Europe’s 2027 LNG Ban Could Redraw the Global Gas Map

Brussels is moving to outlaw Russian LNG by January 1, 2027. Here is how a phased cutoff could reroute cargoes, shift pricing power, accelerate new supply from the U.S. and Qatar, and reshape Europe’s decarbonization timeline.

The new line in the sand

Brussels is pushing to outlaw imports of Russian liquefied natural gas by January 1, 2027. The date matters. It turns a political aspiration into a countdown that producers, traders, and grid operators will plan against. It also draws a bright line between today’s flexible LNG market and the more segmented map that likely follows.

From 2022 to 2024, Europe cut pipeline gas from Russia but still allowed LNG to dock, regasify, and in some cases transship to third countries. A legal prohibition in 2027 would end that bridge. The immediate question is not only how Europe fills the gap. It is how cargoes, contracts, and capital will reorganize around a rule that takes effect on a specific day. For context on parallel timelines, see EU ban and U.S. LNG timelines.

This is a phased story. Contracts roll off, infrastructure comes online, and the market reprices risk in steps rather than a single lurch. The most important steps arrive in winter 2025–26, then again through calendar 2026 as new projects ramp, and finally at the January 1, 2027 line when Russian LNG is no longer a European option.

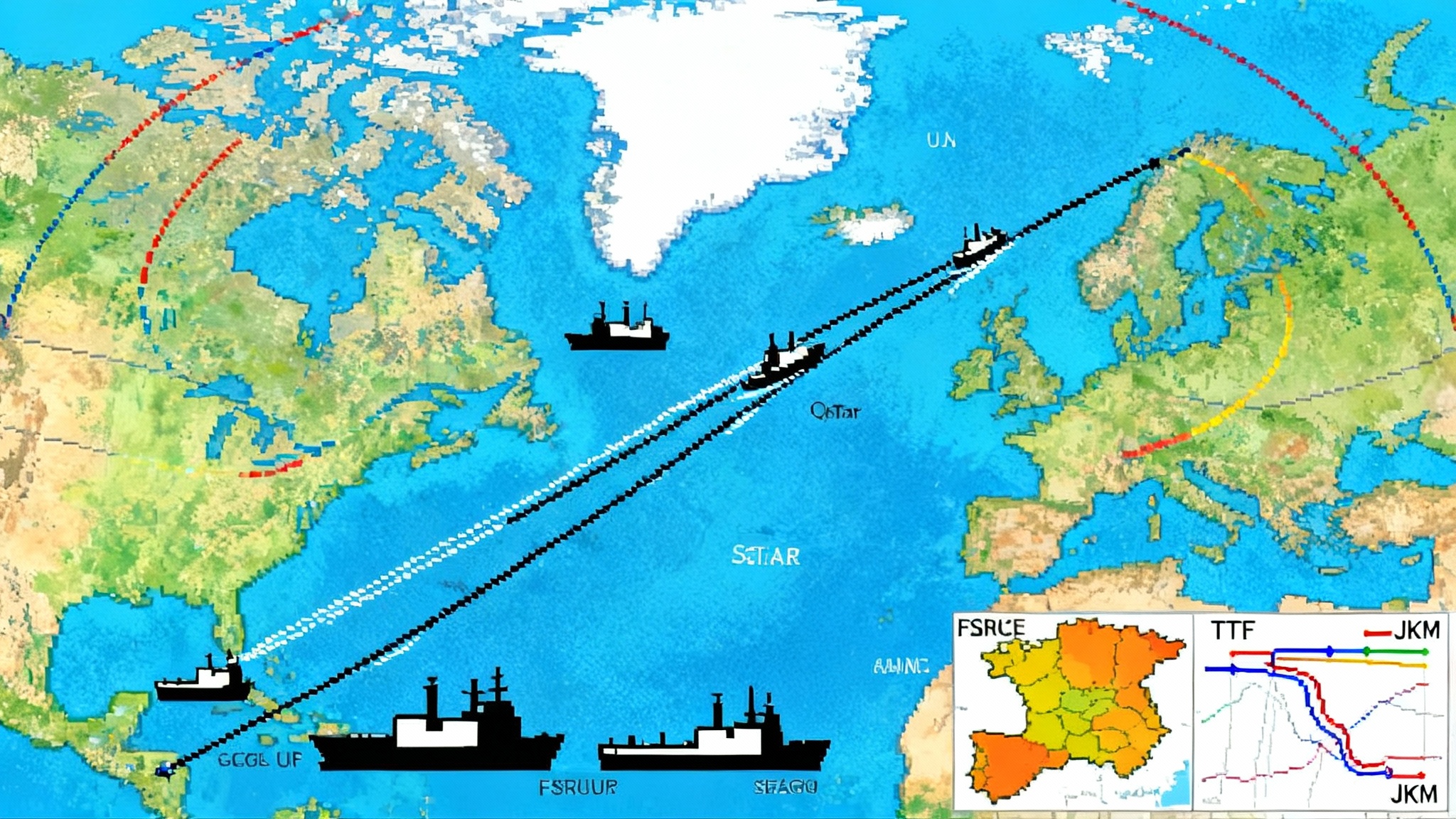

How the barrels move when the rules change

Russian LNG has mostly come from Yamal LNG and, in fits and starts, the sanctioned Arctic LNG 2 project. Today a share of those volumes reaches Europe directly, while another share relies on European ports for ship-to-ship transfers, seasonal buffering, and regas. A ban forces a new routing logic.

- Cargoes that once landed in Spain, France, Belgium, or the Netherlands must either find Asian buyers or flow to non‑EU customers via non‑EU transshipment points.

- The Northern Sea Route can carry Arc7 ice‑class vessels east to Asia during the summer window, though winter routing still needs either ice‑class all the way or transshipment to conventional carriers. Fleet availability becomes a hard physical constraint.

- Murmansk and Kamchatka transshipment hubs take on a larger role, while European terminals lose the arbitrage revenue from handling and re‑export.

For Europe, the gap is not only about replacing a number of billion cubic meters. It is about replacing a flexible swing source that used to arrive when prices spiked. That swing will now favor Asia, where discounted Russian barrels are more likely to settle into portfolios in China and other buyers comfortable with compliance risk.

Pricing power migrates

In the 2022–2024 shock, the Dutch TTF price became the global pacemaker. Asia’s JKM often followed TTF’s lead, with Europe acting as the marginal buyer that set the clearing price for LNG. A 2027 ban tilts some of that power back toward Asia.

- If Europe cannot or will not take Russian LNG, its marginal supply increasingly comes from the U.S. Gulf Coast and Qatar, plus a thinner spot market. When Europe must attract cargoes in a tight moment, the bid may need to beat not just JKM but also the opportunity cost for long‑haul shipping from the Gulf or Ras Laffan.

- Asia, in turn, can accept more Russian volumes at a discount. That does not guarantee lower JKM outright, but it does create a two‑tier market where some buyers have access to cheaper Russian supply and others do not. The price signals get noisier.

- Volatility migrates. With fewer short‑notice molecules available inside Europe, weather and nuclear outages in the EU could trigger sharper TTF spikes. Meanwhile, Asian prices may see more range‑bound trading when Russian cargoes anchor baseload demand.

The supply response: America and Qatar step on the gas

The 2027 deadline arrives just as a wave of new capacity is set to crest.

- U.S. Gulf Coast: Multiple projects are scheduled to bring new trains online between late 2025 and 2027. Gulf Coast cargoes are destination‑flexible and well suited to replacing lost Russian barrels in Europe. Their ramp matters for winter 2026–27, when Europe will be preparing for the final cutoff.

- Qatar: The North Field East expansion begins to add volumes in the middle of the decade, with additional trains from North Field South later in the 2020s. Long‑term sales and purchase agreements already tilt a portion of this output toward Europe, and more could follow as utilities lock in post‑2027 cover.

Together, these two supply centers change the map. By 2027, the typical marginal cargo serving Europe will either come from a U.S. project with a full slate of offtakers or from Qatar’s expanding portfolio. Spot tonnage still matters, but it will sit atop a wider base of contracted flows.

Infrastructure: Europe can import, but can it move the gas?

Europe’s regasification capacity expanded quickly after 2022 through floating terminals in Germany and the Netherlands, plus upgrades elsewhere. On paper, capacity looks ample. On the ground, bottlenecks still shape prices and flows.

- Iberia: Spain has a surplus of regas capacity but limited pipeline connections into France. Unless new interconnections are built or hydrogen‑focused projects are adapted to move methane during the transition, a lot of Spanish capacity will remain underused as a continental backstop.

- Germany: FSRUs at Wilhelmshaven, Brunsbüttel, and other sites arrived in record time. The next phase is replacing floating units with permanent facilities and building out grid reinforcements that move gas east and south without congestion pricing.

- Italy and Southeast Europe: LNG entry points help diversify away from pipeline risk, but seasonal demand swings and storage constraints still leave these markets sensitive to winter cold snaps.

By 2026, Europe will likely have enough nameplate capacity to replace Russian LNG imports. The question is whether the molecules can reach the right place at the right time. That is where internal pipes, storage fullness on November 1 each year, and demand management do the heavy lifting. For the policy backdrop on wiring and cross‑border flows, see how state leverage in grid planning is evolving.

Asia’s spot market feels the knock‑on effects

Asia becomes the default sink for Russian cargoes that Europe no longer takes. Three things follow.

- A larger share of Russian LNG lands in China under framework deals and via traders willing to manage sanctions exposure. This shifts some of Asia’s marginal demand from the open spot market into more structured bilateral flows.

- JKM still spikes when the weather bites. Yet the presence of discounted Russian supply for part of the buyer universe can dampen those spikes relative to a world where everyone is chasing the same spot cargo.

- Emerging Asian buyers could benefit if traders carve out compliant structures that route discounted molecules to markets hungry for fuel‑switching away from coal. That depends on how U.S. and EU enforcement evolves in 2025 and 2026.

The upshot is a thinner, more segmented spot market. For traders, that means the old playbook of moving a cargo between basins on small price signals gets riskier. For utilities, it argues for more term cover into 2027, even if that feels less flexible than the spot‑heavy strategies of the late 2010s.

Russia’s workarounds will run into physics and finance

Sanctions on Arctic LNG 2 and related shipping have already slowed Russia’s LNG growth plans. A Europe‑wide ban adds a high fence on the western side of the map. The likely responses are predictable.

- Maximize the eastbound summer window on the Northern Sea Route, then rely on transshipment at Murmansk or Kamchatka to stretch winter flows on conventional carriers.

- Expand domestic or friendly‑flag services for insurance and class to reduce exposure to Western enforcement actions.

- Offer deeper discounts to anchor offtake in Asia and in non‑EU Europe, while limiting visibility into trade routes and ultimate destinations.

The bottleneck is ice‑class tonnage. Arc7 carriers are specialized, expensive, and slow to build. Retrofitting or repurposing conventional carriers cannot substitute in winter. Even with generous discounts, Russia will face a cap on deliverable volumes to Asia once Europe is off limits.

The parallel U.S. debate: sanctions and shipping

Washington is unlikely to sit out the 2025–2026 phase. Expect renewed debate over how aggressively to police ship‑to‑ship transfers, price discounts, and service providers linked to Russian LNG. The policy question is whether to mirror the oil price cap architecture and insurance leverage, or to rely on project‑level sanctions and targeted designations.

Two cross‑currents will shape the stance.

- The U.S. has a commercial interest. Every increment of friction on Russian volumes raises the call on Gulf Coast cargoes. That could lower Henry Hub inventories and, in tight moments, lift domestic prices.

- The U.S. also has an inflation and energy security interest in keeping global LNG flows as smooth as possible. Overreach on enforcement that reduces total supply could push up global prices, which would bite Europe and some emerging markets.

The likely outcome is a calibrated approach. Enforcement that narrows loopholes for Russian LNG routed through opaque structures, but stops short of measures that risk accidental chokepoints in a cold winter.

What it means for decarbonization

A 2027 ban sounds like a fossil policy, but it reaches into Europe’s climate math. By removing a tranche of flexible supply, Europe increases the premium on reducing gas demand in buildings and power.

- Heat: Heat pumps, district heat upgrades, and efficiency retrofits do more than cut emissions. They also reduce exposure to winter gas price spikes. National plans that front‑load installations in 2025 and 2026 will pay off exactly when the ban starts.

- Power: More wind and solar help, but reliability hinges on storage, interconnectors, and flexible demand. Batteries smooth daily peaks. Interconnectors and demand response handle longer lulls. Gas peakers still matter, yet the fewer hours they run in 2027, the less LNG Europe needs to backstop them. The interplay with data center growth is real, as mapped in AI power rush and gas.

- Industry: Electrification and hydrogen pilots will not transform heavy industry overnight. What they can do is shave the top of the gas demand curve and reduce curtailment risk in a tight winter.

The paradox is real. Europe may sign more long‑term LNG contracts to cover 2027, even as demand is designed to fall steadily through the late 2020s. If policymakers get the pacing right, those contracts function as insurance rather than a new dependency.

Scenarios: winter 2025–26 and the 2026–27 buildout

Scenarios are how to make sense of the moving parts. Think in two chapters before the ban takes effect.

Winter 2025–26: a test of nerves

- Base case: Storage enters November 2025 near the top of the five‑year range. Weather is average. Nuclear output in France is solid. TTF trades in a wide but manageable band. Europe outbids Asia a few times in December and February, but the market absorbs it. Industrial demand continues its cautious recovery.

- Bullish risk: A cold snap in December collides with low wind and an outage at a major regas terminal. TTF spikes, and European utilities scramble for incremental Gulf Coast cargoes. Asia holds steady thanks to Russian barrels under contract, so the spread blows out in Europe rather than across both basins.

- Bearish risk: A warm winter and strong renewables ramp leave storage fat in March. TTF sinks, a few U.S. cargoes are rerouted to Asia, and the market heads into summer 2026 with confidence high.

2026–27: the supply swell meets a hard deadline

- Base case: New U.S. trains and Qatari volumes arrive through 2026. By autumn, Europe has secured enough term cover to offset the loss of Russian LNG on January 1, 2027. Bottlenecks remain in Iberia, but Germany and the Netherlands handle most of the heavy lifting up north. TTF volatility persists but within a known range.

- Tight case: Delays at one or two U.S. projects and hiccups with a Qatari train reduce expected supply. A colder than normal January 2027 arrives just as the ban starts. Europe leans on demand response, storage withdrawals, and a few coal restarts. Prices jump, then normalize by March as project issues clear.

- Loose case: The buildout is on time, Asia is mild, and Europe’s demand keeps falling as efficiency gains land. The ban takes effect with little drama. TTF and JKM decouple at times, reflecting the two‑tier market, but the global system proves resilient.

Winners and losers in a remapped market

-

Winners

- U.S. LNG exporters and tolling offtakers see higher utilization and deeper ties with European buyers. Shipping firms with conventional carriers benefit from longer‑haul flows from the Gulf to North Europe.

- Qatar gains portfolio leverage. Its ability to swing deliveries between basins grows as Europe’s dependence on Russian LNG disappears.

- FSRU owners and regas terminal operators in northern Europe earn steady throughput fees, especially where onshore replacements are not yet built.

-

Losers

- Russian LNG projects face structural discounts, seasonal routing constraints, and a persistent shortage of specialized tonnage.

- European traders who profited from transshipment and flexible handling lose a lucrative arbitrage line.

- Spot‑reliant buyers without access to discounted Russian cargoes in Asia face episodic price spikes when the weather turns.

What to watch between now and January 1, 2027

- The letter of the law: The exact text of the ban, exemptions if any, and rules for cargoes already afloat or partially transshipped.

- U.S. project timelines: A slip of a few months on one large Gulf Coast train could matter if it coincides with a cold January in Europe.

- Qatar’s sales strategy: How much goes long‑term to Europe versus portfolio sales with destination flexibility.

- EU grid upgrades: Interconnectors, compressor debottlenecking, and storage targets for November 1, 2026.

- Sanctions enforcement: The treatment of ship‑to‑ship transfers, service providers, and gray‑market insurance for Russian LNG, especially during winter.

The broader arc

The 2027 LNG ban is not the end of Europe’s energy transition. It is a hinge. After January 1, 2027, Europe buys what it needs from a global market that is deeper on paper but more segmented in practice. The continent leans harder on efficiency and electrification to take pressure off winter gas demand. The United States and Qatar become the core external suppliers. Russia pivots east as far as physics and finance allow.

In other words, the global gas map does not snap. It redraws. The lines move from Europe’s terminals toward the Gulf Coast and Ras Laffan. They bend seasonally along Arctic routes to Asia. And under those lines, the power grid, heat pumps, and storage tanks do the quiet work that makes 2027 a manageable deadline rather than a cliff.

That is the bet Europe is placing today. The market will spend the next sixteen months deciding how to price it.