America’s Uranium Ban Triggers a 2025 Enrichment Sprint

With Russian enriched uranium blocked as of August 11, 2024 and waivers ending after January 1, 2028, the United States has launched a $2.7 billion push to rebuild fuel supply. Here is how 2025 is unfolding, who is winning and losing, and what to watch through 2028.

The August 2024 line in the sand

A quiet sentence in federal law set off a loud scramble. The United States banned imports of Russian enriched uranium beginning August 11, 2024, with case by case waivers allowed only through January 1, 2028. The same policy package steered up to $2.7 billion toward rebuilding a domestic fuel chain that had withered under decades of offshoring. The message was clear. Keep the lights on today, but prepare to stand on your own by 2028. The stakes span 92 operating U.S. reactors and every utility portfolio manager who buys their fuel. For the legal start date, waiver window, and funding envelope, see Reuters on the U.S. ban begins Aug. 11.

2025 becomes a crash program

With the calendar doing the counting for everyone, 2025 shifted from planning to execution. Two milestones defined the year so far. First, Urenco USA began bringing new enrichment cascades online in New Mexico, the first meaningful U.S. capacity growth in years. Second, Centrus crossed a long awaited HALEU production goal and secured an extension that starts to turn demonstration into supply.

These steps do not close the gap by themselves. They do start to change procurement math, contract terms, and risk allocation on both sides of the table. Utilities that built their portfolios around Russian EUP or swing deliveries now face a different future. Suppliers that showed plans on slides now have to prove they can stand up steel, people, and product on schedule.

Urenco USA’s new cascades and a 15 percent lift

In May 2025, Urenco USA started up the first new cascade at its National Enrichment Facility in Eunice, New Mexico. In September 2025, it began producing with a second new cascade. The company’s current expansion plan adds about 700,000 SWU of capacity between 2025 and 2027, raising the site’s output by roughly 15 percent compared with the pre expansion baseline.

Why this matters

- It is domestic SWU that can be contracted in U.S. dollars under U.S. law without waiver risk. That reduces some of the counterparty, sanctions, and logistics friction that has haunted procurement teams since early 2022.

- A recurring cadence of new cascades matters more than any single cascade. It signals that crews, tooling, and QA processes are in a rhythm, which lowers execution risk for volume growth in 2026 and 2027.

- A 15 percent lift is not a flood, but it is a real increment that can re balance tails optimization decisions at utilities and fuel fabricators.

Contracting implications

- Expect firmer take or pay structures and delivery windows on new long term SWU deals. Domestic capacity that is actually ramping tends to price certainty into the term sheet.

- The expansion strengthens the hand of U.S. utilities negotiating for 2027 first deliveries. It is not a buyer’s market, but it is no longer a single source scramble.

Centrus delivers 900 kg of HALEU and wins a DOE extension

In late June 2025, Centrus announced that it had produced and delivered 900 kilograms of HALEU to the Department of Energy, meeting the production target for Phase II of its DOE contract. DOE extended the agreement for an additional year of production through June 30, 2026 as part of Phase III, with further options at DOE discretion. For the milestone and extension details, see Centrus delivers 900 kg HALEU.

Why this matters

- It confirms the supply chain can produce HALEU in the United States at a commercial site, not just in lab runs. That turns years of planning assumptions into something utilities and developers can schedule around.

- The one year extension into mid 2026 helps bridge the gap between demonstration output and multi supplier availability that DOE plans to create under its broader fuel buy program.

- It keeps the workforce hot. The biggest risk in centrifuge programs is not physics, it is pauses that cause talent and learning curves to dissipate.

Caveats to watch

- 900 kilograms is an achievement but not a full market. Advanced reactor deployments could require multiple metric tons per year per project. Commercial scale requires sustained capital, more cascades, and downstream conversion and fabrication capacity, which are not yet mature at the same pace.

Winners and losers in 2025

Winners so far

- Urenco USA. Demonstrated schedule performance and a visible 2025 to 2027 ramp that utilities can plan around. That shows up in stronger contracting positions and the ability to push for multi year volumes.

- Centrus. The only Western HALEU enrichment output today. The DOE extension pushes the program from pilot toward early productization. The company is now central to any developer schedule that needs domestic HALEU before 2028.

- Conversion and deconversion providers that can scale. The demand signal for UF6 conversion has been rising since 2022. HALEU adds deconversion challenges to oxides or metals that will favor early movers with licensed, staffed lines.

- U.S. based fuel fabricators. Qualified capacity in the United States that can handle both LEU and HALEU product forms becomes strategically valuable as waivers wind down.

Pressured players

- Rosatom linked traders and intermediaries. The waiver clock and utility reputational risk reduce appetite for Russian linked volumes even when technically allowed.

- Late moving utilities. Those counting on cheap spot or mid term Russian EUP are now forced into tighter windows, smaller uncommitted slices, and potentially higher all in delivered costs.

- New reactor developers without near term HALEU plans. Project timelines that do not align with 2025 to 2027 material availability risk slipping into the post 2028 world where competition for HALEU could be even sharper.

SWU and conversion markets under pressure

Separative work and conversion have been tight since 2022 and 2023. The 2024 ban and 2025 ramp only reinforce those pressures. The ripple effects also intersect with broader fuel trade shifts captured in our analysis of Europe’s Russian gas pivot.

What is pushing SWU pricing and availability

- Structural loss of a major supplier. Removing Russian EUP from U.S. portfolios forces reallocation to Western capacity that was not built for this share of global demand.

- Underfeeding to overfeeding swing. When SWU tightens, enrichers reduce underfeeding and increase tails assay. That shifts more demand back to the conversion market and raw U3O8.

- New cascade cadence is real but measured. U.S. additions in 2025 and 2026 matter, yet they come in steps, not surges.

Conversion pinch points

- UF6 conversion capacity has been ramping back after years of dormancy, but every uptick in tails assay and every contract that swaps EUP for SWU plus feed tightens the conversion balance again.

- HALEU adds a specialized twist. The supply chain must handle small lots, stringent safeguards, and different material forms. Licensed HALEU deconversion to oxide or metal is still a niche capability, so scheduling conflicts can cascade quickly.

What this means for delivered fuel costs

- Portfolio costs tend to rise when security of supply becomes the premium attribute. Utilities should expect to pay for firmness, earlier nominations, and domestic origin.

- Optionality has a price. SWU options, swing volumes, and tails flexibility can be valuable tools, but sellers will charge for them.

Utility procurement risk in the waiver era

Waivers exist to keep reactors fueled, not to preserve business as usual. They are time limited, documented, and politically visible. That changes risk calculus. Procurement also intersects with transmission and market rules, including evolving FERC 1920 A grid planning that can affect load growth expectations and outage coordination.

Key risks to manage

- Delivery certainty versus price. The cheapest offer that depends on a waiver can become the most expensive if the waiver fails or is conditioned in a way that adds time and cost.

- Counterparty concentration. Shifting large blocks from one supplier to another can create single point risk at exactly the wrong time. Balanced portfolios matter more in tight markets.

- Transportation and packaging. Cylinder availability, route permissions, and security planning add scheduling risk that traders cannot always fix with price alone.

- Licensing and fabrication changes. Reactor core design tweaks, burnable absorber strategies, or pellet specs that require new approvals can add months. Align fuel design changes with fabrication slot availability early.

Practical moves in 2025

- Lock in core SWU for 2027 to 2029 now, even if feed is not fully covered yet. It is easier to add feed later than to find SWU when cascades are sold out.

- Consider toll enrichment and feed ownership for flexibility. That can help balance conversion constraints with enrichment slots.

- Coordinate tails strategy with fuel designers. A modest shift in tails assay can smooth procurement and reduce schedule risk.

- Monitor data access and reporting changes that influence power market hedging, including the EPA’s 2025 data blackout.

What to watch through 2028

Timelines for LEU versus HALEU

- LEU. Urenco USA’s expansion schedule runs through 2027 with a target of roughly 15 percent more U.S. capacity on the back end of the period. That is the nearest concrete source of domestic SWU growth.

- HALEU. Centrus has proven output and holds a DOE backed production path through mid 2026 with options beyond that. Additional HALEU enrichment, conversion, deconversion, and fabrication nodes need to mature in parallel to meet multi ton annual demand by the late 2020s.

Deconversion bottlenecks

- HALEU produced as UF6 must often be deconverted to oxide or metal. That requires licensed lines, specialized containment, and trained staff. The most likely pinch points are small lot scheduling conflicts, not physics. Watch for announcements that add deconversion bays or shift hours to increase throughput.

Fabrication capacity and qualification

- LEU. Traditional fuel fabrication capacity remains tight in certain plants and lead times have stretched. Any vendor outage or extended maintenance creates ripples.

- HALEU. Fabrication is a story of formats. Oxide based fuels for some advanced light water designs may be closer to commercial practices. TRISO and metallic fuels require different facilities and qualification pathways. Expect staggered readiness by product form, not a single on switch.

The waiver horizon

- Waivers expire after January 1, 2028. Contracts that assume Russian EUP deliveries later than that date should be treated as contingent. Portfolio managers should model the value of certainty against any cost savings offered by waiver dependent volumes.

DOE contracting cadence

- The Department of Energy intends to use multi year offtake to catalyze private investment. Watch the timing and structure of awards under the fuel buy program. Awards that commit to volumes across 2026 to 2028 will shape which projects get financed and which remain slideware.

Allied supply and coordination

- Expect continued coordination with allied enrichers and fabricators. Cross border solutions can help, but only when logistics, export controls, and regulatory approvals are secured early. Contracts that rely on multiple jurisdictions need extra lead time.

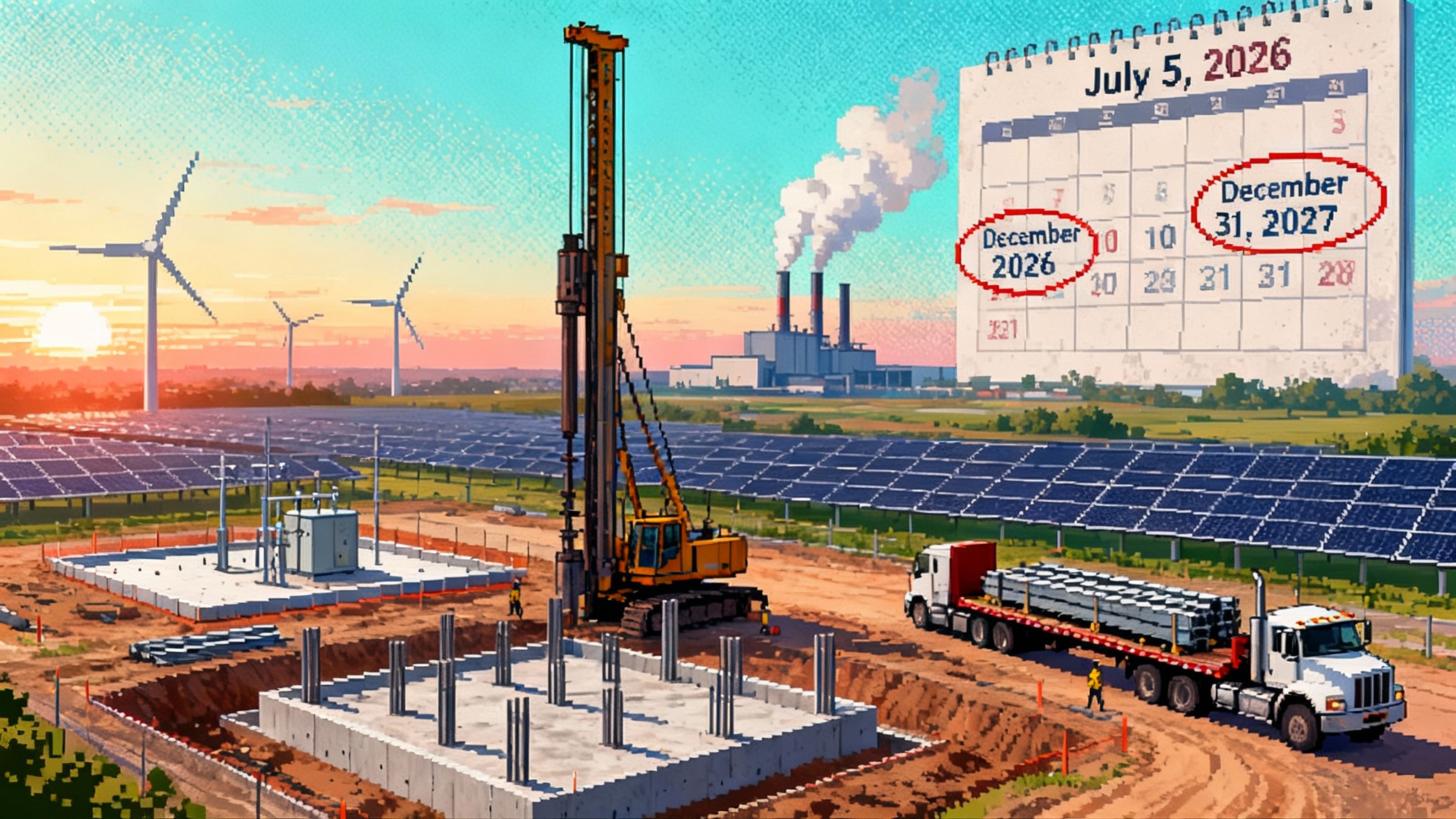

A simple map of 2025 milestones

- May 2025. Urenco USA starts its first new cascade, the first physical U.S. enrichment capacity addition in years.

- June 2025. Centrus completes delivery of 900 kg HALEU under Phase II and receives a DOE backed production extension into mid 2026.

- September 2025. Urenco USA begins production with a second new cascade, keeping the 2025 to 2027 expansion cadence intact.

These are not headlines in search of a trend. Together they form the spine of a rebuild that continues into 2026 and 2027.

Playbooks for each stakeholder

For utilities

- Shift from opportunistic to portfolio procurement. Anchor with long term SWU, then layer in feed and conversion as slots open.

- Value schedule integrity. Delivery assurance, early nominations, and transparent logistics often beat a lower unit price.

- Keep at least one domestic path in every core. If a waiver falls through, you still have a compliant baseline.

For suppliers

- Maintain a visible, repeatable commissioning cadence. Investors and customers reward predictability more than heroics.

- Build redundancy in critical spares and QA. The first new cascades and lines must run to prove the next wave.

- Co develop with fabricators. Align material form, packaging, and QA handoffs so that every kilogram moves without rework.

For advanced reactor developers

- Tie your technical roadmaps to real fuel readiness dates, not aspirations. If your first core depends on a material form that has not been fabricated at scale in the United States, bring a second path.

- Secure deconversion and fabrication slots early, even for test articles. Everyone else needs the same bays and autoclaves.

For investors and boards

- Follow awarded volumes, not announced ones. DOE backed offtakes and executed utility contracts are the best predictors of who scales.

- Watch workforce stability around key sites. Retention, training pipelines, and local partnerships will separate performers from presenters.

Bottom line

America’s 2024 ban set a deadline. 2025 turned it into a work plan. Urenco USA’s new cascades and Centrus’s HALEU milestone are not the end state, but they are the first visible steps in rebuilding domestic enrichment and the broader fuel ecosystem. SWU and conversion remain tight, deconversion and fabrication for HALEU are emerging, and procurement risk is shifting from price to certainty. Through 2028, the winners will be the players that turn schedules into steel, and the utilities that price certainty correctly while the window for waivers closes. The rebuild is underway. The clock is running.