Cheap DOE 1706 Loans Are Rewiring the American Grid

Cheap federal credit under Section 1706 has kicked off a utility debt supercycle that lowers bills, hardens reliability, and moves power through existing corridors faster. Here is how the window through September 30, 2026 is reshaping what gets built first.

The quiet breakthrough behind a noisy year

A few milestones from 2025 tell a bigger story about the power system you depend on daily. On January 17 the United States Department of Energy closed a $15 billion loan guarantee to PG&E under Section 1706 of the Energy Policy Act, the Energy Infrastructure Reinvestment authority created by the Inflation Reduction Act. One day earlier the Loan Programs Office previewed the scale of this new financing channel, announcing a bundle of conditional commitments totaling $22.92 billion to regulated utilities in a dozen states. That tranche included PacifiCorp, DTE Energy’s electric and gas subsidiaries, Consumers Energy, and Alliant’s utilities in Iowa and Wisconsin, among others. The plan is simple and radical at once: use cheap federal debt, routed through a flexible facility sized for utility portfolios, to lower the cost of modernizing the grid.

Then came July. The administration pulled back support for the Grain Belt Express transmission line, terminating an expected multibillion dollar federal loan guarantee. The message might have seemed contradictory. It was not. Section 1706 is still open for business, but it will favor shovel ready portfolios that cut bills, harden reliability, and reduce emissions risk, especially when those projects sit mostly inside existing corridors and can move within the 2025 to 2026 window.

This is the utility debt supercycle. It is not about piling on risky leverage. It is about swapping expensive capital for cheaper capital to rebuild the same essential network faster.

What Section 1706 really does

Section 1706 is a specialized lane in the Department of Energy’s Title 17 program for reinvesting in energy infrastructure. In plain terms, it lets the federal government guarantee low cost loans for projects that retool, repower, repurpose, or replace existing energy infrastructure, plus upgrades that help operating infrastructure avoid or cut air pollution and greenhouse gases. Regulators then require the borrowing utility to pass the interest savings on to customers.

The structure matters. Instead of financing one megaproject at a time, the Loan Programs Office created a facility sized to a utility’s capital plan. That lets the borrower bring in diverse projects on a rolling basis, provided at least one anchor project clears environmental review and eligibility up front. The utility can then draw as it builds, which fits the way real grid work happens.

Why cheap federal debt changes the build list

If you are a utility chief financial officer, you care about two things when you plan upgrades. Can I recover the costs in rates, and what is my cost of capital while I build. Section 1706 tilts the second question in your favor.

Consider a simplified example. A utility expects to spend 5 billion dollars on reconductoring, transformers, hydropower upgrades, and virtual power plants over the next five years. Replacing 150 basis points of borrowing cost with federal pricing reduces interest expense by roughly 75 million dollars per year during the peak construction period. In a service territory with 2 million customers, that is about 37 dollars per customer per year in avoided carrying cost before taxes and other adjustments. Scale the portfolio to 10 or 15 billion dollars and the savings compound. Those dollars are the difference between a rate case that holds steady and one that pushes bills higher while the utility races to meet surging demand from data centers and electrification.

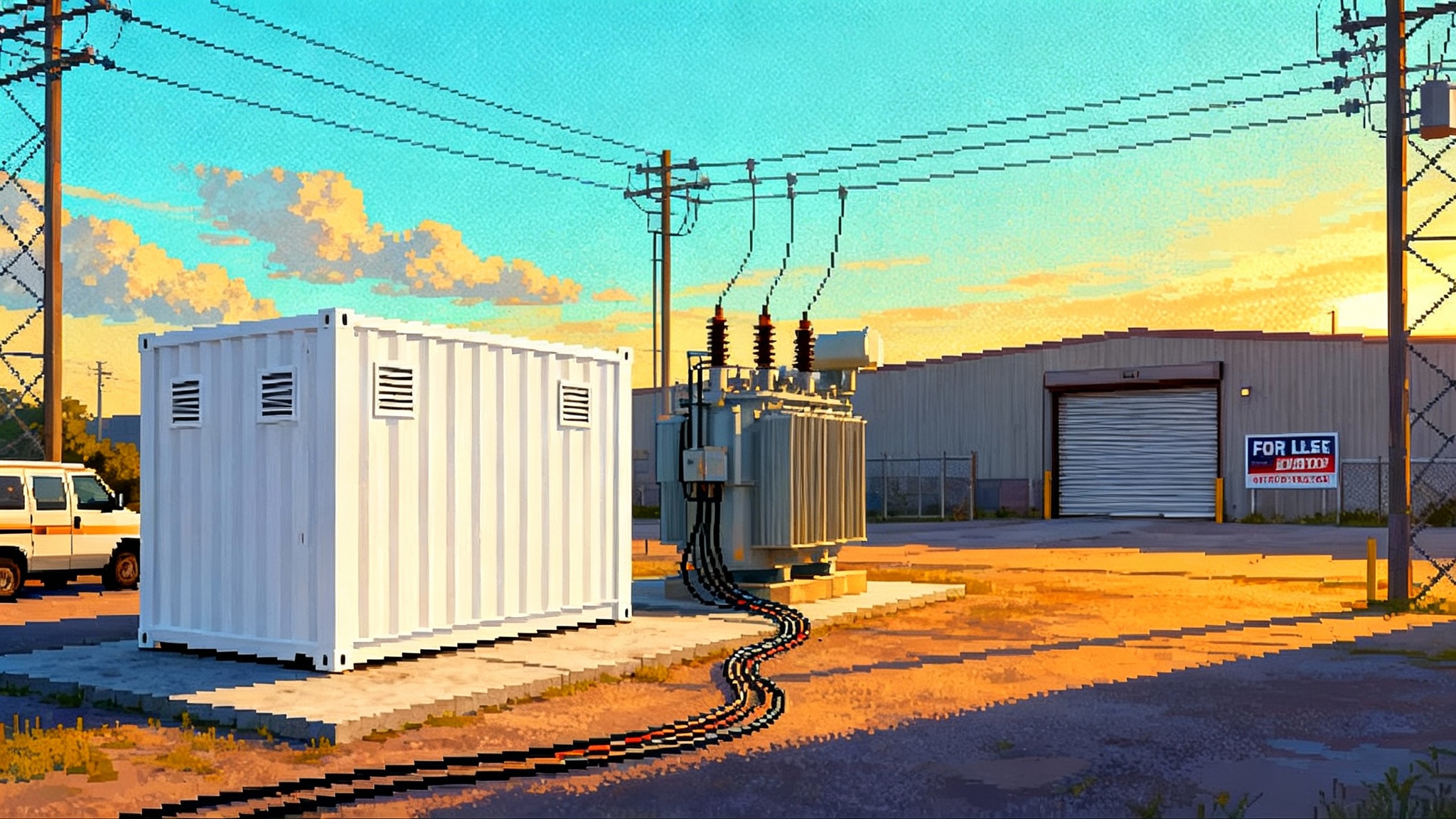

Cheaper debt changes which projects pencil out first. It favors portfolios that are fast to permit and install, that relieve thermal bottlenecks where lines already exist, and that deliver measurable reliability and affordability benefits. Four buckets stand out in 2025.

The new first movers: four buckets of 1706 projects

- Reconductoring and advanced conductors

Utilities can replace century old aluminum steel reinforced wire with modern high temperature low sag conductors that carry far more current over the same towers. The labor is familiar, the right of way is already there, and the gain in transfer capacity is immediate. In some cases utilities can double throughput on congested corridors without a new line or a new tower. That is the fastest way to move more wind and solar output and to serve fast growing loads.

- Grid enhancing technologies you can install by the next peak

Dynamic line ratings use sensors and weather data to safely increase the capacity of existing lines when conditions allow. Topology optimization software reroutes flows around congestion. Smart power flow controllers push power where the network can handle it. These technologies do not require long permitting fights. Under a 1706 facility they can be ordered in batches and installed as part of a systemwide upgrade program.

- Hydropower modernization for flexible capacity

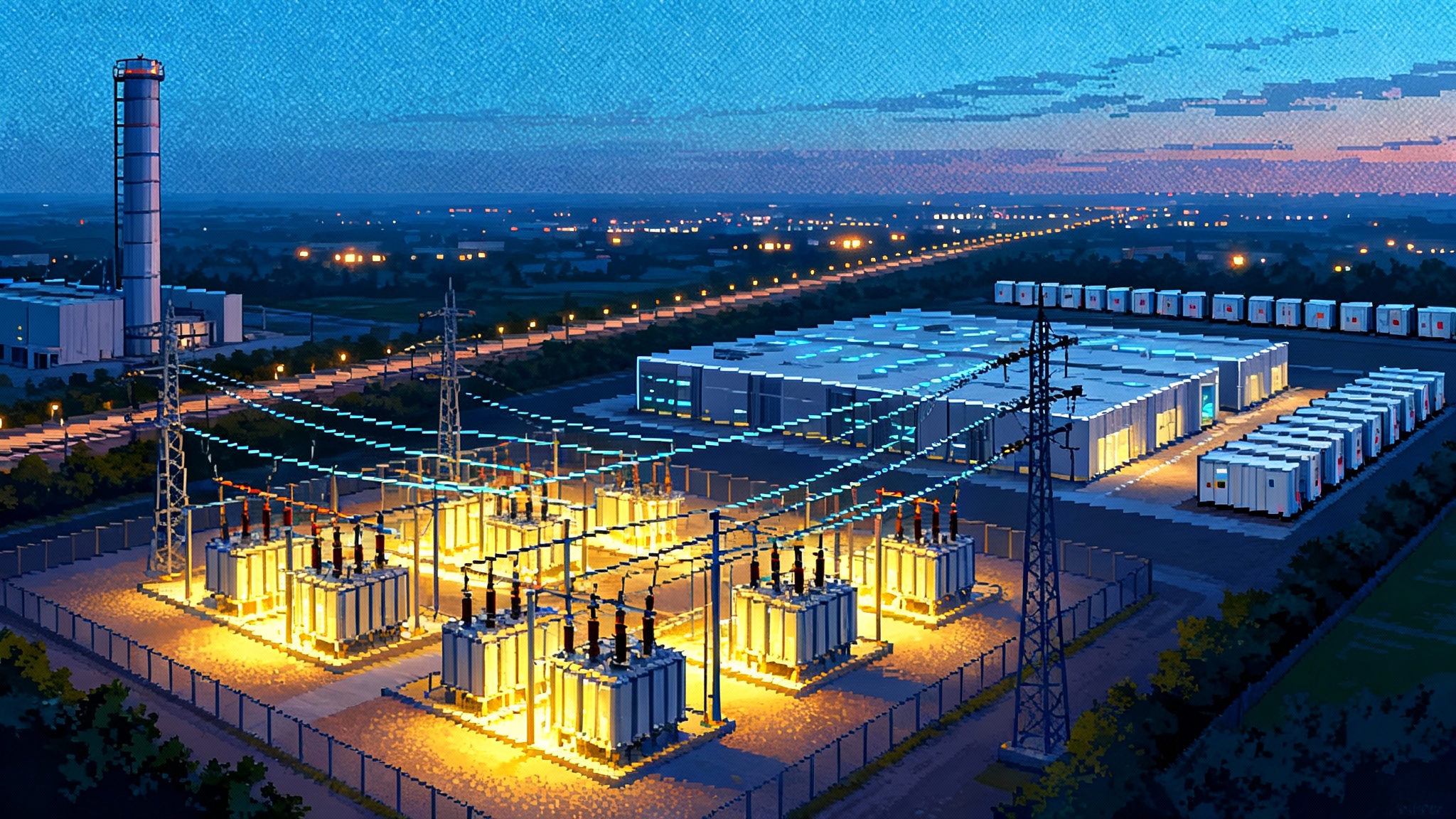

Replacing runners, rewinding generators, and upgrading controls at existing dams raises output and improves flexibility. That flexibility is priceless in the late afternoon when solar fades and demand spikes. In the PG&E portfolio, hydropower upgrades are paired with batteries to firm the system through the evening ramp, a dynamic explored in grid batteries become America’s new peaker. For the longer view on storage at dams, see our look at GW-scale hydro storage on the grid map.

- Virtual power plants as a distribution resource

Virtual power plants aggregate thousands of devices like home batteries, smart thermostats, commercial refrigeration controls, and electric vehicle chargers. With the right tariffs and control software, those devices can respond in minutes to shave peaks or fill valleys. Under 1706, utilities can treat these portfolios as regulated upgrades that substitute for or defer traditional capacity expansions.

2025 milestones that turned this from theory to practice

Two announcements brought the approach from fine print to reality. The Department of Energy closed the PG&E facility on January 17, 2025, and the Loan Programs Office outlined a utilities focused wave on January 16 totaling nearly 23 billion dollars across 12 states. You can read the program’s own summary of that multistate batch in the LPO conditional commitments overview, which lays out the borrowers, states, and project types, and explains how customer savings must be passed through when the debt is cheaper than the market.

In July the administration canceled support for the Grain Belt Express loan guarantee. That was a setback for one long haul project and a reminder that single line greenfield corridors remain politically difficult. It did not change the basic math for reconductoring, hydropower upgrades, grid enhancing technologies, or virtual power plants that live inside existing rights of way.

Rates and reliability: what customers will feel first

Customers do not experience the grid as an abstract network. They feel it as a monthly bill and as the lights staying on when a storm hits or when a heat dome sits over a region for days.

-

Bill pressure: Federal guarantees cut carrying costs during construction and early operation, which reduces the revenue requirement utilities must recover in rates. Regulators can require explicit bill credits tied to the difference between federal pricing and what the utility would have paid in the bond market. That makes it possible to invest heavily while softening near term bill increases.

-

Fewer outages and faster restorations: Reconductoring reduces thermal overloads that trigger protective trips, and it enables greater backfeed options for crews during restoration. Hydropower upgrades add flexible megawatts that help utilities ride through net load ramps. Grid enhancing technologies reduce congestion that otherwise forces curtailments or leaves pockets of the system exposed.

-

Less wildfire and extreme weather risk: Undergrounding remains expensive, but targeted sections combined with covered conductor, sectionalizing, and fast isolation yield outsized risk reduction in fire prone corridors. Hydropower and battery upgrades keep more of the system online when transmission corridors are constrained by weather.

The data center surge and what 1706 can solve right now

Large data centers are queuing by the dozens near cheap power and ready fiber. They want multi hundred megawatt interconnections on short timelines. The fundamental constraint is not generation alone, it is the thermal and protection limits of the network between where power is and where the load wants to be.

This is where the 1706 facility becomes a scheduling tool. Reconductor the nearest 230 kilovolt line instead of waiting for a new corridor. Add dynamic line ratings and topology optimization to push power around local bottlenecks. Require each new campus to enroll in a utility administered virtual power plant tariff that shapes demand with on site batteries and flexible computing loads. For rate design and interconnection strategy, see the utility playbook for AI data centers. Use hydropower upgrades and short duration batteries to cover the afternoon and evening ramps until larger transmission projects clear. The effect is to turn five year problems into two year solutions.

Policy turbulence without paralysis

The Grain Belt decision shows that megaprojects that cross multiple states can swing with politics, landowner opposition, or shifting cost allocations. The takeaway for utilities and state commissions is not to wait. Section 1706 is sized to help you build what is already in your franchise and what your state can approve quickly.

Two facts define the window. First, the Department of Energy designed the utility facility so borrowers can add projects over time once the anchor package is cleared, which reduces front end paperwork for every subsequent work order. Second, the Energy Infrastructure Reinvestment authority remains available for commitments only through September 30, 2026, based on current guidance. That is close in utility time. If you plan to draw in 2027 and 2028, you likely need to secure the commitment by mid 2026.

A 2025 to 2026 playbook for states and utilities

Here is a concrete checklist to capture the debt supercycle while the window is open.

-

Pick an anchor you can build in 2026. Good anchors are multi asset packages with clear environmental reviews, like a hydropower upgrade paired with reconductoring on two congested corridors. If the anchor is clean, the rest of the facility can fund dozens of smaller projects on a rolling basis.

-

File an integrated affordability plan with your application. Show your commission in writing how the interest savings will appear on bills. Propose a bill credit line that equals the difference between federal and market interest costs for the facility during construction years.

-

Stand up a grid enhancing technologies factory model. Pre qualify vendors for dynamic line ratings, power flow controllers, topology optimization, and advanced relays. Issue task orders every quarter. Treat GETs like software upgrades rather than one offs.

-

Pre approve advanced conductor standards. Adopt a specification for high temperature low sag conductors across multiple voltage classes. This avoids project by project debates and lets procurement aggregate demand to lock in price and delivery slots.

-

Create a virtual power plant tariff that dispatches and pays like a plant. Define baseline, response time, event windows, and performance penalties. Enroll large new loads, municipal aggregators, and retail programs under the same rules so the portfolio scales fast.

-

Use distribution hosting capacity maps and queue rules to triage data center requests. Offer a fast lane that requires locating near reconductoring corridors, co funding onsite batteries, and accepting scheduled load shaping in exchange for a guaranteed interconnection date.

-

Pair 1706 with securitization for retirements. If you are closing an old plant, securitize the remaining book value with low cost bonds while you finance the replacement portfolio under 1706. That keeps rates flat while you change the asset mix.

-

Align fuel clause and capacity market filings with the facility timeline. If you are in a capacity market region, set your bid strategy based on the flexible megawatts from hydropower upgrades and virtual power plants, not just new peakers.

-

Build the workforce pipeline now. Tie your application to community college programs and union apprenticeship pathways. The fastest projects will stall if you do not have enough qualified lineworkers, relay technicians, and hydro electricians.

-

Pre negotiate intercreditor terms. Many utilities already have first mortgage indentures and pollution control bonds. Work with your treasurer and external counsel so the 1706 facility slots in cleanly without last minute lien surprises.

-

Use your commission’s existing cost recovery tools. Capital trackers for transmission and distribution, forward looking test years, and multi year rate plans all help you bring 1706 savings to customers in real time instead of waiting for a full rate case.

What this means for investors and developers

For independent power producers, the signal is to site near the existing network and to collaborate on reconductoring plans that unlock deliverability. For data center developers, the cheapest path to a firm interconnection is to bring demand flexibility and onsite storage into your request from day one. For manufacturers, advanced conductors, sensors, power electronics, and hydropower components will see steady orders through 2026 with buyers that care about schedule certainty even more than a few percentage points of price.

The two numbers to memorize in 2025

-

15 billion dollars. That was the size of the PG&E facility that proved the utility model is bankable at scale under Section 1706.

-

22.92 billion dollars. That was the near term wave of conditional commitments that showed a multi state portfolio approach is live across the country.

Everything else flows from those precedents. The July pullback on a single long corridor did not change them.

The window will not stay wide forever

Elected leaders can change priorities. Federal credit subsidy is finite. Supply chains for conductors, transformers, and high voltage equipment are tight. The Department of Energy’s own guidance says the Energy Infrastructure Reinvestment authority remains available for commitment through September 30, 2026, which is tomorrow in utility time. If you want to run a 2027 to 2028 build program on cheaper debt, you need to secure your commitment in 2025 or early 2026 and lock in procurement capacity now.

The bottom line

America is in a utility debt supercycle, but it is a healthy one. The Department of Energy is replacing expensive private capital with cheaper public credit to bring forward the grid we already know we need. The result is not a shiny megaproject you can see from the interstate. It is a thousand concrete upgrades that push more power through existing lines, turn hydropower into a more flexible partner, and make the demand side act like supply when you need it.

States and utilities that move first will get the savings, the reliability, and the headroom to serve surging loads from data centers and electrification. Those that wait will find the window narrower, the parts harder to buy, and the projects more expensive to finance. The strategy is straightforward. Choose an anchor you can build, put real bill credits in your filing, stand up a factory for grid upgrades, and use virtual power plants as standard equipment. If you do that in 2025, you will be rebuilding the grid at the speed and price customers deserve, while the cheap debt window is still open.