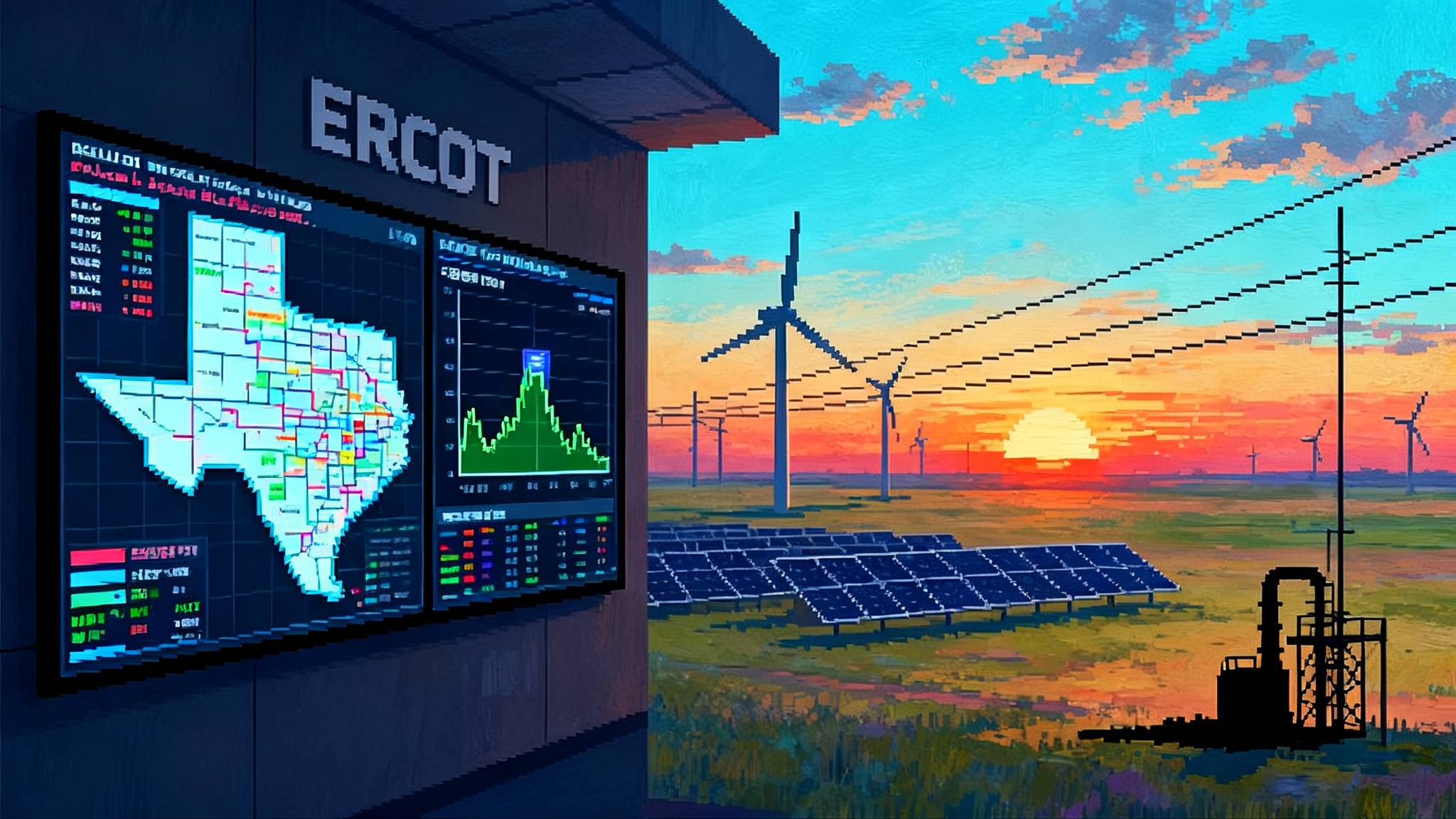

How ERCOT’s RTC+B Will Rewrite Texas Power in 90 Days

ERCOT will activate Real-Time Co-Optimization plus Batteries on December 5, 2025. Here is how the shift will reset battery revenues, renewable dispatch, scarcity pricing, and reliability in Texas over the first 90 days.

The switch flips in December

On December 5, 2025, the Electric Reliability Council of Texas plans to go live with Real-Time Co-Optimization plus Batteries, often shortened to RTC+B. This is not a routine software patch. It is a fundamental redesign of how the real-time market decides what to produce, who provides reserves, and how much everyone gets paid. ERCOT has said the move will boost efficiency and reliability, and the target date is December 5, 2025. You can read ERCOT’s announcement of the date and rationale in its news release: ERCOT go-live on December 5, 2025.

Why does this matter now? Because the first 90 days, through early March 2026, will reset price signals in the nation’s most entrepreneurial power market. Battery owners, renewable operators, gas fleet managers, retailers, and investors will all see their spreadsheets behave differently. The key is to understand the new mechanics and prepare tactics before the first five-minute interval clears. As Texas load grows, including from AI’s gigawatt appetite, these price signals will matter more than ever.

Co-optimization in plain English

Today in Texas, procurement of ancillary services like regulation and contingency reserves mainly happens day ahead. Then the real-time system dispatches energy. That split means the market sometimes holds back megawatts for reserves even when those megawatts would be more valuable clearing energy in the moment. It is like running a restaurant where cooks are assigned to make appetizers and entrees in separate rosters, and no one can swap positions at the pass when a big table suddenly orders only entrees.

Co-optimization merges those decisions every five minutes. The system looks at all offers for energy and all offers for ancillary services, then chooses the mix that maximizes total value while respecting the physics of the grid. If energy is scarce, the algorithm can pull megawatts out of reserves and into energy, and it will pay a higher price for reserves that are truly scarce. If reserves are tight, it can move the other way and pay for flexibility. One brain, one solution per interval.

This has three consequences that every market participant should internalize:

- More consistent price formation across products. Expect tighter links between real-time energy prices and ancillary prices since both come from the same optimization.

- Sharper, shorter scarcity adders. Scarcity adders will line up with the real-time quantity of reserves, not rough estimates. Spikes may be shorter or sharper, depending on conditions.

- Systematic recognition of opportunity cost. Batteries, gas peakers, and controllable loads will be paid for the flexibility they give up when they commit to one product over another.

The B in RTC+B, and why it is pivotal

The plus sign is not marketing. ERCOT is also changing how it models Energy Storage Resources. Historically, batteries were represented in a so-called combo model, part generator and part load. Under RTC+B, ERCOT is moving to a single model resource with state of charge and limits integrated in the dispatch engine. That change matters because it lets the system co-optimize a battery’s charge, discharge, and ancillary capability in a physically consistent way. ERCOT’s implementation details reference this shift to a single model and confirm the December target; see the market notice that explains the single-model representation of batteries.

For operators, a unified battery model means the market can commit a 200 megawatt, 800 megawatt-hour asset to discharge 120 megawatts for energy and hold 40 megawatts for regulation up in the same interval, if the state of charge and ramp constraints allow. The settlement prices for those megawatts will reflect their true opportunity cost because the optimizer is solving one problem rather than two disjointed ones.

Batteries, a new revenue stack

Many Texas batteries earned a large share of their 2023 and 2024 revenue in regulation and the new ERCOT Contingency Reserve Service. Real-time co-optimization will not erase that value, but it will change when and how it appears.

- Regulation spreads may compress. With more battery flexibility presented to the optimizer every five minutes, the market can source regulation from assets with the lowest opportunity cost at that moment. That often means batteries, especially when energy prices are moderate. Expect average regulation prices to drift lower in non-scarcity hours, even as a smaller number of intervals become more valuable when reserves get tight.

- Energy arbitrage will become more responsive. A battery that used to keep headroom for day-ahead ancillary awards will instead watch five-minute scarcity signals. When reserves tighten, the optimizer will pay more for energy and for the specific reserve that is scarce. Batteries that keep nimble state-of-charge strategies will capture those bursts.

- The volatility mix will change. More intervals will clear with small adjustments to reserve awards. Fewer intervals will clear with inconsistent price relationships between energy and ancillaries. That is good for strategies that rely on correlation and risk controls and challenging for strategies that leaned on persistent mispricings.

A hypothetical example makes this concrete. Say a 100 megawatt, 400 megawatt-hour battery faces a five-minute interval with a 45 dollar per megawatt-hour energy price, 20 dollars per megawatt regulation down, and 38 dollars per megawatt regulation up. In the old split world, the battery might have a day-ahead regulation up award to honor and would discharge only 20 megawatts for energy. Under co-optimization, if the optimizer needs energy more than regulation up, it can clear 80 megawatts of energy and 10 megawatts of regulation up, and pay a higher price for the 10 megawatts of flexibility that remain. The owner earns more in that tight interval and the system gets what it needs most.

What to do if you own or operate batteries

- Tighten state-of-charge forecasting. Use higher frequency weather and load data, plus generator outage intelligence, to forecast reserve scarcity. The first win will be arriving at high state of charge before reserve tightness shows up in pricing.

- Redraw offer curves. Offer more flexible, price-responsive ancillary blocks that reflect marginal state-of-charge value. Avoid flat blocks that ignore the battery’s dynamic energy opportunity cost.

- Automate with fail-safes. Co-optimization rewards speed, but ERCOT settlement is unforgiving. Build controls that honor telemetry, ramp, and state-of-charge constraints with hard limits. Include manual overrides for telemetry loss or communications issues.

Renewables, a new dispatch rhythm

Wind and solar will feel the change through co-optimized curtailment and reserve procurement. Some of these shifts intersect with compliance and performance expectations under FERC’s 2025 IBR rule.

- Midday solar. When the system needs regulation down or fast downward flexibility, the optimizer can back down solar a few percent to free reserves from other units. That is a smaller bite than the traditional redispatch that sometimes caused larger curtailments, but it may occur more often. Solar owners should track how often their meters show minor co-optimized curtailments that free up reserves elsewhere.

- Evening ramps. As the sun sets and load rises, co-optimization should pull batteries into energy sooner when reserves are adequate. That can smooth the net load ramp and reduce uneconomic curtailment of wind that was sometimes caused by coarse reserve accounting.

- Hybrids. Co-located or merchant-coupled batteries can bid more precisely. Solar plus storage can offer energy and regulation as a package that holds state of charge through the afternoon so that the battery is available when reserves are scarce after sunset.

Tactical moves for renewable owners

- Revisit self-scheduling rules for hybrids so the storage asset can respond to real-time reserve prices without blocking solar output unnecessarily.

- Update plant controller constraints. Ensure maximum and minimum output limits are coordinated with the battery’s participation so the combined site does not trip inverter limits during fast redispatch.

- Model reserve revenue. Include a reserve co-optimization term in merchant forecasts for 2026. The old assumption that ancillary revenue is mostly day-ahead will understate the value of flexible behavior.

Scarcity pricing, adders, and what shifts

Texas relies on the Operating Reserve Demand Curve to translate scarcity of reserves into a price adder on top of energy. When reserves fall, the adder rises. Under RTC+B, the reserve quantity that feeds the curve will better reflect the co-optimized view of what is truly available. That means scarcity adders may appear a few intervals earlier when reserves tighten quickly, and they may disappear faster once the optimizer pulls in batteries and flexible gas units.

The net effect is likely to be fewer long stretches of middling adders and more short bursts of high adders when real scarcity bites. Gas peakers with fast starts and batteries that manage state of charge prudently will be paid for showing up at the right five minutes, not just the right hour.

What to do if you operate gas units

- Price your reserves with a clear view of ramp rates and start costs. Under co-optimization, the system will pay for capability when it is scarce. Blunt offers may be bypassed in favor of batteries or other flexible units.

- Strengthen telemetry and operational discipline. Missed dispatch instructions will cost more when every five-minute interval counts.

- Align fuel logistics. If you rely on pipeline nominations or on-site fuel, verify that your fuel plan can support short, high value runs without long lead times.

Reliability, fewer blind spots

Real-time co-optimization should reduce the number of times the system pays twice for the same unit of flexibility, once in day ahead and again in real time. It should also cut back on redispatch that creates hidden scarcity by holding back reserves in one place while another constraint binds.

Batteries will be visible as unified resources with state-of-charge limits and ramping behavior modeled directly in the dispatch engine. That should reduce awkward situations where a battery clears a set of instructions that are technically feasible in separate systems but are not feasible in the physical world. The outcome should be cleaner frequency control, faster recovery from contingencies, and fewer avoidable uplift costs. For aggregations of behind-the-meter assets, see how virtual power plants in 2025 may complement RTC+B.

The first 90 days, what to watch

From December 5, 2025 through March 4, 2026, track these signals to see whether the market is behaving as designed and to find trading edges early.

- Day-ahead versus real-time ancillary spreads. If day-ahead prices are persistently higher than real-time, co-optimization is drawing down reserve scarcity in real time. Expect day-ahead offers to adjust.

- Share of ancillary awards to batteries. Track the megawatts and the percentage by product. A steady rise means the optimizer is leaning on battery flexibility.

- Frequency of Operating Reserve Demand Curve adders above 100 dollars per megawatt-hour. Compare to last winter’s profile. Earlier but shorter spikes would confirm more responsive co-optimization.

- Uplift trends. Look for a decline in local congestion uplift that cannot be explained by weather or outages. Cleaner price formation should reduce uplift noise.

- RUC calls and emergency actions. If reliability unit commitments and emergency instructions fall, the system is finding more of what it needs inside normal dispatch.

- Price reversals. Watch for five-minute intervals where energy and reserve prices move in opposite directions without a clear physical reason. A high count can signal bad offers or data issues that create opportunity or risk.

- Settlement disputes and resettlement notices. Early errors are common after a major upgrade. Have a process to review and challenge material discrepancies quickly.

A practical playbook for this winter

For battery owners and operators

- Build a co-optimization aware bidding engine. Convert static ancillary blocks into laddered blocks that move with expected energy prices and state-of-charge value. Include real-time penalties for violating state-of-charge floor or ceiling.

- Recalibrate availability. Provide availability for all three modes, charge, idle, and discharge, with clear ramp time assumptions. Inaccurate availability will either strand value or create penalties.

- Rehearse edge cases. Simulate a telemetry dropout at 6 pm on a high price day, or an unexpected plant outage on the same node. Document operator playbooks so the team knows when to switch to safe modes.

- Reprice maintenance. With more revenue tied to short, valuable intervals, the opportunity cost of an afternoon maintenance window will rise. Use the last month of pre go-live data and the first month of RTC+B to reset maintenance timing.

For wind and solar owners

- Enhance curtailment analytics. Tag every five-minute curtailment with a likely cause code, reserve need versus congestion. Use that to inform future offers and to justify performance under power purchase agreements.

- Co-locate controls with batteries. If you operate a hybrid site, ensure the site controller can present both assets coherently. The optimizer cannot reward flexibility it cannot see.

- Hedge prudently. Expect lower day-ahead ancillary premiums and more real-time revenue. Shift hedging instruments toward products that reference real time where appropriate.

For gas fleet managers

- Offer flexible reserves. Separate offers for fast start capability, sustained output, and quick ramping. The optimizer will pay for the attribute that is scarce.

- Validate startup logic. Co-optimization can create clustered starts. Confirm that crew scheduling, emissions limits, and fuel arrangements can handle short, frequent dispatches.

For retailers and traders

- Update risk models. Replace independent energy and ancillary distributions with a joint model. Add a state-of-charge aware component for batteries in your portfolio.

- Adjust hedges. Consider instruments that settle on real time if your exposure grows with co-optimization.

- Monitor nodal idiosyncrasies. Co-optimization solves a system problem, but local constraints will still drive node by node outcomes. Build dashboards for your key hubs and delivery points.

For investors and boards

- Ask for a post go-live scorecard. Management should track realized ancillary share, realized scarcity capture hours, and any settlement disputes in the first 30, 60, and 90 days.

- Recut valuations. If your model assumed large day-ahead ancillary spreads, revise with more real-time value and a different volatility mix. Pay special attention to debt service coverage ratios for merchant batteries.

- Fund control upgrades. Small investments in forecasting, site controls, and telemetry will punch above their weight in a co-optimized market.

Tripwires and misconceptions

- This will not eliminate congestion. Co-optimization improves system-wide efficiency, but local line constraints will still create nodal price differences and curtailments. Focus on your nodes and your interconnections, not just system averages.

- Ancillary revenue does not disappear. It shifts. Expect fewer hours with high regulation prices and more value in short scarcity windows where reserves truly matter.

- Automation without oversight is risky. Five-minute markets reward speed. They also punish bad data. Operators still need authority to step in when telemetry or communications fail.

- Credit and collateral will move. With more value in real time, collateral calls can change shape. Be prepared for new worst case days.

The bottom line

Real-Time Co-Optimization plus Batteries is a long planned move to make the Texas market smarter in the moment. The optimizer will choose the best combination of energy and reserves every five minutes, and it will see batteries as the flexible assets they are. That should reduce avoidable costs, sharpen scarcity signals, and reward resources that can pivot quickly.

The payoff for participants is not automatic. It flows to teams that recode their bidding engines, align operations with the new single model view of storage, and track the right metrics from the first day. In a few months, we will know which portfolios adapted, because their revenue will tell the story. Prepare now, watch the early signals, and let the new price formation do what it was built to do, pay the right resource at the right minute.