Texas Nears Class VI Primacy, Priming a Gulf Coast CCS Boom

EPA signaled approval of Texas Class VI primacy on June 9, 2025, with comments closed August 1. Here is how state control could speed Gulf Coast CCS and what to prioritize in the next 6 to 12 months.

The spark: EPA signals Texas primacy

On June 9, 2025, the Environmental Protection Agency proposed approving Texas’ application to run its own Class VI program for carbon dioxide storage wells, with the comment period closing on August 1, 2025. The move puts the Railroad Commission of Texas on the cusp of overseeing geologic storage permits statewide, outside of Indian country. That sounds bureaucratic, but it could change the speed and scale of carbon capture projects from Houston to Corpus Christi. You can read the agency’s summary here: EPA proposed Texas primacy.

Why does this matter? Because for the past several years, developers have queued at the federal window for Class VI permits that authorize injection into deep saline formations designed for permanent storage. Texas primacy would shift most of that work to Austin, where a single agency can coordinate geoscience, drilling standards, and enforcement across a state built on subsurface know-how. If Louisiana’s experience with primacy is any guide, state-run permitting can cut uncertainty and compress the timeline between concept and injection.

Think of primacy as handing the traffic light controls from Washington to Texas at the on-ramp of a new Gulf Coast highway. With green lights more predictable, private capital and project teams can hit the accelerator.

What accelerates under state control

State primacy will not rewrite the federal Safe Drinking Water Act or the technical bar that Class VI wells must clear. It can, however, speed three practical chokepoints:

- Early alignment. A Texas regulator who knows local geology, land systems, and pipeline corridors can flag fatal flaws in months instead of years. That reduces the risk of redesign late in the process.

- Parallel processing. Surface access, pore-space aggregation, pipeline routing, and front-end engineering can proceed in lockstep with permit review when there is one primary forum for outreach and technical dialogue.

- Field oversight. Inspections and data requests tend to be faster when the inspector can drive to the site, not fly across the country.

For emitters and storage developers, time is the currency that matters. Shorter permitting cycles translate directly into lower development costs, earlier first injection, and a better match to the 12-year window of federal carbon credits under Section 45Q.

Where the buildout could show up first

The Gulf Coast is a stitched-together quilt of high-volume emitters, deep storage options, and existing rights-of-way. Expect activity to concentrate in four verticals.

-

Power generation. Combined-cycle gas plants around the Houston Ship Channel, the Golden Triangle, and San Antonio could add capture units that pull carbon dioxide off flue gas. The attraction is stable operations, known volumes, and the ability to co-optimize with grid needs. The challenge is fitting capture, compression, and dehydration into tight footprints while maintaining high capacity factors.

-

Liquefied natural gas. Liquefaction trains produce a relatively pure stream of carbon dioxide from acid-gas removal, which is cheaper to capture than dilute flue gas. LNG developers that can match a capture block to a Class VI sink and an offtake agreement for transport can undercut costs per ton and market lower-carbon cargoes to buyers in Europe and Asia. For market context, see our Gulf Coast LNG reset outlook.

-

Cement and lime. Process emissions from calcination are stubborn, and carbon capture is the principal tool available at scale. Texas has cement plants near rail and water that can move equipment and materials efficiently. Expect pilot lines that become full-scale retrofits as vendors standardize designs for high-alkali fuels and variable kiln loads.

-

Petrochemicals and hydrogen. Steam crackers, reformers, and ethylene oxide units produce concentrated carbon dioxide streams. Producers already run complex turnarounds and unit revamps on tight schedules, which pairs well with bolt-on capture modules. The business case improves when operators can allocate 45Q revenue to units with the highest tons per hour and lowest incremental energy penalty. For policy backdrop, review our hydrogen 45V rules update.

The 2026 to 2030 playbook

State-run permitting is the enabler, not the destination. To turn primacy into concrete projects, here is the operational plan most teams will follow.

1) Faster permits through better dossiers

The winning teams will arrive with complete, decision-ready applications. That means:

- High-resolution subsurface data. Run modern 3D seismic where you can, plus wireline logs and pressure tests that establish confining zones and monitoring intervals. Do not rely on vintage data unless you can tie it confidently to your area of review.

- Defensible area-of-review modeling. Build pressure plumes, migration envelopes, and fault analyses that you can explain to a county commissioner as easily as to a hydrologist. Use visuals and plain language that reduce the perceived risk of vertical migration.

- Complete well construction plans. Show how cement, casing, and packer choices protect drinking water and accommodate long-term monitoring. Spell out the sequence for temporary shut-ins, workovers, and eventual plugging.

- Early public engagement. Treat your draft application like a town hall document, not a legal brief. Post simple schematics. Offer office hours near the site. This lowers the temperature before the formal notice-and-comment period.

2) Pore-space deals that stick

Texas law clarifies that pore space generally sits with the surface estate unless documents say otherwise. That makes deal structure more like a wind or solar lease than a traditional mineral lease. The practical steps:

- Map surface and mineral estates. In legacy oil and gas towns, expect intricate ownership. Title opinions and curative work take time, so start early.

- Standardize your leases. Use templates with clear indemnities, access rights, and long-term monitoring language. Ten pages of plain terms beat fifty pages of bespoke clauses.

- Coordinate with mineral operators. You must show storage will not harm present or future oil and gas production. Expect tracts where you need side agreements with working interest owners.

- Look offshore as a release valve. State waters offer large tracts with a single public landlord and fewer surface conflicts, though they demand higher standards for well design and monitoring logistics.

3) CO2 pipeline corridors and common carriage

Pipelines are the circulatory system of a carbon network. Much of the Gulf Coast already has rights-of-way, survey data, and community memory of pipeline construction, which shortens development time. The smart approach in 2026 to 2030:

- Bundle projects into corridors. Design multi-user trunks with large diameters, then gather from capture sites with smaller laterals. This spreads fixed costs across more tons and allows expansion without re-permitting the spine.

- Engineer for phase behavior. Supercritical transport minimizes volume, but your front-end engineering must manage water content, impurities, and pressure control to avoid phase changes.

- Align on safety ahead of time. Expect more attention to dispersion modeling, emergency response plans, and real-time monitoring after recent incidents. Build joint training with local responders into your corridor budget and schedule.

- Reserve tie-in slots. If you are an emitter that is not ready to build your own pipeline, reserve capacity and interconnects now. The best corridors will fill up.

4) Bankable finance with 45Q transferability

Section 45Q remains the revenue backbone. The Inflation Reduction Act lets many developers sell their tax credits for cash rather than rely on complex tax equity. Treasury and the Internal Revenue Service finalized transferability rules in 2024, including a mandatory pre-filing registration process and recapture guardrails. See the summary here: IRS final transferability rules. For broader financing shifts, see how tech neutral tax credits are changing capital stacks.

What this means in practice:

- Fewer intermediaries. You can sell the credit directly to a buyer with tax capacity. Cash proceeds are not taxable to the seller and are not deductible by the buyer, which simplifies pricing.

- Credit insurance is standard. Buyers will demand policies that backstop recapture risks tied to storage integrity or reporting errors. Budget for premiums and added diligence.

- Pre-filing registration is a gate. Do not leave it to year end. You will need registration numbers tied to specific facilities and tons.

- Stacked revenue. Some projects will layer 45Q with low-carbon product premiums, voluntary carbon market claims, or offtake bonuses for lower life-cycle intensity. Bankers will prefer contracted, auditable revenue over speculative upside.

5) Offtake and MRV readiness

Carbon capture projects do not move forward until volumes, quality, and verification are nailed down.

- Define the product. For emitters selling carbon dioxide to a storage operator, set specs for water content, pressure, and contaminant limits. Quality slips can trigger pipeline upsets or storage breaches.

- Write reliable offtake contracts. Long-tenor, take-or-pay agreements tied to measured tons give lenders confidence. Include maintenance windows and outage protocols so neither side is surprised during a turnaround.

- Build MRV like a core system. Monitoring, reporting, and verification must comply with federal greenhouse gas reporting rules. Draft the plan early, budget for baseline monitoring, and align with the storage operator so your data flows are consistent from flange to formation.

Near-term risks to watch

Every acceleration carries risk. Here are the ones most likely to matter in Texas first.

- Legal challenges. Environmental groups or landowners could challenge the primacy decision or individual permits. Even unsuccessful suits can delay schedules by months. Mitigation: front-load record building, demonstrate preserved water protection, and maintain a clear public interest narrative.

- Community consent. Pore-space leases, pipelines, and wells cross real people’s land and neighborhoods. Mitigation: negotiate community benefits that go beyond jobs, such as air monitoring, emergency response equipment, road repair, and local contractor set-asides.

- Liability handoff. Operators plan for eventual site closure and, in some cases, transfer of long-term stewardship to the state. Mitigation: model closure funding from day one, and ensure your leases and financial assurance instruments match regulatory expectations.

- Pipeline safety and routing. Federal pipeline standards continue to evolve. Mitigation: design dispersion modeling and emergency planning into route selection, and commit to joint drills with local responders before commissioning.

- Policy durability. 45Q is statute, but market practice is still maturing. Mitigation: lock in transfer counterparties with firm pricing, and use conservative assumptions on start-of-injection dates and capture rates.

What to do in the next 6 to 12 months to reach FID

If you intend to sanction a project during the Texas primacy window, treat the next year as your make-or-break sprint. Here is a focused checklist.

- Lock the storage site. Finish site characterization, file complete well designs, and secure monitoring well locations with landowner access. Have a draft permit package ready to submit the day primacy is final.

- Aggregate pore space. Close options with every surface owner in the storage footprint, and execute leases with clear unitization and access language. Build a data room for regulators that shows the title chain and curative work.

- Advance FEED. Complete front-end engineering and design for capture and compression, including tie-ins to existing units and power balance studies. Identify long-lead equipment and place pre-orders where sensible.

- Secure transport. Choose your pipeline corridor, reserve interconnects, and run hydraulic models that cover ramp-up, outages, and emergency depressurization. Begin surveys and early right-of-way negotiations.

- Finalize offtake. Execute term sheets that specify tons per year, purity, pressure, delivery points, maintenance schedules, and remedies for under-performance. Align measurement plans across custody points.

- Prepare MRV. Draft the monitoring, reporting, and verification plan together with your storage operator. Identify baseline surveys, monitoring technologies, and data ownership so there are no reporting gaps.

- Line up 45Q monetization. Complete pre-filing registration, select a credit purchaser, and negotiate credit purchase agreements with clear recapture and indemnity language. Price credit insurance and integrate those terms into the contracts.

- Build community consent. Hire a local community liaison, publish a construction calendar, fund first-responder training, commit to a noise and traffic plan, and publicly track complaints and responses.

- Set FID gates. Define the minimum conditions for sanction: permit milestones, pore-space coverage percentage, executed offtake, financial assurance, and credit monetization. Do not drift into a soft FID; make it binary.

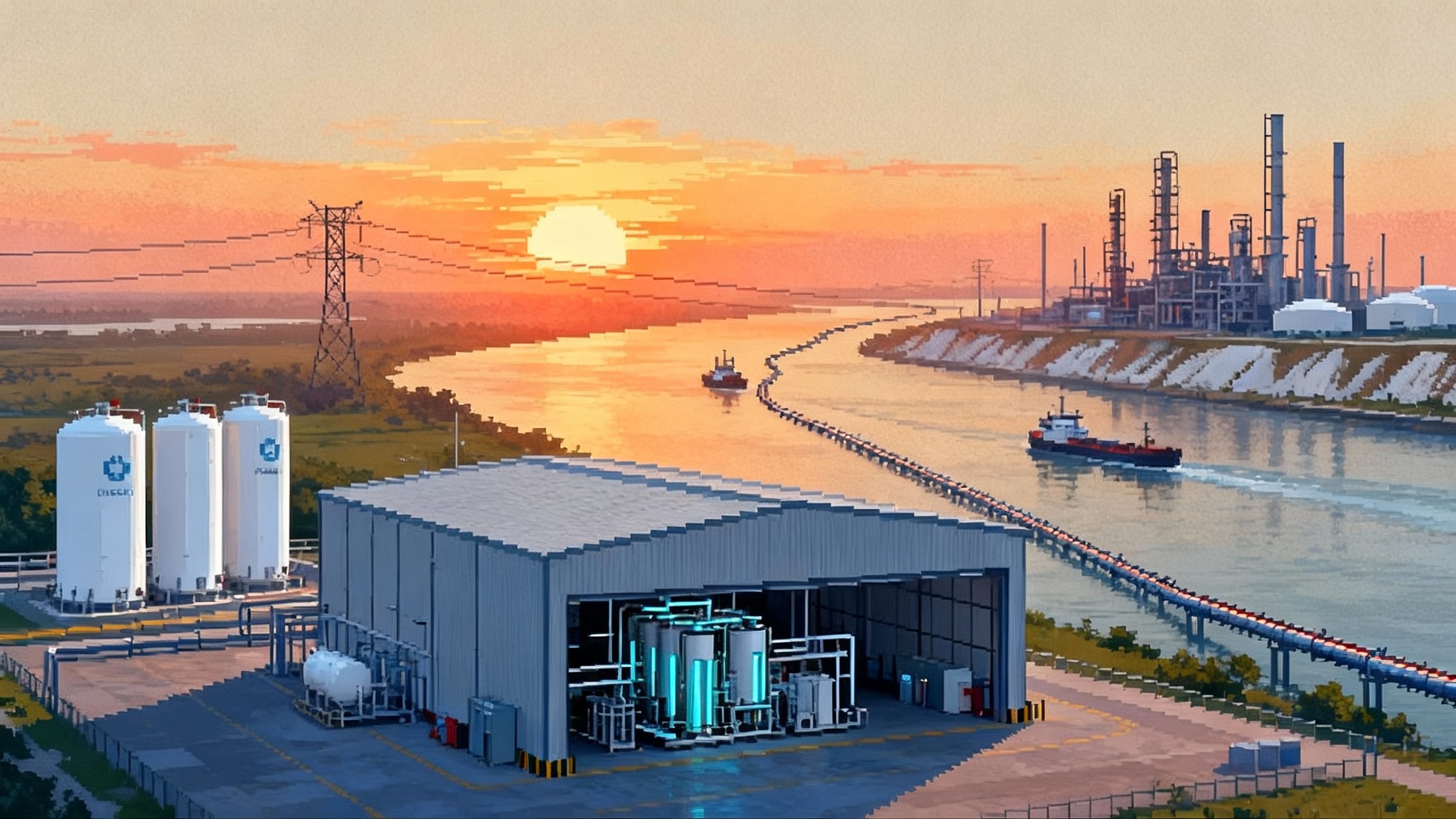

How the Gulf Coast could look by 2030

By 2030, Texas could host a network of saline storage sites onshore and offshore, fed by common-carrier pipelines moving carbon dioxide from power plants, LNG facilities, cement kilns, and petrochemical complexes. The day-to-day work would feel familiar to anyone in the region’s energy business: development teams managing permits, land, and engineering; control rooms monitoring pressure and flow; and field crews maintaining wells and rights-of-way. The difference is the product. Instead of moving hydrocarbons to the surface, the system will be moving carbon dioxide underground to stay.

The upside is concrete. A faster permit clock reduces carrying costs. Aggregated pore space reduces title risk. Pipeline corridors smooth interconnects and concentrate safety investments. Transferable 45Q turns tax credits into near-cash revenue. Strong offtake and MRV turn those tons into bankable contracts.

None of this happens by accident. It happens because developers and emitters make disciplined choices in the year primacy becomes real.

The moment to move

Texas primacy is not a headline to admire. It is a clock that just started ticking. The early movers will bring decision-ready permits, pore-space maps, corridor reservations, MRV plans, and credit transfer term sheets to the table before others finish their kickoff meetings. If you plan to see first injection before the end of the decade, treat the next two quarters as your runway and the next two after that as your takeoff. The air is clearing, the tower is local, and the window is open.