After the Freeze: Who Wins NEVI’s 2025-26 Buildout

A February 6 funding freeze, a June 24 injunction, and an August 11 guidance reset have rewritten the EV fast charging map. With Tesla easing off new Supercharger builds, retailers, utilities, and oil majors are poised to capture 2025-26 NEVI awards.

The pause, the thaw, and a new map of U.S. fast charging

On February 6, 2025, the U.S. Department of Transportation ordered states to stop obligating new National Electric Vehicle Infrastructure funds, freezing a $5 billion program that had become the backbone of highway fast charging. The move stunned state DOTs and developers that had spent two years shaping corridor plans and queuing projects. Coverage at the time, including the Politico account of the decision, laid out the stakes and set the context for this analysis.

On June 24, 2025, a federal district court issued a preliminary, partial injunction. It did not fully restore the 50 state status quo, but it required DOT to resume processing obligations for previously approved plans in 14 plaintiff states after a short stay. The result was a two track America: some states restarted under 2023-24 playbooks while others waited for new federal guidance.

That new guidance arrived August 11 as an interim revision from the Federal Highway Administration. It narrowed planning requirements, loosened spacing flexibility, encouraged selecting locations where the station owner is also the site host, and pared back process steps that had slowed awards. The interim guidance took immediate effect while FHWA solicits further comment. See the FHWA summary of NEVI revisions.

Taken together, the February pause, the June thaw, and the August reset are reshaping who builds fast charging in 2025-26. With Tesla easing off its Supercharger expansion, the center of gravity is tilting toward retailers, utilities, and oil majors with travel center footprints.

What the June 24 injunction did and did not do

- Restored approvals in 14 states. Arizona, California, Colorado, Delaware, Hawaii, Illinois, Maryland, New Jersey, New Mexico, New York, Oregon, Rhode Island, Washington, and Wisconsin could proceed under previously approved plans. DOT could not withhold or revoke approvals without statutory procedures.

- Left three jurisdictions outside initial relief. The District of Columbia, Minnesota, and Vermont did not demonstrate immediate harm at that stage and must move under the revised guidance.

- Kept FHWA process intact. Even in thaw states, each site still requires an obligation request and normal federal aid steps.

Practical effect: a split pipeline. In the 14 injunction states, backlogged sites can move first where site control, utility studies, and equipment orders are in place. Elsewhere, states are rewriting plans to fit the August guidance, then re sequencing corridor gaps.

How the August guidance changes the chessboard

The interim guidance is a genuine simplifier. Four changes matter most for who wins next:

- Shorter, lighter state plans. Less time writing means more time awarding, which favors states with shovel ready clusters and developers with repeatable templates.

- More spacing flexibility. Instead of a rigid 50 mile drumbeat, states can justify practical spacing to serve real trips. That favors hosts with the best highway real estate, even if a few miles off ideal mile markers.

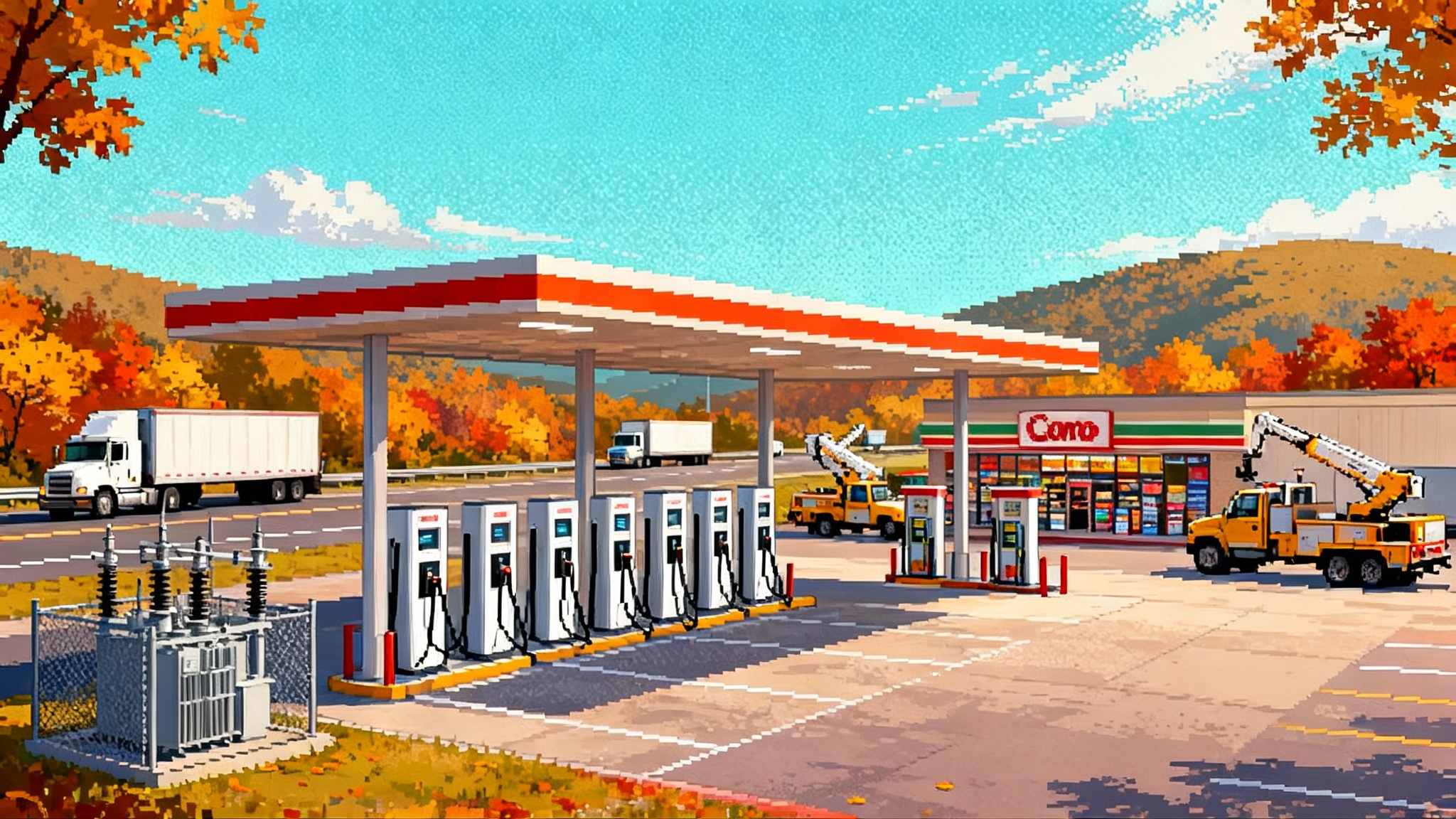

- Preference for aligned site hosts. Encouraging cases where the station owner is also the site host reduces landlord tenant friction. Travel center chains, c stores, and big box lots that can self permit, self build, and self maintain gain an edge.

- Fewer prescriptive extras. Lighter paperwork on community engagement, evacuation plans, and add ons shifts scoring weight toward speed to energization and uptime guarantees.

Net effect: awards gravitate to players that control land, parking, power upgrades, and operations under one roof, and that can replicate a compliant site at scale. For a parallel shift in policy leverage, see how states gain leverage in FERC 1920 A.

Tesla’s Supercharger slowdown opens the door

Starting in April 2024, Tesla cut and reorganized its charging organization and publicly signaled a slower pace for new locations with more emphasis on uptime and expansions at existing sites. Consequences followed:

- Bid capacity dropped. Tesla had been a top winner or finalist in many first round NEVI competitions. A smaller green field appetite created openings.

- Site hosts diversified. Landlords that had pre negotiated for Superchargers are taking calls from other networks and OEM backed JVs.

- States hedged. Program managers leaned into multi vendor awards and chains with visible construction crews.

In short, Tesla’s pivot did not remove a competitor so much as it removed the most vertically integrated, lowest friction bidder from some shortlists. Immediate beneficiaries include retailers and travel centers that act as their own site hosts, plus oil majors and established networks with balance sheets and procurement muscle.

The new front runners: retailers, utilities, oil majors

- Retailers and travel centers. Love’s, Pilot, Wawa, Sheetz, and regional grocers are bundling food, restrooms, lighting, and 24/7 staffing with 150-400 kW bays. Expect them to lean into the aligned host preference.

- Utilities. Make ready investments and transformer upgrades still gate timelines. Regulated utilities in Colorado, New York, and California are prioritizing NEVI corridors with dedicated interconnection lanes. Public power utilities in the Midwest and Southeast are proposing utility owned sites where statutes allow.

- Oil majors. bp’s TravelCenters of America footprint gives bp pulse first class highway real estate, already translating into ultrafast hubs with room to scale. Shell continues to place highway adjacent sites via hosts and integrators.

- OEM backed JV. IONNA is co locating at top tier c stores and travel corridors with 350-400 kW hardware and driver centric amenities.

- Established EV networks. EVgo, ChargePoint, Electrify America, Francis Energy, and regional specialists win in multi award states because they know the paperwork, have uptime playbooks, and can deploy vendor agnostic hardware.

State by state pivot map for 2025-26

Think three buckets: Thaw States that can run with 2023-24 plans, Reset States that will relaunch under the August guidance, and Edge Cases that must thread both. For how Texas and California fit into broader power dynamics, see our look at the Texas and California grid moment.

Thaw States

- Arizona. Interstate gaps on I-10 and I-40 move first. Travel center hosts dominate; utilities prioritize transformer swaps near metros.

- California. CEC run awards keep pace. Electrify America, ChargePoint partners, and new high power entrants split corridors; utility make ready remains the long pole.

- Colorado. Backlog clears on I-25, I-70, and I-76. Expect mixed wins among EVgo, Tesla holdovers, and retailers; Xcel interconnection lanes cut cycle time.

- Delaware, Rhode Island. Small networks and quick buildouts. Grocery and c store lots are favored; reliability KPIs will be scrutinized.

- Hawaii. Utility owned or utility partnered sites are advantaged. Expect fewer, higher reliability sites rather than dense coverage.

- Illinois, Maryland, New Jersey, New York. Turnpikes, service plazas, and anchored retail rule. Agencies lean into proven vendors with service level track records; public power partners keep queue times in check.

- New Mexico, Oregon, Washington, Wisconsin. Rural corridor fill ins get attention. Retailers and travel centers win on land control; utilities focus on substations to hit energization dates.

Reset States

- Texas. Massive geography plus ready hosts. Expect Love’s, Pilot, Buc ee’s, and OEM JV nodes on I-10, I-20, I-35, and I-45 to capture early 2026 energizations; utility queue reform is the decider.

- Florida. Travel center and c store sites on I-75 and I-95 move fast; coastal resilience features get value engineered without old paperwork drag.

- Ohio, North Carolina, Georgia. Prior winners are favored for repeats. Duke and Southern territories trim months with standardized designs.

- Indiana, Tennessee, Arkansas, Kansas, Virginia. Revised guidance helps fill the last 50-70 mile gaps, then non corridor coverage. Expect oil major hubs at highway interchanges.

Edge Cases

- Minnesota, Vermont, District of Columbia. Plans must align to the August guidance before obligations flow. Expect quick pivots that prioritize permitted, utility ready sites.

Near term timelines you can plan around

- Q3 2025. Interim guidance in force. Thaw States obligate funds on vetted sites. Reset States finalize streamlined plans and reopen RFPs with simpler scoring and stronger uptime guarantees.

- Q4 2025. Contracting and notice to proceed ramp. Retailers and travel centers break ground where utility gear is reserved. Oil major hubs begin to scale. Expect ribbon cuttings in Thaw States and high visibility groundbreakings elsewhere.

- H1 2026. First large wave of 4 to 8 stall 150-400 kW sites reaches energization, especially along interstates where pads, switchgear, and conduits were pre staged. OEM JV sites open in c store lots with amenities tuned for 20 minute dwell times.

- H2 2026. As more corridors reach built out status, states expand into non corridor and redundancy builds. Retailers add second clusters in metro adjacent suburbs; utilities chip away at the longest interconnection jobs. Reliability metrics and uptime bonuses begin to influence follow on awards.

Who wins under the revised guidance

-

Best positioned

- National travel center chains that own pads and parking, can standardize across dozens of sites, and negotiate utility work at scale.

- Oil majors with integrated retail networks and a mandate to deploy ultrafast hardware near heavy traffic, with lighting, cameras, restrooms, and food service that build user confidence.

- OEM backed networks that can lean on dealership service footprints and offer roaming with predictable payment experiences.

- Networks with proven high uptime, documented mean time to repair, and remote diagnostics. In 2025 contracts, those stats sell more than glossy renderings.

-

Moving up

- Public power utilities and co ops in rural states that can own or co own stations, solving land, interconnect, and operations in one entity.

- Regional grocers and big box lots that already invested in conduit and switchgear, now rewarded by the new flexibility.

-

Losing altitude

- Single site landlords without 24/7 amenities. The tilt toward aligned site hosts deprioritizes anonymous lots.

- Pure hardware vendors without an operations partner. States are rewarding uptime track records and end to end delivery capability.

- Tesla on green field builds in 2025-26 relative to its 2022-23 momentum. The company can still win where it commits build teams, but a slower expansion pace creates room for others.

How money and risk will actually flow

- Fewer bespoke RFPs. States will reuse simplified templates that emphasize uptime, interoperable payments, and energization deadlines.

- More awards per host. Expect multi site packages with consistent designs and a single utility playbook, cutting permitting and construction variance.

- Utility slots as bottleneck. Even with lighter paperwork, transformers and switchgear remain scarce. Winners pre allocate gear and schedule crews months ahead.

- Uptime contracts as tiebreaker. Minimums are still on paper, but states will write bonuses and penalties tighter than before. Networks with real telemetry and field service coverage will separate from the pack.

What to watch between now and mid 2026

- Interconnection lead times. State PUCs and utilities are piloting fast lanes for highway sites; jurisdictions that institutionalize those will energize earliest.

- Reliability data. Public dashboards and quarterly reports will begin to show port level uptime. Contracts will follow data.

- Retailer OEM tie ups. Expect more convenience chains to ink partnerships with OEM backed networks and oil majors to fill signature gaps on long interstates.

- Load growth context. The charging buildout intersects with surging power demand. See how the AI power rush is colliding with the grid landscape.

Bottom line: NEVI’s 2025-26 buildout will be led less by pure play charging startups and more by companies that already own the land, the restroom keys, and the utility relationships. With a court driven head start for 14 states and new guidance that eases red tape elsewhere, the land grab is on, and the winners are the ones that can pour concrete, pull cable, and hit uptime at scale.