Speed to Power: How AI Will Fast-Track a New U.S. Grid

Washington’s new Speed to Power push aims to deliver the electricity surge needed for AI and data centers by fast-tracking generation and transmission. Here is how it works, who benefits, who pays, and what it means for prices and emissions.

The inflection point

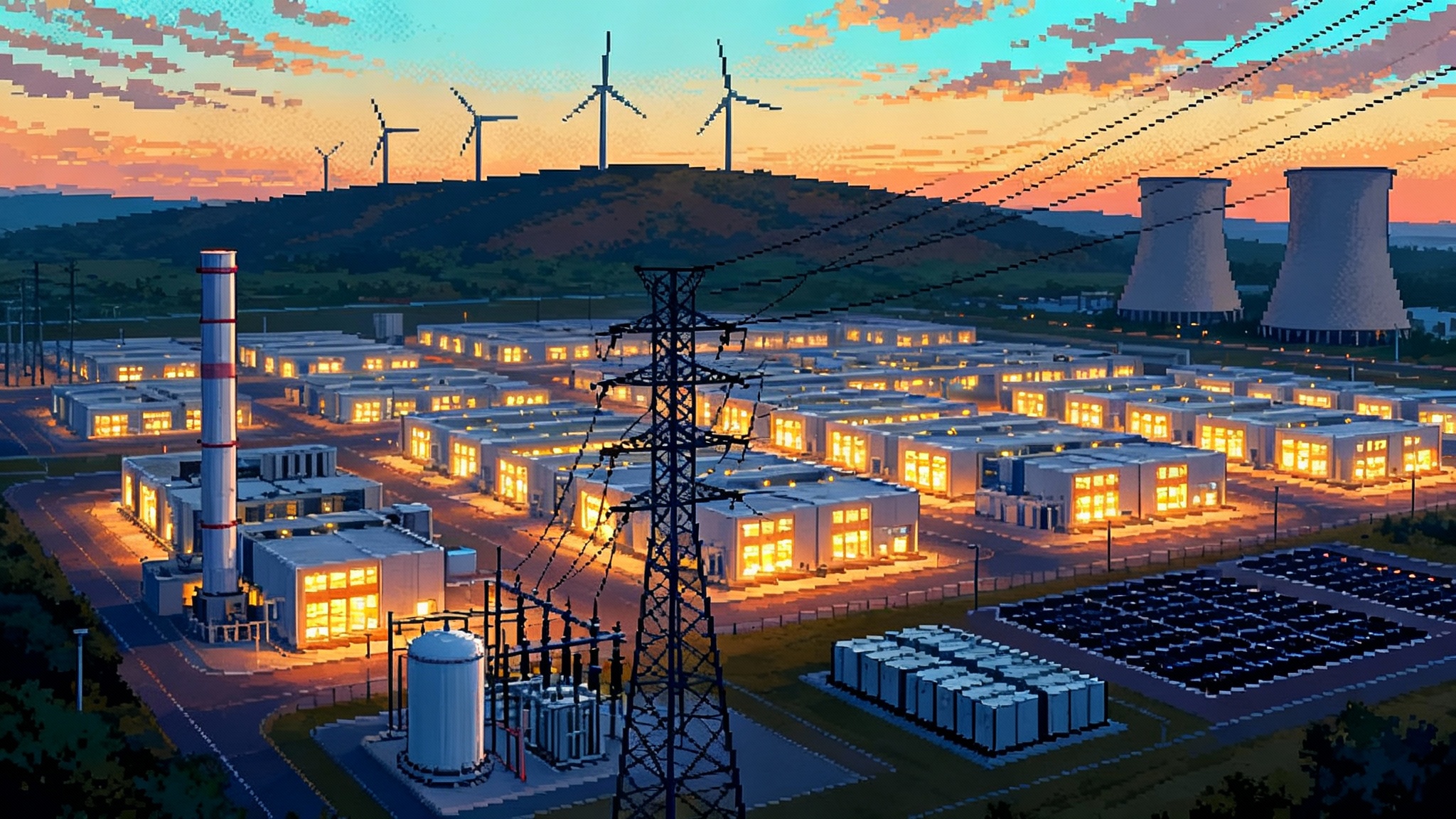

America’s grid just met its next moonshot. The load curve is bending upward as data centers scale for artificial intelligence. Regional operators are warning about tight reserve margins. Utilities are juggling retirements, weather volatility, and a historic queue of projects waiting for wires. Into that mix, the Department of Energy unveiled a plan to compress the timeline from blueprint to electrons: DOE’s Speed to Power.

The premise is simple. If the U.S. wants the economic upside of AI and onshored manufacturing, it needs multi‑gigawatt power fast. The initiative gathers federal tools to move big projects sooner, with a focus on both generation and transmission. This is not a single pot of money. It is a priority posture that promises coordinated federal action, faster reviews, smarter use of federal land, and a clearer lane for projects that can deliver real capacity on near‑term timelines.

What Speed to Power actually is

Speed to Power starts as a request for information, but it is really a roadmap for coordinated action. The initiative signals that DOE will line up the following authorities and programs behind a short list of high‑impact projects:

- Title 17 loan guarantees through the Loan Programs Office for first‑of‑a‑kind or next‑of‑a‑kind generation, storage, and grid technologies that can be de‑risked with federal credit support.

- The Transmission Facilitation Program to help large lines reach financial close by buying capacity, offering capacity contracts, or serving as an anchor customer.

- Grants and cost share under grid modernization and resilience programs, including those aimed at distribution feeders and transformer bottlenecks.

- The National Interest Electric Transmission Corridor process, used to identify areas with chronic transmission shortfalls. When combined with FERC’s backstop authority, this can shorten timelines for lines that cross multiple jurisdictions.

- The Permitting Council’s FAST‑41 framework to put qualifying projects on a public dashboard with coordinated schedules and dispute resolution.

- NEPA streamlining, including use of programmatic reviews and categorical exclusions where impacts are well understood.

- Leveraging federal lands and existing energy sites where corridors, substations, cooling water, or rights‑of‑way already exist.

In plain language, DOE is telling developers and grid operators: bring us big, real projects that can clear engineering, supply chain, and site control hurdles, and we will align the federal apparatus to get them built faster.

Which projects get to the front of the line

Based on the initial framing, priority will tilt toward projects that:

- Add multi‑gigawatt capacity, either as a single site or as a portfolio tied to a cluster of large loads.

- Have near‑term in‑service dates and demonstrated equipment procurement, especially for long‑lead items like step‑up transformers, breakers, and turbines.

- Co‑locate with or reuse existing infrastructure, such as brownfields, retired coal sites, or federal facilities with transmission access.

- Solve a named reliability constraint that grid operators have flagged in recent studies.

- Pair large loads with firm supply, either via on‑site generation, dedicated peakers, or a contractual tie to nearby plants and storage.

- Fit within or adjacent to proposed national interest transmission corridors, improving the chance of backstop siting if needed.

That means conventional assets with short construction cycles can score well. Uprates at existing plants, gas peakers, jet‑engine reciprocating engines, and batteries that can interconnect at existing substations are inherently faster than greenfield wind or solar that require new long lines. Small modular nuclear is likely to be prioritized on federal sites if sponsors can show credible supply chain and licensing timelines. Long‑haul transmission that sits on known corridors or PMA rights‑of‑way is another early favorite.

The likely winners and losers

Winners

- Gas peakers and flexible thermal. Quick‑start units that can be ordered today and delivered within two to three years fit the moment. They can anchor large data center campuses and backstop variable renewables. In regions with seasonal tightness, this is the fastest reliability hedge.

- Life extensions and uprates. Extending the life of existing coal and gas plants, plus turbine and boiler uprates, can add hundreds of megawatts per site with relatively modest environmental reviews compared with new builds.

- Batteries and grid‑forming inverters. Four to eight hours of storage can shave peaks, provide fast frequency response, and free up transmission headroom. Projects interconnecting at existing substations can move quickly.

- Nuclear in select places. Uprates at existing reactors and early SMR deployments on federal land or at DOE sites could benefit from coordinated permitting and federal site control. Timelines are still long compared with gas and batteries, but clear signals and land access matter.

- Transmission developers with ready corridors. Sponsors holding rights‑of‑way, environmental baselines, and manufacturer slots for transformers and conductor will be positioned to clear the queue when DOE flags corridors of national interest.

Losers

- Slow‑to‑permit renewables without firming. Wind and solar still dominate interconnection queues, but greenfield projects that require new high‑voltage lines and have long land and wildlife reviews are less likely to be the first through under a speed screen unless the transmission is already financed.

- Communities near extended coal plants. Life extension can keep jobs and tax base, but it also prolongs local air and water impacts. Expect more community benefit negotiations, monitoring, and mitigation as tradeoffs become explicit.

- Intermittency‑only strategies. Corporate buyers relying solely on annualized renewable energy credits will find that approach mismatched to grid operators’ reliability needs and to AI’s round‑the‑clock power profiles.

Reliability, prices, and emissions

Reliability. In the near term, adding fast‑build capacity and extending existing plants will improve reserve margins and reduce the risk of emergency procedures during extreme heat or cold. Batteries at congestion points can cut load shed risk and reduce forced outages by providing voltage support and frequency response. Transmission targeted at known bottlenecks will amplify those gains, especially where geography allows power to flow from surplus to deficit areas during weather events.

Power prices. Expect a mixed picture. Capacity market prices are already signaling scarcity in parts of the country. Fast‑tracked supply should temper those spikes later in the decade, but near‑term bills may rise as utilities and independent power producers lock in equipment, labor, and financing for rush projects. Transmission adds to rate base before it saves money, yet over time it lowers production costs by accessing cheaper generation and reducing congestion rents. Large loads that accept curtailment or bring their own firming will help stabilize local prices.

Emissions. Speed to Power is reliability‑first. Extending coal and building gas will lift or hold emissions higher than an all‑clean buildout would, especially in the first half of the decade. Batteries, uprated nuclear, and congestion‑relieving transmission will offset some of that. The emissions arc depends on how quickly cleaner firm power and new wires arrive, and how aggressively life extensions sunset when the system has headroom again.

Permitting timelines. The goal is to shrink multi‑year permitting into something closer to months for defined categories. Expect more programmatic reviews, greater use of categorical exclusions for well understood activities, and a single federal schedule for qualifying projects. The biggest gating factors will be state siting decisions, manufacturing slots for large transformers and breakers, workforce availability, and the time it takes to acquire land or easements.

How grid operators are already adapting

- PJM. The country’s largest RTO created a one‑time fast lane to bring near‑term capacity online. In May, PJM announced that it had chosen a slate of projects across gas, nuclear, and batteries to add roughly nine gigawatts of unforced capacity by 2031. See the details in PJM selected 51 projects. The signal is clear. If you can build by the end of the decade, you get a front‑row seat.

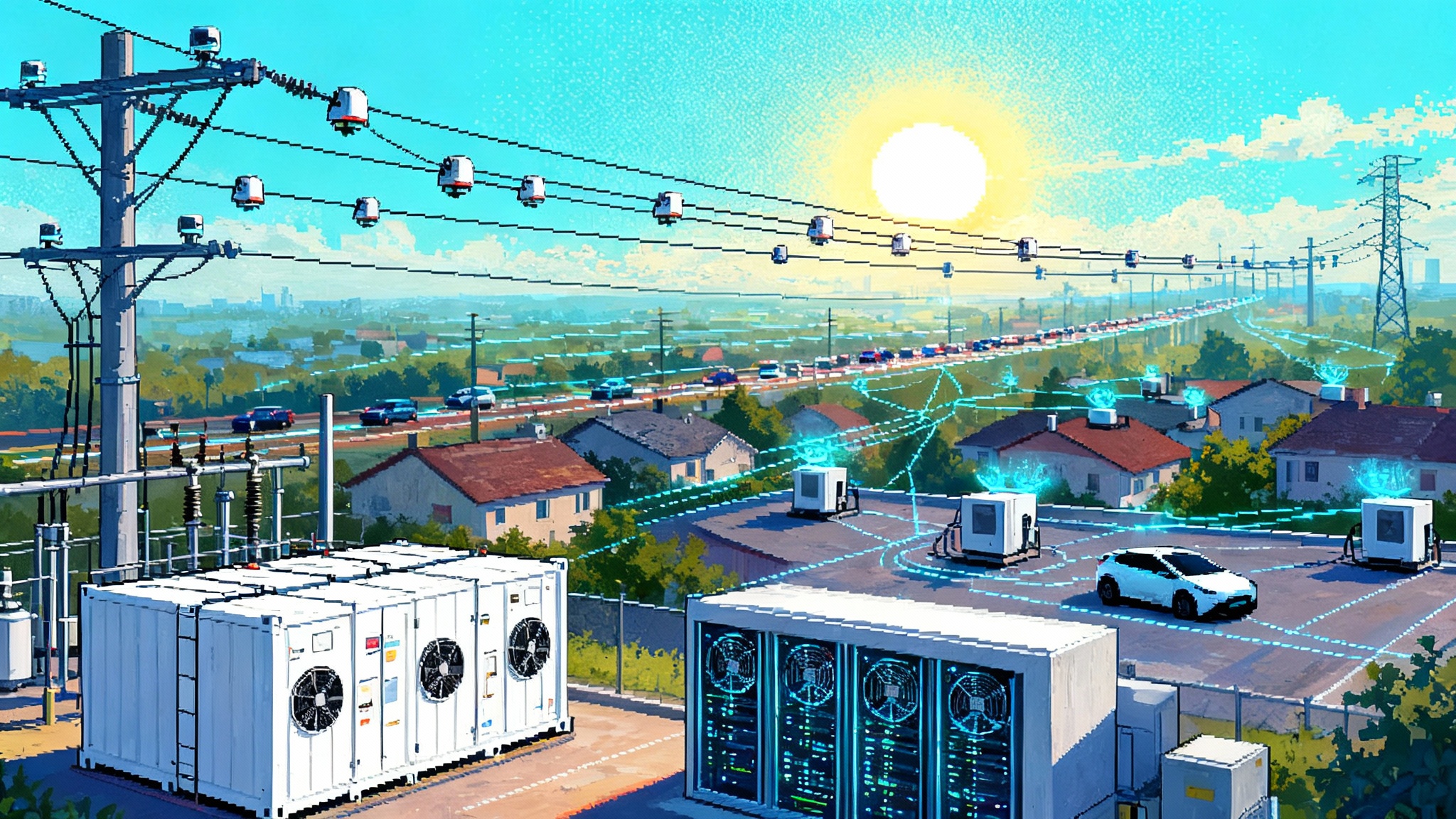

- ERCOT. Texas is redefining how very large loads interconnect. The state has directed its commission and grid operator to set standards for 75‑megawatt‑plus loads, push cost responsibility onto those customers, and enable curtailment or on‑site firming during emergencies. Expect more colocation of data centers with gas turbines and batteries, more behind‑the‑meter generation, and clearer disclosure of interconnection impacts.

- SPP. The Great Plains grid is standing up two new pathways. One accelerates generation that can shore up resource adequacy on a near‑term horizon. The other sets a 90‑day study track for high‑impact large loads that pair with on‑site or nearby generation or accept operating limits during tight conditions. That combination gives developers and large buyers a playbook to match demand with firm supply.

- MISO and others. With demand rising, expect more temporary fast‑tracks that prioritize shovel‑ready plants and storage able to reach commercial operation in three to six years. These programs will likely sunset once reserve margins stabilize.

The corporate pivot: 24/7 clean power meets firm supply

Big Tech’s procurement model has been evolving from annual renewable matching to 24/7 carbon‑free energy. Speed to Power accelerates a second shift: pairing clean power with firm supply, grid services, and local wires.

Here is what changes in practice:

- From pure VPPAs to tolling and offtake. Expect more long‑term deals that secure the output of a specific gas peaker plus batteries or a nuclear uprate tied to a campus. Those deals will come with curtailment rights, black‑start capability, and upgrades to local substations.

- Behind‑the‑meter grow‑ups. Large campuses will expand on‑site batteries and backup engines. The difference is integration. Operators will build switchgear and controls that allow staged throw‑over from grid to on‑site power and back, and that can sell ancillary services when the grid is healthy.

- Federal land as a siting option. Data centers co‑located on or near DOE or Interior lands with transmission access will get attention, especially where a federal landlord can coordinate environmental review and land use at scale. That model suits early SMR hubs and large substations meant to serve multiple tenants.

- Real 24/7 accounting. Corporate energy teams will track hourly supply and emissions at the busbar, not just at a balancing area average. That pushes buyers to procure a bundle that meets local reliability needs while hitting carbon goals.

Community impacts and equity

Speed can widen or close trust gaps. Communities near extended coal plants will ask for stronger monitoring, cleaner fuels, or a retirement date in exchange for near‑term reliability. Rural counties along new transmission corridors will want local hiring, road upgrades, and property tax certainty. Federal agencies are likely to require community benefits agreements, enhanced consultation with Tribes, and mitigation funds as conditions for expedited reviews. Sponsors that show their homework and put real money into local priorities will move faster.

Five practical forecasts

-

Capacity first, transmission next. The first wave will be uprates, peakers, and batteries at existing interconnection points. The second wave will be multi‑state lines that unlock remote clean power and reduce congestion costs in urban load centers.

-

More hybrid projects. Developers will package gas peakers and batteries with curtailment commitments from the data center. That lowers interconnection upgrades, compresses permitting, and gives grid operators dispatchable options.

-

Shorter, thicker lines. Expect more 345 kV and 500 kV double‑circuit rebuilds along existing corridors and more advanced conductors on existing towers. Right‑sizing and reconductoring beat greenfield routing when speed is the goal.

-

Nuclear becomes site‑specific. Uprates at existing plants are the near‑term nuclear growth story. First‑of‑a‑kind SMRs will concentrate at federal sites or brownfields with cooling water and security perimeters. The sites that solve those constraints will attract multi‑tenant campuses.

-

Price signals shift load behavior. When scarcity pricing and capacity payments jump, flexible loads respond. Expect more voluntary load reduction programs for data centers, coupled with financial incentives for quick ramp‑down and guaranteed ride‑through on backup power.

What to watch next

- DOE’s first short list. The initial batch of projects that DOE highlights will set the pattern. If it features uprates and brownfield peakers, developers will follow that recipe. If it includes a federal‑land SMR or a long‑lead transformer factory, the market will infer a broader industrial strategy.

- Transmission corridor designations. When DOE advances corridor designations, watch which regions come first and how they pair with load growth. Corridors near data center clusters will indicate where interregional lines can move.

- FERC compliance calendars. As regional operators file compliance for long‑term transmission planning and cost allocation, the timelines and state engagement windows will signal how quickly large portfolios can lock cost recovery.

- State‑level large‑load rules. Texas has moved fast. Other states will follow with standards that require big loads to share costs, accept curtailment, or bring on‑site firming. That will shape where the next gigawatt campuses choose to locate.

- Supply chains. Transformer and breaker lead times, turbine manufacturing slots, and skilled labor availability will define what “fast” really means in 2026 and 2027. Sponsors with reserved factory slots will set the pace.

Bottom line

Speed to Power reframes the national conversation. It is a reliability plan first, paired with a realism about what can be built quickly at scale. The initiative will produce more gas peakers, life extensions, and targeted batteries in the next few years, with transmission and cleaner firm power ramping behind them. Prices are likely to rise before they fall. Emissions may tick up before new wires and nuclear flatten the curve. For grid operators, developers, and Big Tech, the message is the same. Speed counts. The projects that are engineered for fast permitting, firm capacity, and community acceptance will decide where the next wave of data centers land and whether the AI boom lives on a stable grid.