USDC at Checkout: Stripe, Shopify and Coinbase Go Live

Stripe adds recurring stablecoin billing, and Shopify with Coinbase enable USDC on Base at checkout. Merchants get lower fees, faster settlement, and global reach.

The week that onchain payments grew up

Crypto has spent a decade selling the future while most buyers kept paying with the past. That balance just shifted. With USDC live at checkout through Stripe, Shopify, and Coinbase, and with recurring stablecoin billing finally productized, onchain payments moved from conference demo to credible default for real commerce.

This is not a flashy new token. It is plumbing. It is the difference between shipping packages and shipping promises. USDC on Base gives merchants a digital dollar that settles fast, costs less, and behaves like software. Stripe’s new recurring stablecoin flows give subscriptions a native home onchain. Shopify brings the long tail of merchants. Coinbase brings the wallets and the rails. Together they form a triangle of distribution, tooling, and demand that can push crypto out of speculation and into everyday spend.

Below we unpack what turns on under the hood, who wins and loses, and how to build for the wave that is coming into 2026.

Why USDC on Base matters at checkout

Merchants pay for three things every time a buyer taps pay. They pay for authorization, for settlement, and for risk. Card rails bundle all three and charge accordingly. Stablecoin rails unbundle them and turn each step into software.

- Lower fees: Carded online payments often land between 2 and 3 percent plus a fixed fee. USDC transfers on Base routinely cost pennies. Even after a payment processor margin, the unit economics shift from percent of basket to cents per transaction. At scale, that cost curve compounds.

- Faster settlement: Instead of waiting one to three business days, USDC settles within minutes on a public ledger. Working capital cycles shorten, refund windows are clearer, and treasury teams can move funds programmatically.

- Global reach: A buyer in Lagos, Berlin, or Manila with a wallet can pay in a dollar asset without needing a local card rail approval. Merchants can sell to the world on day one and reconcile everything in dollars.

Think of it like shipping containers. Before containers, every crate needed custom handling at each port. After containers, logistics became standardized and cheap. USDC on Base is the container. The checkout button becomes a crane that moves value in a predictable, visible box.

Subscriptions, finally native to the internet of money

Recurring payments have been the quiet giant of internet commerce. Media, software, memberships, donations, even consumables are moving to subscription. Until now, crypto could not handle recurring billing in a way that merchants trusted and finance teams could reconcile.

Stripe’s recurring stablecoin flows change that. The key ideas are simple.

- A customer authorizes a smart contract to pull a fixed or metered amount of USDC on a schedule.

- The wallet signals consent at sign up, similar to how card on file works, but with programmable guardrails like spending caps, expiration dates, and one-click revocation.

- On each billing date, an automated pull is attempted. If funds are available and within limits, it settles. If not, the processor can retry, fall back to a secondary rail, or prompt the user to top up.

For merchants, this looks like the subscription dashboards they already know. For customers, it eliminates card expirations, reissued numbers, and cross-border approval randomness. For developers, it exposes clear hooks for webhooks, invoices, and dunning logic without maintaining sensitive card data.

What wallets and point of sale can do now

- Tap to pay, practically: Consumer phones can act as payment instruments while the merchant device acts as a terminal. The buyer scans a dynamic code or taps a deep link and confirms in wallet. There is no new hardware in the middle, only software that triggers a payment request and a smart contract that records it. Account abstraction and passkeys make smart wallets the default.

- One-touch refunds and partial credits: Because the settlement is onchain and programmable, a merchant can issue a refund that lands in the same wallet, with auditability that accounting can trust.

- Loyalty tied to receipts: A wallet that signs a purchase can also receive a loyalty asset. It could be as simple as a points balance or as rich as a transferable perk token. The receipt and the reward live in the same place.

- Multi-party payouts: Marketplaces, affiliates, and creators can receive their split at the moment of settlement. No batch payouts on Fridays, no spreadsheets to reconcile. The contract executes the split.

The compliance and foreign exchange plumbing you cannot see

Payments live or die on compliance. Stablecoin payments are no exception. The difference is that much of the compliance now runs in software rather than only in people and paperwork. For policy context, see our America's Stablecoin Law field guide.

- Know your customer and sanctions checks: Wallets and processors can screen counterparties before allowing a transaction. If a buyer signs from a prohibited jurisdiction, the request is blocked. Addresses associated with sanctions are denied. These controls are not optional for big platforms.

- The travel rule and information sharing: For transfers that qualify as regulated, processors can attach metadata about sender and receiver to meet travel rule requirements. That data can be passed privately through secure channels while the payment itself remains onchain.

- Chargeback alternatives: You cannot reverse a chain transfer by fiat. That sounds scary until you remember that merchants mainly fear chargebacks because they combine fraud and forced refunds. Instead, processors offer dispute resolution and buyer protection as opt-in services. Refunds are voluntary but incentivized, and fraud controls happen before settlement using device signals, behavioral data, and address history.

- Fiat on and off ramps stitched to treasury: Most merchants still have fiat obligations. Payroll, rent, taxes, and suppliers expect dollars in a bank. Processors can auto-convert a configurable slice of USDC to fiat and sweep it to bank accounts on a schedule. The rest can be left onchain for payouts, rewards, or yield policies.

- Tax and reporting: Every onchain sale still needs an invoice, a tax code, and a revenue recognition policy. Modern processors post a parallel ledger that maps transaction hashes to invoices and charts of accounts. Finance teams can export that ledger into enterprise resource planning systems and reconcile it like any other tender type.

How the money really moves

Let us walk a concrete example.

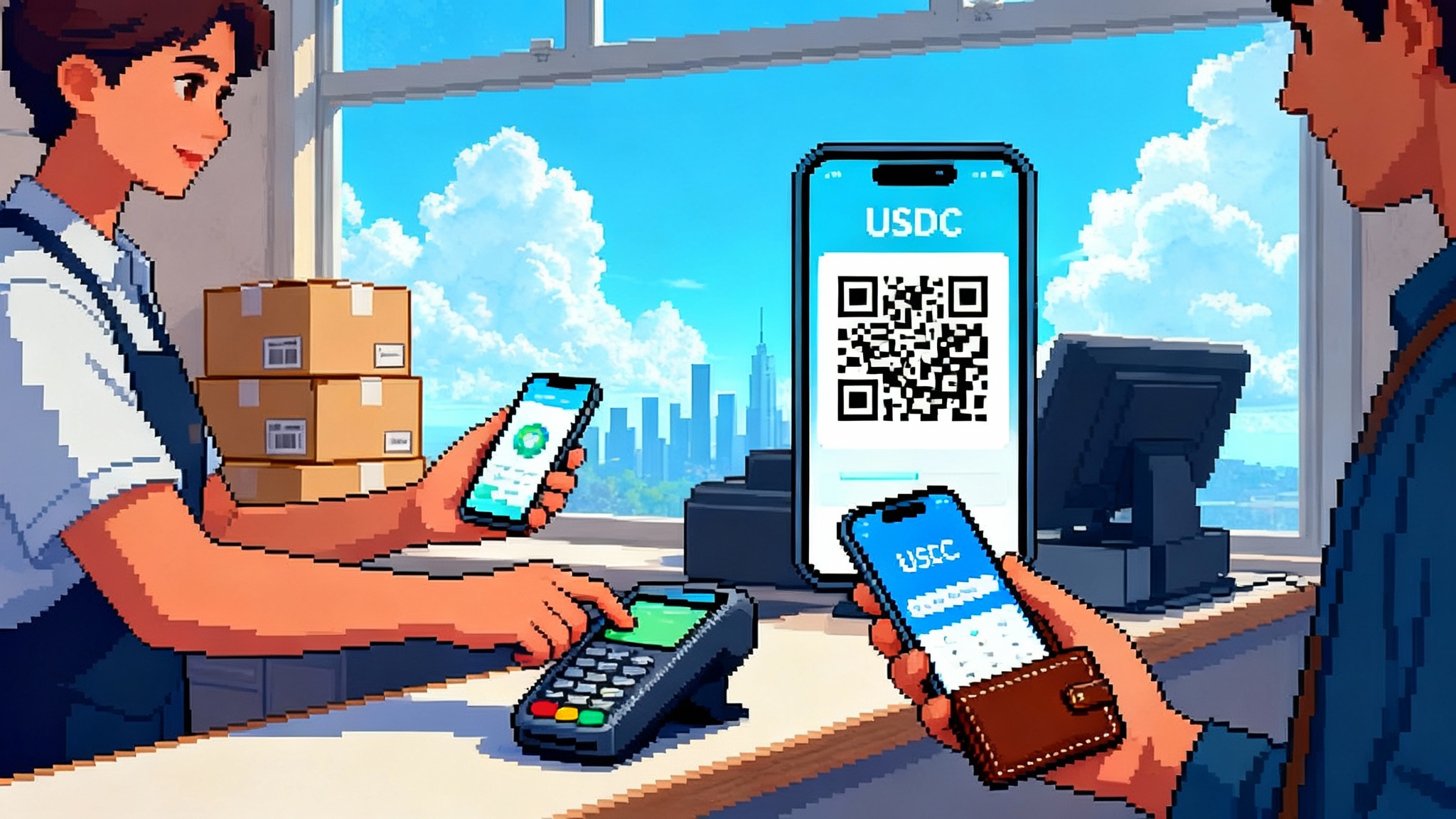

- A shopper with a wallet visits a Shopify store that displays Pay with USDC on Base. The price is 49 dollars.

- At checkout the store quotes the total, plus a network fee estimate that rounds to a fixed cents amount for the buyer. The merchant chooses to absorb or pass through this fee.

- The buyer approves a transfer of 49 dollars in USDC to a payment contract that immediately splits 48 dollars to the merchant and 1 dollar to the processor.

- The contract emits an event with order id, timestamp, and amount. The order system marks the order paid and triggers fulfillment.

- Treasury policy is set to auto-convert 70 percent to fiat daily. The processor batches swaps through a regulated liquidity partner, sends dollars to the merchant bank, and leaves 30 percent as USDC for supplier payouts next week.

For subscriptions, steps 1 to 3 happen once, plus an approval for scheduled pulls. Each cycle repeats 3 to 5, with retries and alerts if funds are missing.

Winners and losers across fintech and layer twos

- Winners: Merchants that run tight margins. Think electronics, furniture, or cross-border digital goods. A 150 basis point swing on cost of payments can be the difference between advertising or not, expansion or not.

- Winners: Wallets that feel like banking apps. A checkout wallet must auto-detect chains, abstract gas, and explain in clear language what is happening. The wallet that nails receipts, refunds, and scheduled payments will feel like magic. That trust compounds.

- Winners: Base and any layer two with cheap, reliable blockspace and strong developer toolkits. Checkout hates variable throughput and surprise fees. Chains that deliver predictable finality and easy account abstraction will gain share, a theme echoed in fault proofs remaking 2025.

- Winners: Stablecoins with tight banking relationships and clear compliance posture. When treasury teams ask hard questions about reserves, redemptions, and audit trails, the answers must be crisp.

- Losers: Standalone cross-border payment companies that tax card volume without adding risk controls or acceptance lift. If a stablecoin rail can move value with software-level overhead, rent-seeking intermediaries get compressed.

- Losers: Layer ones and twos that price blockspace for trading rather than payments. If fees spike during market volatility, carts get abandoned. Payments want smooth seas.

- Losers: Wallets that chase speculation over service. If the first screen is charts instead of receipts, shoppers will not adopt.

Four sharp implications for operators

- Redesign pricing for cents, not percent: When transaction cost is a few cents, small-ticket items and micro-upgrades become feasible. Bundle digital extras at 99 cents. Sell add-on services at 1 dollar weekly. Test new shapes because the fee math finally works.

- Make refunds a feature, not a fight: Build a policy that pre-approves instant refunds up to a threshold. Advertise it. The confidence lift will raise conversion more than the cost of a few refunded items.

- Treat payments as a marketing channel: Every receipt is a permissioned touchpoint in a wallet. Deliver loyalty and support in the same surface. Ask for a review when the onchain delivery event fires, not days later by email.

- Move suppliers onchain: If you take USDC in, pay USDC out. Offer a faster-pay discount to contractors and creators who accept onchain. The working capital cycle will tighten further.

The 2026 builder roadmap

Use the next 18 months to move from pilot to platform. Here is a practical plan.

-

Q1 2026: Ship the zero to one

- Add USDC on Base as a tender type alongside cards in your checkout. Keep price parity with fiat. Show the estimated fee clearly.

- Turn on recurring stablecoin billing for one product tier. Start with audiences that struggle with card approval rates like international users or young subscribers.

- Instrument end to end analytics. Track conversion, approval, refund rate, and customer support tickets by tender type.

-

Q2 2026: Make it trustworthy

- Build clear receipts. Show a payment reference, the contract address, and a human-readable amount. Add one-click refunds with policy thresholds.

- Add address reputation checks and device risk signals before you surface the wallet option. Decline politely with a fallback to card when risk is high.

- Integrate accounting. Map each onchain payment to an invoice id. Export a daily subledger that finance can load into your accounting system.

-

Q3 2026: Expand acceptance and reduce friction

- Offer in-person acceptance with a merchant phone as the terminal. Use a dynamic code and deep link flow so the buyer approves in wallet with one tap.

- Add loyalty tied to receipts. Drop points or perks to the buyer wallet after each successful payment. Make rewards visible in checkout.

- Roll out supplier payouts in USDC. Start with affiliates and creators. Publish a short playbook for partners on how to receive and cash out.

-

Q4 2026: Optimize and differentiate

- Move to intelligent routing. If fees or congestion rise, route payments to the cheapest supported rail without the buyer noticing.

- Experiment with metered billing. For usage-based products, pull small amounts frequently and show real-time balances in the user dashboard.

- Offer a premium program for onchain-first customers. Faster refunds, better perks, and early access. Let the economics pay for the benefits.

Practical guardrails before you scale

- Handling mistakes: Onchain is final. Build a confirm step that shows the exact amount and merchant name. Allow a short grace window for users to cancel before the transfer is mined.

- Gas abstraction: Hide gas from users. Your processor can sponsor fees or batch settlements so buyers do not need spare tokens beyond USDC.

- Support scripts: Train agents to read a transaction hash, confirm status, and process refunds. Give them a playbook for subscription pauses and payment method changes.

- Treasury policy: Decide what percent of USDC you convert daily and what percent you keep onchain. Document thresholds for extraordinary conversions during market stress.

- Legal and tax: Work with counsel on terms that describe the onchain nature of payments, refunds, and subscriptions. Confirm how sales tax is calculated and reported for digital goods delivered cross-border. For broader ecosystem shifts, see passkeys make smart wallets the default.

The broader shift: from intermediated trust to verifiable service

The internet replaced middlemen with protocols. Payments held out because the hardest parts of money are compliance, fraud, and reconciliation. That moat is now software. Stablecoins wrap dollars in code. Wallets turn users into permissioned endpoints. Processors become orchestration layers that combine risk controls, compliance, and developer experience.

None of this means cards disappear. They will remain the default in many markets, and they still excel in consumer protections. But it does mean that the next million merchants can choose a different default when selling to the world. If a buyer can pay with a compliant, low-cost digital dollar and a merchant can settle in minutes with a clear ledger, the rational choice will shift.

What to do next

- If you are a merchant: Pick one product line and turn on USDC at checkout. Make it visible but not pushy. Measure the lift in conversion and the drop in failed payments in your hardest markets.

- If you are a wallet builder: Prioritize receipts, refunds, and scheduled payments. Make the first purchase effortless and the first refund delightful.

- If you are a processor or platform: Offer merchants a migration path that feels familiar. Do not ask them to become experts in chains. Give them a toggle and take the risk and complexity behind your API.

The story here is not coins. It is customers. The winners will be the teams that make paying and getting paid feel obvious, quick, and fair. With USDC on Base live in the big pipes and subscriptions finally native to the rail, onchain payments no longer need a leap of faith. They need a shopping cart and a reason to buy.

A smart conclusion for a pivotal moment

In every payments shift, one thing decides the winner. It is not the logo, the chain, or the brand. It is the moment a buyer clicks pay and nothing surprising happens. That is the bar. If USDC on Base, Stripe’s recurring flows, Shopify’s checkout surface, and Coinbase’s wallets continue to make nothing surprising happen, the center of gravity will move. Not in a headline, but in a million small transactions that settle quietly and on time. That is how speculation becomes service, and how onchain payments become commerce.