Palisades Comes Back: The New Playbook for Reactor Re‑life

With a fresh DOE loan disbursement on September 16 and summer NRC approvals, Palisades now has a credible path to a Q4 2025 restart. Here is the playbook behind the financing, offtake and licensing, what it means for MISO, and how SMR co-location could multiply the impact.

The comeback gets real

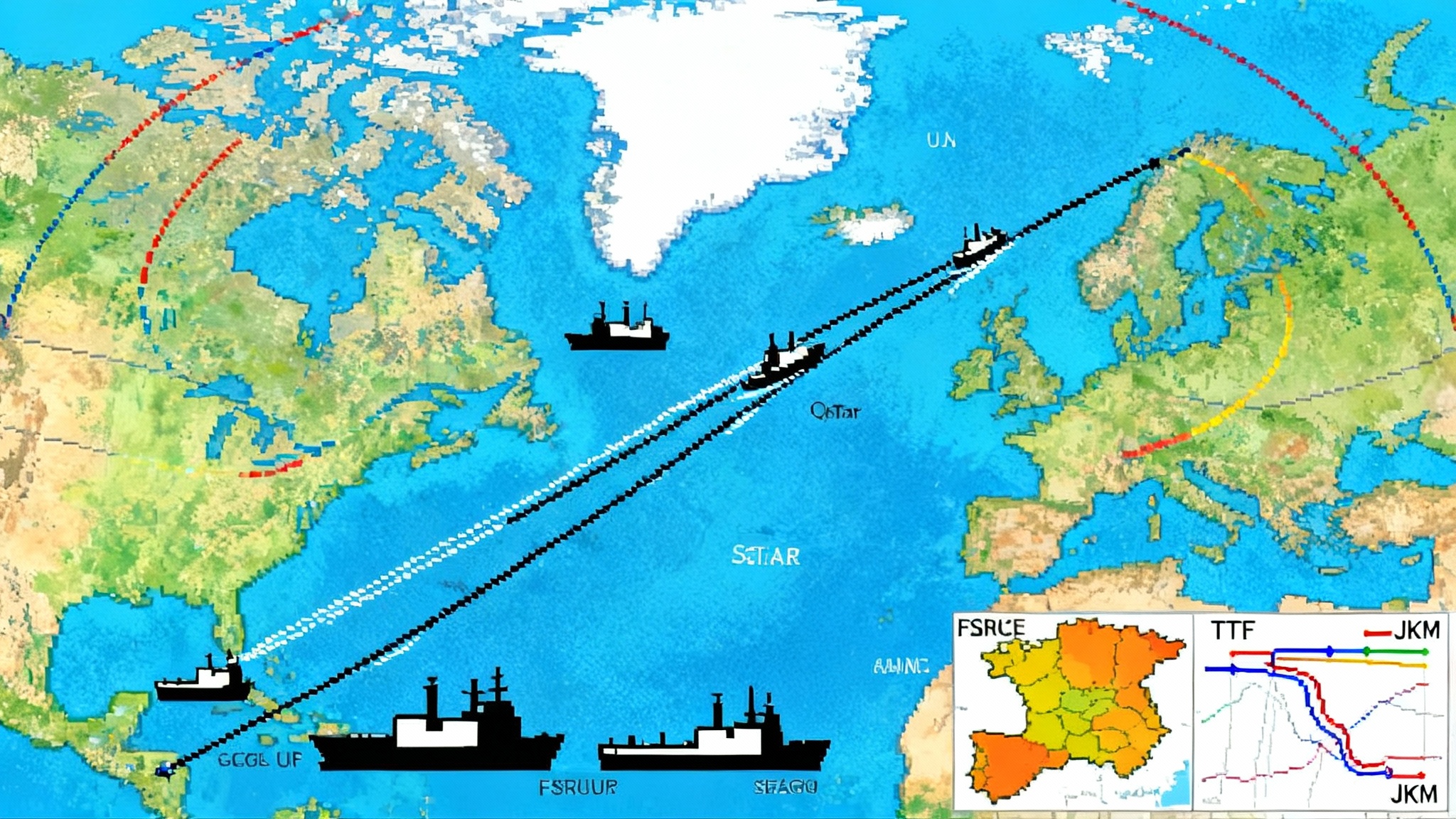

On September 16, 2025 the Department of Energy released another tranche of loan-guarantee financing to Holtec for the Palisades restart, bringing cumulative disbursements close to half a billion dollars under DOE’s 1.52 billion dollar loan. That fresh cash, paired with summer regulatory milestones, locked in a realistic shot at a fourth quarter 2025 restart, the first time a retired U.S. reactor would return to service. See reporting on the DOE releases September tranche.

For a nuclear industry long defined by retirements, Palisades is a pivot. It shows that returning a shuttered pressurized water reactor to service is not only technically feasible, it can be financed, licensed and contracted in a way that appeals to lenders and grid planners who need firm power.

What made the restart possible

The financial spine: DOE LPO plus state and co-op support

Financing came together in layers. The DOE Loan Programs Office supplied the anchor, a 1.52 billion dollar loan guarantee sized to refurbishment, refueling, regulatory work and restart. The State of Michigan backed the effort with appropriations that signaled durable policy support, which helped crowd in private capital. That combination reduced project risk and cost of capital.

Key takeaways:

- Use federal credit to bridge first-of-kind risk. It lowers the hurdle rate and unlocks vendor terms.

- Target state funds at specific blockers. Focus on work packages that de-risk schedule.

- Leverage existing site assets. Switchyard, interconnection and local workforce shorten timelines.

The offtake that made lenders comfortable

A long-term offtake is the second pillar. Wolverine Power Cooperative agreed to buy up to two thirds of Palisades output, with project partner Hoosier Energy taking most of the remainder. For lenders, a cooperative buyer with a reliability mandate and a portfolio that values carbon-free baseload is ideal. It anchors revenue away from volatile spot markets and aligns incentives during a period of rising peak loads.

The NRC steps that mattered

Regulatory momentum accelerated in mid 2025. The Nuclear Regulatory Commission approved the key actions that allow Holtec to transition Palisades back to operational status, including transfer of operating authority, reinstatement of operational programs and authorization to receive and load fuel once conditions are met. The agency’s July order, paired with environmental findings, set the stage for operator staffing, procedure reconstitution and pre-startup testing under the original license timeline. For context, see the NRC’s July 24 order, license transfer.

The repair plan for aging hardware

Every restart hinges on a credible equipment strategy. At Palisades, the high-visibility scope item is the steam generator tube population. Holtec pursued a license amendment to use modern Alloy 690 sleeves to repair defective tubes instead of plugging them, which preserves heat-exchange performance. Combined with extensive component inspections, replacements and control-system upgrades, the path targets Q4 2025 critical-path milestones. The work is sequenced with fuel delivery windows, operator training and outage logistics to limit overlap and schedule risk.

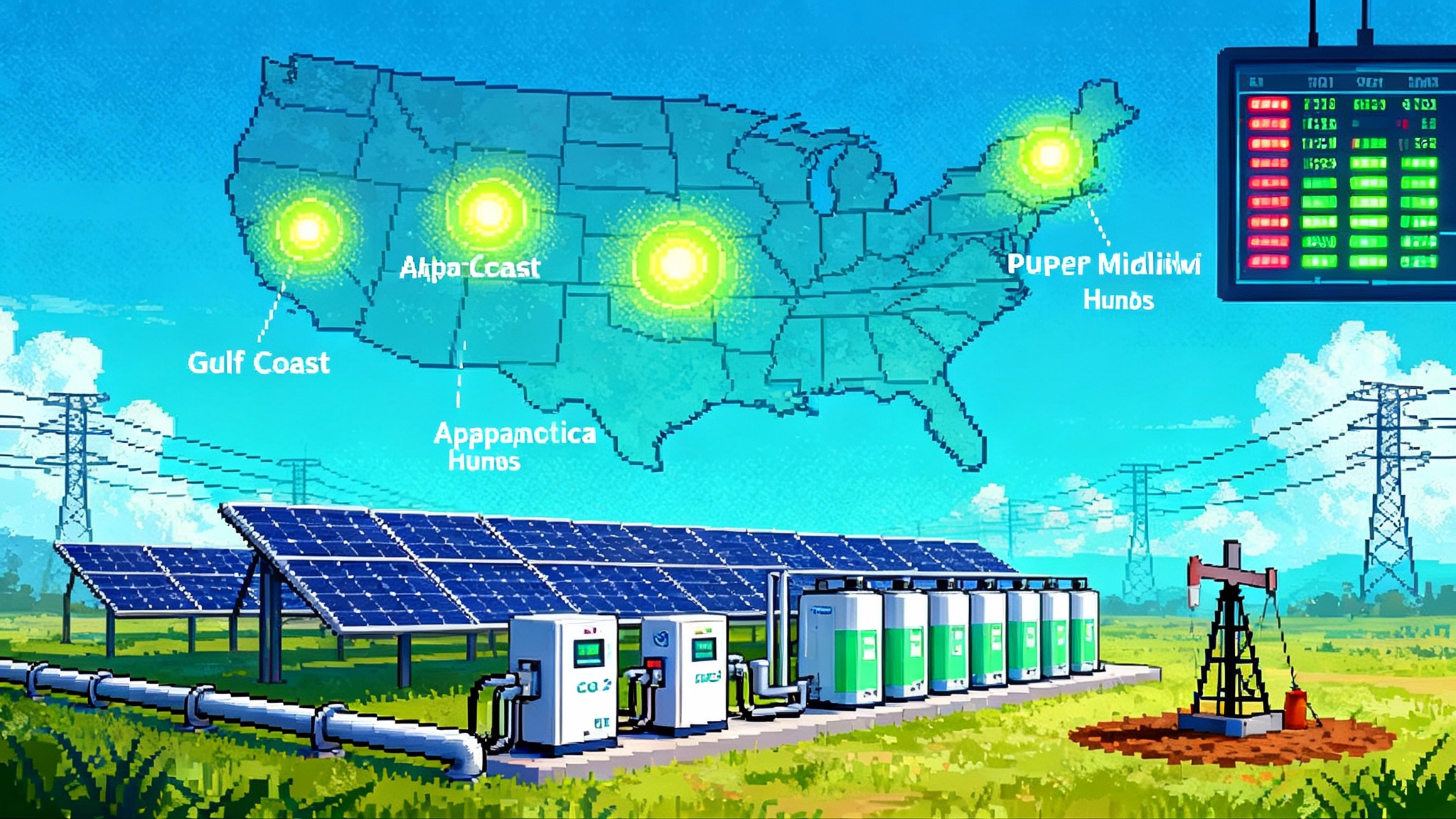

What Palisades means for MISO during the AI load boom

Palisades adds about 800 megawatts of dependable capacity to MISO’s Lower Peninsula of Michigan as accredited capacity tightens and weather extremes add uncertainty. At typical capacity factors, an 800 megawatt nuclear unit produces roughly 6.4 terawatt-hours per year, enough to serve hundreds of thousands of homes and to offset a meaningful slice of new incremental demand.

MISO planners have been revising load forecasts upward for data center clusters, electrified manufacturing and transport. Peak growth that used to be a rounding error is now material. Storage and demand response will help, but they do not replace firm capacity that can run through long cold snaps or multi-day heat domes. For interconnection context, see how fast-lane processes are evolving in MISO and PJM fast tracks, and how the AI buildout is reshaping grid topology in AI islands collide with Texas.

For data center developers, the presence of a large carbon-free baseload unit in state is strategically useful. It can underpin carbon claims, enable round-the-clock clean procurement and reduce reliance on imported power during tight hours. For Michigan ratepayers, it can dampen price spikes that often coincide with low wind and high load.

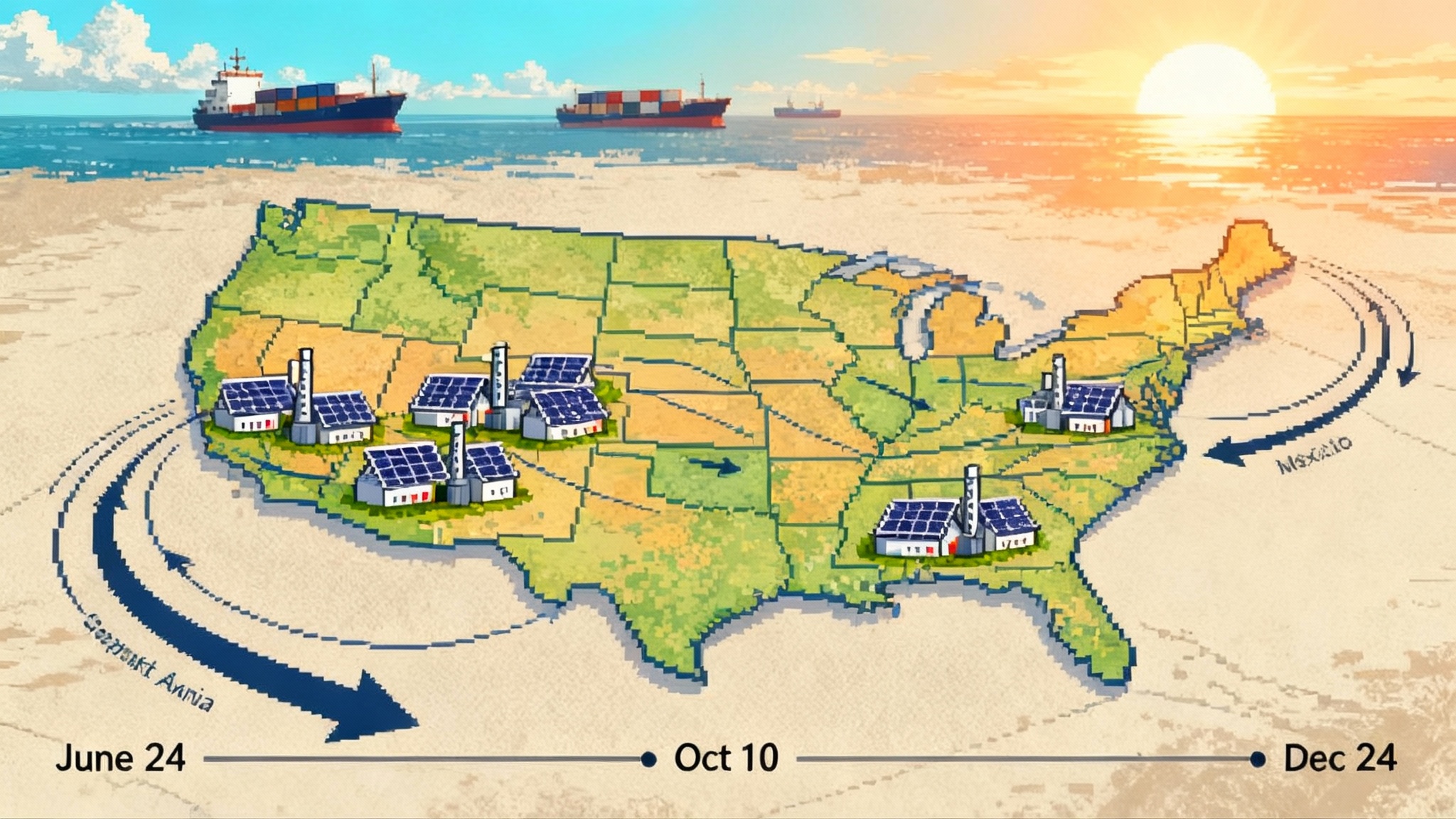

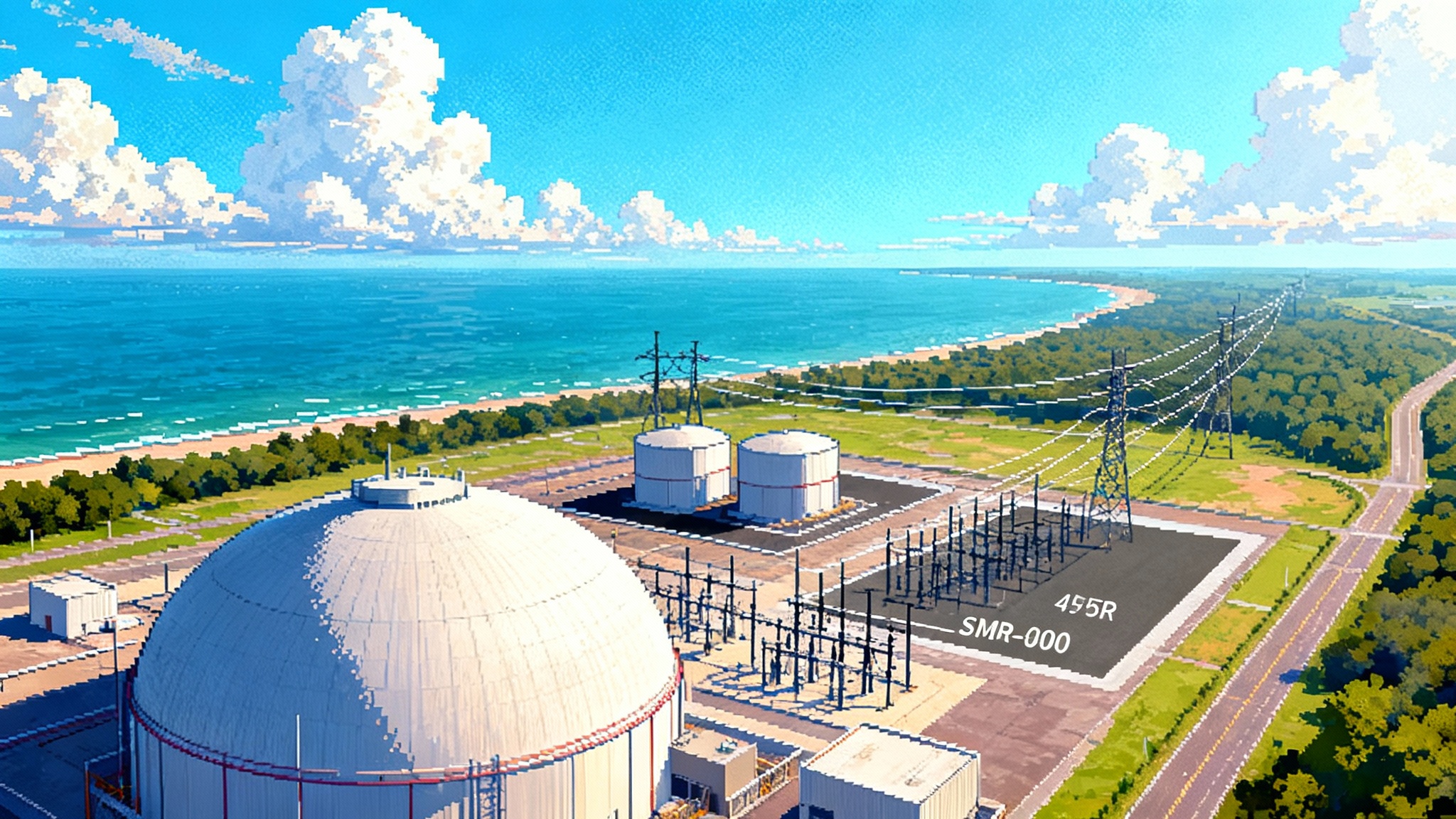

The co-location kicker: two SMR-300s by 2030

Holtec’s plan does not stop at the big unit. With Hyundai E&C, the company has positioned the site for two SMR-300 units targeting initial operation by 2030. Co-location matters. A restarted plant restores nuclear operating culture, an emergency plan, a trained workforce and a grid node already capable of handling large injections. That infrastructure shortens timelines and reduces risk for first-of-kind small reactors.

If realized, the combination of the restarted large reactor and two SMRs would nearly double the site’s clean output by early next decade. That aligns with Michigan’s clean power goals and gives MISO a rare cluster of firm, carbon-free capacity inside one interconnection position. For how market design is evolving alongside reliability needs, see the West’s two-track day-ahead market.

The re-life playbook, distilled

Here is the emerging template Palisades is writing for others:

- Start with a viable asset. Strong historical safety record, an intact nuclear island and transmission interface in good condition. Deep decommissioning steps lengthen timelines and increase cost.

- Secure anchor financing. Use DOE LPO to de-risk capital, add targeted state support and align debt service with a conservative restart schedule.

- Lock in offtake early. A long-tenor PPA with a creditworthy utility or co-op stabilizes cash flows and signals regional reliability benefits.

- Build a clean licensing map. Sequence exemptions and license-basis changes, technical amendments for repairs or upgrades and operational program reconstitution. Run environmental reviews and emergency planning in parallel.

- Execute an equipment triage. Prioritize steam generators, reactor coolant pumps, feedwater heaters and turbines. Decide early whether to repair or replace and align with outage windows and vendor queues.

- Reconstitute people and procedures. Recruit former staff, pair with new hires and run rigorous operator training and requalification. Test procedures in simulator drills and NRC-graded exercises.

- Keep the community in the loop. Visible progress, clear job pipelines and honest safety communication sustain local support.

The risks, without the spin

- Steam generator repairs. Sleeving must pass analysis, mock-ups and NRC review. Unexpected tube wear could change scope. Contingency: plug allowances, spare parts and pre-staged vendor crews.

- Licensing timelines. Re-life raises novel procedural questions. Maintain float and avoid stacking dependencies on a single approval.

- Legal challenges. Intervenors can add schedule friction. Robust engineering and environmental cases limit risk.

- Supply chain and workforce. Nuclear-grade components have long lead times. Use advance purchase, dual-qualified suppliers and early QA. Plan operator licensing and craft labor ahead of fuel delivery.

- Startup reliability. Expect a shakedown period. Use conservative ramp rates, extra instrumentation and phased power ascension tests.

Who could follow, and when

- Three Mile Island Unit 1, Pennsylvania. Constellation is advancing a restart plan with interconnection, emergency planning and workforce hiring underway. Public targets have pointed to operations as early as 2027 to 2028 if financing, offtake and licensing align.

- Kewaunee, Wisconsin. EnergySolutions is pursuing an Early Site Permit with WEC Energy Group for potential new nuclear in the 2030s. That is a repower, not a re-life, but it mirrors Palisades co-location logic.

- Oyster Creek, New Jersey, and Pilgrim, Massachusetts. Both are Holtec sites. Given decommissioning progress, restarts are unlikely, but SMR co-location later in the decade is plausible.

- Improbable re-lifes. Zion in Illinois, San Onofre in California and Crystal River in Florida are too far into dismantlement for practical restarts. New nuclear there would be greenfield or a new build on existing sites.

Timelines vary by plant condition. A site like TMI-1, which shut for economic reasons rather than major equipment failure, can credibly move from decommissioning status to operations in roughly three to four years if the stack of financing, offtake and licensing is assembled early. Sites that have removed key components or advanced further in decommissioning add many years and cost.

Why Palisades matters beyond Michigan

The U.S. needs firm, carbon-free capacity to complement rapid growth in wind, solar and storage, and it needs projects that can deliver before the 2030s. Palisades checks both boxes. It adds 800 megawatts of round-the-clock power in a region with steady load growth and tighter reserve margins. It proves a re-life can be permitted within the existing NRC framework, financed under DOE’s LPO and contracted with buyers who value reliability as much as carbon attributes.

Most importantly, Palisades hands the industry a working playbook: federal credit to bridge restart risk, state seed money to solve blockers, a cooperative offtaker to anchor revenues, a licensing map that sequences approvals and an equipment plan that favors repair where possible and replacement where prudent. Add a co-location step for SMRs and the benefit compounds. Repeat this a handful of times and the grid looks different.