EGS goes bankable: Cape Station’s 500 MW leap to 24/7

Fervo Energy’s Cape Station in Utah has pushed enhanced geothermal from pilot to bankable with major equipment awards, financing, and long-term PPAs. Here is the 2026-2028 commercialization roadmap and what it means for utilities and 24/7 buyers that need firm, clean capacity.

The moment EGS turns into a bankable product

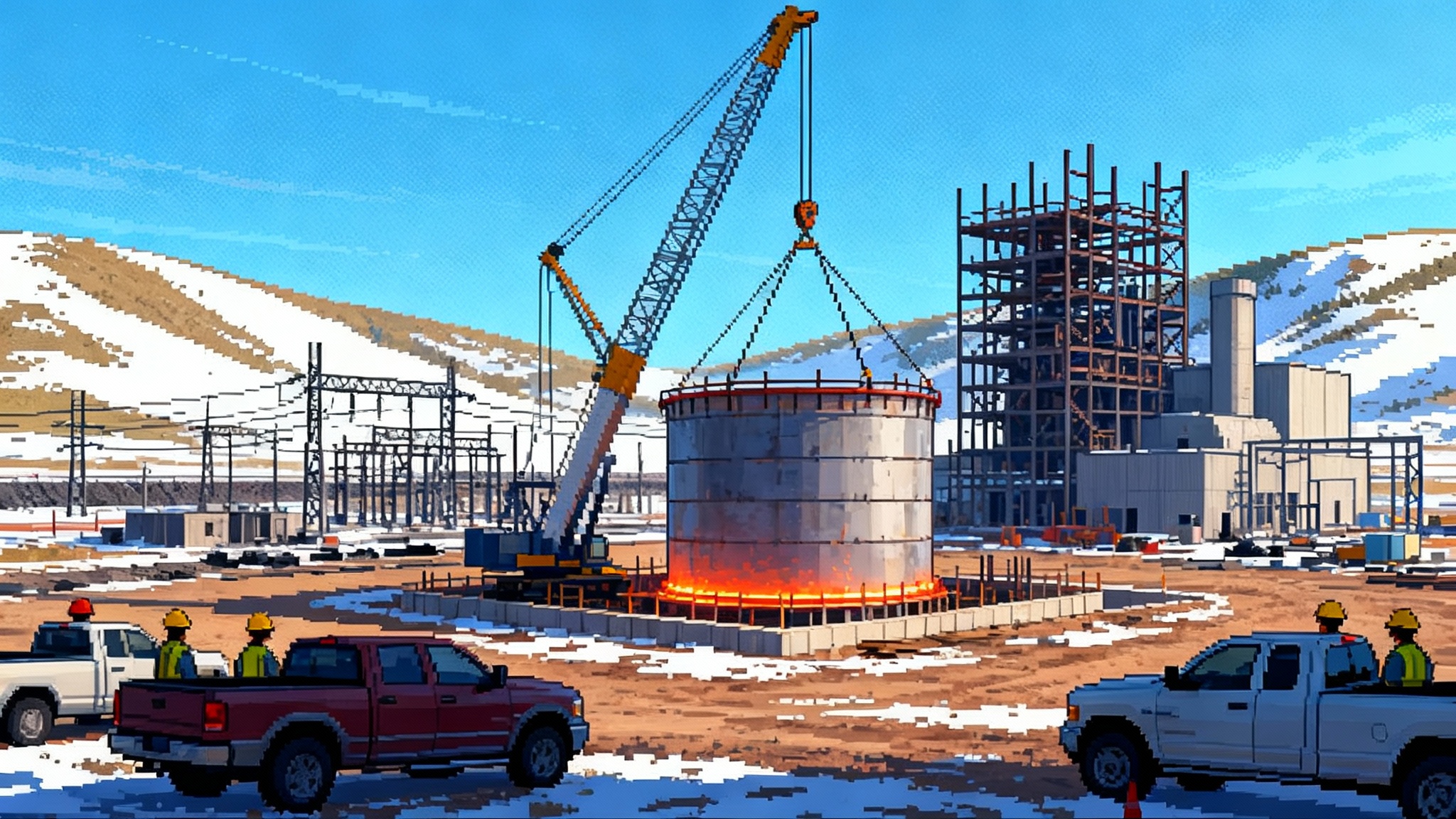

In the span of a few months, enhanced geothermal shifted from promising demos to real, financeable power plants. This fall, Fervo Energy locked in long-lead equipment for Cape Station in southwest Utah and gave lenders and buyers the one thing they wanted most: proof that delivery risk is shrinking. The headline moves were decisive. Fervo awarded major surface power packages for Phase II at Cape, including a five-unit Organic Rankine Cycle block expected to produce about 300 megawatts once complete, supplied by a blue-chip turbomachinery house with global manufacturing depth and grid track record. That award signals the supply chain is ready to scale, not just tinker. See the Baker Hughes contract announcement.

Cape Station is now scaled toward 500 megawatts across two phases. Phase I targets first power in 2026. Phase II extends through 2028. The project sits next to the Department of Energy’s Frontier Observatory for Research in Geothermal Energy and near the long-running Blundell geothermal plant, which means it benefits from a rare mix of data density, service vendors, and existing transmission.

From demos to debt and delivery

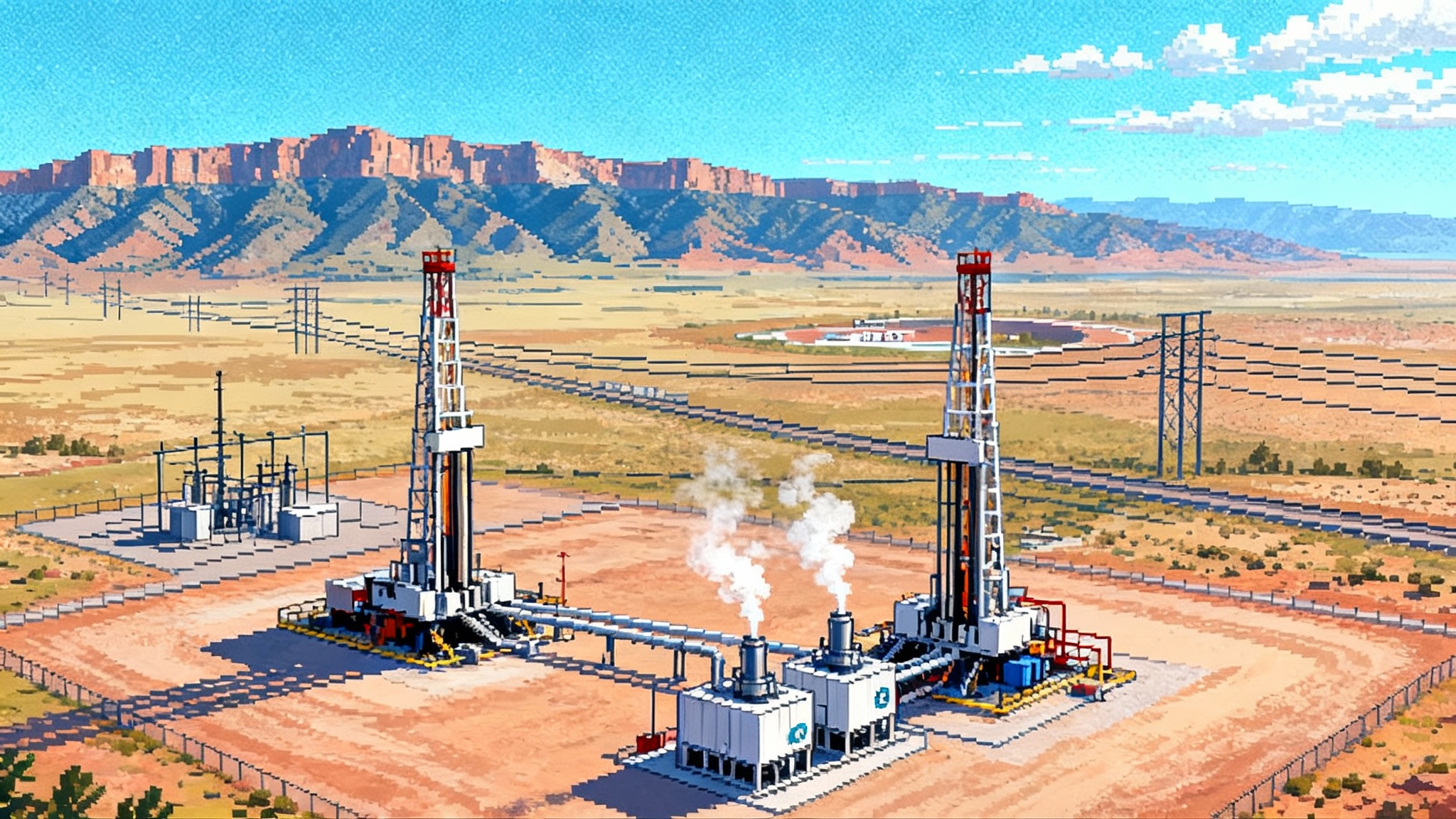

Two years ago, enhanced geothermal was still proving that oil and gas drilling know-how could reliably unlock hot rock. In 2023 Fervo’s Project Red in Nevada showed commercial delivery at small scale. In 2024 and 2025, Cape Station took that downhole learning and stacked it into a factory-like drilling program. The company reports that its fastest Cape well was completed in roughly three weeks, a large step change from early horizontal wells, with costs per horizontal well cut almost in half. Those gains came from concrete choices developers and drilling engineers will recognize: larger casing to improve flow, optimized well spacing guided by fiber optic sensing, repeatable multistage stimulation, and a playbook that treats each pad like a shift on a manufacturing line rather than a one-off science project.

On the commercial side, Cape Station’s offtake mix matured quickly. Southern California Edison signed for 320 megawatts across two contracts. Clean Power Alliance increased its take to 48 megawatts. Shell Energy North America agreed to buy 31 megawatts beginning in 2026. With these additions, Fervo has filled the initial 500 megawatt program at Cape, stacking 15-year agreements that clear a path for construction debt and vendor financing. The sequence also matters. Buyers moved after seeing drilling productivity data, then equipment vendors followed with firm awards, and financiers came in behind both with additional capital dedicated to Phase I and early Phase II works. In June 2025 Fervo announced a new 206 million dollar financing to accelerate Cape development, another sign that lenders now view enhanced geothermal as executable rather than experimental. That trend dovetails with evolving DOE 1706 loan programs, which are reshaping capital stacks across the grid.

This is what bankability looks like in practice. There are real purchase orders for turbines, expanders, and generators. There are interconnection pathways and a realistic critical path to commercial operation dates in 2026 and 2028. There are stepwise milestones to unlock funds. And there are counterparties on both sides with incentives to finish on time.

Why fall 2025 is different

-

Manufacturing-style drilling. Productivity gains now follow a learning curve rather than luck. Horizontal drilling and stimulation have become routine steps, not heroic one-offs. Fiber optics give engineers real-time visibility into fracture growth and reservoir response. Larger casing and improved completion designs lift flow per well, which also lifts megawatts per pad. The result is a path to lower levelized cost of energy without waiting for a moonshot technology.

-

Supply chain commitments from heavyweight vendors. The surface plant at Cape Station will rely on proven Organic Rankine Cycle modules. Multiple vendors have now committed capacity for Phase II, including three 60 megawatt units from a global leader in ORC technology and the five-unit Baker Hughes block. Those awards do not just add megawatts. They create schedule certainty, lock in pricing for long-lead items, and ensure availability of field service crews during commissioning windows. That is the difference between a plan and a power plant.

-

Siting near existing wires and data. Cape Station sits along a corridor with the Department of Energy FORGE site and the operating Blundell plant. That location shortens the distance from the wellhead to the substation and leverages a region already familiar with geothermal operations. The Milford area also hosts large wind projects tied into the Southern California power system, which underscores the presence of high-capacity transmission in the neighborhood. For a new firm resource, shaving years off interconnection timelines can be as valuable as shaving dollars off turbine prices.

The 2026-2028 commercialization roadmap

Enhanced geothermal will scale through a series of practical steps, most of which are already in motion at Cape Station and peer projects.

-

Drilling like shale, but for heat. The recipe is to go horizontal in hot crystalline rock, create controlled fracture networks, then produce hot water through one wellbore and return cooled water through another. The levers for year-over-year improvement are familiar to oilfield veterans: rate of penetration, bit life, nonproductive time reduction, lost circulation control, and faster, safer tripping practices. Expect operators to standardize pad designs, pipe tallies, and casing programs so that each successive well is as predictable as a batch in a factory. The payoff is fewer rigs for the same megawatts and rising output per well.

-

ORC modules on a cadence. Organic Rankine Cycle plants are modular by nature. Vendors can pre-assemble skid packages, pair expanders with the right working fluids, and repeat the installation sequence pad by pad. At Cape, Phase I modules are slated for 2026 delivery, followed by larger Gen 2 units across 2027 and 2028. As vendors localize manufacturing and field service in North America, lead times should compress and contingency buffers can shrink. The most important step in 2026 is to prove that each added ORC block comes on time and meets its guaranteed heat rate and availability. Once a developer demonstrates two or three on-time blocks, lenders will treat the rest like repeatable additions, not reinventions.

-

Build where the wires already are. The FORGE and Blundell corridor provides a template. It combines strong geothermal gradients with proven access roads, existing substations, and a regional workforce that knows how to drill, operate, and maintain high-temperature wells. Cape Station was sited to take advantage of this. Other developers will follow the same logic, hunting for heat first, but narrowing to places with short spur lines to bulk transmission. In the West, that often means working near legacy thermal plants or renewable hubs that already connect to California and other load centers.

-

Contract structures that match the product. Utilities want firm energy during evening peaks and early mornings when solar fades. Corporate buyers with 24/7 clean energy goals want high hourly matching and predictable delivery. The first wave of enhanced geothermal contracts reflect this. They are 24/7 supply agreements that treat the product as a capacity and energy hedge, not just a flat shaped block. Expect more contracts with shaped delivery, seasonal flexibility, and integration with storage. The developers that win in 2027 will be the ones that prove they can tailor dispatch within the limits of reservoir management and ORC turndown, while still offering a simple, financeable contract.

What it means for utilities

-

Replace some gas without losing reliability. Enhanced geothermal produces steady output with high availability. It can anchor portfolios that today lean heavily on solar and batteries. For load-serving entities facing clean firm procurement mandates, 100 megawatts of geothermal capacity is not the same as 100 megawatts of solar. It reduces variability and the volume of storage needed to cover long winter evenings. For complementary strategies, see how grid batteries as new peakers are changing resource planning.

-

Hedge against interconnection risk. Many utilities have gigawatts stuck in congested queues with uncertain network upgrades. Projects like Cape Station that tie into proven corridors reduce that risk. The practical advice for resource planners is to issue targeted requests for proposals that prioritize near-wire siting and require proof of deliverability studies rather than only generator interconnection queue position.

-

Use modular milestones to manage risk. Instead of buying a 400 megawatt block in one bite, structure procurements with stage gates tied to drilling, well testing, and ORC factory acceptance tests. Pay for performance as each module reaches commercial operation. That aligns utility and developer incentives and makes it easier to finance each tranche.

What it means for 24/7 corporate buyers

Corporate demand is exploding, especially from artificial intelligence data centers and cloud campuses. Buyers want hourly clean energy matching, not just annual credits. Geothermal fits because it delivers at night and in winter. The 2024 agreement among Google, NV Energy, and Fervo in Nevada showed how regulated markets can adapt through special tariffs and resource plans. For background on the utility side, see our guide to AI data center rate classes.

On contract terms, buyers should ask for options to increase volume as plants scale, plus clauses that allow for limited seasonal shaping. Developers, in return, will ask for take-or-pay structures and inflation indexing to protect capital recovery. Both sides should agree on transparent hourly carbon accounting so that the 24/7 claims withstand investor and regulator scrutiny.

Incentives are shifting, so structures must adapt

Beginning in 2025, the United States moved to technology-neutral production and investment tax credits under Sections 45Y and 48E of the tax code, which explicitly include geothermal as a zero-emissions resource. Final rules released in January 2025 clarified qualification and offered long-term visibility, subject to eventual phase downs tied to national emissions milestones. That clarity is one reason enhanced geothermal developers and their lenders grew more confident in 2025. See Treasury's final 45Y/48E rules.

At the same time, policy debates in Washington have created uncertainty about the duration and transferability of some credits. Utilities and buyers should plan for both scenarios. If transferability remains available, projects can raise cash by selling the credits and pair that with construction debt. If Congress curtails credits for projects that start after a certain date, developers will need to place more emphasis on long-term offtake, higher capacity factors, and vendor terms that push cost certainty forward. Either way, the strategy is the same: move projects with near-term commercial operation dates to financial close quickly, then sequence later phases to fit whatever credit landscape emerges.

The operating playbook utilities should expect to see

- Capacity factors in the 80 to 95 percent range when reservoirs are managed conservatively and downtime is planned during shoulder seasons.

- Turndown capability at the ORC plant that allows modest load following without cycling the reservoir. Expect 50 to 100 percent turndown on the expander side, with best performance when changes are scheduled rather than abrupt.

- Water management plans that minimize freshwater use, including nonpotable sourcing and closed-loop operations to limit losses. In the Milford area, experiments at FORGE demonstrated how to manage stimulation and circulation in hot dry granite while tracking seismicity and flow.

- A maintenance rhythm that looks more like a combined-cycle plant than a wind farm. There will be outages for turbine overhauls, pump replacements, and instrumentation recalibration, all of which can be scheduled to avoid peak seasons.

Risks to price and schedule, and how to manage them

-

Subsurface variability. Even with fiber optics and offset data, hot rock can surprise. The mitigation is over-provisioning of wells during early phases, so that a weaker producer does not jeopardize a commercial operation date. Developers should carry spares in the well plan, then roll extras into the next pad if not needed.

-

Long-lead components. Expanders, generators, and heat exchangers control the schedule once drilling is under way. The fall awards at Cape Station reduce that risk by reserving factory slots. Utilities should ask to see vendor letters, production schedules, and shipping plans, not just glossy equipment names.

-

Interconnection upgrades. Even near existing wires, protection settings, relay upgrades, and transformer replacements can cause delays. Developers should start utility engineering reviews early and offer to fund owner’s engineer support to move studies faster.

-

Policy timing. If federal credit rules tighten, late-stage projects may lose some value. The hedge is to lock in offtake with price adjusters that share upside and downside relative to defined policy changes, and to keep a tax credit sale strategy ready so that a project can monetize credits as soon as it qualifies.

What to watch in the next 12 months

- Phase I commissioning milestones at Cape Station. On-time delivery, heat rate, and availability tests will set the template for the remaining modules and for copycat projects.

- Additional vendor localization. Expect announcements about North American assembly capacity for ORC skids and turboexpanders, which shortens logistics and improves service response.

- Replication beyond Utah and Nevada. The next wave will target heat near wires in other Western states and potentially in the Gulf region where oilfield services and transmission corridors overlap.

- New 24/7 contracts that combine geothermal, long-duration storage, and shaped delivery. Buyers will start to price the value of overnight clean energy explicitly, which should pull more enhanced geothermal into resource plans.

The bottom line

Enhanced geothermal moved into the bankable column in 2025 because it started to look like a product line rather than a prototype. Drilling followed a learning curve. Vendors took real orders and committed factory time. The best sites plugged into wires that already exist. Utilities and corporate buyers signed contracts built around reliability, not just annual megawatt-hours. The payoff is simple. By 2026, the first 100 megawatts at Cape Station will give planners and data center operators a new lever. By 2028, expanded blocks will push geothermal toward the front of the clean firm pack. When clean energy needs to be there at 2 a.m. in February as well as at noon in May, the grid needs heat it can schedule. In 2025, enhanced geothermal finally showed it can deliver that heat on time and at scale.