Telegram’s TON Mandate and US Wallet: Crypto’s Superapp Moment

Telegram unified mini apps on TON and rolled out a U.S. wallet, collapsing discovery, onboarding, and payments into one chat. Here is how that changes adoption curves, what to build next, and the risks to manage.

The moment crypto has been waiting for

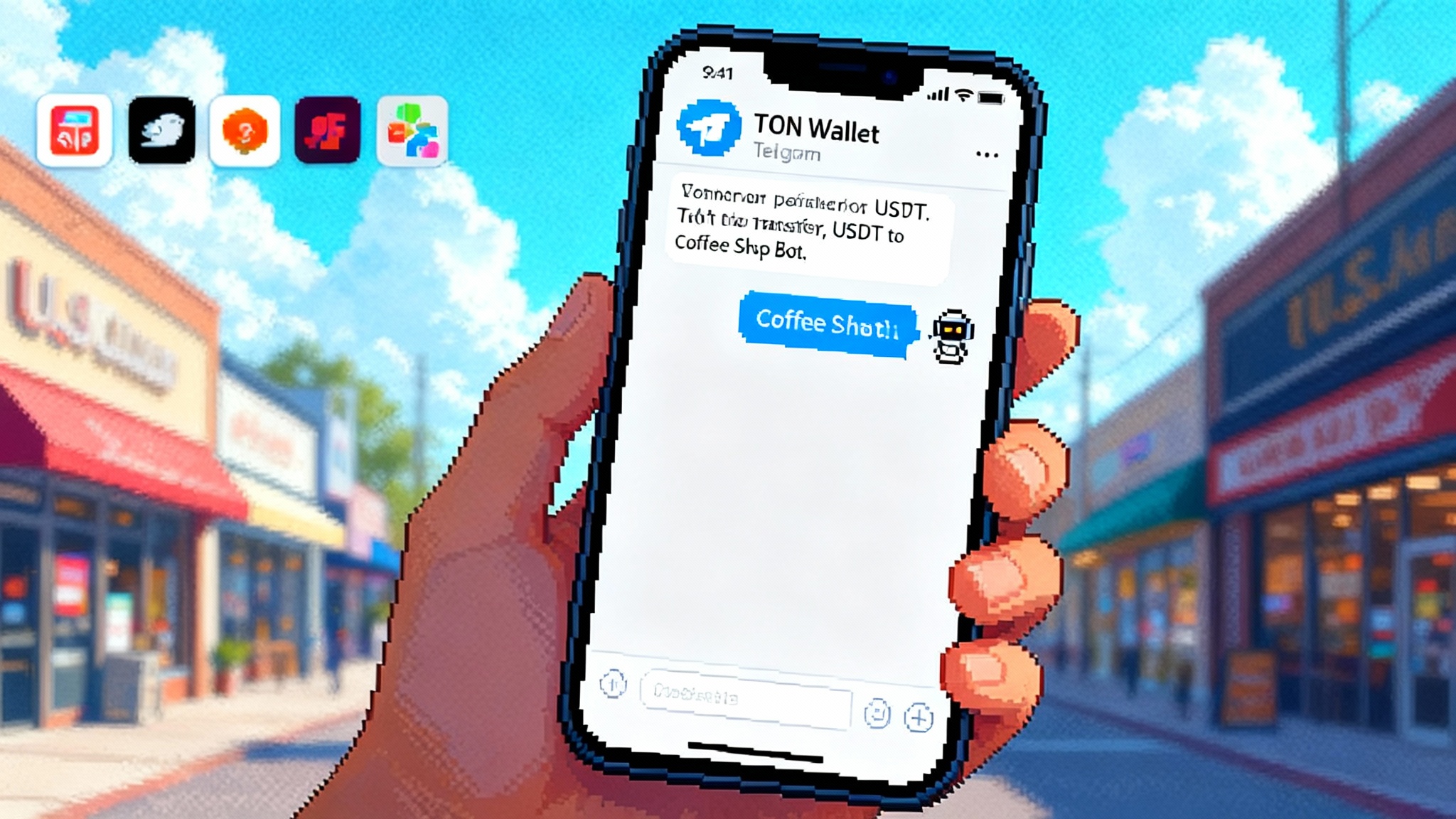

Two decisions made Telegram feel less like a messenger and more like a distribution, payments, and onboarding machine. First, Telegram and TON Foundation set a hard, near-term requirement for blockchain-powered mini apps inside Telegram to migrate to TON and to use TON Connect as the only wallet connection standard, with a public deadline of February 21, 2025, as outlined in the TON exclusivity announcement.

Second, on July 22, 2025, Telegram began rolling out its in-app, self-custodial TON Wallet to U.S. users. For the first time, the United States got the same tap-to-use crypto experience that had already reached over 100 million activations worldwide, as covered in the CNBC report on the U.S. launch.

Combine the mandate and the U.S. wallet, and you get crypto’s first credible superapp moment outside of China. Not a concept demo, not a whitepaper, but a live funnel where discovery, onboarding, and payment flow together in one place.

Why this changes the adoption curve

Most crypto projects struggle with three separate problems: finding users, getting them to a wallet, and convincing them to fund that wallet. Telegram collapses those steps into a single interface.

- Distribution now lives in chat. Bots, channels, and mini apps sit next to your friends and groups. A referral link is a message, not a website prompt.

- Onboarding is part of the interface. The wallet is inside the app, so a first transfer feels like sending a photo. Private key handling is still present, but the journey from first click to first asset is shorter.

- Payments are native to the conversation. Users can pay a game, a merchant, or a creator without swapping apps or copying addresses.

Add USDT on TON and you get a stable unit that non-crypto users recognize. When the denominator is a dollar, price anxiety recedes. When the wallet is in a chat list, discovery is daily. When the app can push notifications, retention mechanics move from Discords and email lists into a place where people actually open messages. For the policy backdrop in the United States, see our explainer on the GENIUS Act on stablecoins.

What this unlocks next

1) Mini games at real scale

The mini app mandate reduces the number of wallet connection patterns to one. Less time on integration means more time to tune gameplay loops and conversion. Expect simple formats to dominate first: idle clickers, trivia, puzzle battlers, and collectible trading games that reward chat invitations and group play. Think of it like the App Store in 2009, but with an instant social graph and a primitive but adequate payments rail.

Why this matters: games are not just entertainment. They are on-ramp machines. A user who buys a 3 dollar starter pack in USDT is a user who now understands the wallet, the asset, and the flow for future purchases. Developers can A/B test price points per country in the same chat interface. Viral loops are messages, not push notifications that may be throttled by a mobile operating system.

What to build: a Telegram-native game that treats chats as lobbies, not an afterthought. Offer free progression that culminates in a small USDT unlock. Use in-chat tournaments on weekends tied to channel sponsorships. Let creators sell limited badges inside the game with settlement in USDT and distribution through the channel that promoted the event.

2) Merchant payments inside the inbox

Telegram wallet flows make a simple use case viable at last: pay a small business the same way you tip a creator. A coffee shop can run a bot that generates a pay link in chat. The customer taps to send USDT on TON, and the shop’s bot prints a paid ticket. No card terminals, no chargebacks. For online merchants, checkout is a Telegram deep link that opens a confirmation inside the app. For recurring creators, subscriptions are simply scheduled transfers.

The operational shift is subtle but real. A merchant can settle daily in USDT, convert to local currency on an exchange, and keep a small working balance in Toncoin for fees. Chargebacks do not exist on chain, so the shop must adopt refund policies and support scripts, but the core benefit is immediate finality and lower fees on small transactions.

3) Real-world assets come to the chat economy

Stablecoins made dollars programmable. The next step is to bring other assets with real demand into the same interface. Tokenized gold has already reached TON through specialized omnichain deployments, and regulated, yield-bearing cash equivalents are appearing in conservative jurisdictions. For most consumers the first touch will still be USDT, but expect on-chain treasuries, gold, and secure notes to ride the same pipes in markets where regulations permit it. The value is not speculation. It is programmable payouts and collateral that a bot can understand. For a European view on tokenized funds, see how Europe’s tokenised funds boom is reshaping distribution.

A concrete example: a creator membership that pays monthly USDT rewards pulled from a tokenized cash vehicle, while the membership token doubles as a discount badge in participating mini apps. Settlement, proof of ownership, and distribution all happen in Telegram.

4) Cross-chain USDT without the bridge fatigue

Interoperability is finally shifting from wrapped tokens to message-based liquidity routing. LayerZero’s tooling is enabling omnichain versions of stable assets that unify liquidity across networks, and TON’s integration is bringing that capability into its ecosystem. The important nuance is governance and origin. Some omnichain deployments, like USDT0, are community or consortium projects that coordinate native USDT liquidity across chains by mint and burn logic, rather than Tether issuing a new token on every network. For a user or a merchant, the practical effect is that moving value between TON, Ethereum, Tron, or other chains feels closer to a native transfer and less like a risky trip through a third-party bridge interface.

If you are a builder, this means two things. First, you can accept USDT on TON in your mini app and still allow users to withdraw to the chain they use elsewhere. Second, you can design flows that keep settlement on TON while giving exits to other ecosystems without managing complex liquidity pools yourself.

The risks hidden inside the upside

Platform dependence

Telegram is the funnel. That is the opportunity and the risk. If the company changes discovery mechanics, ad pricing, or bot policies, your customer acquisition cost can move overnight. If country regulators pressure app stores, certain flows could be throttled in mobile builds. Mitigation is a dual strategy: build your audience in channels you control and maintain a web fallback. Make sure your identifier is not just a bot name but also an email list and a domain that your users recognize.

Compliance and changing rules

The U.S. rollout is a milestone, not a blanket permission slip. Stablecoin rules, state money transmitter licenses, and bank partnerships matter. For merchants, the safe path is to process only user-initiated payments, avoid custody where possible, and document your flows. For games, forbid payouts in jurisdictions that restrict them and verify users where required. Bake regional switches into your product early, not as a last-minute patch after a policy letter arrives. For authentication design, study why passkeys make smart wallets the default and plan recovery accordingly.

Custody user experience

Self custody is empowering, but recovery is hard and scams are relentless. Seed phrases are a support nightmare. Use passkey options where available, encourage multi-device wallet sync, and offer clear, human instructions on what to do if a phone is lost. Design fee abstraction so a new user does not face a stalled transaction because they have zero Toncoin for gas. Consider sponsoring small amounts of fees to ensure first-session success. In games and consumer apps, protect users with in-app transaction previews that read like receipts, not hexadecimal.

Fraud and scam hygiene

Telegram is a social network of public groups. That makes it a dream for community growth and a magnet for scammers. Enforce allowlists in your mini app. Display a visible verified badge if you qualify. Teach users that support will never DM them for a seed phrase. In your bot, rate limit suspicious behavior and fail safe. At scale, payments teams operate like trust and safety teams. Treat them as such.

The builder playbook

Here is a concrete plan to ship something real inside Telegram over the next 90 days.

- Wire TON Connect first

- Make TON Connect your only wallet connector inside the mini app. This aligns with platform rules and reduces edge cases. Test on mobile and desktop Telegram clients because your users will move between them.

- Keep a clear state model: connected, disconnected, pending. Preload the call to connect in a modal and keep it simple. No jargon, no warnings that would scare a new user.

- Design a chat-native funnel

- Start with a bot that handles onboarding and routes to your mini app. Think of the bot as your home page. Every acquisition route should land there, including channel posts, creator shoutouts, and keyword replies.

- Build a welcome flow that grants a free, limited item to new users and invites them to try a paid action. If you are a merchant, this can be a 5 percent coupon that expires in 24 hours. If you are a game, a starter kit with a one-tap 1.99 dollar upgrade.

- Price and settle in USDT

- Quote prices in USDT to remove volatility. Hold working balances in USDT and only convert to fiat when needed. For cross-border teams, USDT reduces banking delays and gives you 24-7 settlement.

- For game rewards or cash-like benefits, implement jurisdiction filters and make terms explicit. If you require know your customer checks for withdrawals, say so at the start.

- Use Stars and Ads to grow, then translate spend into Toncoin

- Telegram Stars are the in-app currency for digital goods and promotion. Use Stars to sell boosts or cosmetic items inside iOS builds and convert earned Stars into Toncoin through the official channel to fund development and ad spend. This sidesteps mobile store restrictions on crypto purchases.

- Run Telegram Ads against your own channel posts and creator collaborations. Measure the cost to add a wallet-connected user, not just a subscriber. Tie ad spend to a target like cost per first USDT transaction and cut any campaign that does not hit it within three days.

- Build for interoperability without making it the user’s problem

- Offer a clear exit to other chains using cross-chain USDT routes that do not require risky wrapped assets. Explain in one sentence what will happen before a transfer leaves TON and make sure fees are visible upfront.

- Keep your core ledger on TON to take advantage of low fees and a standard connection surface. Use cross-chain functionality only when a user needs it.

- Ship a trust layer

- Publish a simple, human security page inside your bot. Include how to verify the real account, what your support will never ask, and how to recover access. Make this link a persistent button in the bot menu.

- Implement a default spend limit per day with a one-tap increase flow. Most users never hit it, but it stops common theft patterns.

What to watch through the first half of 2026

- U.S. wallet engagement, not just installs. The question is how many American users make a first USDT transfer, not how many tap the wallet icon. The early signal to track is weekly active wallets per thousand U.S. Telegram users.

- Merchant primitives. Expect the first high-quality payment mini apps to ship in early 2026 with receipts, refunds, and lightweight inventory. The winners will feel like Square’s first iPhone era tools, but inside Telegram chats.

- Compliance clarity on stablecoins. If federal or state rules stabilize, expect U.S. merchants to move from testing to real volume. Watch for announcements that pair U.S. money transmitter coverage with Telegram mini app checkout. Context is evolving quickly alongside the GENIUS Act on stablecoins.

- Interop maturity. If message-based omnichain networks keep earning share, users will treat cross-chain exits as routine. The result is simple: more deposits to TON from ecosystems where users keep larger balances, and smoother exits when they need to bridge out.

- Creator commerce. Ads priced in Stars, payouts in Toncoin, and paywalled posts tied to a wallet check will create a clearer economy for channels. If conversion rates hold, expect a wave of channel-native products, from pay-once ebooks to ticketed audio rooms.

- Games that look like businesses. If two or three mini games crack retention with fair monetization, they will argue for Telegram as a viable platform for studios, not just viral hits.

The bottom line

Crypto’s superapp dream has always hinged on the same question. Can you put discovery, onboarding, and payment in the same place that people already use every day. Telegram’s 2025 moves suggest the answer can be yes. A hard integration standard reduced developer uncertainty. A U.S. wallet put an easy on-ramp in the biggest consumer market. USDT gave people a stable unit that feels like money, not a bet.

The work ahead is not abstract. It is product, policy, and operations. Build the funnel in chat. Price in stablecoins. Respect regional rules. Design custody that feels safe for ordinary people. If builders do that, by mid-2026 we will not be asking whether crypto can find its superapp. We will be measuring how much of everyday internet commerce now happens inside a messenger that grew up into a marketplace.