AI islands collide with Texas’s new 765 kV power superhighway

AI data centers are racing into the Permian on islanded gas-plus-battery microgrids while Texas readies 765 kV lines to move bulk ERCOT power west. SB 6 rewrites who pays, how to connect, and when operators must curtail.

Two Texases are emerging for AI power

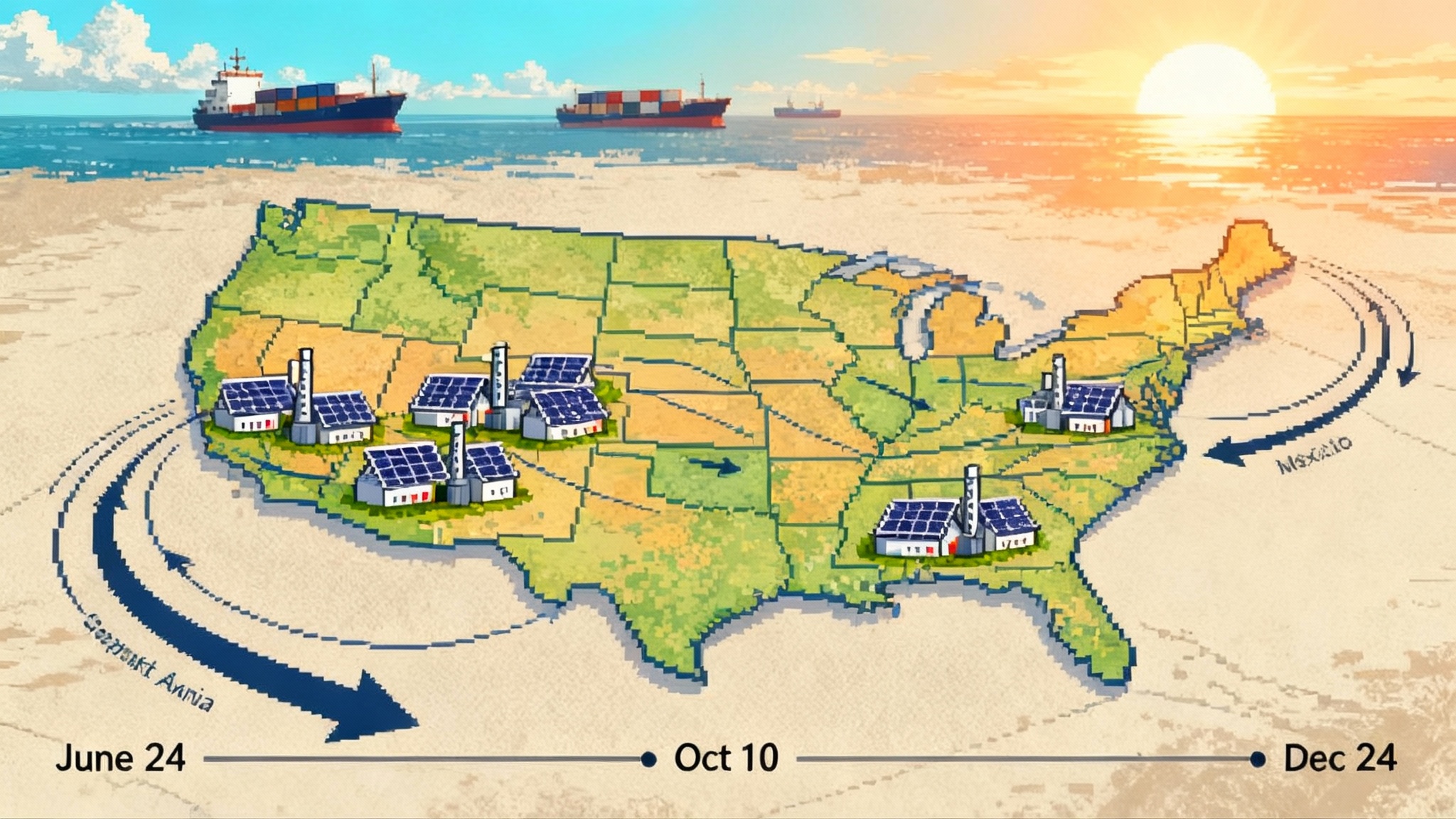

On one side are off-grid campuses blooming across the Permian. In Midland County, developers secured 320 acres for a data center hub that plans 150 megawatts next year with room to scale to multiple gigawatts, backed by dedicated natural gas and battery support. The model is straightforward: build an islanded, behind-the-meter microgrid using reciprocating engines and batteries, skip the ERCOT interconnection queue, and scale as fast as servers arrive.

On the other side is a grid Texas is rushing to bulk up. In April 2025, state regulators approved extra-high-voltage 765 kV transmission corridors as part of the Permian Basin Reliability Plan to push bulk power toward the oil patch and data center clusters. The lines are designed as a multi-lane superhighway that can move more power with fewer corridors, but they have ignited resistance across Hill Country communities concerned about viewsheds, land rights, and wildfire risk. For national context on transmission governance, see how states gain leverage in grid planning.

Hovering over both is a new law passed on May 27 and signed June 20, 2025: SB 6. It rewrites how very large loads plug in, what they must disclose, how much cost they shoulder, and under what conditions grid operators can curtail them. The Legislature’s message is clear. Texas wants the AI boom, but not on ratepayers’ backs or at the expense of reliability. For specifics on thresholds, study fees, and curtailment protocols for new large loads over 75 megawatts, see this summary of Texas SB 6 large load rules.

What SB 6 actually changes for big loads

SB 6 targets very large single-site loads by default at 75 MW and above, with room for the Public Utility Commission of Texas to adjust. The law directs the PUCT to craft uniform interconnection standards and cost participation rules that apply across investor-owned utilities, municipal utilities, and co-ops. Key shifts:

- A uniform study on-ramp. New large loads must post a flat initial transmission screening fee, no less than six figures, to trigger a consistent set of studies. That standardizes a process that has varied widely and has been vulnerable to serial applications and speculative requests.

- Financial skin in the game. SB 6 requires uniform financial commitment for necessary network upgrades, with deposits or prepayments credited to actual costs. It is designed to curb speculative queue squatting and reduce stranded investment risk.

- Full disclosure. Applicants must tell the interconnecting utility if they are pursuing similar service elsewhere in Texas and report any on-site backup generation. That data flows to ERCOT for planning and resource adequacy modeling.

- Netting with on-site generation under scrutiny. If a generator wants to net meter with a new large load, the PUCT must approve it after system studies. Conditions can require that formerly dispatchable capacity remains available during emergencies and that behind-the-meter customers reduce load under specified events.

- Reliability services from the demand side. The PUCT will create a competitive service to procure advance load reductions from large customers to stabilize the grid in tight conditions. For how other regions are accelerating large-load interconnections, see who connects first now.

- The curtailment kill switch. Before a new very large customer connects, utilities must install the equipment and protocols to curtail that load during firm load shed events. In short, no more connecting a mammoth site without a definitive way to turn it down fast when the grid is in distress.

- Who pays is under review. SB 6 orders a review of how wholesale transmission rates are assessed, including what elements should be considered non-bypassable.

Put together, SB 6 trades speed for certainty. It does not promise instant interconnections, but it sets lanes, fees, disclosures, and emergency controls up front so planners can integrate multi-hundred-megawatt loads without guessing.

Off-grid microgrids vs the new superhighway

The Permian’s off-grid strategy solves one problem fast. If you do not touch the grid, you can build now. A behind-the-meter gas-plus-battery microgrid avoids ERCOT’s queue and most of the transmission cost allocation that SB 6 tightens.

But it creates a different set of tradeoffs:

- Emissions. A modern large reciprocating engine can hit mid 40 percent thermal efficiency and respond quickly to load swings. Paired with batteries, it can smooth spikes and improve local power quality. Even so, it is still a fossil generator. ERCOT’s system power from January to August 2025 hit a record 46.5 percent clean share, while California’s reached 74 percent. Sourcing from a grid trending toward half clean will generally yield a lower carbon intensity than a gas-only island unless the off-grid operator procures verifiable clean electricity or offsets at scale. See reporting on Texas and California clean power shares.

- Local air and noise. NOx and criteria pollutants are local. Engine choice, aftertreatment, and duty cycle matter for compliance and community acceptance. Hill Country pushback to new high-voltage lines is intense, but opposition to clusters of engines near ranches or towns can flare just as quickly.

- Reliability scope. For the grid, an islanded data center is one less multi-hundred-megawatt interconnection to manage this year. For the operator, reliability rests on gas supply firmness, engine uptime, and parts logistics. Many designs add battery redundancy to ride through maintenance and step loads. Some will add a small grid tie later for market services. Fully off-grid sites cannot sell demand response into ERCOT and cannot benefit from ERCOT’s diversity and reserves during contingencies.

- Price risk. Off-grid buyers lock in fuel and O&M, gaining insulation from grid price volatility, yet they forgo the option value of buying from a wholesale market adding vast solar and batteries that can push down real-time prices in many hours.

By contrast, the 765 kV buildout aims to change the geography of supply and demand. One extra-high-voltage circuit can move the power of multiple 345 kV lines with lower losses over long distances and fewer rights-of-way. The controversy is routing. Hill Country landowners see little local benefit and significant visual and environmental risk. Utilities argue that fewer, higher-capacity lines can meet West Texas growth while minimizing total disturbance. That fight will play out over routing and mitigation in the next several years.

Who ultimately pays

This is the heart of SB 6. Before 2025, a large load could sometimes structure on-site generation and retail arrangements to limit exposure to shared transmission charges, shifting costs to other customers. SB 6 pushes the pendulum back by:

- Direct funding of upgrades. Large loads must fund interconnection-driven upgrades through deposits or prepayments that are trued up against actuals.

- Reassessing rate design. Portions of transmission access and wholesale service charges may be deemed non-bypassable. Even if a campus self-supplies much of its energy, it would still pay into the backbone it depends on for redundancy or future market access.

- Tightening netting rules. Arrangements between a new load and an existing generator will be reviewed and conditioned to protect reliability and cost allocation.

For broader policy context on transmission cost allocation and governance, revisit how states gain leverage in grid planning.

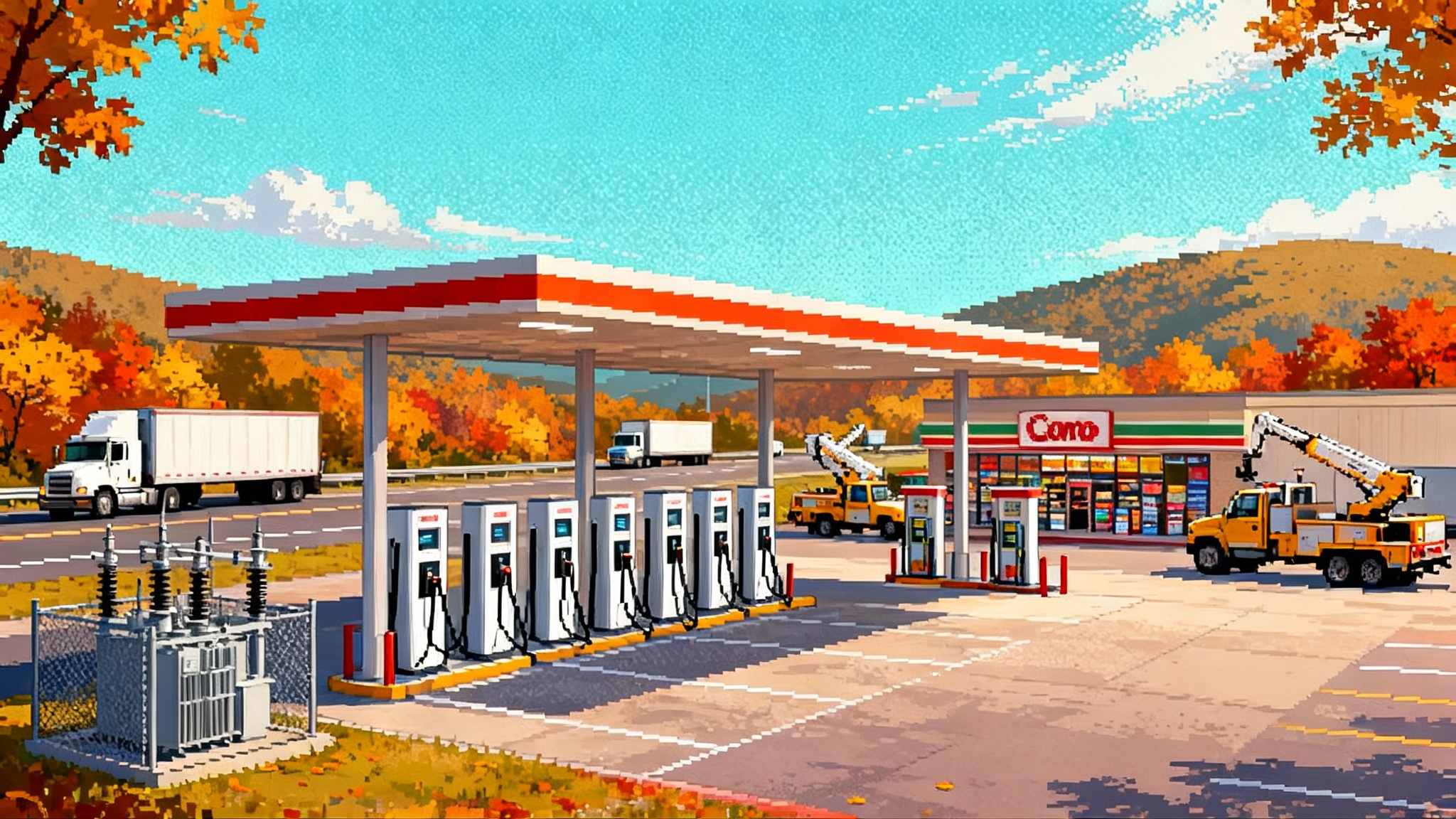

The curtailment kill switch in practice

The law’s call to enable curtailment before connection makes Texas an early mover on load governance. Technically, this means metering, communications, relays, and controls that let utilities and ERCOT drop a data center’s draw in firm load shed events without ambiguity. Policymakers learned from crypto mining volatility and early AI pilots that soft asks are not enough. Codifying a hardware and protocol standard creates certainty on both sides.

For operators, this is manageable. Most modern campuses already use advanced power management to protect servers and cooling during sags and swells. Integrating a clear external curtailment signal is a definable engineering task. The bigger issue is the business model: when curtailed, do you get compensated through the new demand reduction service the PUCT is setting up, and how is that priced against lost compute revenue.

Emissions math and the reliability ledger

- Grid mix is getting cleaner. Record solar additions and the rise of multi-hour batteries have pushed ERCOT toward a near half clean mix for much of 2025, reducing average and marginal emissions in many hours.

- Off-grid gas burns all hours. Some developers will match consumption with purchased renewables or build co-located solar. Others will rely on efficiency and battery hybrids. Without a credible clean power strategy, an off-grid campus will have a higher carbon intensity than buying from ERCOT on average.

- Waste heat and water. Engines produce useful heat that can be captured for absorption chilling or industrial uses, but most campuses will dump it. Cooling water needs and local thermal plumes can be constraints. Air-cooled designs ease water use but can raise acoustic and thermal challenges.

Reliability cuts both ways:

- For ERCOT. Every islanded campus is one less immediate demand to serve and one more risk removed from tight summer evenings, yet it is also one less flexible load that can be paid to turn down when reserves are thin.

- For the campus. Off-grid shifts reliability onto fuel contracts and spares. Most operators will either dual-source gas, overbuild engine N plus 2, or add a grid intertie as insurance.

The 2030 demand picture

Industry forecasts suggest U.S. data centers could approach a tenth of total electricity use by 2030 depending on AI adoption and efficiency gains. That is not a cliff. It is a climb that compounds year over year. Texas and California are positioned to meet that increase because they are adding solar, wind, and batteries at national-leading rates and they have active policy debates on how to align large loads with system reliability.

The opportunity set by player

-

Hyperscalers

- Fast path: launch on islanded gas plus batteries in the Permian to meet 2026 to 2027 compute needs. Design for an eventual grid intertie under SB 6 to access lower marginal energy when ERCOT prices dip and to sell demand reductions into the new service.

- Emissions strategy: contract new-build renewables and storage in ERCOT, even if islanded initially. Use financial PPAs with additionality, then physically interconnect when the 765 kV corridors open. Engineer a curtailment interface that protects servers while meeting PUCT standards.

- Cost control: treat the SB 6 study fee and deposits as option premium for future grid access. Build the kill switch and telemetry on day one to avoid retrofit.

-

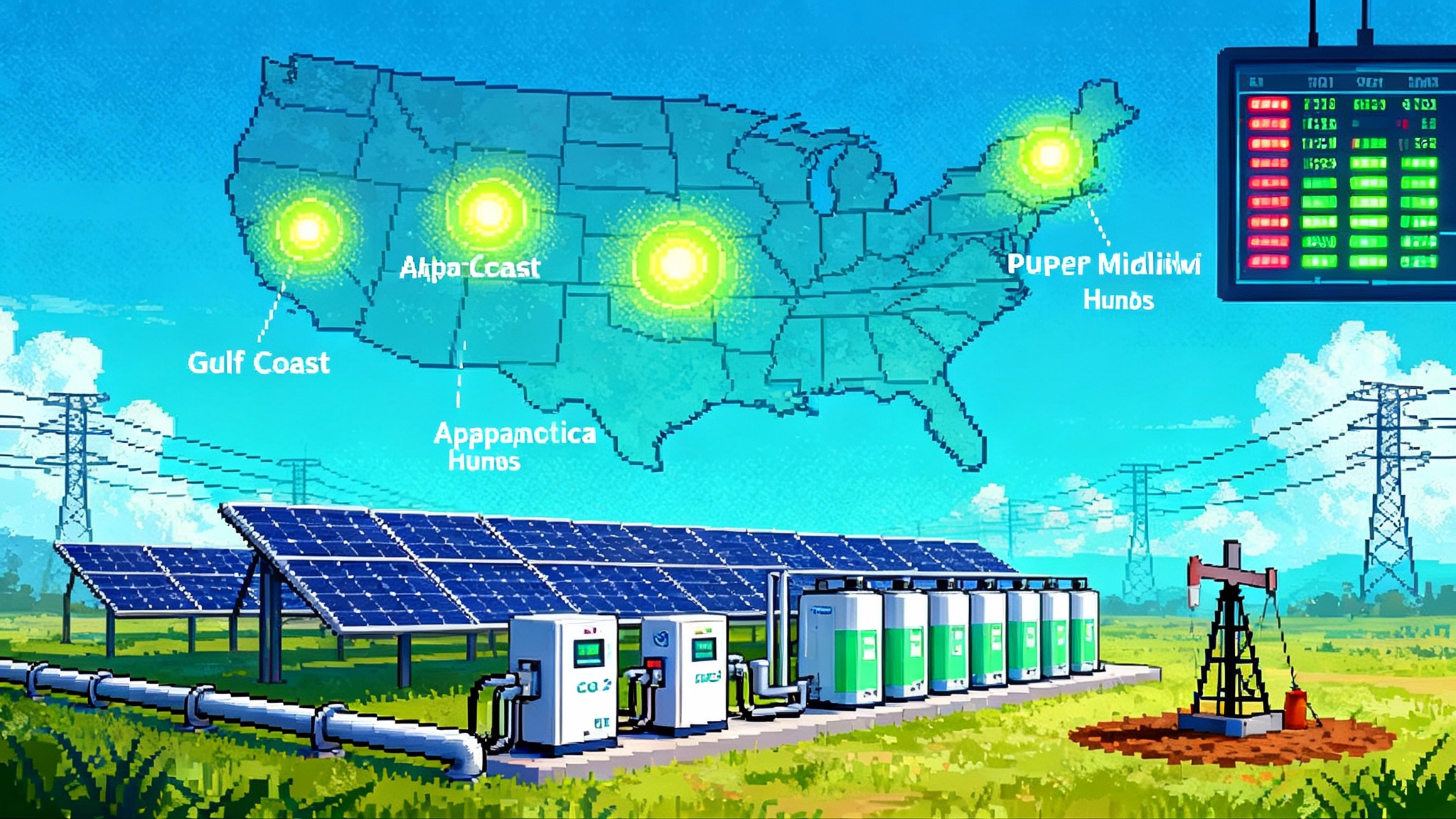

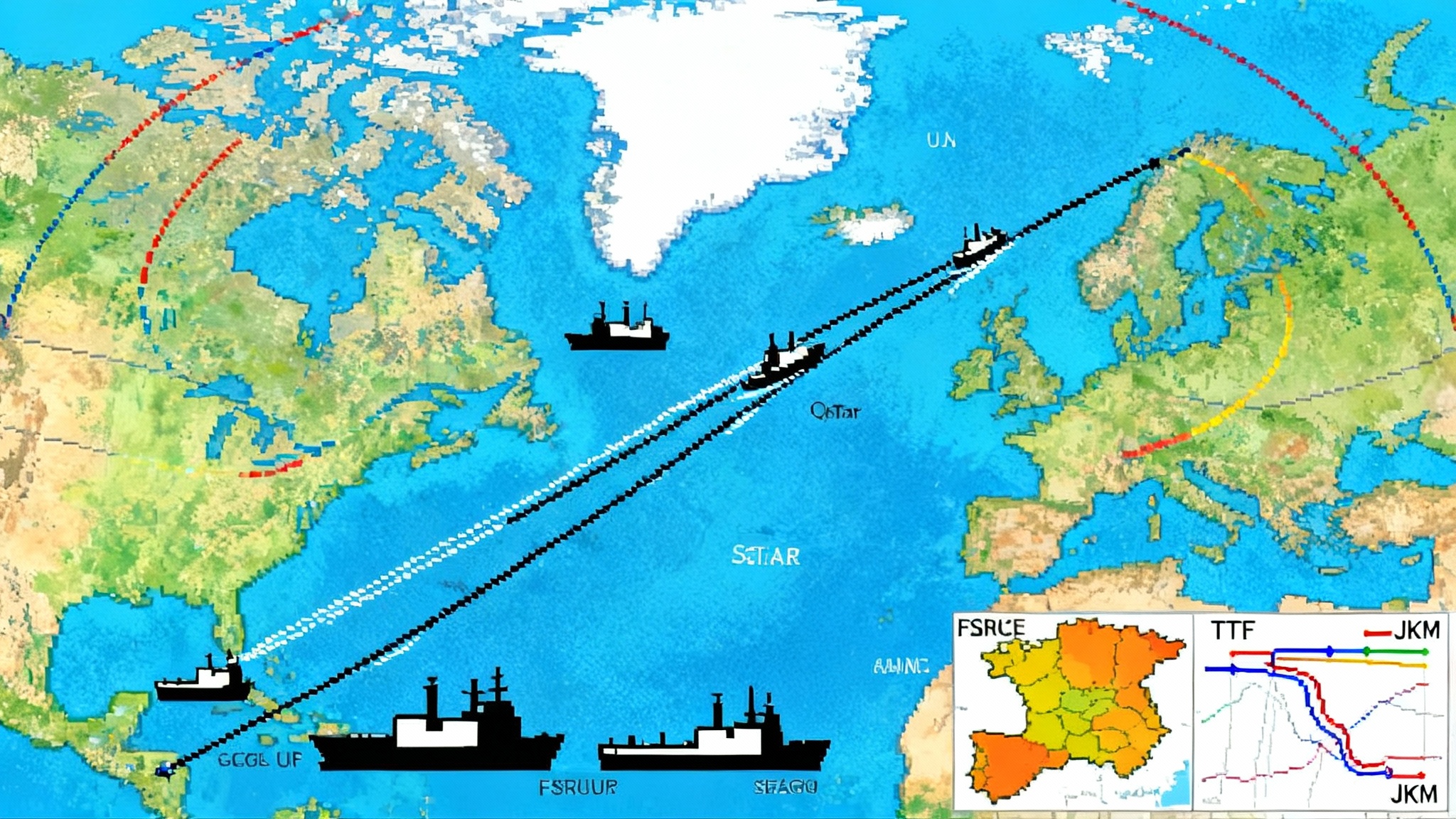

Gas producers and midstream

- Near term: lock in multi-year firm supply for islanded campuses. Offer price hedges indexed to Waha gas that keep all-in power below grid alternatives in peak years. For market tailwinds, see America's LNG reboot and Gulf projects.

- Mid term: pair gas supply with carbon solutions. On-site oxidation catalysts for NOx are the floor. Evaluate CO2 capture pilots or blue hydrogen blends if policy incentives align.

- Long term: expect a pivot to grid-plus-gas hybrids as the 765 kV lines arrive. Structured tolling where engines run for peak and resilience while grid supply handles base hours could extend engine life and cut emissions.

-

Renewables and storage developers

- Near term: sell additionality. Off-grid buyers need credible decarbonization claims. Offer 12 to 15 year virtual PPAs with shaped profiles aligned to data center load and deliver DC-coupled storage options for when they interconnect.

- Mid term: target the Permian edges. As 765 kV import paths advance, interconnection points near the new substations will become high value for utility-scale batteries.

- Long term: pitch hybrid resource clusters. Solar plus 4 to 8 hour batteries near the superhighway nodes can feed both grids and data centers, with curtailment-friendly control schemes to monetize the PUCT’s demand reduction service.

What to watch next

- PUCT rulemakings under SB 6. The fine print on non-bypassable charges and the exact curtailment interface will determine cost and compliance. Expect workshops on telemetry specifications, tripping priorities, and testing protocols.

- Routing battles on the 765 kV corridors. Hill Country resistance will drive route changes and mitigation requirements. Watch for narrower rights-of-way, wildlife protections, and selective undergrounding near critical crossings.

- The hybridization of today’s islands. Many early off-grid campuses will seek a grid tail once the superhighway is within reach. That is when SB 6 cost sharing and disclosure rules will show their teeth.

Bottom line

Texas is building two answers to AI’s power appetite at once. Off-grid microgrids are the sprint, delivering compute quickly in West Texas with a fossil footprint that operators must actively decarbonize. The 765 kV superhighway is the marathon, opening a durable path to move large volumes of increasingly clean ERCOT power to the Permian. SB 6 ties them together by making interconnection predictable, cost sharing fairer, and curtailment enforceable. For hyperscalers, gas suppliers, and clean energy developers, the winning play is to launch fast on islands, line up clean energy and controls that meet SB 6, and be ready to plug into the superhighway the moment the pylons rise.