CCS’s 2025 permitting pivot rewires where carbon can go

State primacy over Class VI wells and the first Gulf Coast permits are finally moving U.S. CCS from proposals to construction. Texas and Appalachia are speeding up while tougher pipeline standards may decide who reaches financing and rights of way first.

The year permitting finally moved the map

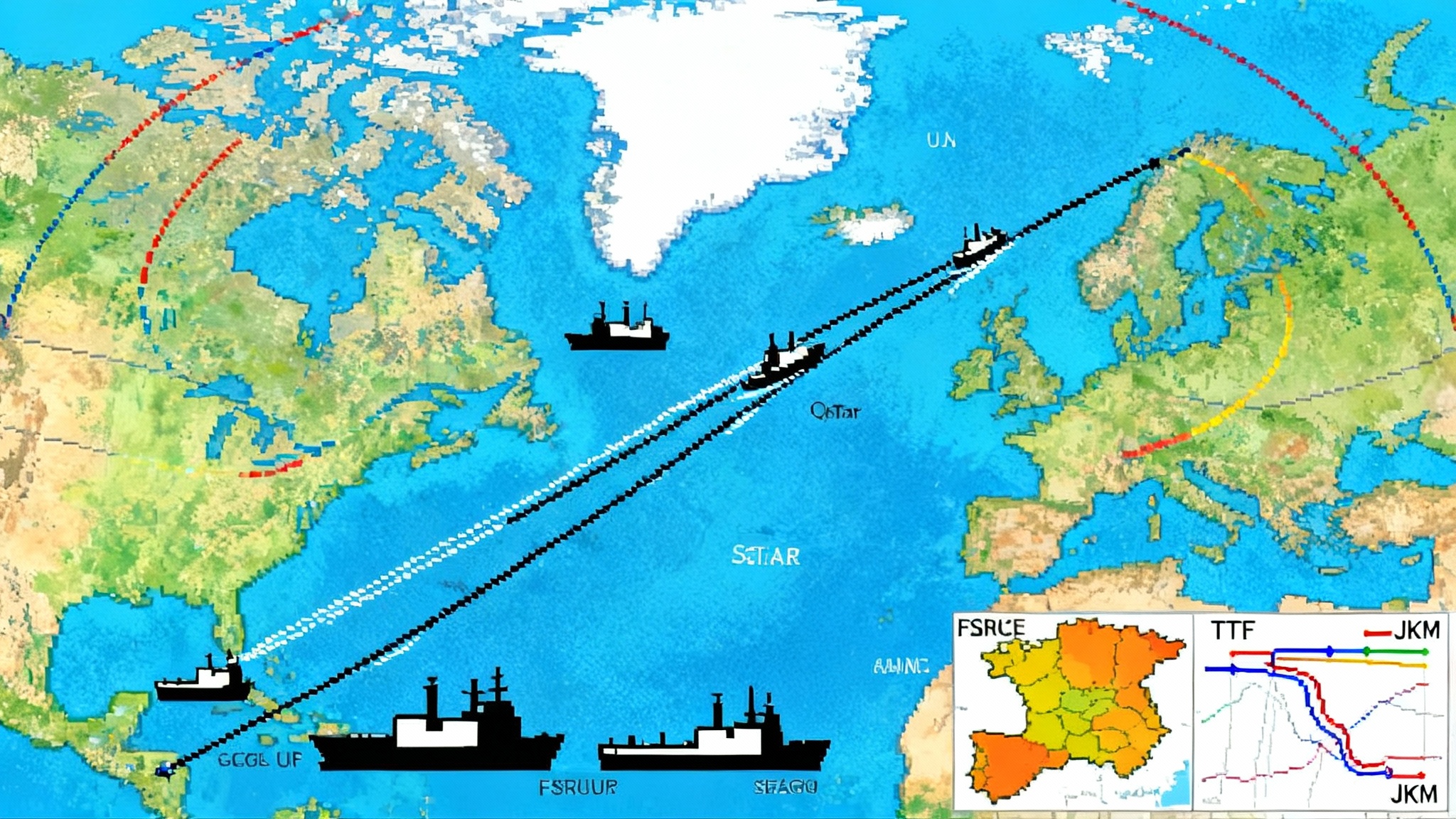

For years, carbon capture and storage in the United States moved on project timelines but stumbled on permits. In 2025 that changed. State primacy over Class VI wells expanded, the Gulf Coast saw its first new storage permits issued, and federal safety standards for carbon dioxide pipelines advanced. The combination is redrawing where CO2 can be stored at commercial scale, who gets financed first, and which regions are at risk of being left behind. This state-level shift echoes the growing state leverage in FERC 1920-A that is reshaping transmission planning.

Primacy is power, and it is shifting

A state that holds primacy for Class VI injection wells can write and issue permits under a program at least as protective as federal rules, while the Environmental Protection Agency retains oversight. That authority matters for timelines, staffing, and local familiarity with geology. In 2025, momentum tilted toward states that have primacy in hand or are close to it.

- North Dakota and Wyoming were early adopters, building muscle on pore-space law and monitoring requirements.

- Louisiana clinched primacy and, in September, issued its first state-run Class VI permit, signaling that developer queues on the Gulf Coast are finally converting into decisions.

- West Virginia secured primacy in the first quarter of 2025, opening a lane for Appalachian projects to move without waiting on federal docket backlogs.

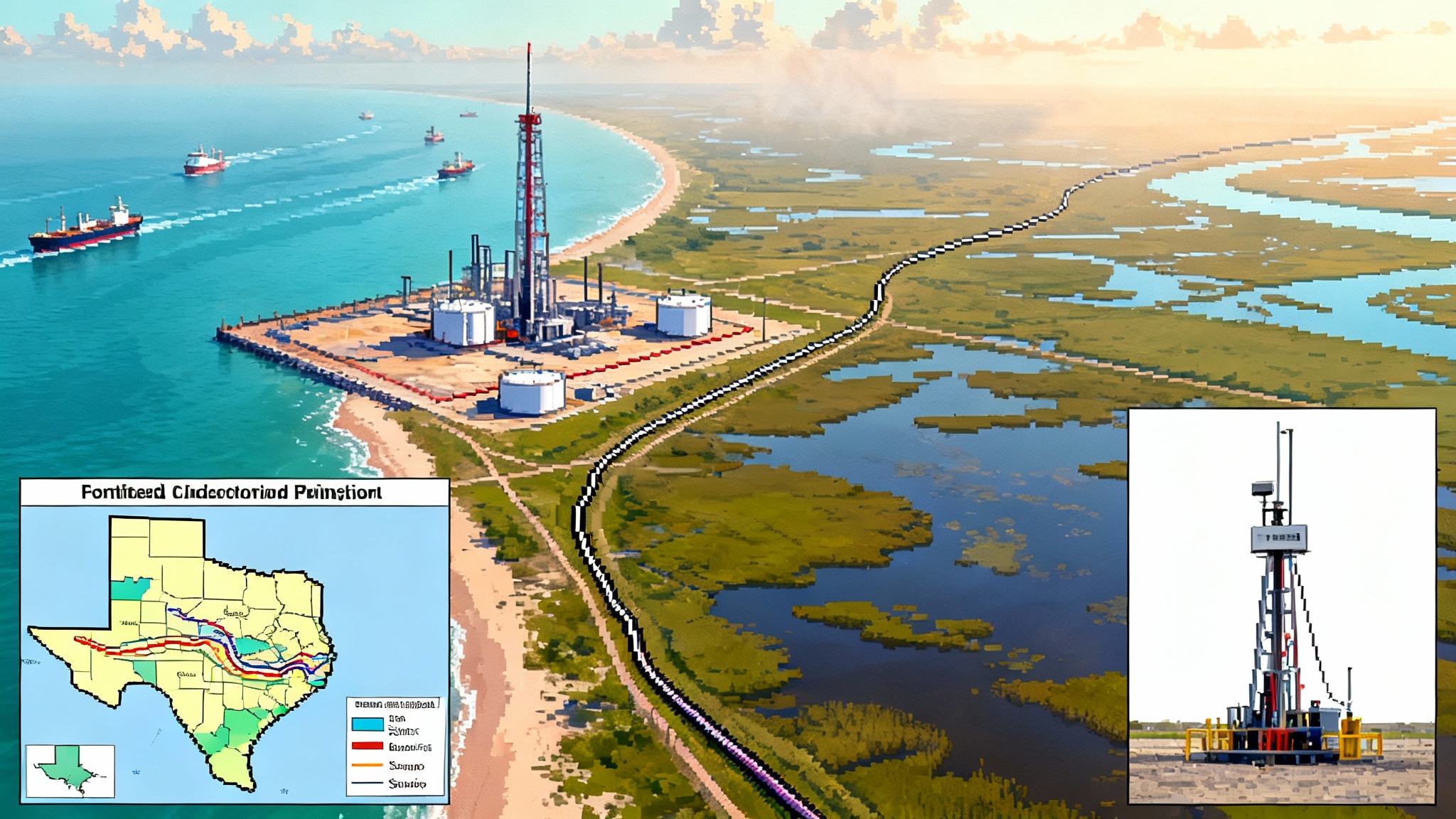

- Texas, already home to dozens of storage proposals, is on the cusp of joining the club. Even before state control arrives, the EPA issued the first Texas Class VI permits in April to Oxy Low Carbon Ventures for an Ector County site, a signal that Gulf Coast storage is shifting from concept to construction. See the EPA final Class VI permits.

Primacy does not guarantee speed, but it aligns incentives. State agencies that know their formations and have pore-space case law can reduce the iteration cycles that slow federal reviews. They can also coordinate across water, air, and surface impacts with one set of calendars and one set of neighbors.

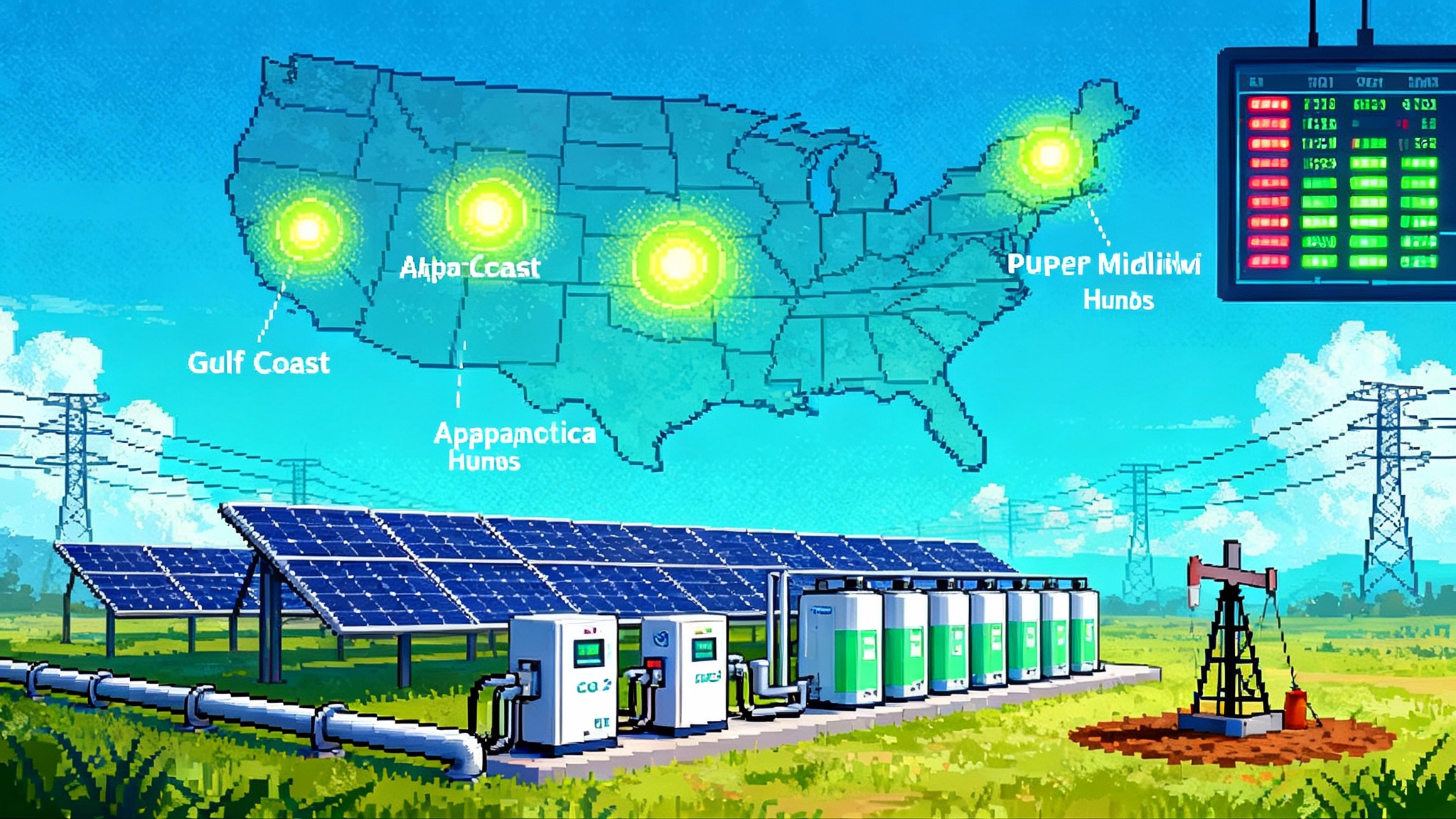

The first wave on the Gulf Coast

The Gulf Coast has the emitters, the geology, and the midstream to move first. Now it has permits.

- Texas: The Oxy approvals marked a milestone for saline storage aligned with direct air capture and industrial CO2 streams. Expect similar projects along the Permian rim and the Coastal Bend, especially where operators can marry existing subsurface data with CO2 offtake agreements.

- Louisiana: The inaugural state-issued Class VI permit at Hackberry shows that Baton Rouge is willing to decide. That decision sits at the tip of a larger spear. LNG complexes, refineries, ammonia, and petrochemicals from Lake Charles to the River Parishes have applications in process. As those convert to draft permits, the region’s first true hubs, with multiple emitters feeding common sinks, may take shape.

- Houston Ship Channel: A cluster of applications tied to refinery and chemical corridors is moving through technical review. Public notices and draft permits there would accelerate final investment decisions for capture projects that have been waiting on certainty about where the molecules will go.

The practical effect is simple. For oil and gas led hubs with surface rights and subsurface data, the Gulf Coast’s permitting thaw shifts CCS from slide decks to execution schedules. For cement, ammonia, and other hard-to-abate sites near planned storage footprints, offtake contracts become bankable rather than hypothetical.

Appalachia finally gets a lane

Appalachia’s emissions profile is different. It is heavy on gas processing, power, and materials, and lighter on coastal petrochemicals. The geology is complex, and projects have struggled to thread federal permitting, pore-space aggregation, and community questions about induced seismicity.

West Virginia’s primacy approval changes that calculus. With a state program, project sponsors can pre-file, scope seismic networks, and coordinate with state environmental and emergency agencies on one timetable. That helps hubs tied to hydrogen production and gas processing clusters in the Ohio River Valley. It also helps cement plants in the broader tri-state area that can justify capture if a reliable storage site is within pipeline range.

The catch is regional. Pennsylvania and Ohio do not yet have primacy. Cross-border pipeline routing will require both technical diligence and political choreography. Still, with one anchor state empowered to issue Class VI permits, Appalachian projects with West Virginia reservoirs can move sooner.

Pipeline rules are about to govern the pace

Storage permits are only half the challenge. Most emitters are not sitting on top of their sinks. CO2 has to move, often across county and state lines, and safety standards for that movement are being rewritten in response to the Satartia, Mississippi rupture in 2020.

Federal regulators have proposed comprehensive updates for CO2 pipelines. The draft rule would establish design and operating requirements for gas-phase CO2 lines, set conditions for converting legacy lines to CO2 service, require operator training and equipment support for first responders, and mandate more detailed dispersion modeling and community communication. Developers are already engineering to these expectations to avoid redesigns later. Read the PHMSA proposed CO2 pipeline rule.

The upshot: routes through denser towns, steep terrain, or areas with limited egress will face tougher modeling and public scrutiny, and that will influence which projects can line up financing and rights of way quickly. Corridors that follow existing energy ROWs and can demonstrate layered safety controls will get to construction first.

Who moves first, and why

- Oil and gas led hubs: Subsurface datasets, land departments that know how to unitize pore space, and balance sheets comfortable with long-tailed monitoring obligations. In-house pipeline expertise matters under the new safety regime.

- Cement and ammonia: Process emissions are concentrated and steady. Where plants sit within 50 to 150 miles of permitted or near-permitted storage, the capture plus pipeline equation is finally underwriting. Expect early movers in the Gulf Coast and parts of Appalachia.

- Blue hydrogen clusters: Where hydrogen hub awards anticipate geologic storage, primacy and pipeline clarity unlock the sequence. See how policy shifts are reshaping projects in hydrogen’s 2025 reset.

Who lags:

- Isolated emitters in states without primacy: Federal permits are moving but remain resource constrained. Without a clear storage partner, these projects struggle to raise construction capital even if the capture unit is technically straightforward.

- Power generation retrofits: Sensitive to fuel spreads, heat rate penalties, and market rules. Some will move, particularly where policy or offtake contracts backstop risk, but most will wait for pipelines and storage hubs to harden first.

Bottlenecks that still bite

Community consent, post Satartia

Public memory is long on safety. Communities want plume modeling in plain language, evacuation planning, and clear commitments about operating conditions and emergency response. Developers that treat public hearings as a checkbox will lose months. Those that co-design response plans with local fire chiefs and invest in continuous air monitoring will close gaps faster.

Induced seismicity and pressure management

For saline storage, pressure can travel through formations even if injected CO2 stays put. States with primacy are setting expectations for seismic arrays, step-rate tests, and pressure management plans, including brine production where needed. Teams that treat these as early design choices will preserve injection capacity and avoid shut-ins after microseismic events spook the neighborhood.

Financing mechanics

The 45Q tax credit remains the bedrock of CCS finance, but capital stacks still hinge on bankability of offtake and transport. Lenders and tax credit buyers want fully wrapped risk from capture to storage, including pipeline interconnects, monitoring plans, and pore-space control. The more a project looks like a midstream contract chain, the easier it is to raise money.

Surface and pore-space alignment

Unitizing pore space across dozens of tracts remains one of the slowest parts of any project. States that have clarified pore-space ownership and established clear rules for unit formation and compensation, including post-closure liability transfer to the state under defined conditions, will see fewer courthouse delays.

Interstate coordination

Appalachian projects will cross borders. That means coordinating not only pipeline safety expectations but also water, wetlands, and endangered species reviews. Early joint scoping meetings with agencies across state lines can shave quarters off schedules.

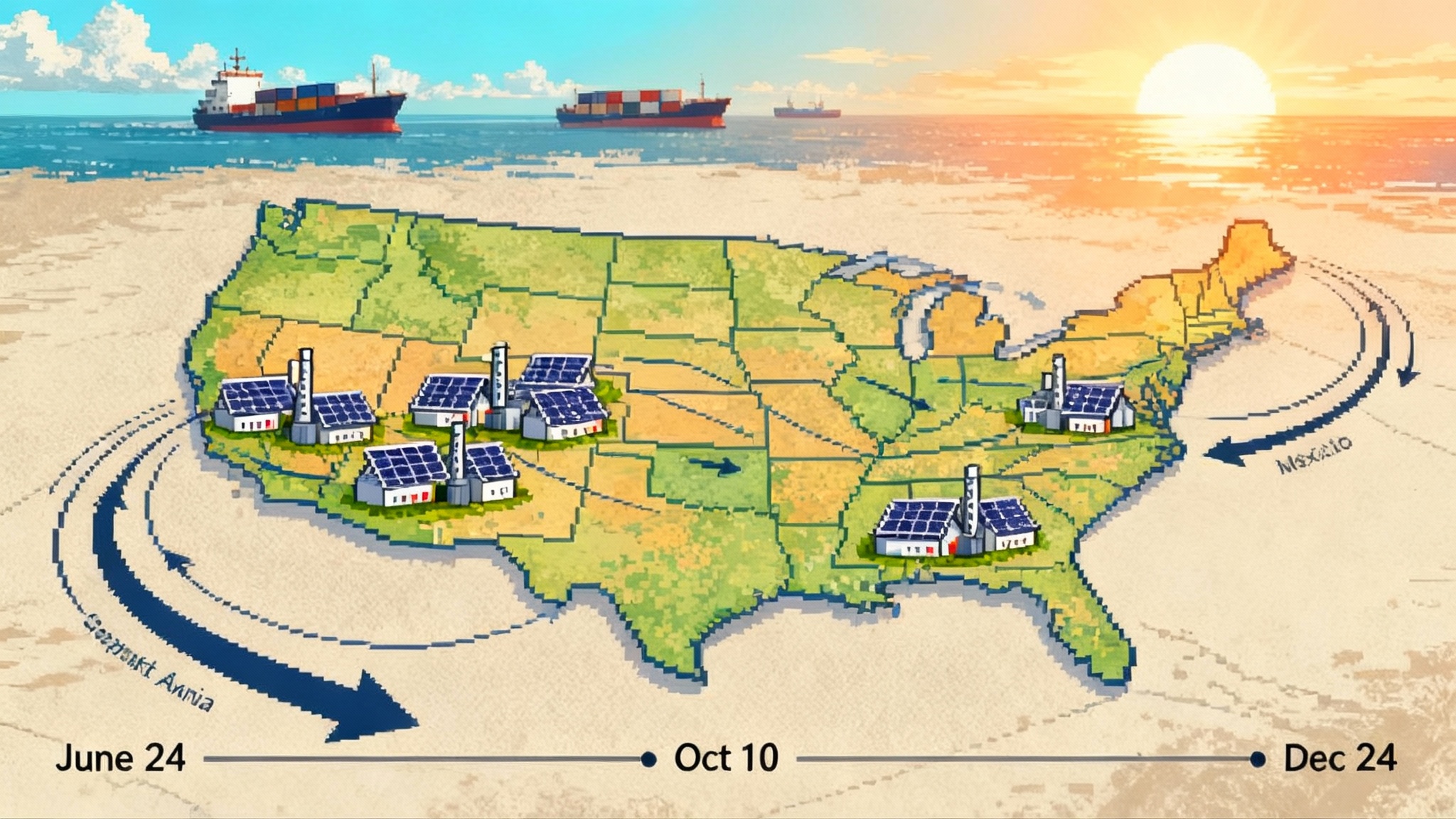

What this rewiring means for the U.S. map

- Texas and Louisiana are the center of gravity for the first industrial-scale storage hubs, with midstream-ready corridors and state or federal permit momentum. Rising industrial and data center demand will intersect with these corridors, as seen in AI’s grid moment in Texas.

- West Virginia creates an Appalachian anchor for projects that can keep most of their infrastructure inside one primacy state.

- States without primacy and with diffuse emitters will still see pilots and strat wells, but their big projects will either wait or ship molecules to neighbors.

12 to 24 month watchlist: from paper to pore space

These projects and corridors have the ingredients to move from applications to injection tests in the next two years. Each is advancing permits, community engagement, and financing in parallel.

- Oxy Ector County, Texas: With final Class VI permits in hand, watch for well construction, mechanical integrity tests, and initial injection aligned with direct air capture and industrial offtake. Keep an eye on reservoir pressure management as additional wells are proposed.

- Hackberry, Louisiana: The state’s first Class VI permit sets up a near-term test case for injection and monitoring program execution along the Cameron Parish coast. Expect detailed public reporting on pressure fronts and seismic monitoring to build confidence for the next wave.

- Houston Ship Channel clusters, Texas: Multiple applications tied to refineries and chemicals are in the queue. Public notices and draft permits would catalyze final investment decisions for capture units waiting on storage clarity.

- Gulf Coast Sequestration, Lake Charles area, Louisiana: A large saline unit positioned to aggregate emissions from LNG and petrochemicals. Watch for draft, then final, permits and land assembly milestones.

- Air Products River Parishes, Louisiana: Blue hydrogen capture paired with Class VI applications in review, with potential to create a multi-tenant corridor if pipeline siting lands cleanly under proposed safety rules.

- Denbury and CapturePoint projects, central and western Louisiana: Strat wells and Class VI applications point toward multi-well developments that could serve cement and ammonia alongside hydrocarbons.

- West Virginia Appalachian storage sites: With primacy effective, look for early permits aimed at gas processing, hydrogen, and cement. Projects that can confine routes within the state boundary will have a timing edge versus cross-border concepts.

Signals to track on all of them:

- Draft to final permit cycle time and conditions on pressure management and seismic monitoring

- Community benefit agreements, first responder training, and dispersion modeling transparency

- Pipeline route control, including valve spacing strategy and emergency isolation design under the pending PHMSA rule

- Tax credit transfer closings and the emergence of standardized contracts that tie capture, transport, and storage into one bankable chain

The bottom line

Class VI primacy decisions and the first Gulf Coast permits have lowered the activation energy for U.S. CCS. Add pending federal pipeline standards that push better design, training, and community communication, and you get a clearer playbook for developers and financiers. The next 12 to 24 months will reward projects that align geology, rights of way, and communities, and that treat safety and transparency as core design. Texas and Appalachia have new tailwinds. Others will catch up, but the storage map is already being redrawn.