FERC 2222’s 2025 Kickoff and the Demand-Side Capacity Race

Order 2222 moved from paper to code in 2025, and the demand-side capacity race is on. Here is the rollout by ISO, what can show up by summer 2026, and the revenue stack that makes virtual power plants bankable.

The moment VPPs stopped being a side project

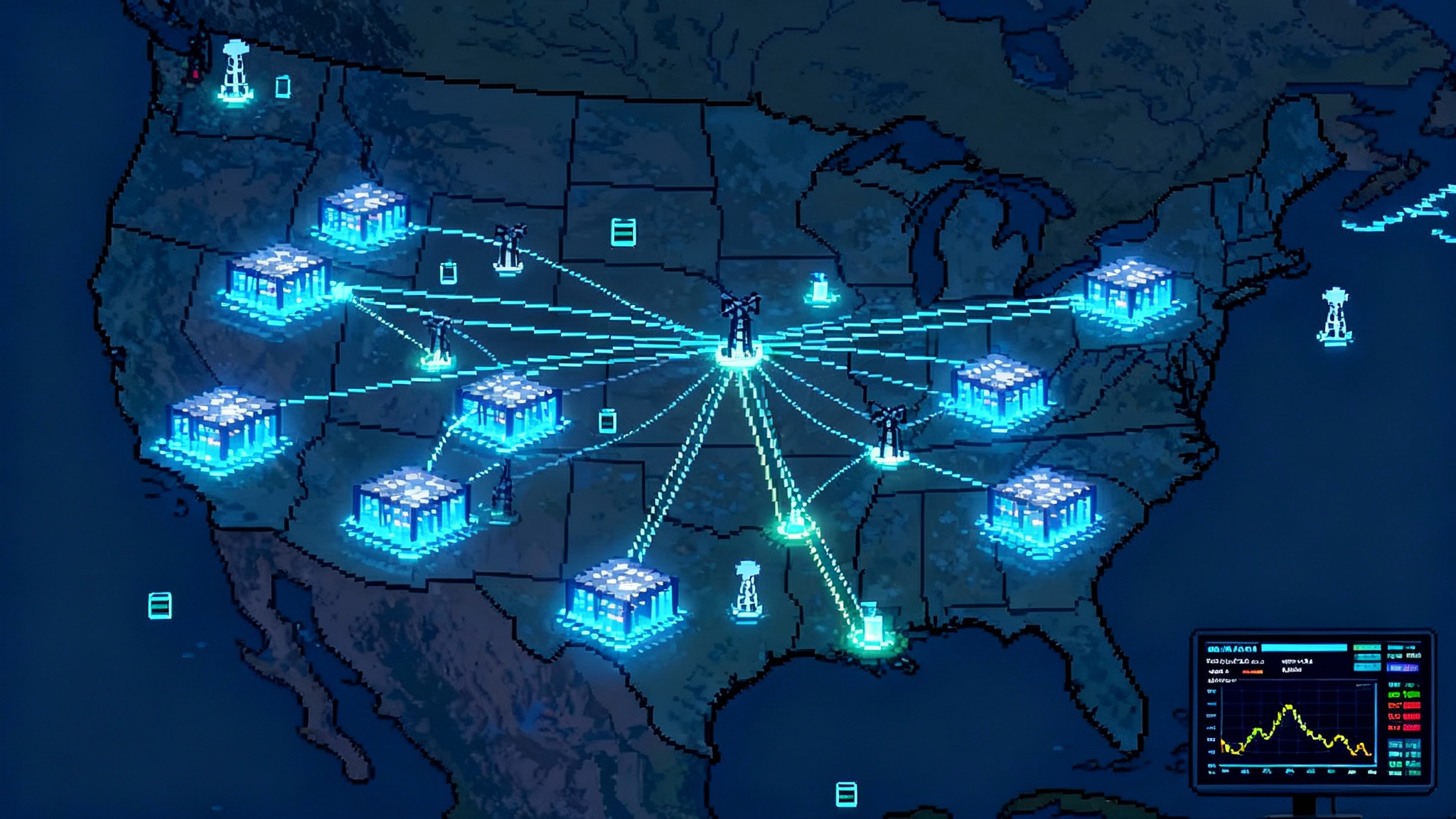

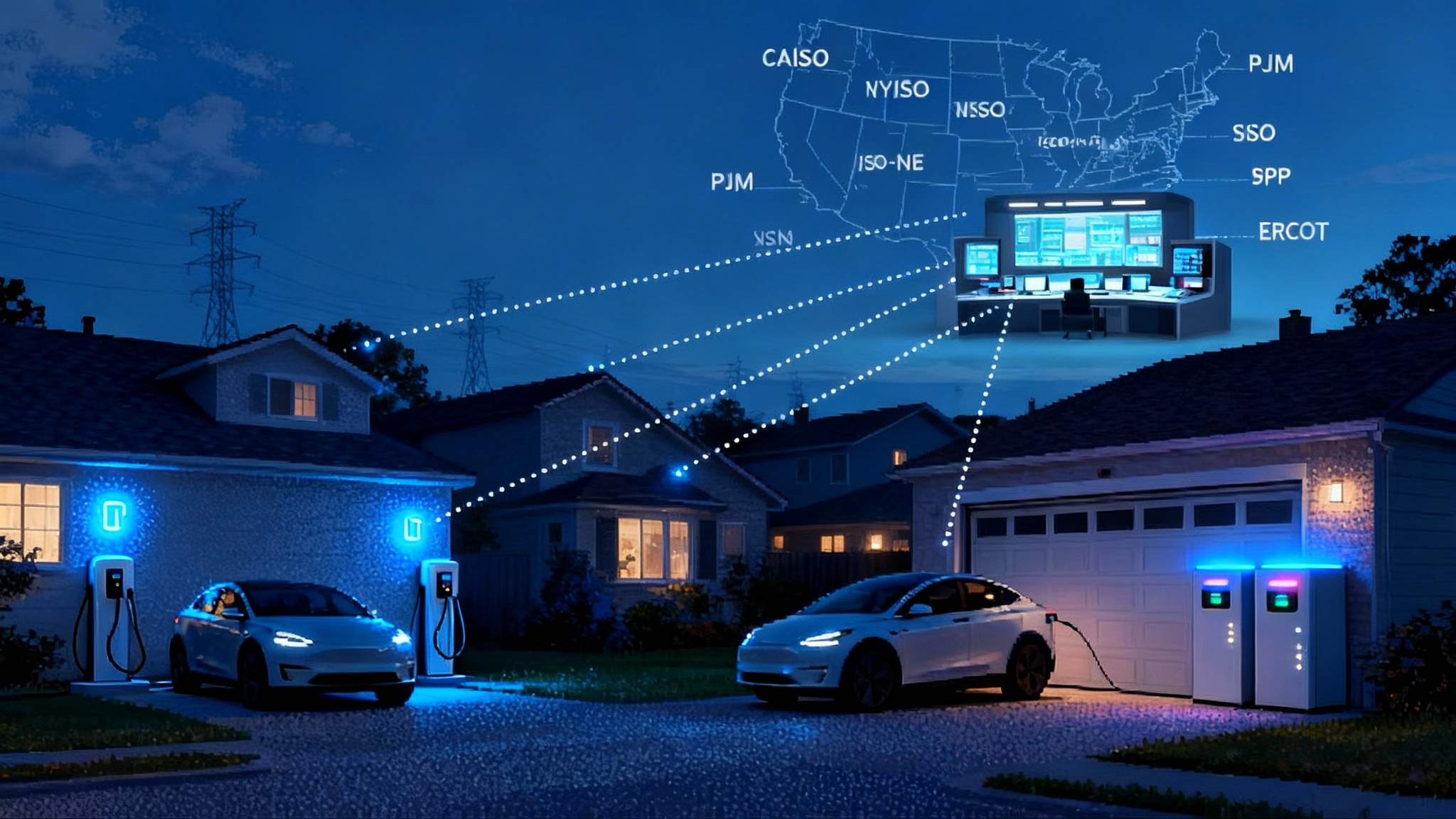

If 2023 and 2024 were the years virtual power plants proved they could work, 2025 is the year they became policy. At its 2025 meetings, the Federal Energy Regulatory Commission acted on compliance filings from the California Independent System Operator and the New York Independent System Operator, moving the landmark Order 2222 from paper to code and directing further changes to remove barriers for distributed energy resource aggregations. ERCOT, which sits outside FERC jurisdiction, also expanded its Aggregated Distributed Energy Resource pilot, signaling an appetite to scale from dozens of megawatts to the low hundreds. As AI load reshapes planning, dependable demand-side capacity matters more every quarter.

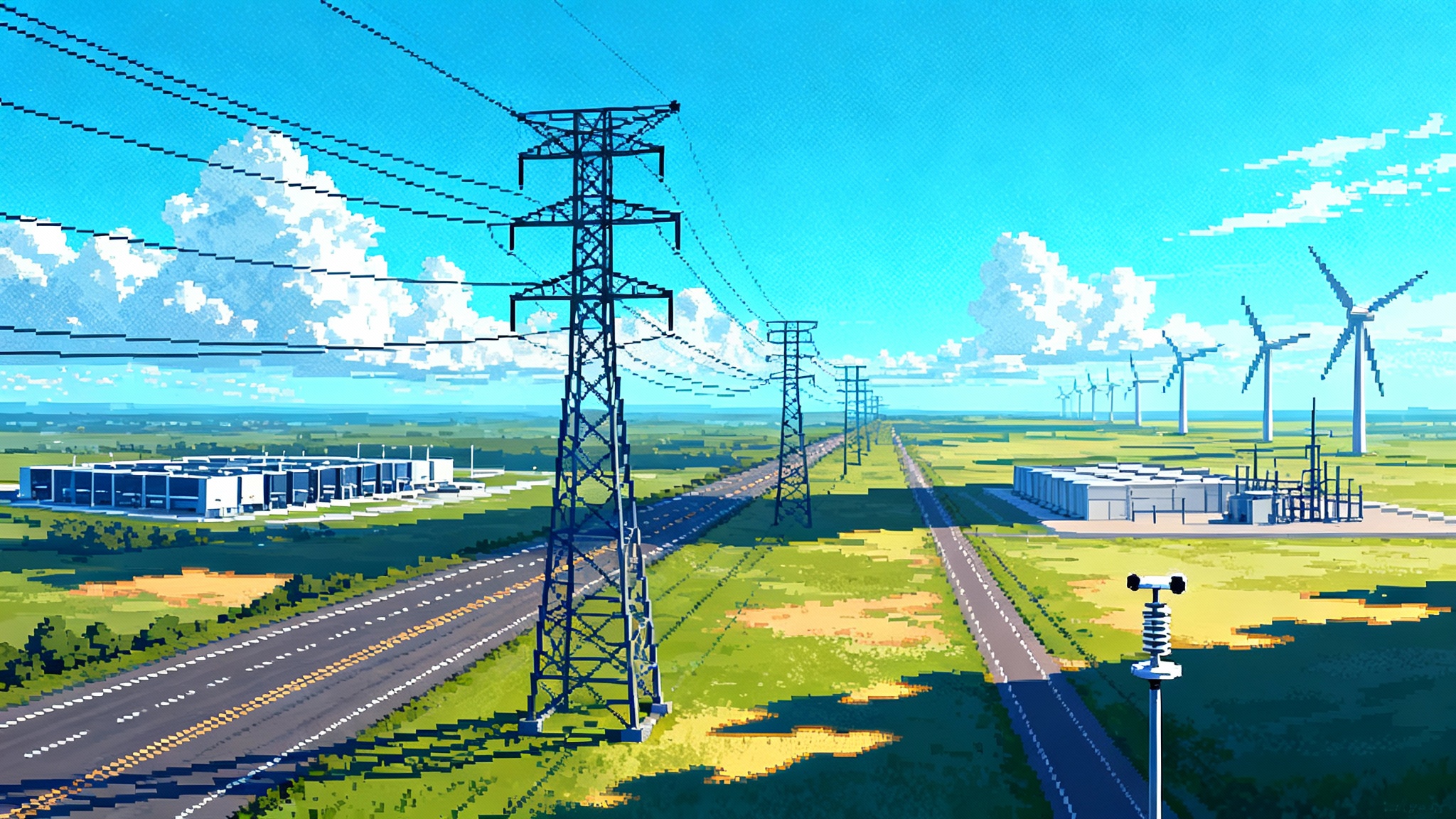

The headline is simple. Devices in homes and businesses can now be organized to compete in wholesale markets more like a power plant. Thermostats that ease a degree in a heat wave, electric vehicles that charge when prices fall, and home batteries that export during peaks can be orchestrated as a dependable, metered resource. What was once a set of small utility pilots is turning into a capacity race.

What Order 2222 actually unlocks

Order 2222 requires regional wholesale markets to allow aggregations of small resources to provide capacity, energy, and ancillary services if they can meet performance and telemetry standards. Two details matter for operators and product teams:

- Heterogeneous aggregations. Batteries, thermostats, and managed chargers can be combined inside one portfolio as long as the net performance matches the product requirements.

- Distribution coordination. Aggregators must pass distribution utility review, avoid double counting with retail programs, and share data for safe local operations. That sounds like friction, but it is also the bridge that makes dispatch at scale practical.

The rollout by market, 2025 to 2030

Here is the latest go-live map across the organized markets. For dates and scope, the most concise public summary is on FERC’s explainer page for Order 2222, which reflects recent Commission actions and filings by each operator: Order 2222 implementation by ISO.

- CAISO. Compliance accepted with additional directives in 2025. CAISO already had a DER Provider model, and the 2025 actions focus on aligning the model with full 2222 features and coordination rules. Expect incremental openings for heterogeneous aggregations and clearer dual participation rules.

- NYISO. Full Order 2222 implementation targeted by the end of 2026, with staged functionality along the way. NYISO has enabled participation for some DER aggregations already, but the full software and settlement stack completes in 2026.

- ISO New England. Energy and ancillary services open on November 1, 2026. Capacity participation aligns with Forward Capacity Auction 19 milestones in early 2026.

- PJM. Capacity market participation aligns with a February 1, 2027 effective date. Energy and ancillary services follow on February 1, 2028. The long lead is driven by significant clearing engine and registration system changes.

- MISO. A two phase plan runs through 2027 and 2029, tied to market system upgrades and a purpose built enrollment and mapping process.

- SPP. Second quarter of 2030 for full Order 2222 functionality, subject to ongoing revisions.

ERCOT is not under Order 2222, but it matters for where aggregators can earn today and learn for tomorrow. In June 2025 ERCOT adopted Phase 3 of its ADER pilot structure and in October raised participation caps again, moving toward a more open aggregator model and larger total capacity. You can follow the pilot specifics and the most recent cap increases on the official program page: ERCOT ADER pilot materials.

The near term unlock in gigawatts

Between now and summer 2026, the markets with the most near term potential are CAISO, NYISO, ISO New England, and ERCOT. The numbers below are conservative estimates based on device inventories, existing program enrollment rates, and market caps. They assume enrollment growth that tracks recent utility and aggregator sign ups and that distribution reviews keep pace with applications.

- New York. 0.6 to 1.0 gigawatts of flexible, dispatchable capability by summer 2026. This includes managed EV charging in downstate zones, thermostat fleets in utility programs, and several hundred megawatts of residential and commercial batteries. The constraint is not hardware; it is software, telemetry, and settlement that finish hardening in 2026.

- New England. 0.3 to 0.6 gigawatts by late 2026 as energy and ancillary services open, with capacity market participation guiding earlier commitments. New residential battery growth in Massachusetts and Maine plus commercial demand response in Connecticut anchor the ramp.

- California. 0.5 to 0.8 gigawatts of incremental VPP capacity that can newly stack services due to 2222 aligned participation, on top of a large baseline of demand response and behind the meter storage already active. The big change is deeper access to ancillary services and clearer dual enrollment.

- Texas. 0.2 to 0.3 gigawatts under the ADER pilot by summer 2026, driven by cap increases, a simplified participation pathway that resembles the Non Controllable Load Resource model, and several expanding utility plus aggregator partnerships. The pilot limits keep the near term number below half a gigawatt, but the learning value is high.

Add those up and a realistic summer 2026 unlock is 1.6 to 2.7 gigawatts of dependable, dispatchable capacity that clears wholesale markets with verifiable baselines. The wide band reflects local program design, distribution approvals, and how quickly aggregators can convert waitlists into telemetry verified portfolios.

The revenue stack that makes VPPs bankable

No two portfolios clear the same stack, but the math that matters to boards and credit committees is consistent across regions. Here is how the dollars line up, with live market price levels to anchor the scale.

- Capacity market revenue. The capacity anchor is back. PJM’s 2026 to 2027 auction cleared at the system cap of roughly 329 dollars per megawatt per day. That is about 0.329 dollars per kilowatt per day, or roughly 120 dollars per kilowatt per year when annualized. Portfolios in zones with higher constraints may see more, portfolios in ISO New England or New York often clear lower on average but can target seasonal peaks that pay well. The underwriting lesson is to size conservative capacity payments as a floor and treat upside as bonus.

- Ancillary services. Regulation and reserve products can add meaningful dollars per kilowatt per year for batteries and some thermostatically controlled loads, but performance risk is real. In New York, day ahead regulation capacity can clear in the single digit to low teens dollars per megawatt hour in normal conditions, with spikes when supply tightens. CAISO’s regulation and non spin averages are typically in the low single digits per megawatt hour month over month, but scarcity days swing outcomes. Aggregators that can qualify a portion of their fleet for regulation up and down while keeping the rest for capacity and energy tend to outperform.

- Day ahead and real time energy. Batteries that arbitrage evening peaks and EVs that follow price aware managed charging do most of the work here. On a per kilowatt basis, this is often the smallest slice but a critical one for total returns, especially in California and Texas where price spreads are common and growing. The practical constraint is device wear and tear and customer comfort. The right amount of cycling and the right temperature bands keep participation high and churn low. New storage chemistries will also matter, including sodium ion’s early grid role.

Three practical notes round out the business case:

- Stack only what the software can prove. Markets pay on verified performance, not intent. Measurement and verification must survive settlement and audit.

- Seasonality is a feature. Summer and winter peaks drive a large share of value. Contract designs that reflect this reality will recruit customers efficiently and avoid overpaying for low season flexibility.

- Device mix is the margin engine. A 5 kilowatt home battery paired with a smart thermostat and managed charger produces more reliable capacity than any of those devices alone. Heterogeneous aggregations are not a theory; they are the new default.

Where to bid, when, and with what

Here is a simple market prioritization for the next 36 months.

2025 to summer 2026

- CAISO. Bid demand response and storage into day ahead energy, non spin, and regulation where telemetry is solid and dual enrollment is approved. Use 2025 compliance clarity to expand heterogeneous aggregations.

- ERCOT. Register under the ADER Phase 3 model, pick a Qualified Scheduling Entity with strong telemetry tooling, and target contingency reserve and non spin. Keep unit economics conservative due to pilot caps and evolving rules.

- NYISO. Build the pipeline now for a 2026 scale up. Focus on managed charging and thermostat fleets in zones with summer reliability constraints and on batteries where distribution approvals are tractable.

Late 2026

- ISO New England. Bring mixed portfolios online for energy and ancillary services, with capacity obligations guiding winter readiness. Expect tougher performance rules and plan for winter peaking conditions.

2027 to 2028

- PJM. Use the February 2027 capacity effective date to commit dependable portfolios, then step into energy and ancillary service participation in 2028 after software and registration systems are in place.

- MISO. Phase in as Phase 1 and Phase 2 gates open between 2027 and 2029. Expect more distribution coordination work and plan for a longer interconnection review path at the distribution level. Pair demand-side scale with transmission headroom unlocked by DLR and AAR approaches.

- SPP. Treat 2030 as the commercial target while piloting with forward looking utilities in 2027 to 2029.

The acceleration playbook for summer 2026 readiness

This is a practical to do list for utilities, original equipment manufacturers, and aggregators. Follow it and you can stand up 100 to 300 megawatts of dependable flexibility in a service territory in under 12 months.

Utilities

- Create a single enrollment spine. One web flow, one consent screen, and one meter data authorization that covers thermostats, chargers, and batteries. Minimize clicks and watch sign ups rise.

- Pre approve device lists by feeder. Work with distribution planning to publish where batteries and exports are welcome and where they are limited. Clear green, yellow, red maps shorten review cycles.

- Offer a seasonal capacity retainer. Pay a per kilowatt summer and winter retainer with a bonus for verified performance in scarcity hours. Customers understand a retainer. It also aligns your incentives with market needs.

- Share five minute usage data with permission. Aggregators cannot meet regulation or non spin telemetry rules without low latency visibility. Put secure data feeds in place now.

- Put a budget number on churn. Set customer experience guardrails for thermostat comfort bands and charger delays. Losing trust burns more value than any marginal megawatt hour earned.

Original equipment manufacturers

- Build the grid interface into the device. A thermostat or inverter should ship with telemetry and control options that meet ISO specs without an add on box. Publish application programming interfaces and align on cybersecurity standards utilities will accept.

- Write the dispatch warranty in plain English. Battery customers will join VPPs if they know how many cycles are expected, what happens in an outage, and what they get paid. Clarity beats promises.

- Price per kilowatt year. A standard per kilowatt per year offer simplifies channel sales. Let aggregators add performance upside on top.

Aggregators

- Design for heterogeneous portfolios. That means a dispatcher that can call thermostats, chargers, and batteries in different combinations and still hit an ISO product shape. It also means baseline models that survive settlement disputes.

- Map the markets to the fleet. Build zonal portfolio plans for New York and New England and keep one eye on PJM capacity dates. Do not wait for perfect rules to start recruitment and device onboarding.

- Invest in distribution relationships. A dedicated interconnection and hosting capacity team will be a competitive advantage for at least the next three years. Faster approvals become higher market share.

- Negotiate telemetry once. Pick standards that cover ERCOT and the Eastern markets and reduce vendor sprawl. A single path to five minute and two second telemetry saves engineering time and audit headaches.

Policy levers that move real megawatts

- Data access. States can require utilities to provide near real time usage data to customers and their authorized agents. A standard, secure data feed is worth more than a dozen pilot press releases.

- Dual participation clarity. The fastest way to scale is to allow a customer to be in a retail program and a wholesale aggregation with clear rules that avoid double counting. Publish those rules with examples.

- Distribution review service levels. Set and track service level agreements for distribution reviews of aggregated portfolios. A 30 to 45 day standard with clear rejection reasons turns queues into schedules.

- Capacity accreditation that fits devices. Let a thermostat count for what it can do with reasonable persistence assumptions. Overly conservative accreditation rules strand value and slow sign ups.

- Default rates that reward flexibility. Time varying rates and demand charges that reflect system conditions make managed charging and thermostat control valuable every day, not just during declared events.

Companies to watch

- Tesla, Sunrun, and Sunnova on residential batteries and home energy management in California, Texas, and the Northeast.

- Enel, CPower, Voltus, and EnergyHub on commercial and industrial demand response and mixed portfolios across PJM, NYISO, and ISO New England.

- Octopus Energy, AutoGrid, Uplight, and OhmConnect on software, customer acquisition, and event design that drives high participation.

A simple metaphor for a complex transition

Think of the grid as a highway at rush hour. For a century we just made the lanes wider. Order 2222 and the ERCOT pilot are the on ramp meters, the carpool rules, and the navigation apps that steer traffic around trouble in real time. The cars are still the same, but the flow is smarter. Everyone gets home faster and the system wastes less.

The takeaway for 2026

Summer 2026 is close enough to plan for and far enough to matter. Markets are opening in sequence, the pilot in Texas is scaling, and the software is catching up to the hardware. The winners will not be those with the most devices. They will be the teams that turn devices into dependable market products, prove performance at audit time, and treat distribution coordination as a first class engineering constraint. Start now, build for verification, and bid where the rules and the revenue line up.

In other words, recruit the devices you already touch, wire them to markets that are going live, and design for customer trust. If you do that, you are not just chasing a trend. You are building capacity the grid can count on.