Europe’s tokenised funds take off as FCA backs direct to fund

Two moves just flipped tokenised funds in Europe from pilots to plans: the FCA’s direct to fund consultation and a regulated euro stablecoin for atomic settlement. Here is what changes, why it matters, and how managers can act before 2026.

The week Europe’s fund plumbing changed

Two announcements have tipped Europe’s tokenised fund market from pilot mode into a real operating agenda. On October 14, 2025 the United Kingdom’s Financial Conduct Authority opened FCA consultation CP25/28 on fund tokenisation to formalise tokenised units for authorised funds and to introduce a new optional dealing model called direct to fund. The paper explains how managers can issue, record and redeem fund shares on public chains and how investors can deal directly with the fund without the manager acting as principal. It even sets a timeline to publish final rules in the first half of 2026.

At the same time, DWS, the Deutsche Bank majority owned asset manager, announced a tokenisation push, preparing its first tokenised fund and building partnerships with digital administrators, transfer agents and smart contract specialists. This is the first clear sign that a top five European manager intends to execute at scale rather than experiment. For precedent on production activity, see how UBS took tokenized fund orders live.

What the direct to fund model actually changes

Today, most United Kingdom authorised funds still use a box model. The authorised fund manager deals as principal, maintains an inventory of units and stands in the middle of investor cash flows. The FCA’s proposal lets cash flow directly between the fund and the investor. No box to manage, no manager acting as principal, and materially less client money overhead.

In plain language, this is like letting passengers book seats with the airline rather than going through a consolidator that holds spare seats in its own account. You still have safety checks, but you cut out an entire hop that added cost and risk without adding value.

Two clarifications in the consultation are pivotal for builders:

- The FCA does not object in principle to using public blockchains, provided obligations around resilience, privacy and consumer outcomes are met.

- The regulator explicitly discusses atomic settlement, where a token representing a fund unit swaps for a token representing cash in a single on chain transaction.

These points remove the main architectural ambiguity that kept many pilots confined to private ledgers.

The missing cash leg arrives as a euro stablecoin

A settlement rail only works when both sides of the swap are on chain. Equity, bond and fund tokens have been on chain for years; regulated cash has not. That gap just closed in Europe. In July, AllUnity, a joint venture backed by DWS, Flow Traders and Galaxy, launched EURAU, a fully reserved euro stablecoin aligned with the European Union’s Markets in Crypto Assets Regulation and supervised by Germany’s BaFin. See the AllUnity EURAU launch announcement.

Why this matters for funds: the direct to fund model needs a digital euro that is regulated, redeemable and operational at institutional scale. With EURAU as the settlement leg, two things become possible:

- Primary issuance can run continuously. Mint fund units in exchange for EURAU 24 hours a day because both assets are programmable and finality is immediate on the chain of issuance.

- Redemptions compress to T+0. Units can be burned for EURAU with no dependency on batch banking windows. That makes liquidity promises tangible for both retail and institutional investors.

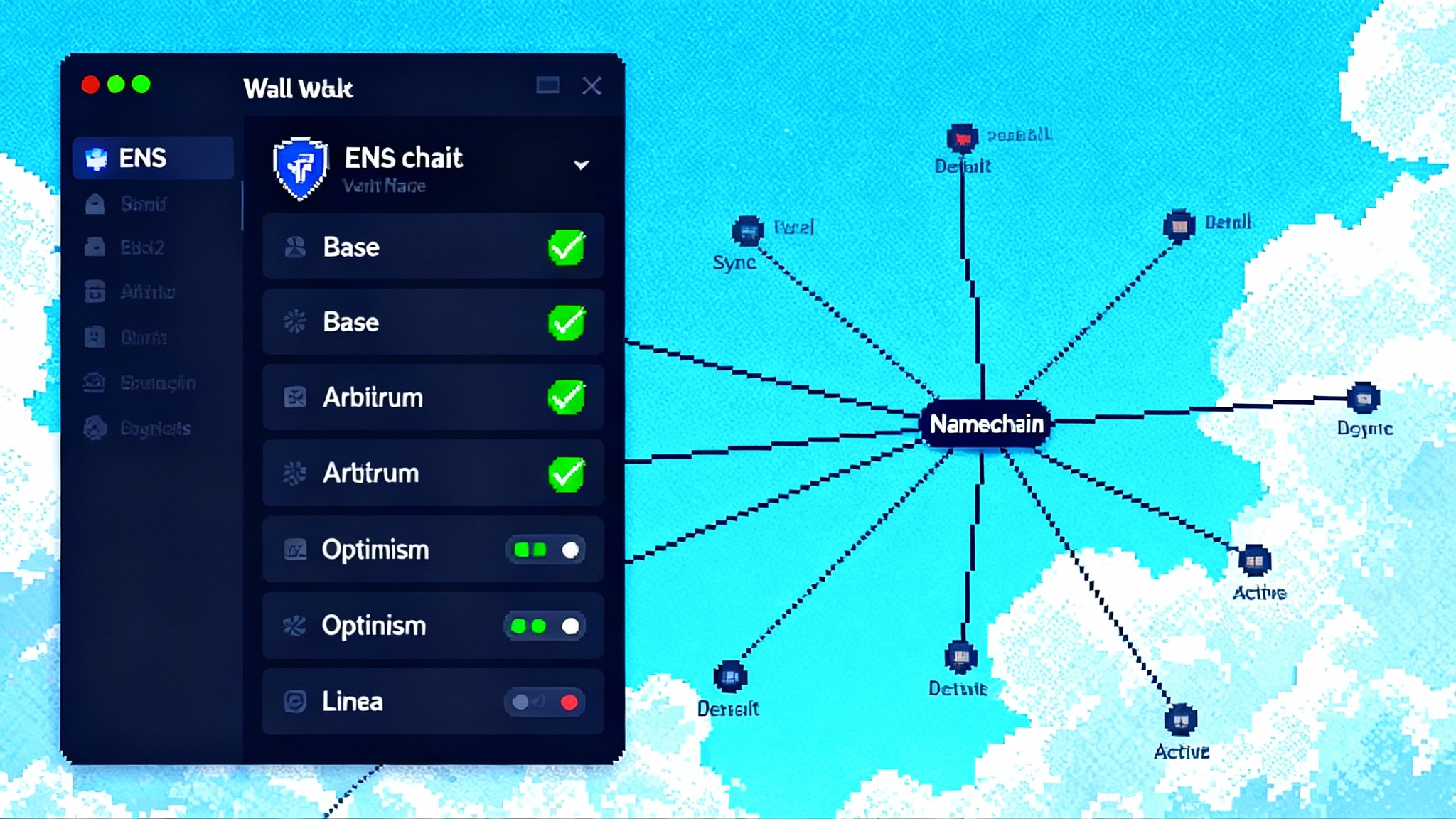

Wallet native KYC turns compliance into a feature

The other persistent pain point has been investor onboarding across platforms. Tokenised funds can push Know Your Customer checks into wallets using verifiable credentials. Think of it as a reusable boarding pass. Once a qualified investor wallet carries a credential that proves residency, sanction checks and investor category, the fund’s transfer restriction logic allows the unit transfer. If the credential expires, transfers pause until the holder refreshes it with an approved verifier. As wallets evolve, features like passkeys make smart wallets the default, making credential based flows simpler for end users.

How it works in practice:

- The investor completes KYC with a transfer agent or a qualified compliance provider and receives a signed credential in their wallet.

- The fund’s token contract checks an allowlist oracle that reads the credential without revealing sensitive data on chain.

- Subscriptions and redemptions settle atomically: fund units for EURAU in, EURAU for burned units out.

- Reporting is generated from the on chain register, which now matches the transfer agent’s books by design.

What this unlocks for UCITS on public chains by 2026

With the FCA targeting a policy statement in the first half of 2026, Europe is on course for tokenised Undertakings for Collective Investment in Transferable Securities to launch on public networks where it is operationally justified. Expect the first wave to focus on assets that reward continuous issuance and fast settlement:

- Money market strategies that promise daily liquidity today can move to true same day redeemability in EURAU, with gates and swing pricing encoded in the token.

- Short duration bond funds can run intraday subscriptions before the dealing cut off and use on chain transfer fees to manage flows.

- Index trackers with high fund of funds usage can cut reconciliation time because the on chain register is the golden record across layers.

The regulatory text also invites a second order effect: competition between hubs. Luxembourg and Ireland have been the default for European fund domiciles. United Kingdom authorised funds with direct to fund and tokenised units will force a re think about where to launch strategies that benefit most from atomic settlement and wallet native compliance.

The squeeze on United States managers

There is a clear commercial edge for the first managers who can issue, redeem and distribute 24 hours a day using a regulated euro stablecoin. The gap is not technology; United States managers already use digital wallets and permissioned chains for operational tasks. The gap is policy and plumbing. Europe now has a pathway to on chain cash leg settlement and a regulator that has described a public chain path for funds, while the United States is still clarifying stablecoin legislation and fund tokenisation rules. For the U.S. policy arc, see the GENIUS Act stablecoin framework.

Implications:

- European asset managers can win cross border mandates that require euro cash settlement and intraday liquidity, especially for treasury style allocations and sweep programs.

- Transfer agents and administrators that master wallet native KYC and on chain registers will become preferred vendors for global product launches.

- United States managers will face client pressure to match T+0 liquidity terms in their European ranges and to provide equivalent operational speed domestically once legislation catches up.

How DeFi rails plug in without custody risk

The most common concern from fund boards is that connecting to decentralised finance means handing custody to a protocol. It does not. Patterns are emerging that allow protocols to integrate exposures while the investor never gives up control of the actual fund tokens.

Three designs to watch:

- Permissioned pools for tokenised units. Automated market makers can restrict pool membership to wallets that carry the fund’s credential. Liquidity is provided by qualified investors or market makers that accept transfer restricted units. The pool’s smart contract can be whitelisted by the issuer without granting it withdrawal rights to investor wallets. Prices can come from on chain NAV or a time weighted oracle. The investor keeps custody of the units at all times.

- Non custodial collateralisation. Real world asset money markets can accept tokenised fund units as collateral through escrow modules that only ever lock the asset in the investor’s own wallet via a delegation mechanism. The protocol enforces a lien through a smart contract hook that prevents transfer while a loan is outstanding. Upon default the unit redeems to EURAU, which is then routed to lenders by the protocol’s liquidation engine. No third party takes possession of the unit.

- Wrapped exposures with provable backing. For distribution into venues that cannot hold the primary token, managers can support a wrapped receipt token that is minted one for one when a qualified custodian locks the primary share. The wrapper inherits transfer restrictions and supports instant redemption to the primary token on verification. The fund board controls the allowlist for wrappers, so custody never leaves approved entities.

These designs work because transfer restricted tokens turn compliance into code. Standards such as transfer hooks and role based whitelists are live across multiple chains, and the FCA’s acceptance of public networks keeps the door open to composability rather than closed platforms.

Distribution compression, explained with a simple walk through

Picture a euro money market fund issuing units on Ethereum at 09:15 Berlin time. A corporate treasurer mints units by sending 10 million EURAU from a whitelisted wallet. The fund’s smart contract checks the credential, enforces minimum order size and mints units in the same block. The treasurer’s treasury management system sees the new position immediately because the wallet is the position.

At 16:30 the same day, the treasurer redeems 2 million units to meet payroll. The contract burns the units and sends 2 million EURAU back to the treasurer in seconds. No correspondent bank queue, no transfer cut offs, no reconciliation delay. The administrator’s system reads the on chain register and posts the day’s activity without chasing statements from multiple banks. The depositary runs its checks against the same register.

That is distribution compression in action: fewer parties in the critical path, fewer files to reconcile, more time for actual risk management.

Concrete steps for market participants

If you run an asset management business in Europe or you distribute European products globally, here is a practical playbook for the next two quarters:

- Stand up a direct to fund pathway. Map your dealing workflow and identify where box management and client money processes will be replaced by direct investor cash flows. Engage your depositary early so safekeeping and oversight are designed for on chain registers from day one.

- Choose your settlement leg. If your range is euro denominated, treat a MiCAR aligned stablecoin like EURAU as a core vendor. Validate mint, burn and reporting processes, and test multi chain issuance to avoid venue lock in.

- Build wallet native onboarding. Select a credential standard and pick one or two verifiers to issue KYC credentials into investor wallets. Integrate transfer restrictions at the token contract so compliance is enforced by code, not by hope.

- Define a DeFi exposure policy. Decide where your funds will allow price discovery and collateral use. For each venue, confirm that custody never leaves an allowlisted wallet and that liquidation, if any, returns EURAU, not a protocol’s governance token.

- Educate your sales force. The one liner that resonates with clients is simple: subscribe or redeem any time, see positions in your wallet instantly and have cash reach you in seconds because the fund and the euro both live on chain.

What to watch next

Three near term milestones will determine how fast this new market structure scales:

- The FCA’s final policy statement in the first half of 2026, which will lock in the direct to fund rules and formal guidance for tokenised units.

- DWS moving its first tokenised fund into production grade issuance, setting a blueprint for other large managers.

- A euro stablecoin network effect. Watch for issuance volume and integration into major fund administrators’ systems.

The bottom line

A regulator has put a real blueprint on the table, a top manager is preparing to launch at scale and the missing euro cash rail now exists in a regulated form. The next two quarters are no longer about pilots. They are about wiring together issuance, EURAU settlement and wallet native onboarding so that by the first half of 2026 European funds can live on public chains with credible liquidity and compliance. The opportunity for managers is more than marketing novelty. It is a chance to rebuild distribution around direct investor relationships, faster balance sheet turns and transparent books that reconcile themselves. If you can explain to a client why their subscription, their fund unit and their euro cash all settle in one place, you will own the conversation when the market opens on Monday.