Arbitrum and OP Stack switch on fault proofs, remaking 2025

Two landmark 2025 activations turned permissionless validation on for the largest rollups. Here is how Stage‑1 decentralization reshapes withdrawals, bridges, liquidity, and the builder playbook.

The quiet revolution everyone waited for is now live

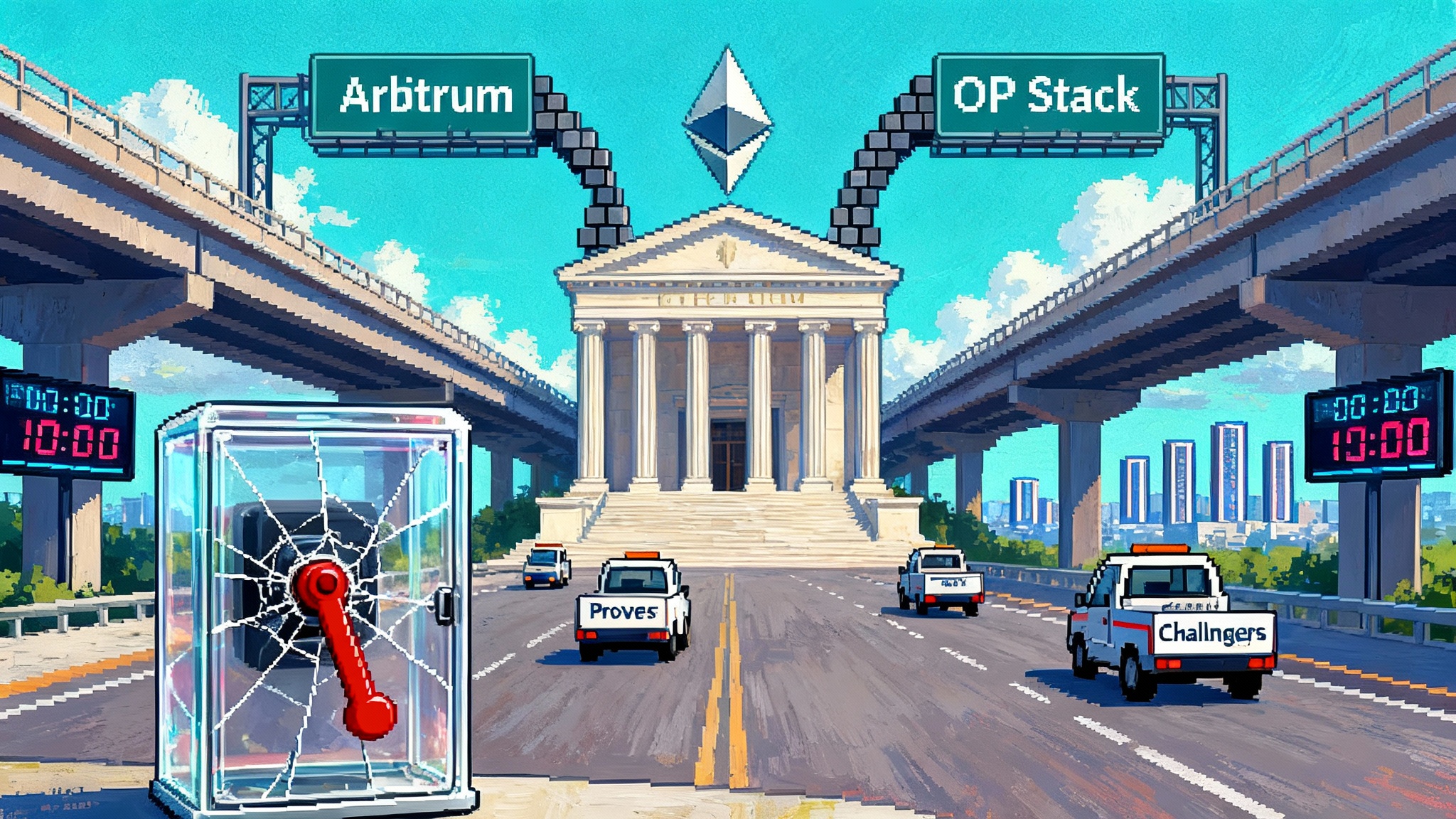

When rollups arrived, they promised Ethereum-level security with the scale of a separate lane. The reality for years was closer to training wheels. Fraud proof systems were on testnets or gated. Security councils held emergency brakes. Users still relied on trusted parties if something went wrong. In 2025 that changed. Two dates mark the pivot: on February 12, 2025 Arbitrum activated BoLD, and on October 2, 2025 the Optimism Superchain shipped Superchain Upgrade 16a. Together they pushed permissionless validation and live fault proofs into everyday production across the largest generalized rollups.

This is a quiet revolution because nothing flashy appears in the user interface. A swap looks like a swap. A bridge looks like a bridge. Yet the security model under the hood changed in a way that matters when things break. The difference between hoping someone will save you and knowing anyone can fix it is the difference between a nightclub with a single bouncer and a city with rule of law.

What actually changed on those dates

Before February and October, both ecosystems had fault proof designs but relied on restricted sets of actors. If a sequencer misbehaved or an invalid state root reached Ethereum, a narrow group needed to push the red button. Now the red button is public. A few concrete shifts:

- Permissionless validation: anyone who runs the proving stack can challenge an invalid state root. No whitelist. No backchannel.

- Live fault proofs: disputes are resolved by the protocol, on Ethereum, within the challenge window. No off-chain assurances, no soft promises.

- Stronger canonical bridges: messages and withdrawals that depend on the rollup’s posted state root now sit behind a dispute game that any motivated participant can play, not only insiders.

BoLD on Arbitrum and 16a on the OP Stack did not erase all governance or safety valves. At Stage‑1, councils and upgrade timelocks still exist, and they should. The point is that with live fault proofs on, a malicious or faulty sequencer is no longer a terminal risk to user funds if someone, anyone, is willing to run a prover and contest.

Stage‑1 decentralization, in human terms

Think of Stage‑0, Stage‑1, Stage‑2 as the phases of teaching a teenager to drive. Stage‑0 is the parking lot with an instructor’s brake pedal installed. Stage‑1 is the open road with real traffic, plus a guardian in the passenger seat and a mandated speed limit. Stage‑2 is a fully licensed adult who drives alone with the same rules as everyone else. In rollup terms:

- Stage‑0: no functioning fault proofs on mainnet, heavy reliance on a multisig or foundation.

- Stage‑1: fault proofs live on mainnet, anyone can participate, but some upgrade powers and emergency pauses remain.

- Stage‑2: fault proofs plus slow, credibly neutral upgrades, and minimal special governance powers.

Arbitrum and the OP Stack moved into Stage‑1 in 2025. That shift changes where trust sits. Instead of trusting that a council will act if needed, you can rely on an open market of challengers, watchdogs, and provers whose incentives are aligned with catching errors.

Why permissionless validation matters

Blockchains do not fail often. But when they do, they fail hard. Permissionless validation introduces three practical properties:

- It removes single points of failure. If a whitelisted validator goes offline during a dispute, someone else can step in.

- It creates a credible threat of challenge. The possibility that any third party can win a dispute forces sequencers to behave and reduces the odds of invalid postings in the first place.

- It turns correctness into a commodity. If the proof system is public, specialized operators can compete on proving cost and latency, reducing the friction to maintain integrity at scale.

This is not academic. In a world with many OP Stack chains and the Arbitrum ecosystem processing millions of transactions daily, the law of large numbers demands that the dispute path not depend on relationships. Now it does not.

What changes for users today

Users should not need to read design documents to stay safe. With Stage‑1:

- Withdrawals are safer by default: the challenge window is still there, and funds still wait to clear. The difference is that the path to stop an invalid withdrawal does not rely on a backchannel. If a sequencer posts something wrong, any challenger can contest it.

- Canonical bridges gain credibility: if you used the official rollup bridge and waited for the dispute period, your risk of being rugged by an invalid state root is much lower. Third‑party fast bridges still help with latency, but the underlying risk they hedge against is smaller, which should compress fees for instant liquidity over time.

- Forced actions are real: if a sequencer stalls, users and apps can rely on the force‑inclusion and force‑withdrawal mechanics knowing that contestation is public. That means a stuck rollup is an inconvenience, not a catastrophe.

A simple mental model: imagine every withdrawal sits in an escrow with a public alarm on the wall. In 2024, only staff had the key to the alarm. In 2025, the glass box says break in case of emergency and anyone may pull the handle.

What builders should do now

If you are shipping on Arbitrum or the OP Stack, Stage‑1 is not fire‑and‑forget. It demands a few upgrades in your own stack.

-

Add re‑proving flows for critical state. For anything that shuttles value or governs permissions across L1 and L2, do not just accept a posted state root. Re‑prove it:

- Re‑execute key transactions locally against the rollup node and compare the resulting state to the posted output root.

- Subscribe to dispute game events on Ethereum. If a root you care about is challenged, pause dependent actions until the dispute resolves.

- Store proof metadata. Keep the proof hash or one‑step proof commitments in your logs so you can audit and replay later.

-

Monitor upgrade pipelines like production dependencies. Treat chain software upgrades exactly like a major database migration:

- Track release candidates and scheduled activations for your target chain. Set calendar holds around upgrade windows.

- Run canary nodes on the new software in parallel and evaluate state diffs on testnets before the mainnet flip.

- Add alerting on L2 output proposals and on the L1 inbox and outbox contracts so you catch anomalies early.

-

Bake in diversity in your infrastructure:

- Run more than one proving client if the ecosystem offers options. Diversity reduces correlated failures.

- Separate concerns. Use one cluster for sequencing‑facing RPC, one for archival reads, one for proof generation. This helps when a dispute spikes load.

-

Plan for partial liveness failures. In a dispute, throughput can dip or finality can extend. Time‑bound actions in your app should degrade gracefully:

- Use timeouts and fallbacks, not infinite waits.

- Queue messages that depend on a challenged root and surface status to users.

-

Update your bridge policy. If you run a fast bridge, adjust fees and collateral rules to reflect the new base risk. If you consume fast bridge liquidity, add logic to prefer canonical bridges for large withdrawals where latency is less important than certainty.

How these changes ripple into liquidity

Liquidity follows the cheapest defensible path. Live fault proofs push that path toward the canonical bridges and shared messaging layers secured by Ethereum. Three effects to expect through 2026:

- Price compression on fast bridge liquidity: if the residual risk of invalid roots falls, insurers and market makers can price instant exits more cheaply. Expect tighter spreads and more competition.

- Deeper pool consolidation around L1 finality: builders will push settlement of high‑value positions back to Ethereum more often. That means fewer chain‑specific liquidity silos, because the canonical path becomes good enough for most flows. See how POL and AggLayer reset liquidity for a related architectural shift.

- More predictable capital cycles for apps: re‑proving flows allow a protocol to automate rollovers only after a specific root finalizes. That improves net asset value accounting and lowers operational risk during market stress.

Governance in a Stage‑1 world

Stage‑1 does not eliminate governance. It changes its job description. Instead of being the last line of defense, councils and token holders manage upgrades and respond to rare emergency conditions under transparent constraints. That invites healthier governance mechanics:

- Longer and enforced timelocks for upgrades that touch the fault proof system.

- Public bounties and service‑level commitments for provers and challengers, funded by protocol treasuries.

- Independent monitoring guilds with on‑call rotations, similar to incident response in traditional software operations.

Expect a political shift too. If anyone can challenge, the power to censor or delay becomes less credible. Debates move from who is allowed to act to how quickly the system should accept upgrades and how to compensate the people who keep watch.

The road to Stage‑2 in 2026

Stage‑2 means the training wheels come off. To get there, rollups need three things to mature in 2026:

-

Stricter upgrade constraints. Upgrades that can alter the fault proof rules should be slow, transparent, and narrowly scoped. Expect multi‑week timelocks and on‑chain veto powers that are separate from token voting.

-

Battle‑hardened proving clients. Diversity is security. Multiple proof implementations that can cross‑check each other make it dangerous for a single bug to slip through. The value of client diversity is evident in Solana’s multi‑client era, and rollups should trend the same way.

-

Standardized cross‑rollup verification. The fastest route to interop is not bespoke bridges. It is a common way to verify each other’s outputs under Ethereum. Once each rollup can verify another’s finalized outputs without special trust, atomic application patterns become realistic across the rollup economy.

When these pillars harden, Stage‑2 will not be a banner drop. It will feel like turning a dial. Upgrade delays grow, emergency powers shrink, proving stacks diversify, and cross‑rollup verification becomes boring and cheap.

Interop that changes how apps are built

Fault proofs are not just about stopping bad states. They are the foundation for safer interop. Here is why:

- If Rollup A can verify Rollup B’s finalized state under shared rules, you can build applications that straddle both without a bespoke trust bridge. That means a lending market on Arbitrum accepts collateral that lives natively on an OP Stack chain, or vice versa, with settlement stitched together by Ethereum.

- Liquidity providers no longer need to guess which bridge a protocol will favor. The canonical path becomes the default, and fast liquidity becomes a commodity service wrapped around it rather than a separate risk surface. Pricing power will shift much like the Uniswap DUNA shift reshaped protocol fee expectations.

- Governance can specialize. Protocols can elect to use a single token or council on one chain while enforcing their policies across many, because the enforcement anchor is Ethereum and the verification fabric is the same everywhere.

The outcome is not one chain to rule them all. It is many chains, each optimized for a community or product, that share a common security court and a common way to check receipts.

Practical playbook by role

-

For wallet teams: show users the status of the latest output root, whether it is challenged, and when a withdrawal will finalize. Add clear labels for fast versus canonical exits and default to the canonical path for high‑value transfers.

-

For protocol engineers: wire in re‑proving for administrative actions. A governance parameter that changes cross‑chain should only flip after the target root finalizes. Build an allowlist of acceptable dispute outcomes and halt if an unexpected branch wins.

-

For risk and ops: maintain a chain matrix. For each chain you depend on, track proving client diversity, upgrade cadence, challenge window length, and council powers. Treat exceptions as change‑managed events with explicit sign‑off.

-

For market makers and bridges: adjust pricing models to the new residual risk. Separate inventory risk from proof finality risk. Offer cheaper instant exits that default to a fallback of canonical finalization if liquidity dries up.

-

For researchers and auditors: focus reviews on the boundary between the virtual machine that executes transactions and the fault proof system that proves them. Bugs there propagate across ecosystems.

The signal hidden in the stability

The magic of 2025 is not that rollups got faster or cheaper on a single day. It is that the safety net under the performance finally looks like Ethereum again. With Arbitrum’s BoLD live from February 12 and the OP Stack’s October 2 maintenance hardening, permissionless validation is no longer a roadmap item. It is a property of production systems.

The next twelve months will be less about promises and more about posture. Builders who adopt re‑proving, monitoring, and upgrade discipline will compound trust with every release. Users who default to canonical bridges for serious money will sleep better. Treasuries that fund provers and watchdogs will buy real security, not vibes. By the time Stage‑2 arrives, interop will feel normal rather than new.

The quiet revolution is not loud because the right kind of security never is. It is the click you do not hear when you lock your door because the lock is part of the house. In 2025, rollups became part of that house. In 2026, they will make the neighborhood feel connected.