumer fintech brands to launch or relaunch wallets that look like ordinary sign-ins. Funding the first actions, letting users pay fees in stablecoins, and embedding recovery will become table stakes. The upside is higher retention and new revenue at the wallet level, not only at the card or exchange level.

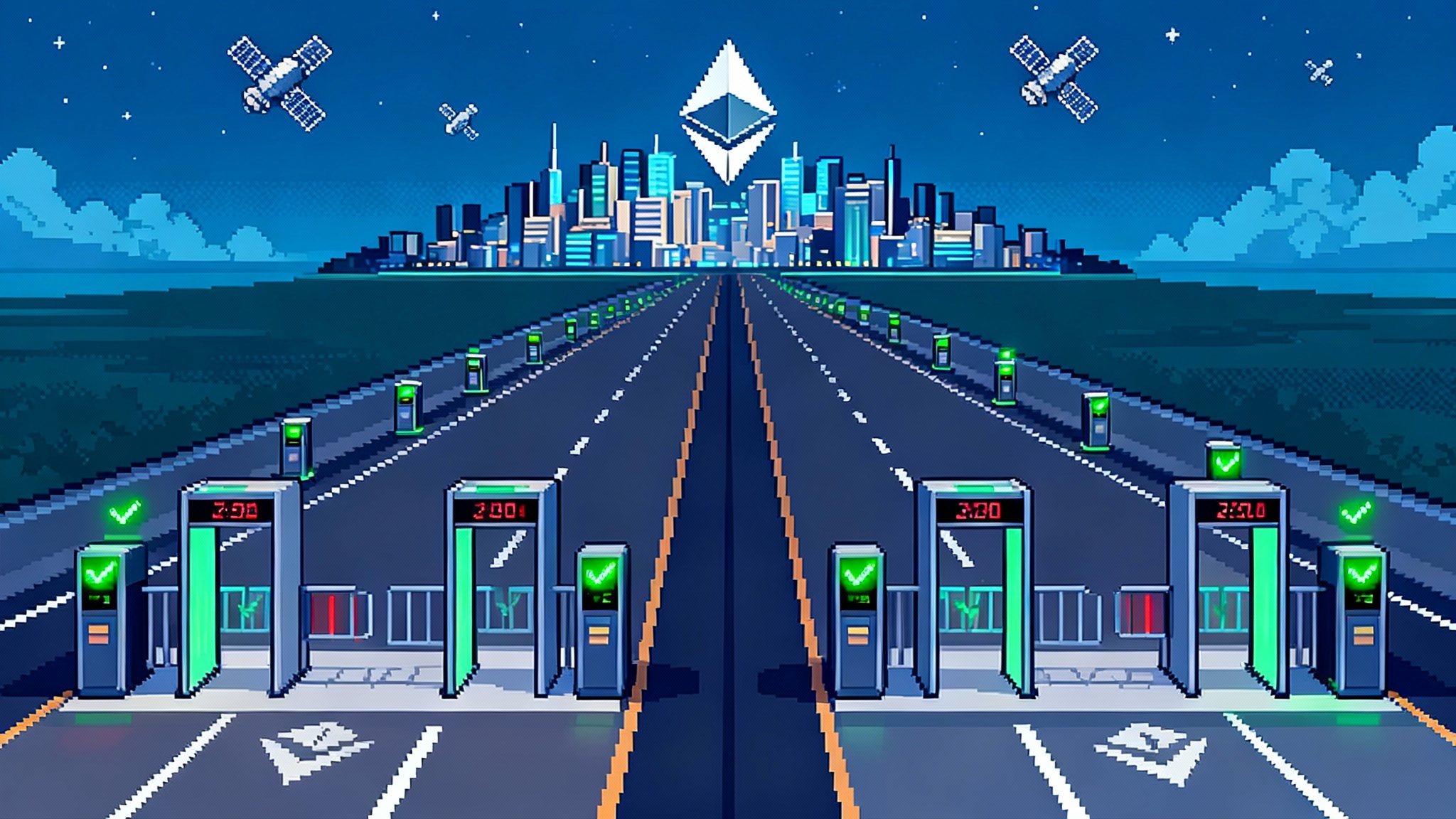

Why this ignites a Layer 2 land grab

Layer 2 networks already compete on fees and developer experience. EIP-7702 hands them a new lever: wallet onboarding at the network edge.

-

Subsidized first-run experiences: An L2 can sponsor gas for a user’s first week. Pair that with one-click passkey creation and you can collapse the cold start that kills most onboarding.

-

Bundlers, paymasters, and SDKs as product: Networks will package 7702-ready SDKs that handle batching, sponsorship, and recovery out of the box. The fastest path to a live app will decide where developers build.

-

Distribution through consumer apps: L2s that can hand a partner a drop-in wallet with integrated passkeys and simple billing will win the next generation of non-crypto apps that want crypto features.

The playbook looks familiar. Mobile platforms won by giving developers batteries included. L2s will do the same with wallets.

The new wallet stack in plain English

Here is how a modern flow looks behind the scenes, without the jargon.

- A user opens your app and taps Create wallet. Their phone presents the passkey prompt. They confirm with Face ID.

- In the background, your app registers a passkey and asks the account to enable smart-account features for this session using EIP-7702. Think of it as temporarily granting the account a helper program.

- The user picks an item to buy. Your app bundles the approval and the purchase together into one request. You agree to pay the network fee for them, or you charge a small flat fee in a stablecoin.

- The user confirms once. The helper program executes the steps and records the result on chain.

- If the user switches phones, they sign in with their passkey again. If they lose everything, they can trigger a recovery that was set up when the wallet was created.

This is not a dream. It is the path that many teams are shipping today.

Security model shifts you should understand

Smart accounts and passkeys reduce many common risks, but they introduce new ones to manage.

-

Private key still matters: Even if an account delegates to smart code, the original private key can still sign. You must educate users and design flows that protect this key. Separate where it lives. Encourage hardware or enclave storage.

-

Delegation hygiene is essential: Only delegate to reviewed implementations. Build a clear revocation path so a user can cut over to fresh code instantly if needed. Monitor for unexpected designator changes.

-

Social and device recovery needs rate limits: Recovery is power. Use time locks, multiple independent factors, and notifications. Do not let a single compromised inbox rekey a high-value account instantly.

-

Session keys are powerful tools: Limited-scope keys allow smooth gameplay or trading bots, but they must be scoped and expire by default. Treat them like temporary badges that only open the hallway you intend.

If you treat these as engineering requirements rather than optional extras, you get a safer system than today’s seed-phrase wallets with fewer ways to make irreversible mistakes.

What builders should do in the next 90 days

-

Prototype a passkey-only onboarding: Replace seed phrases with passkeys for new users and hide everything technical until it is needed. Measure completion rates and time to first action.

-

Add batching to your top two flows: If you run a marketplace, bundle approval and purchase. If you run a game, bundle mint and move. Count the clicks you remove.

-

Decide your sponsorship strategy: If you can afford it, pay gas for the first week. If not, accept stablecoins for fees. Either reduces friction compared to requiring Ether upfront.

-

Ship a recovery story: Offer multi-factor recovery with a time delay. Let users add a second passkey or a hardware key. Give them clear instructions during setup, not after a loss.

-

Monitor the wallet layer: Treat 7702 delegations and recovery events as high-signal security events. Alert users when they happen. Confirm they are expected.

What this means for users

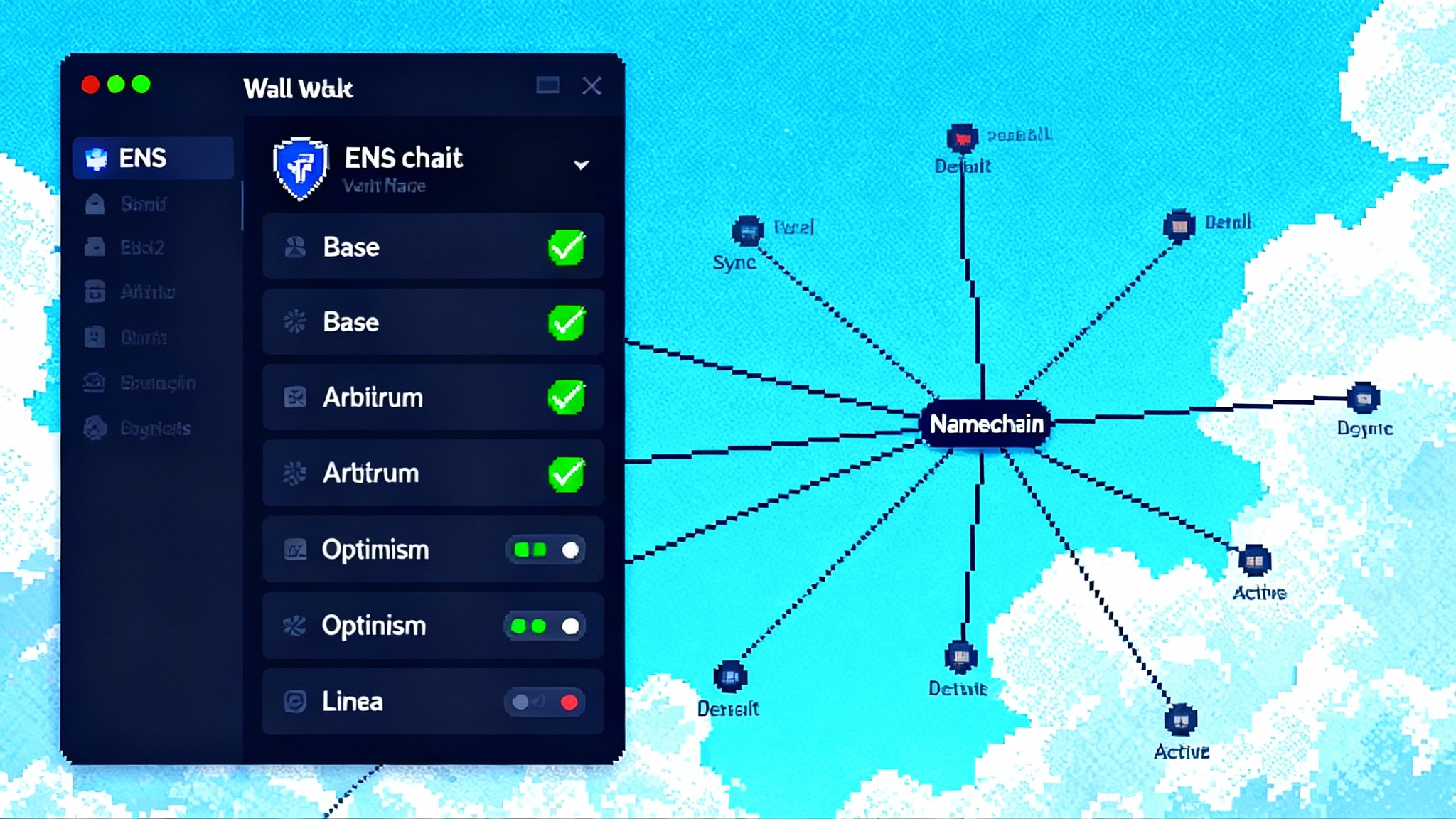

Most people are not excited by protocol names. They notice when something that used to be annoying becomes easy. That is the real test for Pectra’s impact. Similar UX resets are arriving with ENSv2 Namechain and L2 primary names.

- Wallets will be as easy to create as a passkey for your favorite website.

- You will not need to buy Ether to try an app for the first time.

- Big scary seed phrases will give way to device prompts and recoverable plans you understand.

- Approvals and swaps will compress into one press instead of two or three.

In short, the sharp edges that kept friends and family at arm’s length will start to smooth out. That is how you get from the next million users to the next hundred million.

The next 12 months: a forecast

-

Wallets become an in-app feature: Expect consumer apps to embed passkey-native wallets as a sign-in option. Extensions stay for power users, but they stop being the default.

-

L2s subsidize gas at scale: To win mindshare, networks will pay for early transactions and publish ready-to-use 7702 toolkits. The cost is a marketing line item, not a protocol tax.

-

Fintech brands launch or relaunch wallets: They will pitch safer recoveries, payment routing with stablecoins, and useful limits that keep accounts safe for family use. Their support teams already know how to help non-experts recover access. That advantage will show.

-

Standards converge around a few battle-tested implementations: Open-source smart-account code and passkey libraries will harden quickly. Audits and bug bounties will focus the ecosystem on a small set of reliable patterns.

-

Fraud moves to new angles: Phishing for passkey prompts and tricking users into approving broad session keys will rise. User education and permission screens must improve accordingly.

None of this requires a new protocol change. It requires teams to implement what Pectra already made possible.

A clear scoreboard for the new wallet race

How will we know who is winning the wallet layer in this new era? Watch three numbers.

-

Time to first successful action: From install or sign-up to first on-chain action. Under one minute wins.

-

Percentage of gasless first sessions: The higher the better. Gasless sessions correlate with lower abandonment.

-

Recovery success rate: The share of locked-out users who regain access without support tickets. Good recovery builds long-term trust.

Teams that optimize these will pull ahead. Users will feel the difference without learning any acronyms.

The bottom line

Pectra brought many upgrades to Ethereum. EIP-7702 is the one changing what a wallet is. By letting any account behave like a smart account when needed, it unlocks passkey-native onboarding, gasless transactions, batched flows, and sane recoveries. That combination shifts crypto from a hobbyist setup to an everyday one. Over the next year, fintechs and Layer 2 networks will race to own the wallet experience because that is where users feel value first. The winners will make crypto feel invisible until the moment it matters. That is how you onboard the next 100 million users: not with a new slogan, but with a better first minute that anyone can understand.