The West’s day-ahead showdown: EDAM vs. Markets+ by 2027

The West is splitting into two day-ahead hubs as CAISO’s EDAM starts in 2026 and SPP’s Markets+ aims for 2027. See who is joining which market, the go-live timeline, and what the split means for prices, reliability, congestion rents, and investment signals.

A 2025 turning point that sets up a 2026-2027 market split

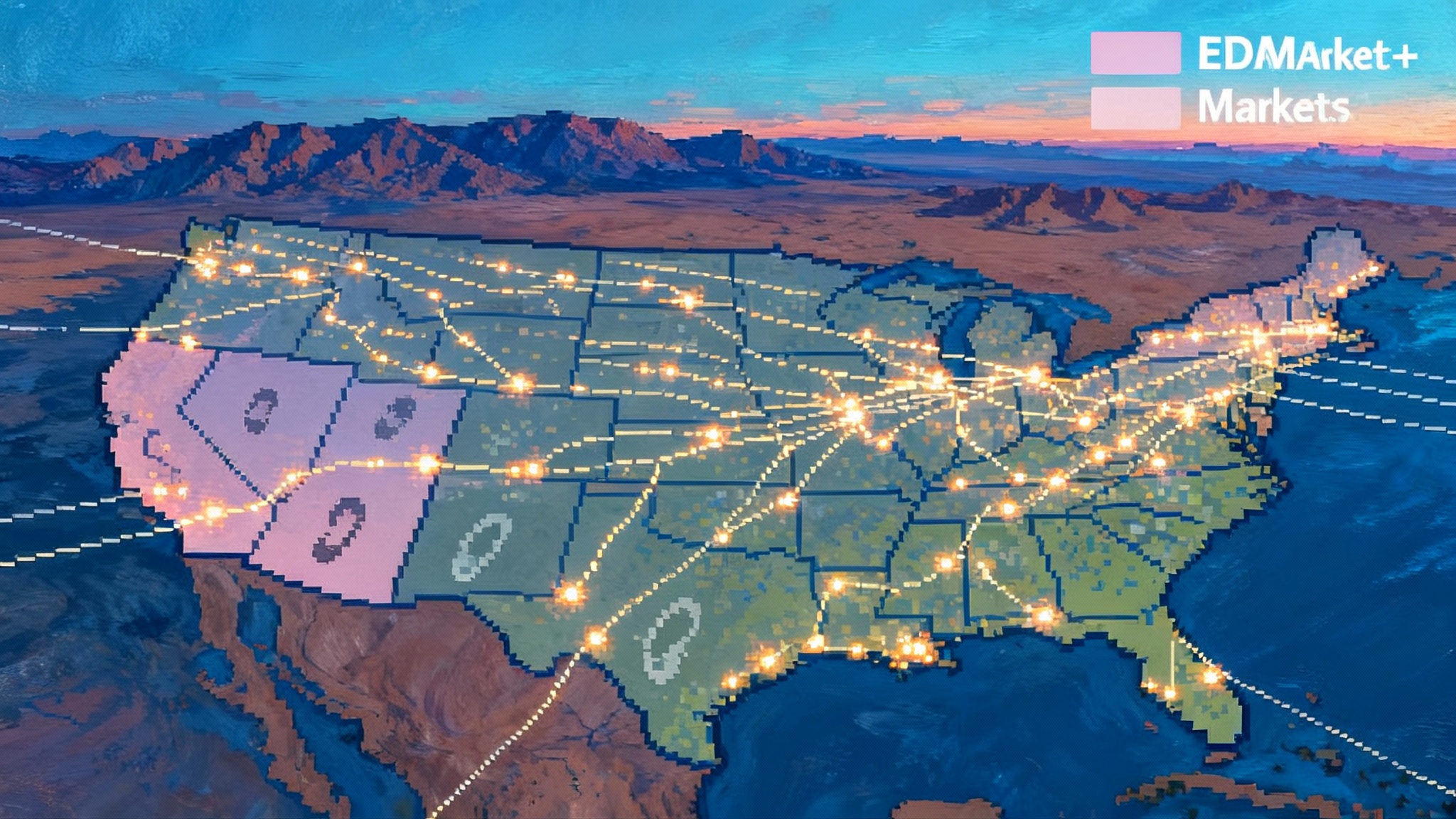

The Western Interconnection is heading into a decisive two-year stretch. In 2025, a cascade of approvals and utility commitments locked in a two-track future for day-ahead trading. On one track is the California ISO Extended Day-Ahead Market, or EDAM, which begins operations in 2026. On the other is Southwest Power Pool’s Markets+, which is building toward a coordinated launch in 2027. The result is a regional map that looks less like a single market and more like a pair of competing hubs with a long seam between them.

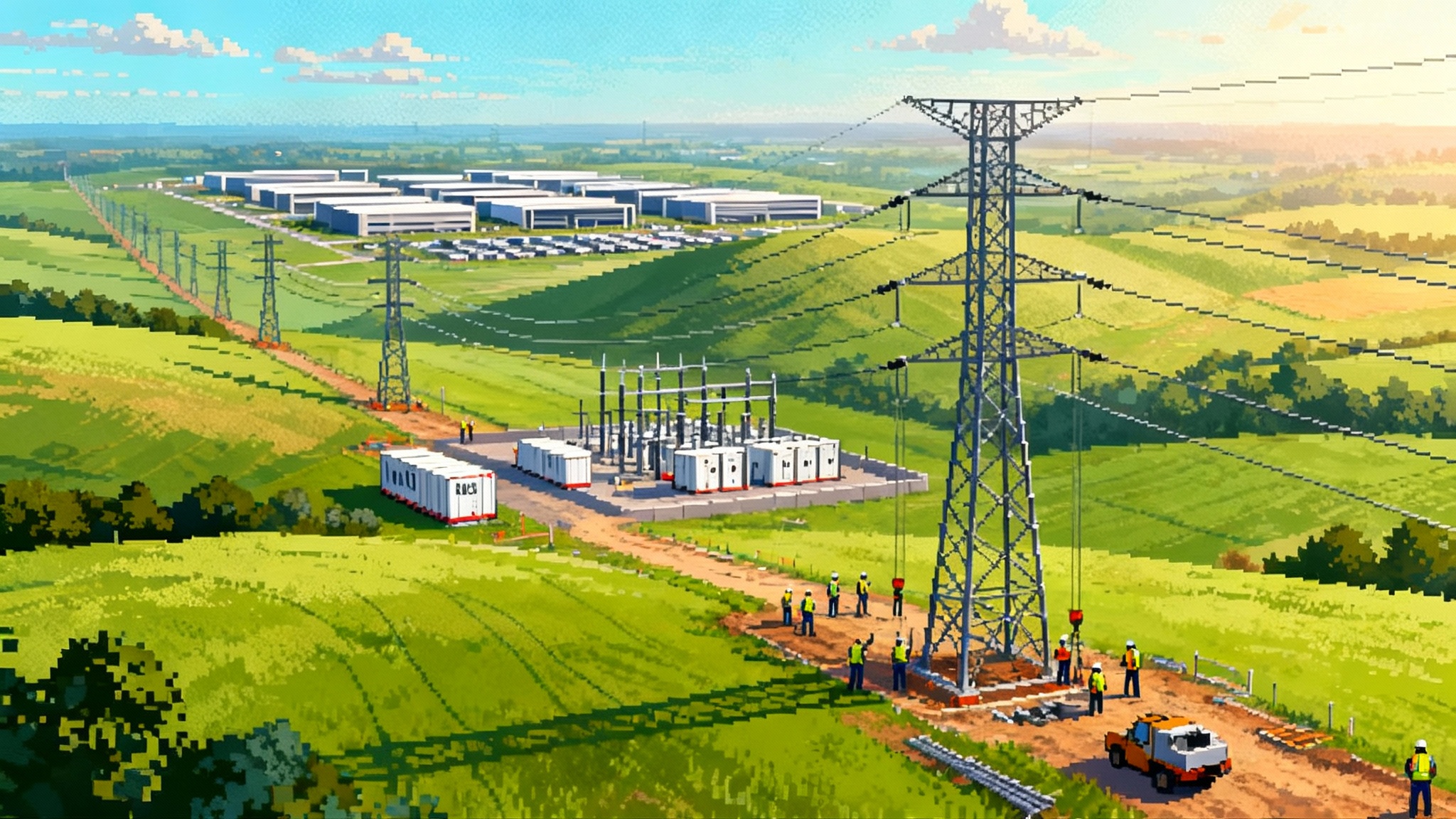

The stakes are high. Day-ahead markets set most wholesale prices, shape reliability during heat waves and winter storms, and determine who earns congestion revenue. For utilities facing surging load from data centers and electrification, and for financiers weighing billions of dollars in lines, storage, and renewables, which side of the seam you sit on will matter. For broader policy context on grid rules and demand growth, see FERC's September grid reboot and FERC 1920-A and data centers.

Timelines at a glance

- EDAM has cleared major tariff milestones and is moving through implementation and settlement testing for a first wave of participants starting in 2026. CAISO’s stakeholder docket shows an activation milestone on May 1, 2026, and a 2025 push to finalize how congestion revenues are allocated across participating balancing areas. See the official record of the CAISO EDAM status and timeline.

- Markets+ secured FERC approval of its tariff in January 2025, locked financing and phase-two governance in mid 2025, and is targeting an October 2027 go-live for its first cohort. SPP publishes a running roster of entities helping shape and fund the rollout, flagged for the October launch where applicable. See SPP’s list of Markets+ phase two participants.

Who is going where

EDAM first movers and announced join dates

- PacifiCorp: first mover, targeted spring 2026 entry.

- Portland General Electric: targeted fall 2026 entry.

- Balancing Authority of Northern California, which includes SMUD: targeted spring 2027 entry.

- Los Angeles Department of Water and Power: Board approval secured, targeted mid 2027 entry.

- Turlock Irrigation District: implementation agreement signed, targeted 2027.

- Public Service Company of New Mexico: implementation agreement signed in 2025, targeting 2027 with modeled gross annual benefits around 20 million dollars.

- Imperial Irrigation District: implementation agreements to join both WEIM and EDAM, targeting 2028.

Markets+ phase-two participants and initial-cohort signals

- Arizona group: APS, SRP, TEP, and UniSource announced Markets+ plans with a goal to participate at or shortly after the 2027 launch, citing reliability and nearly 100 million dollars in projected customer savings above current market participation.

- Powerex: funding and participation commitment, identified for the October 2027 launch cohort.

- Tri-State Generation and Transmission Association: identified for October 2027.

- Idaho Power: listed among phase-two participants and shown by SPP as planning for the October 2027 launch.

- Bonneville Power Administration: adopted a policy in May 2025 to pursue Markets+, with timing subject to subsequent rate and tariff proceedings and execution of market agreements.

The practical takeaway is that EDAM goes first with an Oregon and multi-state PacifiCorp anchor, then expands into California and New Mexico in 2027, while Markets+ forms a 2027 launch spine from the Desert Southwest through the Northwest anchored by the Arizona utilities, Powerex, and others, with BPA charting its path to join under its new policy direction.

Why it matters: the price story

Day-ahead co-optimization tends to converge prices across wider footprints, reduce uplift, and cut procurement risk. Two examples worth flagging:

- PNM modeled around 20 million dollars per year in gross benefits from moving into EDAM. The utility has already reported more than 100 million dollars in cumulative savings from CAISO’s real-time WEIM since 2021, a useful proxy for additional value unlocked by the day-ahead layer.

- Portland General Electric’s analysis concluded EDAM offered the best net customer value among options it evaluated, with modeled gross cost savings in the mid single to high teens of millions of dollars annually depending on participation.

Markets+ participants point to a different value stack. The Arizona coalition emphasizes reliability and access to Northwest hydro and broader regional diversity that can lower procurement costs during summer peaks. Powerex and other Northwest entities underline a design that preserves firm transmission rights and congestion rent hedges while enabling efficient day-ahead transfers. For price outcomes, the mix of hydro in the north, nuclear and gas in the middle, and solar-heavy portfolios in the south should yield complementary trading patterns that level out volatility when weather extremes hit at different times. Developers tracking federal incentives and build costs should also watch the 45Y and 48E crunch.

In both markets, the big wildcard is participation depth. More balancing areas means more efficient unit commitment, better use of transmission, and stronger liquidity. That is why the 2025 wave of funding commitments, implementation agreements, and governance seats is so critical. It tilts the scale on price convergence early in the life of each market.

Reliability under extreme weather

The West’s recent heat waves and extended cold snaps have exposed the limits of bilateral scheduling and small balancing footprints. Day-ahead markets change the playbook in several ways:

- Coordinated unit commitment across a larger footprint secures ramping capability for net load swings linked to solar and wind variability.

- Co-optimized energy and reserves improve scarcity pricing signals and the placement of ancillary services.

- Broader interchange reduces localized shortfalls during weather-driven peaks by tapping distant diversity. Northwest hydro can support Southwest heat events, while desert solar can assist shoulder-season hydro replenishment.

- Both markets include resource sufficiency checks. Markets+ ties participation to the Western Resource Adequacy Program, which aligns planning reserves and obligations across participants.

Utilities that faced emergency purchases in 2020 and 2022 are betting that day-ahead coordination trims those tail risks and smooths emergency procurement costs that otherwise flow through to customers.

Congestion revenue and hedging: how the designs differ

Congestion revenue is not just accounting trivia. It determines whether legacy firm rights and market hedges actually protect customer budgets. On this point, the designs intentionally diverge.

- EDAM and congestion revenue allocation: Under the core EDAM design, congestion revenue is assigned to the balancing area where the constraint binds, with suballocation under that entity’s tariff. In 2025, CAISO ran an expedited initiative to refine the handling of parallel flows that can arise when a schedule in one balancing area increases flows on a constraint in a neighbor. The outcome was a final proposal and tariff filing to land a transitional allocation that better aligns congestion rents with rights, in time for first-wave EDAM go-lives. The full sequence is visible in the CAISO EDAM status and timeline.

- Markets+ and congestion rights: Markets+ ties congestion rent distribution to contributed transmission and recognizes firm rights under participating OATTs. It adopts a familiar SPP-style hedging approach that uses auctioned congestion rights and revenues to distribute day-ahead congestion rents. For entities that have built and paid for firm transmission paths, this structure is attractive because it minimizes basis risk between legacy rights and day-ahead settlement outcomes.

The common goal is hedgability. If a balancing area or transmission customer cannot count on congestion revenue to offset expected day-ahead congestion, procurement costs rise and retailers face more volatile rate cases. Both markets spent 2025 tuning these mechanics. EDAM focused on cross-BAA parallel flow alignment. Markets+ refined how contributed rights and non-participating system interactions would be honored while still clearing efficient transfers.

Transmission investment signals

Nodal prices, congestion rents, and curtailment patterns are the market’s way of telling builders where to place wires, batteries, and flexible generation. The split market future will shape those signals in four ways:

- Price maps will reflect two clearing engines with different participant sets. Developers should expect persistent seams congestion between EDAM and Markets+ footprints until enough high-capacity interties are built or until seams rules mature.

- Where hydro meets solar, locational spreads are likely to narrow in typical conditions and widen in extreme ones. That creates compelling cases for long-duration storage near constraints that bind under drought or evening peaks.

- Markets+ entities that contribute firm transmission should see clearer congestion rent streams linked to those paths, which can de-risk merchant expansions that ride those corridors.

- EDAM’s transitional congestion revenue allocation is designed to protect rights holders as parallel flow effects emerge at market launch, which should prevent sudden shifts in hedge performance that might otherwise chill investment.

For financiers, the near-term question is not which market pays more, but where price formation will be most stable for 10 to 20 years. Areas with deep participation and transparent congestion management will command a premium.

Case studies: how key players are positioning

PNM, New Mexico

- Decision: Committed in July 2025 to join EDAM, targeting a 2027 start.

- Rationale: Builds on significant WEIM savings and models around 20 million dollars in incremental annual benefits in day-ahead. The move also aligns with PNM’s broader transition portfolio and need to optimize imports and storage under rising summer peaks.

- What to watch: Transmission import capability during evening peaks and the performance of EDAM’s parallel flow allocation for any interstate constraints that affect New Mexico imports.

LADWP, California

- Decision: Board approval to join EDAM, targeting mid 2027.

- Rationale: Enhance reliability and affordability while maintaining vertical integration and local control. EDAM lets LADWP optimize its diverse fleet and transmission rights day ahead without full balancing area integration into CAISO.

- What to watch: The interplay between LADWP’s congestion revenue and its internal rights on key import paths as EDAM ramps.

Arizona cohort, APS, SRP, TEP, UniSource

- Decision: Announced Markets+ participation plans with an eye on the 2027 launch, citing reliability and customer savings.

- Rationale: Rapid demand growth in Arizona and the opportunity to lean on Northwest hydro, regional wind, and a broader balancing area during severe heat. Markets+ governance and congestion rent treatment were cited as strong fits for their risk posture.

- What to watch: Summer 2027-2028 heat season performance, intertie limits with EDAM neighbors, and the evolution of markets-based hedges for key import constraints.

Bonneville Power Administration, Pacific Northwest

- Decision: Issued a final Day-Ahead Market Policy in May 2025 to pursue Markets+ participation.

- Rationale: BPA highlighted governance, resource adequacy, greenhouse gas accounting, and congestion rent treatment as decisive design advantages for Markets+ relative to EDAM. BPA also underscored the need to preserve the value of the Federal Columbia River Power System and customer obligations.

- What to watch: Follow-on rate and tariff proceedings, execution of market agreements, and the alignment of BPA’s hydro operations with Markets+ scarcity pricing. BPA’s timing relative to the October 2027 launch will influence Northwest liquidity at go-live.

Powerex, cross-border merchant

- Decision: Funding and participation commitment for Markets+, shown in SPP’s roster for the October 2027 launch.

- Rationale: Independent governance and a market design that preserves hedges and recognizes contributed transmission. Powerex has also signaled interest in supporting interregional connectivity with incremental transmission investments.

- What to watch: Cross-border trade patterns across the seam, and how Markets+ and EDAM handle greenhouse gas accounting on exports into carbon-priced jurisdictions.

The 2026-2027 watchlist

Milestones that could sway utilities, data centers, and financiers:

- EDAM first operations, 2026: Execution quality during PacifiCorp’s spring 2026 and PGE’s fall 2026 entries, including price convergence, scarcity pricing during heat events, and initial congestion revenue allocations across BAAs.

- EDAM second wave, 2027: BANC spring 2027 and LADWP mid 2027 entries will show how EDAM scales with more public power balancing areas. PNM and Turlock onboarding timelines will shape New Mexico and Central Valley price maps.

- Markets+ system build, 2025-2027: Progress on market trials, parallel operations, and October 2027 go-live readiness. Keep an eye on the final composition of the launch cohort and any late joiners.

- BPA implementation steps, 2025-2026: BPA’s rate, tariff, and agreement processes will clarify timing and scope of its Markets+ entry, which is pivotal for Northwest liquidity and hydro optimization.

- Seams management, continuous: Coordination protocols between EDAM and Markets+, including congestion modeling and interchange scheduling, will determine how often the seam binds and how expensive those hours become.

- Resource adequacy alignment: Markets+ WRAP alignment and EDAM sufficiency tests will set planning and procurement behaviors. Any divergence in how each market credits imports, storage, and demand response will affect buildout decisions.

- Greenhouse gas accounting refinements: Design details for greenhouse gas attribution on transfers into carbon-priced states will influence dispatch and bilateral contracting at the seam.

- Data center siting: Watch announcements in Phoenix, Salt Lake City, Las Vegas, and along the I-5 corridor. Developers will weigh wholesale price stability and interconnection timelines that are shaped by each market’s congestion patterns and planning signals.

- Transmission approvals: Regulatory milestones for large interties and uprates that relieve chronic seams constraints will catalyze additional participants and reduce price separation.

Bottom line

The West is not converging on one day-ahead market. It is getting two, with EDAM going live first and Markets+ forming a second hub a year later. That does not have to be a problem. If both launch cleanly, manage congestion rents fairly, and coordinate across the seam, customers will see more stable prices and fewer emergency purchases as extreme weather becomes more frequent. For utilities and financiers, the next 24 months are the window to align portfolios, hedges, and transmission bets with the market design that best matches their risk and governance preferences.