Order 1920’s trench fight: courts, clocks, and cost splits

Order 1920 left the page and entered the trenches in 2025. Rehearing clarifications, a new FERC chair, Fourth Circuit consolidation, and a demand shock from data centers now collide with looming compliance deadlines that will decide who actually builds long lines.

2025 turned Order 1920 from rule text into a ground war

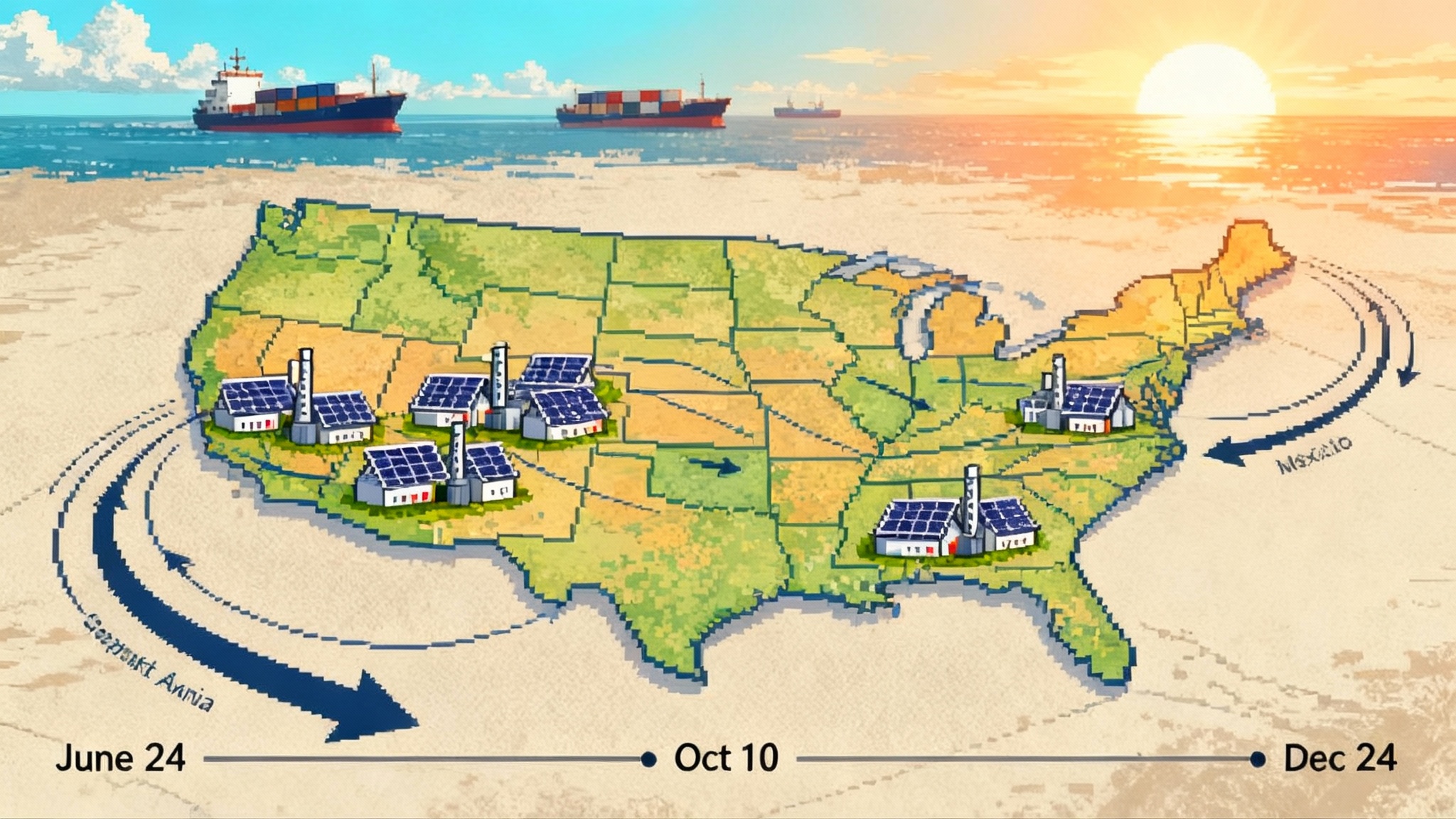

Three pivots set the pace this year. First, FERC issued Order 1920-B on April 11, clarifying cost allocation and state roles after a wave of rehearing requests. Second, on August 13, President Trump named Commissioner David Rosner as chair, reshaping the Commission’s tone on implementation and litigation strategy. Third, the many challenges to the rule were consolidated in the U.S. Court of Appeals for the Fourth Circuit, where a single panel will now hear attacks from multiple states and interests as compliance clocks keep ticking. Those clocks matter most for CAISO, PJM, and the non-RTO West, where initial filings are due by mid-December 2025 under FERC’s updated schedule. See the official dates in the FERC Order 1920 compliance schedule.

What 1920-B settled, and what it deferred

1920-B did three practical things:

- It affirmed that legacy planning and cost allocation practices are not up to the task for long-term reliability and affordability, while leaning harder into state engagement to reach cost sharing agreements before projects are selected.

- It answered process questions. Transmission providers must run transparent long-term planning with scenario analysis, evaluate a defined set of benefits, and propose ex ante cost allocation methods that comply with cost-causation unless states agree on something else.

- It kept some controversial ideas out of the rule. A federal right of first refusal tied to joint ownership stayed on the shelf, and incentive questions like CWIP reset were left to other dockets.

What 1920-B did not do: it did not make litigation go away, and it did not remove the need for states to decide how to decide within the six-month engagement period that runs before compliance filings.

How states are using the six-month windows

Order 1920 requires every region to host a six-month engagement period for Relevant State Entities to negotiate either: 1) one or more ex ante cost allocation methods for long-term regional lines, or 2) a State Agreement Process that lets one or more states voluntarily take on a defined share of costs, either before selection or within six months after selection.

Here is where the windows are being used, and how:

- PJM: OPSI members pressed for more time and PJM requested an extension of the engagement period, which FERC granted. With a December 12, 2025 compliance deadline, states are using standing OPSI processes to hash through voting rules and candidate benefit metrics while exploring a flexible State Agreement Process as a parallel path. The aim is to avoid post-selection fights by setting a clear ex ante rule of the road. For how queue reforms intersect with deliverability, see our look at PJM, MISO and CAISO’s fast tracks.

- CAISO: The ISO ran a defined engagement period from November 1, 2024 to May 1, 2025 to canvass options for a cost allocation framework consistent with California law and to gauge appetite for any State Agreement Process in a footprint that is mostly single-state but often coordinates with neighbors. CAISO did not ask FERC for an engagement extension.

- NorthernGrid and WestConnect (non-RTO West): Western state energy officials formed a dedicated committee to coordinate positions and jointly requested more time. FERC granted extensions for both the engagement period and the initial filings. Context on market design dynamics appears in the West’s two-track day-ahead market.

- SPP: The region sought and received an engagement extension, signaling that state commissioners want a real shot at landing a consensus framework in a footprint that spans very different retail and resource policies.

- MISO, FRCC, SCRTP and SERTP, ISO-NE, NYISO: These regions did not request an engagement extension. They are moving toward 2026 or 2027 compliance under the standard window, relying on existing state organizations and voting rules to shape filings.

Translation: regions with the toughest multi-state politics or the biggest long-haul needs asked for time to lock in a deal. The ones with clearer legacy processes or narrower footprints stuck to the clock.

Who won filing extensions, and why that matters

FERC granted time extensions for several regions after motions by transmission providers and state entities. The practical upshot for 2025:

- Initial compliance filings due December 12, 2025: CAISO, PJM, NorthernGrid, WestConnect. Interregional coordination filings follow into early 2026.

- Extensions into mid-2026 or later: MISO, SPP, FRCC, SCRTP and SERTP, NYISO. ISO-NE received the longest runway into 2027 to align with its planning reforms.

These extensions do two things. They lengthen the state engagement window where requested, and they reset when the first long-term planning cycles must begin. Under 1920-A, the first long-term cycle must commence no later than two years after initial compliance is due. That means parts of the country may start the first cycle in 2026, while others will push into 2027. If you want lines under construction before 2030, moving the 2026 cohort is critical.

The Fourth Circuit will shape how far 1920 can reach

The consolidation of cases in the Fourth Circuit puts every theory on the table in one courtroom: federalism, cost causation, the sufficiency of FERC’s Section 206 record, and how to read the Federal Power Act after the Supreme Court’s Loper Bright decision. Here is the likely fault map:

- Most durable pieces: FERC’s authority over practices that directly affect transmission rates, like regional planning process requirements and cost allocation frameworks tied to cost causation.

- Most exposed pieces: requirements that look like FERC dictating specific planning outcomes or forcing particular benefits without enough record support. Panels can trim the rule rather than vacate it, with close scrutiny of anything that appears to step into state siting prerogatives.

- Procedural land mines: claims that FERC failed to respond to material comments in certain regions, or that timelines were arbitrary given the complexity of state law. These can lead to remands that slow filings but do not kill the core rule.

Bottom line: expect trench warfare, not a single knockout. The most likely outcome is a narrowed but intact rule that leaves the new state engagement and ex ante frameworks standing while sharpening how regions justify benefit metrics and selection criteria.

Demand shock raised the stakes in real time

Two market signals collided with the 1920 calendar this year.

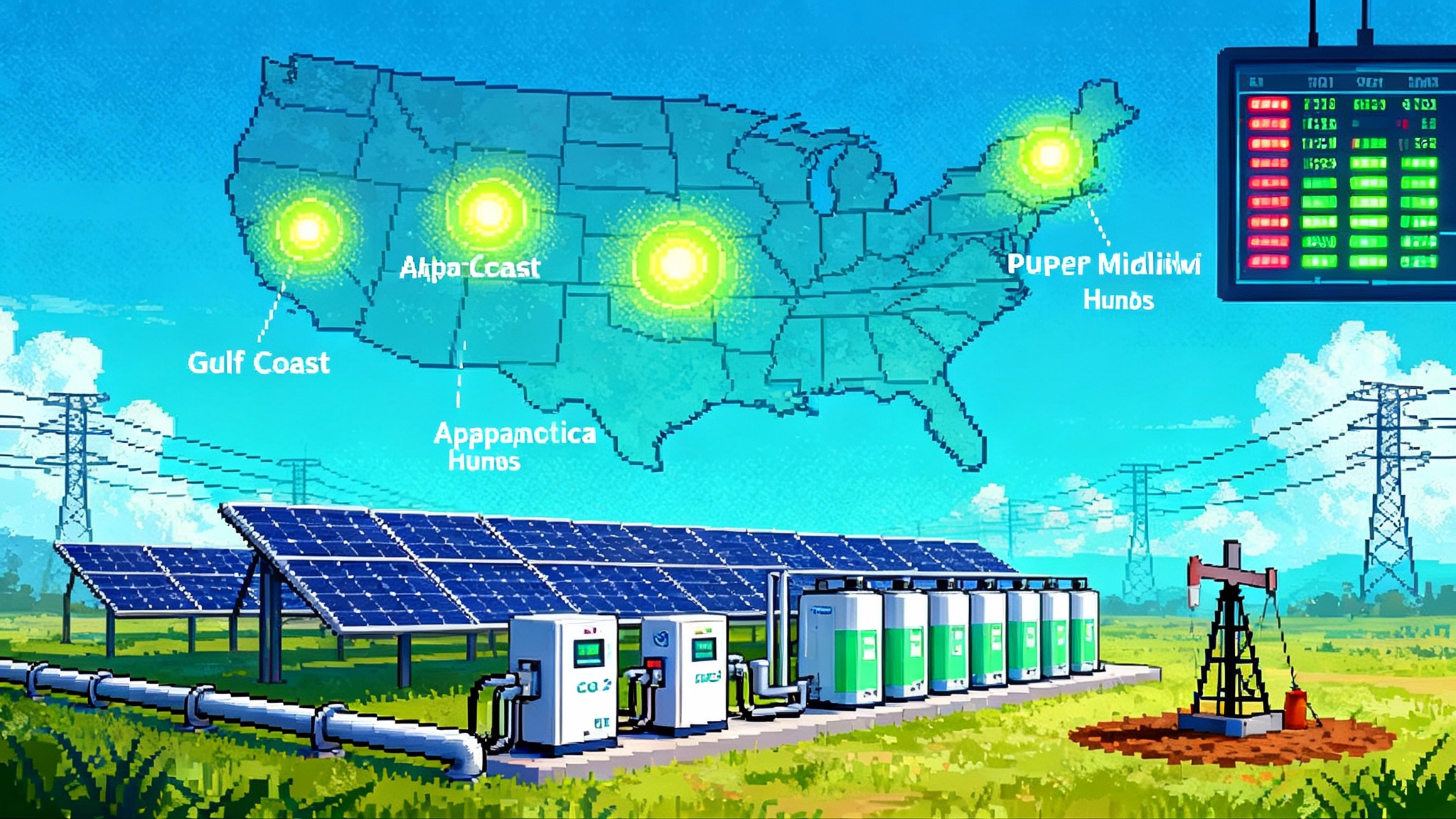

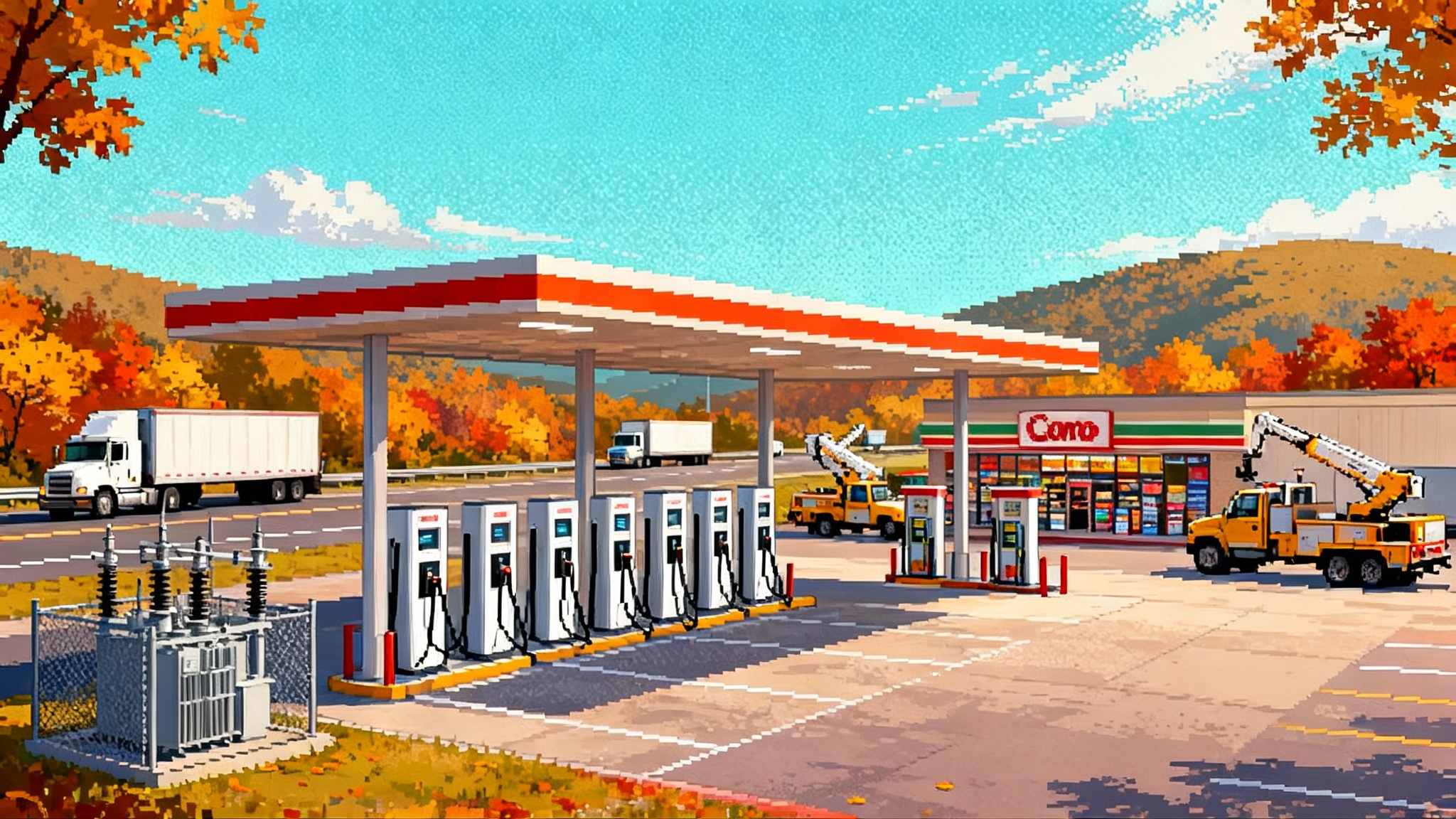

- Data center load: NERC’s summer assessment flagged broad peak increases and pointed to voltage-sensitive large loads like data centers as a growing reliability risk. RTOs and states responded by tightening interconnection and forecasting rules for large new customers. The new FERC chair also pressed grid operators for stronger large-load forecasting practices in September. For a related lens on load pockets, see how AI demand and Texas transmission are colliding.

- PJM capacity prices: PJM’s 2025-2026 auction cleared at a record PJM-wide price, and the 2026-2027 auction later hit the tariff cap across the footprint. PJM’s own reporting tied the run-up to rising demand, retirements outpacing interconnections, and rule changes that better price risk. See PJM’s 2024 Markets report.

Together, the reliability alerts and price signals say the quiet part out loud: either plan and share costs for long-haul delivery or pay in scarcity pricing and delayed siting case by case.

Why the six-month windows decide whether lines get built

Transmission only gets easier if cost allocation is boring. The engagement windows are the one shot to make it boring by:

- Setting a default ex ante method that is roughly commensurate and transparent. That reduces litigation risk later because everyone knows the denominator when benefits are counted.

- Establishing a State Agreement Process as a safety valve. States that want specific cost control or consumer protections can opt into a portfolio on tailored terms.

- Agreeing on benefit metrics and time horizons up front. The benefits under 1920 can be contentious if left to case-specific fights. Locking a portfolio approach now helps.

Regions that finish 2025 with a settled method will start their first long-term cycles in 2026 with a path to select, not just study, multi-state lines. Regions that punt will enter 2026 with modeling debates but no way to split the bill when a project clears the analysis.

The playbook for developers, utilities, and regulators

Developers

- Pre-package portfolios, not orphan lines. Show how three to five lines together produce more stable, shareable benefits than a single corridor.

- Bring state-friendly finance. Offer joint ownership options with public power or co-ops and pair merchant risk with rate-based mini-tranches where feasible.

- Front-load deliverability. Tie your transmission portfolio to a concrete block of queued projects that solve reserve margin and congestion in the same stroke.

- Do the permitting pre-work. Secure corridor control, early NEPA scoping, and community benefit terms now.

Utilities and transmission providers

- Land an ex ante method that can survive court review. Keep the benefit list concise, show rough commensurability with clear math, and set a defensible cost-benefit threshold.

- Make the State Agreement Process real. Specify how a subset of states can opt into a portfolio and how others are insulated.

- Align local right-sizing with regional needs. Fold end-of-life replacements into the long-term plan where upsizing avoids a future second build.

- Upgrade large-load intake. Create a standard path for data centers that covers ride-through, on-site backup behavior, and forecast discipline.

State regulators

- Decide how you decide. Adopt a clear voting rule inside OPSI, OMS, NESCOE, or your regional forum.

- Lock in guardrails. Put in writing the cost-cap, consumer-protection, and benefit-measurement guardrails you will require to sign an ex ante method or a State Agreement Process.

- Use the extension if you need it, but trade time for certainty. If your region asked for more months, close issues and then commit so the first long-term cycle can start on time in 2026 or 2027.

- Build a record for court. Document how your engagement choices protect consumers and improve reliability.

What is most vulnerable post Loper Bright

- Benefit mandates without a tight record. If courts view some benefit requirements as lightly supported or overbroad, they may send those back for more explanation.

- Local planning transparency and right-sizing rules, if read as intruding on state siting. Regions can reduce risk by showing how these provisions change rates and reliability outcomes rather than siting outcomes.

- Timelines justified poorly. Courts often remand deadlines that do not reflect administrative reality. Filing extensions already granted are a hedge, but additional relief must be backed by facts.

The safe core remains: FERC can require just and reasonable planning and cost allocation practices. Expect surgical changes, not a wipeout.

The near-term timeline

- Now through October 2025: State engagement sprints in PJM and the non-RTO West. CAISO finalizes its filing for December. SPP and others continue engagement work under extensions.

- December 12, 2025: First-wave compliance filings due for CAISO, PJM, NorthernGrid, WestConnect. Interregional filings start in early 2026 for those regions.

- 2026: First long-term cycles begin in regions with 2025 compliance. Others tee up 2027 starts. The Fourth Circuit likely issues rulings or interim orders that will shape how prescriptive filings can be.

The bottom line

The next 90 days decide whether Order 1920 speeds real steel or becomes another stack of white papers. Regions that use engagement windows to lock in a simple, transparent cost split will start selecting lines in the first long-term cycles and will be first to connect new generation and serve data center load without leaning on scarcity pricing. Regions that wait for a perfect court answer will lose another year and invite higher costs. The tools are on the table. Pick them up, agree on how to share the bill, and build.