Tariffs reshape the U.S. solar map as 2025 trade cases widen

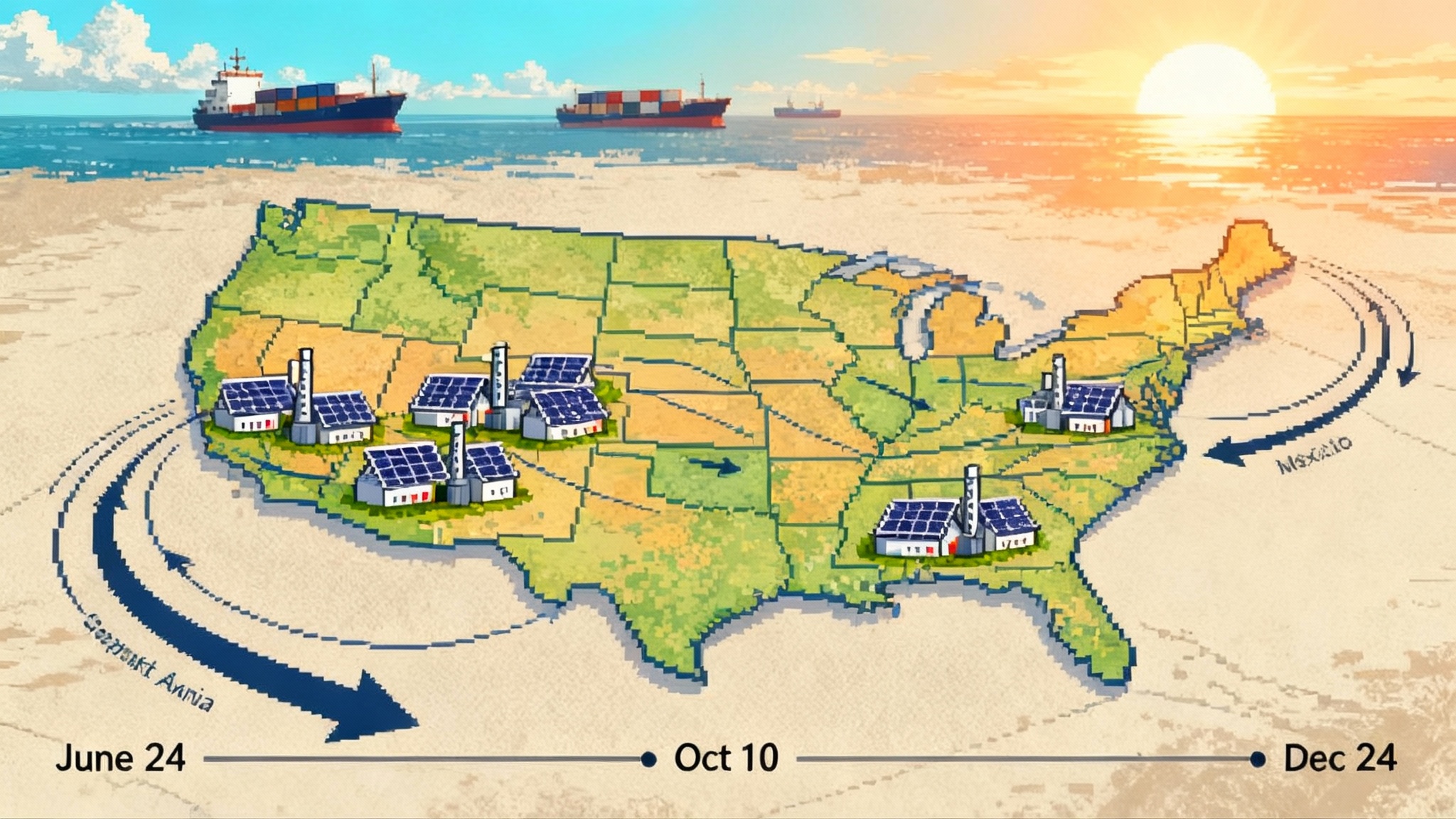

June 24 changed the U.S. solar market. Antidumping and countervailing duty orders on four Southeast Asian countries bent the price curve, and fresh probes into India, Laos, and Indonesia could force another pivot before year end. Here is what it means for sourcing, PPAs, and schedules.

The day the price curve bent

On June 24, 2025, the U.S. Department of Commerce issued final antidumping orders on crystalline silicon solar cells and modules from Cambodia, Malaysia, Thailand, and Vietnam. Commerce also finalized companion countervailing duty orders that day. The Federal Register notice sets cash deposit rates that run from single digits to triple digits depending on company and country, putting real weight behind a long running threat environment. Read the underlying order in Commerce’s June 24 AD orders.

For developers, EPCs, and buyers, that single day effectively bent the U.S. module price curve for late 2025 and 2026 deliveries. Contracts that assumed Southeast Asia modules at global spot levels now have to reconcile with U.S. specific duty exposure. Manufacturers with domestic capacity, or with tariff light footprints in North America, suddenly have the high ground.

What the orders changed in practice

The June orders triggered two immediate shifts:

-

Import math changed overnight. Cash deposit rates on entries from the four countries now apply at the company level. Malaysia shows a low single digit rate for some producers and a zero rate for one large integrated plant, while other named firms face rates above 80 percent. Thailand’s all others rate is above 100 percent. Vietnam’s named producers cluster in very high double digits, with one major firm above 120 percent, and a Vietnam wide rate above 270 percent. Cambodia’s all others rate clears 100 percent. A few companies can still ship at competitive duty exposure, many cannot.

-

Project schedules and bid stacks were re worked. Any 2026 module award that relied on low duty Southeast Asia volume is now a risk item. The more a developer concentrated on a single country or brand in the four named markets, the bigger the scramble.

Then the circle widened

In late summer 2025, the U.S. International Trade Commission voted to proceed with new cases targeting solar imports from India, Laos, and Indonesia. Reuters reported the initiation timeline and the expected statutory milestones, with preliminary countervailing duty decisions around October 10 and preliminary antidumping decisions around December 24. See the coverage that ITC moved the new cases forward.

If those preliminary determinations land affirmative, provisional measures can start to bite before year end. That would extend tariff exposure to the very countries many buyers turned to after earlier trade actions. The risk perimeter is expanding just as 2026 procurement windows open.

Who wins now

-

Domestic module and cell manufacturers. The orders funnel IRA driven demand toward U.S. plants and adjacent North American lines. Capacity that can certify domestic content becomes more valuable, especially where buyers can claim the IRA’s domestic content bonus. That bonus is a 10 percent adder for the PTC and a 10 percentage point adder for the ITC, which meaningfully improves after tax economics on utility scale projects.

-

Projects that can qualify domestic content. With tariff hit imports priced higher, the bonus can be the difference between a go and a no go. Developers that already mapped bill of materials to meet the steel and iron and manufactured product thresholds have a head start.

-

Tier one firms with U.S. or Mexico assembly. Lines in Georgia, Ohio, Alabama, Texas, and along the border can command better terms and longer visibility. Mexican assembly that uses non covered cells can be a bridge so long as rules of origin and scope are met.

Who is scrambling

-

Utility scale developers heavy on Southeast Asia supply. They face repricing on 2026 and 2027 delivery schedules. Many bid portfolios assumed modules at or near global spot. Those bids need new math.

-

EPCs with fixed price wraps. If their wrap assumed tariff light imports, they need reopeners or they risk project level losses. Some are rebidding full EPC scopes for 2026 start dates to add tariff contingencies and domestic content certification services.

-

Corporate buyers and utilities with 2024 to 2026 PPA vintages. Where offtake was priced before the latest orders, sponsors are returning to the table seeking price reopeners, schedule relief, or technology substitutions like larger DC to AC ratios and added storage duration to recover value.

Tariff exposure by origin, at a glance

These are directional and contract specific. Always check your supplier’s exact case rate, any company specific exclusions, and whether export subsidy offsets alter the AD cash deposit.

-

Cambodia. AD cash deposit rates are in triple digits for all listed and all others entries. In practical terms, Cambodia is high risk unless you have a specific ruling.

-

Malaysia. A split picture. One major plant is at zero for the AD cash deposit, and another is in low single digits, but several named entities are in the 80 percent range. The all others AD rate tracks to the low single digits. CVD rates also apply. Net effective duty can be low for the right counterparty and very high for the wrong one, which is why counterparty diligence matters.

-

Thailand. All others AD cash deposit is above 100 percent. Several named firms are well above that. Thailand is generally not a viable low duty source unless a specific producer has an unusual profile.

-

Vietnam. Named producers cluster around very high double digits, with one prominent firm above 120 percent, and the Vietnam wide entity above 270 percent. Vietnam is mostly off the board for price sensitive utility scale awards unless you can source from a named producer with a lower adjusted deposit and live with the residual risk of administrative reviews.

-

India, Laos, Indonesia. Not yet subject to final orders, but now under investigation. The early case milestones point to provisional CVD as early as October and AD as late December. If either preliminary finding is affirmative, provisional measures can apply to entries after those dates. Buyers that pivoted to these origins in the past nine months are exposed to mid contract duty risk.

The punchline: the cheapest global module is no longer the cheapest landed U.S. module unless it comes from the right plant with the right case rate. Sourcing now starts with a tariff map, not a price list.

How PPAs and interconnection queues will feel it

Near term impacts show up in four places.

-

U.S. module ASPs decouple from global spot. The post order U.S. module clearing price for utility scale tends to rebase higher when shipped from covered origins, while U.S. and Mexico capacity prints a premium with less tariff variance. If global spot sits in the low to mid teens per watt, U.S. delivered pricing for tariff safe supply can land materially above that range.

-

PPA pricing nudges up for tariff exposed pipelines. On a representative 200 MWdc project with a balanced DC to AC ratio, a five to eight cent per watt module delta can move the all in capital stack by 2 to 4 percent, which often translates to roughly 3 to 9 dollars per megawatt hour on a 20 year contracted profile. Projects that secure the domestic content bonus can claw back a meaningful share of that increase, which is why some buyers are re evaluating whether to pair PTC with domestic content instead of ITC in markets with strong capacity factors.

-

Schedule risk increases around year end. If the India, Laos, and Indonesia cases produce affirmative preliminary determinations, provisional measures would apply to entries after those dates. Cargoes scheduled to land in late Q4 might be retimed into Q3 or pulled into early Q1 with different origins. Logistics teams are already resequencing shipments and adjusting letters of credit conditions.

-

Interconnection attrition ticks up. Marginal projects that depended on razor thin EPC bids are the first to slip milestones or convert to storage forward stand alone plans. Expect more requests to modify CODs, inverter set points, and operating parameters as sponsors try to hold queue positions while resetting technology choices. This is colliding with other grid shifts like FERC 1920 A grid planning and the AI power rush and the grid.

Dates to watch in late 2025

- Around October 10. Preliminary CVD determination for the India, Laos, and Indonesia cases.

- Around December 24. Preliminary AD determination for the same cases.

- Early 2026. If the cases proceed, final determinations and potential ITC votes on injury. That sequence would set the long term baseline for U.S. imports from those origins.

Mark your calendars. These are the gates that will determine whether today’s hedges become tomorrow’s standard practice.

Practical hedges that are working now

Developers and offtakers are not waiting for December. Three categories of hedges are gaining traction this quarter.

-

Dual sourcing with U.S. and Mexico lines. Split the module award. Put a firm tranche on a domestic or Mexico line with delivery windows that align to your COD, and a flexible tranche tied to a lower cost import contingent on duty outcomes. Include a swap right that lets you slide volume between tranches based on preliminary determinations. Many buyers couple this with a most favored nation clause on U.S. production to capture any mid year price normalization.

-

Contract reopeners tied to AD and CVD milestones. Define a narrow set of reopeners that kick in only if preliminary determinations impose cash deposit rates on your named supplier above a threshold. Pair the reopener with either a price band adjustment or a documented right to switch to a named domestic supplier at a preset index. The goal is to avoid full contract unwind and keep site work moving while you reprice modules.

-

Storage forward procurements. Where interconnection is uncertain or panels are the bottleneck, lock in batteries first. Stand alone storage with IRA incentives can carry a portion of the project economics while module sourcing catches up. Sponsors then add PV in a second phase when domestic content supply opens up or when case rates settle. Buyers like the emissions and capacity benefits that arrive sooner, and it keeps the queue position alive. See how supply swings have stressed other technologies in Offshore wind grid whiplash.

Other tools you will hear in bid rooms:

-

Cell versus module strategy. Some sponsors are exploring importing cells from tariff safe origins and assembling in North America for domestic content credit. This is a manufacturing and logistics lift, but it can be the cleanest line to the bonus.

-

Tax equity guardrails. New term sheets often require clarity on domestic content qualification paths and may cap tariff pass through. Building those rules into EPC and module purchase agreements reduces closing risk.

-

Contingency budgeting. EPCs are bumping tariffs into owner contingencies rather than EPC price lines. Sponsors then decide how to deploy the contingency once real case rates and domestic content status are known.

What to do before the next vote

If you are a developer, EPC, or buyer with 2026 and 2027 CODs, here is a practical checklist for the next six weeks.

- Map your portfolio to case rates by supplier and country. Identify which awards rest on a zero or low cash deposit assumption and which rest on triple digits.

- Tie module awards to the October and December milestones. Add conditionality to letters of credit, delivery windows, and price bands.

- Get a domestic content plan on paper. Know whether your project is aiming for the ITC or PTC pathway, and what bill of materials certification steps are required.

- Add a storage first optionality line to your internal capital plan. Even if you never pull it, it changes your negotiating leverage.

- Revisit PPA pricing only where you must. Bring buyers a package that includes a credible domestic content route, a revised COD schedule, and a small set of technology enhancements that lift project value.

- Communicate with interconnection providers early. If a milestone is at risk, propose a formal path to hold the queue position and swap technology parameters if needed.

The bottom line

The June 24 orders did not just add friction at customs. They changed the center of gravity of U.S. solar procurement. Add the late 2025 investigations, and the safe path looks different again by December. The winners are the builders of domestic capacity and the developers who treat trade as a first order design variable. Everyone else will need to reprice, re sequence, or re negotiate. The good news is that the market has tools. Use them now, before the next decision lands.