AI’s 2025 Power Land Rush Is Rewriting U.S. Utility Plans

Record load forecasts, PJM fast tracks, and hyperscaler buildouts turned data centers into the anchor tenants of American power in 2025. See where demand is clustering, how procurement is shifting to hourly certainty, and which playbooks will win in 2026.

The year data centers took over the load forecast

A quiet revolution became hard to ignore in 2025. Utilities from the Mid-Atlantic to Texas told investors they were raising capital spending to meet a sudden and durable surge in electricity demand. The catalyst is not a wave of new houses or factories but the rapid buildout of artificial intelligence data centers. Regional grid operators have felt the pressure most acutely. PJM Interconnection, the regional transmission organization that coordinates power for 65 million people from Illinois to New Jersey and Virginia, created an emergency fast track to pull capacity into service before reliability margins tighten. In early May, PJM selected dozens of shovel-ready projects through what it calls the Reliability Resource Initiative, a one-time lane to add firm capacity quickly. The numbers matter less than the signal it sent. Rules are being rewritten to chase load that is arriving faster than the grid can connect new resources. PJM’s Reliability Resource Initiative details show a system prioritizing near-term reliability while long lead-time projects wait in line.

Utilities have responded in kind. Several raised multi-year transmission and distribution budgets, added new gas and storage proposals to their resource plans, and told regulators they need bigger substation and high voltage investments to serve hyperscaler campuses measured in hundreds of megawatts. It is not a blip. It is the industrial power supercycle, and artificial intelligence is its front man.

Where the hyperscaler load is clustering

Think of the United States grid as a patchwork of places where power can be delivered quickly and at scale. In 2025, the clusters are consolidating around a few repeating advantages: spare high voltage capacity, fast permitting, available water or proven heat management, competitive rates, and interconnection queues that are not completely gridlocked.

-

Northern Virginia in PJM. Loudoun and Prince William Counties remain the center of gravity. Dominion Energy’s territory sits atop massive fiber networks and a dense web of substations. Grid congestion is real, which is why PJM is pushing new transmission from west to east and tapping uprates at existing plants. Expect more activity to shift south and west of the tightest nodes, into corridors that can accept 230 kilovolt and 500 kilovolt reinforcements.

-

Pennsylvania and the Mid-Atlantic interior. Nuclear heavy zones with strong transmission are becoming a release valve for Virginia. The Susquehanna nuclear plant in Pennsylvania and surrounding high voltage lines provide a template for large, long-term clean power contracts that can flow to multiple campuses across the region.

-

Central Ohio and the Ohio River Valley. American Electric Power territory and independent transmission projects around Columbus and New Albany are attracting mixed portfolios of gas, solar, and batteries, with easy highway and fiber access. Substations are being upsized to handle blocks of 100 megawatts or more.

-

The Carolinas. Duke Energy territory is seeing steady interest that blends retrofit of older coal sites with new gas plus solar plus battery hybrids. The attraction is speed to serve, abundant sites near existing transmission, and a deep contractor bench.

-

Greater Atlanta and North Georgia. Georgia Power’s ability to move quickly on distribution and build new gas peakers alongside solar and storage has made metro Atlanta a new favorite, especially for operators that want one foot in the East Coast time zone without northern congestion.

-

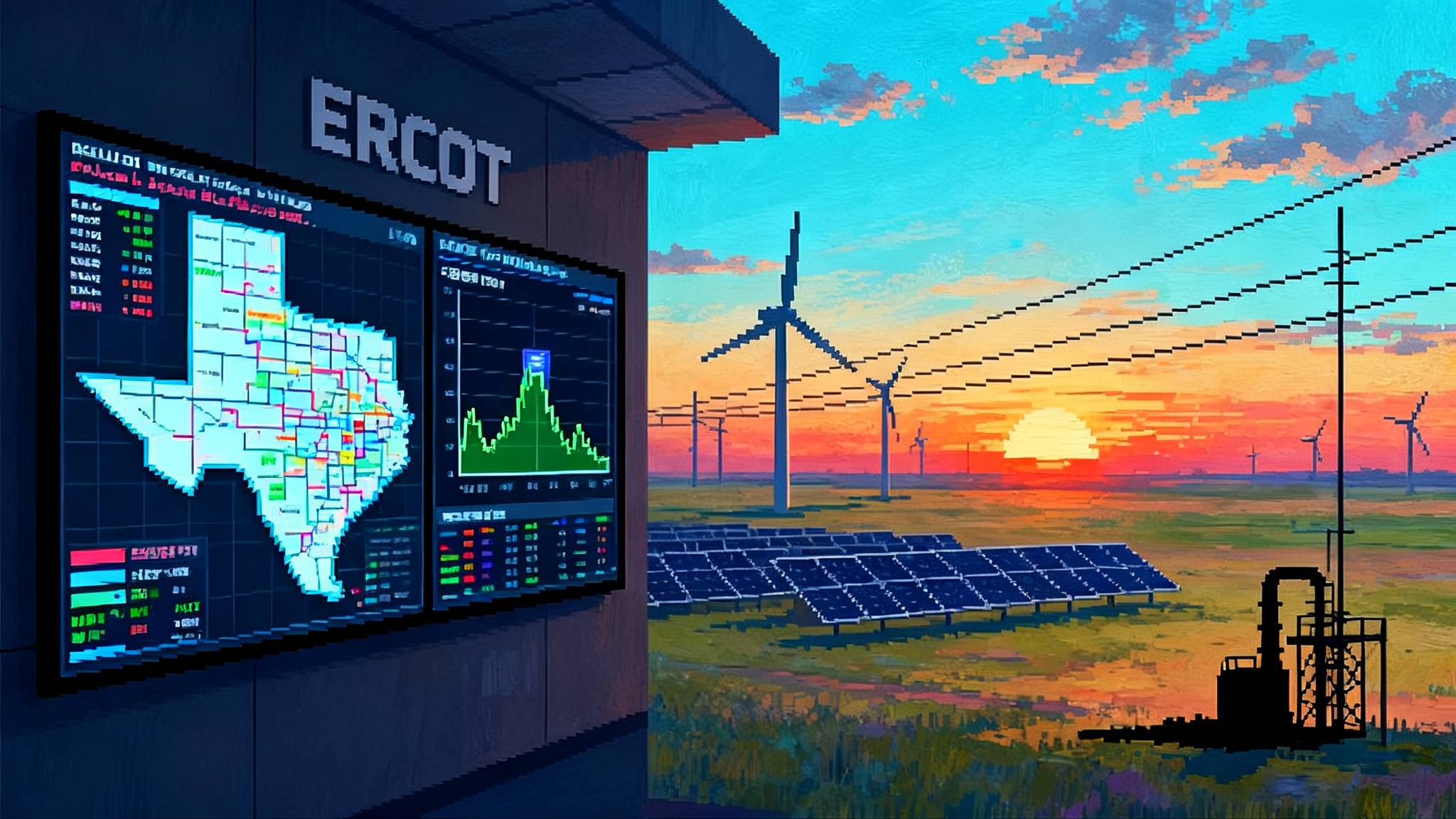

Texas, especially Dallas Fort Worth and San Antonio. The Electric Reliability Council of Texas interconnection is fast by national standards. Developers pair merchant solar, giant batteries, and flexible retail contracts to deliver competitive prices. The bargain is volatility. Customers that can flex loads and bring their own storage find a good fit.

-

The Upper Midwest triangle of Iowa, Nebraska, and Missouri. Longtime data center towns like Council Bluffs, Altoona, Papillion, and North Kansas City have spare land, cheap wind or hydro-backed power, and transmission headroom. Municipal utilities and public power give developers clear timelines and rates.

-

The desert Southwest around Phoenix and Reno. Speed to build and land availability are strong, though water and summer peak capacity are constraints. Operators that invest in advanced cooling and on-site storage still see a path.

-

The Pacific Northwest interior. Eastern Oregon and central Washington offer hydro-anchored grids and experience with large server farms. Interconnection timelines are lengthening, which favors projects that can repower existing sites and tap uprates at legacy substations.

Two patterns cut across these regions. First, many winning sites sit near existing high voltage infrastructure that was built for yesterday’s coal or industrial loads and can be repurposed. Second, campuses are spreading out within each metro to avoid overloading single substations, which reduces permitting friction and allows phased energization.

The procurement pivot: from annual megawatt-hours to hourly certainty

The power contracts that fueled the last decade of cloud growth are not enough for the artificial intelligence era. Annual matching deals that buy renewable certificates against a year of consumption do not ensure power is clean or available at the exact hour a cluster of training jobs lights up. The shift underway is more granular and more physical.

-

24 by 7 carbon free energy. Rather than buying generic certificates once a year, hyperscalers are signing structured deals that match consumption with zero carbon generation in the same grid and for each hour. That can look like a retail supply contract that mixes nuclear, hydro, wind, solar, and batteries, tracked with hourly certificates. Microsoft’s early Virginia agreements with retail suppliers and developers pioneered the template that others are now adapting in PJM and beyond.

-

Front of meter instead of behind the meter. The first wave of direct-wire proposals to plug campuses straight into a plant met regulatory resistance because skipping the grid also skips paying for it. The emerging compromise keeps transactions at the wholesale or retail meter, preserves grid compensation, and still gives buyers strong delivery and carbon attributes. Amazon’s 17 year contract for up to 1.92 gigawatts from the Susquehanna nuclear plant moved exactly this way, converting a behind the meter plan into a grid connected power purchase agreement with transmission reconfiguration built in. It is a clean firm pillar that can scale because it fits market rules. AWS and Talen’s nuclear PPA shows how nuclear supply can be contracted for hyperscaler fleets while staying inside the regional market.

-

Direct-wire renewables with storage where permitted. Some states allow private wires on or across single-owner campuses. Where it is legal, developers are pulling medium voltage lines from a dedicated solar or wind array into the campus and adding four to eight hour batteries to ride through ramping events. This reduces congestion risk but depends on local law and utility agreements.

-

Storage plus peaker hybrids. Developers are pairing new fast start turbines with blocks of batteries under one interconnection. Batteries handle most short duration peaks and provide frequency response, while gas covers heat waves and long cloud events. The hybrid optimizes fuel costs and cuts emissions intensity while qualifying for capacity revenues. In PJM and the Southeast, these are emerging as practical bridge assets.

-

Tolling agreements with independent power producers. When delivery risk is high and load steps are lumpy, buyers are signing tolls that control an existing plant’s output in exchange for a monthly reservation charge and fuel pass through. The buyer gets operational control and capacity shape. The operator gets contracted revenue. The key innovation is tying the toll to hourly carbon performance and firming it with purchased storage blocks so that emissions and price outcomes are both bounded.

Under the hood, all of these structures depend on better measurement. Hourly certificates, substation level telemetry, and machine learning forecasts of campus load are replacing spreadsheets and annual averages. That is making it possible to promise an engineering team that a training run at 2 a.m. next Tuesday will have clean, firm megawatts waiting.

The PJM fast tracks point to a broader answer

PJM’s accelerated tracks are controversial because they give priority to resources that can arrive quickly. Speed is the scarce commodity. The right question is not whether to prioritize speed. It is how to prioritize speed without baking in thirty years of gas dependency. The practical answer is to run three parallel fast tracks in every region that expects large digital loads.

-

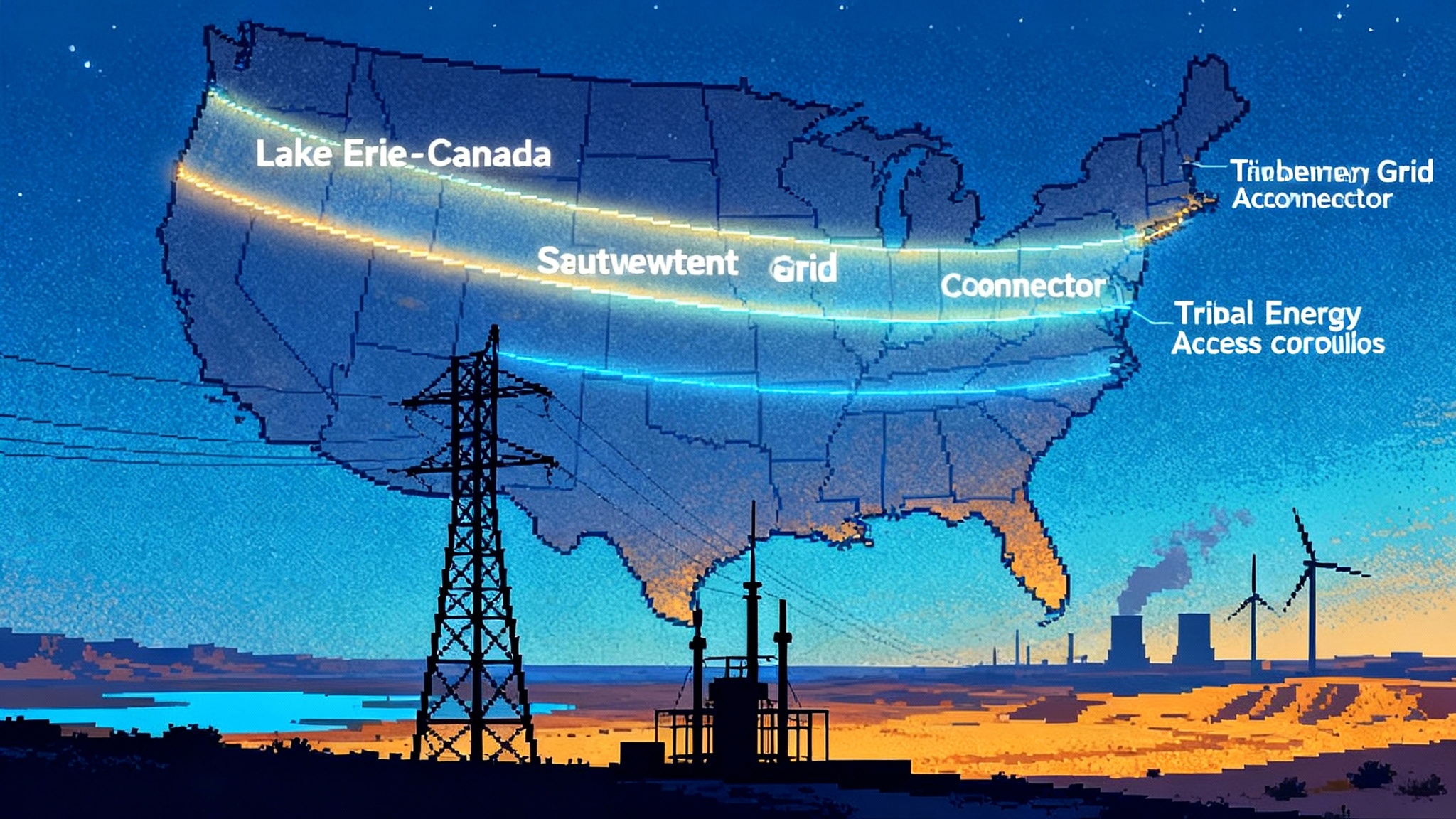

Fast track one, clean firm power. Uprates and life extensions for existing nuclear plants should get pre-engineered packages and priority interconnection. Advanced geothermal can ride the same lane, especially in places with oil and gas subsurface data. Where state policy allows it, carbon capture retrofits at efficient gas plants can be a transitional option with strict heat rate and capture performance guarantees. State energy offices can pre qualify sites by interconnection headroom and cooling water availability, then run standardized solicitations that award take-or-pay contracts with performance credits tied to hourly carbon intensity. For context on the momentum behind nuclear in 2025, see America’s nuclear reboot.

-

Fast track two, grid scale storage. Battery projects in the 100 to 500 megawatt range with four to eight hours of duration can clear interconnection faster than new pipes, and in many substations they are the only thing that fits in time. The reforms that matter are in capacity accreditation and market rules. Storage must be credited for the stacked services it actually provides, from peak shaving and ramping to congestion relief and local reliability. Regulators can require utilities to run competitive storage procurements that score projects on cost per reliable kilowatt at the substation and on their ability to defer wires. This aligns developer incentives with reliability.

-

Fast track three, grid enhancing technologies. The cheapest new capacity in 2026 is on the wires we already have. Dynamic line ratings, topology optimization software, power flow control devices, and advanced conductors can unlock ten to twenty percent more transfer capacity on critical paths in months, not years. For why ratings reforms matter, see our take on FERC 881 ambient ratings.

If each region runs all three tracks at once, the result is a ladder. Clean firm anchors the top rung, storage fills daily gaps, and grid upgrades widen the rails that everything runs on. That is a grid that can meet artificial intelligence demand growth without defaulting to a single fuel.

Who wins in 2026

The winners are not just the places with the cheapest power. They are the places with the most predictable path to a meter that can energize in phases.

-

Regions with nuclear anchored portfolios. Pennsylvania and parts of the Midwest and Mid-Atlantic that can blend nuclear with batteries and renewables will sell hourly clean supply at scale. Buyers that need 24 by 7 matching for climate targets will favor them.

-

Texas nodes with storage depth. In 2026, the Dallas Fort Worth and San Antonio areas that add large batteries at the right substations will be able to offer firm delivery windows that compete with regulated regions on reliability while keeping merchant price advantages, backed by ERCOT’s RTC+B reform.

-

Southeast utilities with standardized hybrid blocks. The utilities that pre permit gas plus storage hybrids at retired coal sites and publish shovel ready interconnection packages will be able to book multi campus deals with predictable energization.

-

PJM zones that complete west to east transmission. As new 765 kilovolt projects knit the interior to Virginia and Maryland, data center development will spread to subregions that can promise less congestion risk and lower curtailment. Developers that learn to stage campus buildouts with transmission milestones will capture the best sites.

-

Upper Midwest public power. Municipal and cooperative providers that can move land, interconnection, and rates through local boards will continue to land expansions from existing customers who want predictable relationships as much as they want cheap electrons.

On the deal side, two structures will dominate new signings in 2026. First, long horizon front of meter contracts that blend nuclear, storage, and renewables with hourly matching, often with a retail supplier integrating the stack. Second, tolling style capacity agreements for five to ten years that give the buyer operational control of a specific block of dependable generation, firmed with guaranteed storage. Direct wire projects will still happen, but more often within a single parcel or campus where they do not cross public rights of way and where they do not trigger cost shifting concerns.

A field guide for decision makers

-

If you are a utility executive, pre engineer your substation upgrades and publish a public map of energization dates by feeder. Developers will stack their plans behind your credible milestones. Add a grid enhancing technology program with transparent metrics and invite third party performance guarantees. You will cut congestion costs and win regulatory support for higher capital plans.

-

If you are a hyperscaler energy lead, build two portfolios in parallel. One is an hourly matched clean supply in the region with the best nuclear or hydro anchor and the most professional retail supplier. The second is a tolling plus storage package near your largest growth campus that you can call on during weather and price spikes. Use the hourly certificate data from the first to set procurement rules for the second so the emissions profile converges over time.

-

If you are a developer, specialize. Either become the best at storage plus peaker hybrids that close in under three years or become the integrator that can deliver 24 by 7 matched retail supply with clean firm anchors. The generalists will lose to teams that can break interconnection bottlenecks or integrate supply across markets with software and metering.

-

If you are a regulator, insist that utilities score all new investments on cost per reliable kilowatt-hour at the substation during the top one percent of peak hours. That metric naturally elevates storage and grid enhancing technologies where they work and points to clean firm additions where they are needed. It also gives you a way to evaluate tolling proposals without hand waving.

-

If you are an economic development leader, identify two brownfield sites with high voltage access and water, and run your own predevelopment. Clear zoning, complete environmental baselines, and solve for road access before you recruit. The next wave of campuses will reward the cities that act like developers.

The bottom line

Artificial intelligence did not invent the grid’s problems, it concentrated them. 2025 exposed how much latent demand was waiting for a credible path to power. PJM’s emergency lanes and utility budget jumps are early responses to a new class of customers that plan in terawatts of hours and think in site portfolios, not single buildings. The next move is ours. If regions run parallel fast tracks for clean firm power, grid scale storage, and grid enhancing technologies, the country can meet this decade’s data center buildout without locking itself into a single fuel. The prize is not only reliability for servers. It is a playbook for how the United States grows load again while modernizing the network that carries it.