Restaking goes multi-chain as EigenLayer hits Base L2

EigenLayer just switched on multichain verification, letting Actively Validated Services run on Base and other Layer 2s while keeping Ethereum-grade security. See what it unlocks, who it shifts, and how to build for 2025 and 2026.

Breaking: the security anchor stays on Ethereum, the speed moves to L2

Restaking’s next act is here. EigenLayer has introduced multichain verification so Actively Validated Services, the networks that oracles, data layers, bridges, shared sequencers, and coprocessors rely on, can execute on Layer 2s and still inherit Ethereum-grade security. The first integration targets Coinbase’s Base network on testnet, with broader L2 support on the roadmap. The Block on multichain launch.

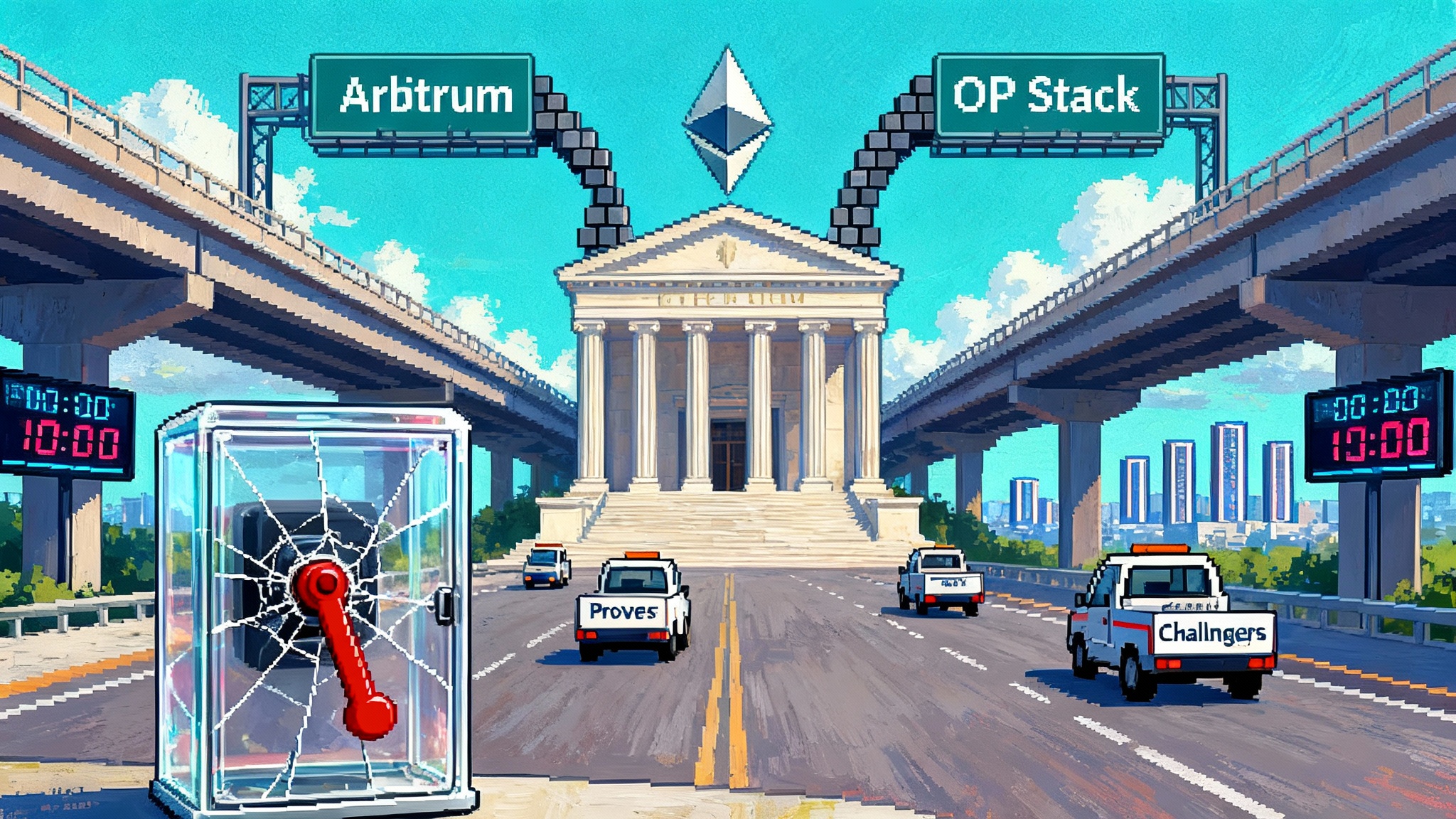

If you think of Ethereum as the world’s strongest courthouse, multichain verification lets you hold the trial in the courthouse while running the day-to-day business in a modern office tower across town. The ruling, final and enforceable, remains anchored to Ethereum where stake and slashing live. The work, fast and inexpensive, takes place on an L2 that users already frequent.

What actually changed under the hood

Until now, AVSs faced a brittle choice. Run on Ethereum Layer 1 and enjoy the deepest security, or move to a faster, cheaper chain and rebuild trust with weaker guarantees. Multichain verification decouples these concerns.

- Execution home on an L2: the AVS posts updates, aggregates signatures, and serves users where block times are quick and fees are low.

- Verification and slashing on Ethereum: operator stake, operator sets, and slashing conditions remain on L1. Misbehavior is adjudicated where the economic weight lives.

- State sync between chains: the AVS maintains a canonical view of who the operators are, how much stake backs them, and what counts as a fault. That view is rooted in Ethereum and mirrored on supported L2s so the service can run at L2 speed without drifting from L1 truth.

In plain English, the security plug stays in the Ethereum outlet while the appliance runs in another room. It is the same electricity, just a longer extension cord that is engineered so no one can swap it for a fake.

Why this is a big unlock for infrastructure teams

The infrastructure that blockchains depend on is often priced out of Layer 1, especially when demand spikes. Multichain verification changes the math for several categories:

- Data availability layers: Teams like EigenDA and competitors in the modular stack can publish and sample data at L2 costs while still being slashable on Ethereum. That brings per-transaction costs down and opens the door to cheaper rollup throughput. For more context on DA cost dynamics, see blob surge and DA wars.

- Bridges and interop layers: Message networks such as LayerZero or Hyperlane can route more traffic near users on L2s, then enforce disputes and penalties through Ethereum’s stake. That reduces latency without relaxing security.

- Oracles: Networks like Chainlink and Pyth can push frequent price updates where traders actually transact, while preserving credible enforcement on L1. You get fresher feeds at lower cost and no trust downgrade.

- AI and compute coprocessors: Emerging networks such as Ritual, Axiom, or Risc Zero powered services can do heavy lifting where it is economical, then settle results and enforce honesty on Ethereum. That is a natural fit for inference markets and zero knowledge proof generation that would be too expensive on L1.

The short version: build where it is cheap, settle where it is safe.

The competitive shift: rollups vs Layer 1s

Multichain verification quietly strengthens the rollup thesis.

- For rollups: L2s become the default execution home for middleware. If an AVS can live on Base or another L2 and still inherit Ethereum security, app teams gravitate toward the place with users and low fees. That makes L2 ecosystems stickier, since developers can bundle an oracle, a data layer, and a coprocessor all within the same L2 without sacrificing slashing guarantees. A related shift is how fault proofs remake 2025.

- For Layer 1s: sovereign L1s that competed on raw throughput or fees face headwinds. Their value proposition narrows to unique features, distinct communities, or native asset economics. If critical services can be Ethereum-secured while running at L2 speed, spinning up a new L1 solely for cost advantages looks less compelling. See how AggLayer resets multichain liquidity for an adjacent consolidation trend.

- For shared sequencers and interchain services: a cross-rollup security market becomes realistic. Shared sequencing, cross-chain MEV smoothing, and settlement services can run primarily on L2s and expose the same slashing backstop to multiple rollups at once.

The practical takeaway is that the app layer consolidates around L2 hubs. New L1s must differentiate with something stronger than cheaper blockspace.

How slashing and risk work across chains

Security only matters if it is enforceable. The design goal is simple: a fault on an L2 must burn or reassign stake on Ethereum, predictably and quickly enough that rational operators behave. Here is how to think about it:

- Root of truth on Ethereum: operator registration, operator set updates, allowed key types, and the slashing contract live on Ethereum. That contract defines violations and penalties.

- Evidence flow from L2 to L1: when an AVS detects a violation on the L2, it produces evidence that can be verified or challenged. The evidence, once finalized, is relayed to Ethereum. If unchallenged within the dispute window or verified through a proof, the L1 contract executes the slash.

- Finality lag is a feature: the system expects a delay between an L2 event and an L1 slash. This is a safety valve for reorgs, out-of-order messages, and fraud proof challenges. Builders should design user-facing timeouts and circuit breakers around that window.

- Failure domains are compartmentalized: L2 outages or sequencer hiccups degrade liveness, not safety. If the L2 halts, the slashing logic and stakes remain unaffected on Ethereum. Once the L2 recovers, state sync resumes.

- Replay and double counting protections: the AVS must include chain identifiers and nonce schemes so the same message cannot be replayed on another network. A basic rule is that every signed statement commits to chain id, slot or block number, and an AVS-specific domain separator.

Think of slashing like insurance with on-chain claims. The claims desk is on Ethereum, the incidents can happen on any supported chain, and the paperwork must be standardized so malicious actors cannot file the same claim twice or forge signatures.

Costs, latency, and developer ergonomics

On an L2 like Base, gas costs and confirmation times are far lower than on Layer 1. That matters for AVSs that need to update often. Signature aggregation, data posting, partial proofs, and oracle heartbeats all get cheaper, which allows higher update frequencies and better user experience. By anchoring slashability on Ethereum, you avoid reinventing the security wheel for each L2.

Operationally, integration is framed as parameterization rather than a rewrite. Developers set AVS contract parameters to recognize the L2 environment, configure relayers or bridges for evidence passing, and point operators to the L2 execution home. The L1 slashing contract remains the same, which keeps the compliance surface familiar for auditors and operators.

What it means for Base right now

Base is the first L2 to host multichain verified AVSs in public testing, with the initial rollout on Base Sepolia. Eigen Labs has described this as a milestone that brings the performance of L2s to Ethereum-secured services, while targeting mainnet environments after the test period. Cointelegraph interview with Eigen Labs.

For Base developers, the headline is straightforward. You can start building and load-testing your AVS where the users are, then rely on Ethereum’s stake and slashing to keep operators honest. The integration meets teams where they already deploy applications and reduces the friction of cross-chain orchestration.

Who wins first

- Trading and derivatives apps: faster oracle updates and liquidation checks at L2 speed, with the credibility of L1 slashing, improve solvency and user trust.

- Rollups that rely on external DA: cheaper sampling and posting on L2 expand the viable design space for throughput and data-heavy apps.

- Cross-chain apps: bridges and messaging layers that already speak to many chains can now unify security under one L1 slashing contract, while serving traffic locally on each L2.

- AI-enabled apps: inference, ranking, and verification services can run frequent jobs on L2 and settle accountability to Ethereum. This creates a clear path for pay-per-inference markets with verifiable quality control.

Who needs a new plan

- New general-purpose L1s: competing on gas price alone will not be enough. They will need differentiated features like unique state models, specialized hardware markets, or native real-world integrations.

- AVSs that ignored slashing: reputation-only systems will feel outdated if peers offer real stake-backed guarantees with the same user-facing performance.

- Operators running only on L1: the revenue mix shifts as more AVS workloads move to L2. Operators should prepare L2-capable infrastructure, hardened relayers, and monitoring to capture the next wave of jobs.

A builder playbook for 2025 to 2026

Use the following checklist to go from idea to a production AVS in the multichain model.

- Define the trust contract

- Write down three crisp misbehaviors you will slash for. Example for an oracle: equivocation within a time window, out-of-bounds price relative to reference feeds, or failure to publish under normal network conditions.

- Translate each into verifiable evidence that can be relayed from the L2 to Ethereum. Prefer small proofs or signature sets over heavy payloads.

- Start on Base Sepolia

- Deploy the L2 execution contracts and a minimal L1 slashing contract wired to your operator set. Use test operators you control, then invite a small group of professional operators for adversarial drills.

- Instrument your relayer path. Prove you can relay fault evidence from Base to Ethereum reliably, handle reorgs, and avoid duplicates. Log chain ids, block numbers, and replay guards.

- Operator onboarding and economics

- Publish hardware and latency requirements for operators on the L2. If you require GPUs or high IOPS storage, say so, and price rewards accordingly.

- Keep reward schedules simple at launch. Pay base rewards for availability, add bonus buckets for timely performance, and reserve a portion for incident response costs.

- Slashing rehearsals

- Run tabletop and live-fire tests. Trigger simulated faults and verify that your L1 slashing contract executes the correct penalty after the dispute window. Document incident timelines and operator appeal paths.

- Define partial credit and de-escalation. For example, slash less for a rare liveness miss that does not harm users, slash more for equivocation or provable corruption.

- Security and audits

- Audit the L1 slashing logic separately from L2 execution logic. Treat the relayer like a key management system. Never allow the relayer to unilaterally decide what is a slashable fault.

- Add observation redundancy. At least two independent watchers should verify faults, even if only one submits. This reduces single points of failure and censorship risk.

- Mainnet progressive rollouts

- Stage to Base mainnet with a small operator set, daily caps, and opt-in clients. Publish a status page and a rollback plan. Start with read-only clients, then gradually accept write-critical flows.

- Expand to a second L2 only after you have automated evidence relaying and monitoring. Do not multiply operational risk before you can measure it.

- Communicate guarantees

- Describe your guarantees in user language. Say what can go wrong, what would be slashed, and who is liable. A clear service-level statement builds trust and helps regulators and partners understand the model.

Guardrails and risk design

- L2 dependency risk: if the L2 suffers downtime, your service stalls but does not lose funds. Build user-facing timeouts and fallbacks that reflect that reality.

- Cross-chain message risk: treat relayers like a safety-critical system. Use multiple providers or a permissioned committee to avoid a single operator flipping the kill switch.

- Parameter drift risk: lock critical parameters behind timelocks and publish change notifications. Sudden changes to quorum sizes or time windows create social attack surfaces.

- Economic risk: tune rewards so that honest participation strictly dominates misbehavior after expected slashing. Dry-run reward and slash scenarios with conservative stress assumptions.

Milestones to watch next

- Base mainnet support for multichain verified AVSs. The initial announcement targeted 2025 after the Sepolia test cycle. Teams should track EigenLayer and Base engineering channels for the switch from testnet to production, since that is the gating factor for real user flows.

- Additional L2 integrations. Expect other ecosystems to follow Base, especially those with strong developer traction and mature tooling.

- First real slashing events originating on an L2. The first public, cleanly executed slash will validate the model and clarify timelines between L2 detection and L1 enforcement.

- Operator marketplaces that advertise L2 readiness. Look for operator dashboards that expose latency, region, hardware, and slash history across chains.

The bigger picture: a market for security that spans chains

Restaking made Ethereum’s security rentable. Multichain verification makes that security portable. The likely end state is a security market where AVSs bid for stake, operators price their time and hardware by risk, and execution homes are chosen for user experience rather than trust compromises. Rollups become busy cities where services live, Ethereum remains the court and bank vault where disputes and value are settled.

The surprise is not that this model arrived. The surprise is how quickly the tooling is becoming usable. If you are building an oracle, a data layer, a sequencer, or a coprocessor, the window from concept to Base mainnet is shrinking from quarters to months. The teams that plan slashing first, automate cross-chain evidence early, and rehearse incident response will capture the first wave of demand.

Closing thought

Blockspace is abundant, trust is scarce. With multichain verification, EigenLayer is telling builders they no longer have to choose between the two. Keep your guarantees where the stake is, move your workloads where the users are, and let the market reward the services that prove it.