How 2025 locked in the West’s two-track day-ahead market

In 2025, CAISO’s EDAM and SPP’s Markets+ moved from debate to buildout. Here is who joins when, how the seam will work, and what changes by 2026 to 2028.

The year the West chose two tracks

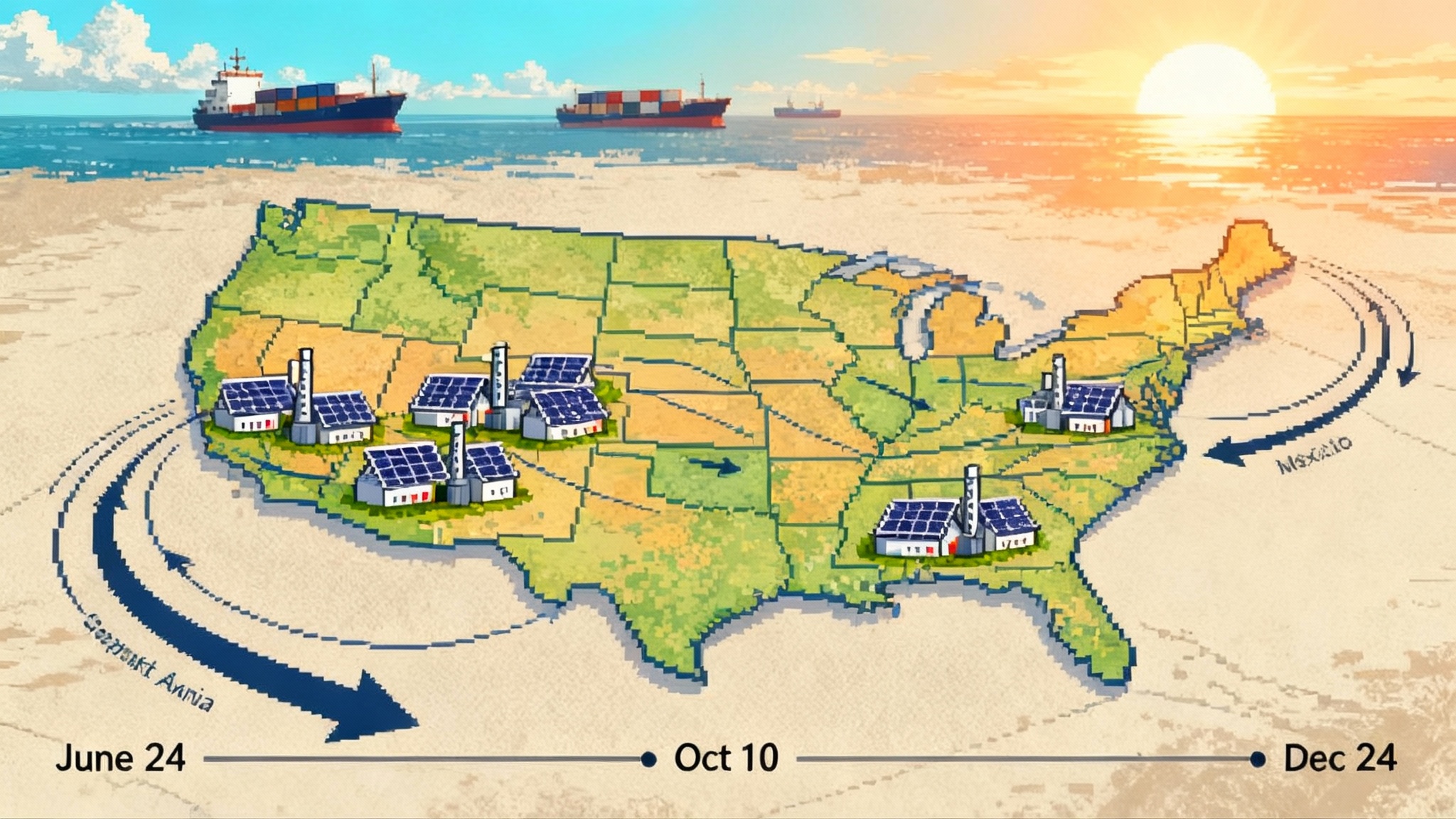

In 2025 the Western Interconnection stopped debating and started building. On one track, the Southwest Power Pool’s Markets+ cleared its last big prerequisite when FERC approved its tariff on January 16, 2025, allowing SPP to lock in phase-two funding and begin market buildout for a 2027 launch (FERC approves Markets+ tariff). On the other, CAISO’s Extended Day-Ahead Market moved from concept to a real footprint, with PacifiCorp, Portland General Electric, the Balancing Authority of Northern California, Los Angeles Department of Water and Power, and Public Service Company of New Mexico all signing implementation agreements and targeting go-lives that begin in 2026 and extend through 2027.

The practical result is a two-track West. By late decade, the region is likely to operate two day-ahead markets that touch most of the Western Electricity Coordinating Council’s load, but not all in the same market. That sets up a new set of challenges and opportunities around seams, resource adequacy, greenhouse gas accounting, and transmission rights.

Why it matters now

- A split footprint reshapes unit commitment, reserve sharing, and price formation.

- Seams rules will decide whether congestion costs are hedgeable or volatile.

- WRAP’s binding era adds a common adequacy scoreboard both markets must respect.

Who is where, and when

-

Markets+: After FERC accepted the tariff and later approved SPP’s funding mechanism, SPP confirmed sufficient phase-two commitments to move to systems development and trials. The phase-two roster includes the Bonneville Power Administration and Powerex, plus APS, SRP, TEP, and several Northwest public utilities. Markets+ is targeting a 2027 go-live.

-

EDAM: CAISO’s sign-ups include PacifiCorp and PGE with 2026 entry targets, LADWP and BANC around 2027, and PNM in the 2026 to 2027 window. Those additions triggered governance milestones and put shape around an initial footprint from Southern California through the Pacific Northwest and into the Interior West.

-

The overlay: SPP’s separate expansion of its RTO services into the West in 2026 will operate alongside Markets+. Some WEIS participants will become SPP RTO members for transmission planning and operations while Markets+ provides day-ahead and real-time market services for a broader set of entities.

What the split changes, and what it does not

Physics do not change. Power still follows flows, not contracts, and the Western grid remains a single synchronized machine. What does change is who optimizes which generators and lines in the day-ahead horizon.

-

Unit commitment diversity: Each market will commit resources to serve its footprint’s expected load and reserves. A broader footprint captures more weather, load, and renewable diversity. Two footprints dilute that benefit, so each market may carry more internal reserves than a unified footprint would require.

-

Intermarket transfers: The seam between EDAM and Markets+ will be managed with scheduled transfers based on available transmission, not a single co-optimized dispatch. That demands robust intertie offer frameworks, dependable tagging, and clear rules for redispatch if real-time conditions diverge.

-

Price formation at the seam: Absent tight coordination, day-ahead price separation will appear across seam interfaces. That is not inherently a flaw, but it raises stakes for congestion management, hedging, and settlement rules that recognize parallel flows.

Seams coordination moves from theory to rules

The seam is where design details become bills. Both markets are embracing flow-based optimization inside their footprints, yet both must respect legacy contract-path rights at their borders.

-

Parallel flow recognition: When EDAM dispatch in one balancing area induces flows over a constraint in a neighboring EDAM area, the market collects congestion rents. Stakeholders flagged that some rents tie to parallel flows that originate or sink elsewhere, and that current rules may not return value to the rights holders that absorbed the congestion. CAISO launched an initiative to tighten EDAM congestion revenue allocation, including treatment of cross-BAA parallel flow effects (EDAM congestion revenue allocation initiative).

-

Transmission contribution and opt-outs in Markets+: FERC accepted SPP’s framework in which participating transmission service providers contribute flow-based capability to the market while retaining certain opt-outs and honoring existing OATT commitments. That balance is pivotal. Too little transmission contributed and prices fragment with higher congestion costs. Too permissive an opt-out and participants could game availability.

-

Joint operating playbooks: Even without a formal joint optimization, the two operators will need well-rehearsed procedures for day-ahead and real-time redispatch at the seam during stressed conditions. Think pre-arranged redispatch priorities, counterflow offers, and congestion management protocols that slot into WECC reliability standards.

WRAP integration: same scoreboard, two leagues

The Western Resource Adequacy Program is moving into its binding era by Winter 2027 to 2028, with a transition that allows staged entry. Markets+ closely aligns with WRAP constructs and requires compatibility with WRAP’s forward showing and operations program. EDAM participants can also be in WRAP, but EDAM must translate California’s resource adequacy frameworks into WRAP’s metrics where applicable. The test by 2027 is straightforward: both markets must ingest WRAP sufficiency results and enforce consistent short-term sufficiency obligations, without double counting deliverability across the seam.

Greenhouse gas accounting: two designs, shared risks

-

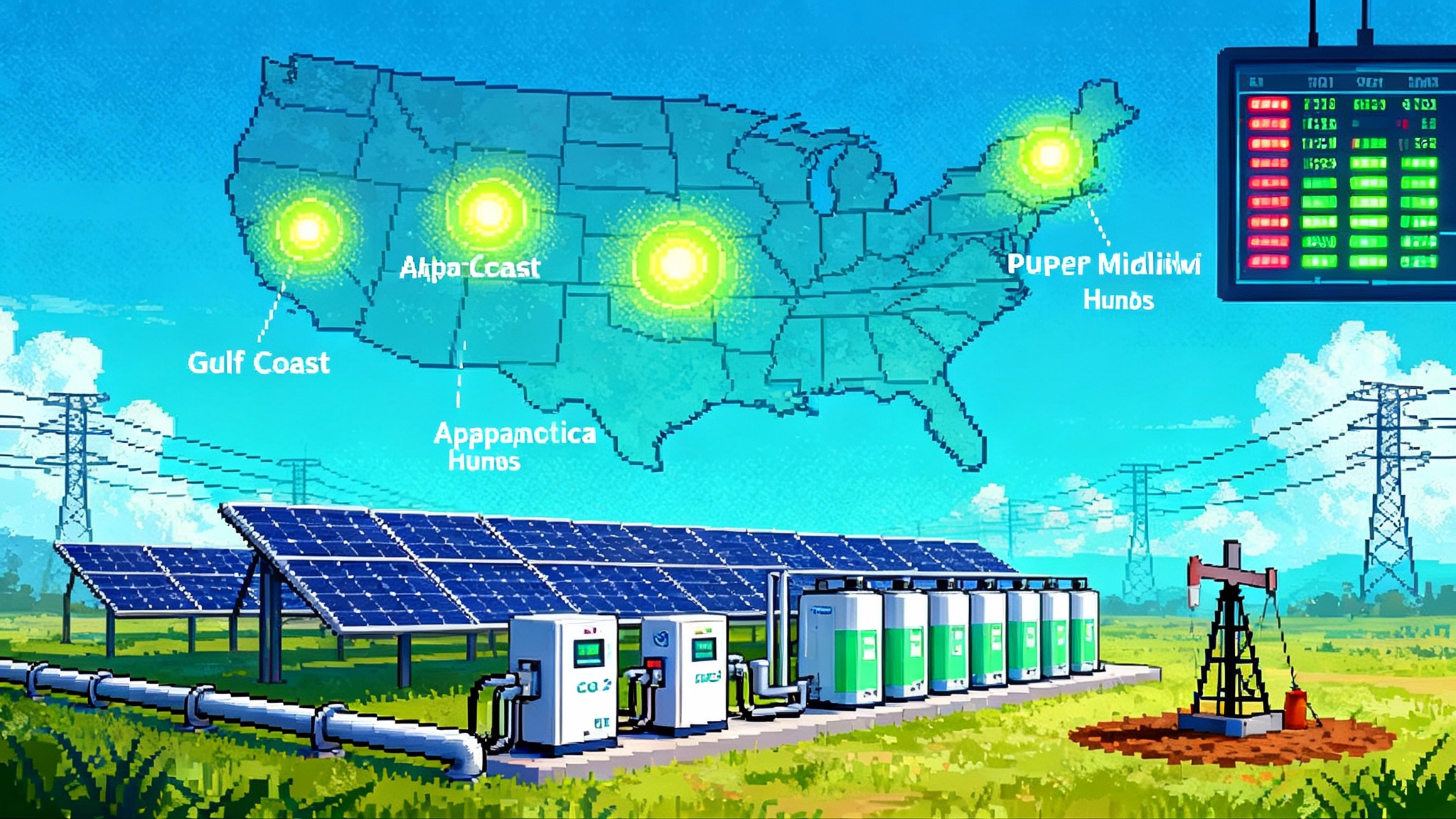

EDAM: CAISO is extending the WEIM’s resource-specific attribution approach to the day-ahead timeline. A reference pass establishes a counterfactual dispatch. Exports into GHG-priced areas carry attributed emissions and associated costs, which curbs leakage and preserves carbon price signals while letting non-GHG areas transact without bearing those adders.

-

Markets+: Western states inside Markets+ have different GHG regimes, so SPP and stakeholders developed protocols for tracking and embedding state policy price adders into commitment and dispatch. FERC signaled it will watch how those adders are implemented and how resource aggregations and e-tagging support compliance. The risk to manage in both markets is the same: avoid creating low-friction leakage paths at the seam that undermine state carbon programs or strand hydro and renewable value.

Transmission rights and hedging: who gets the congestion rent

This is where the two market designs are deliberately different, and where 2025 set the course for fixes.

-

In EDAM: Congestion revenue allocation must address cross-BAA parallel flows so legacy firm rights are not exposed to day-ahead constraints without a path to recover rents. CAISO’s new initiative is designed to close that gap in time for first-wave go-lives.

-

In Markets+: The tariff establishes a congestion rent allocation tied to contributed transmission and recognizes that some rights holders on non-participating systems can contribute their rights. The framework aims to preserve OATT priorities while giving the market enough firm capability to clear efficient transfers.

The bottom line for utilities and their regulators is hedgability. If transmission rights cannot reliably offset expected day-ahead congestion on critical paths, procurement and risk management costs rise. Both markets have work to do in 2025 to 2026 to make the hedge story pencil out for customers.

Costs and benefits: who pays, who saves, and when

-

Implementation and run costs: SPP’s Markets+ implementation is financed under a FERC-approved funding mechanism, with costs recovered over time from participants. CAISO’s EDAM leverages an existing platform but requires participant integration work and ongoing administration fees.

-

Benefit timing: Entities with large import or export optionality, flexible hydro, or significant renewable variability tend to see earlier benefits. Those with constrained transmission or limited flexibility may see positive net benefits only once neighbors join, interfaces are upgraded, or cross-market hedges mature. For how state roles are changing in transmission, see our read on state leverage in grid planning.

-

Rate design: Expect contested cost recovery dockets at state commissions and public power boards. The questions are familiar: how much to capitalize versus expense, how to allocate market uplift and congestion costs, and how to credit congestion revenues back to native load and wholesale customers.

Reliability: the work that matters before first power

A single West-wide market would minimize redispatch coordination, but two markets can still deliver reliability gains if they do the blocking and tackling now.

-

Aligned sufficiency tests and penalties: WRAP gives both markets the same capacity yardstick. Real-time sufficiency enforcement and penalties for leaning on neighbors should be aligned to reduce friction during stressed hours.

-

Stress playbooks at the seam: Publish and drill the steps for heat waves and winter events. The sequence for curtailing exports, relaxing interchange limits, and activating emergency schedules should be explicit to operators and market participants on both sides. The surge of AI-driven load growth makes these drills more urgent.

-

Data transparency: Day-ahead intertie schedules, residual transfer capability, outage coordination, and emergency assistance transactions should be visible enough for market monitors and regulators to spot trouble early.

What to watch from regulators and the courts

-

FERC compliance and oversight: Watch the compliance filings that add specificity around Markets+ transmission contribution, opt-outs, and reporting. On EDAM, keep an eye on tariff updates that implement congestion revenue allocation refinements and any governance steps linked to the growing footprint.

-

Western state PUCs: Several utilities need regulatory approval to join a day-ahead market or to recover related costs. Early orders will set precedent on how commissions judge market benefits, integration budgets, and customer protections.

-

WRAP transition orders: WRAP’s shift to binding operations by Winter 2027 to 2028 will come with tariff and business practice updates. Key questions are penalty levels, deliverability definitions, and how WRAP operations coordinate with market scarcity pricing.

-

Pacific Northwest litigation: Environmental and consumer advocates have challenged BPA’s Markets+ decision in the Ninth Circuit, arguing the agency underestimated costs and environmental impacts relative to an EDAM path.

The 2026 to 2028 scoreboard

-

2026: EDAM’s first movers enter, SPP’s Western RTO services start for initial members, and seam procedures see their first stress tests during summer peaks. For a parallel view of how queues and timelines are evolving, see fast-track interconnections in CAISO.

-

2027: Markets+ targets go-live with a cohort that includes BPA and Powerex, while EDAM adds LADWP and BANC. WRAP’s binding season begins in Winter 2027 to 2028, giving the West a common adequacy framework during extreme conditions.

-

2028: Both markets should be in steady operations with larger footprints, refined congestion revenue allocation rules, and matured intertie scheduling practices. The focus shifts from standing up the markets to optimizing them and building transmission that unlocks the next tranche of benefits.

Bottom line

The West did not get a single day-ahead market in 2025. It got two. That makes seams work, WRAP integration, and transmission rights more important, not less. If CAISO finalizes a congestion revenue allocation that protects firm rights, if SPP and its transmission providers contribute transparent and durable transmission to Markets+, and if both markets line up with WRAP’s binding program, the region can still capture most of the reliability and cost advantages that motivated market expansion in the first place. The next three years will show whether that promise holds in operations, or whether the seam becomes the story.