States gain leverage in FERC 1920-A grid planning

FERC’s rehearing order 1920-A elevates state authority in 20-year transmission planning and cost allocation just as AI and data centers push load forecasts higher. See what changed, key dates, and how sponsors can win approvals.

The short version

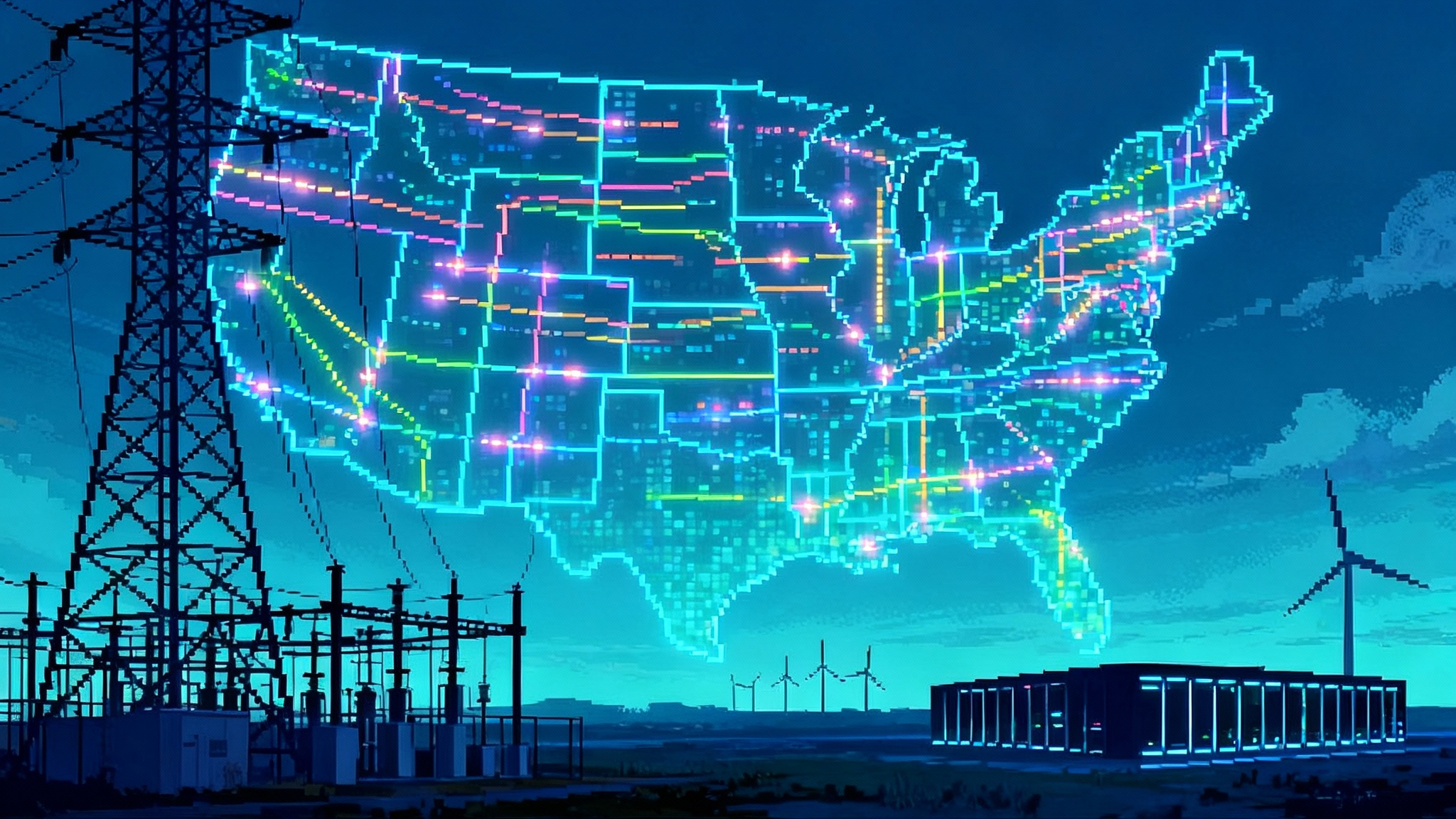

States just gained real leverage over how the next generation of big transmission lines gets planned and paid for. FERC Order 1920 in 2024 created a 20-year regional planning process with required benefit metrics. The rehearing order, 1920-A, sharpened state roles in scenario design and cost allocation and gave them more time to hammer out cost-sharing agreements before utilities file their tariffs. With demand from data centers, AI training clusters, industrial loads, and electrification rising faster than expected, the new rules create both an on-ramp and new gatekeepers.

Quick date check

You may have seen references to a late August 2025 rehearing. Here are the key milestones, in order:

- November 21, 2024: FERC issues Order 1920-A, a unanimous rehearing and clarification that strengthens state roles in scenario design and cost allocation and allows up to a six-month extension of the state engagement period on cost allocation. See the FERC 1920-A summary.

- April 11, 2025: FERC issues Order 1920-B, further affirming the state-centric pieces and clarifying other issues.

- August 2025: New leadership at FERC takes shape, with David Rosner named chair on August 13, 2025. The policy substance of 1920-A remains intact, and process letters and schedules begin steering implementation toward 2026 filings under that framework.

Bottom line: the state-empowering changes are real and trace back to November 2024, and they now sit in a live 2025-2027 compliance window.

What 1920-A changed

Order 1920 set the bones: every transmission provider must run a long-term regional planning process that looks at least 20 years ahead, is reassessed every five years, and uses a defined set of benefits to evaluate multi-value lines. Order 1920-A then made four changes that give states both voice and leverage:

- Scenario design with state fingerprints

- Planners must build long-term scenarios using best available inputs. Under 1920-A, if relevant state entities ask for additional reasonable scenarios to weigh cost allocation choices or a state agreement process, planners must add them. The scenario suite becomes a negotiation object, not just a modeling choice.

- A longer and more flexible state engagement period

- 1920-A confirms a six-month engagement period in which states negotiate either an ex ante cost allocation method or a voluntary state agreement process. If states request it, FERC will extend that period by up to six more months and adjust compliance dates accordingly.

- State proposals get filed on equal footing

- If relevant state entities reach agreement on a cost allocation method or a state agreement process, the transmission provider must include that state-backed proposal in its compliance filing, with supporting evidence, even if the utility prefers another design. FERC makes the final call, but the state-crafted method arrives as a live option.

- State consultation is now a tariff requirement

- Before a transmission provider proposes any amendment to its long-term cost allocation method or state agreement process, it must consult with state entities and document the results on a public website. That creates a paper trail, adds transparency, and deters sudden reallocations without dialogue.

There are also timing tweaks. Staff presentations around 1920-A explained that the first long-term regional planning cycle must begin no later than two years after initial compliance filings are due. That gives regions time to line up modeling, benefits measurement, and stakeholder processes without tripping over existing calendars.

The benefits lens sponsors must plan around

Regional planners must measure at least seven required benefits when evaluating long-term transmission facilities:

- Avoided or deferred reliability investment and aging asset replacement

- Reduced loss-of-load probability or reduced planning reserve margins

- Production cost savings

- Reduced transmission energy losses

- Reduced congestion from outages

- Mitigation of extreme weather and unexpected conditions

- Capacity cost benefits from reduced peak energy losses

Put simply, the rule pushes planners to capture more than one value stream at once and to do it on a 20-year view. Sponsors should anchor cases in all seven, not just production cost.

The compliance calendar through 2027

FERC has published a region-by-region schedule for two required compliance filings: the first covers most of 1920’s regional planning and cost allocation requirements, and the second covers interregional coordination. Several regions received deadline extensions, and some states have already asked for extended engagement periods. Treat the FERC compliance schedule as your source of truth.

Highlights as of September 2025:

- Early filers in 2025: CAISO, NorthernGrid, WestConnect, and PJM have first compliance filings due December 12, 2025, with second filings for some regions starting in February 2026.

- 2026 cluster: FRCC, SPP, SERTP, SCRTP, MISO, and NYISO face first compliance filings between April and June 2026, with interregional filings in late 2026 or mid 2027 depending on partners.

- 2027 tail: ISO-NE’s first and second filings are both scheduled in mid June 2027.

Remember the engagement period clock. Where states request the extra six months, initial compliance filing dates may shift to accommodate that extended negotiation window.

Why AI and data centers loom large

Load growth from hyperscale data centers and AI training clusters is exerting unusual pressure on near-term capacity and long-term planning. Utilities and RTOs in PJM, MISO, and NYISO have revised load forecasts upward due to large, concentrated computing campuses with around the clock duty cycles. For context, see our reporting on the data center power surge, how AI could fast-track a new grid, and Big Tech’s grid land grab dynamics.

Who gains and who faces friction

- Utilities and transmission owners: A clearer framework and more durable approvals if they secure state buy-in on benefits and cost allocation. Expect more pre-filing work to document state consultation and, in some cases, parallel filings for utility and state-backed designs.

- Renewable developers: Multi-value lines that unlock prime wind and solar zones become more financeable when costs are agreed up front. Expect more weight on quantified resilience and losses reductions, not just production cost savings.

- Hyperscale data centers: Sponsors seeking gigawatt-scale campuses in FERC-jurisdictional RTOs can shape scenarios and cost allocation indirectly through state commissions. States hosting large new loads may push to keep more costs inside the beneficiary footprint.

- Non-RTO regions and ERCOT: 1920 and its rehearings apply to public utility transmission providers with FERC-jurisdictional OATTs. ERCOT sits mostly outside this framework, shifting uncertainty to ERCOT market design and state-level transmission policy.

Where state engagement will speed things up

- Right-sizing replacements: Rebuilds that up-voltage aging 115 kV or 138 kV lines on existing corridors often thread the needle on siting and acceptance. Clear benefits ledgers help states bless these quickly.

- Load-driven backbones near growth nodes: Aligned siting bodies and commissions can push for 230-500 kV additions feeding planned campuses when benefits and losses reductions pencil.

- Portfolios that match policy: Pair reliability fixes with economic upgrades and storm hardening so state commissions can show customer value across multiple metrics.

Where it can stall

- Multi-state cost fights: Lines with diffuse benefits across states with different retail politics are ripe for delay. If states cannot reach agreement during the engagement period, FERC still decides, but the record can stretch.

- Scenario disputes: State-requested variants that materially shift benefits can add modeling rounds and months. Sponsors should anticipate sensitivities and bake them into roadmaps.

- Interregional seams: Even with a second filing dedicated to interregional coordination, seams between PJM-MISO, PJM-NYISO-ISO-NE, and SPP-MISO remain tricky.

Litigation and politics under new leadership

FERC’s composition shifted in August 2025 with a new chair. The core of 1920-A remains in place and is embedded in the compliance calendars. Sponsors should plan for three risks:

- Judicial review risk: Expect challenges arguing that FERC overstepped on benefit metrics or consultation mandates. Build records that meet the Federal Power Act’s just and reasonable standard.

- Implementation risk: RTOs will translate requirements into tariff language with varying specificity. Ambiguity in benefits or selection criteria invites protests.

- Policy signal risk: Leadership can shape guidance and staff priorities without changing rule text. Watch for signals on large load forecasting, resilience, and consumer protections.

How to structure a benefits case in 2026

- Anchor on all seven benefits

- State plainly how the project or portfolio scores on each benefit, including reduced energy losses and capacity cost from reduced peak losses.

- Make scenarios a negotiated deliverable

- Offer at least one state-requested variant up front and document inputs and assumptions.

- Connect benefits to who pays

- Tie each benefit to beneficiaries and propose a transparent weighting method.

- Use portfolios to balance value

- Pair a high-voltage line with right-sized rebuilds to balance benefits across states.

- Commit to cost discipline

- Offer cost containment, independent validation, and stage gates with re-evaluation triggers.

- Bring siting agencies in early

- Include siting authorities, not only commissions, during the engagement period.

- Pre-wire interregional logic

- Preview benefits methods on both sides of a seam so they flow into the second compliance filing.

- Speak directly to large loads

- Include letters of intent or anonymized load schedules and show on-site resources or flexibility measures that reduce peaks.

What to watch through mid 2027

- The first wave of 2025 filings: How CAISO, PJM, NorthernGrid, and WestConnect write benefits measurement into tariffs will set de facto standards.

- Engagement period extensions: Where states request extra time, watch for corresponding shifts in compliance dates and stakeholder calendars.

- Interregional choreography: 2026-2027 is when seams filings arrive. Early joint modeling protocols and shared benefits definitions will matter.

- Large load guidance: Expect more Commission or staff attention on forecasting and integrating high-density loads.

The takeaway

Order 1920 created the framework for long-term, multi-value grid planning. Order 1920-A gave states tools to shape the inputs and the money, with time to use them. Under new leadership, FERC appears intent on keeping those tools in place while regions move toward 2026-2027 compliance. For sponsors, success hinges on three moves: make the benefits case complete, make scenarios a shared product with states, and make cost allocation feel fair in the places that pay.