States vs. PJM: AI-fueled demand ignites a grid reckoning

Electricity bills are surging across PJM and capacity prices have jumped nearly tenfold in two years. On September 23, 2025, a new bipartisan Governors’ Collaborative meets to press for faster transmission, market fixes, and a stronger state voice over the nation’s largest grid operator.

The spark: bills spike, governors unite

Electricity bills across the PJM footprint climbed sharply in 2024 and 2025, while capacity costs surged nearly tenfold in two years. In response, a bipartisan group of governors formed a PJM Governors’ Collaborative and set a summit for September 23, 2025, to push for a stronger state role in pricing and planning. Their case has been amplified by reporting that governors seek more sway over PJM, as consumers face higher bills and concerns about reliability.

Behind the headlines is a fight over who sets the rules, how transmission costs are shared, and whether capacity prices are overshooting during rapid load growth and clogged interconnection queues.

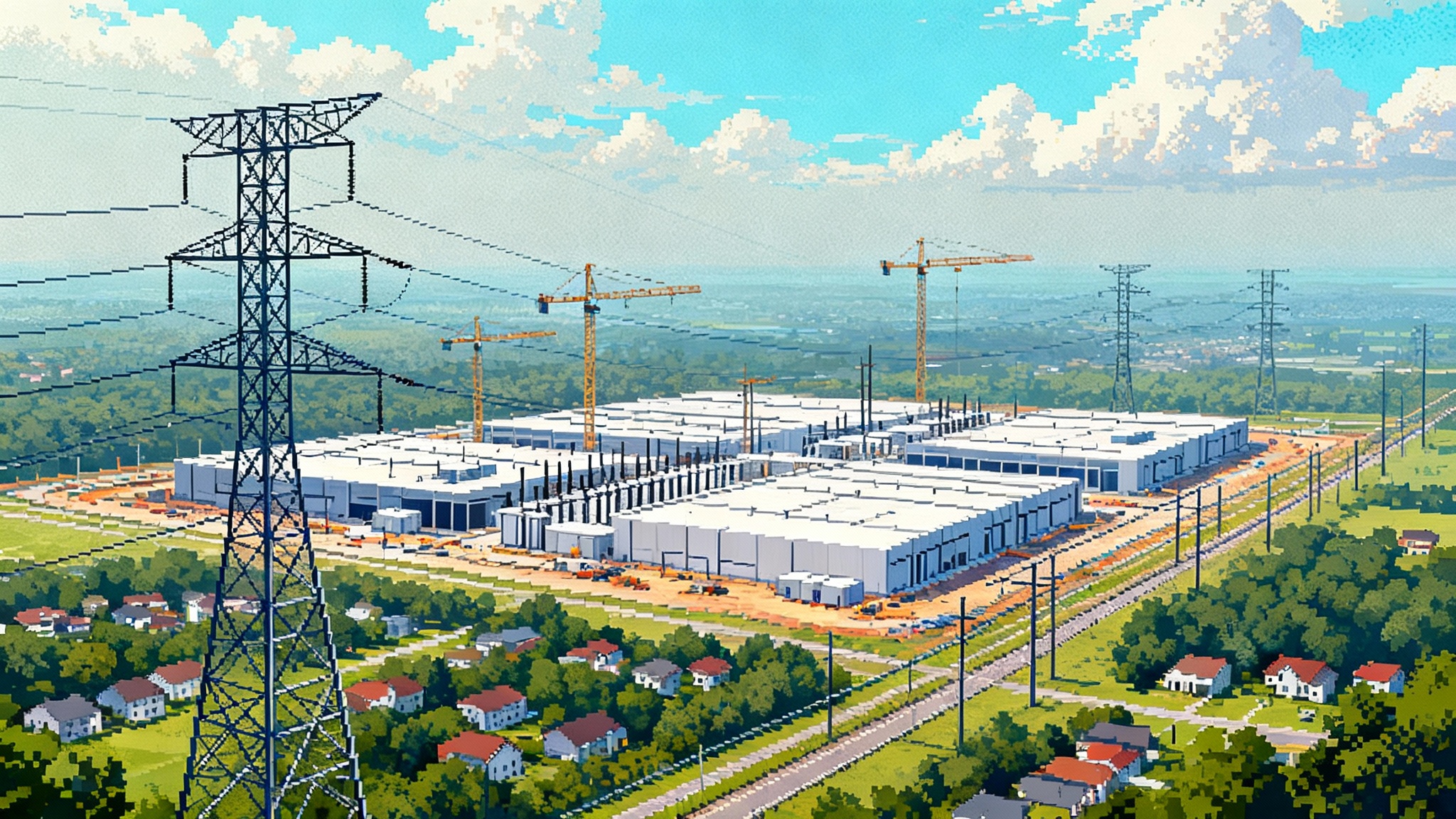

What AI is doing to the load curve

AI data campuses run around the clock with high load factors, short build timelines, and a tendency to cluster near fiber, water, and favorable tax regimes. In hot spots like northern Virginia, multi‑gigawatt clusters are compressing a decade of growth into a few years. This profile stresses the grid by creating local congestion, pushing up capacity obligations, and reducing the impact of traditional afternoon peak programs. It also tilts economics toward firm, dispatchable supply and long‑duration flexibility that cannot be stood up overnight. For more context on demand patterns, see our overview of AI data center load growth.

A clogged on‑ramp: interconnection queues

PJM’s queue reforms moved from first‑come to first‑ready, yet staff bandwidth and construction windows remain the bottleneck. Projects that lack site control or face steep upgrade costs often drop after years of studies. That uncertainty raises financing costs for developers and shows up as scarcity pricing for consumers until steel is in the ground.

FERC Orders 1920‑A and 1920‑B change the transmission playbook

Orders 1920, 1920‑A, and 1920‑B require long‑term regional planning over a 20‑year horizon, better scenario analysis for emerging loads, and a clearer role for states in cost allocation. For an official overview, see the FERC explainer on Order 1920. States now have a formal window to negotiate cost allocation methods, and RTOs must file state‑backed proposals alongside their own. For practical implications, consult our guide to FERC Order 1920.

Governance pressure: who calls the shots at PJM

PJM is governed by a Board of Managers and stakeholder sectors with oversight from an Independent Market Monitor. Governors argue that consumers should not foot multibillion‑dollar bills without elected officials having a formal role. Proposals circulating in stakeholder circles include:

- A formal state voting block on key market design changes.

- A nominating role for states in selecting the PJM Board, with required consumer and reliability expertise.

- A consultation checkpoint before PJM files major tariff revisions that affect consumer costs.

- State approval for large transmission portfolios that would socialize costs across zones.

These changes would raise questions about independence while aiming to align public finance and consumer protection with system reliability.

Capacity market design under stress

Load growth from data centers and rising retirements tightened supply, leading to higher and more volatile clearing prices. Governors see price spikes that feel disconnected from lived service quality and want clearer scarcity signals. Market participants counter that high prices are attracting the investment PJM needs. For background, see how PJM’s capacity market works.

Reform paths on the table:

- Calibrate the demand curve. Adjust the Variable Resource Requirement shape and zonal calibration to reflect updated reliability values and load shapes.

- Tighten qualification and deliverability. Require stronger proof of fuel security, winterization, and interconnection milestones.

- Seasonal obligations with firming credits. Better match winter risks and 24‑7 loads by valuing storage, demand response, and flexible thermal plants.

- Guardrails on scarcity adders. Consider temporary caps or collars tied to measurable progress on transmission and interconnection.

- Performance incentives that match reality. Align penalties and bonuses with multi‑day events rather than short spikes.

FRR exit option moves to the mainstream

The Fixed Resource Requirement lets utilities meet obligations outside the centralized auction. If high and volatile prices persist, more large load‑serving entities could pursue FRR to control costs. That would reduce market liquidity, shift risks to utility customers, and give states leverage in reform talks.

The cost allocation fight goes front and center

Transmission investments are set to rise as PJM uprates existing lines, builds new 500 kV corridors, and interconnects new generation. The hard part is who pays. Orders 1920‑A and 1920‑B push states to agree on cost allocation methods up front. Options include:

- Portfolio cost sharing. Support a multi‑project portfolio with a transparent benefits ledger by zone and predictable percentage shares.

- Data center cost participation. Use special facility charges or direct funding of local upgrades to reduce socialized costs.

- Adjustable allocation tied to verified benefits. Step down contributions for zones that realize fewer benefits than forecast.

Faster buildouts: where time can be saved now

Near‑term actions that avoid multi‑year siting battles can deliver relief sooner:

- Thermal uprating and reconductoring along existing rights of way.

- Dynamic line ratings to unlock headroom during favorable weather.

- Storage as a transmission asset at constrained nodes with clear cost recovery.

On the generation and load side:

- Fast‑track interconnection for mature projects with site control, financing, and near‑term equipment delivery.

- On‑site firming for data centers using reciprocating engines, hydrogen‑capable turbines, or long‑duration storage with strict performance standards.

- Demand flexibility that matters through shiftable compute, chilled water storage, and dispatchable load reductions with clear telemetry and compensation.

What the September summit could produce

To matter, the Governors’ Collaborative needs to walk out of September 23, 2025, with concrete deliverables:

- A joint cost allocation framework under Order 1920‑A that PJM must file alongside its compliance plan.

- A governance petition that formalizes a state role in tariff changes that materially affect consumer bills.

- A capacity market transition plan that calibrates demand curves, tightens accreditation, and applies time‑limited scarcity guardrails tied to grid upgrade milestones.

- A transmission fast‑lane commitment focused on reconductoring, dynamic ratings, transformer replacements, and a shortlist of new high‑voltage projects deliverable within three to five years.

- A standardized data center tariff with transparent upgrade contributions and emergency performance obligations.

What it means for consumers

- Near term. Prices likely remain elevated through the 2026‑2027 delivery period given what has already cleared and the time needed to build supply and wires. Expect governor‑led bill mitigation via credits or deferrals, but plan for continued pressure.

- Mid term. If queue reforms accelerate completions and a feasible transmission portfolio advances, scarcity should ease. Uprates and dynamic ratings can provide earlier relief.

- Long term. Durable cost allocation and a multi‑year build plan can spread fixed costs across a larger base and restore scale economies. The risk is policy whiplash or fragmented FRR exits that undermine regional coordination.

Five reforms that could actually stick

-

State‑anchored cost allocation with a portfolio lens. Build a transparent benefits ledger by zone and let states sign a default method that PJM files under 1920‑A.

-

A state consent checkpoint for big‑ticket filings. Before PJM files changes that materially affect consumer bills, require an advisory up‑or‑down vote with a published concurrence or objection.

-

A capacity market transition package. Combine calibrated demand curves, stronger qualification standards, and a time‑limited scarcity guardrail that sunsets as specific upgrades come online.

-

A standardized large‑load interconnection compact. Codify timelines, upgrade contributions, and emergency obligations for mega loads so communities and developers know the rules.

-

A wires‑first fast‑lane. Commit to reconductoring, dynamic ratings, and transformer replacements on set timelines, plus a shortlist of high‑impact 500 kV projects with quarterly progress reporting.

The bottom line

PJM is entering a new era. AI‑driven load growth, a backlog of projects, and the biggest federal transmission reforms in a decade have exposed gaps in how the region plans, prices, and governs the grid. If governors can align on cost allocation and pragmatic governance changes, they can turn a noisy political moment into filings that shape prices for the next decade. A credible plan that pairs faster near‑term upgrades with a long‑lead transmission portfolio, tightens capacity incentives to match system needs, and formalizes a state seat at the table can bend the cost curve down without sacrificing reliability.