The Post-IRA Sprint: States rush to lock wind and solar

With federal timelines pulled forward, states are fast‑tracking wind and solar awards to qualify before the 2027 placed‑in‑service cutoff. Here’s how developers are retooling, who benefits, and how to avoid a 2028 project cliff.

The September shock that reset the calendar

On September 26, New York turned a policy dial to high. The governor told state agencies to speed up a new buy of land-based wind and solar specifically to capture federal tax credits before they fade faster than expected. That move, aimed at pulling several gigawatts over the line, made the stakes visible to everyone watching state procurements. It was not just another solicitation. It was a clock check. The message was clear: act now or miss the federal window. The state’s fast-track order followed the One Big Beautiful Bill Act and the guidance that came in its wake, both of which pull the federal timeline forward for wind and solar. For a sense of how quickly this turned, see Reuters’ coverage of New York’s late-September decision to push projects across the line before the revised federal deadlines take hold: New York seeks more wind and solar.

New York is not alone. Procurement offices from the Midwest to the Southwest are recalibrating calendars so awards, permits, and grid interconnection steps line up with the new federal cutoffs. As one marker of the shift, New York’s directive emphasized getting projects started quickly and placed in service sooner so they can still qualify for value that was previously assumed to last into the next decade. That is the new reality. The long runway created by the Inflation Reduction Act is now a short sprint.

What changed in Washington and why it matters now

The One Big Beautiful Bill Act accelerated the phaseout of technology-neutral credits for wind and solar. Instead of a broad runway through 2032, developers now face a tighter pair of tests. To qualify for investment or production credits, utility-scale wind and solar must either begin construction by a fixed date or be placed in service by the end of 2027. Treasury and the Internal Revenue Service followed with guidance that narrowed how the widely used safe harbors apply to projects that start after early September 2025. Law firm summaries lay out the dates in detail, including the begin-construction deadline one year after enactment and the placed-in-service cutoff of December 31, 2027 for wind and solar, with separate treatment for storage. For the underlying mechanics, see this practitioner explainer: Changes to beginning construction rules.

For teams used to an eight-year planning horizon, the new cadence feels like moving from a marathon to a 400-meter dash. The policy goal of the Inflation Reduction Act was a stable investment signal. The new law tilts that signal toward near-term delivery.

The new clock: begin construction vs placed in service

Two gates now dominate capital planning for wind and solar through 2027.

-

Begin construction by the statutory date. Historically, projects could qualify by starting physical work of a significant nature or by incurring at least five percent of total cost, then maintaining continuous work. Treasury’s post-Act guidance narrows what counts for projects that begin after early September 2025. In practical terms, paper shuffling will not be enough. Developers need tangible physical work or real money down on major components.

-

Or enter service by December 31, 2027. This is the other route to credit eligibility. If a project hits commercial operation by year-end 2027, it can still qualify even if it did not satisfy the new begin-construction timing. That creates a surge target for 2027 grid energizations and brings schedule risk into sharp focus for late-stage projects.

The result is a wave of calendar math. If a wind project signs its turbine supply in November 2025, when does it need to break ground to pass the tightened tests. How much equipment must be on site to count as physical work. If flood or wildfire season knocks three months from a 2027 schedule, does the project still finish by year end. These are not hypotheticals for diligence memos. They are board-level decisions being made right now.

How developers and utilities are retooling

Think of the sector as a factory that must hit throughput by a fixed ship date. Every lever that pulls projects forward is now in play.

-

Safe harboring with intent. The five percent cost safe harbor is still part of the toolkit for many projects that start before the September 2025 guidance cutoff, but newer projects are shifting to more concrete steps. That means buying and storing long-lead components to demonstrate genuine progress. For wind, that can include nacelles, blades, and towers. For solar, it often means modules, trackers, inverters, and transformers. The emphasis is on traceable invoices, warehousing, and documented logistics. Teams are drafting warehouse agreements and photographic logs the way they once drafted power purchase agreements.

-

Transferability as a funding bridge. The ability to sell tax credits remains a workhorse in capital stacks. It pulls in buyers beyond traditional tax equity and can speed financial close for projects that are otherwise ready to break ground. Buyers are getting more conservative on diligence and on the price they pay per dollar of credit as legal uncertainties rise, but the market’s core function is still intact. Developers that front-load documentation around eligibility, domestic content, apprenticeship and prevailing wage, and placed-in-service evidence can cut the time from term sheet to closing.

-

Domestic content bonus as an operations problem. The domestic content adder is often the difference between a marginal and a greenlit project. It is no longer a nice-to-have. Developers are mapping bills of materials to steel, rebar, bolts, electrical gear, and trackers to hit threshold percentages. That requires early alignment with manufacturers on serial numbers, mill certificates, and final assembly locations. Success looks like this: procurement builds a one-page domestic content status sheet for every component with named suppliers and contingency options.

-

Merchant exposure and shape risk. With fewer multi-decade credit years ahead, some projects will lean more on merchant revenue earlier in life. That puts capture rate risk on the table. In sunny markets, midday prices can lag the average. In windy markets, night-time shape can help or hurt depending on gas and load. Developers are stacking hedges, basis protection, and storage dispatch to shape revenue. Portfolios that co-locate four-hour batteries next to solar can swing earnings by widening the on-peak spread, even if storage has a different federal timeline. As recent experience shows when Texas batteries overtook California, storage can materially change project economics.

-

Repowering as a pressure valve. Repowering existing wind plants with new rotors and drivetrains can count as new investment and can be done faster than greenfield projects. States with aging fleets can add hundreds of megawatts by 2027 without new interconnection footprints.

Where the bottlenecks bite

-

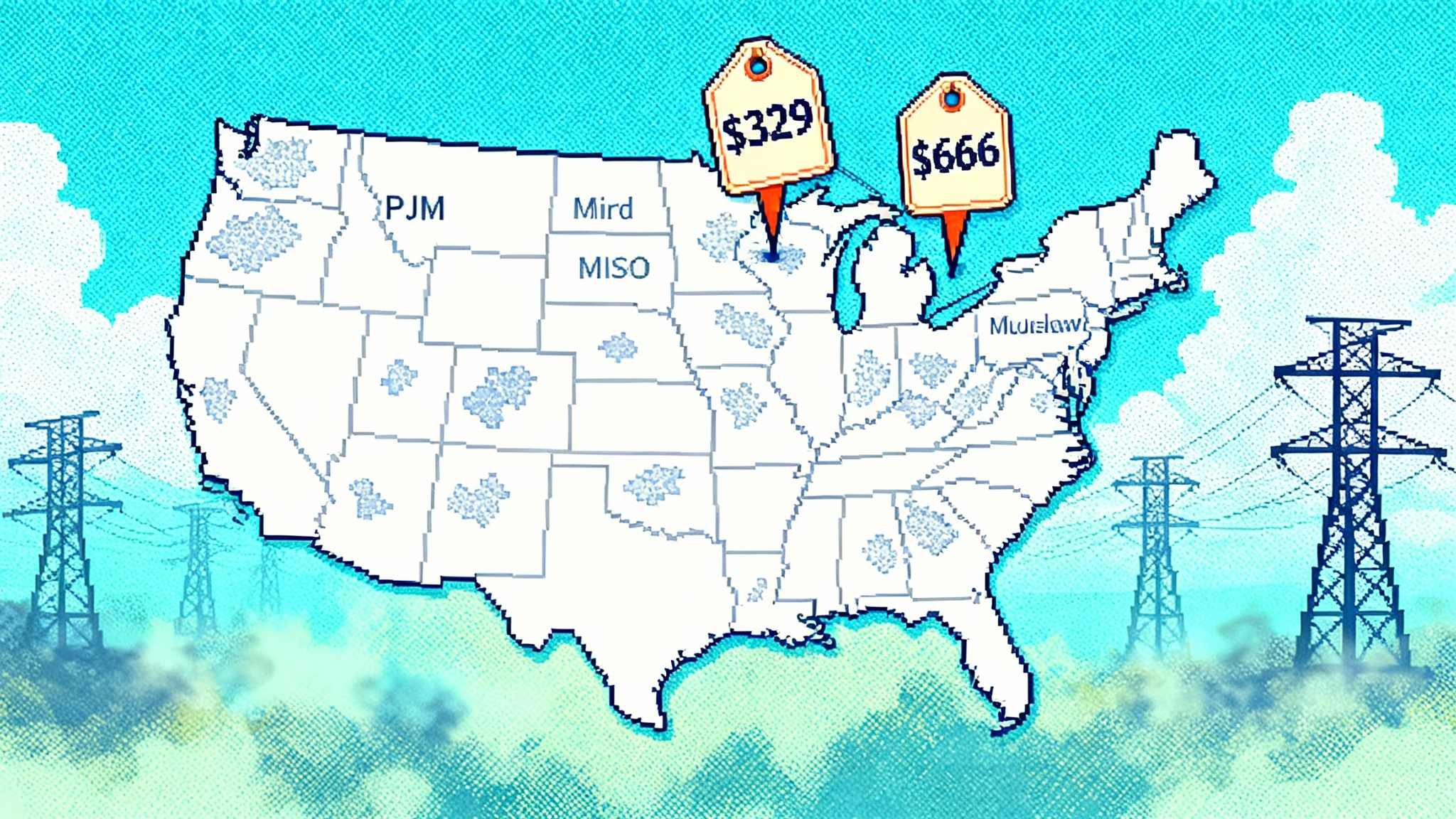

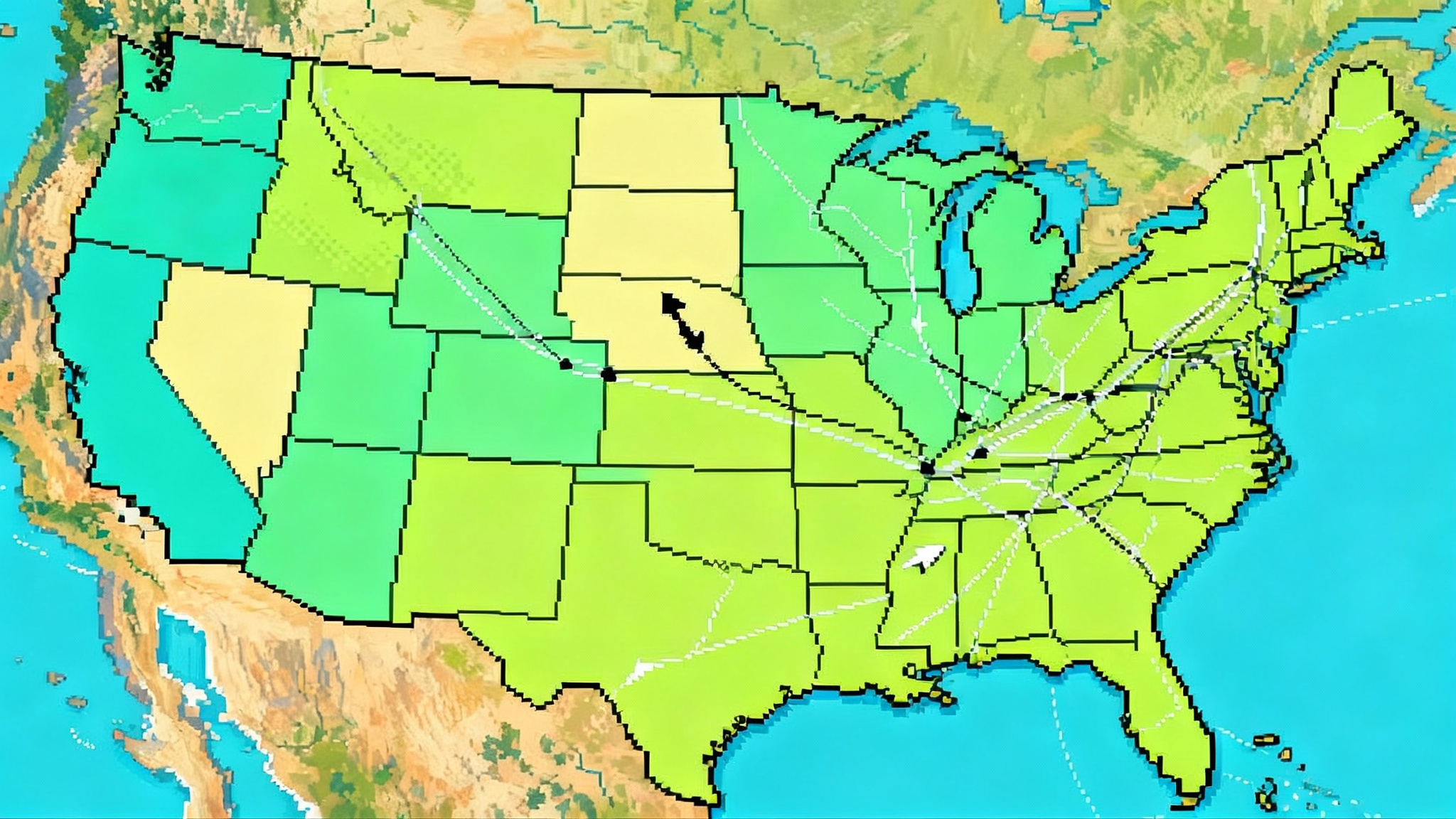

Interconnection queues. Queue rules improved in several regions, but studies and network upgrades still take years. Projects already holding queue positions with completed studies will dominate 2026 and 2027 energizations. New entrants hoping to move from application to commercial operation in two years will struggle unless they piggyback on existing substations or repowerings. Federal designation of NIETC corridors for 2026 to 2032 build may ease some chokepoints if states align permitting and siting.

-

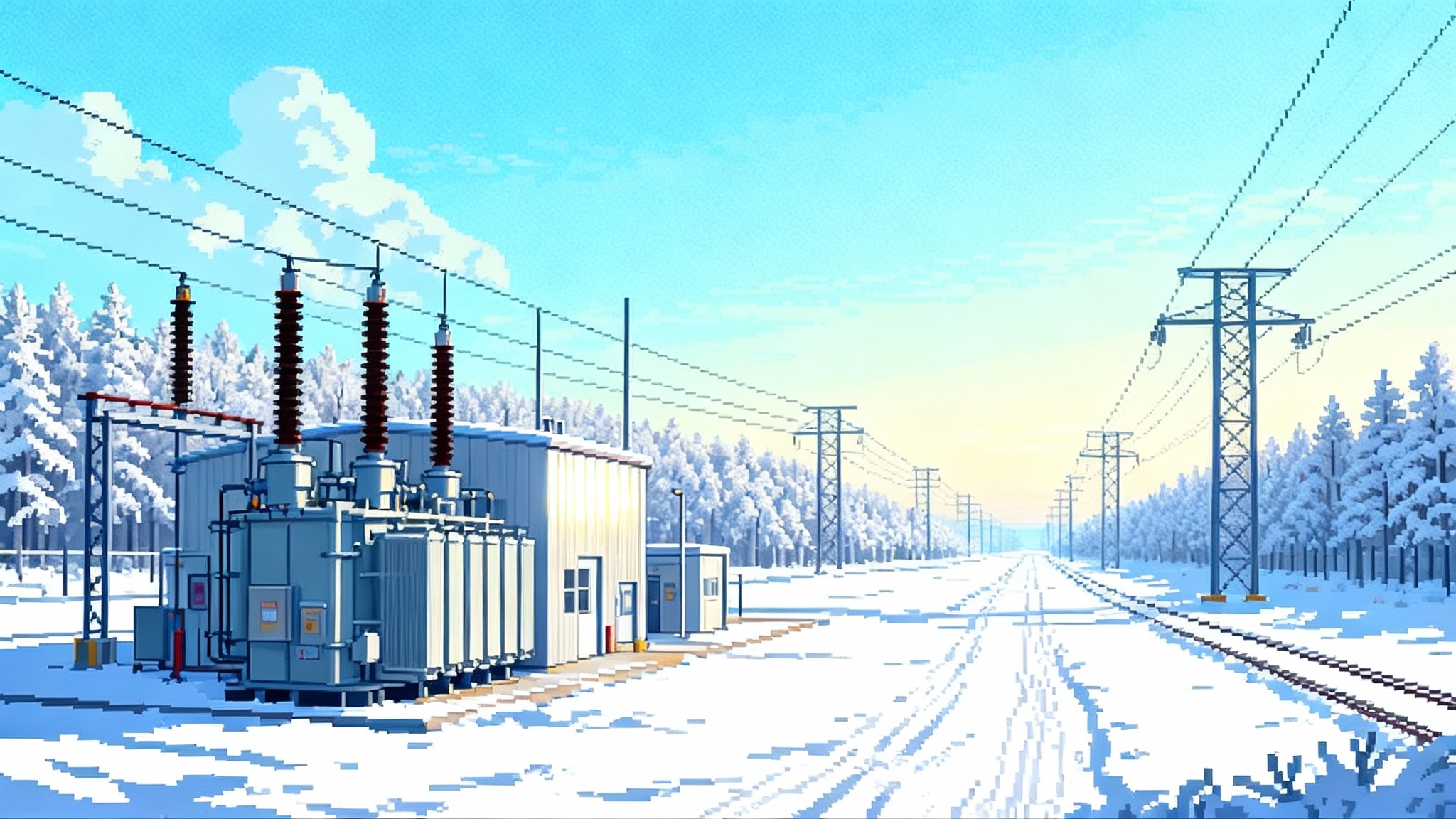

High-voltage equipment and transformers. Lead times for generator step-up transformers and high voltage breakers remain long. The practical response is to place binding transformer orders as part of safe harboring and to align delivery windows with construction packets. Public power agencies are exploring pooled buys to reduce per-unit costs and guarantee supply.

-

Engineering, procurement, and construction labor. Even with productivity gains, there are only so many qualified crews that can pour foundations, set towers, or string tracker rows in parallel. The companies that win 2027 completion races will lock in crews by region. Expect more multi-year, multi-project EPC alliances in which contractors share schedule risk and developers share the upside from finishing earlier.

What actually gets built from 2025 to 2028

-

2025: Shovel-ready solar and repowerings dominate. Look for projects that already cleared environmental review and interconnection to move first. Storage keeps growing on its own track since its credit schedule differs from wind and solar. Small municipal and cooperative utilities that can close quickly will push community-scale solar into service this year.

-

2026: Land-based wind in regions with mature queue positions accelerates. The central corridor from the Dakotas to Texas, parts of MISO, and Mountain West projects with shorter access roads rise to the top. Large single-site solar in Texas and the Southeast with minimal winter construction risk will also surge. Offshore wind that already has offtake and supply chains in place can continue, but late entrants will find it hard to hit 2027 service.

-

2027: The finish-line year. Expect a wave of energizations in the second half as teams race to meet the placed-in-service cutoff. Substations will be busy, and utilities will triage commissioning windows. Any project that slips into early 2028 without meeting the begin-construction rules faces a reassessment.

-

2028: The risk year. Projects without firm interconnection, those waiting on long network upgrades, and late-stage offshore wind procurements that depend on specialized vessels may defer or cancel. Some will pivot to state-only support mechanisms. Others will downsize or become storage-only builds if that pencils without the prior solar or wind assumptions.

Who the winners are

-

Original equipment manufacturers with domestic supply. Manufacturers that can document domestic content on steel, power electronics, and finished assemblies have an edge. Think of utility-scale module makers with U.S. factories, tracker suppliers that form steel domestically, and wind turbine manufacturers with nacelle assembly onshore. Their sales teams are solving a compliance problem as much as they are selling hardware.

-

Tax credit buyers and transfer aggregators. Insurers, large banks, and Fortune 500 corporates with steady tax appetites will be kingmakers. The buyers that standardize diligence and underwriting across many small and mid-sized deals will unlock the most volume in 2026 and 2027. Expect a premium for projects that can present clean, audit-ready documentation on domestic content and wage compliance.

-

States that move first. Jurisdictions that issue clear solicitations by late 2025, sign contracts in early 2026, and coordinate with transmission owners on energization windows will capture the bulk of the 2027 build. That includes states with centralized procurement agencies, public power authorities that can sign quickly, and markets where queue reform already cleared a path.

Playbooks to avoid a 2028 project cliff

For states and public power:

- Pair fast awards with fast interconnection. Require that bids include a firm interconnection schedule and make that schedule an evaluated attribute. Offer milestone bonuses for early delivery in 2027 and price discounts if projects slip.

- Buy transformers and switchgear in bulk. Use state green banks and public power alliances to pre-purchase long-lead grid equipment and then allocate to winning projects. This shortens timelines for all teams and reduces unit costs.

- Standardize credit compliance. Publish a one-stop checklist for domestic content, apprenticeship and prevailing wage, and placed-in-service evidence. Offer template affidavits, so developers do not reinvent the wheel for each award.

- Keep a repowering lane. Set aside a portion of each solicitation for repowerings at existing sites. These megawatts come with lower risk and hit the 2027 deadline more reliably.

- Add a safety net for late finishes. Consider a state credit or an enhanced renewable energy credit tier for projects that miss the federal window but deliver soon after. Tie it to in-state jobs and domestic content, and limit it to projects with interconnection in place before mid-2026.

For developers and investors:

- Front-load real work. Do tangible site work where permitted. Document it thoroughly. For equipment-based safe harboring, focus on items that are custom to the project and have clear serial numbers and chain of custody.

- Lock in EPC capacity now. Sign multi-project master agreements that fix crew availability and key rates. Include schedule incentives with shared savings for early completion.

- De-risk domestic content. Audit your bill of materials with suppliers. Keep a live tracker for each project that highlights domestic content status by component. Build a fallback supplier list for any component that risks slipping below thresholds.

- Build merchant resilience. Use storage to shift energy to higher-priced hours. Add basis protection where feasible, and consider proxy revenue swaps to stabilize cash flows. Align hedges with the 2027 placed-in-service reality, not an older, longer credit period.

- Streamline transferability. Prepare a data room that includes all eligibility documentation, wage and apprenticeship records, domestic content certifications, and a draft tax opinion from counsel. Speed matters because buyers will be triaging dozens of deals at once.

Practical examples from the field

-

A 250 megawatt solar project in the Southwest advances site grading in 2025, warehouses inverters and a portion of transformers by early 2026, and holds a fixed-price EPC slot for summer 2027. It pitches transferability to an insurer with a ready-to-sign package and uses a four-hour battery to shift late-afternoon energy. The result is a credible path to a December 2027 energization.

-

A 300 megawatt wind project in the Midwest signs for towers and nacelles with domestic content certifications. Foundations begin early where winter conditions allow, and the project pairs with a repowering at a nearby site to share cranes and crews. Interconnection upgrades were pre-funded through a joint agreement with the transmission owner, shaving months from the final tie-in.

-

A public power utility aggregates five community-scale solar projects into one solicitation, then pre-orders identical step-up transformers. Common design and pooled procurement create a replicable package that multiple EPCs can build in parallel.

What to watch between now and mid-2026

- The pace of state solicitations and award calendars. States that finalize awards by the first quarter of 2026 are best positioned for 2027 completion.

- How Treasury’s post-September 2025 guidance is applied in audits and diligence. Early rulings and private letter rulings will shape how conservative buyers become.

- Interconnection study throughput at key utilities and independent system operators. The number of completed facilities studies by mid-2026 is a leading indicator for 2027 energizations. Progress on AI data centers and utility capex will also influence load growth and pricing.

- Transformer and breaker factory capacity. Any boost in domestic output will directly affect schedules and domestic content strategies.

The bottom line

The era of leisurely timelines is over. The new federal clock turns near-term delivery into the difference between a viable project and a stranded one. States that act first will import investment and jobs while capturing more federal value before it fades. Developers that treat safe harboring as real construction, that document domestic content like auditors are already on site, and that lock in EPC capacity early will finish. Those that assume yesterday’s credit runway still applies will not. The sprint to 2027 is not just winnable. For teams that reorganize around the new schedule, it can be decisive.

New York’s late-September push is a sign of how the next six quarters will unfold. Awards will be faster. Documentation will be heavier. Construction windows will be tighter. The winners will treat policy change not as a problem to lament but as a project plan to execute. That is how the sector avoids a 2028 cliff and builds more clean power sooner, even on a shortened runway.