Palisades 2025: The Restart Playbook for U.S. Nuclear

Palisades is moving from decommissioning back to generation with a repeatable restart playbook. NRC sequencing, DOE-backed financing, and technology‑neutral credits point to a model that can scale brownfield restarts and site‑add SMRs.

The news peg: Palisades crosses from idea to blueprint

In 2025, the Palisades nuclear plant on Lake Michigan stopped being a what‑if and started looking like a replicable model. By late July, the Nuclear Regulatory Commission approved key actions to move the facility from decommissioning toward operations, including license approvals that authorize fuel receipt and loading, with remaining inspections and testing before synchronized generation. That single decision, while not the final green light, is the inflection point that separates aspiration from execution for America’s first commercial nuclear restart. See NRC approves key Palisades restart actions.

Why this matters goes beyond one plant. Palisades has become a template that other owners, regulators, and buyers can read and reuse. The playbook combines three pillars: a sequenced path through NRC relicensing, an optimized financing stack anchored by the Department of Energy’s Loan Programs Office, and the arrival of technology‑neutral tax credits that change the math for both restarts and new nuclear next to them.

Pillar 1: The NRC relicensing sequence that actually moves work forward

The NRC did not invent a new rulebook for Palisades. Instead, it stitched together familiar steps in a sequence that lets a mothballed plant demonstrate safety and readiness, then systematically regain the authorities it needs to operate.

Here is the rough order that emerged, and why it matters:

-

Environmental review with a finding of no significant impact. This is the backbone that supports subsequent licensing actions. It answers the threshold question: does restarting the plant materially change the environmental footprint beyond what was already analyzed in its licensing basis.

-

License transfer and restoration of operating status. Palisades needed authority moved back from a decommissioning entity to an operating company, then a formal transition from decommissioning status back to an operating license. That restoration is historic and unlocks operator staffing, training, and the ability to receive fuel under the operating rule set.

-

Technical specification amendments that tackle known issues head‑on. For Palisades, the center of gravity included steam generator tube integrity and repairs, reflected in specific amendment requests and component work. Making the safety case on the hardest equipment first de‑risks the schedule by confronting the known critical path.

-

Training accreditation and emergency planning reactivation. Full accreditation for operations training and a graded emergency exercise with federal and state partners are not public‑relations milestones. They are functional proof that the on‑shift team, procedures, and response infrastructure have returned to operating posture.

-

Fuel receipt and load authorization, then test runs and power ascension. Receiving and loading fuel under the restored license marks the point of no return for both the owner and the regulator. From there, the remaining steps are classic startup work: system flushes, cold and hot functional tests, and a power ascension program that validates safety margins at each hold point.

The practical lesson is that NRC does not need a bespoke restart rule. Owners that document the original licensing basis, propose targeted amendments for known gaps, and front‑load operator and emergency readiness can move quickly once the environmental review is in hand.

Pillar 2: Financing that lowers the cost of patience

Restarts take cash before they make cash. The Department of Energy’s Loan Programs Office loan guarantee for Palisades sets the model for how to finance that gap. Long‑lived, capital‑intensive assets benefit most from lower coupons and longer tenors. The LPO structure shifts a big chunk of cost from ratepayers to federal credit while keeping commercial discipline through milestones and disbursement gates. For broader context on federal credit, see how DOE 1706 loans are rewiring the grid.

Two more features matter for replication:

-

Rural cooperative buy‑downs. Wolverine Power Cooperative and Hoosier Energy, the offtakers for Palisades, secured federal rural energy support that effectively lowers the delivered cost of power to cooperative members. For restarts that serve large rural footprints, this kind of support can turn a good resource plan into an affordable bill impact.

-

State co‑investment. Michigan’s appropriation to support the restart did three things at once. It signaled political durability, it provided flexible funding for non‑rate recovery items, and it anchored a local workforce plan that makes restart faster and safer.

The mechanism is simple, even if the paperwork is not. Use federal credit to cut weighted average cost of capital. Layer grants or refundable incentives where they improve affordability for public‑interest buyers. Keep utility balance sheets intact by separating construction‑period risk from post‑COD power sales.

Pillar 3: Credits that are technology‑neutral, and finally nuclear‑native

Three tax code sections drive the next wave of nuclear, and Palisades sits at their intersection.

-

Section 45U is the zero‑emission nuclear production credit for existing reactors. It runs through 2032 and is scaled by market revenues. It is designed to keep today’s nuclear fleet online. A restarted plant that retains its original placed‑in‑service date can potentially qualify once it is back in commercial operation, subject to the credit’s definitions and revenue reduction rules.

-

Sections 45Y and 48E are the new technology‑neutral credits for clean electricity. Any zero‑emission generator placed in service after 2024 can choose between a production credit for 10 years or an investment credit on capital cost, both with bonuses for domestic content, energy communities, and prevailing wages. Treasury and the Internal Revenue Service finalized the general rules in January 2025, confirming that nuclear fission qualifies categorically and clarifying the 80‑20 retrofit pathway that can deem certain heavily refurbished units as newly placed in service. See the final clean electricity credit rules.

-

Why this matters for restarts plus SMRs. A brownfield restart can rely first on 45U to stabilize economics during the early years, while site‑add small modular reactors next door can elect 45Y or 48E. If the restart scope is capital‑heavy enough to meet 80‑20 thresholds, owners may model whether 45Y beats 45U over the next decade. The right answer will vary by power price, capital cost, and bonus eligibility.

The simplified takeaway: 45U keeps the legacy plant viable as a clean firm anchor. 45Y and 48E make the add‑on units pencil without bespoke carve‑outs. Together, they turn a single restart into a multi‑unit growth platform.

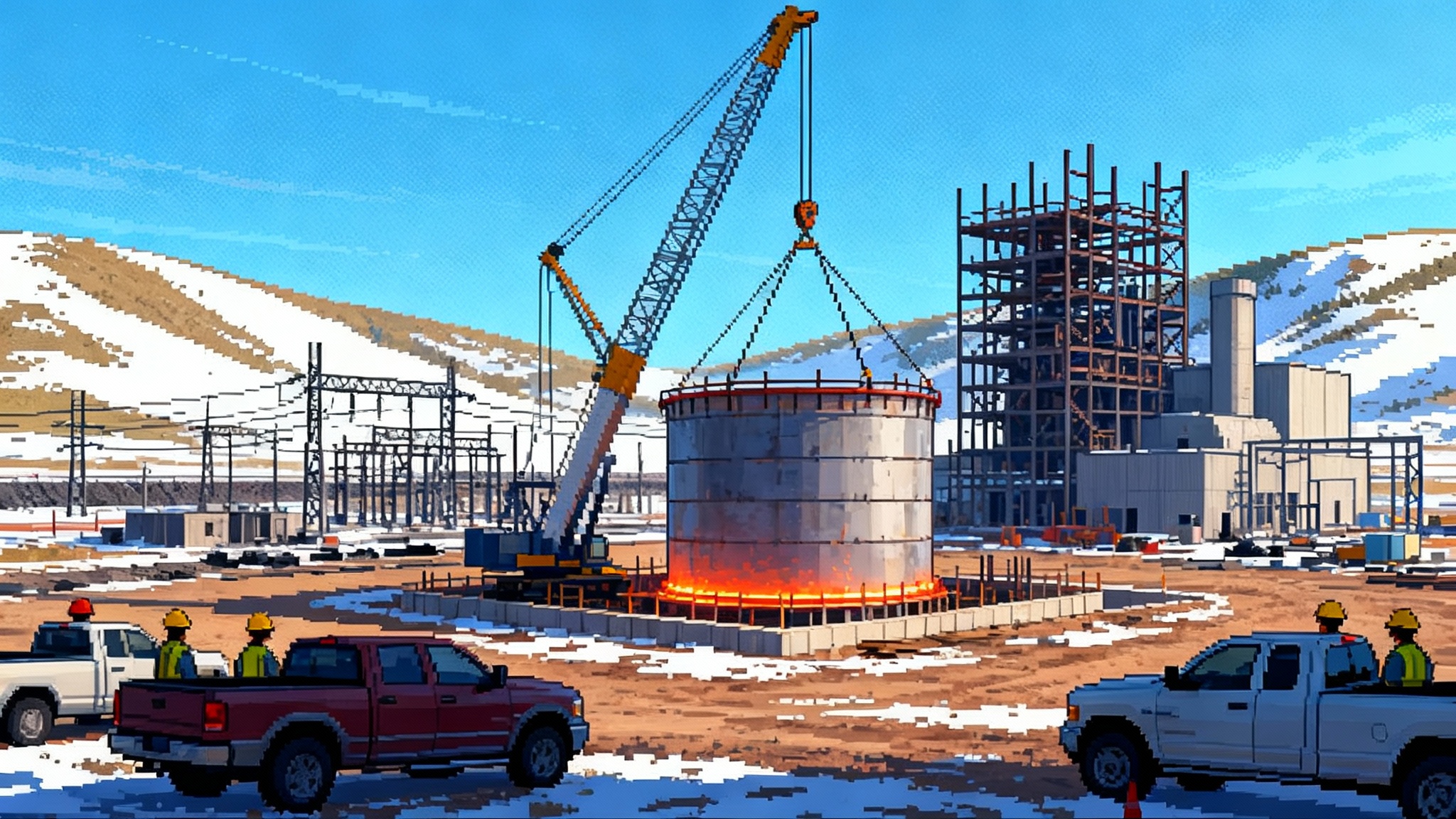

The brownfield restart formula, in plain English

Think of a nuclear brownfield like a great house with an aging roof, original wiring, and a perfect location. You do not bulldoze it, you bring it up to code, replace the roof, and add an in‑law suite. The Palisades formula looks like this:

-

Use the interconnection you already own. Grid queues are long and uncertain. A retired plant’s interconnect, switchyard, and transmission corridor are priceless. As Order 1920 unlocks transmission capacity, preserving a high‑value node can be the difference between a project and a plan.

-

Start with safety‑critical equipment. Steam generator integrity, primary coolant pumps, emergency diesel generators, and reactor protection systems determine both schedule and risk. Finish these scopes early, then use them to demonstrate readiness to the regulator.

-

Over‑invest in people and procedures. A nuclear restart is 50 percent equipment and 50 percent culture. Accredited training, an active emergency plan, and a fully staffed operations crew de‑risk both licensing and startup.

-

Lock down fuel and outage vendors. Restarts compete for the same skilled labor and long‑lead components as the operating fleet. Advanced purchase orders and vendor alliance agreements limit inflation and schedule slippage.

-

Align capital with milestones. Tie loan disbursements and state support to tangible proof points, such as accreditation, component completions, and graded exercises. That discipline imposes schedule truth.

What the power contracts look like now

Power purchase agreements for nuclear restarts are evolving from a single utility contract into a portfolio approach.

-

The cooperative model. Wolverine and Hoosier committed to multi‑decade purchases sized to their members’ needs, then paired those contracts with rural energy grants to buy down cost. This structure is attractive in regions where cooperatives serve large loads and value cost stability more than hour‑by‑hour shaping.

-

The hyperscaler model. Big technology buyers are signing 24 by 7 clean energy deals to cover data center load with hourly matching. That requires firm output and long tenure, which nuclear provides. For demand context, see how AI becomes the new baseload. These contracts often include price escalators tied to inflation, shape premiums to reflect baseload value, and provisions that allocate outage risk between owner and buyer.

-

Hybrid structures. Expect to see portfolios where a cooperative anchors half the output, a hyperscaler takes a firm slice for 24 by 7 matching, and a utility backstops the remainder for reliability. Owners can hedge merchant exposure through capacity markets and ancillary service revenues, but the restart math works best when most megawatt hours are pre‑sold.

Contract clauses worth copying from Palisades‑style deals:

-

Schedule guardrails. Clear remedies if major NRC milestones slip beyond a defined window, paired with relief for regulatory causes beyond the owner’s control.

-

Outage sharing. Pre‑agreed allocations for refueling and forced outages, with make‑whole energy from the owner’s fleet or market purchases at capped prices.

-

Tax credit sharing. A transparent mechanism to pass a portion of 45U or 45Y value through to buyers in exchange for offtake commitments and site access for community benefit programs.

-

Expansion options. Rights of first offer for site‑add SMRs so buyers can scale carbon‑free supply at known locations and transmission interconnects.

Scaling through 2030: from one restart to a fleet strategy

The most important forecast is not how many restarts happen. It is how many multi‑unit sites emerge where a legacy reactor anchors one or two new modular units.

-

Palisades as the first campus. The owner has announced plans to co‑locate two roughly 300 megawatt electric small modular reactors on the same property by 2030, pending licensing. That would nearly double carbon‑free output using the same grid node, shared security and training, and a unified emergency plan. The restart becomes the bridge to first‑of‑a‑kind new build.

-

The next restarts. Three Mile Island Unit 1 in Pennsylvania has a signed 20‑year offtake with a hyperscaler and is targeting late‑decade operations, pending NRC approvals and major component replacements. The project’s cost profile looks broadly similar to Palisades in scale, though scope differs by plant.

-

Brownfield SMR candidates. Owners at retired sites such as Kewaunee in Wisconsin are pursuing site permits that could support new nuclear. The brownfield advantage is the same everywhere: existing switchyards, water access, trained communities, and a workforce that wants to stay in the trade.

Reasonable scenario, not a promise: by 2030 the United States could see one to two restarts online and one or two pairs of modular units under construction at brownfield sites. That is 1.6 to 3.0 gigawatts back on the grid and another 0.6 to 1.2 gigawatts advancing in concrete and steel.

Reliability and cost: what changes on the grid

Nuclear restarts do two things that batteries and peakers cannot easily do together.

-

They restore grid services. A large unit replaces lost inertia and voltage support with a single asset that runs days to weeks at a time. That helps keep frequency steady and limits the need for reactive support during weather events.

-

They flatten the price shape. A baseload plant compresses the spread between off‑peak and peak hours in its zone. That reduces the volatility tax on customers and the premium that buyers pay for round‑the‑clock service.

Cost is not one number, it is three:

-

Restart capital. Palisades‑scale work sits in the low billions of dollars, which is a fraction of new build of the same output. Federal loans and grants reduce the customer impact by lowering the cost of money.

-

Ongoing operations and fuel. Modern fuel contracts and component replacements target capacity factors similar to the operating fleet. Outage discipline is the swing factor for delivered cost.

-

System benefits. Avoided transmission upgrades, preserved interconnects, and reduced reserve needs are real savings that fail to show up in plant‑only levelized cost comparisons. When nuclear restarts displace reliability must‑run contracts or keep a coal unit from a life‑extension workaround, the grid and customers both gain.

How the playbook travels to other regions

Where this model fits next:

-

Midwest and Mid‑Atlantic. Regions with large cooperative footprints, industrial loads, and tight capacity margins benefit most from the cooperative plus hyperscaler model.

-

Southeast. Regulated utility commissions that value long‑term rate stability can pair restarts or brownfield SMRs with multi‑decade cost‑of‑service treatment, provided owners put real skin in the game on schedule.

-

West. Water‑limited areas may favor SMR designs that can use air‑cooled condensers. Brownfield nuclear sites with existing transmission into load pockets are scarce but valuable.

What to watch when evaluating candidates:

-

Licensing posture. Are the environmental reviews scoped to restart and expansion together. Are the hardest technical issues addressed in the first amendment wave.

-

Offtake mix. Does the site have at least two anchor buyers with different risk appetites. Can the contract stack handle a refueling outage without rate shock.

-

Fuel and supply chain. Are long‑lead items ordered ahead of the tight years. Is there a vendor alliance that can move experienced teams between restarts to preserve learning curves.

-

Community benefits. Are state and federal dollars tied to local training, low‑income energy programs, and tax‑base stability. These elements are not window dressing, they are the difference between political friction and momentum.

Concrete actions for owners, buyers, and policymakers

-

Owners. Pre‑file targeted technical amendments and make the steam generator or equivalent critical component the first mover. Structure capital to draw after accreditation and emergency exercise milestones, not before. Secure dual offtakes, one cooperative, one hyperscaler, to balance price stability and credit quality.

-

Buyers. In contracts, match outage design to data center or member needs. Demand a tax credit sharing clause and an expansion option for site‑add SMRs. Require transparent reporting on NRC schedule risk and long‑lead procurement status.

-

Policymakers. Keep loan guarantees predictable, not sporadic. Maintain clear guidance on how 45U, 45Y, and 48E apply to restarts and heavy retrofits. Align state economic development tools with multi‑unit campuses that blend restart and SMR construction, since that is where regional workforce ecosystems grow.

The real lesson of Palisades

America did not find a shortcut. It found a sequence. Palisades shows that a restart can move through the existing NRC framework, that federal credit can make patience affordable, and that technology‑neutral credits can turn a lonely comeback into a campus. If owners focus on the hardest components first, if buyers share risk through transparent contracts, and if regulators keep the rules steady, a handful of restarts and site‑add SMRs can change the shape of the grid by 2030. The first mover is no longer a headline. It is a blueprint.