Hydrogen’s 2025 reset: 45V clarity and methane-fee fallout

Treasury’s January 10, 2025 45V rules give green hydrogen time and certainty, while Congress’ March repeal of EPA’s methane fee eases blue hydrogen’s near‑term costs. Here is how hubs, projects, and offtakers should move through 2028.

The pivot: final 45V rules meet a policy shock

On January 10, 2025 the Treasury Department finalized clean hydrogen tax credit regulations. The rule locks in the three pillar framework and extends the transition to hourly matching until 2030, with annual matching allowed through 2029. It clarifies deliverability through a balancing authority table and opens explicit pathways for storage backed Energy Attribute Certificates and for qualifying renewable natural gas with monthly matching. For developers, this is the bankability moment many were waiting for. See Treasury’s final 45V regulation summary and rule text.

Then came the shock on the blue side. On March 14, 2025 the President signed a Congressional Review Act resolution that nullified EPA’s Waste Emissions Charge rule under the Methane Emissions Reduction Program. EPA subsequently removed the rule from the Code of Federal Regulations in May. The statutory provision remains, but without the implementing rule the fee is not collected. EPA’s program page confirms the sequence and current status: see the Waste Emissions Charge status.

Together, these moves reset project economics and sequencing. Green hydrogen gets time and clearer compliance pathways. Blue hydrogen gets relief from a near term upstream cost pressure that many modeled into gas supply prices for 2026 and beyond. The result is a more competitive field, with financing and offtake decisions now hinging on siting, grid deliverability, storage integration, and state politics around CO2 pipelines. For the grid dimension, see how states gain leverage in grid planning.

What changed inside 45V, translated for bankability

Developers care about what underwriters will accept. Three items in the final rule stand out.

- Hourly matching starts January 1, 2030. Until then, annual matching is acceptable. This gives electrolyzer fleets four full calendar years to phase in flexibility, storage, and data systems. For projects with 2026-2028 commercial operation dates, this defers the capex and software complexity that banks flagged in 2024.

- Deliverability is mapped to balancing authorities. Treasury publishes a table that ties generators and hydrogen facilities to regions through their balancing authority interconnections. This removes ambiguity about whether a PPA across a seam counts, and it resolves arguments about using REC regions or RTO footprints. It also means boundary projects need to read the table, not just look at a map.

- Storage and gas attributes are codified. Storage can shift the temporal profile of clean electricity so long as the registry can track discharge time, and on site storage can be verified with meters. For RNG and coal mine methane, monthly matching is required along with first productive use and alternative fate guardrails. Book and claim is permitted within these tighter rules.

Bottom line for diligence: developers can now structure time matched PPAs with a storage rider that makes hourly compliance achievable in 2030, rather than trying to solve it on day one. Third party verification and registry capability still matter, but the path is visible and, in many regions, financeable.

The methane fee repeal and blue hydrogen costs

The repealed rule would have charged qualifying oil and gas facilities for methane emissions above thresholds, starting at 900 dollars per metric ton and rising to 1,500. Many blue hydrogen models assumed partial pass through of those costs into gas prices and gathering fees, especially in basins with higher observed methane intensity. With the rule nullified, that expected premium disappears for now.

This does not make blue hydrogen free. It reduces a prospective cost headwind and some compliance uncertainty in supply contracts. Major drivers remain: gas price volatility, carbon capture plant capex and energy penalties, CO2 transport and storage tariffs, and the credit stack interaction between 45V and 45Q. Still, when developers sharpen pencils for 2026-2028 final investment decisions, the repeal nudges blue hydrogen toward the money in regions with established CO2 storage and short pipeline routes.

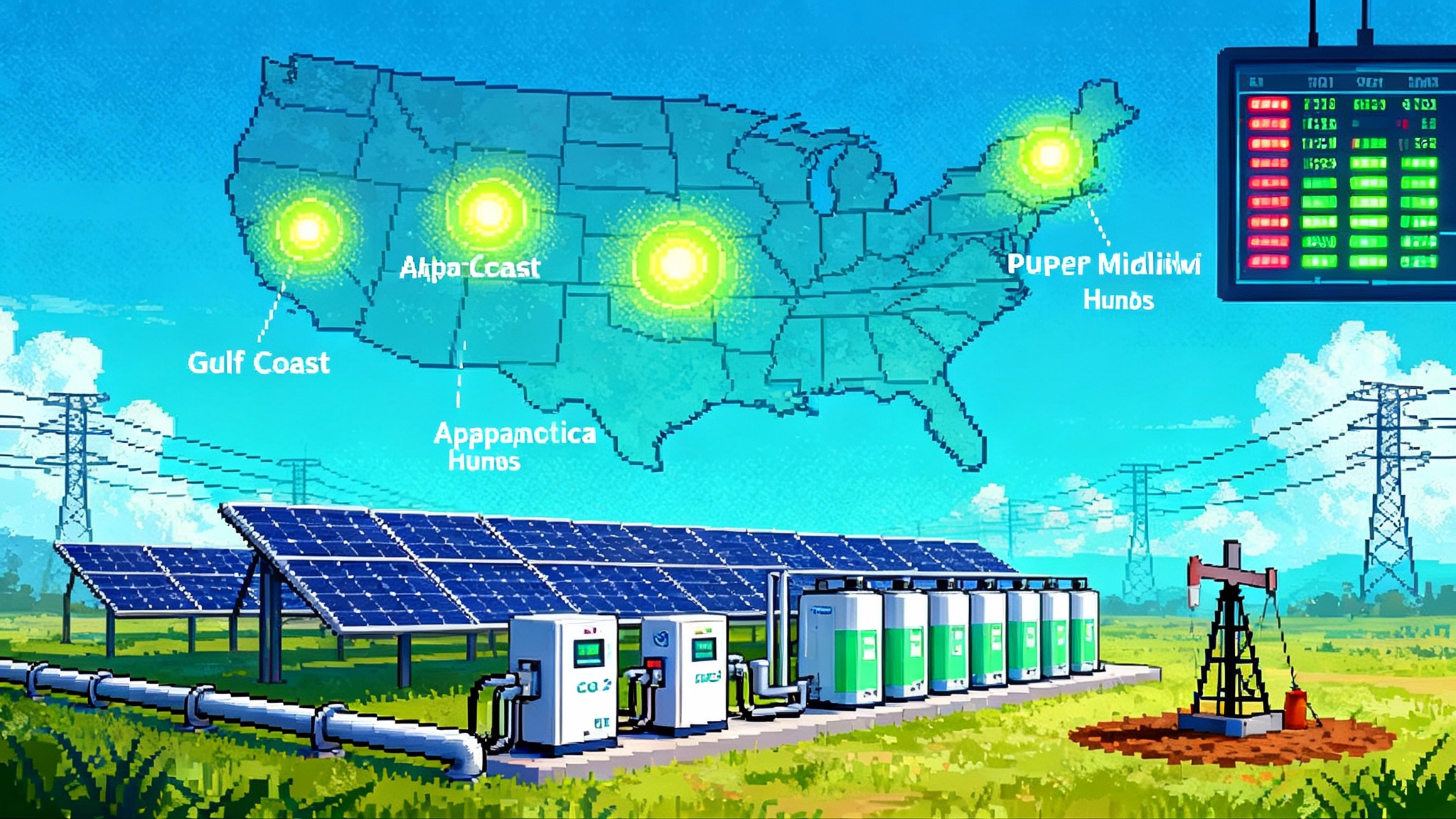

DOE hubs: where momentum likely persists

DOE has been reconsidering portions of the Hydrogen Hubs portfolio since March 2025, with reporting indicating potential reductions for hubs in California, the Pacific Northwest, the Mid Atlantic, and the Chicago centered Midwest. Hubs in Appalachia, the Gulf Coast, and the Upper Midwest appear to retain stronger federal support. Even where funding is trimmed, strong state programs, port logistics, and private capital can keep individual projects moving. The signal to developers is to plan for more self help and tighter phasing of scope.

Here is how that rolls down to project risk by region.

Gulf Coast

- Why it advances: dense refining and chemical complexes, firm load for hydrogen offtake, proximity to CO2 pipelines and Class VI storage development, deep liquids and power markets, and port export optionality for ammonia and methanol.

- 45V edge: abundant clean power options that fit the deliverability rules, including nuclear uprates, grid connected solar and wind with storage, and time matched PPAs backed by expanding hourly EAC capability. See how the Texas and California grid moment shapes power availability.

- Blue pathway: short haul CO2 transport to onshore sequestration lowers capture and pipeline risk. The methane fee repeal marginally improves upstream gas cost outlook and simplifies gas supply contracting.

- Likely winners: refinery hydrotreating hydrogen, export ammonia complexes with integrated storage coupled electrolyzers, flexible e methanol tied to curtailment capture.

Appalachia

- Why it advances: abundant low cost gas, inside the fence blue hydrogen for refining and ammonia, growing CO2 storage activity in the region, and industrial heat use cases that can absorb early volumes.

- 45V edge: deliverability clarity helps nuclear adjacent electrolyzer siting inside PJM or TVA footprints. Storage backed EACs give developers operating flexibility when local grids are tight.

- Blue pathway: repeal of the methane fee reduces projected gathering and processing surcharges in some project models. The real swing factor remains CO2 transport and pore space access.

- Likely winners: blue ammonia for domestic fertilizer, refinery hydrogen swaps that free gray units for retirement, and steel demonstration volumes where DRI conversions are on the drawing board.

Upper Midwest and the Heartland

- Why it advances: wind rich resources, industrial clusters, and a set of projects that assumed modest hub co funding but can still proceed with 45V and state support.

- CO2 pipeline headwinds: South Dakota banned the use of eminent domain for CO2 pipelines on March 6, 2025, which complicates multi state CO2 network build outs aimed at ethanol and blue hydrogen. Developers will have to rely on voluntary easements or reroutes, increasing schedule risk.

- 45V edge: the MISO balancing authority split is now explicit, which helps craft deliverability compliant PPAs. Hourly matching in 2030 gives electrolyzers time to pair with storage and tap curtailment hours.

- Likely winners: green hydrogen for ammonia blending at fertilizer plants and for pilot DRI lines tied to Great Lakes steel, grid connected projects that can prove time matching with batteries, and behind the meter wind plus electrolyzer pilots.

California

- Policy strength vs funding risk: strong state demand signals and credit markets, plus a need to decarbonize refineries and freight, argue for continued project activity. Potential federal hub trims raise the bar on private capital participation and phased execution.

- 45V edge: deliverability clarity within California’s balancing authorities simplifies compliance for in state PPAs. Storage backed EACs can turn the state’s midday solar into bankable hydrogen hours.

- Likely winners: refinery offtake, transit fueling clusters, and ports adjacent ammonia cracking pilots if export import chains mature.

Pacific Northwest

- Opportunity: hydropower and wind resource can produce low CI electrons, and industrial load pockets in Oregon and Washington create offtake anchor points.

- Risks: hub reconsideration and transmission constraints point to smaller, modular project phases. Time matched procurement will hinge on storage availability or sophisticated utility PPAs.

Mid Atlantic and Chicago centered Midwest

- Opportunity: large nuclear fleets and heavy industry in PJM and around Chicago give green hydrogen a credible path to low CI.

- Risks: a tougher federal funding backdrop means projects must lean on 45V, utility partnerships, and corporate offtake, rather than hub grants.

Why flexible, storage coupled electrolyzers just crossed the bankability line

Before January, many credit committees viewed hourly matching as an execution cliff. The final rule’s 2030 start date, plus recognition of storage backed EACs and metered on site storage, flips that narrative.

- Contracting: developers can sign time matched PPAs with a storage annex that defines discharge timestamping, metering, and EAC retirement. Annual matching during the transition simplifies operations while registries build hourly capability.

- Operations: plants can run dynamically to harvest low price hours, then rely on stored energy to keep stacks within healthy cycling limits. OEM warranties can be written to reflect cycling and cold start profiles tied to storage dispatch rules.

- Verification: third party assurance is easier with a single source of truth for balancing authority deliverability and with registry upgrades that tag discharge hours. Finance teams can underwrite verification cost and residual risk more comfortably than under the proposed 2028 deadline.

For project capex, adding storage is now a cost to compare against 2030 credit compliance and curtailment capture. In high curtailment markets, the IRR math increasingly favors at least modest storage paired with electrolyzers. For a demand side backdrop, see the AI power rush and grid.

CO2 pipeline politics tilt the playing field

South Dakota’s March 6, 2025 law banning eminent domain for CO2 pipelines echoes a broader trend of state activism around carbon transport.

- Interstate complexity increases. Multi state projects must harmonize the strictest state’s constraints, so one jurisdiction can set the effective standard for route selection and timelines.

- Route length and easements rise. Longer, more circuitous routes with only voluntary easements increase cost and delay. For hub scale blue hydrogen to move, developers will favor states with clearer eminent domain pathways or on site storage.

- Near source capture wins. Projects that capture CO2 and inject into nearby formations, or that tie into existing CO2 corridors with settled rights, will outcompete long greenfield routes.

Expect a premium for projects with secured pore space, executed right of way, and a demonstrated community benefits track record. This affects not just blue hydrogen but also green hydrogen derivatives like e ammonia that plan on co located CO2 offtake for synthetic fuels.

Sector by sector outlook for 2025-2028

Here is a simple forecast of likely winners and laggards across three major offtake sectors.

Ammonia

- Winners

- Gulf Coast export complexes pairing flexible electrolyzers with storage, plus blue ammonia where CO2 storage is short haul and 45Q can be layered efficiently.

- Heartland fertilizer plants adding green hydrogen blending under annual matching, with a plan to add storage for hourly by 2030.

- Watch items

- European import standards and hourly matching expectations by 2030, which could shape offtake price spreads.

- Laggards

- Projects hinging on long CO2 pipelines across states with new right of way constraints, and PNW export concepts that rely on sizeable hub grants while transmission remains tight.

Refining

- Winners

- Gulf Coast refineries swapping gray units for blue hydrogen with nearby storage, or contracting for green volumes under time matched PPAs in balancing authority compliant footprints.

- Watch items

- Scope 1 and 2 accounting alignment, since many refinery strategies will be judged on delivered kg CO2e per kg H2 with IRS verification.

- Laggards

- Standalone refinery projects in regions with uncertain CO2 transport, thin power markets, or limited ability to secure balancing authority deliverable clean power.

Steel

- Winners

- Great Lakes DRI pilots tied to nuclear hour PPAs and storage, staged to hit hourly matching in 2030.

- Watch items

- Pellet quality and DRI plant readiness, since H2 quality and delivery profiles must match metallurgical constraints as much as tax rules.

- Laggards

- Greenfield DRI in transmission constrained regions that cannot secure deliverable, time matched power at scale before 2030.

A practical checklist for sponsors and offtakers

- Site inside a favorable balancing authority, then build your PPA and storage plan around that electrical interconnection, not just a REC region.

- Model a 2030 storage retrofit or expansion path if you plan to start with annual matching. Write retrofit triggers into EPC and O&M.

- Specify registry capability and auditor scope in contracts, including discharge time tracking for storage backed EACs and monthly matching for RNG.

- For blue hydrogen, secure pore space and permits early, and price in a corridor premium if you depend on multi state CO2 rights of way.

- Hedge around policy risk by keeping 45Q and 45V options alive in your design, and by avoiding single point dependency on hub grants.

- Align offtake with verified CI delivery. Put verification deliverables and remedies in the term sheet so buyers can claim credits or meet internal decarbonization rules.

What to watch next

- Hourly EAC registries scaling through 2026-2029, including discharge timestamping and cross registry harmonization.

- DOE decisions on hub funding reallocations and any safe harbor updates to the balancing authority table.

- State actions on CO2 pipeline siting and eminent domain, especially in Midwest corridors.

- Power market curtailment patterns and storage costs, which will determine where flexible electrolyzers monetize the most value.

- International buyers’ standards for ammonia and steel, which will drive whether annual matched projects from 2026-2029 can secure long dated offtake at a premium.

The headline: Treasury gave green hydrogen room to run with clear rules and time to prepare for hourly compliance. Congress removed a near term cost headwind for blue hydrogen by nullifying EPA’s methane fee rule. DOE hub funding is less certain in several regions, which means private capital and state policy will sort near term winners. Between now and 2028, projects that are flexible, storage coupled, and sited where CO2 pipelines are politically feasible will move. Those that are rigid, transmission isolated, or reliant on long contested CO2 corridors will wait.