HALEU’s turning point: America’s fuel plan gets real

June 25, 2025 put real fuel in play. Centrus delivered 900 kg of HALEU to DOE and won a production extension through June 30, 2026, just as the Russian uranium import ban that took effect on August 11, 2024 drives the market toward a hard stop on waivers by January 1, 2028.

Why June 2025 changed the fuel story

For years, every US advanced reactor schedule began with a caveat: fuel. That shifted on June 25, 2025, when Centrus produced and delivered 900 kilograms of HALEU to the Department of Energy and secured a production extension through June 30, 2026. It is the first meaningful domestic supply of HALEU, turning plans into product and funding a path to keep producing at least 900 kg per year. See how Centrus details its June HALEU deliveries.

Policy pressure rose at the same time. The law banning imports of Russian enriched uranium took effect on August 11, 2024, with waivers capped each year and ending January 1, 2028. DOE’s summary spells out the clock and the caps. Read how DOE explains the ban and waivers.

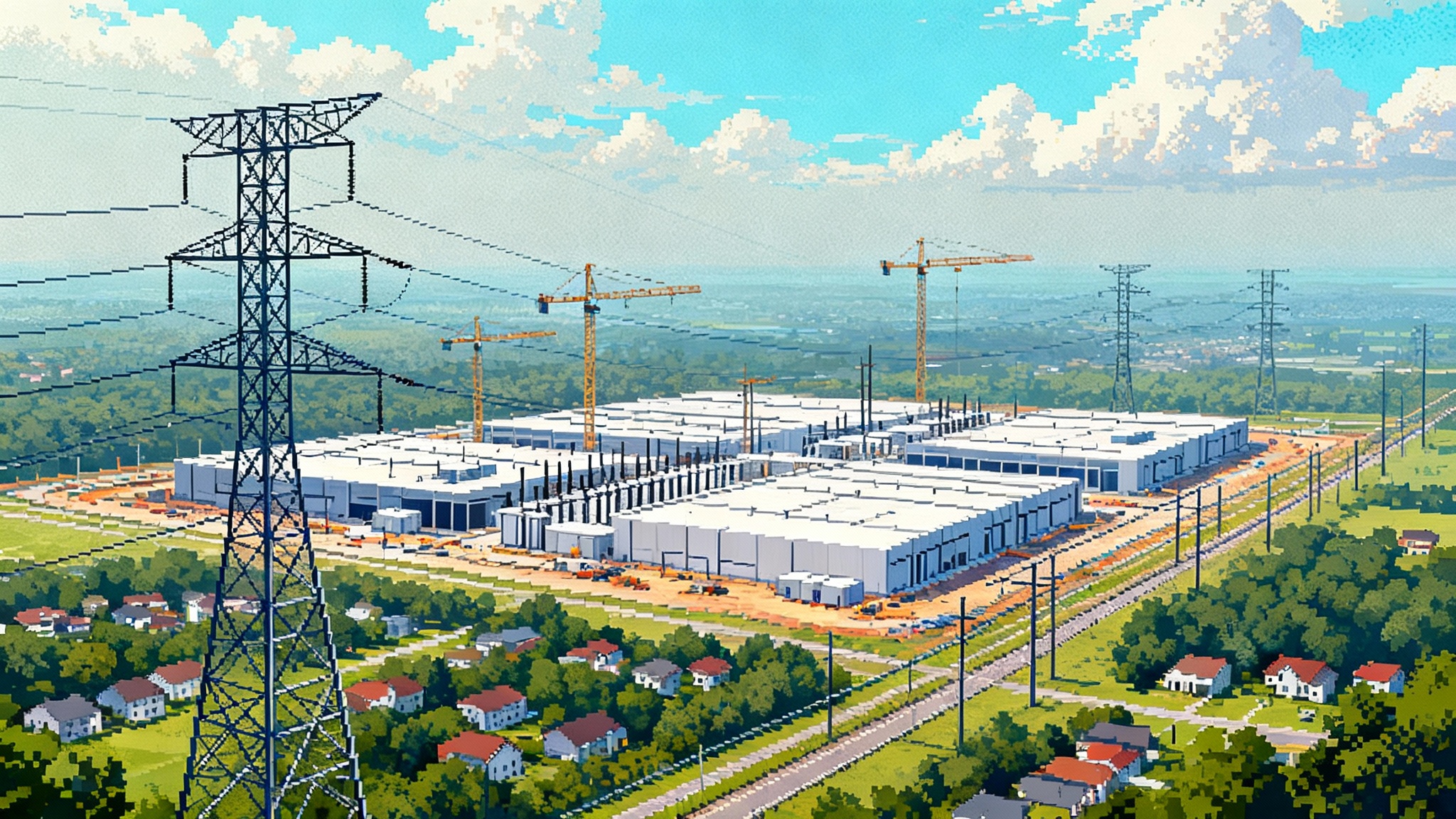

This fuel shift lands amid rising electricity demand and changing grid rules. For context on planning and load growth, see our analysis of the new grid playbook for data centers and the AI power boom and LNG exports.

The 2025 to 2028 clock

- August 11, 2024: Russian enriched uranium import ban takes effect. Limited waivers can be issued case by case.

- Calendar 2025 to 2027: Annual waiver ceilings step down. Utilities must plan reloads against shrinking headroom.

- January 1, 2028: Waiver authority ends. Portfolios must be independent of Russian supply.

- June 2025 to June 2026: Centrus Phase III year one under DOE option. Additional options could extend production beyond 2026 subject to funding and DOE decisions.

- 2025 to 2027: Urenco USA adds roughly 700,000 SWU in New Mexico and pursues licensing up to 10 percent enrichment for LEU+.

- 2024 to 2027: DOE’s HALEU Availability Program moves from awards to site work on US deconversion and metallization.

Where the bottlenecks will bite

1) Enrichment to HALEU

- What exists today: Centrus is producing HALEU in Piketon at a demonstration footprint aligned with about 900 kg per year, now under a live production contract through June 30, 2026.

- What demand looks like: DOE planning points to more than 40 metric tons needed by about 2030 for demos and initial deployments, with domestic demand potentially on the order of 50 metric tons per year by 2035 as fleets scale.

- Gap for 2028 readiness: Several first cores drive near term needs. A microreactor may require tens of kilograms while a 300 to 400 MWe fast reactor first core can need several metric tons of HALEU in metal form. A prudent 2028 target is several metric tons in the right forms, not just UF6.

- Western LEU backstop: Urenco USA and European plants are lifting SWU for LEU, easing pressure on the legacy fleet. HALEU still requires dedicated cascades, security, and licenses that take time, so near term HALEU leans on Centrus until additional Western lines are online.

2) Deconversion and metallization

- Why it matters: Enrichment output is UF6 gas. Reactors need oxide powder, metal, or TRISO kernels. Commercial scale US capability is still building.

- What exists today: Limited, specialized capacity has supported defense, research, and TRISO development. DOE issued deconversion IDIQ awards in October 2024 to stand up US oxide and metal. Developers such as TerraPower and Framatome have announced a HALEU metallization pilot.

- The near term gap: Even if UF6 output rises, deconversion and metallization can bottleneck delivery. The 2026 to 2027 objective is repeatable, licensed batches that meet fabricator specs.

3) Fabrication

- LEU+ oxide fuel: Westinghouse and Framatome are preparing to make LEU+ slightly above 5 percent to lengthen cycles for the existing fleet.

- TRISO for HTRs: BWXT has legacy capabilities and X-energy’s TRISO-X facility is advancing. Volume is limited and hinges on HALEU oxide kernels.

- Metal fuel for fast reactors: TerraPower’s metallurgy pilot with Framatome is critical to stand up domestic metal capability.

- The gating item: Qualification and licensing for higher enrichment handling, new chemistries, and new product forms. Early lead test assemblies, shipping approvals, and outage windows are premium assets.

Who benefits and what could go wrong

Centrus

- Why it wins: First Western producer of HALEU, delivered 900 kg in June 2025, and holds a live contract through June 2026 with options.

- Risks: Scaling requires capital, cylinders, and task orders. A single-site footprint and appropriations timing add execution risk.

Urenco

- Why it wins: US SWU expansion supports the legacy fleet and LEU+. Urenco also holds a DOE HALEU IDIQ that could enable a second Western HALEU source with dedicated cascades.

- Risks: HALEU needs different cascades and security envelopes. Investments likely track firm orders and licensing.

Orano

- Why it wins: European capacity expansion plus US plans in Oak Ridge, along with DOE awards for HALEU enrichment and deconversion.

- Risks: US timelines depend on licensing, siting, funding, and customer commitments.

Fabricators and deconverters

- Why they win: LEU+ extends cycles for the legacy fleet. US deconversion opens a new market as HALEU UF6 converts into oxide and metal.

- Risks: Qualification, audits, and NRC approvals can slip schedules.

Utilities

- Why they win: Western SWU expansions, LEU+ adoption, and growing conversion capacity provide a path off Russian material.

- Risks: Waiver caps decline annually and disappear by 2028. Late re-sourcing risks price spikes and outage congestion.

Advanced reactor developers

- Why they win: DOE is allocating HALEU to select projects and initial domestic batches exist.

- Risks: TRISO kernels and HALEU metal still hinge on US deconversion and metallization arriving on time.

DOE funding levers now in motion

- HALEU Availability Program: 10-year deconversion IDIQs to place orders as sites come online.

- Enrichment IDIQs: Multiple awardees create competition and redundancy for future HALEU capacity.

- Federal offtake: LEU purchases to underpin domestic enrichment investment.

- Credits and loans: Section 48C can defray capex and LPO financing can match long paybacks if milestones are met.

- Import ban signal: A hard stop on Russian supply by January 1, 2028 aligns federal procurement with domestic and allied sources.

What it means for project timelines

- Microreactors and test beds: First to leverage DOE allocations and Centrus output. Smaller core loads enable earlier demonstrations if deconversion and fabrication are ready.

- High temperature reactors: TRISO throughput is the pace-setter. Kernel and compact production must cadence reliably.

- Fast reactors: HALEU metal is the long pole. Successful metallization pilots unlock first cores and reloads.

- Context: As nuclear scales, grid planners are also integrating new demand and resources. See how batteries as the new peaker plants are changing capacity planning alongside firm generation.

Implications for the life-extended fleet

- LEU+ as bridge: Moving from 4.95 percent to roughly 6 to 8 percent can extend cycles and reduce annual SWU and conversion needs.

- Licensing and logistics: Plants need vendor qualification plus NRC permissions for higher enrichment transport and handling.

- Portfolio effect: Staggering LEU+ adoption and uprates across units helps avoid synchronized outages and spot market exposure.

A practical playbook for 2025 to 2028

For utilities

- Convert legacy Russian positions into Western options early and treat waivers as last-resort insurance.

- Pursue LEU+ licensing and lead test assemblies to enable longer cycles by 2027.

- Book conversion and enrichment together with fabrication slots to avoid stranded material.

For advanced reactor developers

-

Lock in deconversion and fabrication partners now. Sequence kernel, powder, or metallization capacity alongside enrichment contracts.

-

Design for flexibility in first cores. Qualify multiple suppliers and forms where possible.

-

Use DOE task orders and allocations to crowd in private capital, then scale to multi-ton commitments that justify new cascades.

For investors

- Look for three markers: multi-year offtakes, visible NRC progress for higher enrichment handling, and deconversion moving from award to hardware.

- Expect tightness in SWU and conversion to keep price signals elevated. Companies with real throughput, not just plans, earn premiums.

The upshot

The United States now has a domestic HALEU supply line producing cylinders and shipping product. Centrus’s 900 kg delivery on June 25, 2025 turned policy into fuel. With the Russian import ban in force since August 11, 2024 and waivers ending January 1, 2028, every portfolio must be Western by the 2028 refueling cycle. From here, success is a manufacturing and licensing challenge: turn IDIQs into oxide and metal on US soil, and turn lead tests into licensed, repeatable fuel. Get both fronts moving and advanced reactors can load first cores on credible dates while the life-extended fleet gains breathing room with LEU+.

![Why Your UI Shows [object Object] and How to Fix It Fast](https://fvnmlvqcgqaarpyajaoh.supabase.co/storage/v1/object/public/images/1758580185084-c5pj4s.png)