AI’s data‑center boom is reshaping the U.S. grid now

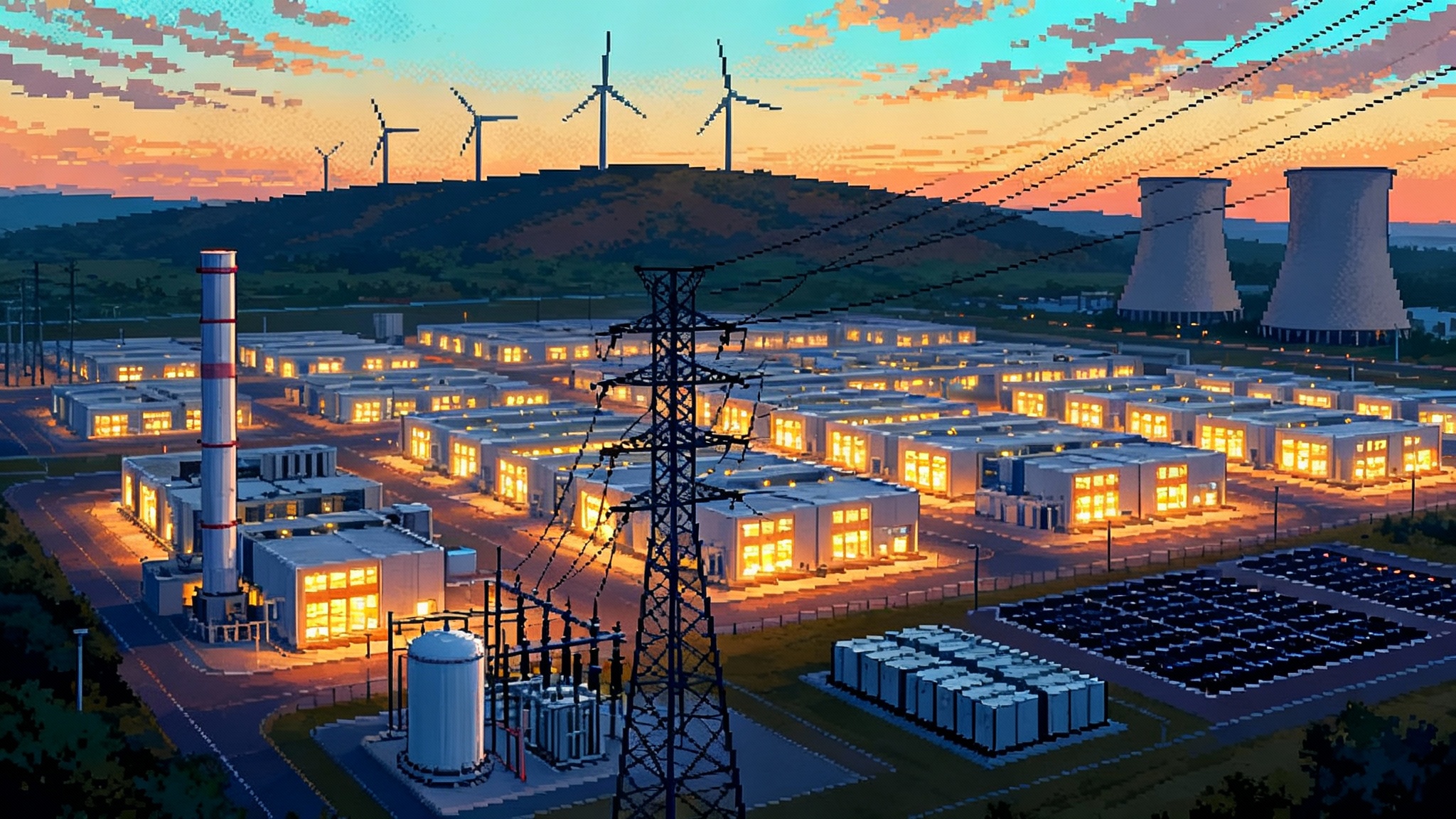

Record peaks and hyperscale buildouts have collided in 2025. From Virginia to Texas and Georgia, utilities are racing to add capacity, revive gas, sign nuclear and renewables deals, and fast‑track storage and wires.

The summer AI met the U.S. grid

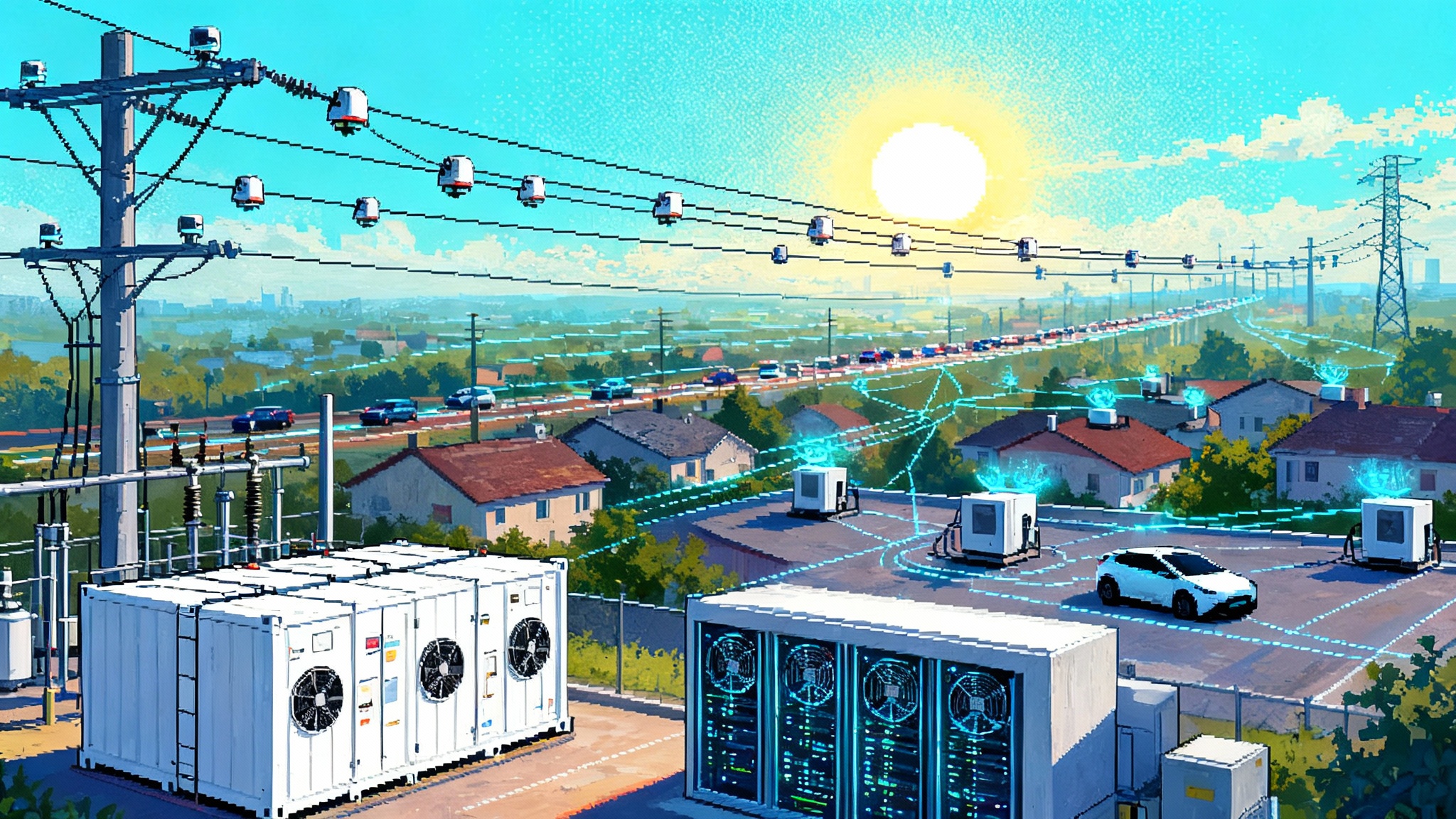

If you felt like this summer ran hotter and the grid tighter, you are not imagining it. U.S. electricity use is on track to set new records in 2025 and again in 2026, with data center growth the standout driver alongside population shifts and extreme heat. That is not a vibe, it is the official forecast from EIA’s Short‑Term Energy Outlook. AI training and inference workloads are pushing power densities in server halls to levels that were rare even five years ago, and those halls are no longer small. The modern hyperscale campus often requests 200 to 1,000 megawatts of firm capacity, then replicates that blueprint across a region.

Two clocks are now out of sync. Hyperscalers can stand up a campus in 18 to 30 months. The grid that must feed it takes much longer. Even with faster interconnection rules, utility‑scale generation and long‑range transmission lines tend to move on five to ten year cycles, local substations and high‑voltage feeders on three to six. That mismatch is the heart of 2025’s power scramble.

What is actually driving the load spike

- AI compute intensity: Training frontier models can demand tens of megawatts for weeks, and the supporting clusters for inference run hot around the clock. Liquid‑cooled racks lift power density, but they do not lower total load.

- Bigger campuses: The typical new build is no longer 20 megawatts. It is 100 to 300 megawatts for phase one, with land set aside for multiples of that.

- Geography: Growth is concentrated in PJM’s Mid‑Atlantic zones, Texas, and the Southeast, where land, tax policy, and interconnection points have been favorable.

- Electrification and reshoring: Semiconductor fabs, battery plants, and logistics hubs add non‑data loads that compound local peaks.

- Weather: Longer heat waves move peak hours later into the evening, when solar output fades and firm capacity must carry the system.

Timelines that do not line up

- Substations and transformers: Extra‑high‑voltage step‑downs can take three years from design to energization, longer if custom transformers face supply bottlenecks.

- Interconnection queues: Process reforms are helping, yet many regions still have backlogs. Even when generation is ready, transmission to deliver it to the campus may not be.

- Gas procurement: Revived peaker projects face siting, air permitting, and gas supply line lead times. Simple‑cycle turbines are faster than combined cycles, which is why many utilities favor peakers for near‑term reliability.

Result: utilities are layering stopgaps. Shorter‑lead gas peakers and uprates at existing plants, big battery additions, nuclear and renewables‑heavy power purchase agreements, and targeted transmission reinforcements that can be built in two to four years rather than seven to ten.

Case study 1: PJM and Northern Virginia

Northern Virginia remains the epicenter of U.S. data center demand. PJM’s 2025 long‑term forecast points to a step change in peak load over the next decade, with data centers as a primary contributor. Dominion Energy’s contracted and studied data center capacity ballooned over the last 12 months, and the company is asking regulators to approve a new rate class for very large, high‑load‑factor users. The theory is simple. If a facility requires hundreds of megawatts of firm capacity, it should shoulder the direct costs and the risk that the grid invests to serve it.

Local realities make that harder in practice. Transmission routes across Loudoun and Prince William Counties are contested, and timelines matter. Grid planners warn of equipment overloads by the late 2020s if new 230 kV and 500 kV lines slip. In parallel, capacity prices in PJM have jumped, improving the economics for new dispatchable resources and storage and raising the pass‑through capacity charges on retail bills.

Meanwhile, hyperscalers are turning to nuclear for firm, carbon‑free supply. The latest example is a long‑term PPA that shifts an earlier co‑located arrangement at a Pennsylvania nuclear station to the front of the meter, adding certainty for both the plant owner and the buyer while feeding power through the regional grid. For PJM, the near‑term reliability story is a blend of upgrades at existing gas sites, life‑extension work at nuclear stations, an uptick in four to eight hour batteries, and targeted transmission builds into data center clusters.

What to watch in PJM

- Whether Virginia regulators approve a separate data center rate class and minimum take provisions that reduce stranded cost risk.

- The pace of new high‑voltage lines into Loudoun and Prince William, where local siting opposition can add years.

- How much firm, carbon‑free supply hyperscalers lock in through nuclear PPAs and uprates versus relying on market purchases backed by storage and demand flexibility.

Case study 2: ERCOT and Texas

Texas has become a laboratory for meeting rapid load growth with speed. ERCOT saw new seasonal demand records this year, including a winter all‑time high in February. The region is also absorbing the largest wave of new batteries in the country. By mid‑2025, ERCOT overtook California for operating grid‑scale storage and is on pace to expand further through year end. The operational playbook is straightforward. Batteries charge in the late morning and early afternoon when solar is strong, then provide fast ramping and reserves across the evening peak. That lowers the need for peakers to run every day, which keeps air quality impacts down in urban load pockets.

Texas is also leaning on a new state energy fund to co‑finance fast‑track gas plants with low‑rate loans. Several projects in the Houston zone are slated for 2026 to 2028 service, aimed at shoring up reserve margins during extreme summer evenings and winter cold snaps. The policy bet is that a merchant market with a deeper stack of batteries and some new firm gas will ride through the next three summers without blackouts while transmission projects continue to move power from the west to the big load centers along I‑35 and the Gulf Coast.

What to watch in ERCOT

- Whether storage additions keep outpacing load growth and how often batteries set prices in the evening peak.

- The buildout of solar in the west and south versus new transmission to Houston, Dallas, and Austin.

- The take‑up rate for state loans for gas projects and whether supply chain constraints slow those builds.

Case study 3: The Southeast’s utility response

The Southeast is seeing extraordinary load requests, with Georgia, the Carolinas, and Tennessee fielding multi‑hundred‑megawatt data center proposals on top of new industrial loads. In July, Georgia regulators approved a resource plan that keeps coal units available longer, adds new renewables and over a gigawatt of storage, and pursues selective gas upgrades and uprates to manage near‑term peaks. Duke Energy has raised its five year capital plan to expand both wires and generation, while exploring take‑or‑pay contracts that require large customers to commit to minimum purchases over long periods. TVA’s final 2025 planning documents are pending, but the public draft centered on a diverse build of solar, storage, and flexible thermal to guard reliability as heavy industrial and data center loads arrive.

The throughline in the Southeast is a regulated utility model that can mobilize large capital plans quickly. That accelerates solutions, yet it brings rate pressure, which is why commissions are scrutinizing who pays for what when a single campus can drive a new substation, a new 230 kV line, and gas backup.

Policy crosswinds that matter

Two regulatory tracks will shape how fast the grid can catch up.

- Long‑range transmission planning: In 2024 the federal regulator finalized a rule that requires each region to run long‑term scenario planning, pick cost‑effective lines, and decide how to share the costs across states. The goal is to move from reactive, project by project builds to portfolios designed for future load and resource mixes. The follow‑on orders in late 2024 and April 2025 clarified state roles and cost allocation. Implementation now lands with the grid operators and utilities, and it is a big deal for connecting remote wind and solar to the very places where AI demand is rising. See the official explainer on FERC Order 1920 long‑term planning.

- EPA standards and uncertainty: Carbon rules for new gas and existing coal were finalized in 2024, then targeted for repeal in 2025. Until courts and the agency settle on the final framework, utilities will tilt toward resources that hedge policy risk, for example batteries, uprates at existing nuclear, and simple‑cycle gas that runs rarely. That policy fog slows some big bets but it does not change the near‑term need for capacity.

Who is winning, who is not

- Nuclear: Clear winner where creditworthy buyers want firm, carbon‑free megawatts. Uprates and long‑dated PPAs help plants cover rising maintenance costs and keep capacity in the market. For hyperscalers, nuclear makes scope‑3 math and ESG narratives work while avoiding the volatility of merchant markets.

- Gas peakers: Back in fashion as a reliability backstop. Simple‑cycle turbines with fast starts can be permitted and built faster than combined cycles, and they fit a system with lots of solar and batteries. They tend to run infrequently but are essential insurance on the worst days.

- Batteries: The default peaker of first resort in sunny regions. Four to eight hour systems are soaking up solar midday and delivering just when campuses ramp. As interconnection queues thin and inverter‑based resource rules stabilize, batteries will carry even more of the ramping and reserves burden.

- Demand response and flexible compute: An underused lever. AI training is not always tied to real time. If buyers accept time‑of‑use pricing with real penalties, large jobs can avoid the 6 to 9 p.m. window, and inference clusters can ride battery buffers. Data centers already own backup generators. Swapping some diesel runtime for batteries and structured curtailment contracts earns revenue and reduces local pollution.

- Mid‑merit fossil: Combined cycles that expect high annual run hours face policy and economics risk, especially where batteries and solar are eroding peak prices. In regulated regions, some will still be built, but the bar is rising.

The capex bill and your power bill

Utilities are posting the biggest capital plans in a generation. Here is how that shows up for customers.

- Rate base math: Wires, substations, and plants roll into rate base and earn an allowed return. The more capital spent, the higher base rates go, subject to prudence reviews.

- Riders and trackers: Separate line items recover fuel, capacity market charges, and specific program costs. In PJM states, the jump in capacity prices adds to bills even if base rates stay flat.

- Who pays: New rate classes for very large, high‑load‑factor customers are designed to assign costs to the loads that cause them. Many utilities now require upfront contributions and long commitments, take‑or‑pay structures, or collateral, so that campuses cannot walk away after the grid invests.

- The numbers: Several large utilities have asked for mid‑teens percentage base rate increases over the next two years to cover grid upgrades, generation investments, higher materials and labor, and capacity or fuel costs. Others have lifted five year capex by double digits to serve data centers and industrial growth. Expect more applications that pair higher capex with special rate designs for hyperscalers to limit cross‑subsidies.

Reliability now, decarbonization still on track

Near‑term reliability does not have to derail climate progress. A pragmatic playbook can do both.

- Site where wires already exist: Prioritize campuses at or adjacent to 230 kV and 500 kV switchyards, brownfield power plant sites, and retired industrial hubs. Interconnects are faster, community acceptance is higher, and the cost per megawatt is lower.

- Hybrid procurement: Pair nuclear or gas‑backstop PPAs with large blocks of solar and wind and four to eight hour batteries. The firm block satisfies 24x7 needs, the renewables and batteries lower cost and carbon.

- Grid‑enhancing technologies: Dynamic line ratings, power flow controllers, and topology optimization can add meaningful transfer capacity in months, not years. These tools help ride through the next three summers while larger lines are permitted.

- Flexible compute contracts: Time‑of‑use tariffs with real scarcity adders, plus automated job scheduling that avoids the evening peak. Add behind‑the‑meter batteries sized for 30 to 60 minutes of full campus load to cover short emergencies and reduce grid stress.

- Storage everywhere: Treat batteries as standard equipment for new substations feeding data center clusters. They provide fast reserves and voltage support and reduce the need to run peakers for short ramps.

- Upgrade the fleet you have: Uprates at existing nuclear, efficiency gains at gas peakers, turbine inlet cooling for extreme heat days, and better winterization. Small capacity additions at existing sites often beat greenfield builds on speed.

- Demand response at scale: Expand industrial and commercial curtailment programs with transparent, day‑ahead signaling so large loads can plan around events. Pay real money. It works.

The bottom line

AI is not a future energy story. It is a 2025 story that is changing how utilities plan and how regulators assign risk. The immediate response will be a mix of nuclear contracts, life‑extended thermal plants, and a tidal wave of batteries, with selective new gas peakers to cover the worst hours. The medium term answer is more wires, planned with long‑range scenarios that match where the load is actually going, which is exactly what the new federal transmission rule tries to force into practice. If utilities, hyperscalers, and regulators align fast, the grid can grow into this decade’s compute boom without sacrificing reliability or the emissions gains the power sector has already banked.