Europe's 2027 Russian LNG Ban vs America's LNG Reboot

Brussels is moving to halt Russian LNG on January 1, 2027, just as Washington restarts LNG approvals. We pressure test construction, pipelines, ships, methane rules, and financing to see whether new US supply can fill Europe’s gap without spiking prices at home.

The new deadline that reframes Europe’s gas map

On September 19, 2025, Brussels put a hard date on a question markets have debated since 2022: when does Russian LNG stop flowing into the EU. According to reporting that day, the European Commission intends to propose a ban on Russian LNG imports effective January 1, 2027, as part of its nineteenth sanctions package tied to the war in Ukraine. If adopted, that timing pulls forward the practical end of Russian gas in Europe and concentrates minds in Houston, Doha, and Brussels alike. See Reuters on plan and timing.

A ban that takes effect at the start of 2027 means the critical proving ground is winter 2026-27. Storage will be drawn down at the coldest point of the year, power grids will still depend on gas for flexibility, and industrial users from fertilizer to glass will need price and supply stability to plan ahead. Europe’s question is simple: can non-Russian LNG and pipeline gas plus demand reduction cover the gap without a price spike or rationing. The corollary in the United States is equally sharp: can America expand LNG output and move molecules to the docks without blowing out domestic prices or emissions.

This piece pressure tests what must go right and where it can go wrong across US liquefaction buildouts, pipelines, shipping, methane rules, and financing. Then it models price, emissions, and security outcomes for winter 2026-27 under best, base, and worst cases.

America’s LNG reboot, explained

In January 2024 the United States paused approvals for some new LNG export permits while the Department of Energy reexamined public interest tests. That pause ended on January 21, 2025, when DOE formally resumed processing applications and extensions. The move reopened a long doorstep of projects and expansions along the Gulf Coast. DOE said the Office of Fossil Energy and Carbon Management would return to regular order and proceed in parallel with environmental reviews. See DOE Jan 21 announcement.

Policy changes matter, but the calendar matters more. Most of the LNG that Europe can count on by winter 2026-27 was already under construction or well into commissioning by early 2025. Permits granted in 2025 help later years. What matters for 2026-27 is steel in the ground and power to the cold boxes.

What can be ready by winter 2026-27

Think of US LNG supply in three buckets.

1) Projects already commissioning or ramping in 2025-26

- Two midscale trains at Corpus Christi Stage 3 are slated to keep ramping into 2026. The midscale design spreads execution risk, and feed gas pipelines into the Corpus hub are mature. Output from Stage 3 is already visible in feed-gas flows.

- Plaquemines LNG continues staged commissioning through 2025 and into 2026. Venture Global’s commissioning playbook has frustrated offtakers, but it still pushes real molecules into the market. For Europe, what matters is physical cargoes, even if contract disputes linger.

- Golden Pass LNG has been delayed but remains a swing factor for 2026. One to two trains online before the 2026-27 winter is possible in a bullish case, with a third sliding into 2027. Its scale means each train adds meaningful supply to Atlantic Basin balances.

2) Projects with first-cargo risk in late 2026 or 2027

- Port Arthur Phase 1 and Rio Grande Phase 1 carry first-cargo timelines that cluster in 2027. Slippage or acceleration of a quarter shifts the winter 2026-27 balance more at the margin than the core.

- Smaller or modular projects and capacity debottlenecking can add incremental volumes. They are not large enough individually to change Europe’s winter balance, but together they pad the cushion.

3) Paper capacity that needs time

- Projects like CP2, Lake Charles, and various brownfield expansions benefit from the resumed DOE process, but final investment decisions, EPC awards, and financing push material volumes past winter 2026-27.

Bottom line on timing: If commissioning schedules largely hold, the US can likely add multiple billion cubic feet per day of effective export capacity versus 2024 levels by winter 2026-27. The precise number depends on ramp curves, maintenance, and weather-related outages, but the direction and magnitude are supportive for Europe.

The chokepoints that decide the outcome

Liquefaction construction

- Labor and logistics: Gulf Coast labor remains tight. Turnover, on-site productivity, and specialized subcontractor availability can slip schedules by months. Modular trains help, but critical path items like cryogenic heat exchangers or power systems still bind.

- Weather: Late-season Gulf storms in 2026 could disrupt commissioning, damage temporary systems, or force evacuations. Even brief interruptions compound on tight schedules.

Feed gas and pipelines

- Permian and Haynesville supply looks ample in aggregate, yet bottlenecks matter locally. The Permian has added takeaway capacity, but constraints or maintenance on key lines into the Freeport, Corpus, Sabine, and Plaquemines corridors can shave peak deliverability. New lateral pipelines dedicated to specific terminals must be energized early and tested under load.

- Gas quality and pressure management during commissioning can constrain instantaneous send-out. It is not just nameplate capacity. It is stable feed-gas quality at the flange when you need it.

Shipping and ports

- Vessels: The global LNG carrier orderbook remains heavy through 2026. The fleet is large enough overall, but many newbuilds are tied to Qatar’s North Field East volumes and long-term charters in Asia. European buyers will want time charters or portfolio supplier flexibility locked well before winter.

- Chokepoints: The Panama Canal saga mainly hits US Gulf to Asia flows, not transatlantic runs, yet it still reshapes global fleet positioning and spot rates. Atlantic Basin cargoes to Europe benefit from shorter hauls, but winter congestion at European terminals, fog in the Gulf, and pilotage delays can stack up at the worst moment.

- Port infrastructure: Channel deepening at Corpus and traffic management at Sabine and the Mississippi matter for schedule certainty. Small delays at berth can cascade into lost cargoes in a tight week.

Methane rules and certification

- Policy flux: US methane regulation has been in motion since late 2023. Operators have been tightening leak detection and ending routine flaring at new sites, while policy debates in 2025 injected uncertainty into deadlines and reporting rules. For buyers, the signal is clear either way: Europe is moving toward methane performance thresholds for imported gas later this decade, so sellers that prove low upstream and midstream methane intensity will win contracts on better terms.

- Measurement: Exporters that deploy continuous monitoring, replace pneumatics, and verify with third-party MRV stand to access green premia and avoid future barriers. Those who do not will face tougher contract negotiations and potentially higher financing costs.

Financing

- Interest rates and insurer scrutiny raised project hurdle rates through 2024-25. Offtakers have been willing to sign for 15 or 20 years, but some European buyers prefer shorter tenors that line up with decarbonization plans. That creates financing gaps that require creative structures, government credit support in buyer countries, or portfolio players to bridge. For winter 2026-27 the key is less about new FIDs and more about insulating projects already under construction from cost overruns and supply-chain shocks.

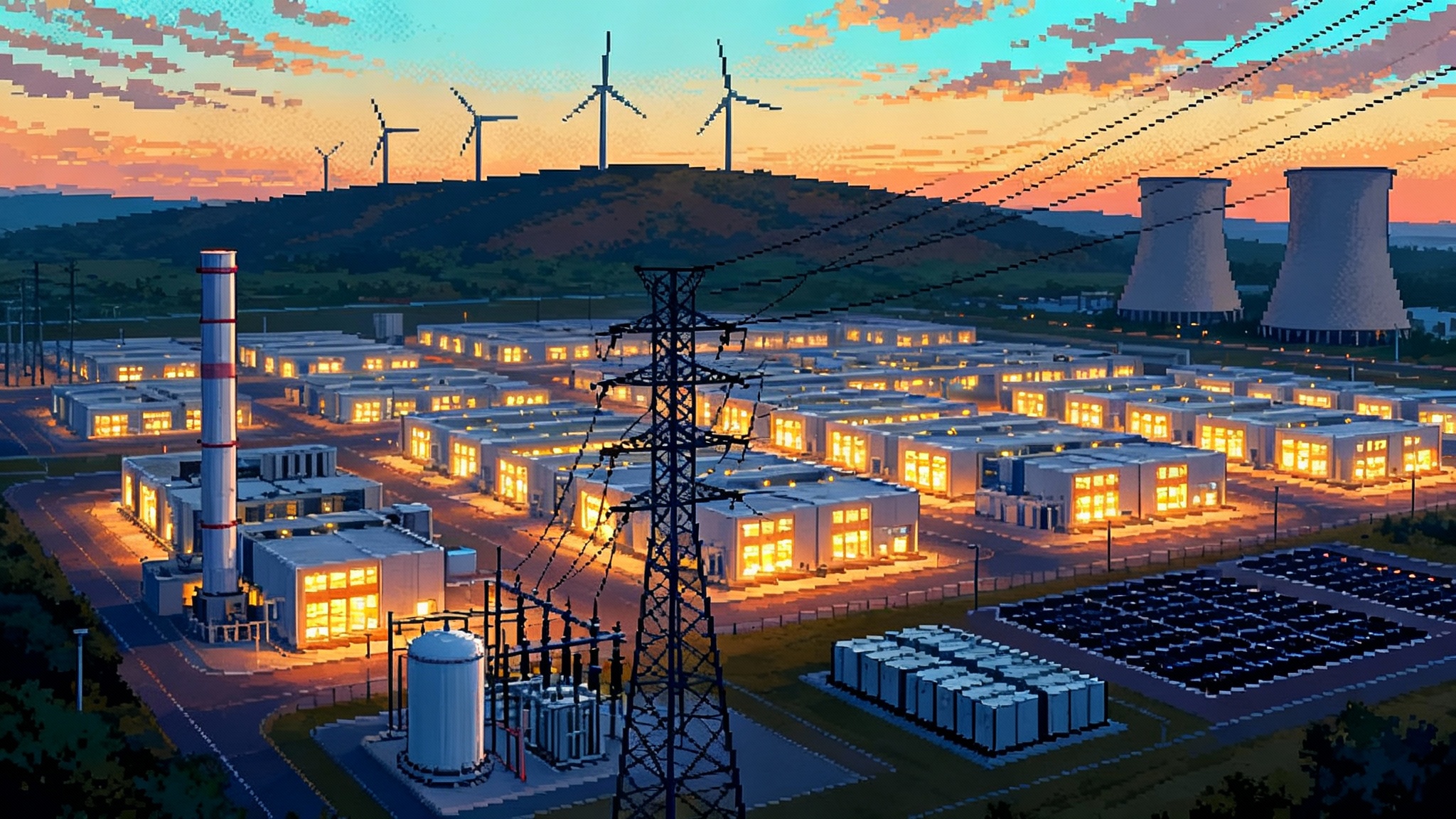

Power system context

- Gas will continue to balance intermittent renewables in winter. The surge in compute loads adds another layer of demand risk, as covered in our analysis of data center demand reshaping the grid and why a capacity-first transition is emerging.

How much Russian LNG is Europe replacing

Russian LNG still supplied a mid-teens percent share of EU LNG imports in 2025, concentrated through terminals in France, Belgium, Spain, and the Netherlands. A 2027 ban removes that optionality, so Europe must lean harder on US, Qatari, West African, and potentially East Med cargoes. Pipeline flows from Norway and North Africa continue to underwrite base supply, but LNG sets the marginal price in winter.

The math is manageable if project ramps arrive on time and weather cooperates. It gets hard if any two of these three fail at once: a cold European winter, meaningful ramp delays, or a supply disruption elsewhere that pulls cargoes away from Europe.

Scenario modeling for winter 2026-27

These scenarios focus on the January to March 2027 window when a Russian LNG ban would bite, storage is lowest, and US projects are mid-ramp.

Assumptions used across cases

- European demand: Normalized to the post-2022 efficiency baseline. Power demand reflects continued renewable growth and modest nuclear and hydro rebound versus 2022-24 troughs.

- US liquefaction: Commissioning and ramp behavior track past Gulf projects, with weather and reliability sensitivities as noted below.

- Shipping: Adequate carrier availability, with higher day rates in stress scenarios. No structural constraints at European regas terminals beyond seasonal congestion.

Best case

- Supply and weather: Europe has a normal to mild winter. Norway and North Africa pipeline flows are steady. US commissioning stays on schedule, with Golden Pass and additional Corpus and Plaquemines volumes hitting stride by December 2026. LNG shipping day rates rise seasonally but remain below 2022 peaks.

- Prices: European TTF averages in the equivalent of 28 to 40 dollars per MMBtu for peak winter weeks, with spikes short lived and largely weather driven. US Henry Hub averages in the mid 3s to low 4s, with brief touches above 5 during Arctic outbreaks. Retail impacts in the US are modest outside of a few New England peaking days.

- Emissions: Upstream methane intensity continues to fall at leading US producers, and several liquefaction sites deploy lower-carbon power or waste heat measures. Lifecycle emissions per delivered MMBtu to Europe trend down versus 2023 baselines.

- Security: Europe enters February with storage near the upper end of the five year range. Industrial curtailments are limited. Cargoes are available with a short lead time when cold snaps appear. The 2027 ban arrives with confidence.

Base case

- Supply and weather: Winter is seasonally average. US projects see typical commissioning hiccups and brief weather outages. Golden Pass delivers smaller but meaningful volumes. Europe backfills the Russian LNG ban by leaning on US and some Qatari cargoes, plus a bit more demand response.

- Prices: TTF prints sustained winter averages in the mid 30s to low 50s. Henry Hub ranges between 4 and 5, with basis blowouts in a couple of constrained US regions during cold waves. European power prices are manageable but volatile on still winter days.

- Emissions: Mixed progress. The best operators continue to lower methane, while policy uncertainty slows upgrades elsewhere. Lifecycle emissions per delivered MMBtu are roughly flat versus 2023-24 averages, with incremental reductions where continuous monitoring and electrified compression are adopted.

- Security: European storage draws at a healthy clip in January but remains adequate. Industrial users absorb higher prices but avoid widespread shutdowns. Security of supply improves versus 2022-23, but buyers keep optionality in case late winter turns cold.

Worst case

- Supply and weather: A cold European winter coincides with commissioning delays and Gulf storm damage. A global outage, such as an Australian or Nigerian LNG disruption, pulls spot cargoes away from the Atlantic. European nuclear or hydro underperforms.

- Prices: TTF spikes into the 60s to 90s for extended stretches, with triple digit prints possible during a multi week cold snap. US Henry Hub moves above 6 and can briefly trade 7 to 8. Regional basis in the US Northeast and Upper Midwest jumps sharply on pipeline constraints.

- Emissions: Higher flaring in stressed basins and more rerouting of cargoes lift lifecycle emissions per delivered MMBtu. Older steam turbines at some plants run harder to meet peak power loads in Europe, nudging power sector emissions up in January and February.

- Security: Europe manages through with strong demand response and emergency measures. Some industrial curtailments return. The lesson becomes clear that a 2027 ban requires more structural insurance than expected.

What the EU and US can do now to bend outcomes toward the best case

- Lock in flexible term volumes: European buyers should push portfolio sellers for winter-weighted delivery options and destination flexibility in 2026 and 2027. Optionality beats spot exposure when multiple risks are live.

- De-risk commissioning: Developers can front-load reliability testing and secure critical spares. Early proof of sustained run rates at trains scheduled to ramp in late 2026 will calm markets.

- Keep methane on a continuous improvement path: Even amid regulatory flux, operators that deploy continuous methane monitoring, eliminate high-bleed pneumatics, and document performance will find it easier to sign European contracts and to access cheaper capital.

- Smooth the last mile at regas terminals: European TSOs can sweat the small stuff that becomes big under stress. Berth availability, boil-off management, slot allocation transparency, and coordination with power system operators can shave the top off price spikes.

- Prepare for weather and outage insurance: A joint EU buyer group could prearrange a standby tranche of cargoes for January and February 2027, triggered by storage thresholds or weather indices. Portfolio sellers have the balance sheets and fleet access to structure this at reasonable premia.

- Mind US consumers: State regulators and utilities can expand residential efficiency and weatherization ahead of winter 2026-27, and strengthen peak-day gas deliverability plans in constrained regions. Those moves reduce the risk that higher LNG pull tightens domestic balances at the worst moment.

For the policy backdrop on grid buildout that will shape winter reliability, see how Washington is attempting a fast track to wire the AI grid.

How the numbers add up

Put the pieces together and the picture is disciplined rather than dramatic. By winter 2026-27, US effective LNG output can plausibly be several Bcf per day higher than 2024 realized exports, with Europe absorbing a large share due to voyage economics and portfolio positioning. Norway and North Africa pipe flows continue to underwrite base load. Asian demand growth competes for cargoes but does not overwhelm the Atlantic Basin if weather is normal. The ban’s success then hinges on avoiding a cluster of negative shocks and on starting the winter with storage well above average.

On price, the base case keeps European gas below crisis levels, with volatility rather than scarcity doing most of the damage. US prices rise from 2024 lows but remain moderate if production growth and storage management keep pace with LNG pulls. On emissions, the direction depends on operator choices in the shale patch and at the terminals more than on a single federal rule. The commercial incentives to certify low methane intensity and to electrify where feasible remain strong because European counterparties increasingly demand it.

What to watch between now and mid 2026

- A clear, legally durable EU act turning the proposed Russian LNG ban into binding law with a January 1, 2027 start date and practical guidance for terminals and shippers.

- Proof points on Gulf Coast ramps: sustained multiweek run rates from new trains at Corpus Christi Stage 3, Plaquemines, and Golden Pass.

- Vessel availability and charter pricing for winter delivery windows into Northwest Europe and the Med.

- European storage trajectories through summer 2026 and demand trends in energy intensive industry.

- US methane measurement and reporting practices adopted voluntarily by major producers and midstream companies even as formal rules are debated.

The bottom line

Europe’s proposed January 1, 2027 ban on Russian LNG and America’s January 2025 return to approving LNG exports set a tight two year clock. The calendar says there is just enough time for US supply to fill most of the gap if construction stays on track, pipelines deliver, ships are ready, and storage starts high. The market says that two or more things going wrong at once could still force a spike.

The prudent path is to treat winter 2026-27 like a final exam. Lock in flexible volumes, de-risk commissioning and feed-gas, verify methane performance, and keep consumers insulated with efficiency and peak-day planning. If those boxes get checked, Europe can enter 2027 with Russian LNG in the rearview mirror and without reliving 2022. If not, the price of learning will arrive on the coldest nights of January.