Summer 2025: Grid Batteries Become America’s New Peaker

Q2-Q3 2025 rewrote the peaker playbook. Batteries covered record evening peaks in California and Texas, set prices in critical intervals, and moved beyond pure arbitrage. Here is how longer durations, hybrids, and better rules can unlock the next 50 gigawatts.

The summer the peaker model flipped

For decades, the peaker was a gas turbine waiting for a few hot hours to earn its keep. In the summer of 2025, the job description changed. Grid-scale batteries showed up in the tightest evening hours, repeatedly and at scale, and the market behaved differently as a result. Developers describe those days like a relay race: solar hands off to storage, storage carries the baton through the evening ramp, and the night shift of wind and thermal generation picks it up later.

By late June, the installer scoreboard told the same story. The United States set a new quarterly record for storage build in the second quarter, with utility-scale batteries driving the surge. California Independent System Operator and the Electric Reliability Council of Texas then turned those megawatts into dependable evening capacity across July and August. On June 19, batteries supplied roughly a quarter of California’s evening peak, overtaking gas for those hours, a moment captured in live operations data and national reporting. See the figures in this account of how batteries supplied 26% of evening peak.

Texas offered its own proof. In mid-July, storage injected more than six gigawatts during the evening ramp, covering close to a tenth of demand at that instant. One concise write-up noted that storage output hit 6,309 MW while several coal units were offline, a very 2025 story about what is actually firm when the sun is low and the air conditioners are not.

From arbitrage to reliability and price-setting

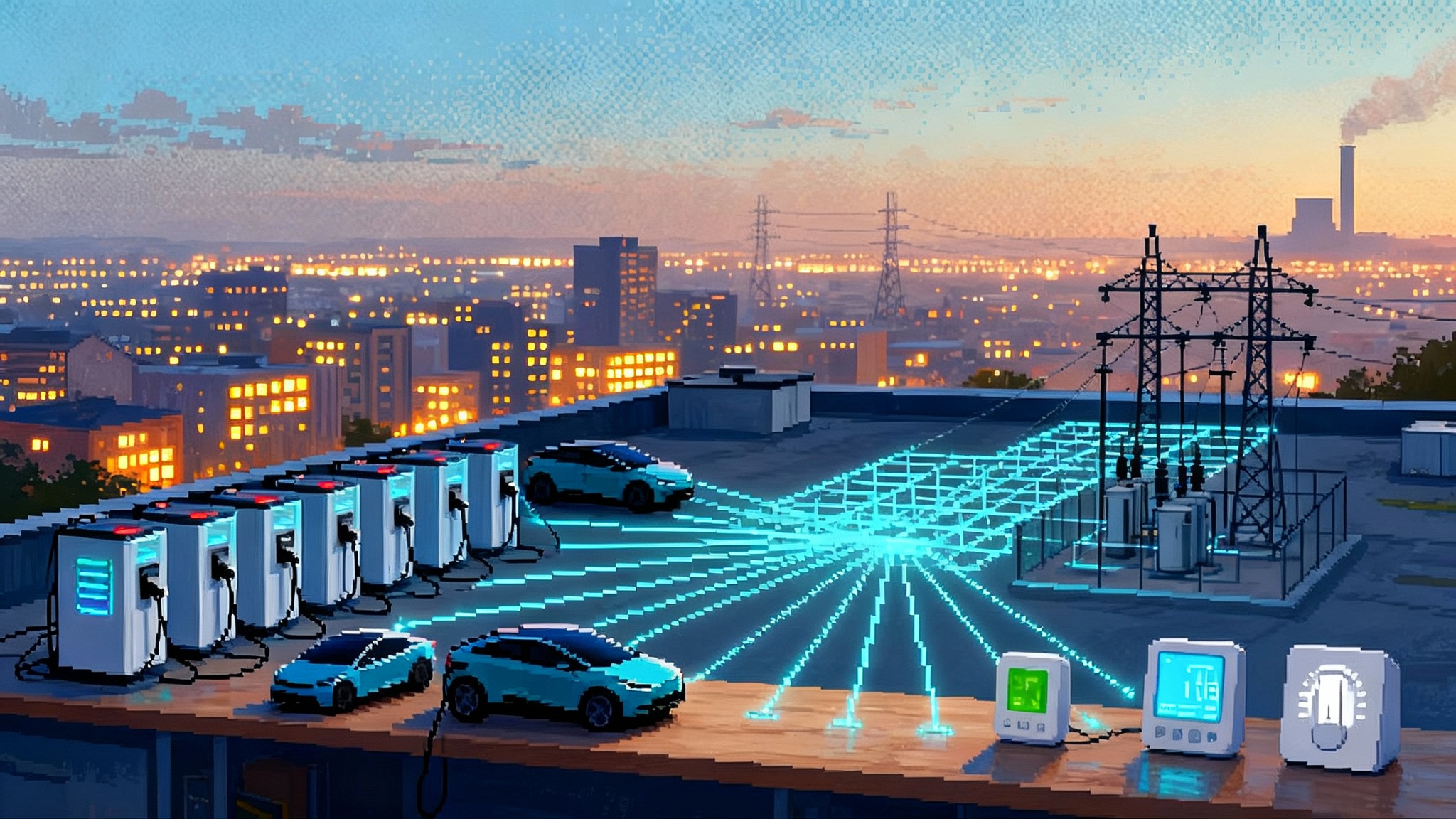

For years, the elevator pitch for grid batteries was simple arbitrage: charge at noon when power is cheap, discharge at 7 p.m. when it is not. That song is still on the playlist, but the summer showed a broader role with concrete effects on reliability and price formation.

What changed in practice

- Coverage of the net-peak hours became systematic. In both California and Texas, four-hour batteries formed a dependable block from roughly 5 p.m. to 9 p.m., shaving the steepest ramps. That predictable block reduced the frequency and severity of scarcity adders in many evenings and lowered the odds of emergency alerts.

- Batteries began to set prices in key intervals. When a large fleet is at the margin, the offer prices from batteries determine the clearing price. You could see that in real-time intervals where batteries were the swing resource, particularly in Texas on hot, low-wind evenings and in California on high-solar days with tight ramps.

- Portfolio behavior changed. Thermal fleets leaned on batteries to reduce start-stop cycling of older peakers, and renewables owners used batteries to firm and shape deliveries into contracted hours. The net effect was fewer awkward price spikes and more hours where the market cleared at levels consistent with marginal costs rather than panic premiums.

A useful metaphor is traffic control at a busy intersection. Arbitrage is the green light during predictable times. Reliability is when the police officer steps in during an unexpected jam. This summer, batteries did both. They smoothed the routine flow and they showed up when a lane was blocked or demand surged.

Longer duration and hybrids change the math

The step-change is not only about megawatts. It is also about hours and integration.

- Duration: The market premium is shifting from two-hour assets toward four, six, and even eight hours, because the most valuable risk to cover is no longer a single price spike, but multi-hour tightness after sunset and, in some regions, morning ramps in winter. Effective Load Carrying Capability studies in both California and Texas reward longer discharge windows. Developers now model six-hour units as the default for the late-evening shoulder and see eight-hour options as insurance against longer ramps, contingency events, and shoulder-season volatility.

- Hybrid power purchase agreements: Solar-plus-storage hybrids and wind-plus-storage hybrids let owners charge behind the meter at an effective zero marginal cost. That shields the battery from high midday wholesale prices and improves round-trip margins. Hybrids also unlock new contracting forms: shaped energy deliveries that match a customer’s 5 p.m. to 10 p.m. need, minimum guaranteed availability blocks, and tolling structures where the offtaker dispatches the battery within defined guardrails.

- Merchant plus contracted blends: Many 2025 deals split a battery’s capacity between contracted evening blocks and merchant exposure in the real-time market. This lowers financing costs without giving up upside during unexpected scarcity hours.

If 2021-2023 was a race to add any battery, 2025-2027 is a shift to add the right hours.

Where the next 50 gigawatts will land

An honest map of the next wave is not a red-blue political map or a wind-solar resource map. It is a congestion and load-growth map. Three regions stand out for near-term, large-scale additions.

Arizona

- Why it wins: Enormous afternoon solar, a sharp evening ramp, and a growing data center footprint around Phoenix. Utilities such as Arizona Public Service and Salt River Project have lined up multi-year procurement blocks that favor four to six hours of storage. Developers are also stacking storage with new solar in the Palo Verde area to ride firm interties and deliver evening blocks into both local load and exports. Expect new data center rate classes to shape procurement and siting.

- What to watch: Transmission backbones west of Phoenix and interties into California and Nevada. Siting near 230 kV and 500 kV nodes with headroom is the difference between smooth revenues and being trapped by curtailment.

Nevada

- Why it wins: Rapid load growth around Las Vegas, large co-located solar-storage projects in the south of the state, and a utility planning cycle that now treats storage as a default peaking resource. Several recent projects paired 200 to 300 megawatt batteries with new solar, creating shapeable evening products that reduce the need for new gas peakers.

- What to watch: The West of Colorado River transfer limits, Palo Verde import constraints on hot evenings, and whether utility requests for proposals continue to prioritize six-hour blocks.

PJM Interconnection

- Why it wins: Winter reliability pressure after recent cold snaps, plus a swelling pipeline of flexible load such as data centers in Virginia, Ohio, and Pennsylvania. PJM’s capacity accreditation regime now values duration more explicitly, which opens a clearer path for four to eight-hour storage to clear capacity auctions and sign long-term capacity contracts. Storage placed near load pockets and winter-peaking zones can monetize both capacity and energy spreads. See how data center rate classes are reshaping load growth and tariffs.

- What to watch: Queue reform timelines at transmission owners, transformer lead times for 230 kV and 500 kV substations, and winter morning ramps when batteries can offset gas deliverability constraints. Queue reforms will accelerate as the interconnection fast-track arrives.

A second tier of opportunity includes New Mexico and Colorado in the West, Florida and Georgia among vertically integrated utilities, and New York for distribution-level and peaker-replacement programs. But Arizona, Nevada, and PJM are where developers can deploy multi-gigawatt portfolios on practical timelines.

The chokepoints we must solve

Nodal congestion

- Texas: West-to-load center congestion in the late afternoon is the defining pattern. Batteries in the West zone can struggle to discharge into Houston, Dallas, or the coast when wind is light and load is high. The result is low local prices and clipped spreads. Developers should prioritize interconnection near Houston and San Antonio import paths and pair with solar where congestion relief is strongest.

- California: Constraints at West of Colorado River and along key north-south paths limit how much solar and storage can serve coastal load in the evening. Projects clustered in Imperial Valley can be trapped unless interties open up or local load grows.

Interties and imports

- The Southwest relies on Palo Verde and other interties to balance evening conditions. On the tightest days, those paths are saturated. Batteries south and west of Phoenix with firm access can capture premium prices. Those without are price-takers.

- California’s ability to import evening power from neighbors is not guaranteed on regional heat days. In those hours, in-state storage is the margin of safety.

Market rules and products

- California’s resource adequacy counting and flexible ramping products now value multi-hour capability more explicitly, but alignment with evening and winter needs still evolves each year. Clearer capacity credits for six and eight-hour assets would accelerate financing at lower costs.

- Texas has layered new reliability services on top of energy and reserves. Products that compensate sustained four-hour delivery during tight periods strengthen the storage business case. However, oversupply in some ancillary services and erratic procurement volumes can whipsaw revenues and complicate merchant financing.

- Operational discipline is improving after new IBR ride-through rules, which support stability when inverter-based resources dominate.

Supply chain and equipment

- Long lead times for large power transformers and high voltage switchgear can turn a 24-month project into a 36-month project. Developers that secure transformer slots early, standardize on proven inverter-battery stacks, and plan for augmentation will outpace peers.

The acceleration playbook for 2026-2030

To scale four to eight-hour storage and put long-duration technologies on a bankable path, the industry needs a clear, concrete playbook. Here is the one teams are already using or should adopt now.

For developers

- Site for spreads you can actually reach. Favor substations and nodes with proven evening price formation and headroom into load centers. Do not chase the single highest historical price. Optimize for hours you can capture often.

- Move to six-hour as the new default where evening ramps are long and winter risk matters. Use four-hour only where interconnection or capital is tight and merchant upside is strong.

- Co-locate when it protects the charge cost. A solar-plus-storage project that charges behind the meter at zero marginal cost keeps your midday intake predictable even when wholesale prices rise.

- Structure hybrid PPAs around availability blocks and shaped deliveries. Begin with 5 p.m. to 10 p.m. blocks, with performance guarantees and a small merchant sleeve for scarcity hours. Include augmentation rights and partial-operation clauses so the project can start earning early.

- Lock transformer and high voltage gear by notice-to-proceed, not after. Treat those items as the critical path, equal to interconnection agreements.

For utilities and regulators

- Procure in multi-hour blocks that match the net-peak problem. Standard products at four and six hours reduce contract friction and lower prices.

- Credit duration accurately. Capacity accreditation should scale with sustained delivery, especially in winter-peaking systems. That channels capital to the assets that solve the problem.

- Make room for hybrids. Allow direct-charge accounting in settlements so owners are not penalized for behind-the-meter charging. Clarify how hybrids qualify for resource adequacy and reserves to remove ambiguity premium from financing.

- Target intertie upgrades where one more gigawatt unlocks many more. A focused set of reinforcements into Phoenix, Las Vegas, and Southern California load pockets would increase the value of every battery already built in the desert Southwest.

- Add a reliability product that pays for sustained energy. A transparent, technology-neutral product for four to eight-hour delivery during operator-defined tight periods will attract long-duration proposals and lower merchant risk.

For investors and lenders

- Prefer portfolios over single assets. A spread of locations across a congestion footprint smooths revenue and improves debt capacity.

- Underwrite on realized spreads and product revenues, not just backcast scarcity hours. The 2025 lesson is that batteries reduce the tail risk and earn steady mid-evening dollars.

- Value augmentation and control software. Batteries are becoming software-defined power plants. Upgradable controls that capture day-ahead premiums and avoid nodal traps are worth real money.

For long-duration storage providers

- Aim where eight hours matters first. California winter mornings, desert Southwest shoulder seasons, and PJM winter peaks are early bankable niches.

- Sell on system cost avoided. Show how a 10 to 12-hour asset defers a local gas unit, a transmission upgrade, or both, and reflect that in tolling fees over 10 to 20 years.

- Prove operations on a real node. A 50 to 100 megawatt demonstration that clears capacity, delivers contracted blocks, and follows dispatch every day will shrink the financing spread faster than a thousand white papers.

Price formation, with examples you can feel

Consider a hot Tuesday in July in Texas. At 6:45 p.m., load holds steady but wind stays soft. If batteries are at the margin, their offers shape the clearing price. When a fleet of four to six-hour systems bids a smooth block, the evening stack resembles a staircase instead of a cliff. The price signal tells fast-start gas to cover later hours, not to spike now, and it tells an industrial load to curtail early. That is the market doing rational things because the resource stack allows it.

Now consider California on a high-solar Saturday. Midday prices are higher than last year because batteries are charging and adding demand, and imports are limited. Solar-plus-storage projects that charge behind the meter are insulated from that cost and still deliver the evening block at a profit. Standalone batteries feel the pinch at noon but earn it back with price-setting hours at 8 p.m. The point is not that arbitrage is dead, but that it now lives inside a broader reliability role.

Companies shaping the curve

- NextEra Energy Resources and Vistra are scaling multi-hour fleets that bid across both day-ahead and real-time markets.

- Plus Power’s large Texas sites and ENGIE’s new Arizona and Texas projects show how siting near load and co-locating with solar protects spreads.

- AES, Recurrent Energy, and Arevon are leaning into hybrid contracting to deliver evening blocks with clear performance terms.

- Fluence and Tesla are standardizing controls and augmentation playbooks so fleets can tune offers and maintain nameplate capacity over the life of the project.

These firms are not waiting for perfect rules. They are designing around them, which is why the summer looked the way it did.

What this means for 2026-2030

If the second quarter of 2025 was the step-function in capacity and the third quarter was the field test, the next five years will be about stitching storage into the everyday fabric of system planning.

- Expect the United States fleet to tilt toward six-hour systems in evening-peaking markets, with eight-hour pilots in winter-peaking regions that graduate into standard products.

- Expect hybrid PPAs to become boring in the best way, with standard shapes, availability metrics, and penalties that match the service provided.

- Expect merchant revenues to lean more on day-ahead premiums and less on surprise scarcity, because a larger battery fleet prevents the worst spikes in the first place.

- Expect transmission reinforcements to decide which projects actually print cash. A battery behind a constraint is an insurance policy for the wrong neighborhood.

The takeaway

Summer 2025 was not a one-off. It was the first season where batteries became the system’s go-to evening resource in multiple markets at once. The formula is clear. Build the hours that match the ramp. Place them where they can reach load. Contract for reliability first and upside second. Fix the bottlenecks that trap megawatts behind congested wires. Do that, and the next 50 gigawatts will not just get built. They will keep the lights on when it counts.