Speed to Power meets Big Tech’s grid land grab

The DOE’s new Speed to Power push and Microsoft’s fresh Wisconsin build signal a scramble to keep firm capacity online as data centers surge. Here is how rules, costs, and resources are shifting from 2026 to 2030—and who wins or pays.

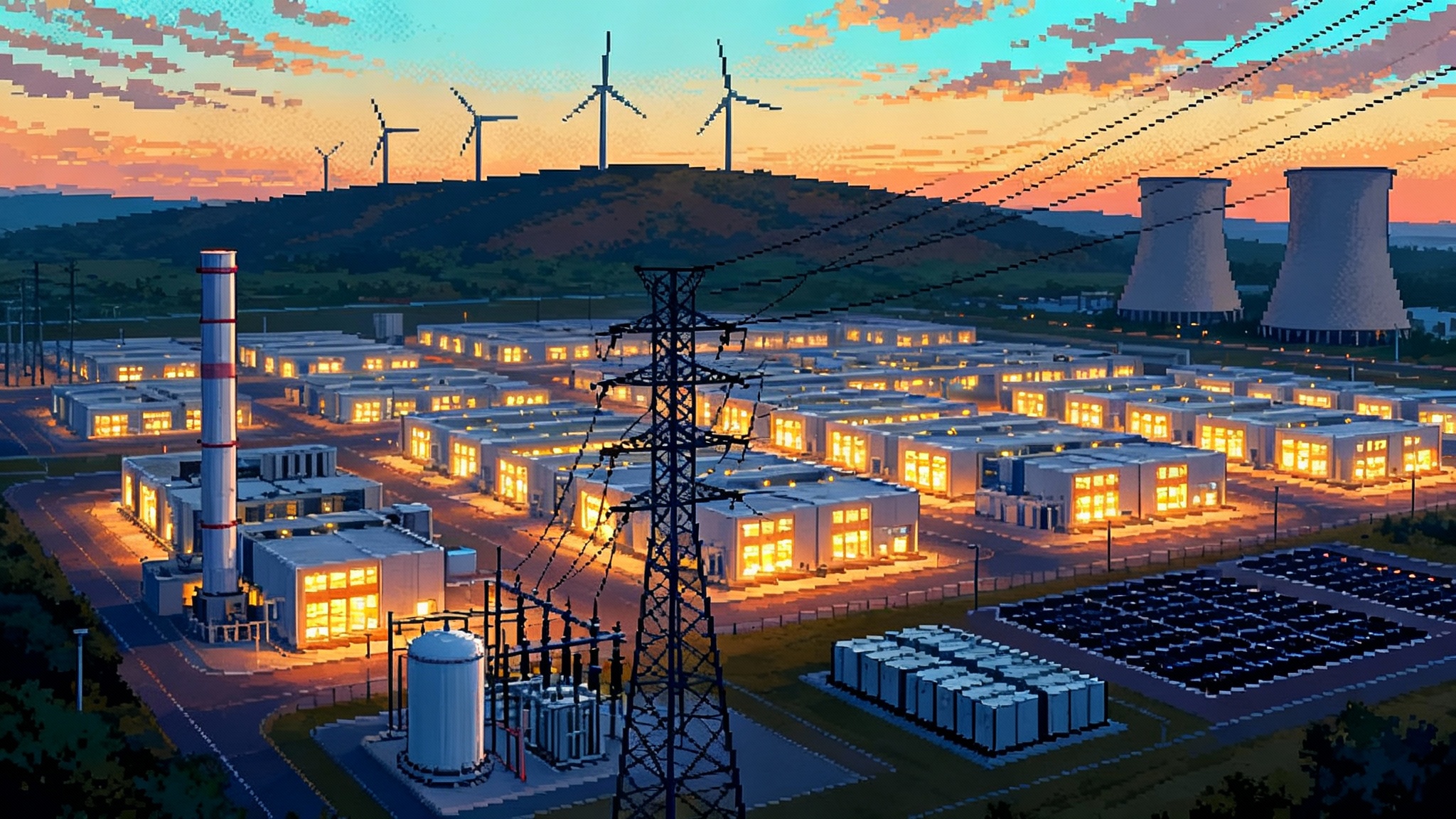

The new grid sprint begins

On September 18, the Department of Energy unveiled Speed to Power, a rapid response effort to identify and accelerate multi‑gigawatt generation and transmission that can meet the AI era’s load surge. The agency framed the program as a reliability move first, a competitiveness move second, and a way to coordinate state, utility, and hyperscaler priorities that have been colliding in queues and at substations. The headline is simple. The United States needs more power, sooner, and the federal government intends to help clear a path. The details matter even more, because they hint at a new playbook: targeted federal intervention, priority corridors, and an explicit bias toward keeping firm capacity online while new steel goes in the ground. Read the announcement here: DOE launches Speed to Power.

Speed to Power sits on top of existing authorities and dollars. Think transmission planning reforms at FERC, federal financing and credit support, and an appetite to use emergency tools to prevent reliability gaps as demand outruns the rate of new interconnections. It also telegraphs a political reality. The center of gravity in energy policy has shifted from how fast to retire legacy plants to how fast to add capacity that works every hour of the year. That shift will shape what gets built, where it goes, and who pays the bill.

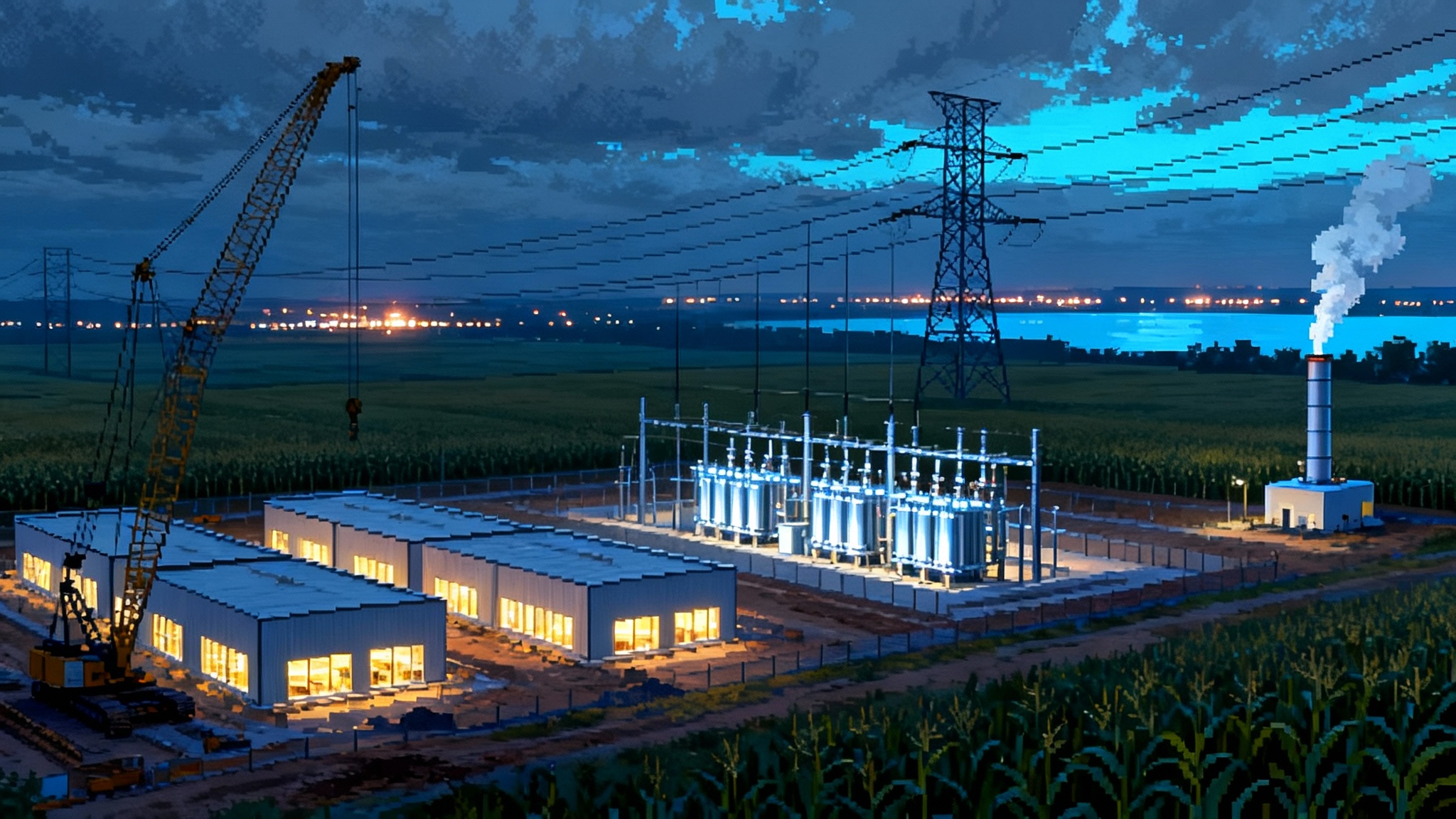

Microsoft plants a massive AI flag in Wisconsin

The timing was not subtle. On the same day, Microsoft said it will expand in Wisconsin with a second major AI data center, lifting its planned investment in the state to more than $7 billion and signaling how hyperscalers plan to anchor the next wave of load. The company also said it would shoulder upfront grid costs to blunt local rate impacts and run a low‑water cooling design tuned to the climate. See the report: Microsoft boosts Wisconsin build.

Wisconsin is a case study in how the new demand will actually land. The sites are tied to existing industrial land and high‑voltage infrastructure. The utility will still need feeders, substations, and some mix of local and regional upgrades. But the economics are changing. Hyperscalers are increasingly willing to prepay for delivery assets, sign special tariffs, and even take partial responsibility for firming their own load profile. That willingness will shape which projects clear the queue and which generation types get financed.

Emergency measures to keep firm capacity online

Behind the DOE’s tone is a simple constraint. The load is climbing faster than the clean buildout can replace retiring coal and aging gas, and faster than most queues can move. The administration has already signaled it will use federal tools to help keep firm capacity online during the buildout. That includes leaning on reliability analyses that identify at‑risk regions and, where needed, coordinating with states to extend the life of gas and coal units that would otherwise retire before replacement capacity is ready.

This is controversial, but it is also what grid operators are asking for. Keeping a subset of units on seasonal or reliability must‑run terms can bridge a three to five year gap while transmission and storage show up. Expect more short‑term extensions and seasonal commitments, plus reliability contracts that pay for availability, not just energy, in places where hyperscale load is landing fastest.

FERC’s transmission rule reshapes who decides and who pays

FERC’s 2024 transmission planning rule and its 2024 and 2025 rehearing orders changed the economics of long wires. Order 1920 and the A and B updates require at least a 20 year view of needs, formal scenario planning, and a more explicit cost allocation process that brings state regulators into the room early. The near term effect is twofold. First, utilities and operators must model large load additions like data centers as a core driver of needs, not an edge case. Second, states gain leverage over who pays for the regional lines that unlock the cheapest resources.

That matters for siting and sequencing. A state that hosts the load but not the cheapest new generation will push for cost sharing across the region. A state that hosts the wind or solar resource will push for a bigger build with right‑sized replacements that add capacity on rebuilt corridors. Expect more joint state processes, more pre‑agreed cost splits, and more lines justified on multi‑benefit grounds. The bottleneck moves from whether to plan to how to permit.

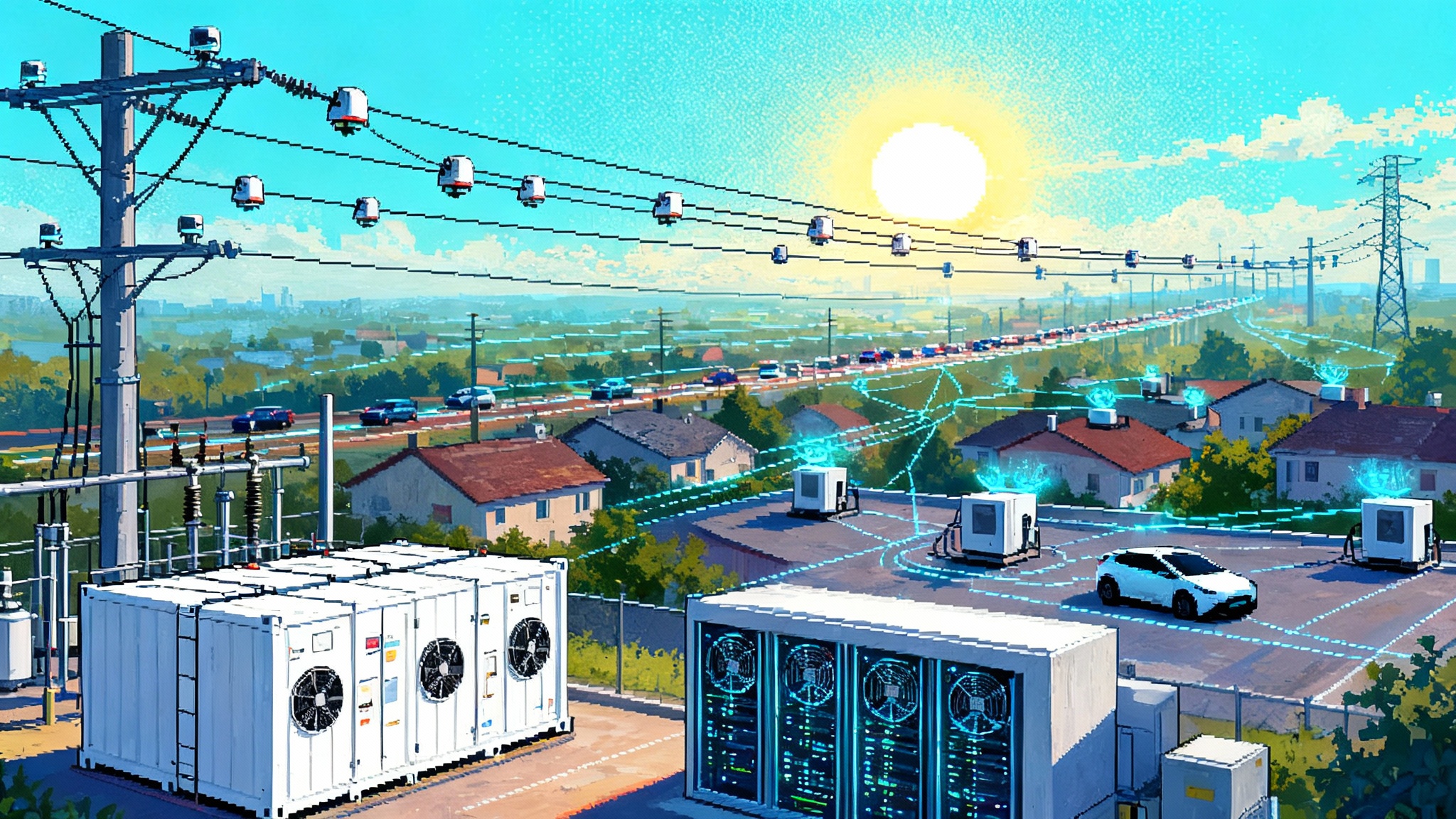

Load is rising faster than the old models expected

PJM’s 2025 long‑term forecast showed a marked shift. Summer peak could rise toward 220 gigawatts by the mid to late 2030s, up roughly 70 gigawatts from today, with winter peaks closing the gap as electrification grows. In the near term, NERC’s 2025 summer assessment flagged a roughly 10 gigawatt year‑over‑year jump in aggregated peak across all regions, with new data centers, electrification, and industrial restarts as leading drivers. These are not speculative numbers. They are turning up as substation requests and as month‑to‑month revisions to utility load forecasts.

Grid operators have also learned that large data centers behave differently than traditional load. They can trip off in a heartbeat if power quality sags, then all return at once. Voltage control, fast frequency response, and ride‑through standards are catching up, but the interim is messy. The practical upshot is that systems will need more dynamic reactive support and more fast reserves near data center clusters.

Who wins in the power scramble

-

Gas and the LNG value chain: Developers of simple cycle turbines that can be online by 2027 to 2029 are in the money. So are owners of efficient combined cycle units that can be contracted as tolling partners for hyperscalers or utilities. The LNG side wins indirectly. If power sector gas demand and price volatility rise, longer term LNG supply deals look more attractive to portfolio players who bridge seasonal spreads. The caution flag is price risk. If gas prices run up, regulators will ask harder questions about cost exposure for captive ratepayers.

-

Batteries and hybrid renewables: Four hour batteries scale quickly, match the midday solar profile, and provide the fast services that make clusters stable. Hybrids that pair solar or wind with storage are clearing queues faster because they can commit to deliverable profiles. Expect a wave of 100 to 300 megawatt battery projects near data center hubs that are structured with capacity payments, performance credits, and, in some cases, direct corporate offtake.

-

Nuclear uprates and life extensions: Uprates at existing reactors are a quiet winner. They deliver zero carbon megawatts without greenfield siting fights and can be financed against long contracts with customers that value 24 by 7 supply. Life extensions do the same. New nuclear will matter later in the decade if licensing stays on schedule, but the credible near term gains are from extended lives and incremental uprates at plants that already run.

-

Grid enhancing technologies: Advanced conductors, dynamic line ratings, and topology control do not make headlines, but they move real power and they can be deployed in months, not years. They are tailor made for a Speed to Power moment because they unlock transfer capacity on existing corridors while the long lines grind through permitting.

-

Flexible demand and thermal management: AI load is not entirely inelastic. Training cycles can shift in time. Operators are experimenting with turbine inlet air cooling at nearby peakers and with waste heat reuse. Expect more fast demand response contracts and more emphasis on power quality equipment inside the fence so data centers ride through disturbances instead of tripping the system.

Who pays, in practice

The cleanest answer would be that the beneficiary pays. In reality, it is mixed, and it will vary by state.

-

Ratepayers: In vertically integrated territories, utilities will propose new peakers, new batteries, and sometimes gas pipeline laterals to serve new load. If these assets are rate based, existing customers share costs unless commissions carve out special tariffs. Expect hearings where consumer advocates press to protect households from cross subsidizing private server farms.

-

Hyperscalers: The big operators are moving fast to make this easier for regulators. They prepay for substations, accept higher delivery rates, sign nonstandard tariffs that recover demand charges quickly, and fund on‑site firming like batteries or even dedicated turbines. The Wisconsin announcements are a template. Prepay what you can, keep water use modest, and commit publicly to minimizing bill impacts.

-

Shared regional costs: Transmission is the thorniest part. Under FERC’s planning rule, states will get a larger say in cost allocation for long lines that benefit multiple regions. If a line mainly moves power to a data center cluster, states may push for a larger direct share from the load customer. If a line unlocks cheap regional supply for everyone, states may spread the costs widely. The politics of this will define which lines move first.

Credible pathways to meet AI demand without blowing climate targets

Think in portfolios, not silver bullets. Three pathways look both credible and fast enough to matter before 2030.

-

Clean firm plus flexible clean: Extend the life of existing nuclear and the most efficient gas units under tight emissions and availability contracts, then layer in a rapid build of solar, wind, and four hour batteries. Use grid enhancing tech to boost transfer capacity on existing lines. This keeps reliability intact and reduces total fuel burn as more midday energy is shifted into the evening. Pros: speed, cost, lower siting risk. Cons: emissions depend on gas runtime, so regulators must watch operating profiles.

-

Behind the fence firming with 24 by 7 procurement: Let hyperscalers directly fund on‑site or near‑site firming, combine that with long term contracts for clean supply that match hourly demand, and use flexible compute scheduling to clip peaks. This can include tolling at an existing combined cycle plant, a dedicated battery block, or contracts for fast response capacity nearby. Pros: lowers cross subsidies, aligns incentives, makes the load easier to serve. Cons: complex contracts, careful coordination needed so private reliability does not undermine system operations.

-

Transmission first in a few corridors: Pick a handful of high confidence corridors where states can agree on cost splits, pull the permits, replace older wires with advanced conductors, and right‑size rebuilds to add capacity. Pair those corridors with staged batteries at the load end. Pros: unlocks low cost clean gigawatts and reduces curtailment. Cons: permitting risk and timeline management, but still the biggest lever long term.

None of these pathways require giving up on decarbonization. They require sequencing. Build batteries where the load lands, extend what you must to bridge the gap, and clear a few transmission corridors that open the cheapest clean supply.

What this means for 2026 to 2030 project pipelines

-

Gas peakers and fast track upgrades: Expect a mini supercycle of 100 to 300 megawatt simple cycle turbines near data center hubs between 2026 and 2029, often paired with 50 to 200 megawatt battery blocks. Expect life extensions and winterization retrofits at existing plants with seasonal reliability contracts.

-

Storage scale up: The four hour battery pipeline will swell in PJM, MISO, ERCOT, and the Southeast. Financing will lean on capacity or availability payments, sometimes backed by corporate credit from hyperscalers with a right to call on the asset during training cycles.

-

Nuclear incrementalism: Uprates and license extensions move quietly through dockets. If regulators pair them with 24 by 7 clean energy procurement from large customers, they become the backbone of corporate decarbonization claims without new greenfield fights.

-

Transmission with near term relief: The first big wave will be reconductoring and dynamic ratings on existing lines, not new greenfield. The second wave will be two or three regional lines that survived the new state engagement process. Developers will bundle storage at endpoints to improve reliability metrics and public acceptance.

-

Interconnection triage: Queue reforms are already prioritizing ready‑to‑build projects that serve clear load. Expect more cluster studies focused on data center zones, with hybrid projects moving first. Developers will co‑locate batteries to get firm deliverability.

The permitting battles to watch

-

Corridors that cross several states with different politics: The new planning rule gives states a bigger voice in cost allocation, which can smooth cost fights. It does not remove local opposition. Projects that right‑size existing corridors will move fastest. New corridors will lean on federal backstops if timelines slip, but that will remain rare and contentious.

-

Gas laterals and peakers near suburbs: Expect water, air, and noise concerns to dominate hearings. Developers will respond with best available controls, limited runtime commitments, and adjacent battery blocks that reduce annual emissions and improve local air quality.

-

Substations in industrial reuse sites: Expect more builds on old factory land or near retired coal plants. Communities often prefer reuse, and interconnection is easier, but expect traffic and construction impacts to drive conditions of approval.

-

Data center standards: Grid operators and reliability authorities are moving toward tighter ride‑through and power quality requirements for large loads. That will show up as conditions on interconnection, with on‑site equipment and controls required to prevent trip‑and‑reconnect swings that add risk to the system.

The bottom line

The AI era is collapsing timelines that used to be measured in decades into a few short years. Speed to Power is the federal signal that reliability comes first while the clean buildout catches up. Microsoft’s Wisconsin move shows how hyperscalers will help pay to make that speed possible. The winners are the technologies and deals that can be permitted, financed, and delivered between now and 2030. The bill will be split between ratepayers and hyperscalers, but the split will be negotiated state by state, tariff by tariff.

The credible path is not mysterious. Keep enough firm capacity online to avoid shortfalls. Build batteries where the load lands. Accelerate a few transmission corridors that open cheap clean supply. Put states and customers in the room to decide who pays. If that happens, the grid gets bigger, cleaner, and more reliable, and the AI buildout does not blow the country’s climate trajectory off course.