AI Data Centers Ignite the Next Utility Capex Supercycle

New utility plans and federal transmission rules show how AI load is reshaping the U.S. grid. See what gets built from 2026 to 2030, who pays for it, and how to curb price spikes while accelerating electrification.

Breaking news, and the signal it sends

Two announcements on September 29, 2025 landed like a starter pistol for the power sector. CenterPoint Energy and PG&E each outlined multiyear, multibillion dollar plans to expand wires and substations to meet an unprecedented surge in electricity demand from artificial intelligence data centers. The scale and timing make one thing clear. A new utility capital expenditure cycle has begun, and AI is the lead car. Reuters’ coverage of CenterPoint’s plan captures the tone across the industry.

What changed is not abstract. A single modern AI campus can draw power like a steel mill, and clusters of campuses accumulate into gigawatt scale load. These facilities want very high uptime and very low latency, so they do not just show up anywhere. They show up near major fiber routes, cool climates or cheap water, and above all near substations that can be expanded quickly. Texas, California, Virginia, Ohio, and parts of the Midwest are already seeing the pull.

Utilities are responding the only way they can. They are planning bigger wires, bigger substations, and faster interconnection schedules. Regulators are aligning rules. Investors are recalculating growth profiles. The result is a capex supercycle that will play out not in years 2040 and beyond, but in the five year window right ahead of us.

The demand spike, explained simply

Think of the grid as a highway system. For a decade we added lots of efficient cars, rooftop solar, and a few new on-ramps. Now AI data centers are eighteen wheelers merging by the dozen. Congestion builds first at interchanges, which in the grid means substations and the high voltage lines that feed them. If we do not widen those interchanges and add new express lanes, everyone sits in traffic, prices spike during rush hour, and reliability suffers.

A single data hall inside a campus can use tens of megawatts. A campus can require hundreds. The electronics waste heat that must be removed by water cooled or refrigerant cooled systems, which adds more electric load for pumps and fans. The result is a compound effect. A city that expected three percent annual growth suddenly faces double digits. Peak demand does not just creep up, it jumps.

The rulebook just changed, and that matters

Federal regulators updated the transmission playbook. In 2024 and 2025 the Federal Energy Regulatory Commission finalized a long term planning rule that requires transmission owners to study future scenarios over multiple decades, to identify projects that address shared needs, and to allocate costs using transparent benefits. The same period saw FERC complete a backstop siting rule that defines how the agency can step in if certain interstate lines stall. The shorthand is this. Plan for the future, show the benefits, share the costs fairly, and have a path if a line is in the national interest but stuck. See FERC’s compilation on its major orders and regulations page for details.

Those changes do not apply everywhere in the same way. Texas’ grid is mostly under state jurisdiction, so the Public Utility Commission of Texas sets the tempo there. That has not slowed ambition. Texas just approved its first 765 kilovolt corridors to move power into the Permian Basin more efficiently, and transmission owners are preparing the engineering and procurement to match.

What actually gets built from 2026 to 2030

Here is the concrete build list that utilities, developers, and regulators are converging on:

- New extra high voltage corridors in data center states. Texas has greenlit 765 kilovolt import paths into the Permian, which allow more power to move on fewer structures. Expect a parallel push for higher capacity conductors, series compensation, and static var support on existing 345 kilovolt backbones into Dallas Fort Worth, Austin, and San Antonio. In the Midwest and Mid Atlantic, plan on reconductoring, substation expansions, and targeted new 500 or 345 kilovolt paths that relieve persistent constraints feeding near fiber rich metros. For deeper context, see our Texas goes 765 kV analysis.

- Substations first, then lines, then transformers again. The fastest wins are often new bays, breakers, and bus work that convert a substation to handle higher currents. The longest lead item is the power transformer itself. Supply chains are tight, so utilities are placing multi year framework orders and qualifying multiple vendors.

- Distribution upgrades to make big service drops possible. Many campuses are seeking dual feeds for resilience, which means multiple high voltage feeders, redundant breakers, and fast transfer schemes. Expect a wave of high capacity feeders and sectionalizing automation at medium voltage.

- Grid enhancing technologies that squeeze more capacity out of steel in the ground. Dynamic line ratings, power flow controllers, and advanced relaying are being inserted into plans. They do not replace new wires, but they can buy two or three summers of headroom while the steel arrives.

- A selective wave of new gas plants in the right places. Where high quality firming is needed near a data center hub, expect simple cycle aeroderivative turbines that start fast, run a few hundred hours per year, and sit behind firm gas delivery with on site fuel backup. Projects will specify low emission packages and hydrogen capable burners to keep options open.

- At least one nuclear restart and groundwork for more firm, zero carbon capacity. The Palisades restart in Michigan is moving through the final regulatory steps with federal support and state coordination. That project is crucial for showing the licensing, workforce, and supply workflows needed to return an existing plant to service safely. For the upstream fuel angle, read our nuclear fuel supply reboot.

- Virtual power plants at real scale. Aggregations of commercial building batteries, residential batteries, managed electric vehicle charging, and flexible industrial loads can deliver capacity and ramping where wires are constrained. These aggregations are dispatched by software, but they are capital efficient because the hardware already exists behind customer meters.

If you work backward from in service dates, the implication is stark. Equipment that needs to be energized in summer 2028 must be ordered in 2026. The utilities that issued plans this week are doing exactly that, and they are signaling suppliers to expand factories.

Who pays, and how the bill is split

Ratepayers, large new customers, and in some cases federal and state taxpayers all share the tab. The splits depend on where you are and what you are building.

- Rate base for public utility projects. For wires that serve broad reliability needs, utilities typically invest and recover costs over decades through regulated rates. Those rates include a return on equity and a return of the capital as the asset depreciates. In practice, that means all customers in a service territory contribute, because they also benefit from a more reliable grid with more headroom.

- Beneficiary pays for regional lines. Under FERC’s planning rule, regions must adopt formulas that link a share of a line’s cost to quantifiable benefits. A city that receives more congestion relief or more reliability benefit can be assigned a larger share. This reduces the fights that stall interregional projects, and it creates a clearer financeable revenue stream for lines that help multiple states.

- Contribution from the new load. Large campus customers often pay for dedicated facilities and near term upgrades at the point of interconnection. Increasingly, they also sign special tariffs that include a contribution for redundancy and accelerated build schedules. Where possible, utilities are standardizing these tariffs to avoid a bespoke deal for every new site.

- Public grants and loans for strategic resources. Programs that support wildfire hardening, transformer factory expansions, or nuclear restarts reduce the overall cost of capital and de risk projects that have broad public benefits.

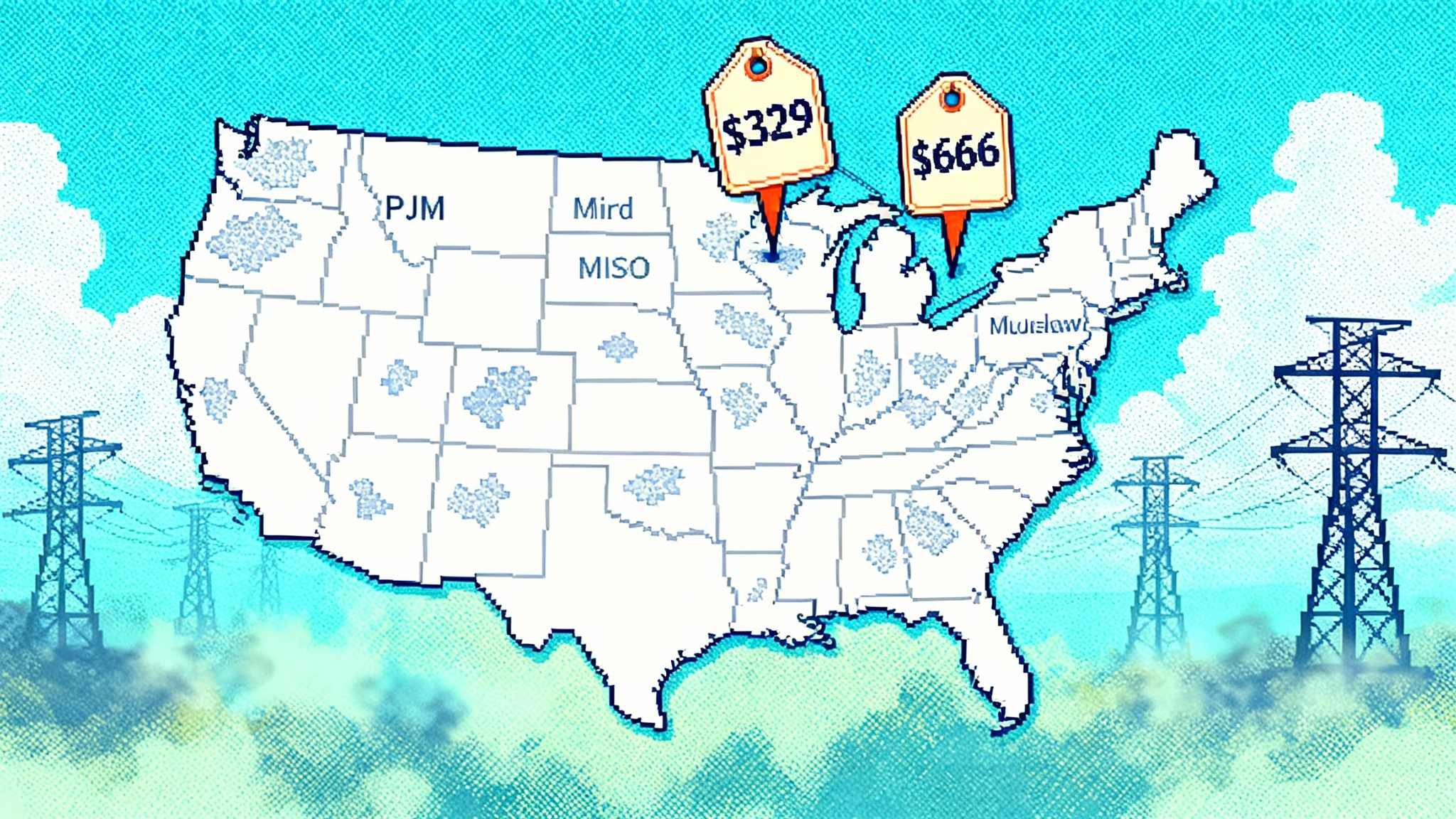

There is a political dimension to who pays. Customers will rightly ask whether they are subsidizing one industry. The practical answer is that a larger system with more investment and more load often has lower unit costs if it is planned well. For a snapshot of how scarcity can bite when planning lags, see our look at the capacity price shock in PJM.

A fast mover playbook to blunt price spikes and outages

The grid can handle the AI wave, but speed and sequence matter. A practical mix can keep prices stable and reliability high, while still enabling electrification of industry and transport.

- Pull forward wires with shovel ready packages

- Pre permit standard segments. Identify two or three standard designs for 765, 500, and 345 kilovolt segments with pre qualified structures, clearances, and conductor types. Pre negotiation with major landowners and pre assembly of environmental studies can cut a year from the schedule when a segment becomes critical.

- Bundle no regrets upgrades. Reconductoring with advanced conductors, dynamic line ratings on wind and solar export corridors, and modular substation bays can be engineered now even if a new line is still in routing.

- Add selective new gas where it does the most good

- Choose locations that also reduce congestion. A fast start turbine near a constrained node can reduce peak prices by letting more renewable generation move across the network. Tie the plant’s revenue to capacity and ancillary services, not energy, to discourage running when cheaper resources are available.

- Tie firm gas to firm responsibility. Require proof of firm pipeline capacity and on site backup fuel, and write contracts that pay for performance during scarcity hours. If a plant misses when needed, payments step down automatically.

- Restart and uprate nuclear for zero carbon firmness

- Use restarts to relearn muscle memory. A successful commercial restart teaches new workers, reboots second tier suppliers, and clarifies modern inspection methods. That experience transfers to future uprates and life extensions.

- Align long term supply with long term load. Where data center clusters want fifteen year commitments, pair them with long lived nuclear or hydro capacity so that financing matches asset life, not just short term prices.

- Treat virtual power plants like a first class resource

- Procure by location, not just by megawatt. VPPs are most valuable when they discharge into the same feeders that serve new campuses. Write solicitations that call for capacity on specific circuits, and let aggregators assemble fleets of batteries, thermostats, and managed chargers to meet those locational needs.

- Pay for verifiable performance. Require telemetry, testing, and settlement that is as rigorous as for a gas plant. Aggregators that can pass a summer test block should be paid a capacity price, not just an energy credit.

- Ask the new load to flex in return for speed

- Deferrable compute is a feature, not a bug. Many AI training jobs can pause and resume without losing work. Require large customers to offer a defined amount of curtailable or shiftable load in exchange for accelerated interconnection and priority engineering. Build automated control paths so the grid operator can call that flexibility within seconds.

This mix puts the fast items first, the long lead items on a locked schedule, and turns data centers into part of the solution during tight hours. Done well, it narrows the price spikes that show up during summer peaks and maintenance outages.

How transmission rulings change project design and siting

Two FERC rules change the conversation in the design room.

- Planning and cost allocation. Order 1920 forces the parties to quantify benefits like congestion relief, avoided reliability projects, reduced losses, and increased access to low cost generation. That sounds bureaucratic, but it removes a classic blocker. When you can compute the benefits in dollars, you can compute who pays which share, and you can finance the line like any other regulated asset.

- Backstop siting. The backstop rule does not let the federal government overrun state processes, but it does define a federal path when a project in a designated corridor is in the public interest and stalled without good reason. It also adds a Landowner Bill of Rights and explicit Tribal engagement requirements. Good developers already do these things. Now they are table stakes.

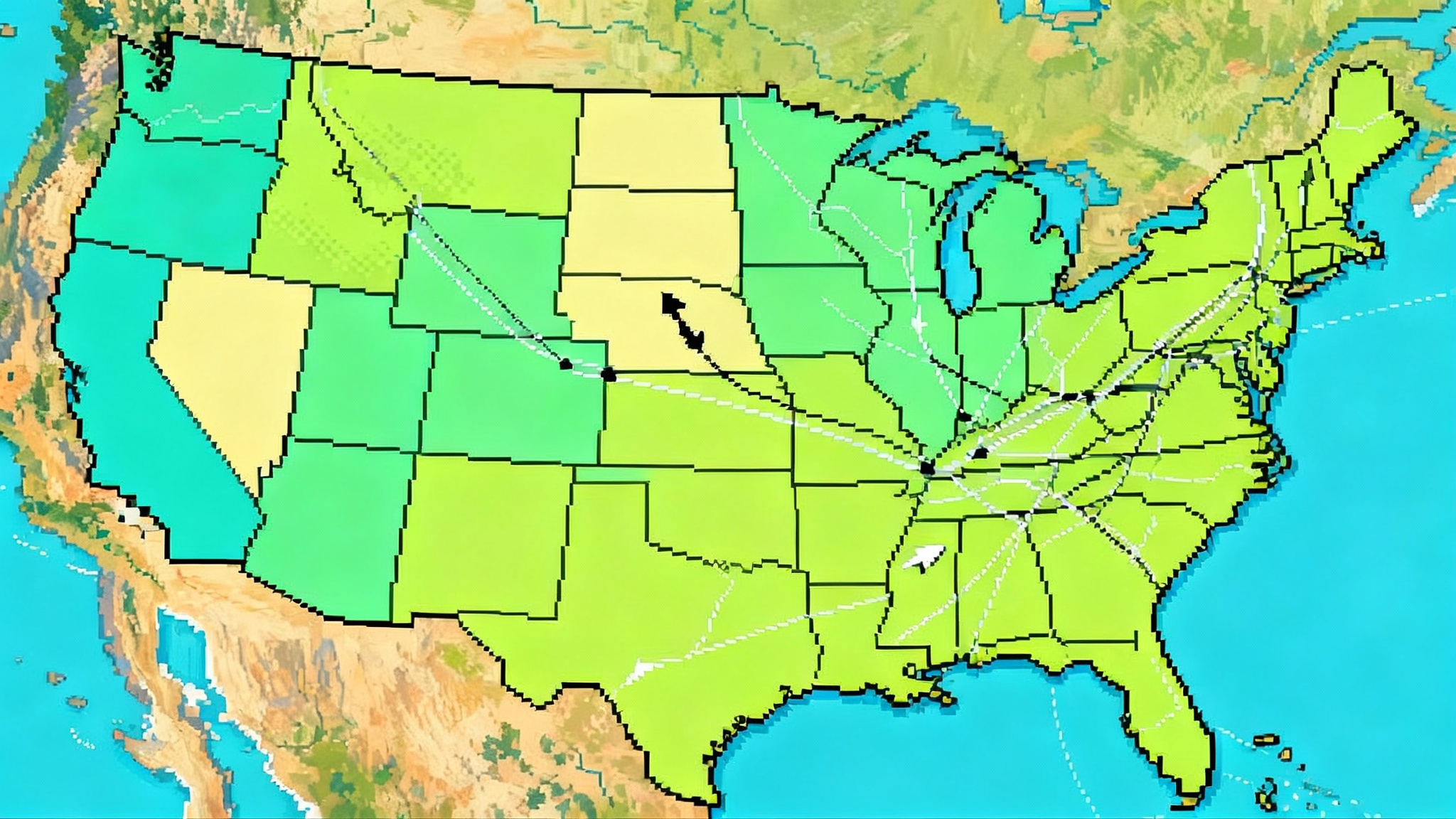

The net effect is more clarity at the start. Developers can size corridors for the 2035 grid instead of the 2028 grid, and they can justify higher capacity builds that avoid coming back to the same right of way in ten years.

ERCOT’s test case for 765 kilovolt

Texas offers a concrete example of how to move fast at scale. The decision to build 765 kilovolt import paths into the Permian Basin recognizes that the legacy 345 kilovolt grid is not always the cheapest way to move the next incremental megawatt. One 765 circuit can carry the power of multiple 345 circuits with lower losses and fewer structures per mile. For landowners that can mean fewer crossings. For ratepayers that can mean lower operating costs over the asset life. For operators that can mean fewer congested edges during rampy spring and fall days when wind and solar shift quickly.

If Texas pairs those backbones with dynamic line ratings and modular substations, it can open large new service drops for data campuses without starving existing customers. The lesson generalizes. In regions with heavy new load, build at the right voltage once, then fill in with targeted reconductoring and VPPs while the anchors are under construction.

Risks to manage, and how to manage them

- Concentration of load. A region that puts too much new load behind one substation creates a single point of failure. Solution. Require dual feeds on separate corridors and a staged energization that ties each tranche of new load to specific upgrades coming online.

- Transformer scarcity. Large power transformers can take two years to arrive. Solution. Pool orders across utilities, qualify multiple manufacturers, and set up refurbishment programs for strategic spares.

- Gas deliverability during extremes. It is not enough to build a turbine. You need firm pipeline capacity and a plan for cold snaps. Solution. Treat deliverability tests like fire drills. Fail the test, fix the constraint, test again.

- Community acceptance. New lines and plants need social license. Solution. Put community benefits agreements in writing early, route thoughtfully, and make the infrastructure as compact as the engineering allows. The procedural rights in the new siting rule are not hurdles, they are how you build trust.

Electrification accelerates if we sequence correctly

There is a deeper prize. If we build the backbone for AI, everyone else can use it. Factory electrification plans in the Southeast, heat pump adoption in California, and fleet charging in the Midwest all move faster when the high voltage grid has headroom and the local substations have modern protection and automation. Data centers are not the only customers that want a more reliable, more flexible grid. They are simply the ones that can contract now for the capacity that makes the shared assets financeable.

Utilities can help by designing tariffs that reward flexibility, not just consumption. Regulators can help by blessing long term resource contracts that match asset lives. Data center operators can help by offering real demand response and by underwriting the wires they need. Software companies can help by building the tools that turn millions of small devices into capacity on call. When each group does its part, price spikes shrink and the path to economy wide electrification gets shorter.

The bottom line

The capex supercycle is not a slogan, it is a construction schedule. The first wave is substation expansions and reconductoring. The second is big backbone lines and new transformers. The selective additions are fast start gas and the first nuclear restarts. The overlay is a virtual power plant that turns existing devices into a dispatchable fleet. The policy frame is a planning and cost allocation rule that rewards building the right thing once and a siting process that is clearer for everyone.

If we use the next twelve months to lock designs, place transformer orders, standardize interconnection tariffs, and procure location specific VPPs, the period from 2026 through 2030 can be remembered for building a grid that kept prices stable, kept the lights on, and unlocked the next wave of American electrification. That is the supercycle worth having.