June 2025 Tariffs Reset U.S. Solar: Prices, Risk, Timelines

New AD and CVD orders on Southeast Asian solar imports reset U.S. module prices and project timelines. Here is what changed on April 21 and June 24, how landed costs now stack up, who can fill the gap, and the moves to make in the next 90 days.

The tariff shock that finally landed

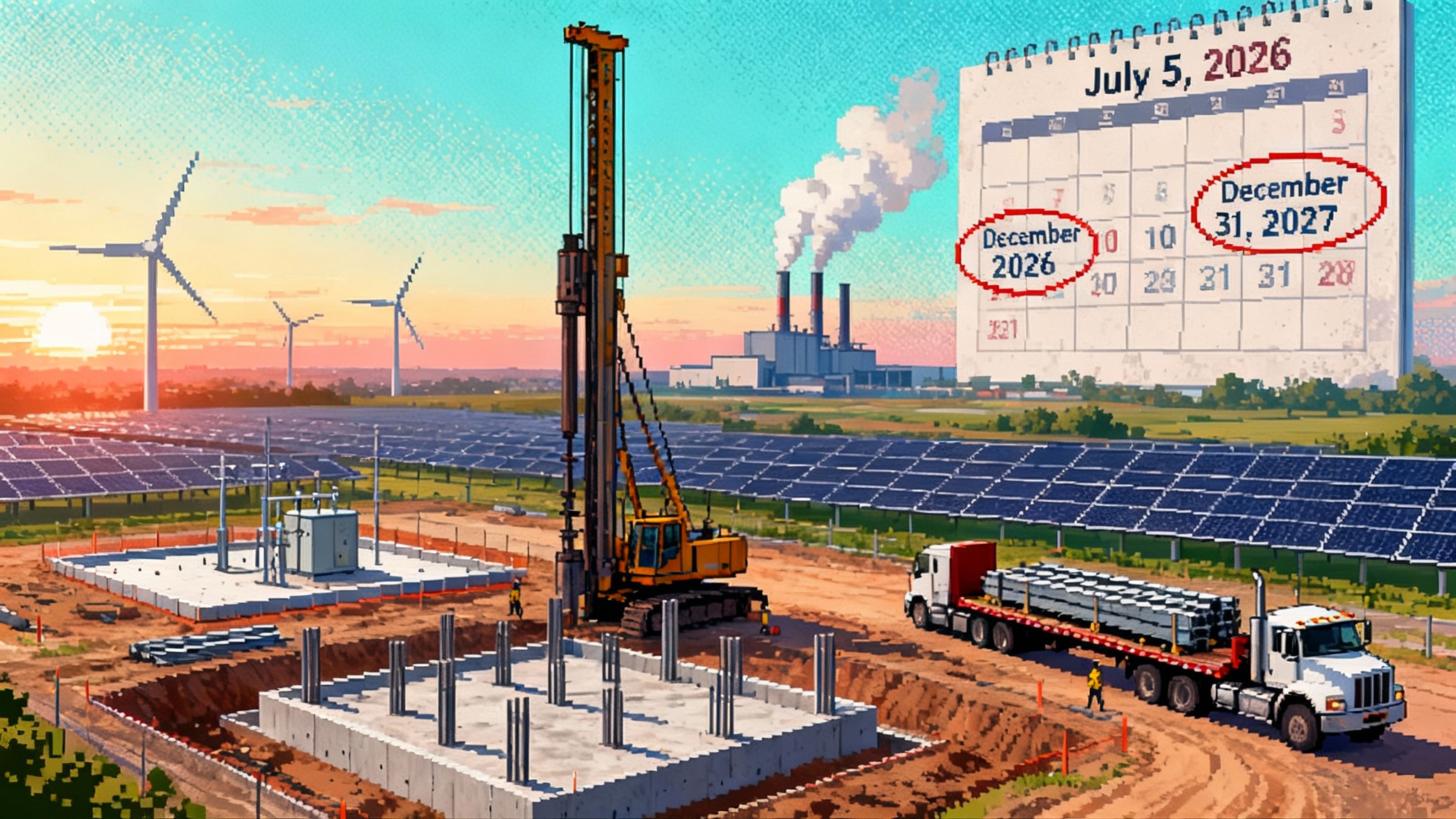

For two years developers and utilities debated whether the Southeast Asia trade cases would end with a slap on the wrist or a structural break. The answer arrived in two beats. On April 21, 2025 the U.S. Department of Commerce announced final affirmative determinations in the antidumping and countervailing duty cases covering crystalline silicon cells and modules from Cambodia, Malaysia, Thailand, and Vietnam in its final AD and CVD determinations. On June 24, 2025 those determinations became law through Federal Register AD and CVD orders, starting the clock on cash deposits, administrative reviews, and a very different price deck for the U.S. pipeline.

This article maps the fallout through 2027. We begin with the price shock, then look at who fills the gap and at what landed cost. We close with the contract mechanics that will decide whose projects still pencil, and the operator playbook for the next 90 days.

For context on how tax credit pressure is already reshaping build decisions, see our analysis in The 45Y/48E Crunch Resets U.S. Wind and Solar.

What changed on April 21 and June 24

- Final rates now apply by exporter and country. Importers must post cash deposits that reflect the sum of antidumping and countervailing rates, net of subsidy offsets where applicable.

- Duties are retrospective. The deposit posted at entry is a placeholder until final assessment after an administrative review. That asymmetry introduces tail risk for importers and anyone backstopping them.

- The scope tracks crystalline silicon cells and modules whether or not assembled into other products. Exclusions are narrow. Bifacial status does not provide a duty shield in these cases.

- ITC’s injury vote unlocked the orders. As of June 24, 2025, entries are subject to AD and CVD cash deposits unless they fall under a specific exclusion.

The headline is simple. Southeast Asia will not be the low cost default for U.S. utility scale modules through 2027. That forces a rapid re-sort of supply, price, and schedule assumptions across the pipeline.

The immediate module price impact

Project budgets that penciled with landed module prices at 22 to 27 cents per watt in early 2025 now face a higher range. The step up depends on three levers.

-

Company-specific rates and cooperation status. Fully cooperative exporters with lower rates may support landed costs in the high 20s to low 30s cents for 2025 deliveries if logistics are optimized. Exporters with higher combined rates push landed costs toward the mid 30s to low 40s. Noncooperative rates are effectively prohibitive and move those suppliers off the field.

-

Who holds the deposit and the risk. Importers that require a price gross up to cover cash deposits and potential review exposure will pass that through. If the developer takes import title, working capital and risk premiums appear in EPC adds.

-

Timing. Q3 2025 deliveries that were already on the water or in bonded warehouses saw the smallest repricing. Q4 2025 and 2026 deliveries are being repriced with fuller deposit and risk cushions.

Base case for new 2026 procurement: 30 to 38 cents per watt landed for Southeast Asia crystalline silicon, with meaningful dispersion by counterparty. That is a large enough step up to change PPA strike economics for projects that were thin to begin with.

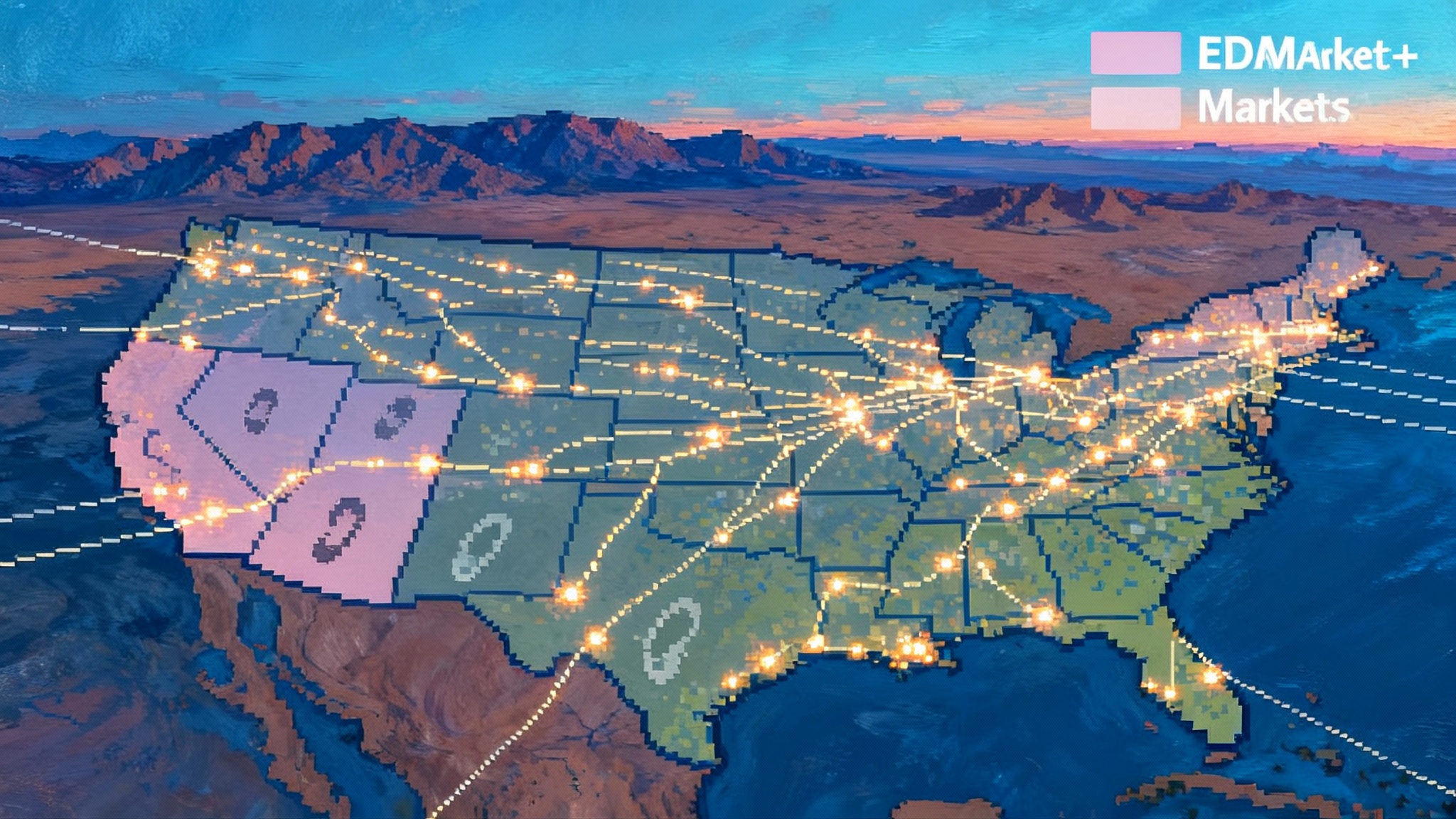

Who fills the gap in 2025 to 2027

The U.S. is not short of module nameplate. It is short of bankable, contracted supply at the price and schedule developers assumed during the 2023 to early 2025 glut. The alternatives line up as follows.

-

U.S. factories supported by 45X. New or expanded U.S. module and cell lines can offer a pricing umbrella. Manufacturers can monetize the Advanced Manufacturing Production Credit and share part of it via lower ASPs or rebates. Expect 2025 to 2026 landed prices in the low to mid 30s for mainstream N type TOPCon, with capacity constrained quarters printing higher. Cell constrained lines price at a premium or require tolling.

-

Thin film. First Solar’s cadmium telluride capacity is largely forward sold, but cancellations and schedule slips surface pockets. Pricing is often indexed to aluminum, freight, and balance of system gains from larger formats. Expect mid 30s to low 40s landed in 2025 to 2026 for late bookings, with a superior yield and degradation profile that improves the levelized energy case even at a higher module ASP.

-

India, Korea, Mexico. These sources are outside the June 24 orders, but two caveats matter. First, logistics and currency pass through can erase headline country advantages. Second, new petitions or scope expansions are not a base case but are a salient risk that lenders will ask you to underwrite. Today’s landed pricing bands: India in the low to mid 30s for bankable names, Korea mid 30s to low 40s, Mexico similar but with shorter haul logistics and fewer port risks.

-

Europe and Middle East tolling. Several OEMs are quoting cell or module tolling to re-domicile content. Pricing depends on whose polysilicon and cells are used. Landed costs are most sensitive to throughput certainty. Short runs price poorly. Multi quarter, multi hundred megawatt programs price better.

-

Technology mix pivots. PERC remains available at a discount but carries a yield penalty relative to TOPCon and HJT. On large DC blocks the energy delta can overwhelm a cent or two of module ASP. Bifacial continues to be standard on utility projects. Glass glass for desert sites with trackers remains the default, with higher shipping costs offset by longer life and lower microcrack risk.

Put simply, the volume is there, but the clearing price has moved up and the spread between sources has widened. The market will arbitrate that spread with contracts that reward schedule certainty and bankability more than the last cent of ASP.

Landed cost math in plain sight

Use this checklist to sanity check quotes.

- Start with FOB module ASP in the origin currency and hedge to dollars.

- Add ocean and inland logistics with a realistic port congestion buffer.

- Apply AD and CVD cash deposit percentages to the entered value if the source is within scope, and note which party posts the deposit.

- Add import brokerage, cargo insurance, and working capital carry on the deposit.

- Include any 45X or other manufacturer credits that are explicitly embedded in price or payable as a rebate.

- Discount for warranty quality if the supplier offers stronger performance terms that reduce long term reserve needs.

Run three scenarios. Base with current quotes. Tight with a 3 to 5 cent step up if Q1 2026 pulls tight. Stressed with a 7 to 10 cent increase if an additional trade action clips an alternative source.

PPA repricing and force majeure risk

Contracts signed in 2023 and 2024 often assumed sub 25 cent landed modules and generous delivery windows. With the new AD and CVD orders in force, two clauses decide who pays.

-

Change in law. Well drafted EPC and supply agreements usually define trade remedies that become effective after execution as a change in law. If your module supply agreement has a pass through, you can reopen pricing or substitute supply. If the PPA also has a change in law mechanism, you can seek tariff related adjustments to price or COD without claiming a default.

-

Force majeure. Tariffs rarely meet the standard. They increase cost but do not make performance impossible. Do not rely on force majeure to cure economics.

Developers should triage PPAs into three buckets.

-

Flexible. PPAs with explicit change in law pricing reopeners or COD windows that stretch into 2026. These are salvageable with a module swap and a small price adjustment.

-

Negotiable. PPAs that allow limited price or COD movement for regulatory changes. These need a structured amendment. Strategies include step up pricing after COD month 12, merchant tail sharing, or a fixed adder if domestic content is achieved.

-

Hard. Fixed price, tight COD, no reopeners. Here the options are sell the queue position, convert to a hybrid with higher capacity factor, or seek a termination for convenience if the offtaker prefers a fresh RFP.

Procurement pivots that work in 2025

-

Lock 45X enabled U.S. supply. Where a manufacturer is willing to pass a portion of its credit through, capture it in a transparent schedule or rebate rather than an opaque ASP. Make the pass through contingent on delivery and production volumes to align incentives.

-

Use tolling plus component audits. If an OEM tolls modules or cells outside Southeast Asia, require batch level bills of materials and production records. Build audit rights and liquidated damages around misrepresentation to satisfy lenders.

-

Shift to indexed ASPs for long builds. If your build stretches over six quarters, fix volume with a glide path that references a public index for a share of the ASP, with a floor and ceiling. This de-risks both sides and supports bankability.

-

Split technology risk. Blend 70 percent TOPCon with 30 percent thin film to hit schedule windows while managing ASP. Model yield and mismatch explicitly rather than treating modules as interchangeable.

-

Re-anchor on warranty value. Extend panel performance and workmanship warranties, and add back to back inverter and tracker warranties. Longer performance terms can offset a few cents of module ASP if they reduce reserve requirements and lender haircuts.

-

Secure logistics early. Book vessel space and inland drayage together with supply contracts. The cost of missed CODs now swamps a few dollars per pallet in freight.

Storage paired projects and interconnection timelines

Higher module ASPs change the storage calculus.

-

DC coupled oversizing trims back. When solar is cheap, oversize the DC array to feed storage. At higher module costs, the marginal MWh is less attractive. Expect more AC coupled designs and right sized DC arrays.

-

Storage still pencils on its own merits. Stand alone storage benefits from IRA tax credits and revenue stacking. The solar tariff shock does not impair four hour storage arborage and ancillary opportunities. But it does change the optimal charge profile for hybrids and may push some projects to add more grid charging capability.

-

Interconnection queues become a pressure valve. Projects with 2025 to 2026 CODs and thin economics will roll into 2027 to catch new pricing, domestic content strategies, or capacity constraints easing. Queue withdrawals will free up capacity for better positioned builds and for projects that can demonstrate domestic content to satisfy utility resource plans. Transmission planning changes described in FERC’s 1920-A hands states the pen on grid planning also shape schedule flexibility.

How utilities, developers, and financiers are adjusting

-

Utilities. New RFPs are arriving with change in law reopeners, domestic content scoring, and schedule flexibility for projects that can prove stable supply chains. Utilities are widening acceptable technology lists to include more thin film and to reward shorter logistics chains.

-

Developers. The winners are cleaning up project scopes, shifting to suppliers with audited bills of materials, and adopting multi source module strategies. They are also reserving contingency in EPC budgets explicitly for trade related cost variance.

-

Lenders and tax equity. Expect tighter conditions precedent around module provenance, tariff exposure caps, and step in rights if a supplier misses delivery windows. Debt sizing will haircut merchant exposure and assume higher curtailment in saturated hours unless the project adds storage or retools to higher capacity factor.

-

Hedge providers. For basis and shape hedges, providers are valuing delivery certainty over the lowest strike. Projects that can attest to domestic content or thin film supply clear faster. Expect more penalties for volume shortfalls and tighter tracking error bands. For the demand side backdrop, see AI Load Rewrites the Grid as Coal Lingers and Gas Surges.

A practical playbook for the next 90 days

-

Map exposure. For every project, list contracted suppliers, country of origin, exporter rates, and who posts the cash deposit. Quantify deposit carry and review risk.

-

Rebase price decks. Move module ASPs to a three scenario range. Re-run PPAs and EPC budgets with revised DC and AC coupling choices.

-

Reopen contracts where possible. Use change in law clauses to renegotiate price, COD, or technology. Aim for modest price adders tied to domestic content or a mix shift that raises net energy.

-

Secure at least one non Southeast Asia pathway. That can be thin film, a U.S. cell plus module line, or a tolling route. Lenders will value redundancy.

-

Negotiate warranty and LD packages as financial instruments. A stronger warranty with bankable LDs can substitute for a portion of contingency.

-

Align tax strategy. If domestic content is realistic in 2026 or 2027, model the ITC adder and include it in offtaker discussions. If not, lean on credit transfer markets to optimize after tax proceeds.

-

Lock logistics with the same urgency as modules. Include buffer inventory for trackers, inverters, and transformers to avoid non module bottlenecks that waste your hard won module schedule.

-

Refresh stakeholder communications. Utilities, landowners, and communities need a transparent schedule and reasoned price narrative. Getting ahead of the story improves amendment odds and protects relationships.

Bottom line

The June 2025 AD and CVD orders closed the book on Southeast Asia as the default low cost module hub for the U.S. market. Prices have reset higher, and the premium for schedule certainty has widened. The good news is that alternatives exist across U.S. factories, thin film, and selective non Southeast Asia sources. Projects will still pencil, but only if teams upgrade procurement, contract mechanics, and schedule discipline. The developers who move first on 45X backed supply, credible tolling, and smart PPA reopeners will own the 2026 to 2027 build window.