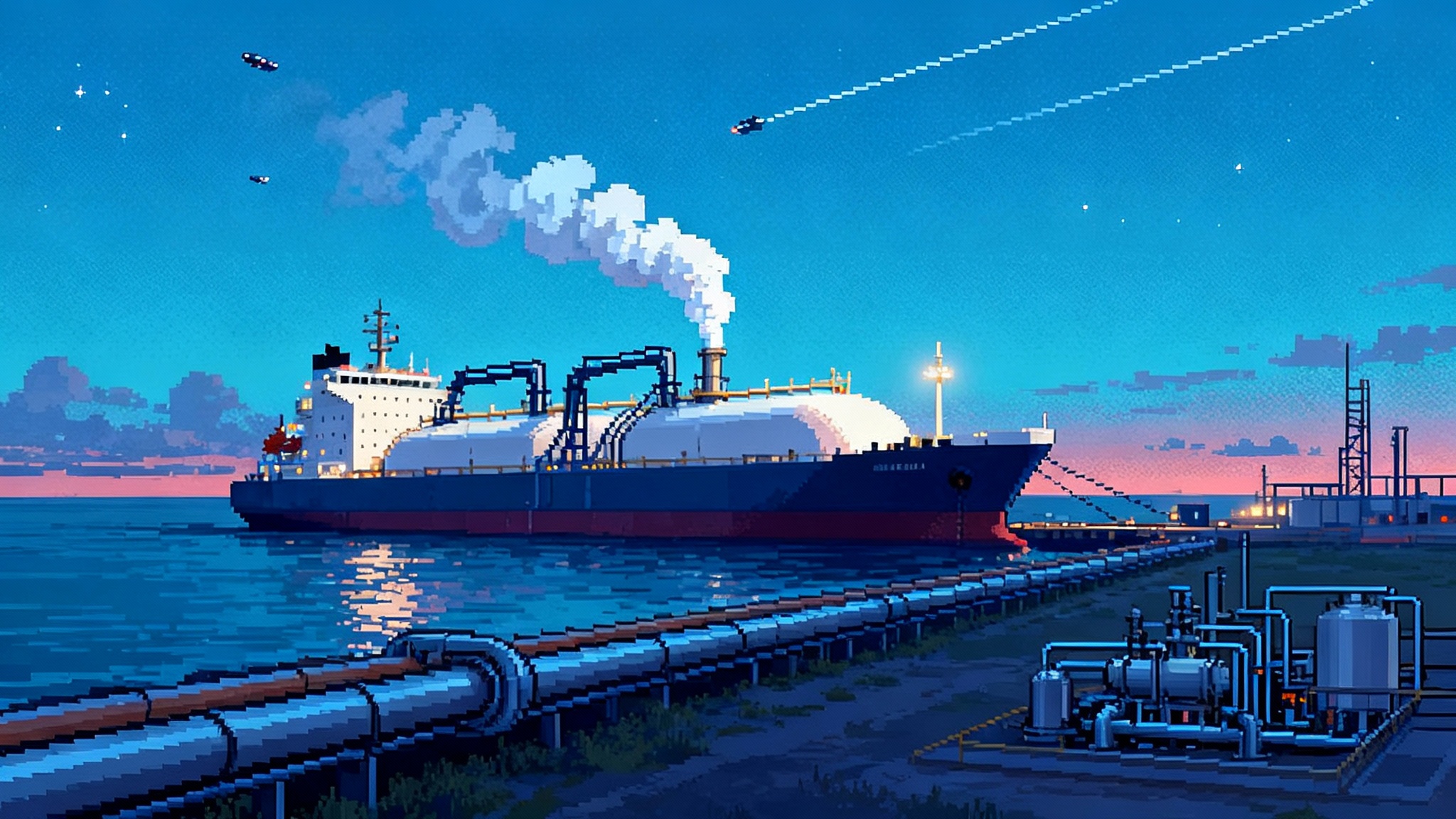

Gulf LNG Whiplash: October approvals and a court shock

October reset the U.S. LNG narrative with a big greenlight in Texas and a courtroom stop in Louisiana. Here’s what the new approvals, legal headwinds, EPC bottlenecks, and grid constraints mean for who actually ships by 2030.

The month LNG hit the gas, then hit a speed bump

October delivered the sharpest turn yet in America’s liquefied natural gas story. On October 16, NextDecade confirmed another step at its flagship project with NextDecade’s Train 5 FID at Rio Grande LNG in Brownsville. That decision adds roughly 6 million tonnes per year of capacity on top of the trains already under construction, and it crystallizes how fast the Gulf buildout is moving again after the pause on non free trade agreement export approvals earlier this year.

Days earlier, a different headline snapped the momentum into perspective. A Louisiana state court vacated Commonwealth LNG’s coastal use permit and sent it back for a new review, directing regulators to account for climate, air quality, and neighborhood burdens together rather than in isolation. It was the clearest signal yet that cumulative impact analysis has arrived as a gating factor for Gulf Coast megaprojects, not just a footnote. The ruling effectively pauses a nine and a half million tonne project until the state reworks the analysis, a reminder that faster federal green lights can still meet state and local red lights. Coverage of the ruling is here: judge tosses Commonwealth’s permit.

Those two moments capture the new LNG whiplash. On one side, federal agencies have been clearing a backlog of non free trade agreement export authorizations and deadline extensions, and developers have been racing to lock down offtake and finance. On the other, state courts and community challenges are forcing broader environmental accounting. Both forces will shape who ships in 2028 and who misses the window.

What October’s moves mean for 2026 to 2032 export capacity

Think of U.S. LNG capacity like a set of conveyor belts that come online in waves. Some belts are already humming, some are half built, and some exist only on contracts and drawings. October’s headlines matter because they nudge more projects from drawings to steel, and they warn that certain sites may need more homework before they pour more concrete.

-

Under construction and near term, 2026 to 2028: Golden Pass in Texas, Plaquemines in Louisiana, and Corpus Christi Stage 3 are the next big additions. Rio Grande Phase 1 is well into construction, and with Train 4 already sanctioned and Train 5 now sanctioned, Brownsville’s line of belts just got longer. Port Arthur Phase 1 continues to advance with firm offtake and site work. Collectively, these can push U.S. nameplate capacity meaningfully higher by the late 2020s, even before any entirely new sites break ground.

-

Late decade to early next, 2029 to 2032: The window becomes project selective. Developers with mature permits, signed long term sales, and financed engineering procurement construction contracts can still hit the early 2030s. Others will slip if they need to redo environmental work, upgrade grid interconnections, or reprice construction.

A practical way to read the October signals is this: more volume is likely by 2030 because several large sites have already cleared the three hard gates, which are permits, offtake, and money. The legal headwinds do not erase that momentum, but they will decide which second wave projects load ships first in the 2030 to 2032 stretch.

Engineering and power: the quiet bottlenecks

In LNG, it is common to focus on permits and contracts. The bottlenecks now emerging are more prosaic.

-

Engineering procurement construction bandwidth. Bechtel, Zachry, McDermott, and Technip Energies are the short list for multi train Gulf Coast jobs. At least three of those are already holding megaproject backlogs. In practical terms, that means new awards face higher prices and stricter change order discipline. If you assume a multi train site requires roughly 50 to 70 million craft hours from notice to proceed through mechanical completion, even a small delay in mobilizing crews or modules can ripple into six or nine months of lost time.

-

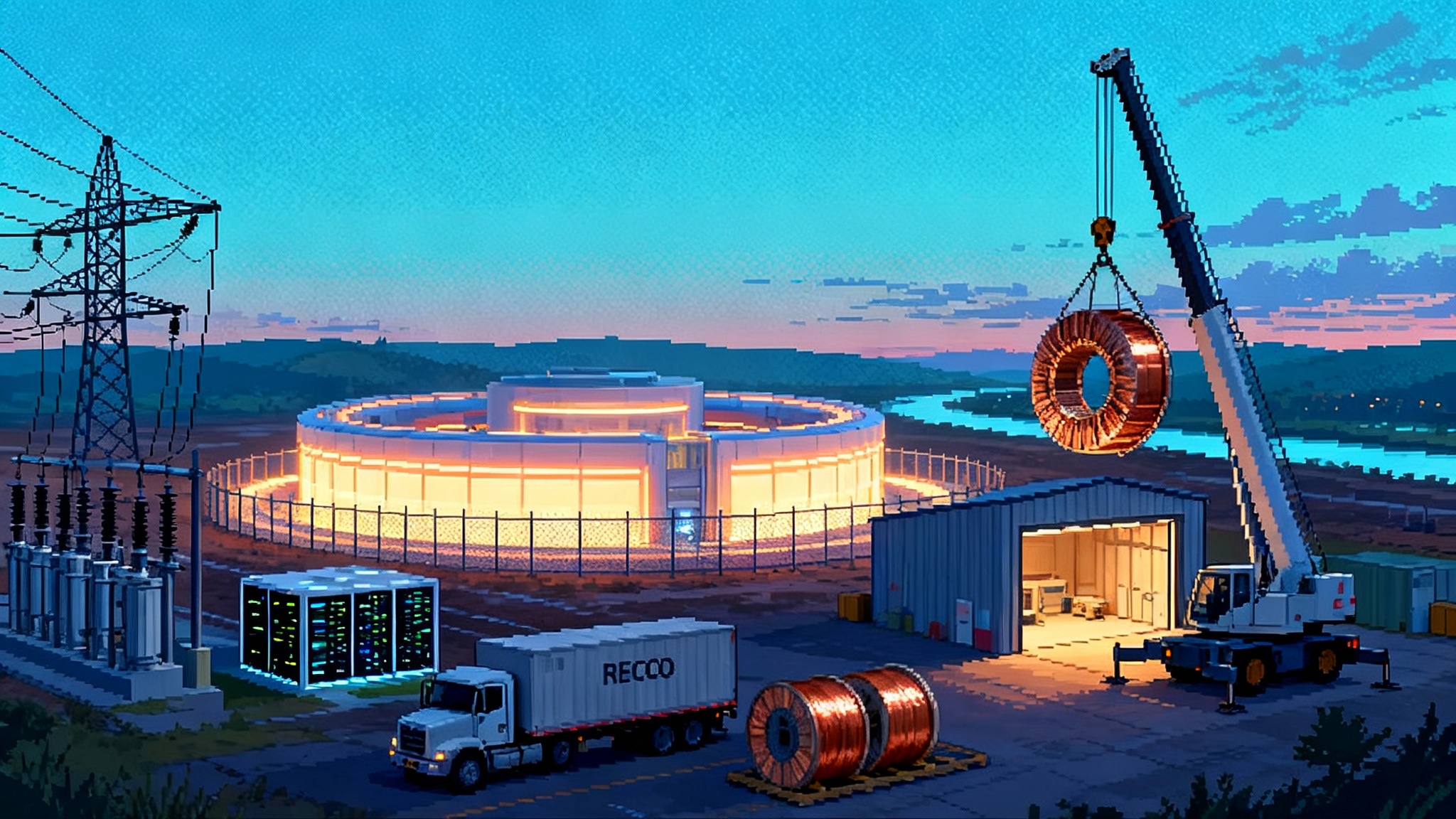

Electric drive versus gas turbine drive. Several expansion projects are evaluating electric motor drives to cut on site emissions. That swaps stacks for substations, and it turns the local grid into a long lead dependency. A single large train with electric motors can draw hundreds of megawatts at peak. A three to five train site can approach gigawatt scale if fully electrified. That, in turn, requires 230 kilovolt or 345 kilovolt interconnections, new substations, reactive power support, and black start solutions. For a deeper look at how new loads are reshaping utility planning, see our analysis on the AI power crunch grid playbook and how FERC 1920-A shapes transmission.

-

Temporary construction power. Even sites that run gas turbines in steady state still need substantial grid power during construction for cranes, welding, camp operations, and commissioning. Contractors that assumed diesel generators will now see higher costs and tighter air permitting around temporary power if local grids cannot absorb new peaks.

The lesson: October’s FIDs are not just commercial wins. They harden the queue for scarce EPC capacity and for transmission work that must be scoped now to keep 2030 schedules intact.

Buyers: Asia leans long, Europe stays flexible, U.S. gas sellers step in

The cast of counterparties also shifted this year, and October put names to it.

-

Asia’s utilities and traders are back in the long term market. JERA added volumes from the new Rio Grande trains. Other Asian names that locked in supply across 2024 and 2025 are still active, with Korean and Indian buyers balancing portfolios after volatile spot years.

-

Middle East and European majors are diversifying. TotalEnergies and Aramco each added long term cargoes tied to U.S. trains during the year. Their strategy blends equity stakes with offtake that can be placed into downstream regasification or sold into hubs.

-

North American producers are now visible on the offtake line. EQT and other U.S. gas sellers have stepped into long term sales at Gulf terminals, seeking to convert Appalachian and Haynesville molecules into seaborne netbacks with lower basis risk.

-

Continental Europe wants flexibility more than sheer volume. European utilities and state buyers are extending midterm deals and seasonal options rather than locking twenty year baseload in every case. That does not shrink U.S. volumes, but it changes the mix of destination clauses and pricing formulas.

The headline for developers is simple. The demand is still there, but the buyer mix now rewards projects that can show schedule certainty, credible carbon intensity plans, and true destination flexibility. For policy and market context on methane performance, see our overview of the methane rules showdown.

Cumulative impact reviews are now schedule critical

The Louisiana court ruling on Commonwealth LNG did more than void a permit. It formalized a higher bar for environmental review in coastal parishes that host clusters of heavy industry. Cumulative impact reviews ask a different question than traditional project by project analyses. They look across the map and across time. How many flares, how many megawatts of new load, how much added ship traffic, and what happens to air basins that are already strained on short term nitrogen dioxide or particulate spikes when wind is calm and humidity is high.

Translating that into project controls

-

Expect additional modeling and monitoring. Sponsors should plan for expanded air dispersion modeling that incorporates nearby plants, marine traffic, and backup generation. Monitoring plans may need more neighborhood sensors and real time public dashboards.

-

Build hurricane and storm surge into the cumulative narrative. Judges and regulators are asking whether facilities in a parish collectively increase storm loss risk for communities, not just whether a single site meets flood elevation rules. That means levees, shelter in place protocols, and mutual aid agreements will matter in hearings.

-

Prepare for environmental justice ground truthing. Agencies are being told to show their work on how they weighed impacts on nearby neighborhoods and fishing communities. That includes outreach records, multilingual notices, and how benefits like jobs, buffers, or emissions reductions are distributed.

The effect on timeline is concrete. A fresh cumulative study cycle can add six to eighteen months depending on data requests, dispersion modeling iterations, and any remand from court to agency and back again. If you depend on a coastal use permit or a state air permit, you should assume the higher bar is now the norm, not the exception.

Three forward scenarios to 2032

-

Acceleration case. Federal authorizations continue at a steady clip, and courts accept enhanced cumulative reviews on a few early test cases. Golden Pass, Plaquemines, Corpus Christi Stage 3, Port Arthur Phase 1, and Rio Grande Trains 1 through 5 reach full operations by 2031. CP2 or another mega site adds first cargoes by 2032. Net result: U.S. capacity rises sharply by 2030 and again in the early 2030s. Spot markets see more U.S. swing supply, and Gulf Coast midstream spends heavily on power lines as several trains go electric.

-

Middle lane. A handful of projects slip a year as EPC capacity and grid upgrades pinch schedules. A few developers reoptimize from four trains to three in their first phase to hold dates and budgets. Capacity still rises materially by 2030, but the bigger step up lands in 2031 to 2032. Long term buyers lean to Henry Hub indexation with carbon adders and performance clauses tied to methane monitoring.

-

Legal chokepoint. Multiple state permits are remanded for expanded cumulative analysis, and one federal programmatic challenge gains traction. Two or three projects that expected to sanction in 2026 push to 2028, and financing windows need to be refreshed. Capacity growth still occurs from the projects already under construction, but the optionality for new trains narrows. Developers shift focus to debottlenecking existing sites and to smaller brownfield additions that can clear review faster.

Which scenario prevails depends on the queue discipline around permits, power, and procurement as much as on gas prices.

A field checklist for tracking the next FIDs

For developers

-

Non free trade agreement status. Confirm whether your DOE order is final and that you have a defensible record on export commencement deadlines. If not, scope your path to a final order and your clock to commence exports.

-

Engineering procurement construction maturity. Press for lump sum clarity, module fabrication slots, and realistic mobilization curves. Ask for a quantified craft labor plan and a contingency budget sized for Gulf weather.

-

Grid interconnection plan. Nail down interconnection voltage, target megawatt draw, and the path to energize temporary and permanent loads. Get written commitments on transmission and substation in service dates, and align those with commissioning windows.

-

Cumulative review package. Prepare a consolidated modeling and monitoring appendix that regulators can adopt. Include regional baselines, across the fence emissions, and storm surge layers. Document community engagement in ways that are easy to audit.

-

Carbon intensity pathway. Specify methane monitoring requirements for feed gas, compression electrification or high efficiency turbines, and any carbon capture milestones. Buyers will ask for this in redlines.

For utilities and grid operators

-

Queue triage. Treat LNG like data centers in terms of load planning. Stage interconnections, so temporary construction load does not compromise reliability for existing customers.

-

Contingency power. Ensure black start and islanding options for critical LNG loads during hurricane season, especially if trains are motor driven.

-

New transmission triggers. Work with developers to convert speculative loads into executable transmission projects, including shared lines among neighboring terminals.

For investors and lenders

-

Offtake quality. Look beyond total contracted volume to the mix of counterparties and contract tenors. A blend of Asian utilities, integrated majors, and producer backed volumes reduces refinancing risk.

-

Schedule realism. Ask for the critical path that includes not only EPC but also interconnection energization, dredging windows, and hurricane hardening milestones.

-

Litigation map. Chart state permits that may face cumulative review challenges. Price longer construction interest and expanded reserves if a site sits in a parish with active environmental litigation.

-

Cost of power. In electric drive scenarios, model the levelized cost of electricity under different tariff designs and include curtailment risk assumptions during extreme weather.

The bottom line

October proved that the U.S. LNG story is not a straight line. A major Texas project moved decisively into build mode, while a Louisiana project learned that environmental math is being redone at the parish level. The net effect for 2026 through 2032 is more volume than many expected six months ago, but also more variability in who gets to ship it. The winners will be the projects that treat permitting, power, and procurement as a single integrated schedule. Get that right and the conveyor belts will keep rolling, even as the legal winds shift.