Fusion’s real start date: DOE’s roadmap and sprint

On October 14, 2025, the Department of Energy unveiled a fusion roadmap that puts dates on paper. With an NRC licensing framework pending, new public funding, hyperscaler offtakes, and magnet supply chain buildout, the next 24 to 36 months will determine how fast pilot plants reach the grid.

Breaking: A calendar for fusion finally exists

On October 14, 2025, the Department of Energy revealed its fusion roadmap in Washington, D.C., setting an official clock for what had long been a moving target. Early details point to tighter program milestones, clearer technology lanes, and a playbook for how federal partnerships are supposed to accelerate private deployment. The reveal matters because it shifts fusion from open-ended aspiration to time-bound execution. When a federal agency puts dates on paper, investors, utilities, and regulators suddenly have a schedule to manage. That is the difference between hope and planning. DOE unveils a fusion roadmap.

If you are scanning for the real start date of fusion, it is not the day a reactor lights up. It is the day buyers, builders, and regulators agree on the path to first power. Today is the pivot point.

The three levers that could pull fusion onto the grid

Think of fusion’s path to the grid as a three-gear transmission. All three gears must mesh, and the system moves only as fast as the slowest one.

-

Public funding and programs: DOE’s Milestone-Based Fusion Development Program, Fusion Innovation Research Engine collaboratives, and INFUSE partnerships have turned basic science into a series of contracted deliverables. The new roadmap tightens those deliverables and links them to siting and commercialization. Translation for teams on the ground: the government is not just paying for experiments; it is purchasing risk-reduction.

-

Big Tech demand and power purchase agreements: Hyperscalers have made fusion more than a science project by writing offtake agreements. Microsoft’s 2023 deal with Helion for delivery in 2028, plus a wave of advanced nuclear deals for data centers, put real load behind the claims. These buyers do not need 1,000 megawatts on day one. They need firm, clean megawatts that can grow with campus footprints. Fusion’s modular designs match that demand curve, and it sits within AI's power scramble in 2025.

-

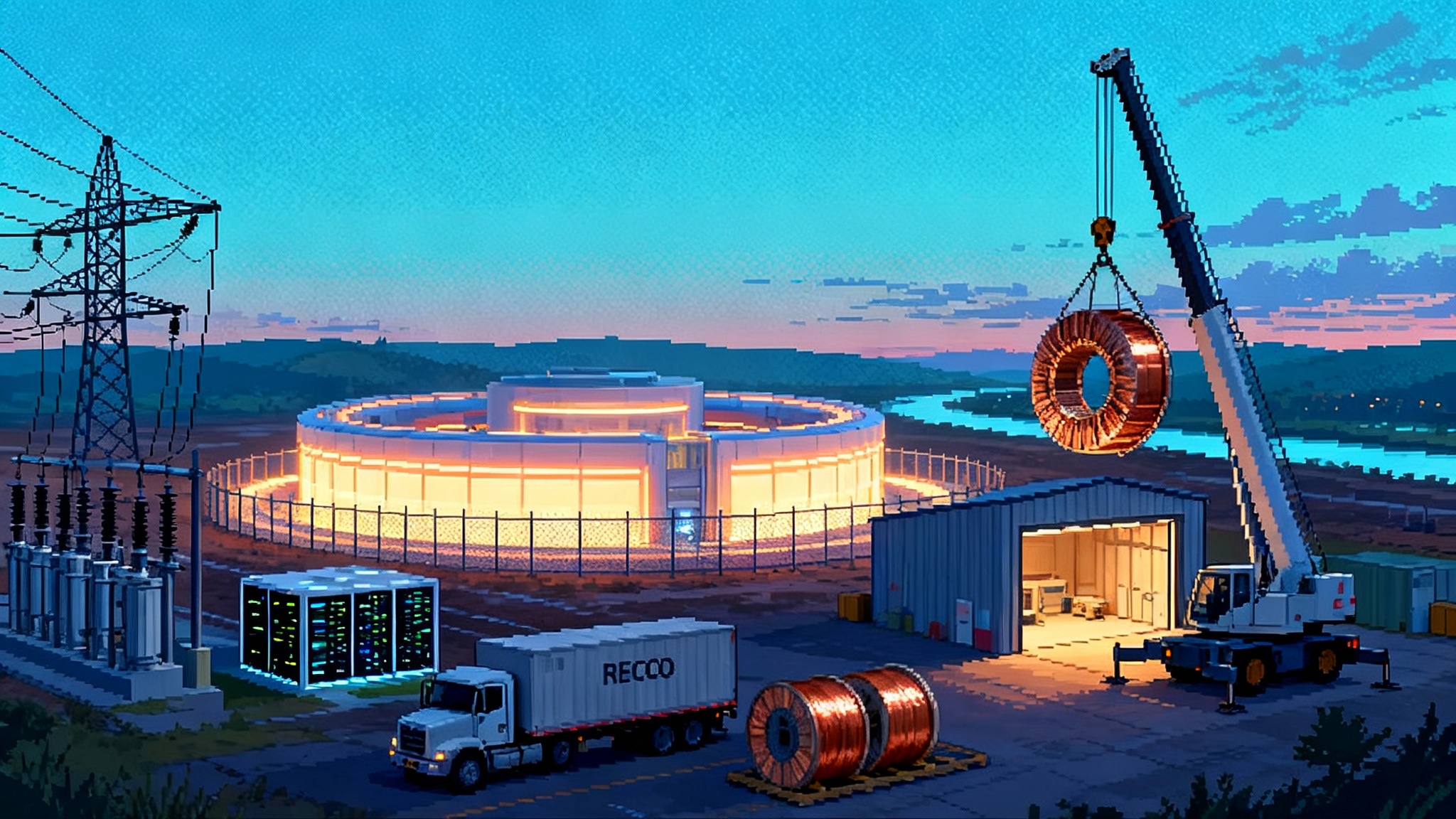

High-temperature superconductor magnet supply chains: Most magnetic-confinement designs depend on rare-earth barium copper oxide tape and cryogenic systems. That means domestic REBCO tape capacity, cryocoolers, and magnet manufacturing are no longer side quests. They are the critical path. U.S. firms scaling REBCO production and coil manufacturing will determine whether prototype machines turn into repeatable products.

When these three gears mesh, a pilot plant can move from slide deck to steel.

24 to 36 months that will make or break the 2030s

Here is a pragmatic timeline from now through late 2028. Treat these as waypoints that change investor risk perception, utility engagement, and project bankability.

-

Q4 2025: The Nuclear Regulatory Commission is expected to publish its proposed fusion machine rule for public comment. This will formalize how fusion devices are licensed as byproduct material rather than under fission power reactor rules and will include draft guidance for possession and operation licenses. The publication date matters because it triggers the comment window and starts clocks inside utilities and state programs. NRC fusion rulemaking status.

-

Late 2025: DOE’s milestone program cycles reach the pre-conceptual power plant design and technology roadmap stage. Companies that clear these milestones become candidates for larger, phase-two awards tied to integrated prototypes. Expect a bifurcation between teams that can show repeatable engineering progress and those still validating core physics.

-

2026: First-plasma milestones for leading magnetic machines are scheduled around 2026. Utilities and investors should not fixate on a single device. What matters is whether several architectures demonstrate progress on confinement, power handling, and component survivability. Multiple credible shots on goal reduce single-project risk.

-

2026 to 2027: State-level licensing and environmental reviews for prototype machines begin to stack up. Because many fusion devices will be licensed by state radiation control programs, watch the Agreement States where projects plan to build. Expect early sites near existing industrial infrastructure, retired fossil plants, and data center clusters with available transmission capacity.

-

2027 to 2028: First integrated demonstrations of high-duty-cycle operation at meaningful power levels become the gating item for project finance. At this stage, the measure of progress is not a press release about a breakthrough pulse. It is the number of consecutive hours at target parameters and the measured degradation of critical components.

This cadence aligns with pilot power in the early 2030s if procurement, construction, and licensing are done in parallel rather than in sequence.

Siting decisions that matter more than the map pins

-

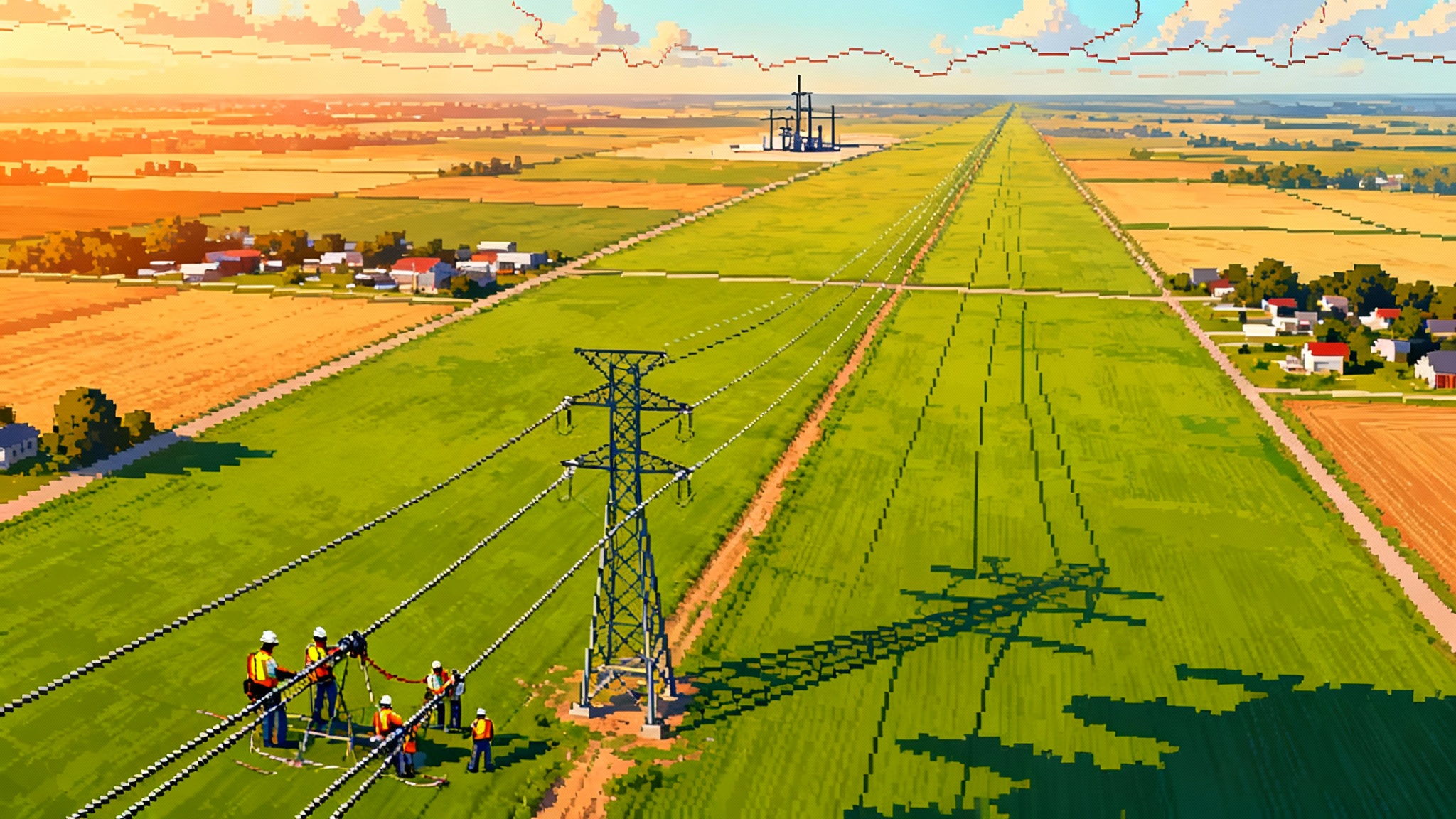

Grid adjacency beats remote isolation: The cheapest megawatt is the one that does not require a new long-distance line. Fusion pilots sited near substations with available capacity will move faster through interconnection queues. Retired coal plants and brownfield industrial parks are prime candidates because they already have switchyards, cooling water, and rail or road access. See how state-led grid expansion rules could shape interconnection and buildout.

-

Industrial heat and data center campuses change the math: Pilot plants that serve both electricity and process heat, or that connect directly to large data campuses, can secure higher value offtake than a merchant generator feeding a congested node. A single campus buyer can simplify credit, scheduling, and telemetry.

-

Community acceptance is a risk variable: Even with simpler licensing than fission, local acceptance can make or break timelines. Early, transparent engagement around radiation safety, tritium handling where applicable, and emergency planning zones turns a red-flag issue into a routine industrial conversation. Developers that arrive with apprenticeship programs and supplier commitments tend to fare better.

The regulatory unlock

The pending NRC fusion machine framework is not a footnote. It is the market’s operating system. If the proposed rule appears in November 2025 as expected, and if comments are resolved in under a year, developers could be pursuing well-understood state and federal licensing paths by late 2026. Two consequences follow:

-

Project finance structures can standardize: When licensing steps are predictable, lenders can model draw schedules, contingency, and reserve accounts. That allows debt to enter the capital stack, replacing all-equity funding.

-

Suppliers can quote with confidence: Magnet and balance-of-plant vendors price risk into their bids. Regulatory certainty lowers the contingency riders buried in those quotes.

Utilities should assign a licensing lead now and map how their state’s radiation control program will treat fusion under the forthcoming guidance. The right move is to start mock licensing timelines with developers and state offices before the proposed rule becomes final. That way, the day the rule is adopted, the paperwork is already drafted.

Follow the magnets and the tape

High-temperature superconducting magnets are the structural steel of fusion. Without enough REBCO tape, there are not enough machines. Three practical realities will dominate the next 36 months:

-

Domestic capacity must rise: Expect announcements of new or expanded U.S. tape lines and coil shops. The leading indicator is not just headline kilometers per year, but yield, conductor performance in high fields, and uniformity over long lengths. Investors should ask for independent test data at operating temperatures and fields relevant to the target devices.

-

Multiyear offtake contracts: Developers will increasingly sign multiyear, volume-firm offtakes with HTS suppliers. These will look like airline agreements for new aircraft: deposits tied to delivery slots, with escalation clauses indexed to input materials and energy. Utilities evaluating developer readiness should ask to see those supply contracts or at least commitment letters.

-

Cryogenics and power electronics are co-bottlenecks: Oversized focus on tape misses the equally critical availability of cryocoolers, vacuum equipment, and high-reliability power supplies. The pilot plants that hit schedule will have locked these in by the time ground is broken. Market dynamics in storage and components are evolving alongside the ERCOT storage pivot and FEOC.

How Big Tech PPAs change bankability

A creditworthy offtaker transforms a fusion pilot from speculative science to an infrastructure project. Here is what to look for in these agreements over the next two years:

-

Capacity and performance bands: Early plants may deliver firm blocks rather than full nameplate. Contracts should define capacity, ramp rates, and penalties within realistic engineering envelopes. This is where direct-to-campus interconnections help because a single load can accept bespoke profiles.

-

Measurement and verification: Bankable deals include third-party measurement, telemetry standards, and settlement systems that handle both kilowatt-hours and capacity value. Integrators like established utilities or power marketers can translate plant behavior into grid products.

-

Step-in rights and O&M: Lenders will demand step-in rights and long-term service agreements for magnets, cryogenics, and plasma-facing components. Expect a small number of specialist service providers to emerge. Developers that line up those agreements now will look different in due diligence.

The watch list: milestones that reduce risk

-

Licensing: Proposed NRC fusion rule publication and comment period in late 2025; Agreement State implementation playbooks; first possession and operation licenses issued to private facilities under the new guidance.

-

Technology: First-plasma milestones on leading magnetic devices; repeated, statistically meaningful runs at design parameters; progress on divertors and first wall materials; for pulsed concepts, cycle life of capacitors and switches.

-

Supply chain: Signed multiyear HTS tape offtakes; coil factory retooling; cryogenic and vacuum equipment allocations; power electronics qualified for fusion duty cycles.

-

Commercial: Additional PPAs or letters of intent from creditworthy buyers; site control, interconnection queue positions, and environmental permits at retired fossil sites; insurance binders for property and business interruption.

-

Finance: First blended debt and equity packages for demonstration plants; export credit or development finance participation for allied-nation suppliers; state incentives aligned to manufacturing jobs and transmission upgrades.

Scenarios utilities and investors can actually use

-

Base case: Rule publication in late 2025, final adoption by late 2026, and steady progress across several architectures. First integrated pilots demonstrate multi-hour operation in 2027 to 2028. A handful of projects close financing in 2028 to 2029 with commercial operation in the early 2030s. Action: identify one to two developers to cultivate now, reserve interconnection capacity at suitable brownfields, and design a PPA with staged performance milestones.

-

Accelerated case: Early pilot machines beat schedules, HTS tape capacity ramps faster than expected, and the rulemaking concludes efficiently. By late 2027, at least one project convinces lenders to provide a material share of project costs. By 2028, utilities sign multi-site PPAs tied to data center expansions, and suppliers begin modular, repeatable builds. Action: assemble an internal fusion working group with procurement, transmission planning, and corporate development; pre-negotiate a framework agreement that can be replicated across sites.

-

Drag case: Supply chain growth lags, local opposition slows siting, or key devices miss performance targets. The rule slips, or comment resolution triggers another round of guidance. Demonstrations still advance, but finance remains equity-heavy through 2028. Action: emphasize options not obligations in offtake structures, require performance bonds, and prioritize site work and interconnection rights that retain value even if fusion schedules move right.

Bankability without the buzzwords

A fusion pilot becomes bankable when three questions have concrete answers:

-

Can it run for long enough, often enough, to meet contracted delivery? Evidence is a test record with confidence intervals, not a one-off peak shot.

-

What breaks first and how fast can it be replaced? Lenders want a parts and maintenance plan with inventory levels, supplier commitments, and outage schedules.

-

What is the cash flow under conservative assumptions? That means capacity payments, contract for differences where available, and conservative capacity accreditation in the target market.

Utilities and investors can make this real with a short checklist:

-

Require an independent engineer review that covers materials lifetime, thermal loads, and control system reliability.

-

Ask for supplier letters and production slots for REBCO tape, coil fabrication, cryogenics, and power electronics.

-

Tie milestone payments to objective tests: hours at power, cycles without fault, and verified component inspections.

-

Align interconnection strategy with the plant’s early output profile, including the potential to serve behind-the-meter loads at industrial or data sites.

-

Build a communications plan with the host community that explains radiation controls, emergency planning boundaries, and workforce benefits.

The takeaway: mark the calendar

The question everyone asks is when fusion starts. The truthful answer changed today. With a federal roadmap in hand and a licensing framework moving toward publication, the next 24 to 36 months will be characterized by fewer hypotheticals and more scheduled work. If DOE’s program dollars keep hitting milestones, if hyperscaler offtakes evolve into standard terms, and if HTS suppliers lock multiyear delivery, pilot plants can credibly target first power in the early 2030s.

That is not science fiction. It is a project plan. Treat the period from October 2025 to late 2028 as the season when fusion either becomes a grid resource you can contract or remains a research line item. The difference will come down to the mundane disciplines that build every other piece of critical infrastructure: licensing on time, buying parts before the world runs out, and writing contracts people can bank.

Fusion’s real start date is not a miracle day on a lab screen. It is the day your organization books its first site walk, opens its interconnection application, and drafts a PPA with measurable performance bands. After today, that date belongs on your calendar.