AI’s grid moment: Texas, California, and the rush for power

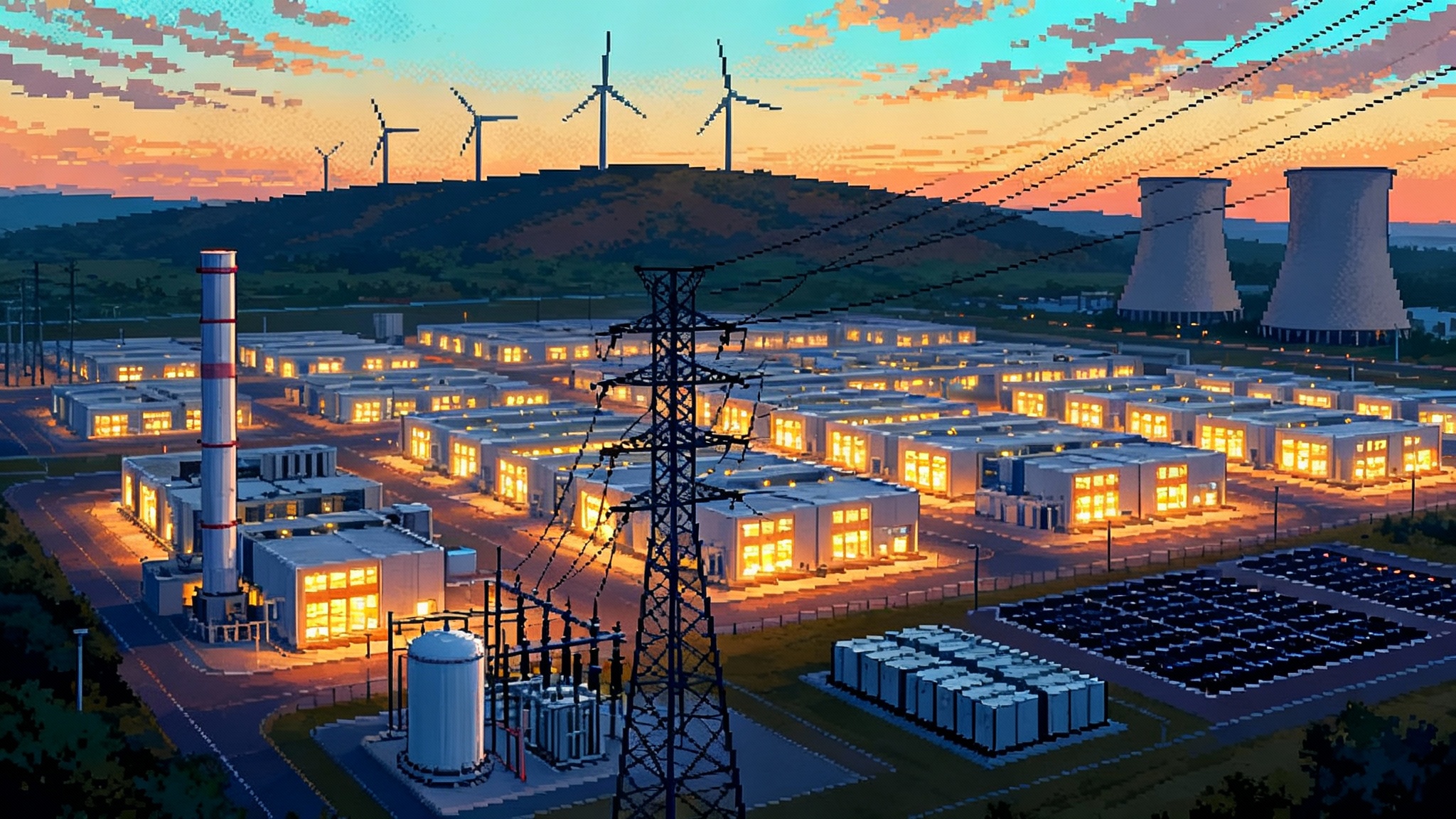

Washington just moved to speed new plants and power lines as AI-driven demand surges. New data shows Texas and California pulling ahead in clean power. Here is how the load is shifting, who pays, who profits, and what 2026 to 2030 could look like.

This week changed the tone

The United States just put a stamp on the AI power scramble. A new federal effort aims to accelerate power plants and transmission lines to meet surging demand from data centers and electrification. The Department of Energy is pitching it as a pragmatic fast track for projects that can be built safely and quickly. The timing is not subtle. AI training clusters, inference at the edge, chip fabs, and hydrogen pilots are all queuing for megawatts the grid does not yet have. The message is simple: capacity needs to show up sooner. Read the details in Reuters’ coverage of the federal Speed to Power push. For context on the policy arc, see our explainer on Washington's AI grid fast track.

Behind that policy headline is a deeper pivot. Utilities are revising load forecasts upward. Hyperscalers are moving from symbolic green claims to steel-in-the-ground procurement. State regulators are being forced to pick winners among competing reliability strategies: gas peakers, nuclear deals, massive batteries, or some mix of all three. For how big loads are changing siting and ownership, read Big Tech's grid land grab.

The AI load curve is different

Data centers once looked like steady, boring industrial load. AI has changed the profile in three ways:

- Density: High-performance computing halls concentrate tens to hundreds of megawatts on single campuses. That collapses years of incremental load growth into a single interconnection request.

- Timing: Training runs create long, continuous draws that do not map neatly to solar peaks. Inference is becoming more 24/7 as AI features seep into every product. The result is a flatter, higher overnight load where wind and nuclear shine and where batteries can earn real money.

- Certainty: Hyperscalers sign long-lived, bankable contracts. That is prompting utilities to plan new firm capacity rather than play it safe with short-term market purchases.

Put together, AI demand pushes operators to value firm megawatts and flexible megawatts at the same time. Flexible capacity from batteries and responsive gas peakers balances the minute to minute. Firm low-carbon capacity from nuclear uprates, hydro, or combined-cycle gas underpins the base.

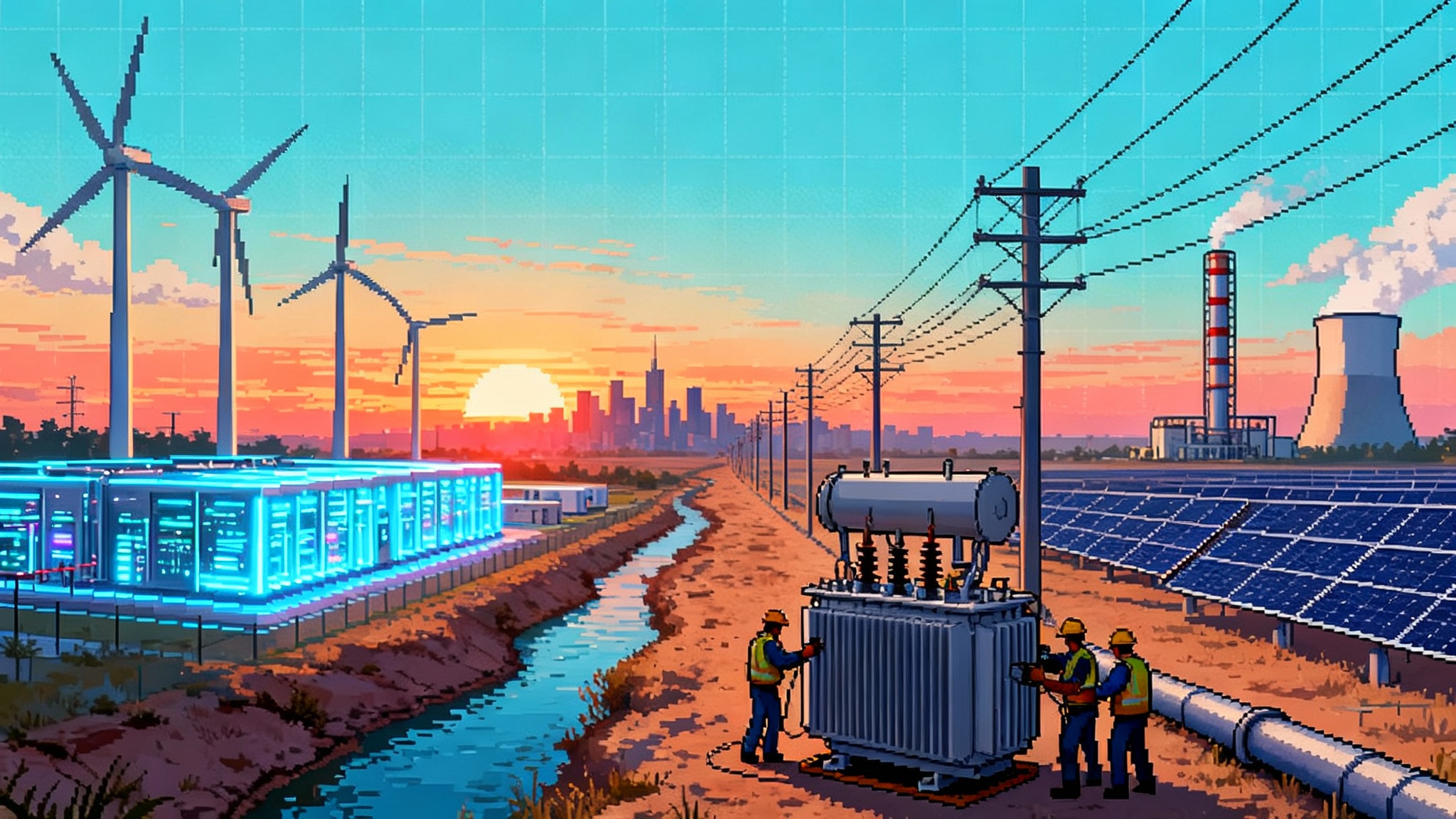

Texas and California are pulling ahead

If AI is the catalyst, Texas and California are the laboratories. New data shows both states widening their lead in clean power, with record shares for renewables and storage in 2025 and a strong pipeline into 2026. In ERCOT, wind plus solar plus a swelling battery fleet are setting the midday and evening prices. In CAISO, solar saturation and the nation’s largest storage fleet are reshaping the duck curve and lowering the cost of evening reliability events. Reuters has a full breakdown of the Texas and California clean power surge. For the broader backdrop, see how the data center boom reshaping the grid is driving local markets.

Why these two? Texas has speed, open access, and a merchant-friendly market. California has long-term procurement mandates and a decade of storage learning. Both have land, transmission corridors, and developers who know how to build at scale. Both also have acute exposure to AI load and are now experimenting with ways to serve it without breaking reliability or the rate base.

FERC planning and the AI clock

FERC’s Order No. 1920 pushed transmission planners to think beyond the next storm season. It asks regions to plan for long-term portfolios that account for changing resources, demand growth, extreme weather, and public policy. It also pushes better cost allocation. That matters because it typically takes seven to ten years to develop big lines.

The AI clock is not waiting. Hyperscalers want energization dates measured in quarters, not decades. That mismatch is driving several behaviors:

- Move fast inside regions: Prioritize projects that can plug into existing substations or co-locate with retiring plants. These sites already have transmission and water rights.

- Short hops over mega-lines: Expect more 50 to 150 mile intraregional upgrades, dynamic line ratings, and reconductoring to unlock capacity in two to five years.

- Merchant and utility hybrids: Utilities rate-base local upgrades that increase transfer limits. Merchants build generation plus storage near load pockets and sign long-term offtakes with data centers.

FERC’s interconnection reforms are slowly unfreezing queues, but they cannot conjure transformers, crews, or rights of way out of thin air. AI demand will reward projects with speed to energization.

The new build mix: gas peakers, nuclear deals, big batteries

- Gas peakers: The fastest firm-ish resource to build at scale. They can be permitted and erected in two to three years on industrial sites. They do not run often, but they matter in net load ramps. Expect more aeroderivative turbines paired with batteries to arbitrage fuel and emissions while shaving peaks.

- Nuclear deals: Uprates at existing reactors are drawing attention because they offer zero-carbon firm power without greenfield risk. Repowering coal sites with small modular reactors is on the whiteboard in multiple states. The gating items are price, supply chain, and licensing certainty. If one project reaches commercial operation before 2030, copycats will line up.

- Massive batteries: Four-hour batteries are the standard, but eight to twelve hour projects are finally penciling as AI demand lifts evening spreads. Leading developers are shifting from pure merchant bets to tolling agreements and capacity contracts that de-risk revenue.

The stress points no one can ignore

- Water: Advanced cooling for high-density racks raises water and siting concerns. Operators are pivoting to closed-loop chilled water, air-cooled heat exchangers, or direct liquid cooling to cut withdrawals. Cities want reclaimed water use, not fresh, and they want guarantees during drought.

- Transformers: Large power transformers remain a chokepoint. Long lead times and limited domestic manufacturing slow substations and plant interconnections. Any plan that depends on dozens of new transformers by 2027 needs a procurement strategy now.

- Interconnection queues: First-ready, first-served reforms help, but studies still stack up at the same bottlenecked substations. Projects that can share network upgrades or fund reconductoring will move ahead of paper queues with no path to steel.

Who pays and who profits

- Ratepayers: They shoulder regulated transmission and distribution costs. If utilities rate-base upgrades to serve large new customers, commissions will ask whether those customers pay their fair share. Expect more special tariffs, upfront contributions, and line-extension policies tailored to massive loads.

- Utilities: They earn on assets in rate base. New substations, feeders, and local transmission are attractive as long as the load is sticky and creditworthy. The risk is stranded costs if tech demand evaporates or migrates.

- Hyperscalers: They profit from locking in low, predictable power costs. The emerging norm is to pay for speed with capital: upfront contributions for grid work, on-site generation, and long-term tolling that guarantees capacity. That buys leverage on siting and permits and lowers public friction.

- Merchant developers: They profit by building fast near load, signing firm offtakes, and stacking revenue streams. The best positioned have portfolios in both Texas and California and can shift capital to whichever permits first.

The politics of cost allocation will decide whether ratepayers subsidize the AI buildout or whether big loads fund their own hookups. Public utility commissions are already signaling that data centers will need to carry more of the near-term network costs.

Siting and permitting flashpoints

- Gas near communities: Peakers proposed outside city limits are facing local pushback. Developers are offering noise controls, limited runtime hours, battery pairing, and decommissioning funds to win support.

- Transmission corridors: New rights of way remain a third rail. Expect more reconductoring, advanced conductors, and dynamic line ratings to squeeze capacity out of existing corridors while litigated greenfield lines grind forward.

- Farmland and open space: Solar and storage face cumulative impact concerns. Counties are mapping avoidance areas and fast-tracking projects on disturbed or industrial lands.

- Water and wastewater: Cities are attaching water reuse requirements and drought curtailment clauses to permits for high-density campuses.

Three scenarios for 2026 to 2030

- Gas and batteries sprint

- Build pattern: Dozens of gas peakers and hundreds of 4 to 8 hour batteries near substations serving AI campuses. Uprates at existing gas plants extend life.

- Reliability: Strong. Peak and ramp coverage improves. Outage risk shifts to fuel logistics and extreme cold events.

- Prices: Volatile but trending stable as storage soaks up intraday spreads. Wholesale prices soften at midday and spike less in the evening than today.

- Emissions: Flat to modestly higher in the near term, then down as batteries displace peaker runtime more often.

- Risk: Exposure to gas price spikes and public opposition near urban sites.

- Nuclear comeback plus deep storage

- Build pattern: One or two first-of-a-kind small reactors reach late-stage construction. Utilities sign long-term contracts to repower coal sites with nuclear. Storage durations creep to 10 to 12 hours on select corridors.

- Reliability: Very strong. Firm low-carbon power smooths overnight. Batteries cover ramps and contingencies.

- Prices: Higher upfront due to capital intensity, then stable and predictable.

- Emissions: Down materially as firm zero-carbon replaces gas at night.

- Risk: Schedule slippage or cost overruns on early nuclear units.

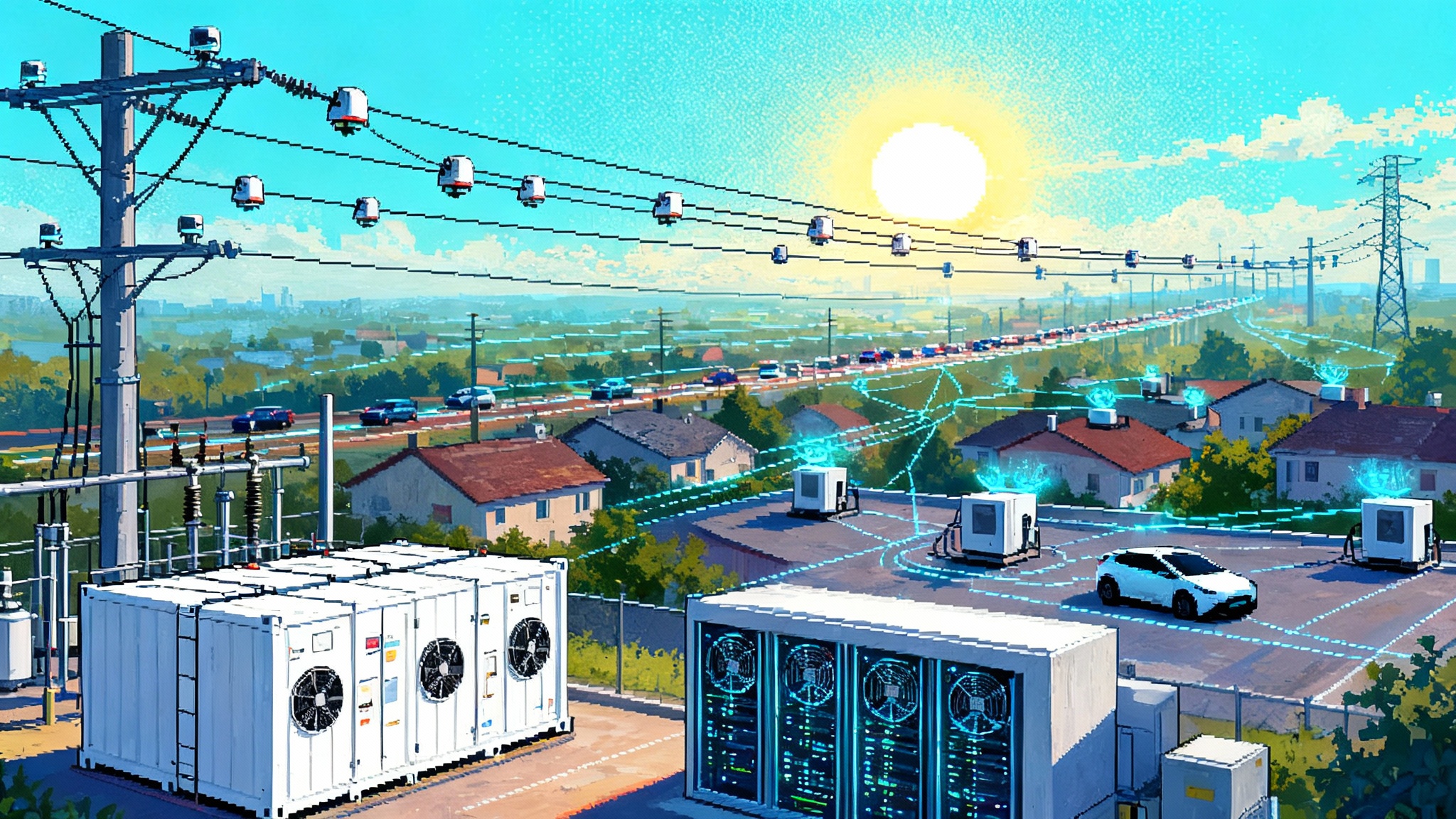

- Distributed acceleration at the edge

- Build pattern: Hyperscalers add on-site generation and behind-the-meter batteries. Utilities invest in feeders, substations, and reconductoring instead of big central plants.

- Reliability: Depends on campus integration and microgrid controls. Resilience can be excellent if designed for islanding.

- Prices: Campus power costs stabilized by private capital. System prices benefit from deferred central upgrades.

- Emissions: Variable. Clean if on-site is paired with firmed PPAs and storage. Dirtier if on-site gas runs frequently.

- Risk: Fragmentation and uneven standards across jurisdictions.

Reality will likely be a blend of all three. Texas leans toward scenario one with merchant gas and batteries. California leans toward scenario two over the decade with long-term clean procurement and advanced storage. Both will see more distributed solutions on campus.

The hyperscaler playbook for 24/7 power

- On-site generation with grid services: Simple-cycle gas turbines tuned for quick starts, paired with large batteries that earn revenue by providing fast frequency response and ramping. Some campuses will explore fuel-flexible turbines prepared for hydrogen blends later.

- Firmed PPAs and tolling: Long-term contracts that bundle renewables, batteries, and firming from dispatchable plants or hydropower. The shift is from annual REC matching to hourly matching and deliverability to the same grid region.

- Siting near renewables and wires: Co-locate with big solar and wind hubs that already have transmission headroom or with retiring thermal sites that have interconnections and water. The fastest path is often behind an existing fence line.

- Interconnection pre-development: Pay early for studies, transformer slots, and shared network upgrades. Treat the grid like a supply chain, not a black box.

- Water and heat management: Lock in reclaimed water supplies where needed and design for minimal withdrawals. Turn waste heat into a product for nearby industrial users or district loops where possible.

- Efficiency as capacity: Optimize models and hardware to cut power per inference. In the AI arms race, every percent of efficiency is a free peaker.

What to watch next

- Federal fast-track details: Agencies will define what qualifies, how environmental review is streamlined, and how communities are engaged. For a broader frame on timelines, see How AI will fast-track the grid.

- State commission rulings: Watch who pays for grid upgrades tied to large new loads. Expect new tariffs that require upfront contributions and minimum-take obligations.

- FERC compliance timelines: Regional plans and cost allocation fights will shape which lines make it into the 2030s.

- Transformer and substation lead times: If those shorten, everything else moves faster.

- Battery duration creep: If eight hour projects scale, the evening peak gets solved without as much new gas.

- Nuclear milestones: Any concrete pour or uprate success will change utility planning models.

The bottom line

AI has forced the grid to grow up faster. This week’s federal move puts speed on the agenda. Texas and California are showing two different ways to do it at scale. The mix will not be ideological. It will be whatever can be financed, permitted, and energized by the time the next AI cluster asks for a delivery date. The winners will be the projects that combine firm capacity, flexible ramping, and credible local benefits, with costs shared fairly between the public and the companies driving the surge.