45Z Goes Live: How New Rules Rewire U.S. Clean Fuels

Section 45Z flipped on January 1, 2025 and is already moving margins. With IRS and Treasury guidance on January 10 and late May updates, the winners are producers that register on time, document wage compliance, and design for LCFS plus low lifecycle emissions.

The switch flipped on January 1

On January 1, 2025, the Clean Fuel Production Credit known as Section 45Z turned from statute into a live market instrument. Ten days later, the U.S. Department of the Treasury and the Internal Revenue Service released the rules that matter for money: who qualifies, how emissions are counted, and the first emissions rate table that anchors the new math of margins. That package also previewed proposed regulations and clarified the big operational questions producers had queued up for a year. Treasury’s release on January 10, 2025 is the keystone event readers should mark.

By late May 2025, the government’s central 45Z page, forms and instructions had been refreshed again, pulling everything into one place and underscoring a core requirement that is already shaping winners and laggards in 2025: you must be registered as a producer at the time of production to claim the credit. The registration rule sounds procedural. In practice, it is a toll booth that decides whose barrels and molecules actually clear into the credit market in the first months of 45Z.

The new margin stack, in one formula

The bones of 45Z are simple: credit per gallon equals an applicable amount multiplied by an emissions factor. The applicable amount is larger for sustainable aviation fuel and increases if a facility satisfies prevailing wage and apprenticeship requirements. The emissions factor is a measure of how far your fuel’s lifecycle emissions are below a fixed baseline.

Here is the plain-language version that matters for planning, using 2025 statutory amounts before any inflation adjustment:

- Non-aviation fuels such as renewable diesel or renewable gasoline: base 0.20 dollars per gallon; if prevailing wage and apprenticeship are satisfied at the facility, the alternative amount is 1.00 dollar per gallon.

- Sustainable aviation fuel: base 0.35 dollars per gallon; alternative amount is 1.75 dollars per gallon if the prevailing wage and apprenticeship requirements are satisfied.

The emissions factor is calculated against a baseline of 50 kilograms of carbon dioxide equivalent per million British thermal units. It is essentially how much of the 50 you eliminated. Example: a fuel with an emissions rate of 10 kilograms per million British thermal units has an emissions factor of 0.8. Multiply that by the applicable amount to get your per-gallon credit.

Two quick examples to make this concrete:

- A sustainable aviation fuel pathway with an emissions rate of 10 has an emissions factor of 0.8. If the facility meets prevailing wage and apprenticeship requirements, the credit is 1.75 times 0.8, or 1.40 dollars per gallon.

- A renewable diesel pathway with an emissions rate of 25 has an emissions factor of 0.5. If the facility meets prevailing wage and apprenticeship requirements, the credit is 1.00 times 0.5, or 0.50 dollars per gallon.

Producers use the Department of Energy’s 45ZCF-GREET model or, for aviation fuels, an allowed aviation methodology, to determine lifecycle emissions. Treasury’s January 10 notices also created a pathway to petition for a provisional emissions rate if your fuel type or configuration is not explicitly listed in the table yet. The headline impact is straightforward: low-carbon intensity fuels earn materially higher 45Z capture. High-carbon intensity fuels earn little or nothing because the formula leaves them with an emissions factor near zero.

For step-by-step rules, applicable amounts, emissions factor mechanics, and producer registration details, the Internal Revenue Service maintains a living guidance page that producers have been bookmarking and checking weekly. It is the best single reference for operators and investors. See the IRS page for the Clean Fuel Production Credit.

Registration is the new toll booth

45Z is not a retroactive credit. To claim it, you must be registered as a producer of clean fuel at the time the fuel is produced. The process runs through Form 637 with the new activity letters for sustainable aviation fuel and non-aviation fuels. If your registration letter is dated June 30, you cannot claim 45Z for gallons produced on June 29. This timing rule is causing very practical effects in early 2025:

- First movers that filed early are booking credits on January and February production. Late filers, even with qualifying pathways, have to wait until the date stamped on their registration approval.

- Credit buyers are pricing transferability with a registration premium. Transferability under Section 6418 allows producers without a large tax bill to sell the credit for cash, but buyers care about registration dates, prevailing wage compliance, and documentation quality. Those items are already showing up in insurance terms and discount rates.

If you take only one operational step after reading this story, make it this: verify your registration status per facility, confirm prevailing wage and apprenticeship documentation flows, and institute a monthly audit of emissions-factor backup tied to your 45ZCF-GREET runs or your aviation certification files.

What the emissions table and methods reward

Think about the 45Z table as a price signal engineered to reward deeper decarbonization of each pathway. Four families of fuels stand out:

-

Sustainable aviation fuel. Alcohol-to-jet and power-to-liquids pathways that pair low-carbon ethanol or synthetic hydrocarbons with clean process energy can reach emissions factors that unlock the largest per-gallon awards in the system. The first commercial alcohol-to-jet plant at LanzaJet’s Freedom Pines in Georgia, designed to convert ethanol into jet fuel, exemplifies how 45Z turns plant-level emissions work into a material revenue line. Hydroprocessed esters and fatty acids plants that can swing to a jet cut also benefit. Facilities like Phillips 66’s Rodeo Renewable Energy Complex in California, which already produces renewable diesel and can produce renewable jet fractions, highlight how pretreatment, waste-lipid sourcing, and process energy choices show up as dollars in the 45Z math.

-

Ethanol with carbon intensity cuts. Grain ethanol producers that reduce emissions with clean power, process heat from renewable natural gas, and smarter logistics can achieve big moves in their emissions rate even before carbon capture. Some will consider adding carbon capture to knock the emissions rate down further, but there is a catch: 45Z has anti-stacking rules. If a facility claims a carbon sequestration credit for the year, that facility cannot claim 45Z for that year. This choice architecture makes ethanol-with-carbon-capture a modeling exercise rather than an automatic stack. The decision swings on gallons, emissions factor, and your ability to value the captured carbon.

-

Renewable diesel and renewable gasoline. Hydrotreaters running used cooking oil, tallow, and distillers corn oil can score strong emissions factors, especially with robust pretreatment and cleaner utilities. The market’s large conversions, including Rodeo in California and Martinez Renewables nearby, were built to generate strong Low Carbon Fuel Standard value. With 45Z live, the same design choices now deliver federal credit upside on every qualifying gallon.

-

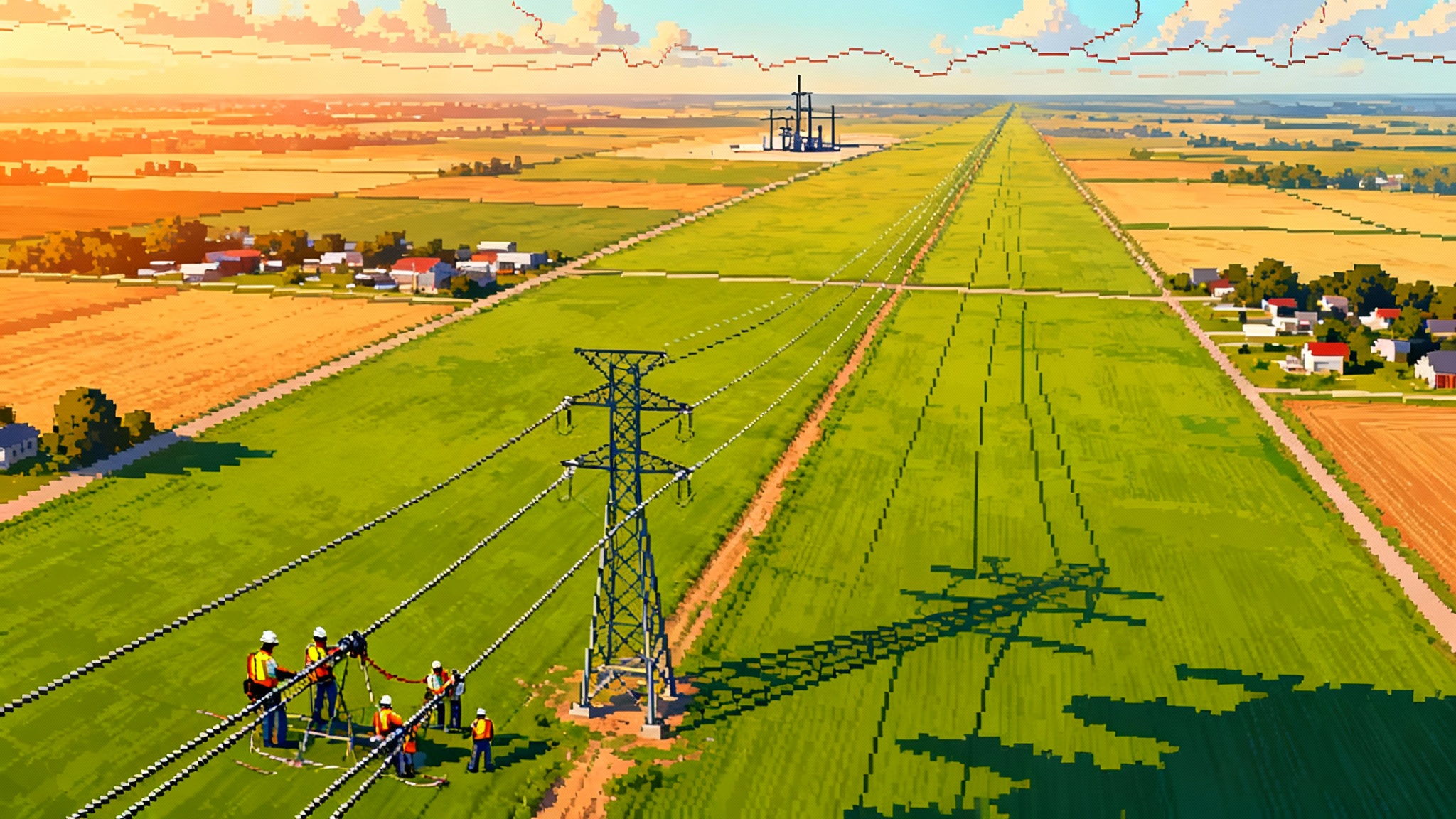

E-fuels. Synthetic kerosene or methanol produced with low-carbon electricity and captured carbon dioxide can push emissions factors close to one. On paper, that maximizes 45Z. In practice, e-fuels will scale where developers can sign long-term contracts for very clean, very cheap power and secure carbon offtake or supply. Competition for firm clean power is intensifying due to AI’s power scramble in 2025 and emerging state-led grid expansion moves.

Where projects pencil out first

Developers and lenders are converging on a few patterns as 2025 contracts firm up:

-

LCFS states plus 45Z. California’s LCFS credits traded in the mid double digits per ton for much of 2025. That is a meaningful but variable uplift. Stacking LCFS with a predictable 45Z per-gallon value tightens project finance models. Pathways delivering big carbon intensity reductions under LCFS typically also deliver higher 45Z emissions factors, so the same engineering work creates two revenue streams.

-

Plants with ready access to clean utilities. If you can switch from grid steam to on-site renewable natural gas or electrify portions of your process with verified clean electricity, you often move your emissions rate enough to change your 45Z bracket. The cheapest emissions reductions in 2025 are often inside the fence.

-

Ethanol-to-jet at or near existing biorefineries. Co-siting allows shared utilities, reduces logistics emissions, and leverages existing permits and workforces. It also lets producers optimize the ethanol’s carbon intensity with incremental investments like thermal oxidizer upgrades or dryer heat integration before sending molecules to an alcohol-to-jet unit.

-

Waste lipids with pretreatment. Renewable diesel and renewable jet made from used cooking oil or tallow tend to start with lower emissions rates than virgin vegetable oils. Projects with proven pretreatment capacity to handle difficult feedstocks earn their advantage twice, in LCFS and in 45Z.

-

E-fuel hubs with firm power. Early e-fuel wins are forming where electrolyzer developers can secure long-duration, low-carbon power at stable prices, often near large point sources of biogenic carbon or direct air capture pilots. The newest 45Z guidance favors explicit, transparent lifecycle accounting for these choices. RNG sourcing and traceability will also be shaped by Europe’s methane rules pressure.

How LCFS and 45Z stack in practice

Stacking is legal and, in most cases, essential. Think of 45Z as a per-gallon federal layer determined by lifecycle performance and eligibility rules, and of LCFS as a per-ton state layer determined by your carbon intensity reduction relative to the jurisdiction’s standard. Because both reward the same engineering measures, the practical advice is to design once for both programs:

-

Model to both frameworks at the same time. For any retrofit or greenfield project, run a combined case that shows how a change in utilities, feedstock, or logistics shifts your LCFS carbon intensity score and your 45Z emissions factor in the same spreadsheet. The cheapest project changes are often those that improve both.

-

Watch prevailing wage and apprenticeship documentation like a hawk. The difference between base and alternative amounts is the biggest single swing in 45Z. Treat it like a primary revenue driver in your contracts and audits.

-

Expect LCFS price volatility. Build scenarios that use a conservative LCFS price and then treat 45Z as the stabilizer. For offtake, specify how price pass-throughs work if LCFS credit prices swing.

-

Document energy and carbon claims tightly. Whether you are using renewable natural gas for process heat or imported electricity backed by contracts, the emissions table and IRS instructions reward traceability. The same files that back your LCFS claim should back your 45Z claim.

2025 to 2027 build cues

The three-year life of 45Z creates urgency. Here is what to watch on the ground:

-

Feedstocks. Sellers of used cooking oil, tallow, and distillers corn oil hold pricing power. Pretreatment capacity is a gating factor. Projects that can run lower-cost, higher-impurity feedstocks will out-earn rivals in both LCFS and 45Z.

-

Carbon capture and pipelines. Midwestern carbon dioxide pipelines are facing new restrictions and permitting churn in 2025, which makes capture-plus-sequestration timing uncertain in some states. That uncertainty is steering some ethanol producers toward non-capture intensity cuts first, while they evaluate whether to prioritize 45Z or a carbon sequestration credit year by year.

-

Renewable natural gas. Expect more on-site or dedicated-supply agreements to decarbonize process heat. The economics often pencil faster than full electrification and come with strong lifecycle documentation.

-

Electrolyzers. Order books are filling for 2026 and 2027 delivery. E-fuel developers that lock in modules and transformers in 2025, along with firm low-carbon power, will be the ones that ship in time to capture at least part of 45Z’s window.

-

Transferability infrastructure. Brokers, insurers, and large credit buyers are standardizing documentation sets for 45Z trades. Producers that align their metering, certification, and wage records with those templates will see lower discounts and faster cash.

Company snapshots to ground the trends

-

Phillips 66 Rodeo Renewable Energy Complex. The San Francisco Bay Area conversion completed in 2024 and is running at large commercial rates with the ability to make renewable jet cuts. It stacked LCFS revenue by design. With 45Z in play, every improvement in feedstock pretreatment and utilities now multiplies its federal credit capture.

-

LanzaJet Freedom Pines. The ethanol-to-jet facility in Georgia is a bellwether for how alcohol-to-jet plus low-carbon ethanol can earn high 45Z values. Watch how its offtake contracts evolve as airlines model 45Z alongside their internal decarbonization targets.

-

Large ethanol platforms. Producers such as POET and ADM have been running facility-by-facility carbon intensity audits, focusing first on clean power and thermal integration, then on capture options. The anti-stacking rule means finance teams are comparing a year of clean fuel credits against a year of carbon sequestration credits at the facility level. Expect different answers at different plants.

-

Martinez Renewables. The joint venture between Marathon Petroleum and Neste shows the other way to win early: scale, pretreatment, and proven hydrotreating that can swing to renewable jet. In a world where LCFS credit prices can wobble, 45Z provides a predictable per-gallon layer that strengthens cash flow.

Risks from policy churn, and why deployment likely accelerates anyway

45Z arrived in an election year and in a fuel market with high regulatory traffic. Congress is debating extensions and design tweaks. Proposals have circulated about restricting or discounting credits for fuels made with certain foreign feedstocks and about revising how indirect land-use change is treated. State-level programs like California’s LCFS are updating targets to steepen decarbonization through 2030 and beyond. Carbon pipeline rules are shifting in the Midwest. And federal agencies continue to update modeling tools.

All of that adds noise to models. Nevertheless, the deployment curve is likely to steepen in 2026 for three reasons that are more structural than political:

-

The rules reward engineering, not labels. The emissions-rate table, GREET modeling, and registration requirements favor producers that can reliably measure and reduce emissions. That builds durable advantages at the plant level that outlast any one policy cycle.

-

The stack is now financeable. With 45Z live and transferable, LCFS established, and aviation buyers showing willingness to sign multi-year offtakes, capital can price risk more credibly. Even if state credit prices bounce, the federal per-gallon layer is a stabilizer.

-

The window is short. A credit that applies to production from 2025 through 2027 pushes developers and boards to pull forward final investment decisions, lock in equipment, and commission sooner. Urgency is a growth force.

What to do now, by role

-

Fuel producers. Confirm facility registration status. Lock down prevailing wage and apprenticeship documentation. Run combined LCFS and 45Z cases for each retrofit option. Consider a facility-by-facility decision tree for carbon capture vs 45Z. If you plan to transfer credits, standardize data rooms to match buyer and insurer checklists.

-

Airlines and fleets. Where you can, shift offtakes to pathways with clear emissions-factor headroom. Tie contract pricing to documented lifecycle methods. Prioritize suppliers that can show registration, wage compliance, and auditable modeling files.

-

Feedstock suppliers. Offer proof packages on origin and logistics. Producers will pay for traceability that improves their emissions factor. Pretreatment-friendly lots are worth more in a 45Z world.

-

Investors and lenders. Underwrite the emissions factor and the registration status, not just the feedstock contract. Model LCFS volatility with conservative cases, and treat 45Z as an independent federal layer with clear compliance gates.

The takeaway

Section 45Z is not a slogan. It is a spreadsheet line powered by a registry letter, a modeling file, and a set of wage records. That is why it is already changing how fuels are made and sold in the United States. In a short window, the credit makes the cleanest gallons meaningfully more profitable and pushes capital toward projects that can prove their emissions math. Policy debates will continue. Plants that can deliver measurable carbon intensity cuts, document them, and sell into both LCFS and 45Z are set to move first and fastest. That is the quiet, durable reason deployment is likely to accelerate from farm to jet.