AI’s power rush is colliding with the grid, gas and nuclear rise

PJM capacity prices hit the cap, Washington is fast-tracking data centers, and a marquee HVDC line just lost federal backing. AI’s load surge is steering utilities toward quick gas, more storage, and revived nuclear while complicating renewables and rates.

The spike that set off alarms

In late July, PJM’s latest capacity auction cleared at the market cap across the entire footprint. The grid operator procured about 134,311 MW of unforced capacity for 2026–2027, and the RTO‑wide price landed at $329.17 per MW‑day. That is roughly $120 per kW‑year for the capacity component alone, a jolt that confirms what planners have been whispering for a year: demand is growing faster than new firm supply. PJM itself pointed to stronger load growth, a tight supply stack, and the need for resources that show up during risk hours. The headline is simple: the largest competitive power market in the country just told everyone that reliable megawatts are scarce and more valuable than they have been in years. PJM capacity auction results spell out the numbers.

Why now. Data centers and AI training clusters are arriving in multi‑hundred‑megawatt blocks. Electrification and reshoring add steady growth on top. Interconnection queues are still jammed, and retirements from aging thermal plants continue. Put that together with a summer‑winter risk profile that is harder to cover with variable renewables alone, and you get a capacity market that finally screams. For context on the load surge, see how the AI data center boom is reshaping the grid.

Washington just put data centers on a glide path

On July 23, the White House moved to accelerate data center buildouts. A new executive order directs agencies to streamline environmental reviews, expand categorical exclusions where appropriate, and tap the FAST‑41 framework so large projects can get a single federal schedule with tighter accountability. Agencies were asked to lean on brownfields and suitable federal lands, and to coordinate permitting for the related wires and substations that make a campus viable. The politics are straightforward: do not let permitting be the reason AI workloads go overseas. For a deeper dive on the policy push, read our analysis of the Washington fast track for the AI grid.

The practical effect is that queues for very large campuses could move faster than the grid infrastructure meant to serve them. If compute gets a green light in months and transmission still takes many years, utilities will lean on solutions they can control now: local gas turbines, uprates on existing plants, utility‑owned batteries, and targeted substation work, even if those choices are not the long‑run least cost.

At the same time, support for super‑wires took a hit

One day after the PJM auction results, the Department of Energy terminated its conditional loan guarantee for the Grain Belt Express HVDC project, a multistate line meant to move Midwest wind toward eastern load centers. The agency said the conditions to close were unlikely to be met and pulled the commitment. Whatever the project specifics, the signal to developers was clear: federal financial backing for big interregional lines is less certain today than it was a year ago. See DOE’s statement, DOE ends Grain Belt financial assistance.

Pair that with the reality that regional planning reforms still take years to translate into steel in the ground, and you have a near‑term bind. Loads are materializing at the edges of existing capacity, while the big pipes that unlock diverse supply are stalled or slowed. For how capacity dynamics are resetting priorities, see the capacity‑first transition under heat and AI.

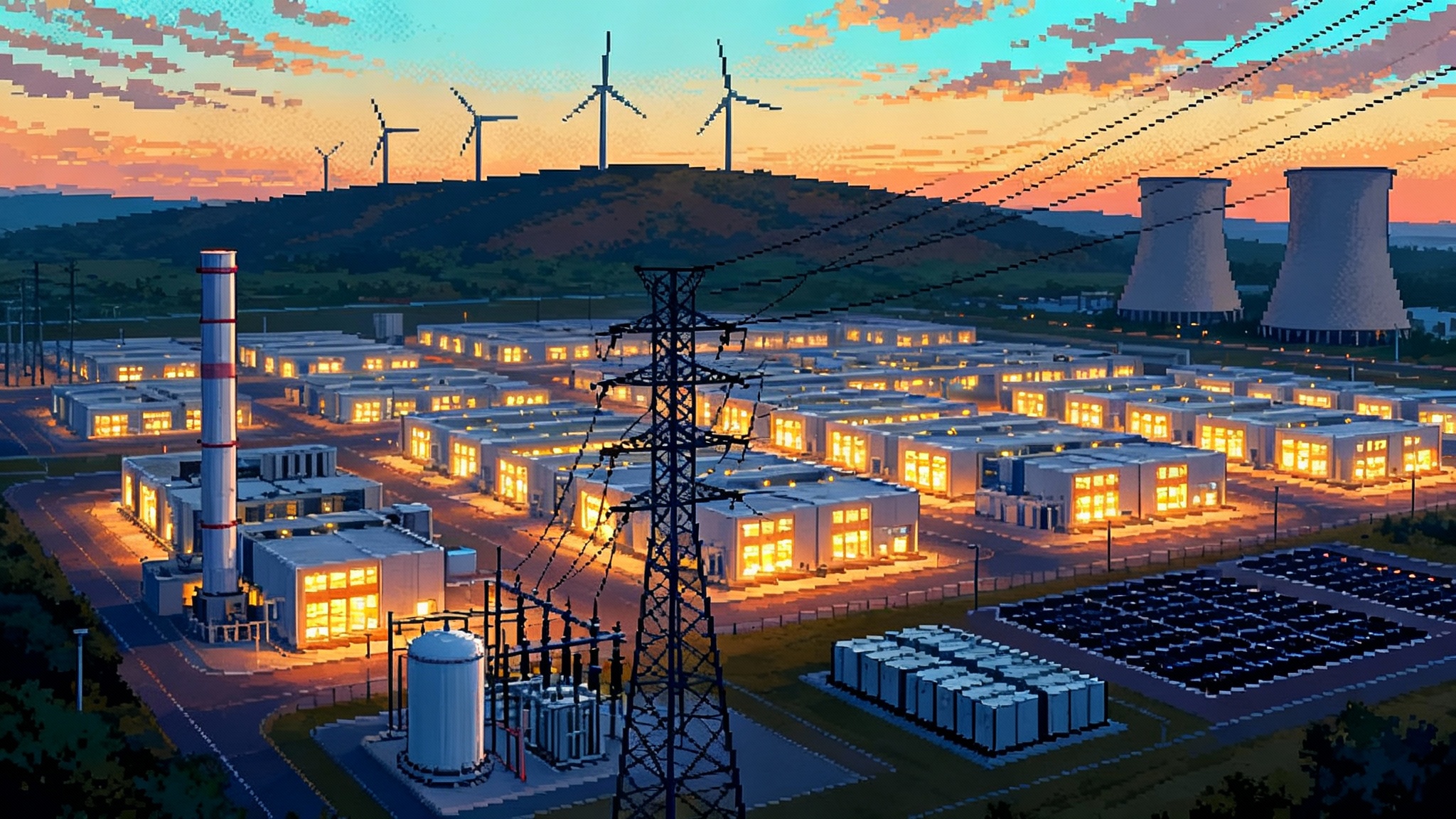

Utilities are reaching for fast, firm power

Across the Southeast and Mid‑Atlantic, integrated resource plans have shifted in the last 12 to 18 months. Several utilities have added gigawatts of simple‑cycle gas and reciprocating engines to the 2030 stack, often paired with four‑hour batteries. The logic is speed and dispatchability. Peaking gas plants can be permitted, sited, and built in two to four years, sometimes faster on brownfield sites. Batteries help shave the top of the peak and provide frequency response, but they do not expand multi‑day firm energy on their own.

Hyperscalers are not waiting either. One prominent AI firm is standing up containerized gas turbines at two campuses in the Mid‑South to bypass lengthy interconnection queues. Others are contracting for on‑site backup that can operate as a grid resource of last resort. The pattern rhymes with the early telecom buildout: put power where the compute is, even if it is not the long‑run optimum.

Then there is nuclear. Utilities that shelved new fission a decade ago are revisiting two paths. First, extend and uprate the existing fleet, which is often the cheapest clean firm energy per delivered MWh if the plant is in good health. Second, explore small modular reactors in collaboration with major customers. In Virginia, Dominion and a leading cloud provider signed an agreement to explore an SMR near the North Anna site. The commercial reality is sobering: the earliest in‑service in the mid‑2030s with significant regulatory and supply chain risk. Still, executives view SMRs as the only credible way to add large, carbon‑free firmness next decade near the data center core.

What this means for prices and reliability in 2026–2028

Capacity price math is dry but important. At $329.17 per MW‑day, the annual capacity charge is about $120 per kW‑year. A large industrial with a 50 MW peak can be looking at roughly $6 million per year in capacity costs before energy and ancillaries, depending on hedges and pass‑throughs. For residential customers, the capacity component is only a slice of the overall bill, yet it is rising into 2026–2027 across much of PJM. Retail impacts will vary by state and supplier contract structure, but the wholesale signal is up and to the right.

Reliability stress will be local and seasonal. Northern Virginia’s clusters will continue to drive summer and shoulder constraints on feeders and 230 kV backbones. Ohio and Pennsylvania will feel winter risk as gas deliverability and generator maintenance windows collide. Short, sharp scarcity events are more likely when a few gigawatts of flexible load and a few gigawatts of firm supply are both late to the party.

For renewables developers, the near term gets harder. High capacity prices should, in theory, help anything that can qualify, including storage. In practice, clogged interconnection studies, uncertain deliverability, and local backfeed limits slow projects that could otherwise temper the price spike. Some wind and solar that do reach COD will see curtailment until transmission catches up.

Winners and losers in the scramble

-

Hyperscalers

- Likely winners if they can pre‑pay for network upgrades, secure on‑site firm power, or sign creative PPAs tied to new firming assets. They will also gain leverage in bilateral deals with utilities that want to keep rate impacts in check. The risk is political: public pushback will grow if large campuses are seen to jump the queue or raise local bills.

-

Independent power producers

- Gas peaker owners and dual‑fuel assets in PJM look like short‑run winners. Storage developers with sites near load pockets will benefit, especially those that can qualify for capacity revenues and arbitrage. Nuclear owners with life‑extension options and uprates in hand have a durable advantage. Coal units without scrubbers or with expensive upgrades left to do are more exposed.

-

Ratepayers

- Residential customers face upward pressure from capacity and local network upgrades. The impact will be muted where states procure supply with long hedges and where regulators force cost sharing with large new loads. Small commercial customers on default service will feel increases earlier than households. Large C&I customers with pass‑through contracts will feel the full signal and may accelerate behind‑the‑meter projects as a result.

-

Renewables developers

- The long‑run story still favors cheap wind and solar paired with storage, but the next two to three years are about siting, deliverability, and firming. Projects with firm interconnection rights and co‑located batteries will fare well. Greenfield projects counting on near‑term interconnection in congested zones will struggle, even if their LCOE is compelling.

What actually works now

-

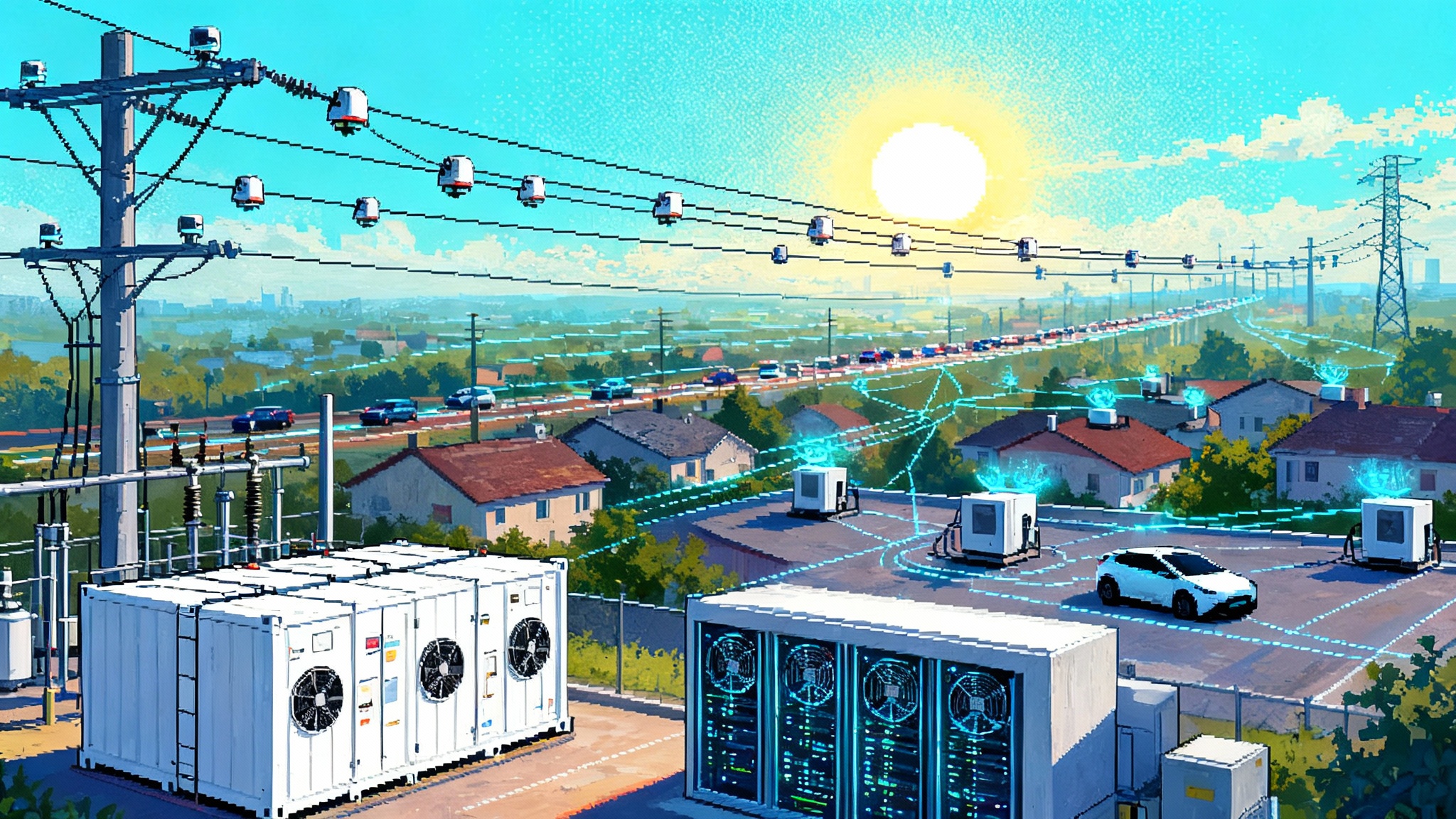

Dispatchable demand from large loads

- The grid needs flexible megawatts as much as it needs new ones. Data centers can offer real, verifiable demand response by temporarily throttling training jobs, shifting inference to other regions, or running on‑site generators during scarcity hours. To make this stick, RTOs should standardize telemetry and baseline rules so large, controllable loads can qualify for capacity value without gaming concerns. States can require flexibility plans as a condition of interconnection for very large new loads. Utilities should offer tariffs that reward guaranteed curtailment with discounts on network upgrade contributions.

-

Storage that targets the peak and risk hours

- Four‑hour batteries are not a panacea, but they are fast to build and powerful in the hours that set capacity and transmission deferral value. Co‑locating batteries at or near data centers yields a double benefit: peak shaving on the customer side and a tool for the utility to manage local feeders. Developers should prioritize nodes where N‑1 contingencies drive recurring congestion, and pair projects with dynamic operating envelopes so dispatch actually helps the grid. Long‑duration pilots are worth doing, but they will not be the workhorses of 2026–2028.

-

No‑regrets wires

- Reconductor with advanced conductors on existing rights of way, add dynamic line ratings where weather allows, right‑size rebuilds during routine replacements, and attack substation bottlenecks. These measures are often one to three year jobs, they add real capacity, and they avoid the political warfare that can swamp a new 500 kV line. Software matters too: topology optimization and remedial action schemes can unlock hidden headroom at modest cost if operators trust the tools.

-

On‑site generation and smarter PPAs

- Expect more behind‑the‑meter engines and turbines at hyperscale campuses, ideally paired with emissions controls and batteries to limit local air impacts. Utilities should channel this, not fight it, through interconnection agreements that require black‑start support or islanding services during emergencies. On the contracting side, move beyond pure energy PPAs. Sign structured deals that pay for capacity, spinning reserve, and voltage support from storage and hybrid plants near load pockets. For renewables developers, pre‑arrange a firming portfolio rather than selling a naked shape to the utility.

The long bets worth making

-

New transmission, built smarter

- The need for interregional lines did not go away. It increased. Regional planning reforms are in place, but will take time to bite. The near‑term reversal on a marquee loan guarantee underscores the political risk, yet it also argues for a narrower, staged approach that focuses on lines with strong reliability and economic cases. NIETC designations will continue to matter, and utilities should package smaller segments with clear benefits rather than chase a single mega‑project that dies under opposition.

-

SMRs, but with eyes open

- Small modular reactors can solve the firm, clean energy problem for dense load clusters in the 2030s. The technology curve is real, yet the first‑of‑a‑kind premium is real too. Sensible sponsors will site SMRs at existing nuclear locations with skilled workforces and established security perimeters, tie offtake to multiple large customers, and separate construction risk from ratepayers as much as possible. Regulators should seek shared‑savings structures and milestone gates instead of blank checks.

How to keep AI growth from breaking the grid

- Require flexibility plans for very large new loads, spell out curtailment commitments up front and pay for them.

- Prioritize substation upgrades and reconductoring where the next 1 to 3 GW of data center demand is already mapped.

- Tender capacity for the 6 to 20 risk hours that drive reliability events, not a generic average hour, so storage and flexible load are paid for what they deliver.

- Standardize fast‑track interconnection paths for on‑site batteries and engines at large campuses, with strict emissions and emergency support conditions.

- Keep building renewables where the wires can take them, and pair each tranche with storage sized to local peak and transmission limits.

- Line up two or three SMR candidates at proven nuclear sites with customer anchors, and let the best executable project proceed.

The core message is not complicated. AI is arriving faster than the grid was designed to expand. Markets are signaling the shortfall, federal policy is trying to remove speed bumps for compute, and interregional wires are struggling to keep pace. In the near term, reliability will be protected by quick gas, more storage, flexible load, and surgical wires. The long game still belongs to bigger wires and new nuclear. The sooner utilities, hyperscalers, and regulators align on that split, the better the odds that prices stabilize and the lights stay on while the next wave of compute comes online.