America’s LNG Reboot: DOE ends pause, Gulf projects sprint

The Department of Energy restored LNG approvals in January 2025, clearing a backlog and jump-starting Gulf Coast projects. We break down who advanced, what volumes are realistic for 2026 to 2030, and which bottlenecks like pipelines, labor and methane rules could still slow the surge.

The day Washington hit reset on LNG

On January 21, 2025, the Department of Energy ended the federal pause on new U.S. LNG export authorizations and told staff to resume non‑FTA determinations under the Natural Gas Act. The move, announced in the official newsroom as DOE ends LNG pause, unlocked a year’s worth of pending decisions and put developers back on the clock. On April 1, DOE also rescinded a 2023 policy that had tightened criteria for commencement‑date extensions, returning those cases to the historic case‑by‑case standard.

Who just got a green light

DOE followed the January reset with a burst of orders through spring and summer. The agency’s 2025 docket reads like a roadmap for the next wave of Gulf exports. The fastest way to verify specific actions is the DOE 2025 authorizations list.

Highlights from 2025 activity:

- Venture Global CP2 LNG, Louisiana — Conditional non‑FTA export authorization in March. It remains one of the largest proposals on the Gulf Coast, with significant commercial interest.

- Commonwealth LNG, Louisiana — Conditional non‑FTA authorization in February and a final non‑FTA authorization on August 29. The developer is targeting a 2025 FID and first LNG around 2029.

- Port Arthur LNG Phase II, Texas — Final non‑FTA authorization on May 29, clearing a major federal hurdle for Trains 3 and 4 and aligning with a busy offtake calendar.

- Golden Pass LNG, Texas — Second extension of the non‑FTA commencement deadline on March 5, moving the date to March 31, 2027 and matching the updated commissioning plan. Operators requested a cooldown cargo beginning in October 2025, a typical late‑stage step.

- Delfin LNG, offshore Louisiana — Extension granted on March 10, pushing the non‑FTA commencement deadline to June 1, 2029. A subsequent request to adjust configuration and timing is pending.

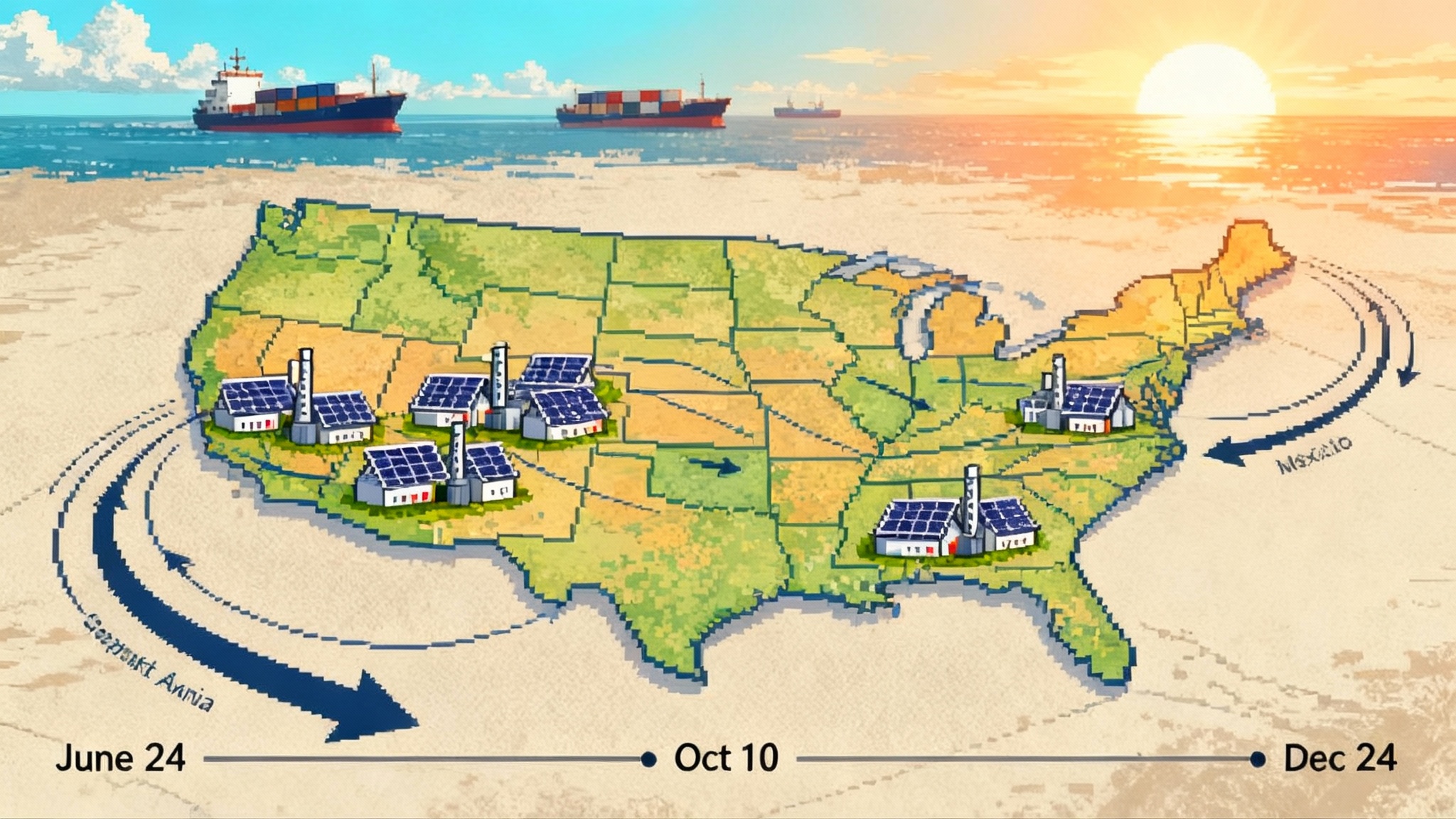

What the timeline looks like for 2026 to 2030

Put DOE’s decisions next to construction status and you can sketch a reasonable arrival curve for new U.S. volumes.

-

Late 2025 to 2026

- Golden Pass Train 1 guides to late 2025 or early 2026 for first cargo, with Trains 2 and 3 following over the next year. If execution holds, Golden Pass becomes the ninth major U.S. exporter and one of the largest single sites.

-

2027 to 2028

- Port Arthur Phase 1 anchors the mid‑decade, overlapping with the tail end of Golden Pass and expansions at Plaquemines and Corpus Christi Stage 3. The effect should be steady additions, not a single spike.

-

2029 to 2030

- Port Arthur Phase 2 now has export authorization and growing SPAs, consistent with a 2025 FID and first LNG near 2029 to 2030. Commonwealth targets 2029 subject to FID. CP2 is the wildcard due to scale, remaining FERC steps and the ability to lock labor and equipment. Delfin’s extension preserves a late‑decade window if financing and shipyard slots line up.

The bottlenecks that matter more than a federal pause

-

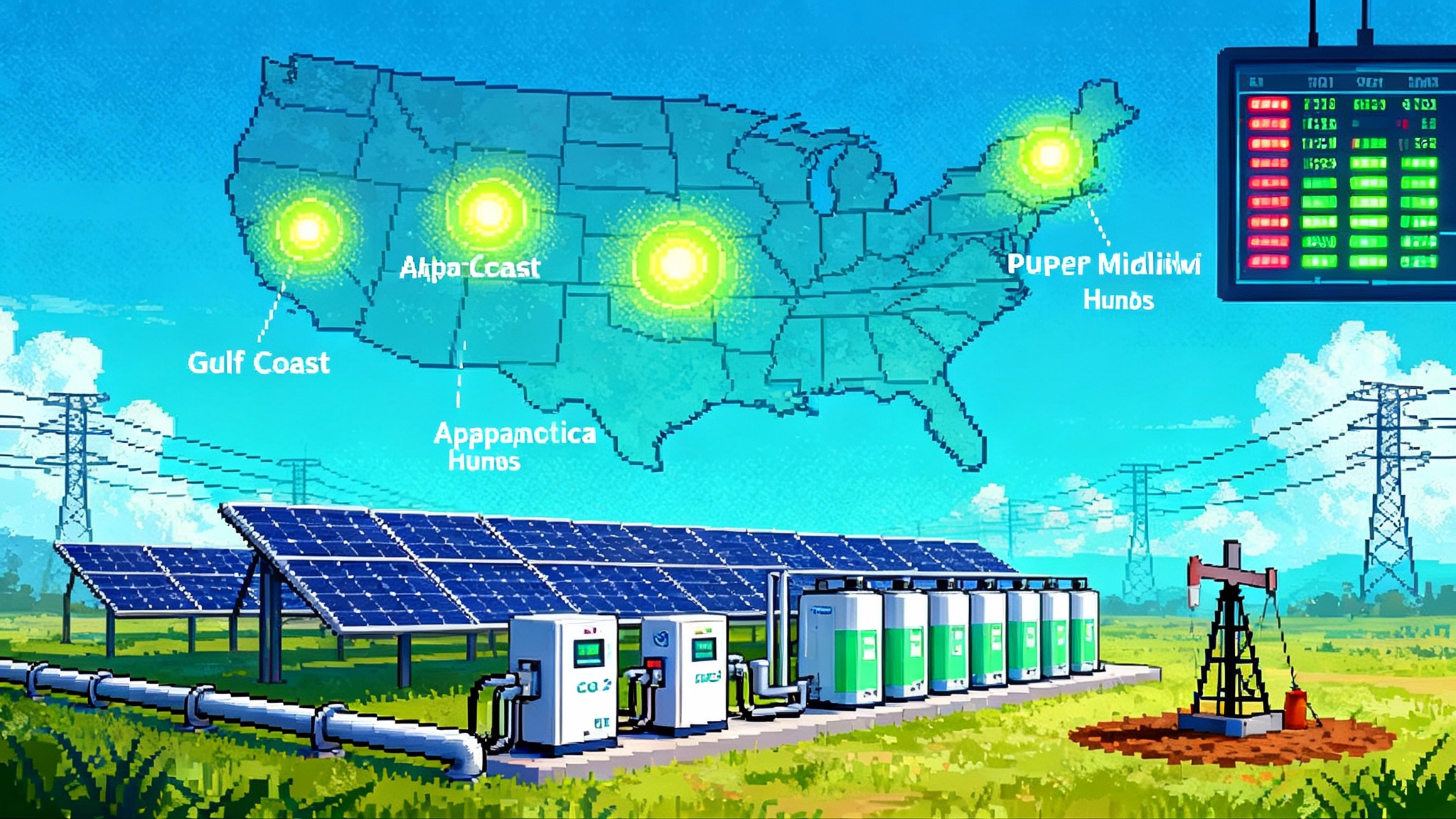

Feedgas pipelines

- Port Arthur’s Louisiana and Texas Connector lines aim for service around summer 2026, with additional intrastate capacity proposed into 2027. CP2 and Commonwealth lean on dense Southwest Louisiana grids, but growth still depends on upstream Permian and Haynesville expansions. For broader siting currents and state influence, see our look at States’ new leverage in FERC planning.

-

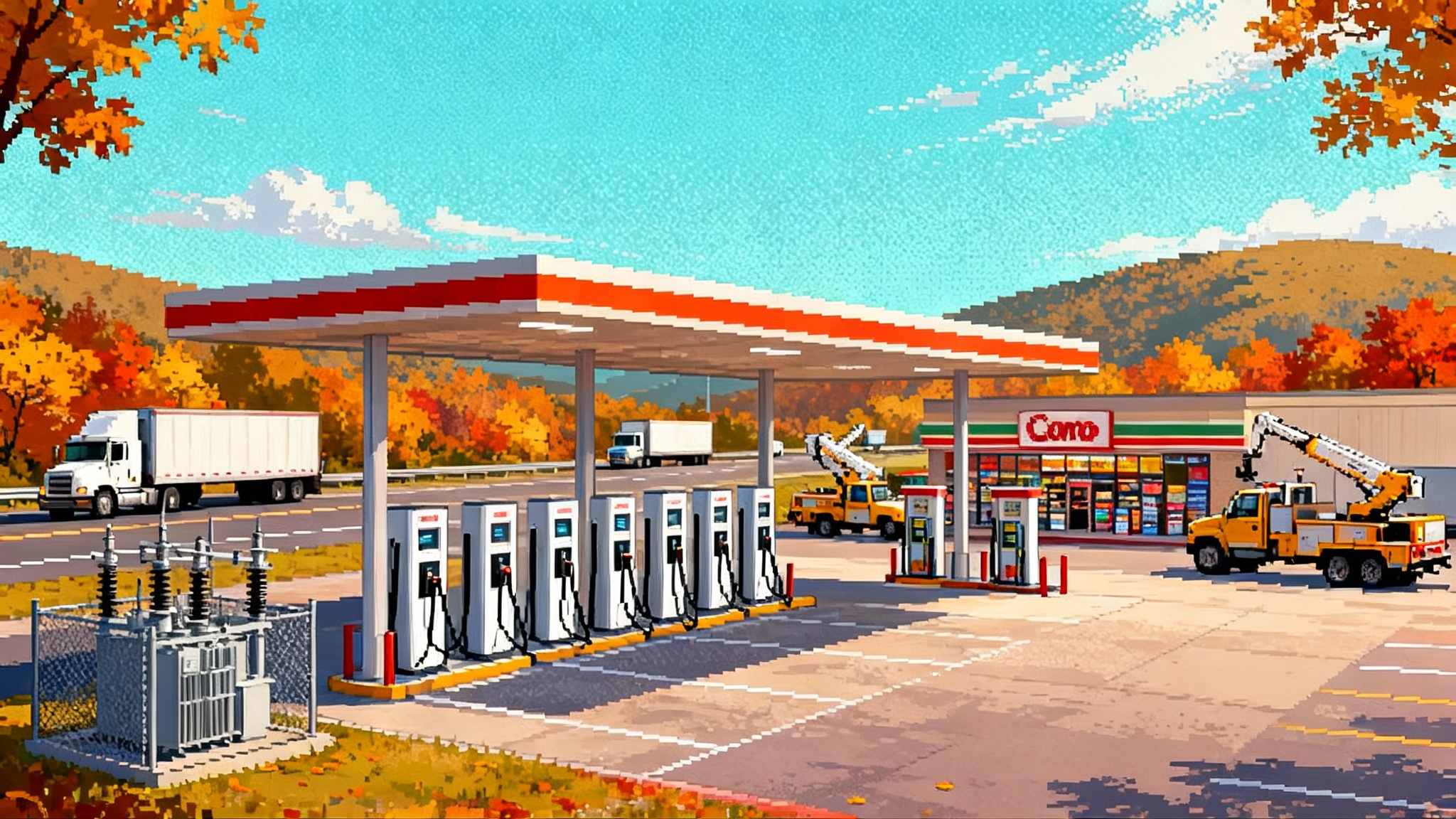

Gulf Coast craft labor

- Multiple mega‑projects are drawing from the same pool of welders, electricians and instrument techs. Overlaps raise costs and stretch punch lists. Modularization helps, but people are the limiting reagent.

-

Shipyard and module capacity

- LNG carriers will be chartered mainly from Asian yards, so the U.S. shipyard pinch is secondary. What bites is global supply for heavy modules, turbomachinery and cryogenic equipment when several mega‑projects buy at once.

-

Local air and coastal permits

- Project‑specific air permits, wetlands work and shoreline setbacks can shape schedules as much as national policy. Recent filings show how supplemental analyses can add months.

-

Methane rules and buyer standards

- The federal methane fee was voided in March, easing near‑term compliance pressure, but market standards are moving the other way. European rules begin phasing in import requirements from 2027, and SPA clauses on measurement and verification are spreading. For context on policy swings, see our piece on methane‑fee fallout and 45V.

2025’s fast‑tracked extensions changed specific projects

-

Golden Pass LNG — DOE’s March 5 order extended the non‑FTA commencement deadline to March 31, 2027. The practical effect is to keep long‑term contracts and financing intact while commissioning completes.

-

Delfin LNG — DOE’s March 10 order extended the non‑FTA commencement date to June 1, 2029. It does not guarantee success, but it preserves an offshore FLNG option for late‑decade volumes.

Who benefits and who bears the risk

-

Gulf Coast developers

- Approvals and extensions make it easier to close bankable SPAs, finalize EPC terms and sequence labor. The risk is execution across overlapping builds and hurricane seasons.

-

Pipeline operators

- Higher, steadier Gulf pulls support new pipe and compression. The familiar risks are permitting delays, right‑of‑way fights and local opposition.

-

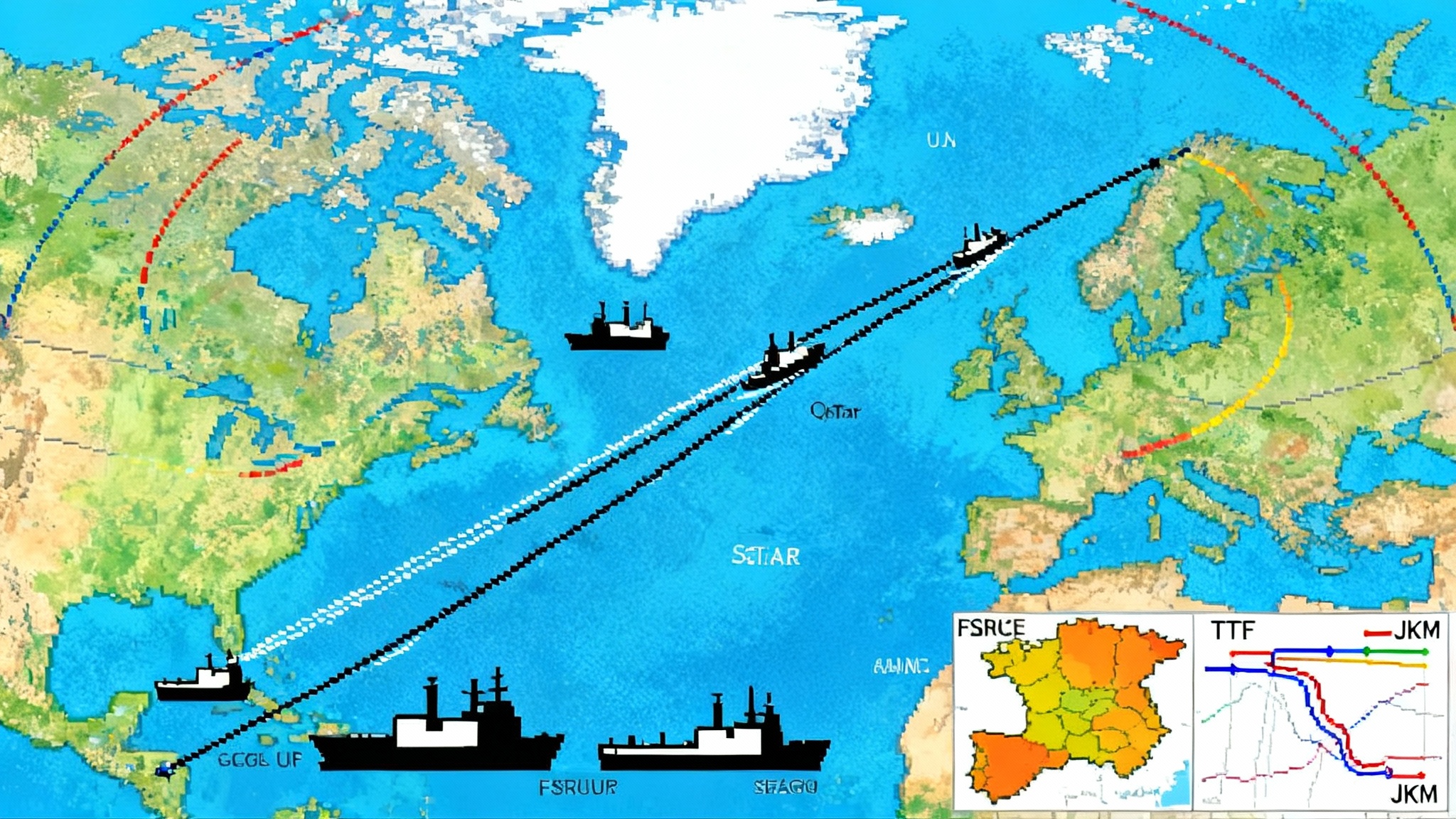

Asian and European buyers

- Buyers sought long‑dated hedges in 2025, especially as Russian supply faces new political pressure in Europe. U.S. Henry Hub‑linked cargoes diversify exposure. Policy whiplash remains a risk. For the geopolitical backdrop, see our analysis of Europe’s 2027 LNG ban.

The bottom line

DOE’s 2025 reset did more than end a pause. It re‑sequenced the next tranche of U.S. LNG with clustered approvals and extensions that put developers in motion again. If the Gulf Coast threads the needle on pipelines, people and parts, the U.S. can add a meaningful wave of exports between 2026 and 2030. If not, the slowdowns will come from weld shops, compressor stations and local permit desks, not from Washington.